|

市場調査レポート

商品コード

1640371

ビットコイン技術-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Bitcoin Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ビットコイン技術-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

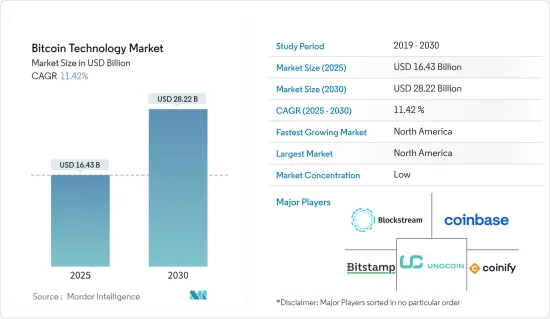

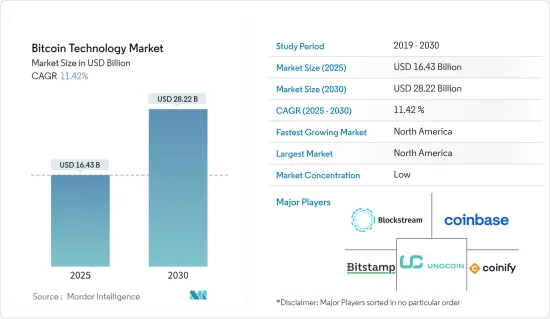

ビットコイン技術市場規模は2025年に164億3,000万米ドルと推定され、予測期間中(2025~2030年)のCAGRは11.42%で、2030年には282億2,000万米ドルに達すると予測されています。

ビットコインのシステムは有限であることを第一の目的として開発されました。そのため、余剰通貨を発行する可能性がなく、インフレの脅威は約ゼロに達します。この点は売り手と買い手の双方にメリットがあります。

主要ハイライト

- ビットコイン決済は、クレジットカードやデビットカードで購入するよりも取引コストがはるかに低いです。中小企業(SME)は予算が限られているため、この特徴の恩恵を受けることができます。ビットコインの受け取りは無料であり、多くのウォレットでは取引手数料の決済額をユーザーが選択できるようになっています。手数料が高ければ高いほど、取引がより迅速に確認される可能性があります。

- 2008年にビットコインの概念が初めて導入され、2022年4月現在、ビットコインの時価総額は約8,211億3,000万米ドル(各種取引所調べ)。ブロックチェーンは、2022年4月4日時点で約1,900万ビットコインが流通していると推定しています。

- Cambridge Centre for Alternative Financeによると、米国では2021年にかなりの量のビットコイン取引が確認されています。さらに、ビットコインの上昇は主に投機的な投資家によって支えられていました。このようなビットコインの高いボラティリティは、機関投資家を支援し続けています。

- ビットコインは、主流への採用に向けて新たな一歩を踏み出す可能性があります。New York Digital Investments Group(NYDIG)によると、米国の一部の銀行の顧客は初めて、当座預金口座を通じてビットコインを購入、保有、売却できるようになります。これまで、ビットコインを採用する人は、無料取引仲介のロビンフッド、決済大手のPaypalやスクエア、あるいはコインベースのような暗号通貨中心の企業など、新世代のフィンテック企業のアプリに頼っていました。一方、銀行は個人顧客向けのビットコインには手を出さず、つい最近、富裕層の資産管理顧客に暗号通貨への投資を許可する計画を発表したばかりです。

- 既存の金融システムと発展途上の暗号エコシステムとの相互関係が強まるにつれ、システミックの安定性に影響を及ぼす波及効果への懸念が高まっています。暗号通貨は長い間、分散投資のツールでした。国際通貨基金(IMF)は2022年初め、ビットコインとS&P500の関係を示す統計を発表しました。このことは、投資家心理が株式市場から暗号通貨に移行することへの懸念を煽っています。

- 暗号通貨のもう一つの改善点は、世界の緊急事態にビットコインがどう対応したかです。ロシアによるウクライナへの攻撃は、ビットコインによる寄付がウクライナの人々に寄せられるなど、世界の大きな支援を呼び起こしました。また、ロシアがビットコインを使用し、世界各国から課された経済制限を回避したとされます。これは企業にとって、自社のプラットフォームから流出した資金が違法行為に使用されているかどうかを判断するという新たな問題を提示しています。

ビットコイン技術市場動向

BFSIが最大の市場シェアを占める

- このセクターにおけるブロックチェーンや分散型台帳技術の採用が進むことで、BFSIセクターによるビットコインへの投資が増加する可能性があります。例えば、決済用の分散型台帳(ビットコインなど)を確立することで、銀行ソリューションは従来のシステムよりも低い手数料で迅速な決済を促進できます。

- 技術はまた、お金を借りる際のセキュリティを強化し、ローンやクレジット産業におけるゲートキーパーの必要性を排除することで、より低い金利を提供することができます。また、貿易金融産業における高額な船荷証券のプロセスを技術に置き換えることで、国際的な貿易当事者間の透明性、安全性、信頼性を高めることができます。

- 決済の円滑化は銀行にとって大きな利益となります。信用状から決済まで、クロスボーダー取引は2016年に世界の決済取引収益の40%を生み出しました。したがって、銀行は送金サービスのようなビットコイン決済サービスを活用して、こうした機会を活用することもできます。

- どうやらJ.P. Morganは、2022年前半に、約300の銀行がモバイルアプリを通じたビットコイン取引を導入する意向のようです。米国銀行とサブ・カストディ契約を結ぶなど、すでに銀行産業への進出を果たしているビットコイン金融サービス会社NYDIGは、こうした銀行の多くと提携しています。暗号通貨市場に参入した最初の銀行はSynovus Financialではないです。オクラホマ州を拠点とするVast Bankは、モバイルアプリを通じて暗号通貨を提供する米国初の国営銀行だと主張しています。

- ウェルスマネジメントの顧客に暗号通貨を導入した最初の大手銀行は、2021年のモルガン・スタンレーです。Morgan Stanleyは、同行に200万米ドル以上の資産を維持している顧客に対し、3つのビットコインファンドへのアクセスを提供しました。

- ローンチは今年後半、2022年に行われます。顧客は、暗号インフラプロバイダのFireblocksと共同で構築したBNY Mellonの暗号ウォレットに、最も重要な暗号通貨であるビットコインとエーテルを保管できるようになります。

- さらに2022年1月、エルサルバドル政府は、ビットコイン債券発行の法的基盤を提供するため、金融市場と証券投資を網羅する約20の法案を議会に送付すると発表しました。

最も高い成長を遂げる北米

- 北米はビットコインマイニングに関して最も急速に成長している地域の一つであり、ビットコインサービスを提供するベンダーもこの地域で拡大しています。例えば、世界の暗号通貨利回り獲得プラットフォームであるセルシウスは、マイニング機器に2億米ドル以上の投資を行い、ブロックチェーンネットワークのためのカスタマイズ可能なインフラとソフトウェアソリューションであるコアサイエンティフィックのポジションを獲得したと発表しました。これらの投資は、セルシオの既存の利益を拡大し、ビットコインマイニング産業における米国最大の投資家の1つとなるものです。

- 2022年4月、ブロックチェーン技術のインフラプロバイダーであるPrime Blockchain Inc.は、10X Capital Venture Acquisition Corp.との最終的な経営統合契約を発表しました。IIを設立し、ブロックチェーンエコシステムへの注力を進めています。このような事例は、調査期間におけるビットコイン技術市場の成長を加速させると考えられます。

- 同市場では、北米におけるビットコイン技術の市場開拓を促進するため、さまざまな企業がブロックチェーン技術企業に投資しています。

- ビットコインの認知度が高まるにつれて、同地域の政府はビットコイン技術の利用を促進するためのイニシアチブを取っています。例えば、2022年3月、カナダ政府は国民が国内でビットコイン(BTC)を合法的な貨幣として使用することを許可しました。これは今後、北米におけるビットコイン技術の後押しとなると考えられます。

ビットコイン技術産業概要

ビットコイン市場は細分化されており、ビットコインに関連した商業活動を提供する新興企業が近年登場しています。現在のシナリオでは、ほとんどのオンラインマーチャントがビットコイン決済の匿名性と効率性を享受し始めており、クレジットカードやデビットカードによる取引に比べて諸経費を削減することができます。

2023年8月、PayPalはPayPal USD(PYUSD)ステーブルコインを米国の一部の顧客に導入しました。ステーブルコインは不換紙幣の価値と連動しており、通常1対1の比率で同通貨の裏付けがあるため、ビットコインやイーサといった人気の暗号通貨よりも変動が少ないです。PayPal USDの購入者は、PayPalと互換性のある外部ウォレット間でPayPal USDを送金し、安定コインを使用して個人間決済を行い、PayPal USDで決済、PayPalがサポートする暗号通貨のいずれかを安定コインとの間で変換できるようになります。

2022年4月、ブロックストリームは新しい太陽光発電ビットコインマイニング施設の建設を開始しました。3.8メガワット(MW)のTeslaソーラーPVアレイと12メガワット時(MWh)のTesla・メガパックは、米国のブロックストリームマイニングサイトにあるオープンソースの太陽光発電ビットコインマイニング施設に電力を供給します。この重要な開発は、以前発表されたブロックストリームとブロック社のプロジェクトをサポートするものです。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因と市場抑制要因の採用

- 市場促進要因

- 分散型・ボーダレス決済システム

- 市場抑制要因

- ボラティリティの高い通貨

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- サービス別

- 取引所

- 送金サービス

- 決済&ウォレット

- 産業別

- BFSI

- eコマース

- メディア&エンターテイメント

- ホスピタリティ

- 地域別

- 北米

- 欧州

- アジア

- オーストラリアとニュージーランド

第6章 競合情勢

- 企業プロファイル

- Blockstream Corporation Inc.

- Coinbase Inc.

- Coinify ApS

- Unocoin Technologies Pvt Limited

- Bitstamp Ltd.

- itBit Trust Company LLC

- Blockchain Luxembourg SA

- Kraken(Payward Inc.)

- BitPay Inc.

- Plutus Financial Inc.(ABRA)

第7章 投資分析

第8章 市場機会と今後の動向

The Bitcoin Technology Market size is estimated at USD 16.43 billion in 2025, and is expected to reach USD 28.22 billion by 2030, at a CAGR of 11.42% during the forecast period (2025-2030).

The Bitcoin system was developed with the primary purpose of being finite. Therefore, inflation's threat reaches almost zero without the possibility of issuing excess currency. This point benefits both the seller and the buyer.

Key Highlights

- Bitcoin payments have much lower transaction costs than purchases made with credit and debit cards. Small and medium-sized enterprises (SMEs) can benefit from this feature because they have a tight budget. Receiving bitcoins is free, and many wallets let users choose how much they want to pay in transaction fees. Higher fees may encourage a transaction to be confirmed more quickly.

- In 2008, the concept of bitcoin was first introduced, and as of April 2022, the market cap of bitcoin is around USD 821.13 billion (according to various exchanges). Blockchain estimates about 19 million bitcoins are in circulation as of April 4, 2022.

- A significant amount of bitcoin transactions were witnessed in the United States in 2021, as per Cambridge Centre for Alternative Finance. Additionally, the ascent of Bitcoin was supported mainly by speculative investors. Such high volatility of bitcoins has continued to help institutional investors.

- Bitcoins may be taking another step toward mainstream adoption. For the first time, customers of some US banks will soon be able to purchase, hold, and sell bitcoin through their current accounts, according to New York Digital Investments Group, NYDIG. Until now, bitcoin adopters relied on the app from the new generation of fintech players such as free trading brokerage Robinhood, payment giants PayPal and Square, or crypto-centric firms like Coinbase. On the other hand, banks have steered clear of Bitcoin for retail customers and only recently announced plans for allowing wealthy wealth management clients to wager on cryptocurrency.

- The growing interconnection between the existing financial system and a developing crypto ecosystem raises worries about spillover effects that may affect systemic stability. Although it now indicates differently, cryptocurrencies have long been a tool for diversification. The International Monetary Fund (IMF) published statistics earlier in 2022 showing a relationship between bitcoin and the S&P 500. This fuels worries about investor sentiment transferring from the stock market to cryptocurrency.

- Another area for improvement with cryptocurrencies is how bitcoins have responded to global emergencies. Russia's attack on Ukraine has sparked huge global support, with Bitcoin donations being poured into Ukrainians. It also prompted Russia's alleged use of Bitcoin to bypass economic restrictions imposed by numerous countries around the world. This presents a novel problem for corporations in determining whether monies leaving their platforms are used for illegal conduct.

Bitcoin Technology Market Trends

BFSI to Occupy the Largest Market Share

- The growing adoption of blockchain or distributed ledger technologies in the sector can help increase investment by the BFSI sector in bitcoins. For instance, by establishing a decentralized ledger for payments (e.g., bitcoin), banking solutions could facilitate faster payments at lower fees than traditional systems.

- Technology can also enhance security while borrowing money and provide lower interest rates by eliminating the need for gatekeepers in the loan and credit industry. Also, by replacing the hefty bills of lading process in the trade finance industry, the technology can provide more transparency, security, and trust among trade parties internationally.

- Facilitating payments is highly profitable for banks. From letters of credit to payments, cross-border transactions generated 40% of global payments transactional revenues in 2016. Therefore, banks can also leverage Bitcoin payment services, like remittance services, to utilize these opportunities.

- Apparently, J.P. Morgan, in the first half of 2022, some 300 banks intend to introduce bitcoin trading through mobile apps. The NYDIG, a bitcoin financial services company that has already made some inroads into the banking industry, including a sub-custody agreement with United States Bank, is partnering with many of these banks. Not the first bank to enter the cryptocurrency market is Synovus Financial. The Oklahoma-based Vast Bank claims to be the first U.S. bank with a national charter to provide cryptocurrency through a mobile app.

- The first major bank to introduce cryptocurrencies to its wealth management clients was Morgan Stanley in 2021. For clients with at least USD 2 million in assets maintained with the bank, Morgan Stanley provided access to the three Bitcoin funds.

- The launch will take place later this year, in 2022. Customers will be able to store bitcoin and ether, the two most significant cryptocurrencies, in BNY Mellon crypto wallets built in collaboration with crypto infrastructure provider Fireblocks.

- Moreover, In January 2022, El Salvador's government announced they would send Congress about twenty bills covering financial markets and investment in securities to provide a legal foundation for issuing bitcoin bonds.

North America to Witness the Highest Growth

- North America is one of the most rapidly growing regions regarding Bitcoin mining, and vendors offering Bitcoin services are also expanding in this region. For instance, Celsius, a global cryptocurrency yield-earning platform, announced investments of over $200 million in mining equipment and positions in Core Scientific, a customizable infrastructure and software solutions for Blockchain networks. These investments serve to scale Celsius' existing interests to make it one of the largest U.S. investors in the Bitcoin mining industry.

- In April 2022, Prime Blockchain Inc., an infrastructure provider for blockchain technology, announced a definitive Business Combination Agreement with 10X Capital Venture Acquisition Corp. II to advance its focus on the blockchain ecosystem. Such instances will accelerate the growth of the Bitcoin technology market in the study period.

- Various companies in the market are investing in blockchain technology firms to facilitate the development of Bitcoin technology in North America.

- As the awareness of Bitcoin is increasing, the government in the region is taking the initiative to promote the usage of Bitcoin technology. For instance, in March 2022, the Canadian government allowed its citizens to use Bitcoin (BTC) as legal money in the country. It will help boost the bitcoin technology in North America in the future.

Bitcoin Technology Industry Overview

The bitcoin market is fragmented, with emerging startups coming up in recent years that are offering commercial activities related to bitcoin. In the current scenario, most online merchants have started enjoying the anonymity and efficiency of Bitcoin payments, which allows them to cut overhead costs compared to credit or debit card transactions.

In August 2023, PayPal introduced its PayPal USD (PYUSD) stablecoin to some customers in the U.S. as more traditional financial companies offer crypto payment options. A stablecoin is less volatile than popular crypto such as Bitcoin and Ether because they are linked to the value of a fiat currency and are usually backed by the same at a 1:1 ratio. PayPal USD buyers will be able to transfer PayPal USD between PayPal and compatible external wallets, make person-to-person payments using the stablecoin, pay with PayPal USD, and convert any of PayPal's supported cryptocurrencies to and from the stablecoin.

In April 2022, Blockstream construction has begun on a new solar-powered Bitcoin mining facility. The 3.8 Megawatt (MW) Tesla Solar PV array and 12 megawatt-hours (MWh) Tesla Megapack will power the open-source, solar-powered bitcoin mining facility at a Blockstream Mining site in the United States. This significant development supports the previously announced project between Blockstream and Block Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Decentralized and Borderless Payment System

- 4.4 Market Restraints

- 4.4.1 Highly Volatile Currency

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Exchanges

- 5.1.2 Remittance Services

- 5.1.3 Payment & Wallet

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 E-Commerce

- 5.2.3 Media & Entertainment

- 5.2.4 Hospitality

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Blockstream Corporation Inc.

- 6.1.2 Coinbase Inc.

- 6.1.3 Coinify ApS

- 6.1.4 Unocoin Technologies Pvt Limited

- 6.1.5 Bitstamp Ltd.

- 6.1.6 itBit Trust Company LLC

- 6.1.7 Blockchain Luxembourg SA

- 6.1.8 Kraken (Payward Inc.)

- 6.1.9 BitPay Inc.

- 6.1.10 Plutus Financial Inc. (ABRA)