|

市場調査レポート

商品コード

1640498

製造業におけるモノのインターネット(IoT)-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Internet-of-Things (IoT) In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 製造業におけるモノのインターネット(IoT)-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

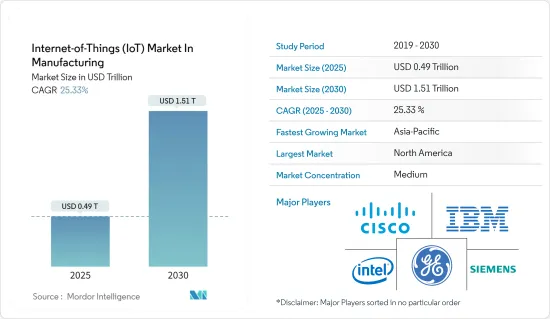

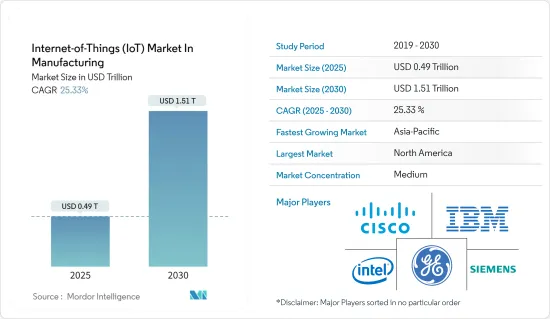

製造業におけるモノのインターネット(IoT)市場は、2025年の4,900億米ドルから2030年には1兆5,100億米ドルに成長し、予測期間(2025~2030年)のCAGRは25.33%となる見込みです。

過去20年間で、トレーサビリティと透明性に対する要求が高まり、企業は製品の生産に関わるプロセスを透明化するようになりました。IoTデバイスによるデータ収集と分析は、製造業者にとってプロセス全体をシームレスにします。

主要ハイライト

- IoTの成長に拍車をかけている要因には、予防保全の重視、生産効率の向上、製造インフラ管理の合理化などがあります。製造業者はIoTのおかげで、これまでにない可視性、洞察力、制御力を手に入れました。生産手順の合理化、ダウンタイムの削減、作業場の安全性の向上、予知保全の実現により、この技術は産業部門を完全に変革する可能性を秘めています。

- 生産現場、サプライチェーン、製品にネットワーク化されたセンサの数が増えるにつれ、製造業者は機械、システム、資産、モノが自動的かつリアルタイムで相互に会話する新世代のシステムに移行しつつあります。コネクテッドデバイスの普及は、バリューチェーン全体を通じて、複数の製造業やサプライチェーンのセグメントで適用可能性を見出しています。

- 製造業におけるIoTは、IoTデバイスが自動的に開発サイクルを追跡し、倉庫や在庫を把握するため、工場での生産フローを助けることができます。IoTデバイスへの投資が過去数十年で急増した理由の1つです。製造、物流、輸送におけるIoTは成長すると考えられます。

- IoTは製造業を大幅に改善する先進技術として広く認知されています。センサ、処理装置、通信、作動装置など、あらゆる産業部門のコンポーネントを統合することができます。この完全に統合されたスマートサイバー・フィジカルシステムは、新たな製造市場と商業的展望を生み出し、第4次産業革命への道筋をつける。産業に大きな可能性をもたらします。

製造業におけるモノのインターネット(IoT)市場動向

サプライチェーンとロジスティクス管理アプリケーションが市場の成長を促進

- RFIDやGPSを含むモバイル機器やセンサの導入により、在庫や倉庫の資産を追跡するサプライチェーンに大きな変化が生じています。

- モバイル技術により、企業は設備、在庫、業務をモニタリングできるようになりました。サプライチェーン全体にわたるリアルタイムのデータを提供することで、アセットインテリジェンスは企業の専門知識と能力を高めることを可能にします。これらのソリューションは輸送ロジスティクス産業の発展を支えてきましたが、モノのインターネット(IoT)のような実現技術と組み合わせることで、さらに多くの資産インテリジェンスを提供し、ユーザーがより賢明な意思決定を行えるようになります。

- 物流センター、倉庫、ヤードは、サプライチェーンの最も重要なエコシステム部分です。企業がこれらのコンポーネントのパフォーマンスを向上させることができれば、業務の効率も向上します。物流産業はますますIoTに依存するようになり、倉庫はクラウドを利用して在庫、車両、設備を追跡するようになると考えられます。RFIDタグを介して接続された多数の機械がこれを可能にします。荷物やパレットはローカルレベルで相互に作用し、企業ベースのサーバーは世界のレベルでそれらの動きや移動の進捗状況を継続的にモニタリングします。

- RFIDタグのような追跡装置を使用して、生産、賞味期限、製造日、アフターセールスの状況、保証期間に関する情報を収集することで、製造中のサプライチェーンのモニタリングをより効果的に行うことができます。

- SAS Instituteによると、製造業から最も恩恵を受ける可能性があるのは英国で、IoTは経済全体の約40億3,200万英ポンドを占めます。同様に、他の経済圏もサプライチェーンの自動化に多額の投資を行い、製造業全体のIoT導入を促進すると予想されます。

北米が最大市場

- 製造業におけるIoT市場は主に北米が支配的です。この地域には米国やカナダなどの新興経済諸国があり、市場関連の研究開発活動に多額の投資を行っているため、新技術の開拓に貢献しています。モビリティ、ビッグデータ、IoTといった動向技術の早期導入により、製造業者はIoT技術を自社のプロセスに統合することを熱望しています。

- コネクテッドデバイスとデータフローは、すでに製造業に応用されています。そのため、インフラコストが削減されることで、納期が早まることが期待できます。競合を維持するため、製造業者はIoTと分析を活用してビジネスを運営し、改善しています。米国では、約35%の製造業者がスマートセンサから生成されたデータを収集・利用して製造プロセスを強化しています。

- ある調査によると、製造業者の約34%が、米国の製造業者は業務にIoTを導入する必要があると考えています。製造業者にとってIoTは、ソフトウェア、クラウドコンピューティング、分析ツールが組み合わされ、さまざまなソースからの生データを意味のある予測に変え、使いやすいインターフェースで表示するエコシステムとなっています。今後5年間で、オートメーションセグメントの接続機器数は50台増加すると予想されています。

- 北米は、その技術力、強固なインフラ、多様な産業、支援エコシステムにより、モノのインターネット(IoT)の製造セグメントで世界最大の市場としてリードしています。同地域が技術革新とデジタルトランスフォーメーションにおける優位性を維持し、世界最大のIoT市場としての地位をさらに強化していることから、製造業におけるIoTの利用は今後も拡大すると予想される、

製造業におけるモノのインターネット(IoT)産業概要

製造業におけるモノのインターネット(IoT)市場は、まとまりがあり首尾一貫しています。インダストリー4.0以降の市場は、企業が製造装置のイネーブラーとしてIoTを選択するようになり、より魅力的なものになり始めています。さらに、市場はセグメント化に傾いています。同市場の主要企業としては、Cisco Systems Inc.、General Electric、Intel Corporation、IBM Corporation、AT&T Inc.、Qualcomm、Siemens AGなどが挙げられます。

- 2022年6月-LabOps Intelligence技術プラットフォームをリードするElemental Machinesと次世代製造実行システム(MES)を開発するMasterControlは、2つの最先端技術を活用した戦略的パートナーシップを発表し、手作業によるデータ収集の自動化、データ整合性の強化、コンプライアンスの保証、細胞治療や遺伝子治療のような先進的生物製剤の生産加速においてバイオメーカーを支援します。

- 2022年5月-RFIDとデジタルIDソリューションの世界最大のサプライヤーであるAvery Dennison CorporationとモノのインターネットのパイオニアであるWilIoTは、IoTを次のレベルに拡大し、人々と環境に利益をもたらすIoTの新時代を切り開くための戦略的提携を発表しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の利害関係者分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場力学

- 市場促進要因

- データ分析の急成長と技術的進歩

- 低運用コストでのサプライチェーン管理とロジスティクスの改善

- 市場抑制要因

- 標準化されたインタフェースの欠如、統合と拡大性の制限

- セキュリティとプライバシーの問題

- 機会

- スマートマニュファクチャリングの未来に不可欠なIoTとビッグデータの融合

- COVID-19がデータセンターサービス市場に与える影響

第6章 主要技術投資

- クラウド技術

- 人工知能

- サイバーセキュリティ

- デジタルサービス

- 産業施策

第7章 市場セグメンテーション

- ソフトウェア別

- アプリケーションセキュリティ

- データ管理と分析

- モニタリング

- ネットワーク管理

- その他のソフトウェア

- 接続性別(定性分析)

- 衛星ネットワーク

- セルラーネットワーク

- RFID

- NFC

- Wi-Fi

- その他の接続性

- サービス別

- プロフェッショナル

- システム統合と展開

- マネージド

- その他

- 用途別(定性分析)

- プロセス最適化

- 予知保全

- 資産管理

- 労働力管理

- 緊急事態・事故管理

- 物流・サプライチェーン管理

- 在庫管理

- 産業別

- 自動車

- 食品・農業機器

- 産業機器

- 電子・通信機器

- 化学・材料機器

- その他のエンドユーザー産業別

- ***地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- アジア

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 北米

第8章 競合情勢

- 企業プロファイル

- Cisco Systems Inc.

- General Electric

- Intel Corporation

- IBM Corporation

- Verizon Communication Inc.

- AT&T Inc.

- Qualcomm

- Siemens AG

- Microsoft Corporation

- SAP SE

第9章 投資分析

第10章 市場機会と今後の動向

The Internet-of-Things Market In Manufacturing Industry is expected to grow from USD 0.49 trillion in 2025 to USD 1.51 trillion by 2030, at a CAGR of 25.33% during the forecast period (2025-2030).

With the increasing demand in the last two decades for traceability and transparency, companies have started making the processes involved in the production of their products transparent. Data collection and analysis through IoT devices make the whole process seamless for manufacturers.

Key Highlights

- Some of the drivers that have fueled the IoT's growth include a greater emphasis on preventative maintenance, increased production effectiveness, and streamlining the management of manufacturing infrastructure. Manufacturers have unprecedented visibility, insight, and control thanks to the IoT. By streamlining production procedures, cutting downtime, enhancing workplace safety, and enabling predictive maintenance, this technology has the potential to transform the industrial sector completely.

- As the number of networked sensors in production, the supply chain, and products grows, manufacturers are moving into a new generation of systems that let machines, systems, assets, and things talk to each other automatically and in real time.The pervasiveness of connected devices is finding applicability across multiple manufacturing and supply chain segments throughout the value chain.

- IoT in manufacturing can help the flow of production in a plant because IoT devices automatically track development cycles and keep track of warehouses and stock. It is one of the reasons that investments in IoT devices have skyrocketed over the past few decades. IoT in manufacturing, logistics, and transportation will grow.

- IoT is widely recognized as a advanced technology that significantly improves the manufacturing sector. It can integrate every industrial sector's components, including sensors, processing units, communication, and actuation devices. This fully integrated smart cyber-physical system creates new manufacturing markets and commercial prospects and sets the path for the fourth industrial revolution. It creates significant potential for the industrial industry.

Internet of Things (IoT) in Manufacturing Market Trends

Supply Chain and Logistics Management Application to Spur Growth in the Market Studied

- There has been a substantial change in the supply chain with the adoption of mobile devices and sensors, including RFID and GPS, to track inventory and warehouse assets.

- Mobile technologies allow businesses to monitor equipment, inventory, and business operations. By giving them real-time data across their entire supply chain, asset intelligence enables enterprises to boost their expertise and capacity. Although these solutions have helped the transportation and logistics industries advance over time, combining them with enabling technologies like the Internet of Things (IoT) can provide even more asset intelligence and help users make more educated decisions.

- Distribution centers, warehouses, and yards are the most important ecosystem parts of the supply chain.If a business is able to improve the performance of these components, the effectiveness of its operations will also improve. The logistics industry would increasingly rely on IoT, and warehouses would use the cloud to track their inventory, cars, and equipment. Numerous machines connected via RFID tags make this possible. The packages and pallets would interact with one another on a local level, while a company-based server would continuously monitor their movements and travel progress on a global level.

- Improved inventory management is a major outcome of IoT adoption in the manufacturing industries, made possible by the availability of real-time object visibility and the capability to track and maintain inventories.Using tracking devices, like RFID tags, to collect information about production, expiration dates, manufacture dates, after-sales status, and warranty periods could make supply chain monitoring during manufacturing more effective.

- According to the SAS Institute, the United Kingdom may benefit the most from the manufacturing sector, with IoT accounting for approximately GBP 4,032 million of the total economy. Similarly, other economies are expected to invest heavily in the automation of the supply chain, thereby driving IoT adoption in the overall manufacturing sector.

North America to be the Largest Market

- North America mainly dominates the market for IoT in manufacturing. This region has developed economies, like the United States and Canada, which heavily invest in R&D activities related to the market, thus contributing to the development of new technologies. With the early adoption of trending technologies like mobility, big data, and IoT, manufacturers are eager to integrate IoT technologies into their processes.

- Connected devices and data flow are already finding applications in manufacturing. Therefore, accelerated deliveries can now be expected as the infrastructure cost is reduced. In order to stay competitive, manufacturers are leveraging IoT and analytics to run and improve businesses. In the United States, about 35% of manufacturers collect and use data generated from smart sensors to enhance manufacturing processes.

- According to a study, around 34% of the manufacturers believe that US manufacturers must adopt IoT in their operations. For manufacturers, IoT has become an ecosystem where software, cloud computing, and analytics tools are combined to turn raw data from different sources into meaningful predictions and present them in easy-to-use interfaces. By next five years, the number of connected devices in the automation sector is expected to increase by 50.

- North America's technological prowess, solid infrastructure, variety of industries and supportive ecosystem have helped it take the lead as the world's largest market for the manufacturing sector of Internet of Things (IoT). The use of IoT in manufacturing is anticipated to continue to grow as the region maintains its dominance in technical innovation and digital transformation, further strengthening its position as the world's largest IoT market,

Internet of Things (IoT) in Manufacturing Industry Overview

The Internet-of-Things (IoT) market in manufacturing is cohesive and coherent. The market after Industry 4.0 has started to be more attractive, as companies are opting for IoT as enablers in their manufacturing units. Moreover, the market is inclined toward fragmentation. Some of the key players in the market are Cisco Systems Inc., General Electric, Intel Corporation, IBM Corporation, AT&T Inc., Qualcomm, and Siemens AG, among others.

- June 2022 - Elemental Machines, a leading LabOps Intelligence technology platform, and MasterControl, a developer of a next-generation manufacturing execution system (MES), announced a strategic partnership utilizing two cutting-edge technologies to assist bio manufacturers in automating manual data collection, enhancing data integrity, guaranteeing compliance, and accelerating production for advanced biologics like cell and gene therapies.

- May 2022- The world's largest supplier of RFID and digital ID solutions, Avery Dennison Corporation, and the Internet of Things pioneer, Wiliot, announced a strategic alliance to expand the IoT to the next level and usher in a new era of IoT that benefits people and the environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth and Technological Advancements in Data Analytics

- 5.1.2 Improved Supply Chain Management and Logistics at Lower Operational Costs

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Interfaces and Limited Integration and Scalability

- 5.2.2 Security and Privacy Issues

- 5.3 Opportunities

- 5.3.1 Intersection of IoT and Big Data Essential to the Future of Smart Manufacturing

- 5.4 Impact of COVID-19 on Data Center Services Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

- 6.5 Industry Policies

7 MARKET SEGMENTATION

- 7.1 By Software

- 7.1.1 Application Security

- 7.1.2 Data Management and Analytics

- 7.1.3 Monitoring

- 7.1.4 Network Management

- 7.1.5 Other Software

- 7.2 By Connectivity (Qualitative Analysis)

- 7.2.1 Satellite Network

- 7.2.2 Cellular Network

- 7.2.3 RFID

- 7.2.4 NFC

- 7.2.5 Wi-Fi

- 7.2.6 Other Connectivities

- 7.3 By Services

- 7.3.1 Professional

- 7.3.2 System Integration and Deployment

- 7.3.3 Managed

- 7.3.4 Other Services

- 7.4 By Application (Qualitative Analysis)

- 7.4.1 Process Optimization

- 7.4.2 Predictive Maintenance

- 7.4.3 Asset Management

- 7.4.4 Workforce Management

- 7.4.5 Emergency and Incident Management

- 7.4.6 Logistics and Supply Chain Management

- 7.4.7 Inventory Management

- 7.5 By End-user Vertical

- 7.5.1 Automotive

- 7.5.2 Food and Agriculture Equipment

- 7.5.3 Industrial Equipment

- 7.5.4 Electronics and Communication Equipment

- 7.5.5 Chemicals and Materials Equipment

- 7.5.6 Other End-user Verticals

- 7.6 ***By Geography

- 7.6.1 North America

- 7.6.1.1 United States

- 7.6.1.2 Canada

- 7.6.2 Europe

- 7.6.2.1 Germany

- 7.6.2.2 United Kingdom

- 7.6.2.3 France

- 7.6.2.4 Spain

- 7.6.3 Asia

- 7.6.3.1 China

- 7.6.3.2 Japan

- 7.6.3.3 India

- 7.6.3.4 Australia and New Zealand

- 7.6.4 Latin America

- 7.6.4.1 Brazil

- 7.6.4.2 Mexico

- 7.6.4.3 Argentina

- 7.6.5 Middle East and Africa

- 7.6.5.1 United Arab Emirates

- 7.6.5.2 Saudi Arabia

- 7.6.5.3 South Africa

- 7.6.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco Systems Inc.

- 8.1.2 General Electric

- 8.1.3 Intel Corporation

- 8.1.4 IBM Corporation

- 8.1.5 Verizon Communication Inc.

- 8.1.6 AT&T Inc.

- 8.1.7 Qualcomm

- 8.1.8 Siemens AG

- 8.1.9 Microsoft Corporation

- 8.1.10 SAP SE