|

市場調査レポート

商品コード

1687155

地熱エネルギー- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 地熱エネルギー- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

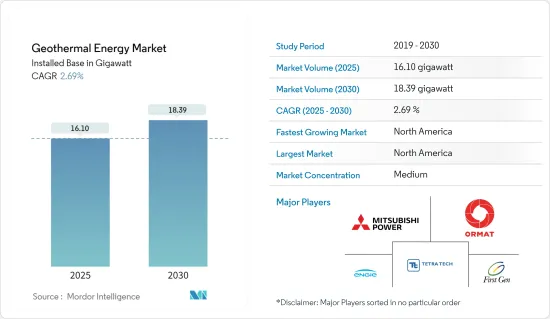

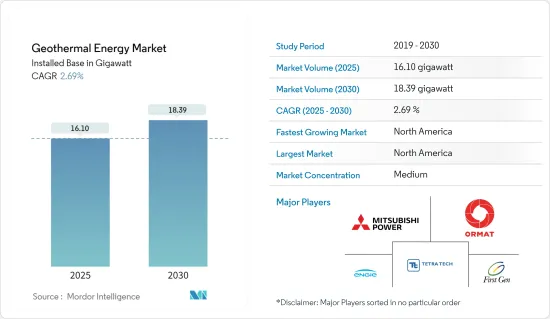

地熱エネルギー市場規模は、設置ベースで2025年の16.10ギガワットから2030年には18.39ギガワットに成長し、予測期間(2025~2030年)のCAGRは2.69%と予測されます。

主要ハイライト

- 中期的には、クリーンでエコフレンドリー資源による電力安全保障への関心の高まりや、地中熱源ヒートポンプや地域暖房を含む冷暖房システム需要の増加といった要因が、地熱エネルギー市場の成長を牽引しています。

- 一方、太陽光や風力のような代替クリーンエネルギー源は有利な市場であるため、予測期間中の市場成長の妨げになる可能性が高いです。

- サステイナブルエネルギー生産を促進するための財政的給付や税還付といった政府主導の取り組みは、予測期間中、地熱エネルギー市場に多くの成長機会を生み出すと推定されます。

- 北米は予測期間中最大の市場になると予想され、需要のほとんどは米国、カナダ、メキシコなどの国々からもたらされます。

地熱エネルギー市場動向

バイナリーサイクル地熱発電所が大きく成長する見込み

- バイナリーサイクル地熱発電所は、摂氏182度(華氏360度)以下の低温流体を組み込んでおり、二次流体からなる熱交換器を通過させています。この二次またはバイナリー流体は、地熱液を気化させ、タービンを回して発電します。

- バイナリーサイクル地熱発電所では、地熱液は直接タービンに接触しないため、他の2つの地熱技術とは異なる機能を持っています。

- バイナリーサイクル発電所の利点は、高温の地熱資源よりも中温の地熱流体の方が利用可能性が高いため、米国エネルギー省の発表によれば、バイナリーサイクル発電所は、この特性を生かした発電として普及する可能性があるということです。

- バイナリーサイクル発電所のコンポーネントには、熱交換器、膨張機、凝縮器、発電機、生産井、再圧入井、タービンが含まれます。これらの発電所の平均的な定格容量は約6MWです。逆に、二重圧力サイクル、二重流体サイクル、カリナバイナリーサイクルなどのバイナリー設計サイクルには、大きな定格容量が共存しています。

- バイナリーサイクル発電所の利点は、高温の地熱資源よりも中温の地熱流体の方が利用可能性が高いため、米国エネルギー省によれば、この特性を発電に生かすためにバイナリーサイクル発電所が普及する可能性があるということです。

- 近年、多くの新規設置が発表されており、予測期間中の地熱エネルギー市場の成長を支える可能性があります。2023年9月現在、トルコのMTNエナジー社は、ババデレ地熱発電所の2号機の環境影響評価(EIA)法を実施するためのプロセスを再度開始しました。この審査は、地域の電力需要を満たすために、11.8MWのバイナリーサイクル発電所を拡大するために行われます。

- 2023年現在、イタリア政府はトスカーナ州で提案されている10MWのバイナリーサイクル地熱発電所の開発を承諾しています。イタリア初のバイナリー発電所は2027年に稼動する予定です。32,000世帯の電力需要を満たし、最大4万トンの二酸化炭素排出を削減する可能性があります。したがって、このようなプロジェクトの開始は、予測期間におけるバイナリーサイクル発電所の活用に役立つ可能性が高いです。

- さらに、2023年には、地熱エネルギーの総設備容量は世界全体で約14,846MWとなり、2022年の1万4,653MWから増加しました。設備容量は世界中で大幅に増加しています。

- したがって、上記の要因や最近の動向から、バイナリーサイクル発電所セグメントは予測期間中に大きく成長すると予想されます。

北米が市場を独占する見込み

- 北米は地熱エネルギーの世界の主要市場の一つであり、米国は設置容量に関して地域と世界市場をリードしています。2023年には、米国で約16.5テラワット時の地熱発電が行われました。これは2022年から約0.5テラワット時の増加です。

- 国内の地熱発電所のほとんどは、地熱エネルギー資源が地表に近い西部の州とハワイ島にあります。カリフォルニア州は地熱による発電量が最も多く、北カリフォルニアのガイザーズ乾式蒸気リザーバーは世界最大の乾式蒸気フィールドとして知られています。

- さらに、カリフォルニア州には国内で最も多くの地熱発電所があります。2023年現在、カリフォルニア州には電力会社によって運営されている地熱発電所が31カ所あります。次いでネバダ州には26の地熱発電所があります。この年、米国全体の地熱発電量は164億6,000万キロワット時のピークに達しました。

- 2024年の国際再生可能エネルギー機関(International Renewable Energy Agency 2024)によると、2023年の米国の地熱発電設備容量の合計は約2674万kWでした。さらに2023年5月、Contact EnergyはMicrosoftと10年間の電力購入契約を結んだと発表しました。この契約に基づき、Contact Energyは、同社がニュージーランドに保有する51.4MWのテ・フカ・ユニット3地熱発電所で発電された再生可能エネルギー全量を供給します。Contact Energyは、2022年8月にテ・フカ・ユニット3地熱発電所を発表し、1億8,900万米ドルで建設される予定です。2023年末までに運転を開始する予定です。

- 2024年2月、米国エネルギー省の地熱技術局は、地熱システムの坑井掘削ツールや産業システムへの低温地熱利用を支援するプロジェクトに対し、最大3,100万米ドルの資金提供機会を発表しました。また、最大2,310万米ドルの資金提供により、坑内セメントとケース評価ツールに対応するプロジェクトが強化されます。

- さらに、この地域では新たなプロジェクトも計画されており、この地域の市場成長を支えるものと期待されています。例えば、2023年3月、メキシコ政府は、連邦電力委員会(CFE)の下で「地熱井掘削サービスの獲得」という入札を通じた探査プロジェクトを発表しました。

- 従って、上記の要因から、予測期間中は北米が地熱エネルギー市場を独占すると予想されます。

地熱エネルギー産業概要

地熱エネルギー市場は細分化されています。同市場の主要企業(順不同)には、Mitsubishi Power Ltd、Ormat Technologies Inc.、Engie SA、Tetra Tech Inc.、First Gen Corporationなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 地熱エネルギーの設置容量と2029年までの予測

- 最近の動向と開発

- 政府の規制と施策

- 市場力学

- 促進要因

- クリーンでエコフレンドリー資源による電力安全保障への懸念の高まり

- 地中熱源ヒートポンプを含む冷暖房システムへの需要増加

- 抑制要因

- 太陽光や風力などの代替クリーンエネルギー源に対する有利な市場機会

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資分析

第5章 市場セグメンテーション

- プラントタイプ

- 乾式蒸気プラント

- フラッシュ蒸気プラント

- バイナリーサイクル発電プラント

- 市場分析:地域別(2029年までの市場規模と需要予測(地域別))

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- ノルディック

- トルコ

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- ナイジェリア

- カタール

- エジプト

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Geothermal Power Plant Equipment Manufacturers

- Toshiba Corporation

- Ansaldo Energia SpA

- Fuji Electric Co. Ltd.

- Baker Hughes Company

- Doosan Skoda Power

- Geothermal Power Plant EPC Companies and Operators

- Mitsubishi Power Ltd

- Ormat Technologies Inc.

- Kenya Electricity Generating Company(KenGen)

- Sosian Energy Limited

- Tetra Tech Inc.

- Engie SA

- First Gen Corporation

- PT Pertamina Geothermal Energy

- Enel SpA

- Aboitiz Power Corporation

- Geothermal Power Plant Equipment Manufacturers

- 市場ランキング/シェア(%)分析

第7章 市場機会と今後の動向

- 金融給付や税還付など、政府が主導するイニシアチブの高まり

目次

Product Code: 55756

The Geothermal Energy Market size in terms of installed base is expected to grow from 16.10 gigawatt in 2025 to 18.39 gigawatt by 2030, at a CAGR of 2.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing electricity security concerns due to clean and eco-friendly resources and increasing demand for heating and cooling systems, including ground source heat pumps and district heating, are driving the growth of the geothermal energy market.

- On the other hand, the lucrative market for alternative clean energy sources like solar and wind is likely to hinder the market growth during the forecast period.

- Nevertheless, government-undertaken initiatives such as financial benefits and tax refunds to promote sustainable energy production are estimated to generate numerous growth opportunities for the geothermal energy market during the forecast period.

- North America is expected to be the largest market during the forecast period, with most of the demand coming from countries like the United States, Canada and Mexico, etc.

Geothermal Energy Market Trends

The Binary Cycle Power Plants Segment is Expected to Witness Significant Growth

- The binary cycle geothermal power plants incorporate low-temperature fluids below 182 degrees Celsius (or 360 degrees Fahrenheit) that are made to pass through a heat exchanger consisting of a secondary fluid. This secondary or binary fluid vaporizes the geothermal liquid and propels the turbine to produce electricity.

- In a binary-cycle geothermal power plant, the geothermal fluid does not directly come into contact with turbines, which makes it function differently from the other two geothermal technologies.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- The components of a binary cycle power plant include a heat exchanger, expander, condenser, generator, production well, reinjection well, and turbine. The average rated capacity of these power plants is around 6 MW. Conversely, large rated capacities co-exist with binary design cycles such as dual pressure, dual-fluid, and Kalinabinary cycles.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- Many new installations have been announced in recent years, which may support the growth of the geothermal energy market during the forecast period. As of September 2023, MTN Energy in Turkey re-initiated the process to conduct an Environmental Impact Assessment (EIA) method for the 2nd unit of the Babadere geothermal power plant. The examination is done to expand 11.8 MW of binary cycle plant to fulfill the electricity requirement of the region.

- As of 2023, the government of Italy consented to develop the proposed 10 MW binary cycle geothermal plant in Tuscany. Italy's first-ever binary cycle plant is expected to become active in 2027. It holds the potential to fulfill the power requirement of nearly 32,000 households and curtail carbon emissions of up to 40,000 tonnes. Hence, the onset of such projects could likely help in utilizing binary cycle plants in the forecast period

- Moreover, in 2023, the total geothermal energy installed capacity globally was around 14,846 MW, increasing from 14,653 MW in 2022. The capacity is increasing significantly across the world.

- Therefore, based on the abovementioned factors and recent developments, the binary cycle power plants segment is expected to grow significantly during the forecast period.

North America is Expected to Dominate the Market

- North America is one of the leading markets for geothermal energy worldwide, with the United States leading the regional and global markets regarding installed capacity. In 2023, approximately 16.5 terawatt hours of geothermal electricity were generated in the United States. This was an increase of roughly 0.5 terawatt hours from the 2022.

- Most of the geothermal power plants in the country are in the western states and the island state of Hawaii, where geothermal energy resources are close to the Earth's surface. California generates the most of the electricity from geothermal energy, whereas Northern California's Geysers dry steam reservoir is the world's largest known dry steam field.

- Moreover, California is home to the greatest number of geothermal power plants in the country. As of 2023, there were 31 such plants operated by electric utilities in the state. Nevada followed, with 26 geothermal power plants. That year, geothermal electricity generation across the United States reached a peak of 16.46 billion kilowatt hours.

- According to the International Renewable Energy Agency 2024, the total geothermal installed capacity in United States was around 2,674 MW in 2023. Moreover, in May 2023, Contact Energy announced that the company had signed a 10-year Power Purchase Agreement with Microsoft. Under the contract, Contact Energy will supply all the renewable energy attributes generated by the company's 51.4 MW Te Huka Unit 3 geothermal power station, New Zealand. Contact Energy announced the Te Huka Unit 3 geothermal power station in August 2022 and will be built at a cost of USD 189 million. The plant is expected to commence operations by the end of 2023.

- In February 2024, the United States Department of Energy's Geothermal Technologies Office announced a funding opportunity of up to USD 31 million for projects that support geothermal systems wellbore tools as well as the use of low-temperature geothermal heat for industrial systems. Also, funding of up to USD 23.1 million will enhance projects to address downhole cement and casing evaluation tools.

- Furthermore, new projects are also planned in the region, which is expected to support the region's market growth. For example, in March 2023, Also, the government in Mexico announced a exploratory project under Federal Electricity Commission (CFE) through a tender called 'Acquisition of Geothermal Well Drilling Services.

- Therefore, based on the above factors, North America is expected to dominate the geothermal energy market during the forecast period.

Geothermal Energy Industry Overview

The geothermal energy market is semi-fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Power Ltd, Ormat Technologies Inc., Engie SA, Tetra Tech Inc., and First Gen Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Geothermal Energy Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Security Concerns Due to Clean and Eco-Friendly Resources

- 4.5.1.2 Increasing Demand for Heating and Cooling Systems, Including Ground Source Heat Pumps

- 4.5.2 Restraints

- 4.5.2.1 Lucrative Market Opportunities for Alternative Clean Energy Sources Like Solar and Wind

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Dry Steam Plants

- 5.1.2 Flash Steam Plants

- 5.1.3 Binary Cycle Power Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Spain

- 5.2.2.5 NORDIC

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.3.1.1 Toshiba Corporation

- 6.3.1.2 Ansaldo Energia SpA

- 6.3.1.3 Fuji Electric Co. Ltd.

- 6.3.1.4 Baker Hughes Company

- 6.3.1.5 Doosan Skoda Power

- 6.3.2 Geothermal Power Plant EPC Companies and Operators

- 6.3.2.1 Mitsubishi Power Ltd

- 6.3.2.2 Ormat Technologies Inc.

- 6.3.2.3 Kenya Electricity Generating Company (KenGen)

- 6.3.2.4 Sosian Energy Limited

- 6.3.2.5 Tetra Tech Inc.

- 6.3.2.6 Engie SA

- 6.3.2.7 First Gen Corporation

- 6.3.2.8 PT Pertamina Geothermal Energy

- 6.3.2.9 Enel SpA

- 6.3.2.10 Aboitiz Power Corporation

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Government-Undertaken Initiatives such as Financial Benefits and Tax Refunds