|

市場調査レポート

商品コード

1685842

軍用機用アビオニクス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Military Aircraft Avionics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍用機用アビオニクス-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

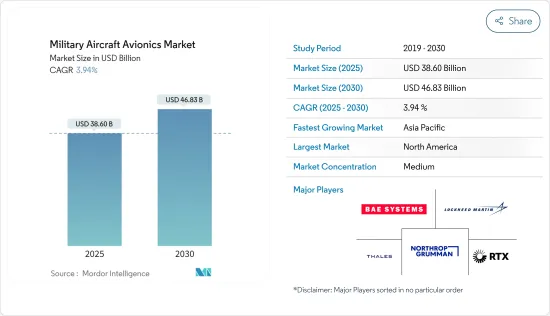

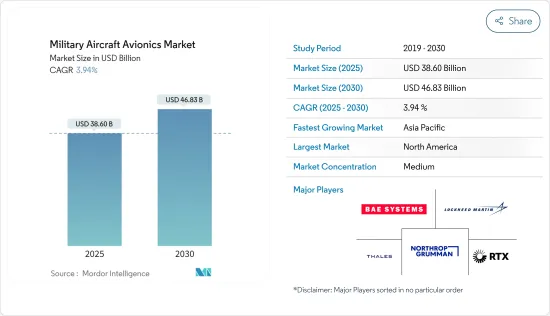

軍用機用アビオニクス市場規模は2025年に386億米ドルと推定・予測され、予測期間(2025年~2030年)のCAGRは3.94%で、2030年には468億3,000万米ドルに達すると予測されます。

地政学的緊張と国境紛争により、世界のいくつかの国は新しい軍用機、ヘリコプター、ドローンの調達を急いでおり、軍事費の大幅な上昇につながっています。数多くの国が、空中戦能力を強化するため、最新鋭の装備品で艦隊の近代化に投資しています。軍用機の調達と近代化に対するこうした投資は、将来の市場成長を促進すると予想されます。

先進的なアビオニクスの導入は、従来の軍用機の古いアビオニクス・システムを置き換える必要性を生み出します。これらの新しいアビオニクス・スイートは、電子戦防御や長距離目標探知・追跡などの新しい戦場要件を満たすために航空機をサポートします。そのため、敵に遅れを取らないために、防衛軍は軍用機のアビオニクスの近代化を計画しています。さまざまな国が、保有機体を拡大するために次世代軍用機を調達しています。

各国のUAVに対する需要の高まりは、高価な有人航空機への潜在的な損害や危険を防止することを目的として、敵対空域上空にUAVを配備する必要性が高まっていることが背景にあります。UAVは、情報・監視・偵察(ISR)任務での有効性に加え、戦闘目標の捕捉や捜索・救助活動も行うことができます。UAVの需要が高まっているのは、主に非戦闘任務に携わる乗組員の安全を確保するためです。さらに、同様の目的で使用される従来の航空機と比較してUAVの調達コストが低いことから、新興諸国によるUAVの取得が増加しています。しかし、高度なアビオニクス・システムにおける認証や新しいハードウェアの統合における課題が、市場の成長を妨げています。非対称的な脅威と複雑な作戦環境を特徴とする現代戦争の性質の変化により、高度に適応可能で柔軟なプラットフォームの必要性が高まっています。このような開発は、将来的に市場開拓の機会を生み出す可能性があります。

軍用機用アビオニクス市場の動向

予測期間中、飛行制御システム分野が市場を独占する

軍用機の飛行制御システム(FCS)は、データ収集システム、オートパイロット、フライトレコーダー、アクティブインセプターシステム、航空機管理コンピュータなど、コックピットの飛行制御のためのハードウェアとソフトウェアシステムで構成されます。現在、軍用機の飛行制御システムは、フライ・バイ・ワイヤ(FBW)技術に基づいて開発されています。さまざまな地域で地政学的緊張が高まっているため、国防軍は戦闘能力の強化を余儀なくされています。多くの国が軍事力強化のために防衛予算を増やし、軍用機やUAVの需要を押し上げています。

さらに、航空機OEMはアビオニクスOEMと提携し、新世代の航空機に高度な飛行制御システムを開発・搭載しています。また、主要企業は、ビッグデータ解析や人工知能(AI)などの次世代技術をコンピュータに統合し、人間が乗務する航空機や乗務しない航空機の自律運用を強化することに注力しています。例えば、2023年1月、フランスはタレスとサベナ・テクニクスに、フランス空軍と宇宙軍のCN-235軍用輸送機のアップグレード契約を付与しました。アップグレードが完了すれば、CN-235艦隊は2040年まで運用可能となります。同様に2024年3月、カナダの国防省(DND)はアークフィールド・カナダ社にCF-18のアビオニクス・イン・サービス・サポートを1億5,700万米ドルで発注しました。このような開発は、予測期間中の市場成長を加速させることが期待されます。

予測期間中、北米が最大の市場シェアを占める見込み

北米は、同市場における支配的な地域企業として台頭してくると予想されます。米国では近年、世界の紛争の増加、地政学的緊張の高まり、テロリズム、米国の潜在的敵対勢力の能力向上などのさまざまな要因により、軍用機用アビオニクスの需要が大幅に増加しています。

米国政府は防衛能力を強化するため、技術プラットフォームに多額の投資を行っています。例えば、2023年の米国軍事防衛費は9,160億米ドルに上り、2022年と比較して2.3%の成長でした。先進兵器への投資が増加しているのは、戦場におけるロシアや中国からの脅威が高まっているためです。こうした軍事費の増加に伴い、米国国防総省(US DoD)は同国の地域防衛力の近代化と能力拡大に取り組んでいます。

例えば、2024年2月、米国陸軍はトライアンフ・グループに、CH-47チヌーク・ヘリコプターのT55エンジンのEMC32T油圧メータリング・アッセンブリー(HMA)燃料制御のアップグレード契約を発注しました。トライアンフは2024年から2028年まで、毎年100台以上のEMC32T HMAをオーバーホールし、最新規格に適合させる。同様に2024年3月、海軍航空システム司令部はボーイング社に対し、新型ジェット戦闘機F/A-18スーパーホーネット17機の爆撃機、センサー、アビオニクスの製造契約を14億米ドルで発注しました。スーパーホーネットは、能動電子走査アレイ(AESA)レーダー、大型コックピット・ディスプレイ、共同ヘルメット搭載型キューイング・システムを特徴としています。北米諸国による航空能力強化のためのこのような投資は、今後数年間の市場成長を促進すると予想されます。

軍用機用アビオニクス産業の概要

軍用機用アビオニクスの市場は半固定的であり、数社のみが市場シェアの大半を占めています。RTX Corporation、Lockheed Martin Corporation、Thales、BAE Systems PLC、およびNorthrop Grumman Corporationは、市場で著名な企業の一部です。主要企業は航空機OEMと長期契約を結び、アビオニクス・システムを提供しています。

Thalesは、NH90、AH-1Z Viper、T129、UH-1Y Venom、Tiger、Rooivalkヘリコプターなどの回転翼航空機プログラムをサポートする著名なヘッドアップディスプレイ(HUD)プロバイダーです。BAE Systems PLCは、F-35ライトニングII戦闘機のアクティブ・インセプター・システム、電子戦スイート、車両管理コンピュータ、識別・通信・ナビゲーション・システム用電子部品を提供しています。主な企業は研究開発に投資し、新しい市場を獲得するために先進的な製品を開発しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- サブシステム

- 飛行制御システム

- 通信システム

- ナビゲーションシステム

- モニタリングシステム

- その他のサブシステム

- 航空機タイプ

- 固定翼戦闘機

- 固定翼非戦闘機

- ヘリコプター

- 無人航空機(UAV)

- 地域

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- L3 Harris Technologies Inc.

- RTX Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales

- BAE Systems PLC

- Honeywell International Inc.

- Elbit Systems Ltd

- Cobham Limited

- Garmin Ltd

- Moog Inc.

第7章 市場機会と今後の動向

The Military Aircraft Avionics Market size is estimated at USD 38.60 billion in 2025, and is expected to reach USD 46.83 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

Due to geopolitical tensions and border disputes, several countries worldwide are expediting their procurement of new military aircraft, helicopters, and drones, leading to a significant rise in military spending. Numerous nations are investing in modernizing their fleets with state-of-the-art equipment to bolster their aerial capabilities. These investments in the procurement and modernization of military aircraft are anticipated to drive market growth in the future.

The introduction of advanced avionics generates the need to replace old avionics systems in conventional military aircraft. These new avionics suites support the aircraft in meeting the new battlefield requirements, such as electronic warfare defense and long-distance target detection and tracking. Therefore, to stay abreast of adversaries, the defense forces plan to modernize the avionics in military aircraft. Various countries are procuring next-generation military aircraft to expand their fleets.

Various nations' rising demand for UAVs is driven by the increasing necessity to deploy them over hostile airspace, aiming to prevent any potential damage or danger to expensive manned aircraft. Besides their effectiveness in intelligence, surveillance, and reconnaissance (ISR) missions, UAVs can carry out combat target acquisition and search and rescue operations. The rising demand for UAVs is primarily motivated by the safety of crew members involved in non-combat missions. Additionally, the lower procurement cost of UAVs compared to traditional aircraft used for similar purposes has led to their increased acquisition by developing countries. However, challenges in certifications and integration of new hardware in advanced avionics systems hamper market growth. The changing nature of modern warfare, characterized by asymmetric threats and complex operational environments, necessitates the need for highly adaptable and flexible platforms. Such developments may create market opportunities in the future.

Military Aircraft Avionics Market Trends

The Flight Control Systems Segment to Dominate the Market During the Forecast Period

A military aircraft's flight control system (FCS) consists of hardware and software systems for cockpit flight controls, such as data acquisition systems, autopilot, flight recorders, active inceptor systems, and aircraft management computers. Currently, the flight control systems in military aircraft are developed based on fly-by-wire (FBW) technology. The rising geopolitical tensions across various regions have compelled defense forces to enhance their combat capabilities. Many countries have increased their defense budgets to strengthen their military capabilities, driving the demand for military aircraft and UAVs.

Additionally, aircraft OEMs have partnered with avionics OEMs to develop and equip advanced flight control systems in new-generation aircraft. Also, key players are focusing on integrating next-generation technologies such as big data analytics and artificial intelligence (AI) into computers to enhance the autonomous operations of human-crewed and uncrewed aircraft. For instance, in January 2023, France granted Thales and Sabena Technics a contract to upgrade the CN-235 military transport fleet of the French Air and Space Force. Once the upgrade is done, the CN-235 fleet will be operational through 2040. Similarly, in March 2024, Canada's Department of National Defence (DND) awarded Arcfield Canada a contract to provide avionics in-service support for the CF-18 fleet for USD 157 million. Such developments are expected to accelerate the market's growth during the forecast period.

North America Expected to Exhibit the Largest Market Share During the Forecast Period

North America is expected to emerge as the dominant regional player in the market. The demand for military aircraft avionics significantly increased in the United States in recent years due to various factors such as the rise of global conflicts, growing geopolitical tensions, terrorism, and the increasing capabilities of potential adversaries of the United States.

The US government has invested heavily in technological platforms to enhance its defense capabilities. For instance, in 2023, the US military defense expenditure rose to USD 916 billion, a growth of 2.3% compared to 2022. Rising investments in advanced weaponry are due to the increasing threat to the country from Russia and China on the battlefield. With this increased military expenditure, the US Department of Defense (US DoD) is working to modernize and expand the country's regional defense forces capabilities.

For instance, in February 2024, the US Army awarded Triumph Group a contract to upgrade the EMC32T Hydraulic Metering Assembly (HMA) fuel control on the T55 engines for the CH-47 Chinook helicopter fleet. Triumph will overhaul more than 100 EMC32T HMAs each year from 2024 to 2028 to ensure they meet the latest standards. Similarly, in March 2024, the Naval Air Systems Command awarded Boeing a contract to build 17 new F/A-18 Super Hornet jet fighter bombers, sensors, and avionics for USD 1.4 billion. The Super Hornet features an active electronically scanned array (AESA) radar, large cockpit displays, and a joint helmet-mounted cueing system. Such investments by countries in North America to enhance their aerial capabilities are anticipated to propel the growth of the market over the coming years.

Military Aircraft Avionics Industry Overview

The market for military aircraft avionics is semi-consolidated, with only a few players accounting for most of the market share. RTX Corporation, Lockheed Martin Corporation, Thales, BAE Systems PLC, and Northrop Grumman Corporation are some of the prominent players in the market. The key players enter long-term contracts with aircraft OEMs to provide avionic systems.

Thales is a prominent head-up display (HUD) provider that supports rotary-wing aircraft programs such as NH90, AH-1Z Viper, T129, UH-1Y Venom, Tiger, and Rooivalk helicopters. BAE Systems PLC provides active inceptor systems, electronic warfare suite, vehicle management computers, and electronic components for identification, communication, and navigation systems in the F-35 Lightning II fighter aircraft. The key players invest in research and development and develop advanced products to capture new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Subsystem

- 5.1.1 Flight Control System

- 5.1.2 Communication System

- 5.1.3 Navigation System

- 5.1.4 Monitoring System

- 5.1.5 Other Subsystems

- 5.2 Aircraft Type

- 5.2.1 Fixed-wing Combat Aircraft

- 5.2.2 Fixed-wing Non-Combat Aircraft

- 5.2.3 Helicopters

- 5.2.4 Unmanned Aerial Vehicles (UAVs)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Israel

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 L3 Harris Technologies Inc.

- 6.2.2 RTX Corporation

- 6.2.3 Lockheed Martin Corporation

- 6.2.4 Northrop Grumman Corporation

- 6.2.5 Thales

- 6.2.6 BAE Systems PLC

- 6.2.7 Honeywell International Inc.

- 6.2.8 Elbit Systems Ltd

- 6.2.9 Cobham Limited

- 6.2.10 Garmin Ltd

- 6.2.11 Moog Inc.