|

市場調査レポート

商品コード

1849913

フレキシブルディスプレイ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Flexible Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| フレキシブルディスプレイ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月23日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

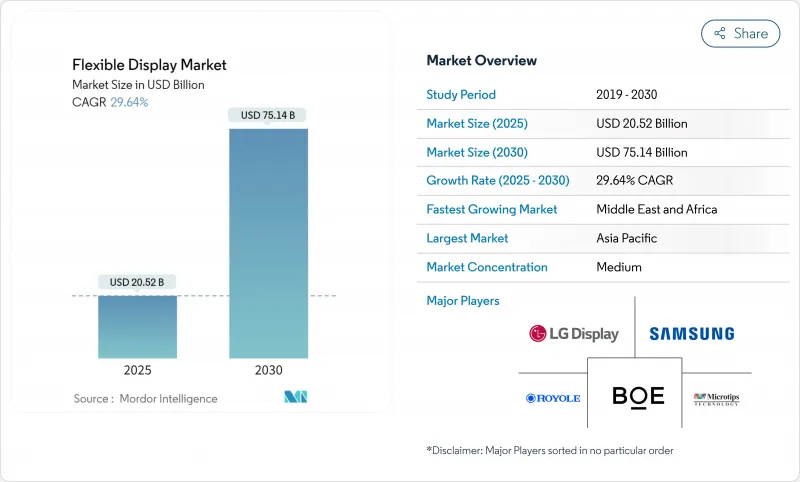

フレキシブルディスプレイの市場規模は2025年に205億2,000万米ドル、2030年には751億4,000万米ドルに達すると予測され、この間のCAGRは29.64%と力強いです。

評価の飛躍は、規模の経済性、材料のブレークスルー、製品設計の自由度が融合し、フレキシブル・パネルがニッチ・コンセプトから、家電、モビリティ、産業環境の主流インターフェイスへと移行する転換点を示すものです。8.6世代OLEDファブへの生産投資、ローラブルの急速な革新、マイクロLEDのウェアラブルへの移行により、対応可能な基盤が拡大しています。中国メーカーが韓国の既存メーカーを上回るスピードで生産能力を拡大し、既成のコスト構造に課題して価格下落を加速させているため、競合の激しさが増しています。同時に、ポリイミド、封止材、ヒンジのノウハウを確保した総合プレーヤーは、供給ショックや訴訟リスクから身を守っています。

世界のフレキシブルディスプレイ市場の動向と洞察

中国と韓国でローラブルおよびフォールダブル・スマートフォンの発売が活発化

フレキシブルOLEDスマートフォンパネルの出荷数は2024年に26%増加し、7億8,400万台に達しました。これは、斬新な形状の製品が買い替え需要をいかに刺激するかを示しています。2025年後半に予定されている新しい3つ折りデザインは、360度の回転と折り目の目立ちにくい超薄型ガラスをもたらし、ブランド差別化を強化します。中国からの参入企業は、ヒンジの耐久性目標と一致させ、設計から発売までのサイクルを短縮することで、迅速に規模を拡大し、価格と技術革新のテンポで既存企業に圧力をかけます。ヒンジ、耐熱ポリイミド、透明カバーフィルムに関連するコンポーネントのエコシステムは直接的に恩恵を受ける。好転はアクセサリー市場や修理市場にも波及し、サービス収入の増加を生み出します。

プレミアムEVの曲面OLEDコックピットが欧州全域で採用される

高級電気自動車は、連続したガラスカバーの下に複数のディスプレイを融合させたEQS SUV Hyper-screenのような広々とした曲面ダッシュボードによって車内体験を向上させる。自動車OEMは、薄型で均一な輝度と設計の自由度を持つフレキシブルOLEDを好み、車両あたりのディスプレイ面積の急増につながっています。ティア1サプライヤーはコックピット・プラットフォームを共同開発するためにパネル・メーカーとの提携を深めており、ソフトウェア定義の自動車戦略では、継続的な無線アップグレードをサポートするディスプレイが求められています。自律走行機能が成熟するにつれて、マルチモーダルインタラクションや伸縮可能なピラーからピラーへのスクリーンは、自動車1台当たりのディスプレイ平方メートル消費量を増加させる。

Gen-8+ポリイミドの歩留まり低下によるスクラップ・コストの上昇

より大きなマザーガラスへのスケーリングは、フレキシブルPI基板の熱応力を強め、欠陥による歩留まり低下を引き起こし、単位当たりのコストを上昇させる。エアロゲル強化PI繊維の調査は、熱安定性を高めることに有望であることを示しているが、工業的な採用はまだ始まったばかりであり、工場は立ち上げ時に高価なスクラップにさらされることになります。

セグメント分析

OLEDは2024年のフレキシブルディスプレイ市場で85%のシェアを占め、発光ピクセルを活用することで、バックライトのない薄型でカーブに適したモジュールを実現します。中国ファブによるコスト低下と蒸発器のスループット向上により、OLEDはスマートフォン、時計、湾曲したインフォテインメント・クラスター用のパネルとして選ばれ続けています。同時に、マイクロLEDの出荷はパイロット生産から初期量産へと拡大し、量子ドットカラーコンバーター、大量転写精度、リペアの歩留まりが向上するにつれて、予測CAGRは36%を記録しています。Tianmaの8インチプロトタイプが証明しているように、マイクロLEDは輝度を10,000nitまで押し上げ、高熱負荷下でも長寿命を実現するため、車載用ヘッドアップディスプレイや堅牢なウェアラブルがまず恩恵を受ける。電子ペーパーは低消費電力サイネージや物流タグの分野でニッチな地位を占めており、量子ドットLCDハイブリッドはミッドレンジ・デバイスの価格と色域のギャップを埋め続けています。

OLEDの優位性は、3つの圧力ポイントに直面しています。第一に、無機マイクロLED材料の長寿命化により、OLEDのバーンインリスクの物語が希薄化すること。第二に、Gen-8.6のコスト優位性により、リジッドOLEDとフレキシブルOLEDのASP格差が縮小し、低予算層がフレキシブル・フォームファクターに移行します。第三に、量子ドットのオンチップ・アプローチがロールtoロールのプラスチック基板と互換性を持つようになり、超大型の透明ウィンドウにおける将来の競合の種となります。それでも、エコシステムの成熟、設備の減価償却、豊富な供給により、中期的にはOLEDが主導権を握ることに変わりはないです。

折りたたみ式デバイスは、2024年のフレキシブルディスプレイ市場の71%を占め、スマートフォンベンダーが二つ折り、三つ折り、折り返しの各形態の改良にしのぎを削る中、依然として数量牽引役であり続ける。ヒンジ形状やUTGラミネーションに関する特許バリケードが先発メーカーのリードを強めているが、ライセンス供与や代替キネマティックスタックの革新を行うライバルを排除するものではないです。CAGR成長率39%で拡大が予想されるローラブルスクリーンは、コンパクトな筐体に収納することで空間効率を高め、ポケットに入るサイズでありながら大画面のディスプレイを求める消費者の需要に応えます。初期のノートブックとタブレットのローラブル・スクリーンは、モーター駆動のスプールと伸張を制限するラミネーションによって、30,000回の作動を超える再現性を達成できることを実証しています。

曲げられるディスプレイやコンフォーマブル・ディスプレイは、機械的負荷がより単純であるため、曲面エッジの携帯電話、フィットネス・バンド、自動車用レーダーの定番であり続けています。伸縮可能な基板メッシュと蛇行する回路パターンによって実現される、新進の「フォームファクター・フリー」クラスは、皮膚接着型健康パッチやソフトロボット向けに活発に研究されています。伸縮可能なディスプレイに関する学術論文は、2014年の17件から2023年には197件に急増し、研究開発投資の活発化を反映しています。商業化は遅れているが、この進展は10年後のユビキタス・アンビエント・ディスプレイの舞台となります。

地域分析

アジア太平洋地域が2024年の売上高の57%を占め、韓国、中国、台湾のPI樹脂合成からモジュール組立までの緻密な製造エコシステムに後押しされています。2028年までのフレキシブルOLED生産能力は、韓国の2%増に対し中国が8%増となり、世界のパネル生産に占めるシェアは68%から74%に上昇します。地域の政策的優遇措置により、土地、税金、電力の面で有利な条件が地元メーカーに与えられ、国内のスマートフォンOEMメーカーが即座に需要を供給します。この好循環は、サプライチェーンの自給自足を強化し、新規ラインの生産期間を短縮します。

北米は、AR/VR、ハイパフォーマンス・コンピューティング、プレミアム・ノートブックの各分野で主導権を握っているため、技術的な牽引力があります。米国ブランドは2026年に向けてOLED MacBookクラスのパネルを調達しており、サプライヤーは静的なUI負荷下で寿命を延ばす酸化物TFTとタンデムスタックアーキテクチャの認定を迫られています。ヒンジ特許に起因する法的リスクは引き続き注視事項だが、各社は発売時期を守るために和解やクロスライセンスを行うことが多いです。マイクロエレクトロニクスのリショアリングに対する政府の助成金は、特にバックプレーンとガラスフリーの封止ツールの分野で、エコシステムの一部を米国内に向かわせる可能性があります。

欧州は、エコデザイン規制と今後のデジタル製品パスポートを通じて規制的影響力を行使し、業界をリサイクル可能な構造と完全な材料開示に向かわせる。ドイツ、スウェーデン、英国の自動車クラスターは、曲面OLEDクラスターを急ピッチで採用し、現地での統合、接合、テストパートナーを刺激しています。2030年までに24%の循環型材料使用という大陸の目標が、溶剤低減PI、生分解性接着剤、分離が容易なメカニカルファスナーなどの研究開発を後押ししています。

中東・アフリカは比較的小規模ながら、CAGR32%と最も速い成長を記録し、交通の要所、スポーツ競技場、レジャー施設でのデジタルサイネージが拡大しています。ガラスファサードに適合するフレキシブルLEDフィルムスクリーンは、斬新なフォームファクターに対する建築家の意欲を象徴しています。政府が支援するスマートシティプロジェクトや高照度環境は、高輝度マイクロLEDを魅力的な選択肢にしています。南米ではスマートフォンの普及が進み、自動車組立工場が輸出モデルにフレキシブルクラスターを指定し始めています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 中国と韓国でロール式・折りたたみ式スマートフォンの発売が加速

- 欧州全域でプレミアムEV向け曲面OLEDコックピットの採用が進む

- 北米で軽量AR/VRマイクロOLEDパネルの需要が急増

- 中国の第8.6世代フレキシブルOLED工場のコスト削減

- EUの循環型経済推進によるガラスフリーモジュール

- 日本と韓国におけるフレキシブル医療用ウェアラブルの成長

- 市場抑制要因

- 第8世代以降のポリイミドの歩留まり低下がスクラップコストを上昇させる

- 封止材供給の逼迫

- 折りたたみ式ヒンジに関する米国中心の特許訴訟

- プラスチックLCDサイネージの寒冷気候における信頼性の問題

- 業界エコシステム分析

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- ディスプレイタイプ別

- 有機EL

- 液晶

- 電子ペーパーディスプレイ(EPD)

- マイクロLED

- 量子ドットとその他の新興タイプ

- フォームファクター別

- フォルダブル

- ローラブル

- ベンダブル

- コンフォーマブル(湾曲/ラップアラウンド)

- 基板材料別

- ガラス

- プラスチック-ポリイミド(PI)

- プラスチック-PET/PEN

- 金属箔

- その他(ポリカーボネート、超薄板ガラス)

- 用途別

- スマートフォンとタブレット

- スマートウェアラブル(腕時計、パッチ)

- テレビとデジタルサイネージ

- パソコンとラップトップ

- 自動車コックピットとインフォテインメント

- AR/VRヘッドマウントディスプレイ

- 産業および公共交通機関のディスプレイ

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- 東南アジア

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- ROYOLE Corporation

- E Ink Holdings Inc.

- AU Optronics Corp.

- Sharp Corporation

- Innolux Corporation

- TCL CSOT

- Visionox Co., Ltd.

- Tianma Micro-electronics Co., Ltd.

- Truly International Holdings

- Japan Display Inc.

- Microtips Technology

- FlexEnable Technology Ltd.

- Plastic Logic Germany

- Chunghwa Picture Tubes Ltd.

- Shenzhen China Star Optoelectronics Technology

- Huawei Technologies Co., Ltd.(Panel R&D)

- Guangzhou OED Technologies Co., Ltd.

- Universal Display Corporation