|

市場調査レポート

商品コード

1851231

分子量マーカー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Molecular Weight Marker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 分子量マーカー:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月22日

発行: Mordor Intelligence

ページ情報: 英文 134 Pages

納期: 2~3営業日

|

概要

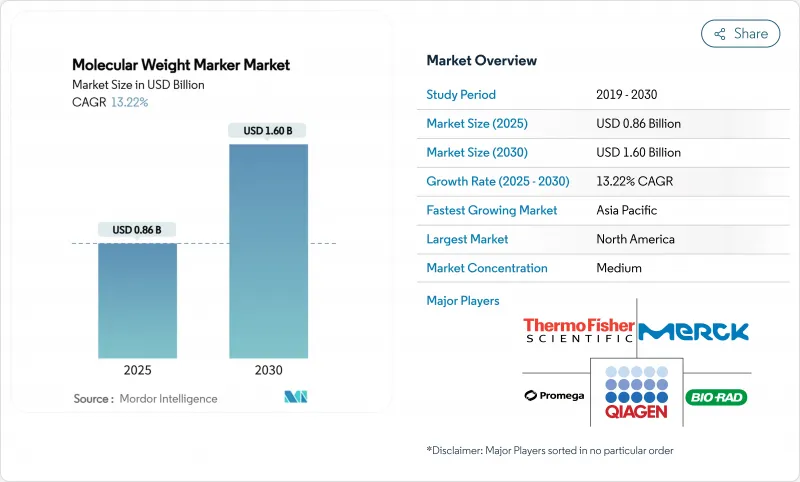

分子量マーカーの世界市場規模は2025年に8億6,000万米ドルと評価され、2030年には16億米ドルに達すると予測されています。

この急速な進展は、ゲノミクスの研究開発資金、分子診断の量的拡大、高度に標準化されたラダーの需要を高める厳格な細胞・遺伝子治療品質管理プロトコルの収束を反映しています。AIに対応したブロット・イメージング・プラットフォームは、一貫した機械読み取り可能なシグナルを提供する蛍光タンパク質やDNAラダーへとラボの嗜好を変えつつあります。北米のイノベーションエコシステムが早期の採用を支えているが、アジア太平洋の野心的な集団規模のゲノミクスプログラムが最大の数量増を生み出しています。ベンダーは、従来の電気泳動消耗品に自動化、インフォマティクス、すぐに使えるケミストリーをバンドルした垂直統合型の製品で対応しており、熟練労働者の不足や規制の複雑さを緩和しています。こうした競合の動きは、分子量マーカー市場を新たなマルチオミクス・ワークフローの中心に位置づけ、POC(ポイントオブケア)診断、マイクロ流体デバイス、連続バイオプロセスが概念実証から商業展開へと移行する中で、新たな収益プールを創出します。

世界の分子量マーカー市場の動向と洞察

ゲノミクスとプロテオミクスにおける世界的研究開発費の増加

政府資金によるゲノミクス・プログラムは、シーケンシングアウトプットを拡大し、分析ワークフローを標準化しています。日本では5年以内に10万個のがんゲノムをプロファイリングする計画があり、研究機関間でデータを調和させるために一貫した分子量マーカーが必要とされています。インドの10,000ゲノムイニシアチブはCARE倫理フレームワークを採用しており、コミュニティの監視と両立する高精度のDNAラダーを支持しています。米国国家ナノテクノロジー計画は、2024年に21億6,000万米ドルを計上し、その一部は、ナノを利用した薬剤設計のための分子量標準などのバイオテクノロジーツールの資金源となっています。機械学習パイプラインは、信頼性の高いバイオマーカー発見モデルを訓練するために均一な入力品質を必要とするため、AI中心の研究予算は需要をさらに増幅します。

分子診断の拡大(PCR/NGS)

POCと分散型ラボはスループットを高め、ターンアラウンドタイムを短縮しています。PCBベースのリアルタイムPCRチップは、+-0.1℃の精度で8℃/秒で加熱し、迅速なランに合わせた低域分子量ラダーに依存するシングルユースアッセイを可能にします。Dragonfly LAMP-LAMPプラットフォームは、持ち運び可能なフォームファクターで96.1%のウイルス検出感度を達成し、フィールド条件下で安定性を維持するプレステインドラダーの需要を喚起します。myeloMATCH試験のような高スループットのNGSワークフローでは、当日報告する前にライブラリーの完全性を確認するために、堅牢なDNAラダーが必要となります。マイクロ流体"ラボ・オン・ア・チップ"システムは、核酸分析を1検査あたり9.5米ドルで28分以内に完了するため、サプライヤーは、コスト重視の診断経済に合わせて、マーカーをシングルユースカートリッジにパッケージするよう促しています。

熟練電気泳動技術者の不足

米国の分子ラボでは、2024年に13.4%の未充足のポジションが報告され、検査スループットを低下させ、自動化への投資を促しています。採用課題は人件費を上昇させるため、管理者は前処理工程を削減するシングルチューブ、プレステンドラダーを好みます。認証プログラムを拡大するための学術的な協力関係が生まれつつあるが、パイプラインが安定するには数年かかると思われます。欧州では、退職の波が赤字をさらに深刻化させており、特に地方の病院では、移動距離が採用候補者の足かせとなっています。

セグメント分析

mRNAワクチンパイプラインが成熟し、次世代シーケンサー(NGS)プロトコルがユビキタスになるにつれ、RNAマーカーは2030年までのCAGRが14.25%と最も速いです。正確なポリ(A)テールとキャッピング効率の検証は、100~10,000 ntの広い範囲をカバーする明確に定義されたラダーに依存しており、治療開発者の間で採用が進んでいます。DNAマーカーは、PCR、クローニング、サザンブロットのルーチンが定着しているため、2024年の分子量マーカー市場シェアは51.51%を維持した。しかし、合成生物学プログラムにおけるCRISPRによるゲノム改変を解決する高分子量フォーマットへと需要がシフトしています。タンパク質マーカーは、サーモフィッシャーによるOlink社の買収に代表されるように、プロテオミクスの資金増加の恩恵を受けています。Olink社は、ハイスループットスクリーニングパイプラインに5,300のバイオマーカーを追加し、校正済みタンパク質ラダーのニーズを活性化しました。

商業的な研究室では、染色しなくても見えるプレステインドタンパク質ラダーを重宝しており、1回のランに30分節約でき、技術者の帯域幅が乏しい研究室の生産性を向上させています。構造プロテオミクスを研究する学術グループは、マルチプレックスイメージングシステムに対応するため、蛍光デュアルチャンネルラダーの採用を増やしています。一方、RNA研究者はラダーの完全性を維持するためにヌクレアーゼフリーのパッケージングを優先しており、サプライヤーは凍結融解による劣化をなくすフォイル包装のシングルユースバイアルへのシフトを促しています。

プロテオミクス・アプリケーションはCAGR 14.85%で進展しており、核酸ワークフローの歴史的優位性を狭めています。ウェスタンブロッティングは依然として主要な使用事例であるが、トップダウン・プロテオミクス、リボソーム・プロファイリング、サーマルシフト・アッセイなどの新しい分野では、複雑なマトリックスでのサイズ確認のためにラダーが使用されるようになっています。AI解析と統合された自動ゲル抽出ロボットは、サンプルバンドの切り出し時間を40%削減し、実験あたりのラダー消費量を増加させました。核酸アッセイは分子量マーカー市場規模の60.53%のシェアを維持し、呼吸器系ウイルス監視のために持続しているパンデミック時代のPCR能力によって支えられています。

POC環境では、15分のレーザー加熱PCRサイクルは、急速な温度遷移下で予測可能な移行をするスナップ冷却ラダーを必要とします。サザンとノーザンブロッティングは、それぞれエピジェネティクスとロングリードのバリデーション研究において重要であり続けるが、配列直接検出は一部の研究者を引き離し続けています。そのため、研究者は在庫を合理化するために、核酸とタンパク質分析の両方で重複するサイズ範囲をカバーする汎用ラダーを好みます。

地域分析

北米は2024年に分子量マーカー市場の38.32%を占め、成熟したバイオテクノロジー・エコシステム、連邦政府の研究開発割り当ての持続、AI主導のラボ自動化の早期導入に支えられています。2024年の国家ナノテクノロジー計画予算は21億6,000万米ドルで、ナノフォーミュレーション研究のためのサイズ標準を含む分子分析ツールの資金源となっています。サーモフィッシャーの31億米ドルのOlink統合に代表されるM&Aは、消耗品ポートフォリオを統合し、ハイスループットのプロテオミクスにリソースを振り向ける。しかし、分子診断ラボの欠員率は13.4%で、施設は手作業を最小限に抑えるターンキーラダーの採用を余儀なくされています。バッチ均一性に関するFDAガイダンスは品質への期待をさらに高め、検証済みでロットの安定した製品を持つサプライヤーを優遇しています。

アジア太平洋地域は、2030年までのCAGRが14.71%と最も急成長している地域であり、政府主導の人口ゲノム解析と国産ワクチン製造の台頭に支えられています。日本の10万人ゲノム計画やインドのCARE主導の1万人ゲノム構想は、ラボ間の標準化を求め、高精度DNAラダーの需要を押し上げます。中国の肺がんプロファイリングは生殖細胞系列と体細胞突然変異のデータを統合するもので、DNAとRNAのデュアルサイズラダーの用途を広げています。この地域のメーカーは、コスト最適化されたPOCプラットフォームに注力しており、湿度の高い気候での輸送に耐えるコンパクトな凍結乾燥マーカーに対する並行した要求を刺激しています。

欧州は、共同研究ネットワークと持続可能性の重視から着実な成長を続けています。IVDRの実施により品質基準が統一され、強固な文書化体制を持つ企業が報われます。一流大学のAI支援ゲル分析プロジェクトは、自動イメージングパイプラインと互換性のある蛍光ラダーの需要を増大させています。環境指令により、サプライヤーは有害色素を削減し、EUグリーンディール目標に沿うよう、プレステンド製品の植物由来色素へのシフトを促されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ゲノミクスとプロテオミクスの世界的研究開発費の増加

- 拡大する分子診断薬ボリューム(PCR/NGS)

- すぐに使えるプレステンドラダーの普及

- 細胞・遺伝子治療のQCプロトコルには高精度のDNAラダーが必要

- Pocデバイスのミニゲルプラットフォームが低域マーカーの需要を増加させる

- AI主導のブロットイメージングソフトウェアが蛍光タンパク質ラダーの必要性を押し上げる

- 市場抑制要因

- 電気泳動技術者の不足

- 厳しい規制グレードの認証(IVDR、USP)

- 医薬品QAにおけるバッチ変動の再現性監査のきっかけ

- マイクロ流体&キャピラリー電気泳動システムへのシフト

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品別

- DNAマーカー

- タンパク質マーカー

- RNAマーカー

- 用途別

- 核酸用途

- PCR

- ノーザンブロッティング

- サザンブロッティング

- 分子クローニング

- その他の核酸用途

- プロテオミクス用途

- ウェスタンブロッティング

- ゲル抽出

- その他のプロテオミクス用途

- 核酸用途

- タイプ別

- 染色済みマーカー

- 無染色マーカー

- 特殊/蛍光マーカー

- エンドユーザー別

- 学術・研究機関

- 製薬・バイオテクノロジー企業

- 研究受託機関

- 臨床検査・診断ラボ

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- F. Hoffmann-La Roche AG

- Merck KGaA(MilliporeSigma)

- New England Biolabs

- Promega Corporation

- QIAGEN N.V.

- Takara Bio Inc.

- VWR International(Avantor)

- HiMedia Laboratories

- GeneDireX Inc.

- BioVision Inc.

- GenScript Biotech Corp.

- Abcam plc

- Cytiva(Danaher)

- SMOBIO Technology

- Analytik Jena GmbH

- Norgen Biotek Corp.

- Boster Biological Technology