|

市場調査レポート

商品コード

1640328

石油・ガスドローンサービス:市場シェア分析、産業動向、成長予測(2025年~2030年)Oil And Gas Drone Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 石油・ガスドローンサービス:市場シェア分析、産業動向、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 130 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

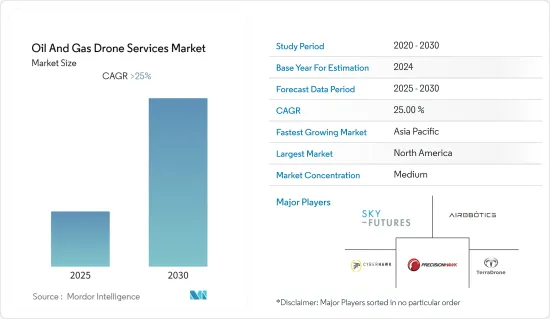

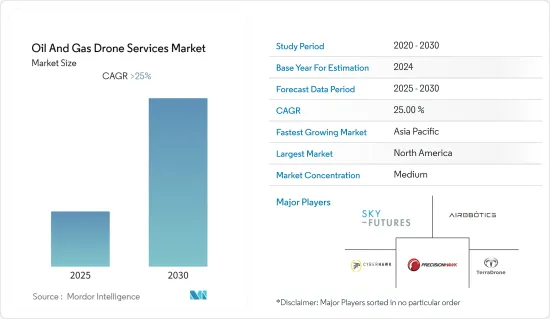

石油・ガスドローンサービス市場は予測期間中に25%以上のCAGRで推移する見込み

主要ハイライト

- 市場は2020年にCOVID-19の悪影響を受けました。現在、市場は流行前のレベルに達しています。中期的には、人工知能(AI)のドローンへの採用と統合が、メタンガス検知と赤外線イメージングの開発と相まって、石油・ガス事業者によるドローンの採用拡大につながる原動力となっており、予測期間中の市場の推進が期待されます。

- 一方で、低速、飛行時間の短さ、ハッカーに対する脆弱性、天候の影響を受けやすいといった技術的な限界が市場の成長を抑制しています。エネルギー需要の高騰により、パイプラインや精製所などの石油・ガスインフラの需要は増加すると予想されるため、石油・ガスドローンサービスプロバイダーにとってはより大きなビジネス機会が生まれます。

- 北米は予測期間中、主要な石油・ガスドローンサービス市場になると予測されています。上流、中流、下流を含む3つのセクターすべてでドローンの採用が増加しているため、近い将来、収益において最大の市場になると予測されています。さらに、この地域全体のオフショア石油・ガス活動の激化は、予測期間中の市場の成長を促進すると予想されています。

石油・ガスドローンサービス市場動向

ドローンと人工知能(AI)の融合が市場を牽引する見込み

- 近年、ドローンは現場内での業務遂行に必要とされていました。石油・ガス事業者によるドローンの使用は、人工知能(AI)とドローンの統合や、赤外線画像やメタンガス検知の開発によって大きな影響を受けています。この進歩により、ドローンのカバー範囲は、目視外飛行(BVLS)が可能なため、目に見える範囲をカバーするだけでなく、より広範囲に及ぶようになりました。

- しかし、現在ではAIの開発により、ドローンは視線を越えてホバリングできるようになりました。AIの統合により、ドローンは視線(BVLS)を超えて飛行し、人手をかけずにはるかに多くのデータを収集できるようになりました。収集されたデータはより正確であることが証明されており、石油・ガス事業者が作業中の事故や漏洩を防ぐのに役立ちます。

- 最新のドローンは、資産からの莫大な量のデータをより速く、より賢く処理します。AIが向上するにつれて、これらのドローンは、そのAI機能を通じて、さらなる行動を独自に決定することができます。

- 2021年、世界の石油生産量は日量8,990万バレルに達しました。2019年の石油生産量は約9,500万バレルで、過去最高を記録しました。しかし、コロナウイルスの大流行と輸送用燃料需要への影響により、翌年は顕著な落ち込みを見せた。石油生産量の増加は、石油・ガスドローンサービス市場を牽引すると予想されます。

- また、石油・ガス会社は人工知能(AI)を使って、ガソリンを作るのに必要な未処理の炭化水素などを掘削・採掘しています。AIは、陸と海の両方で掘削を指示するための正確で精度の高いインテリジェンスを提供するアルゴリズムの作成を支援します。精密な掘削は、災難、火災、石油流出の危険性を低下させながら、浸透率を向上させています。

- さらに、AIを統合したセンサは、閉鎖された建物内を簡単に移動できるようになり、人間が操作しなくても壁との衝突が起きにくくなりました。これらの技術が向上し続けるにつれて、これらのドローンのアプリケーションは増加し、それが市場を牽引すると予想されます。

- したがって、上記の要因に基づいて、ドローンの人工知能(AI)との統合は、予測期間中に市場を牽引する可能性が高いです。

市場を独占する北米

- 北米は、ドローンサービスの主要市場であり、予測期間中、最大の市場シェアを占めると予想されます。米国が北米を支配しており、同地域におけるオフショア石油・ガス活動の増加が予測期間中の市場成長を牽引するとみられます。

- メキシコ湾深海での最近の発見により、深海や超深海での探査活動が増加する一方、浅海での埋蔵量は期間中に減少すると予想されます。このことは、米国における深海活動用の石油・ガスドローンサービスの需要を押し上げると予想されます。

- Shell CanadaとBP Canadaによる最近の2つの掘削計画は完了し、商業的発見の証拠はないです。その結果、カナダの石油・ガスドローンサービス市場は、12件の有効な探鉱ライセンスがまもなく更新されない限り、石油・ガス探鉱活動の減少が予想され、縮小する可能性が高いと結論づけられます。さらに、Sable Offshore EnergyとDeep Panukeプロジェクトの廃止措置が進行中です。十分な市場アクセスの欠如、規制の不確実性による負担の増大、上記2つのプロジェクトの廃止は、今後数年間、カナダ海洋石油・ガス産業の競合を低下させ、石油・ガス掘削サービスの需要に影響を及ぼす可能性が高いです。

- さらに、米国には90万以上の石油・ガス坑井パッドと50万マイル以上のパイプラインがあり、これらすべてに定期的な点検とモニタリングが必要です。American Roboticsは、石油・ガスセグメントのドローン・イン・ア・ボックス市場の世界のTAMきんがく値を220億米ドルと予測しています。そのため、予測期間中に石油・ガスセグメントのドローンサービスの需要が創出されます。

- したがって、外国企業による同国の上流部門への投資の増加と石油・ガス探査活動の増加が、同地域の石油・ガスドローンサービス市場の需要を促進すると予想されます。

石油・ガスドローンサービス産業概要

石油・ガスドローンサービス市場は適度にセグメント化されています。同市場の主要企業(順不同)には、Terra Drones、Airobotics Ltd、PrecisionHawk、Cyberhawk Innovations Limitedなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

- イントロダクション

- 2028年までの市場規模と需要予測(単位:100万米ドル)

- 最近の動向と開発

- 政府の規制と施策

- 市場力学

- 促進要因

- 抑制要因

- サプライチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 地域

- 北米

- アジア太平洋

- 欧州

- 南米

- 中東・アフリカ

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Precisionhawk

- Airobotics Ltd

- Cyberhawk Innovations Limited

- Sky-Futures Limited

- Phoenix LiDAR Systems

- Viper Drones

- SkyX Systems Corp.

- Terra Drone Corporation

第7章 市場機会と今後の動向

目次

Product Code: 51468

The Oil And Gas Drone Services Market is expected to register a CAGR of greater than 25% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels. Over the medium term, the introduction and integration of artificial intelligence (AI) with drones, coupled with the development of methane gas detection and thermal imaging, has been the driving factor leading to the increasing adoption of drones by oil and gas operators, and it is expected to propel the market during the forecast period.

- On the other hand, technological limitations such as low speed, shorter flight time, vulnerability to hackers, and susceptibility to weather are restraining the market growth. Nevertheless, the demand for oil and gas infrastructure, such as pipelines and refineries, is expected to increase due to the soaring energy demand, thus generating more significant business opportunities for the oil and gas drone service providers.

- North America is expected to be the primary oil and gas drone services market during the forecast period. It is projected to be the largest market in revenue in the near future due to the increasing adoption of drones across all three sectors, including upstream, midstream, and downstream. Furthermore, intensifying offshore oil and gas activities across the region are expected to drive the market's growth during the forecast period.

Oil & Gas Drone Services Market Trends

Drones' Integration with Artificial Intelligence (AI) Expected to Drive the Market

- In the recent past, drones were required to carry out operations within the site. The use of drones by oil and gas operators has been significantly influenced by the integration of artificial intelligence (AI) with drones and the development of thermal imaging and methane gas detection. With this advancement, drone coverage has become more widespread than just covering visible areas because they can fly beyond lines of sight (BVLS).

- However, the development of AI now enables drones to hover beyond the line of sight. The integration of AI has helped drones fly beyond the visual line-of-sight (BVLS) and gather much more data without any human effort. The data collected is proven to be more accurate and can help the oil and gas operator prevent mishaps or leakage during the operation.

- Modern drones are faster and smarter in processing enormous amounts of data from assets. As the AI improves, these drones may independently decide on further action through their AI capabilities.

- In 2021, global oil production amounted to 89.9 million barrels per day. The level of oil production reached an all-time high in 2019, at nearly 95 million barrels. However, the coronavirus pandemic and its impact on transportation fuel demand led to a notable decline in the following year. The increasing oil production is expected to drive the oil and gas drone service market.

- In addition, oil and gas companies use artificial intelligence (AI) to drill and mine the unprocessed hydrocarbons and other goods needed to make gasoline. AI aids in the creation of algorithms that deliver precise and accurate intelligence to direct drills on both lands and the sea. Precision drilling increases the penetration rate while lowering the danger of mishaps, fires, and oil spills.

- Further, the AI-integrated sensor can now easily move inside the closed building and is not prone to collisions with walls without the help of any human controlling it. As these technologies keep improving, the application for these drones will increase, which is expected to drive the market.

- Hence, based on the above-mentioned factors, Drones' Integration with Artificial Intelligence (AI) is likely to drive the market during the forecast period.

North America to Dominate the Market

- North America was the major market for drone services and is expected to hold the largest market share during the forecast period. The United States dominates North America, and the increase in offshore oil and gas activities in the region is expected to drive the market's growth during the forecast period.

- The recent discoveries in the Gulf of Mexico deepwater are expected to increase the exploration activities at the deepwater and ultra-deepwater sites, while the reserves in the shallow water are expected to decline over the period. This, in turn, is expected to boost the demand for oil and gas drone services for deepwater activities in the United States.

- The two separate recent drilling programs, by Shell Canada and BP Canada, are complete and show no evidence of commercial discoveries. As a result, it can be concluded that the oil and gas drone services market in Canada is likely to decline, with an expected decrease in oil and gas exploration activities, provided the 12 active exploration licenses are not renewed shortly. Moreover, decommissioning of the Sable Offshore Energy and Deep Panuke projects is underway. The lack of sufficient market access, the increasing burden of regulatory uncertainty, and the decommissioning of the two projects mentioned above are likely to reduce the competitiveness of the Canadian offshore oil and gas industry in the coming years, thereby affecting the demand for oil and gas drone services.

- Moreover, there are more than 900,000 oil & gas well pads and upwards of 500,000 miles of pipeline in the United States, all of which requires regular inspection and monitoring. American Robotics anticipates a global TAM value of USD 22 billion for the oil and gas sector drone-in-a-box market. Thus, creating demand for oil and gas drone services in the forecast period.

- Therefore, the increasing investment in the country's upstream sector by foreign companies and the increase in oil and gas exploration activities are expected to drive the demand for the region's oil and gas drone services market.

Oil & Gas Drone Services Industry Overview

The oil and gas drone service market is moderately fragmented. Some of the major players in the market (in no particular order) include Terra Drones, Airobotics Ltd, PrecisionHawk, and Cyberhawk Innovations Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.2 Asia-Pacific

- 5.1.3 Europe

- 5.1.4 South America

- 5.1.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Precisionhawk

- 6.3.2 Airobotics Ltd

- 6.3.3 Cyberhawk Innovations Limited

- 6.3.4 Sky-Futures Limited

- 6.3.5 Phoenix LiDAR Systems

- 6.3.6 Viper Drones

- 6.3.7 SkyX Systems Corp.

- 6.3.8 Terra Drone Corporation