|

市場調査レポート

商品コード

1686608

マネージドネットワークサービス-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Managed Network Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| マネージドネットワークサービス-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 131 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

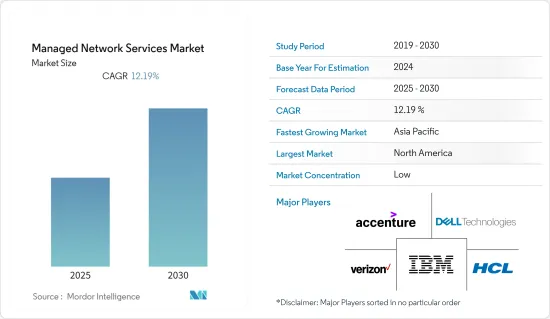

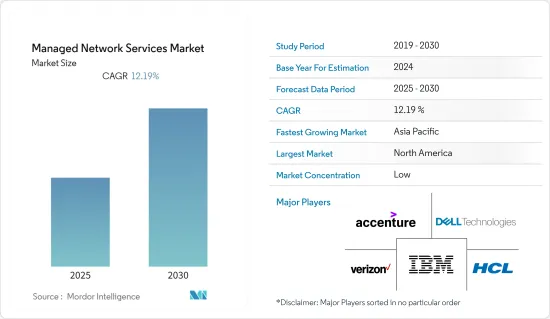

マネージドネットワークサービス市場は予測期間中にCAGR 12.19%を記録する見込みです。

主なハイライト

- マネージドネットワークサービスは、中小企業の成長と目標達成に大きな余地を与えます。中小企業のIT支出は増加すると予想され、中小企業が常に新しいITサービスや拡張ITサービスの導入による事業拡大に注力していることを示しています。中小企業がクラウド・コンピューティングを採用し、サービスを自動化し、高度なデジタル技術を試す傾向が強まるにつれて、マネージドネットワークサービスに対する需要が高まっています。

- マネージドネットワークサービスは、現代のビジネスを支える複雑で重要なネットワークを管理する上で、専門知識、拡張性、セキュリティ、運用効率を提供するため、デジタルトランスフォーメーションの拡大がマネージドネットワークサービスの需要を後押ししています。NTTグループの世界・ネットワーク調査によると、約93%の組織がデジタル・トランスフォーメーションのバックボーンとしてネットワークの重要性を認識しています。

- 現代の超分散型ワークフォースでは、より多くの従業員がさまざまな場所やデバイスからネットワークを利用するようになり、顧客のネットワーキングとセキュリティの要件は進化しています。組織は、新しく高度に分散した労働力に対応するため、こうした困難に対処するソリューションやサービスを模索しており、マネージドネットワークサービス・プロバイダーにビジネスチャンスをもたらしています。

- サイバー犯罪の憂慮すべき増加は、機密情報を第三者にさらすことを含め、ネットワーク管理のアウトソーシングに関連する潜在的なリスクについて、組織を心配させています。マネージド・サービス・プロバイダーが関与する有名なデータ漏洩やセキュリティ事故は、こうした懸念を悪化させ、マネージドネットワークサービス市場の採用をためらう企業も出てくる可能性があります。

- COVID-19危機は、MSPにとって世界レベルで前例のない状況を生み出しました。企業が急速に変化する職場環境に適応するにつれ、コラボレーションとコミュニケーションの質は、生産性と従業員の生産性の両方に大きな影響を与えました。その結果、従業員が個人所有か会社所有かを問わず、使用するデバイスで職場のアプリにシームレスにアクセスできるようにするため、企業のマネージドネットワークサービスに対する需要が高まりました。

マネージドネットワークサービス市場の動向

IT・通信分野が最大のエンドユーザーに

- IT・通信分野のITサービス管理の近代化は、かなり成熟した手法です。これは、オンプレミスとクラウドベースのITソリューションのギャップを埋めるものです。これにより、業務の有効性と効率が向上します。その結果、データの記録、処理、共有方法を企業間で統合することで、社内のIT担当者や社外の関係者のエクスペリエンスが向上します。

- テクノロジーの急速な発展に伴い、通信会社は常にイノベーションに注力しています。その結果、イノベーション、顧客サービス、インフラ構成、人材といった顧客をサポートする高度なソリューションを提供しながら、インフラを強化しています。

- 5Gネットワークの採用拡大が現在の市場動向です。モバイルネットワーク事業者は、5Gの導入による複雑性の増大と、信頼性が高く、安全で堅牢な接続の要件に対応しています。デバイス数の増加、新技術の多様性、サービス要件の広範さが、この複雑さを後押ししています。5Gの利用事例がより洗練され、要求が厳しくなり、重要性が増すにつれて、安全なユーザー体験がエンドユーザーの主要な期待となりました。

- 5Gネットワークが計画され、開発され、構築され、実装されるとき、エンドユーザーのセキュリティと品質体験全体をサポートすることに重点が移ります。このことはさらに、展開されたネットワークの管理・最適化方法の根本的な転換を必要とします。

- 高性能のサービス主導型ネットワークを安全に運用し、技術関連の容量、可用性、パフォーマンスが重要な従来のネットワーク・リソース管理モデルから脱却するために、5Gネットワークの運用と最適化には、技術中心からエンドユーザー・サービス中心へのシフトが必要です。その結果、この移行を支援するテレコムマネージドサービスに対する需要が増加し、市場の収益成長を牽引しています。Ericsson Mobility Report, June 2023によると、5Gの契約数の伸びは当面続くと予想され、年末には全世界で15億契約に達します。

- マネージド・サービスの採用に向けて、世界中のさまざまな企業がさまざまな取り組みを行っています。大企業のセグメントは、市場の成長セグメントとして浮上しています。各社は、より充実したマネージド・サービスを提供するために大きな努力を払っています。

アジア太平洋がマネージドネットワークサービス市場で優位な地位を占める

- アジア太平洋(APAC)地域のマネージドネットワークサービス市場は、いくつかの重要な要因によって拡大しています。マネージドネットワークサービスに対する需要は、急速なデジタル変革、モバイル機器やインターネットの普及率の上昇、eコマースの拡大、信頼性の高い高速接続に対するニーズなどが背景にあります。一部の企業は、新しいデジタル技術をデジタル革命の動きに統合しようとしています。企業がデジタルトランスフォーメーションへの投資を続ける中、どの企業もマネージドネットワークサービス・プロバイダーの助けを借りています。

- APACの企業は、効率的な運用と強固なサイバーセキュリティを確保するためのネットワーク管理のメリットを認識しており、市場の成長を後押ししています。

- 複数の市場企業が競争優位に立つために数多くの戦略に取り組んでおり、マネージドネットワークサービスの需要をさらに促進しています。2023年6月、Mobile World Congress Shanghai 2023(MWCSH 2023)において、ファーウェイは製品とソリューションのイノベーションと実践の共有イベントを開始しました。このイベントにおいて、同社はデータ通信分野におけるデジタル・マネージド・ネットワーク・ソリューションの最新のイノベーションと実践を共有し、通信事業者がインターネット・サービス・プロバイダーからマネージド・サービス・プロバイダーに転換し、デジタル・トランスフォーメーションにおける新たな機会を獲得することを支援することを目指し、市場の成長を促進しました。

- エンドユーザー別では、製造業分野の成長が見込まれています。同地域の製造業は近年、驚異的なデジタル革命を記録しています。中国政府は、生産効率を高めイノベーションを促進するため、従来の製造プロセスにおけるデジタル技術を積極的に支援しています。

- デジタル変革の進展に伴い、信頼性の高い高速接続、デジタル運用の保護、規制基準の遵守に対するニーズが、市場プレイヤーの開拓とともに、同地域の市場成長を促進すると予想されます。

マネージドネットワークサービス産業の概要

マネージドネットワークサービス市場は、小規模な企業によって断片化されており、IBM Corporation、HCL Technologies Limited、Dell、Verizon、Accenture PLCなど、強力な顧客基盤を持つ大手企業によって支配されています。これらの企業は、新たな事業拡大、提携、買収とともに、常にサービスの拡充を図っており、市場浸透度は市場にとって有利で、大きな競争力となっています。

- 2023年8月ベライゾン・ビジネスは戦略的世界・パートナーシップを締結し、HCLTechを世界企業顧客向けのすべてのネットワーク展開における主要なマネージドネットワークサービス(MNS)協力企業とします。HCLTechとVerizonは、Verizonのネットワーキングの強み、ソリューションの提供、スケールと、HCLTechの市場をリードするマネージド・サービスを融合させ、企業顧客向けの大規模な有線サービス提供の新時代を創造します。

- 2022年10月:アクセンチュアとグーグル・クラウドは、世界・パートナーシップの延長を発表し、人材強化のための共同能力の拡大、革新的なデータおよびAIソリューションの創出、クラウドにおける強固なデジタル基盤の確立とビジネスの変革を支援するための強固なサポート提供へのコミットメントを再確認しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19が市場のマクロ経済動向に与える影響

第5章 市場力学

- 市場促進要因

- 社内専門家の不足

- コア業務への集中によるメリット

- マネージド・サービスによる費用対効果とROIの達成

- 市場の課題

- 主要業務のアウトソーシングに消極的な組織

- エコシステム分析

- 価格モデルの分析

- マネージドネットワークサービスの価格モデル

- 価格決定のためのケーススタディ

- ネットワーク機器プロバイダーによるハードウェアの価格設定の詳細

- ネットワーク・アズ・ア・サービス(NaaS)の価格と価格モデルの分析

- 主な使用事例

- ネットワーク機器の動向

- 各種ネットワーク機器(ルーター、スイッチ、サーバー、ネットワークセキュリティ機器など)の全体市場予測

- 市場動向と開発

- ネットワーク機器を提供する主要ベンダー一覧

第6章 市場セグメンテーション

- タイプ別

- マネージドLAN

- マネージドWAN

- マネージドWi-Fi

- マネージド・ネットワーク・セキュリティ

- その他のサービス

- 組織規模別

- 中小企業(SMEs)

- 大企業

- エンドユーザー別

- BFSI

- IT・通信

- ヘルスケア・製薬

- 小売

- 製造業

- 教育

- その他(公益事業、メディアなど)

- 地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第7章 競合情勢

- 市場シェア分析

- 企業プロファイル

- IBM

- HCL Technologies Limited

- Dell

- Verizon

- Accenture PLC

- TCS

- Wipro

- Lumen Technologies

- Cato Networks

- NTT Group

The Managed Network Services Market is expected to register a CAGR of 12.19% during the forecast period.

Key Highlights

- Managed network services give SMEs much space to grow and achieve their goals. IT spending among SMEs is anticipated to rise, demonstrating that SMEs constantly focus on expanding through implementing new and extended IT services. The demand for managed network services is increasing as SMEs increasingly adopt cloud computing, automate services, and experiment with advanced digital technologies.

- The growing digital transformation propels the demand for managed network services as they provide expertise, scalability, security, and operational efficiency in managing complex and critical networks that underpin modern businesses. According to a Global Network survey by NTT Group, about 93% of organizations recognize the significance of the network as the backbone of digital transformation.

- With a modern hyper-distributed workforce, customers' networking and security requirements are evolving as more employees use the network from various places and devices. Organizations are searching for solutions and services to handle these difficulties to serve the new and highly scattered workforce, providing opportunities for the managed network service providers.

- The alarming growth in cybercrimes has worried organizations about the potential risks associated with outsourcing network management, including exposing confidential information to third parties. High-profile data breaches or security incidents involving managed service providers can exacerbate these concerns and lead some businesses to hesitate in adopting the managed network service market.

- The COVID-19 crisis created an unprecedented situation for MSPs on a global level. As businesses adjusted to rapidly changing work environments, the quality of collaboration and communication profoundly impacted both productivity and employee output. This resulted in increased demand for managed network services from businesses so that employees had seamless access to their workplace apps on the device they used, whether personal or company-owned.

Network Managed Services Market Trends

IT and Telecom Sector to be the Largest End User

- Modernizing IT service management for the IT and telecommunications sectors is quite a mature methodology. This bridges the gap between on-premise and cloud-based IT solutions. It improves operational effectiveness and efficiency. As a result, integrating how data is recorded, processed, and shared across companies enhances the experience for internal IT personnel and external constituents.

- With the rapid growth of technology, telecommunication companies are constantly concentrating on innovation. As a result, they are enhancing their infrastructure while providing advanced solutions to support their clients, such as innovation, customer service, infrastructure configuration, and human resources.

- The increased adoption of 5G networks is the current market trend. Mobile network operators handle the increasing complexity caused by implementing 5G and the requirement for dependable, secure, and robust connections. The increased number of devices, a diversity of new technologies, and a broader spectrum of service requirements drive this complexity. As the 5G usage cases become more sophisticated, demanding, and vital, secure user experience has become the primary end-user expectation.

- When 5G networks are planned, developed, built, and implemented, the emphasis shifts to supporting end users' whole security and quality experience. This further necessitates a fundamental shift in how deployed networks are managed and optimized.

- To successfully operate high-performance service-driven networks securely and depart from the traditional network resource management model, where technology-related capacity, availability, and performance are critical, the 5G network operations and optimization require a shift from technology-centric to end-user service-centric. As a result, there is an increase in the demand for telecom-managed services to help with this transition, thereby driving the market revenue growth. According to Ericsson Mobility Report, June 2023, the growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 1.5 billion subscriptions globally by the end of the year, which includes an increase of 500 million subscriptions in the past one year.

- Various players across the world are undertaking various initiatives as a move toward the adoption of managed services. Large enterprises segment has emerged to be a growing segment in the market. Companies are making significant efforts to offer enhanced managed services.

Asia Pacific Holds a Dominant Position in Managed Network Services Market

- The managed network services market in the Asia-Pacific (APAC) region is expanding due to several key factors. The demand for managed network services is driven by rapid digital transformation, rising penetration of mobile devices and the Internet, growing e-commerce, and a need for reliable high-speed connectivity. Some companies seek to integrate new digital technologies into the digital revolution movement. As firms continue to invest in digital transformation, every company has enlisted the help of a managed network services provider.

- APAC businesses recognize the benefits of network management to ensure efficient operations and robust cybersecurity, fueling the growth of the market.

- Several market players are involved in numerous strategies to gain a competitive edge, further fueling the demand for Managed Network Services. In June 2023, at Mobile World Congress Shanghai 2023 (MWCSH 2023), Huawei launched a product and solution innovation and practice sharing event. During this event, the company shared the latest innovations and practices with its digitally managed network solution in the data communication field, aiming to help carriers transform from Internet service providers to managed service providers and capture new opportunities in digital transformation, thereby driving the growth of the market.

- By end user, the manufacturing segment is expected to grow. The manufacturing sector in the region has recorded a tremendous digital revolution in recent years. The Chinese government has actively supported digital technologies in traditional manufacturing processes to increase production efficiency and encourage innovation.

- With growing digital transformation, the need for reliable and high-speed connectivity, safeguarding digital operations, and complying with regulatory standards, along with the developments by the market players, are expected to drive the growth of the market in the region.

Network Managed Services Industry Overview

The managed network services market is fragmented with small players and dominated by major players, such as IBM Corporation, HCL Technologies Limited, Dell, Verizon, Accenture PLC, and others, with a strong client base. These players are constantly providing increased and enhanced offerings, along with newer expansions, partnerships, and acquisitions; the level of market penetration is favorable to the market, and it is providing major competitiveness.

- August 2023: Verizon Business formed a strategic global partnership, making HCLTech its primary Managed Network Services (MNS) collaborator in all networking deployments for global enterprise customers. HCLTech and Verizon bring together Verizon's networking strength, solution offering, and scale, and HCLTech's market-leading Managed Service offerings to create a new era for large-scale, wireline service provision for enterprise customers.

- October 2022: Accenture and Google Cloud announced an extended global partnership, reaffirming its commitment to growing its talent-enhancing joint capabilities, creating innovative data and AI solutions, and providing robust support to assist clients in establishing a solid digital foundation and transforming their businesses in the cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Macroeconomic Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Lack of in-house Expertise

- 5.1.2 Benefit of Extensive Focus on Core Operations

- 5.1.3 Cost Benefits and ROI Achieved through Managed Services

- 5.2 Market Challenges

- 5.2.1 Organizations Remain Reluctant to Outsource Key Operations

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing Model

- 5.4.1 Managed Network Services Pricing Model

- 5.4.2 Case Studies for Pricing Determination

- 5.4.3 Pricing Details of Hardware by Network Equipment Providers

- 5.4.4 Analysis of Pricing and Pricing Model of Network as a Service (NaaS)

- 5.5 Key Use Cases

- 5.6 Networking Equipment Trends

- 5.6.1 Overall Market Estimates for Different Network Equipment (Routers, Switches, Servers, Network Security Equipment, Etc.)

- 5.6.2 Market Trends and Developments

- 5.6.3 List of Major Vendors Providing Network Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Managed LAN

- 6.1.2 Managed WAN

- 6.1.3 Managed Wi-Fi

- 6.1.4 Managed Network Security

- 6.1.5 Other Services

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare and Pharmaceutical

- 6.3.4 Retail

- 6.3.5 Manufacturing

- 6.3.6 Education

- 6.3.7 Others (Utilities, Media, Etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle East and Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Profiles

- 7.2.1 IBM

- 7.2.2 HCL Technologies Limited

- 7.2.3 Dell

- 7.2.4 Verizon

- 7.2.5 Accenture PLC

- 7.2.6 TCS

- 7.2.7 Wipro

- 7.2.8 Lumen Technologies

- 7.2.9 Cato Networks

- 7.2.10 NTT Group