|

市場調査レポート

商品コード

1851293

セキュリティロボット:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Security Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| セキュリティロボット:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月06日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

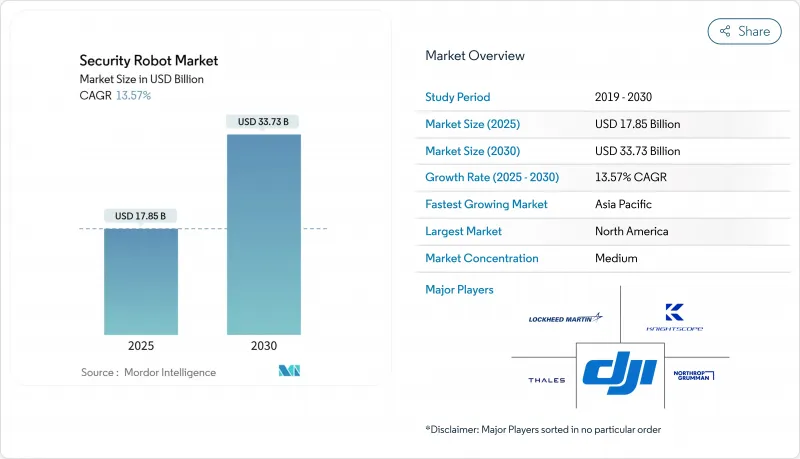

セキュリティロボット市場は2025年に178億5,000万米ドルに達し、2030年には337億3,000万米ドルに拡大すると予測されています。

需要が高まっているのは、自律型プラットフォームがAIの知覚、高度なセンサー、全領域のナビゲーションを融合させ、継続的に稼働し、脅威が顕在化する前に予測するシステムになっているためです。防衛施設、空港、発電所、商業施設などでは、固定カメラや巡回警備員から、24時間体制で監視し、誤報率を下げ、人件費を削減するロボットへの置き換えが進んでいます。さらに、サブスクリプション価格によって初期投資が不要になり、重要インフラへの侵入検知を国家が義務付け、規制の進展によってドローン用の見通し外空域(BVLOS)が開放されたことで、成長はさらに強化されています。一方、サイバーハードニングの格差、断片化された周波数政策、顔認証に対する国民の不安は、ベンダーが技術設計と透明性のあるガバナンスを通じて管理しなければならない逆風を生み出しています。

世界のセキュリティロボット市場の動向と洞察

AI対応知覚スタックの展開による誤警報率の低下

マルチスペクトルカメラとコンピュータビジョンモデルを融合したサーマルイメージングは、空港や原子力発電所でのオペレーターの作業負担を軽減し、迷惑アラームを40%削減しました。NVIDIAのCosmosプラットフォームは、文脈を解釈するVision-Language-Actionモデルを提供し、ロボットが正常な活動と本物の脅威を区別できるようにしています。これらのスタックを統合したエネルギー企業は、オペレータが正確な座標と脅威の分類を受け取ることができるため、事故対応時間を50%短縮することができました。優れた検知精度により、ロボットは実験的な試用からミッションクリティカルな役割へと移行します。

アジアにおける安全パトロールのための民間BVLOSドローン通路の拡大

オーストラリアと日本は現在、検知・回避システムによって安全性を維持しながら、ドローンをパイロットの視界外に置くリスクベースの規制枠組みを通じて、BVLOSパトロールを許可しています。従来は数十人の警備員が必要だった数キロメートルの周囲を1機で確保できるため、カバー範囲が拡大し、1ヘクタールあたりのコストが削減されます。インド太平洋全域の政府は、広大な海岸線や遠隔地の施設に自律型パトロールが不可欠と見ており、地域の需要に拍車をかけています。

マルチロボット艦隊を制限する断片的な無線周波数規制

EU加盟国はそれぞれ異なる周波数帯を割り当てているため、ベンダーは国ごとに無線機をカスタマイズせざるを得ず、規模の経済性が損なわれています。また、2024年のEU AI法は、セキュリティロボットを高リスクのシステムに分類し、コンプライアンスに関する事務作業を増やしてコストを膨らませています。こうしたハードルは小規模プロバイダーの意欲をそぎ、特に国境を越えた施設への複数国での導入を遅らせる。

セグメント分析

UAVは、迅速な配備と広域カバーにより、境界侵犯時の対応時間を短縮できるため、2024年のセキュリティ・ロボット市場の54%を占める。プラットフォームは、電気光学、赤外線、音響センサーを統合し、昼夜を問わず侵入者を追跡します。UAVパトロールに起因するセキュリティ・ロボット市場規模は、BVLOSルールが成熟するにつれて2030年まで着実に拡大すると予測されています。インドとオーストラリアの海軍も、競合する沿岸にまで監視範囲を広げる超大型自律型水中ロボット(XLUV)の需要を後押ししています。

UGVはCAGR15.2%と最も急成長しているセグメントであるが、これは屋内モール、倉庫、データセンターが、空中飛行が現実的でない地上レベルでの持続的な監視を必要としているためです。盗難に悩む小売業者は、管理室にリアルタイムで映像を配信し、音声で抑止のアナウンスを発する小型UGVを採用しています。5Gでリンクすれば、複数のロボットがパトロールを調整し、死角を減らすメッシュを作ることができます。ベンダーは、ライダーベースのSLAMとクラウドホスティングAIで自律性を強化し、検知、分類、対応アクションのループを強化します。ハイブリッド水陸両用ロボットとAUVは、港湾やオフショアプラットフォーム周辺に特化したニッチを開拓し、陸海の境界を越える脅威に対処します。

知覚センサー、計算モジュール、頑丈な筐体は依然として製造コストが高いため、ハードウェアが2024年の売上高の68%を占める。ライダーユニット、サーマルカメラ、エッジGPUが部品表の大半を占め、当面の売上を支えます。しかし、エンドユーザーが運用費モデルに軸足を移しているため、サービスがCAGR 18.9%で先行しています。RaaSバンドルは、ロボット、ソフトウェア、フィールドサポートを複数年契約で提供するもので、顧客は減価償却の心配から解放されます。2024年、ナイトスコープは、K5の全機種をv5構成にアップグレードした場合、顧客の増分コストがゼロであることを実証し、サブスクリプション・サービスの価値提案を明確にしました。

ソフトウェアとAIスタックは、高度な分析、自然言語インターフェース、統合APIをアンロックする年間ライセンスを通じて、粘り強い収益を生み出します。長期的には、これらのデジタルレイヤーはハードウェアよりも高いマージンを得ることができます。クラウドダッシュボードにより、セキュリティ責任者は分散したロボットフリートを監視し、インシデント映像のフォレンジックを実行し、アルゴリズムの更新を無線でプッシュすることができ、ユーザーをベンダーのエコシステムに結び付け、対応可能なセキュリティロボット市場全体を拡大する好循環を生み出します。

セキュリティロボット市場レポートは、ロボットのタイプ(無人航空機、無人地上車両、自律型、その他)、コンポーネント(ソフトウェア、サービス)、エンドユーザー(防衛・軍事、住宅、その他)、用途別(スパイ、爆発物検知、パトロール、その他)、地域別(北米、欧州、その他)に業界を分類しています。市場規模および予測は金額(米ドル)で提供されます。

地域別分析

北米は、他の追随を許さない防衛予算、早期のBVLOS法制化、ロボット新興企業へのベンチャー資金提供などに支えられ、2024年の売上の40%を稼ぎ出しました。米国だけでも、ショッピングモール、企業キャンパス、自治体の駐車場などに1,200台以上の自律型パトロールユニットが配備されています。Knightscopeの導入により、数カ月以内に事件が最大50%削減され、中堅都市が戦力増強としてフリート部隊を試験的に導入することを納得させました。カナダとメキシコは、国境やエネルギー回廊に同様のソリューションを採用し、地域規模の優位性を強化しています。

アジア太平洋地域は、長距離ドローンによるパトロールを許可する規制当局の働きかけと、急増する海軍予算のおかげで、CAGRが最も高い15.4%を記録しています。オーストラリアの1億4,000万米ドルを投じたゴーストシャークXLUUV計画は海底ロボット投資の模範であり、中国は深センの街頭で市民と対話する人型警察ロボットを披露しています。インド海軍は、対潜水艦戦用に12台の国産XLUUVを計画しており、紛争海域での海洋領域認識に対する需要の高まりを裏付けています。

欧州は着実に前進しているが、複雑なAIや周波数規制のためにプロジェクトのスケジュールが延び延びになっています。タレスの18億ポンドの海上センサー契約や、QinetiQの1億6,000万ポンドの指向性エネルギー・プログラムなど、注目度の高い防衛イニシアティブが勢いを維持しています。それでも、周波数帯域の分断が国境を越えたシームレスなマルチロボットの協調を妨げており、インテグレーターは国ごとに通信システムを調整する必要に迫られています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場促進要因

- AI対応知覚スタックの展開により、重要インフラの誤警報率が低下(北米と欧州)

- アジアにおける安全保障パトロールのための民間BVLOSドローン通路の拡大

- 中東のエネルギー資産における境界侵入検知の義務化

- 米国の商業用不動産事業者によるロボットサービス(RaaS)の採用

- 小売店の「シュリンク」危機をきっかけに屋内UGVの需要が加速(米国と英国)

- インド太平洋における自律型水中ISRに対する海軍予算の増加

- 市場抑制要因

- マルチロボット艦隊を制限する断片的な無線周波数スペクトル規制(EU)

- 自治体配備の顔認識パトロールボットに対する市民の反発(欧州)

- 石油化学現場向け高耐久性オールテレーンプラットフォームの高い総コスト(中東)

- なりすましや妨害行為とC2リンクを暴露するサイバー・ハードニング・ギャップ(グローバル)

- バリュー/サプライチェーン分析

- 規制と標準化の展望

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- 無人地上走行車(UGV)

- 自律型水中ロボット(AUV)

- ハイブリッド/水陸両用ロボット

- コンポーネント別

- ハードウェア

- ソフトウェアとAIスタック

- サービス(インテグレーション、RaaS、MRO)

- エンドユーザー別

- 防衛・軍事

- 政府・法執行

- 商業・産業施設

- 住宅および個人邸宅

- 用途別

- パトロールと監視

- 爆発物探知・処理

- スパイと偵察

- 捜索救助/災害対応

- 火災・危険環境対応

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 戦略的な動きとパートナーシップ

- 市場シェア分析

- 企業プロファイル

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Thales SA

- BAE Systems plc

- Leonardo S.p.A.

- Elbit Systems Ltd.

- AeroVironment Inc.

- Knightscope Inc.

- SZ DJI Technology Co. Ltd.

- SMP Robotics

- Boston Dynamics Inc.

- Teledyne FLIR LLC

- Kongsberg Gruppen

- QinetiQ Group plc

- RoboTex Inc.

- Recon Robotics Inc.

- Cobalt Robotics Inc.

- Shield AI

- G4S plc(Allied Universal)

- Magos Systems

- DroneSense Inc.