|

市場調査レポート

商品コード

1851535

自動保管・検索システム(ASRS):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Automated Storage And Retrieval System (ASRS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動保管・検索システム(ASRS):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月08日

発行: Mordor Intelligence

ページ情報: 英文 197 Pages

納期: 2~3営業日

|

概要

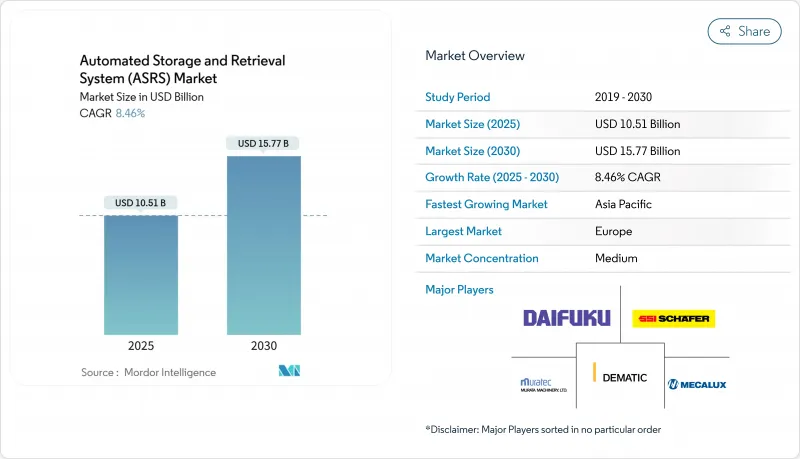

自動保管・検索システムの市場規模は、2025年に105億1,000万米ドルと評価され、2030年には157億7,000万米ドルに達すると予測されています。

これは、インテリジェントな自動化が倉庫オペレータにとってオプションのアップグレードから戦略的必要性へとシフトしていることを強調する堅調なCAGRを反映しています。

eコマース量の増加、慢性的な労働力不足、不動産コストの高騰が相まって、自動保管・検索システム市場の展開がスループット、精度、スペース利用において測定可能な利益をもたらす転換点を生み出しています。ロジスティクス業務において年率5~7%の賃金上昇に直面している企業は、資本集約的な自動化プロジェクトを運営費上昇のヘッジとして扱い、一方、エネルギー効率の高いキューブおよびシャトル・ソリューションは、企業の持続可能性義務に合致しています。テクノロジーの融合がソリューション設計を再構築しています。最新のプラットフォームは、ロボット工学、AIルーティング・アルゴリズム、予知保全アナリティクスを統合し、計画外のダウンタイムを最大30%削減します。早期の採用企業からは、多品種注文プロファイルのサイクルタイムが40%短縮されたとの報告もあり、自動化保管・検索システム市場への投資はオムニチャネル・フルフィルメント戦略の基盤として位置づけられています。

世界の自動保管・検索システム(ASRS)市場の動向と洞察

eコマース・フルフィルメントへの圧力

2025年半ばまでに、アマゾンが100万台のロボットを導入したことは、手作業によるピッキングでは1時間当たり300行に迫るオーダー・プロファイルを維持できないことの目に見える証明となりました。同業小売企業は、注文のサイクルタイムを数時間から数分に短縮するキューブ・シャトル・プロジェクトを迅速に進めることでこれに対応し、自動保管・検索システム市場の予約を加速させました。アパレルと電子機器における返品率の上昇により、精度が重視されるようになりました。AIを強化したグリッパーは現在、99%以上の品目認識精度を達成し、コストのかかる再発送を削減しています。また、フルフィルメント・オペレーターは、ロボティクスがフォークリフトの動きや照明の必要性を制限することで、注文あたりのエネルギー・コストを8%削減できることを発見しました。

上昇する人件費と安全義務

2024年、フォークリフト事故は倉庫での死亡事故のほとんどを占め、米国全体で1週間の負傷保険金請求に8,400万米ドルが費やされました。2025年に発行されたOSHAの新ガイドラインは、雇用者の責任を転換させ、人通りの多い通路から人間を排除する物品対人セルへの転換を加速させました。2028年までに技術者が20%不足すると予測される自動車整備工場では、ミニロードシステムを採用し、不足している労働力を検索から診断の役割に振り向けた。これらの力学を総合すると、中期的な自動化保管・検索システム市場の成長に2ポイント以上のプラス要因となります。

高い初期CAPEXと長期投資回収期間

7万米ドルから300万米ドルまでのターンキープロジェクトは、コスト削減の可能性が実証されているにもかかわらず、多くの小規模販売業者の足かせとなっています。TCOモデルでは、ソフトウエア、試運転、トレーニングが本体価格にさらに40%上乗せされることが多く、マクロ的に不透明な時期にはCFOの快適領域を超えて投資回収期間が伸びることが明らかになっています。サブスクリプションベースの「ペイ・パー・ピック」モデルは、先行費用を軽減するために始まったが、現在利用可能なのは、一部の大量生産ユースケースに限られています。

セグメント分析

固定式通路クレーンの設置は、2024年においても世界売上高の38.2%を占め、予測可能なフローが高いラック構造を正当化する自動車工場と大量消費財工場に軸足を置いています。これらの設備は、歴史的に自動化保管・検索システム市場の設計テンプレートを設定してきたが、ユーザーを特定の通路幅とスループット天井に固定します。キューブベースのグリッドとロボットストレージラインは、ストレージ密度を60%向上させ、検索時間を70秒未満に短縮することで勢いを増し、10年末までに収益ミックスをシフトさせる12.1%のCAGRを牽引しました。AutoStoreやDSVのような人気のある3PLは、9カ国でキューブの展開を拡大し、多目的適応性を強調しました。シャトル・ベースのシステムは中間的な位置を占めています。モジュール式のシャトル・レーンにより、企業は大規模な建物の改修をすることなく、段階的に拡張することができます。この柔軟性は、自動化された保管・検索システム市場への投資を年ごとの需要変動に合わせたいと考える急成長中の小売業者に魅力的です。

垂直リフト・モジュール(VLM)とカルーセル・ソリューションは、収益シェアが10%未満とニッチであることに変わりはないが、床面積が乏しく、部品の完全性が最重要視される場合には、重要な価値を付加します。例えば、医療機器の組立業者は、99.9%以上のピック精度を達成しながら、汚染からマイクロ機械部品を保護するためにVLMを使用しています。ハイブリッド設備は、クレーン、シャトル、キューブを混在させることが多くなっています。このアーキテクチャは、自動化された保管・検索システム市場が、単一技術のベットではなく、カスタマイズされたエコシステムへと進化したことを例証しています。Kardex社とBerkshire Grey社とのコラボレーションは、AIビジョンピックセルをVLMラインに組み込み、99.99%の精度を達成し、現代の倉庫設計を形成する相互受粉の動向を強化しました。

ユニットロードパレットシステムは2024年の売上高の42.5%を占め、自動車サブアセンブリ、飲料パレタイジング、各保管場所に均質なアイテムが保管されるその他のバルクフローが原動力となりました。しかし、eコマースにおけるSKUの爆発的な増加は、ユニットロードクレーンではコスト効率的に満たすことができないトートレベルの検索レートを促進し、ミニロードシステムの需要が11.3%のCAGRで増加しています。ミニ積載トート・ソリューションの自動保管・検索システム市場規模は、1カゴ当たりのオンライン注文が平均35件であるオムニチャネル食料品において、さらに急速に拡大すると予測されます。1つのミニロード通路で1時間当たり最大1,200のトートサイクルを処理できるため、1つのフットプリントで店舗への補充とクリック&コレクトのフルフィルメントが可能になります。

パレット・シャトル・サブシステムは、高スループットのパレット保管と選択的なアクセス要求の橋渡しをし、密度とスピードのバランスをとる設定可能な奥行きを可能にします。ミッドロード・アプリケーションは、数は少ないもの、電子機器やアフターマーケット自動車部品の厄介な中型コンポーネントを扱います。WMSが硬直したサイロ化されたゾーンではなく、リアルタイムの移動あたりのコストに基づいてピックを指示するように、オペレータは、統一されたソフトウェアプラットフォーム内の負荷タイプをますますブレンドしており、自動化されたストレージおよび検索システム市場の微妙な成熟を示しています。

ASRS市場レポートは、製品タイプ(固定アイルクレーンシステム、シャトルベースシステム、垂直リフトモジュール(VLM)、その他)、ロードタイプ(ユニットロード、パレットロードシャトル、ミニロード、ミッドロード、トート/カートン、その他)、アプリケーション(保管とバッファリング、商品対個人のオーダーピッキング、キッティングと順序付け、その他)、エンドユーザー産業(製造業、非製造業)、地域別に業界をセグメンテーションしています。

地域分析

欧州が2024年の世界売上高の33.8%を占め、地域別寄与度で最大を維持。時給28米ドルを超える高い人件費と厳しい労働者安全法制が自動化を財政的に説得力のあるものにし、EUの持続可能性規則が高密度キューブグリッドを建物のエネルギーフットプリントを低減する道として認めました。ドイツのハイテク戦略2025は、ロボット研究開発に3億6,920万米ドルを計上し、ソリューション・プロバイダーを育成する商業エコシステムを強化しました。スカンジナビアの小売企業は、6つの従来型倉庫を1つの自動化施設に圧縮し、出荷される注文1件あたりのCO2を35%削減しました。

アジア太平洋地域は、CAGR11.9%と最速の成長を遂げました。中国の1兆元規模のロボット・メガプロジェクトは、工場の自動化に対する国家レベルのコミットメントを示し、日本は大阪と東京を結ぶ500キロメートルのベルトコンベア・ネットワークを提案し、高スループットのソーテーション・ノードの需要を生み出しました。韓国の政策優遇措置は、スマートファクトリー展開のために1億2,800万米ドルの補助金を追加し、インドはダイフクの2025年工場開設に続く生産拠点となり、地域顧客のリードタイムを短縮しました。したがって、アジア太平洋の自動化保管・検索システム市場は、内需と現地生産能力の両方から恩恵を受けています。

北米は依然としてイノベーションの中心地であり、グローバル・ベンチマークとなるハイパースケールのeコマース実証実験場があります。アマゾンは、AI基盤モデルを導入して群ロボットのルートを変更し、エネルギー効率を向上させながら時間当たりのピッキング数を増加させました。ニューハンプシャー州にあるAutoStoreの新本社には、技術者を養成するアカデミーがあり、スキルギャップの抑制に取り組むとともに、2026年後半までに地域別設置台数が300台を突破するという同社の予測を裏付けています。サウジアラビアの医薬品販売会社は2024年に半自動フルフィルメントを試験的に導入し、ブラジルの3PLは資本財に関する減税措置の恩恵を受け、両地域を今後5年間の成長余地に位置づけています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- eコマース・フルフィルメントへの圧力

- 人件費の上昇と職場の安全義務化

- マイクロ・フルフィルメント/都市型DCへのシフト(アンダー・ザ・レーダー)

- コールドチェーンのための冷凍倉庫自動化(アンダーザレーダー)

- ROIを高める予測メンテナンス分析(アンダーザレーダー)

- APACと欧州の産業政策インセンティブ

- 市場抑制要因

- 高い初期投資額と長い投資回収期間

- ASRS熟練技術者の不足

- レガシーWMSとの統合の複雑さ

- コネクテッドASRS(アンダー・ザ・レーダー)におけるサイバーセキュリティの脆弱性

- 重要な規制枠組みの評価

- バリューチェーン分析

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 主要利害関係者の影響評価

- 主な使用事例とケーススタディ

- 市場のマクロ経済要因への影響

- 投資分析

第5章 市場セグメンテーション

- 製品タイプ別

- 固定アイルクレーンシステム

- シャトルベース・システム

- 垂直リフトモジュール(VLM)

- カルーセルモジュール(縦型、横型)

- キューブ型/ロボット型キューブストレージ

- 負荷タイプ別

- ユニットロード

- パレットロードシャトル

- ミニロード

- ミッドロード

- トート/カートン、その他

- 用途別

- ストレージとバッファリング

- 対人オーダーピッキング

- キッティングとシーケンス

- 組立/生産サポート

- 冷蔵・冷凍ハンドリング

- エンドユーザー業界別

- 製造

- 自動車

- 飲食品

- 医薬品・ライフサイエンス

- エレクトロニクスと半導体

- 金属・機械

- 非製造業

- eコマースと小売

- サードパーティロジスティクス(3PL)と倉庫業

- 空港と手荷物取り扱い

- 防衛・官公庁店舗

- 製造

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- ASEAN

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH(SSI SCHAEFER)

- Dematic Corp.(KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, S.A.

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Bastian Solutions LLC

- System Logistics S.p.A.

- Hanel Storage Systems

- Modula S.p.A.

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH