|

市場調査レポート

商品コード

1850151

小型UAV:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Small UAV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小型UAV:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月26日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

概要

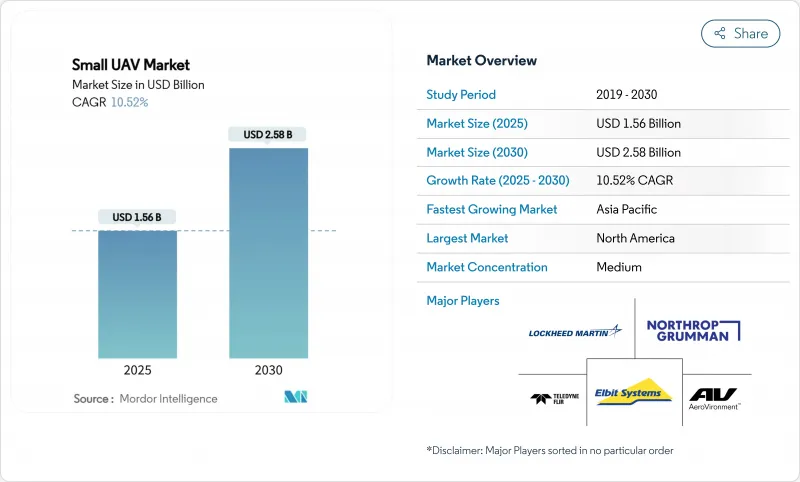

小型UAV市場規模は2025年に15億6,000万米ドル、2030年には25億8,000万米ドルに達すると予測され、CAGRは10.59%で推移します。

北米の防衛調達プログラムと国内ドローン支配に関する大統領令が初期の需要を牽引し、アジア太平洋の近代化計画が採用を加速し続けた。スウォーム自律性、ハイブリッド機体設計、水素燃料電池推進は、対UAS支出が戦術的優位性を鈍らせる恐れがある中でも、新たな差別化の道を作り出しました。半導体とリチウムイオン電池は依然としてサプライチェーンのピンチポイントであり続け、バイヤーは国内調達が確実なベンダーを選好するようになりました。そのため、競合各社は小型UAV市場でシェアを確保するため、垂直統合、ソフトウェア優先アーキテクチャ、輸出準拠設計に注力しています。

世界の小型UAV市場の動向と洞察

紛争環境におけるリアルタイムISRの需要

完全な制空権を持たない指揮官にとって、持続的な監視は不可欠であることが証明されました。小型UAVはレーダー探知範囲下を飛行し、コンパクトなシステムに5億米ドルを投資した米国陸軍の短距離偵察の取り組みに見られるように、戦術タブレットに直接ビデオをストリーミングします。ウクライナ軍は、現場認識のために数百万機の無人偵察機を投入し、量より質の戦術を検証しました。ドイツが供給したHF-1攻撃UAVは、GNSSジャミングを回避するためにAI地形マッピングを追加し、GPSが拒否した回廊内でのISRの価値を拡大した。これらの教訓は、調達の緊急性を高め、小型UAV市場のかなりの部分を下支えしました。

フォース・マルチプライヤーの価値と有人航空機の比較

F-35は1機8,000万米ドルのコストがかかるが、小型UAVの混成群であれば、その数分の一の予算で同等の偵察範囲を確保できるため、指揮官はより多くのターゲットを危険にさらすことができます。オーストラリアの実験では、AIアルゴリズムが複数の無人偵察機を派遣して同時に交戦し、パイロットの作業負担を軽減し、作戦フットプリントを縮小することが示されました。ロッキード・マーティンはその後、自律型ウイングマンを制御するF-35のデモンストレーションを行い、このコンセプトの実行可能性を証明し、世界中の航空軍に小型UAV市場に資金を再配分するよう促しました。

サイバー/EWの脆弱性と対UAS拡散

RTX Corporationの事業部門であるRaytheonは、Coyote迎撃ミサイルを1億9,600万米ドルで受注し、AndurilはRoadrunner/Pulsarを2億5,000万米ドルで受注しました。カタールの10億米ドルのFS-LIDSの購入は、暗号化されていない無線リンクを無力化することができる層状防御を小規模な軍隊でも展開できることを示しています。エルビット・システムズはNATO諸国にC-UASキットを納入し、生存性のアップグレードがプラットフォームのロードマップを形成し、小型UAV市場の短期的な成長を抑制することを再確認しました。

セグメント分析

固定翼システムは、ISRパトロールに必要な航続距離を延長する空力効率により、2024年には55.45%のシェアで小型UAV市場をリードしました。オペレータは、回転式プラットフォームと比較して、そのステルス性の高い音響シグネチャと簡単なメンテナンス・サイクルを評価しました。それでも、陸軍のFuture Tactical Unmanned Aircraft Systemのようなプログラムでは、垂直発進と長距離巡航能力が要求されるため、ハイブリッド機体は13.60%のCAGRを記録しました。これと並行して、ハイブリッド型機種の小型UAV市場規模は、サーボ重量の縮小とフライトコンピュータの小型化によって恩恵を受けました。

回転翼のUAVは、スタミナよりも操縦性が優先される密集した都市の峡谷でニッチを維持した。AIフライトコントローラーにより、ハイブリッド機はホバリングとグライドを自動で切り替え、操縦の負担を増やすことなくカバー率を向上させました。エアロ・ヴァイロンメントのようなベンダーは、このような領域横断的な敏捷性を具現化したJUMP 20-Xプロトタイプを実戦投入し、滑走路が使用できない場所での試験で勝利を収めました。このような特性により、調達計画担当者は機体を多様化し、ハイブリッド機が小型UAV市場全体の予算シェアを増加させることを確実にしました。

重さ2~20kgの小型UAVは、2024年の小型UAV市場シェアの59.17%を占め、部隊の可搬性とEO/IRペイロードに十分なバッテリー容量に合致しています。歩兵部隊は発射レールや回収ネットを必要としないため、採用率は高いままでした。しかし、2kg未満のNano/Microクラフトは、ビデオゲームスタイルのコントローラと250g未満のセンサーが新たな偵察の役割を解き放ったため、12.47%のCAGRを記録しました。Neros Archer FPVドローンがBlue UAS認証を取得し、最前線での使用が規制当局に認められたことを示すと、こうした羽毛のような軽量ユニットの小型UAV市場規模はさらに拡大した。小型(20~150kg)車両は、揚力と燃料容量がステルス性に勝る場合に有用性を維持したが、分散殺傷力への教義上のシフトにより、段階的な注文は控えめなものにとどまりました。海兵隊と陸軍の実験では、使い捨ての発泡スチロール製クアッドコプターでさえ、最小限のコストで有意義な戦場認識が可能であることが確認されました。そのため、小隊のリーダーが耐久性、ペイロード、投げて持ち運べる利便性のいずれかを選択できるような、ミックスド・コンプリメントを指定する調達方針が増え、小型UAV市場が強化されました。

地域分析

北米は、AeroVironmentの9億9,000万米ドルの受賞のような複数年契約や国内調達を義務付ける政策措置の恩恵を受け、2024年の売上高の48.90%を占めました。ブルーUASの認定は、米国のサプライヤーにプリント回路、バッテリー、光学サプライチェーンを内製化するインセンティブを与え、海外制裁のリスクを抑制しました。カナダとメキシコも同様の審査制度を採用し、小型UAV市場内のクロスボーダー需要を維持した。

アジア太平洋地域は、中国、オーストラリア、インド、日本がこの地域の火種を相殺しようと競争したため、2030年までのCAGRが11.95%と最も急上昇しました。北京のマザーシップ・コンセプトと東京のEurodroneとの提携の可能性は、調達を孤立したプログラムから統合された部隊構造へと移行させ、総市場価値を上昇させました。キャンベラがAI制御のゴーストバットスタイルのスウォームに投資したことは、他の太平洋同盟国もこれを真似るという教義の軸足を示すものであり、小型UAV市場の機会を増大させるものでした。しかし、マレーシアのバッテリー工場や台湾のマイコンを中心としたサプライチェーンは、地政学的リスクプレミアムをもたらしました。

欧州では、8,000億ユーロ(9,371億1,000万米ドル)のReArm Europeファンドと1,500億ユーロ(1,757億1,000万米ドル)のEU融資スキームが、現地生産を支援し、外部ベンダーへの依存を緩和しました。ユーロドローンプログラム、ドイツによる英国主導のGCAP加盟の検討、NATOの対UAS調達は、ISRと攻撃型に支出を分散させ、大陸の弾力性を強化しました。カタールの30億米ドルの契約に代表される中東の受注は、アフリカでの採用の遅れを相殺する数量の増加をもたらし、小型UAV市場の幅広い地理的バランスを確保しました。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 競合環境におけるリアルタイムISRの需要

- 有人航空機に対する戦力乗数値

- 国防総省が資金提供する兵士搭載型および分隊レベルのドローンプログラム

- AIを活用した自律的な群集機能

- GPS非搭載ナビゲーションのためのDARPAプロジェクト

- 消耗性徘徊兵器の迅速な配備

- 市場抑制要因

- サイバー/電子戦の脆弱性と対UAS拡散

- 耐久時間が短く、致死量の制限がある

- 輸出管理(ITAR/MTCR)のハードル

- 半導体およびリチウムイオン電池のサプライチェーンリスク

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 翼の種類別

- 固定翼

- 回転翼

- ハイブリッド

- サイズクラス別

- ナノ/マイクロ(2kg未満)

- ミニ(2~20kg)

- 小型(20~150kg)

- 用途別

- 情報監視偵察(ISR)

- 戦闘-徘徊兵器

- 物流と補給

- 電子戦(EW)

- トレーニングとシミュレーション

- 推進タイプ別

- 内燃機関

- 電池

- 燃料電池

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- AeroVironment, Inc.

- Teledyne Technologies Incorporated

- Elbit Systems Ltd.

- BAYKAR MAKINA SANAYI VE TICARET A.S.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Textron Inc.

- Parrot Drones SAS

- Skydio, Inc.

- Anduril Industries, Inc.

- EDGE Group PJSC

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A

- QinetiQ Group

- ideaForge Technology Ltd.