|

市場調査レポート

商品コード

1522844

自動車用車線警報システム:市場シェア分析、産業動向、成長予測(2024~2029年)Automotive Lane Warning Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用車線警報システム:市場シェア分析、産業動向、成長予測(2024~2029年) |

|

出版日: 2024年07月15日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

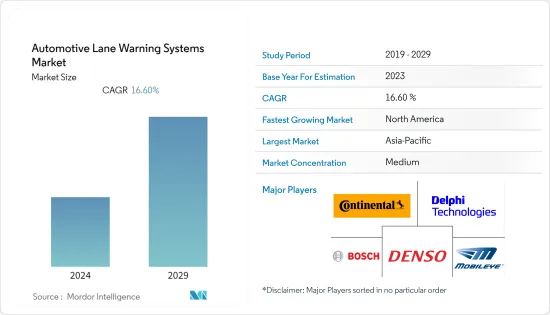

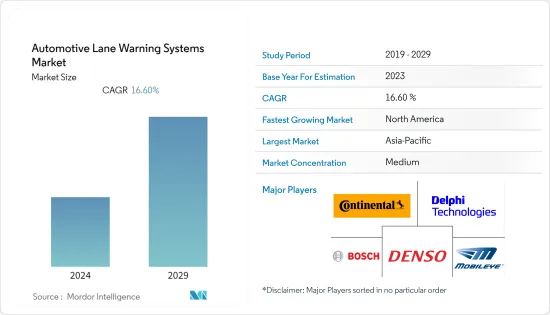

自動車用車線警報システムの市場規模は2024年に59億4,000万米ドルと推定され、2029年には147億9,000万米ドルに達すると予測され、予測期間(2024-2029年)のCAGRは16.60%で成長すると予測されます。

自動車用車線警報システム市場は、交通安全に対する意識の高まりと、自動車の高度な安全機能に対する世界各国の政府からの指令の増加により、著しい成長を遂げています。この市場はADAS(先進運転支援システム)市場の一分野であり、自動車産業のインテリジェント化、自律走行車へのシフトを反映しています。

車線警告システムの需要は、乗用車の生産台数が増加し、自動車メーカーが先進安全機能を標準装備するようになったことで高まっています。消費者の嗜好は、交通安全問題に対する意識の高まりや、こうした技術を搭載した自動車の価値が高く評価されることもあって、先進安全技術を搭載した自動車にますます傾きつつあった。

技術の進歩はこの市場で重要な役割を果たしました。カメラ、センサー、人工知能技術の革新により、車線警告システムの精度と信頼性が高まっています。これらのシステムをアダプティブ・クルーズ・コントロールや死角検出などの他の安全機能と統合することで、より包括的な安全ソリューションが生まれ、市場の成長をさらに後押ししています。

地域別では、先進安全システムの自動車への搭載を義務付ける厳しい政府規制が主な要因となって、欧州と北米の市場が採用面でリードしています。しかし、中国や日本のような国々が自動車技術やインフラ開拓に多額の投資を行っているため、アジア太平洋が急成長市場として浮上しています。

車線警告システム市場の将来は有望で、自律走行車や半自律走行車の拡大にこれらのシステムが統合されることで潜在的な成長機会が見込まれます。

自動車用車線警報システム市場の動向

乗用車セグメントが市場成長を牽引

乗用車セグメントが自動車用車線警報システム市場を牽引しており、世界の乗用車生産・販売台数の増加が大きな役割を果たしています。特に新興国では、乗用車の価格が手頃になり、入手しやすくなっているため、車線警告システムのような高度な安全機能に対する需要も高まっています。当初は贅沢品や高級オプションと見なされていたこうしたシステムは、より安全な自動車を求める消費者の要望と規制当局の圧力の両方によって、主流になりつつあった。

規制の影響は実に大きかった。欧州や北米を含む多くの地域では、新車に先進安全システムを搭載することを義務付けるか、強く奨励する厳しい安全規制を実施してきました。この規制の後押しが、乗用車セグメントにおける車線警告システムの市場を効果的に拡大しました。

高度なセンサー、カメラ、ソフトウェアの統合は、車線警告システムの有効性を向上させただけでなく、時間の経過とともに費用対効果も高めました。技術がより利用しやすくなり、製造コストが下がるにつれて、自動車メーカーは中級車を含む幅広いモデルにこうしたシステムを搭載するようになった。

交通安全問題やADAS(先進運転支援システム)の利点に対する一般消費者の意識の高まりが、購入の意思決定に影響を与えています。消費者は、車線逸脱警告のような安全機能を搭載した自動車を選ぶようになっており、これは安全運転に不可欠であると考えられています。

さらに、コネクテッドカーや自律走行車の台頭は、乗用車セグメントにおける車線警告システム市場にさらなる成長機会をもたらしました。自動車メーカーが半自律走行車や自律走行車の開発に投資するにつれ、高度な車線警告システムやその他のADAS技術の統合が極めて重要になった。

この動向は、乗用車の安全性と魅力をさらに高めるADASの革新によって継続すると予想されます。

北米は自動車用車線警報システムの主要市場

北米は自動車用車線警報システムの主要市場として台頭してきており、この動向は様々な要因が重なりあっています。同地域、特に米国とカナダは、一人当たりの自動車保有率が世界的に最も高い地域の一つであり、車線警告システムを含む先進自動車技術の広大な市場を形成しています。

これらの国々における規制の取り組みは極めて重要であり、積極的な施策によって自動車への安全技術の採用が奨励、あるいは義務化されています。このような規制の後押しは、この地域の強力な技術革新によって補完されており、この地域に拠点を置く多くの大手自動車・テクノロジー企業が、最先端の運転支援システムを継続的に開発しています。

さらに、北米では自動車の安全性に対する消費者の認識と優先順位が高いです。こうした意識は、安全技術への投資意欲と相まって、車線警告システム市場をさらに押し上げています。さらに、政府や団体によるさまざまな交通安全への取り組みが、自動車の高度な安全機能の重要性を強調しています。

北米諸国の経済が堅調なため、個人消費者と車両運行会社の双方がこうした先進技術を搭載したより新しく安全な車両に投資できるようになり、経済的要因も一役買っています。これらすべての側面が相乗的に作用して、北米は自動車用車線警報システムの分野で重要な市場となっています。

カナダ政府は、運転支援技術に関する認識を広める一方で、すべての車両の安全試験と自動運転車およびコネクテッドカーの配備を発表しました。

- 2022年5月、GMはINRIX Inc.との建設的パートナーシップを発表し、Safety View by GM Future Roads &Inrixイニシアチブの下、分析支援クラウドベース・アプリケーションを通じて米国運輸省に安全ソリューション・データを直接提供します。

- 2022年5月、トヨタ自動車はテキサス州オースティンの新興企業Invisible AIから調達したコンピューターベースのビジョン技術を北米の組立工場で使用すると発表しました。この技術は、品質、安全性、効率を向上させるために、体の動きデータを処理することができます。

上記の要因により、車両安全ソリューションの需要は増加するとみられます。これにより、2024年から2029年にかけて調査対象市場の成長が促進されると予想されます。

自動車用車線警報システム産業の概要

自動車用車線警報システム市場は、以下のようなプレーヤーによって支配されています。 Continental AG, Delphi Technologies, Mobileye, Robert Bosch GmbH, Hitachi Ltd, ZF Friedrichshafen AG, DENSO Corporation, and Magna International Inc.

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 安全意識の高まりが市場成長を促進

- 市場抑制要因

- サイバーセキュリティへの懸念が市場成長を抑制すると予測

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 機能タイプ

- 車線逸脱警報システム

- 車線維持システム

- センサータイプ

- ビデオセンサー

- レーザーセンサー

- 赤外線センサー

- 販売チャンネル

- OEM

- アフターマーケット

- 車種

- 乗用車

- 小型商用車

- 大型商用車

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Continental AG

- Delphi Technologies

- Mobileye

- DENSO Corporation

- Robert Bosch GmbH

- The Bendix Corporation

- Hitachi Ltd

- Iteris Inc.

- Nissan Motor Co. Ltd

- Volkswagen AG

- ZF TRW

第7章 市場機会と今後の動向

The Automotive Lane Warning Systems Market size is estimated at USD 5.94 billion in 2024, and is expected to reach USD 14.79 billion by 2029, growing at a CAGR of 16.60% during the forecast period (2024-2029).

The market for automotive lane warning systems was experiencing significant growth driven by heightened awareness of road safety and increasing mandates from governments worldwide for advanced safety features in vehicles. This market is a segment of the broader advanced driver assistance systems (ADAS) market, reflecting the automotive industry's shift toward more intelligent and autonomous vehicles.

The demand for lane warning systems was being bolstered by the rising production of passenger vehicles and the integration of advanced safety features as standard offerings by automobile manufacturers. Consumer preferences were increasingly leaning toward vehicles equipped with advanced safety technologies, partly due to a growing awareness of road safety issues and partly due to the higher perceived value of these technologically-equipped vehicles.

Technological advancements played a crucial role in this market. Innovations in camera, sensor, and artificial intelligence technologies were making lane warning systems more accurate and reliable. The integration of these systems with other safety features, like adaptive cruise control and blind spot detection, creates more comprehensive safety solutions, further driving the market growth.

Regionally, markets in Europe and North America were leading in terms of adoption largely due to stringent government regulations requiring the incorporation of advanced safety systems in vehicles. However, Asia-Pacific was emerging as a rapidly growing market, with countries like China and Japan investing heavily in automotive technology and infrastructure development.

The future of the lane warning systems market appeared promising, with potential growth opportunities in the integration of these systems into the expansion of autonomous and semi-autonomous vehicles.

Automotive Lane Warning Systems Market Trends

The Passenger Cars Segment is Driving the Market Growth

The passenger car segment is leading the automotive lane warning system market, with the global rise in passenger car production and sales playing a significant role. With the increasing affordability and availability of passenger cars, particularly in emerging economies, the demand for advanced safety features like lane warning systems has also escalated. These systems, initially seen as luxury or high-end options, were becoming more mainstream, driven both by consumer demand for safer vehicles and by regulatory pressures.

Regulatory influences were indeed significant. Many regions, including Europe and North America, have been implementing stringent safety regulations mandating or strongly encouraging the inclusion of advanced safety systems in new vehicles. This regulatory push effectively broadened the market for lane warning systems in the passenger car segment.

The integration of sophisticated sensors, cameras, and software not only improved the effectiveness of lane warning systems but also made them more cost-effective over time. As technology became more accessible and less expensive to produce, automakers started incorporating these systems across a wider range of models, including mid-range vehicles.

Growing public awareness about road safety issues and the benefits of advanced driver assistance systems (ADAS) is influencing buying decisions. Consumers were increasingly opting for vehicles equipped with safety features like lane departure warnings, which they viewed as essential for driving safety.

Moreover, the rise of connected and autonomous vehicles presented additional growth opportunities for the lane warning system market within the passenger car segment. As automakers invested in developing semi-autonomous and autonomous vehicles, the integration of sophisticated lane warning systems and other ADAS technologies became crucial.

This trend is expected to continue with innovations in ADAS that further enhance the safety and appeal of passenger vehicles.

North America is the Leading Market for Automotive Lane Warning Systems

North America has emerged as a leading market for automotive lane warning systems, a trend driven by a confluence of factors. The region, particularly the United States and Canada, boasts one of the highest rates of vehicle ownership per capita globally, creating a vast market for advanced automotive technologies, including lane warning systems.

Regulatory initiatives in these countries have been pivotal, with proactive measures encouraging or even mandating the adoption of safety technologies in vehicles. This regulatory push is complemented by the region's strong technological innovation, with many leading automotive and technology companies based here continually developing cutting-edge driver assistance systems.

Moreover, there is a significant consumer awareness and prioritization of vehicle safety in North America. This awareness, coupled with the willingness to invest in safety technologies, has further propelled the market for lane warning systems. Additionally, various road safety initiatives by governments and organizations have emphasized the importance of advanced safety features in vehicles.

Economic factors also play a role as the robust economies of North American countries enable both individual consumers and fleet operators to invest in newer, safer vehicles equipped with these advanced technologies. All these aspects synergistically contribute to North America's position as a key market in the realm of automotive lane warning systems.

The Canadian government announced the safe testing of every vehicle and deployment of automated and connected vehicles while spreading awareness regarding driver assistance technologies.

- In May 2022, GM announced its constructive partnership with INRIX Inc. to provide safety solutions data directly to the US Department of Transportation through its analytics-assisted cloud-based application under its Safety View by GM Future Roads & Inrix initiative.

- In May 2022, Toyota Motors announced that it would use computer-based vision technology sourced from Austin, Texas-based start-up company Invisible AI in its North American assembly plants. This technology shall be able to process body motion data to enhance quality, safety, and efficiency.

Due to the factors above, the demand for vehicle safety solutions is likely to increase. This is expected to propel the growth of the studied market between 2024 and 2029.

Automotive Lane Warning Systems Industry Overview

The automotive lane warning system market is dominated by players such as Continental AG, Delphi Technologies, Mobileye, Robert Bosch GmbH, Hitachi Ltd, ZF Friedrichshafen AG, DENSO Corporation, and Magna International Inc.

Companies are engaging in partnerships and acquisitions to develop new products and expand within the market. For instance,

- In November 2023, Honda Motor Co. Ltd unveiled its latest innovation, the Honda SENSING 360, an all-encompassing safety and driver-assistance system. This advanced technology is designed to eliminate blind spots surrounding the vehicle, aiding in preventing collisions and lessening the driver's workload during operation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Safety Awareness is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Cybersecurity Concerns is Anticipated to Restrain the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 Function Type

- 5.1.1 Lane Departure Warning System

- 5.1.2 Lane Keeping System

- 5.2 Sensor Type

- 5.2.1 Video Sensors

- 5.2.2 Laser Sensors

- 5.2.3 Infrared Sensors

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Heavy Commercial Vehicles

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies

- 6.2.3 Mobileye

- 6.2.4 DENSO Corporation

- 6.2.5 Robert Bosch GmbH

- 6.2.6 The Bendix Corporation

- 6.2.7 Hitachi Ltd

- 6.2.8 Iteris Inc.

- 6.2.9 Nissan Motor Co. Ltd

- 6.2.10 Volkswagen AG

- 6.2.11 ZF TRW