|

市場調査レポート

商品コード

1536796

自動車用ナビゲーションシステム:市場シェア分析、産業動向・統計、成長予測(2024~2029年)Automotive Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車用ナビゲーションシステム:市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年08月14日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

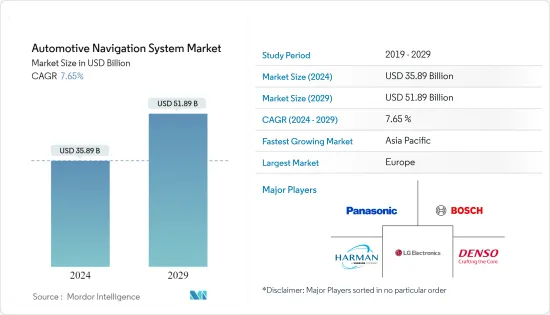

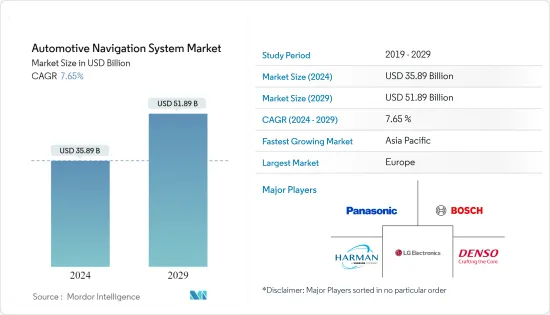

世界の自動車用ナビゲーションシステムの市場規模は、2024年に358億9,000万米ドルに達し、2024~2029年の予測期間中にCAGR 7.65%で成長し、2029年には518億9,000万米ドルに達すると予測されています。

今後数年間で、自動車用ナビゲーションシステムにおけるリアルタイムの交通データ、地図更新、スマートフォン利用の統合が、大きな顧客需要を引きつける主要因となると思われます。さらに、自律走行車とコネクテッドビークル技術の急速な強化は、道路上の他の車両に関するリアルタイム情報に大きく依存するため、高度な自動車用ナビゲーションシステムの需要を促進すると予想されます。しかし、サイバーセキュリティ問題の増加やナビゲーションシステムの高コストが、予測期間中の市場成長を妨げる要因となっています。

さらに、消費者の私的な交通手段を利用することへの嗜好の変化と、世界の物流産業の拡大が、乗用車と商用車セグメントの成長に寄与しており、ひいては自動車用ナビゲーションシステムの普及にプラスの影響を与えています。商用車は、貨物や旅客輸送のために長時間移動する必要があるため、これらの車両の運転手は、移動のダウンタイムを減らすために高速ルートの迅速な知識を必要としています。このような要因が、自動車用ナビゲーションシステム市場の成長に影響を与えると予想されます。

*国際自動車工業会(OICA)によると、乗用車の世界新車販売台数は2021年の5,640万台に対し、2022年は5,740万台となり、前年比1.9%増となりました。

*同様に、小型商用車の新車販売台数は、2021年の1,860万台に対し、2022年には1,980万台となり、前年比7%の大幅な伸びを記録しました。

アジア太平洋は、自動車用ナビゲーションシステムの主要な地域市場として浮上すると予測されており、日本、インド、中国は予測期間中、自動車製造の主要拠点として発展しています。北米および欧州諸国では、自動車用微小電気機械システム(MEMS)センサーの普及により需要が増加するとみられます。これらのセンサーは、最も顕著な新興アプリケーションの1つであり、自動車用ナビゲーションシステム市場の電子制御ユニットやタイヤ空気圧監視システムでますます使用されるようになっています。

自動車用ナビゲーションシステム市場の動向

予測期間中、アフターマーケットセグメントが牽引役となる

純正メーカーによるナビゲーションシステムの工場装着とは別に、アフターマーケットチャネルからの装着率も予測期間中にかなりの伸びを見せそうです。

世界のeコマース産業の成長により、eコマース企業は顧客に時間通りに製品を納品しなければならないというプレッシャーが高まっています。この要件のため、多くのeコマース企業は、企業対顧客(B2C)配送のために既存の物流業者と提携を結んでいます。この需要に対応するため、物流会社はより多くの車両を投入してサービスを拡大しています。これらの車両には主に衛星ナビゲーションシステムが搭載され、スケジュール通りに顧客に届くようになっています。さらに、eコマース企業は、より多くの消費者を惹きつけるために、「どこでも配達」、「即日配達」、さらには「即日配達」といったオファーを導入しています。

*米国のeコマース利用者数は、2021年の2億2,376万人に対し、2022年には2億4,072万人に達し、前年比7.5%の伸びを示しました。

*India Brand Equity Foundation (IBEF)によると、インドは2019~2022年にかけて1億2,500万人の買い物客を獲得し、2025年末までにさらに8,000万人の増加が見込まれています。

近年発売されたほとんどの自動車にはナビゲーションシステムが搭載されており、乗員を楽しませながら目的地への到着をサポートします。工場出荷時にナビゲーションシステムが装備されていなかった古い車でも、アフターマーケットのナビゲーションシステムをダッシュボードに取り付けることができるし、 促進要因はポータブルナビゲーションシステムを使うこともできます。さらに、OEMが提供する車両モデルには装備されていない高度なナビゲーションシステムを組み込もうとする顧客は、これらの製品を購入するためにアフターマーケットの販売チャネルを利用することを好むようになってきています。そのため、二酸化炭素排出量削減に向けた政府の積極的な後押しにより、消費者が電気自動車を選好していることが、アフターマーケット販売チャネルの拡大につながっています。

*国際エネルギー機関(IEA)によると、バッテリー式電気自動車の世界販売台数は、2021年の460万台に対し、2022年には730万台に達し、前年比58.6%増となります。

さまざまなナビゲーションシステムサプライヤーがeコマースプラットフォームに製品を掲載していることから、市場のアフターマーケット分野は予測期間中に急成長を記録すると予想されます。

自動車用ナビゲーションシステム市場をリードする欧州

近年、欧州の自動車産業は世界の自動車輸出大国として台頭しており、欧州の自動車所有者はナビゲーションを自動車の重要な安全対策と考えています。各地域の政府当局は、今後数年間ですべての自動車にGPSシステムを接続することを義務付けています。欧州標準化委員会(CEN)と欧州通信標準化機構(ETSI)は最近、協調型インテリジェント交通システムに規定される標準の初期セットを発行しました。

この地域は販売台数が急増しています。また、Renault, Mitsubishi Electric Corporation, Denso, Bosch, Nissan, Garmin, Hyundai, Toyotaといった自動車OEMの存在も目立っています。安全・セキュリティサービスは、欧州市場全体の自動車産業に最も貢献しており、ナビゲーションは自動車の重要な安全対策と考えられています。

*ドイツ連邦自動車局(KBA)によると、2023年10月の同国の乗用車新車登録台数は前年同月比4.9%増の21万8,959台でした。2023年1~10月の新車登録台数は225万7,025台(前年同期比13.5%増)でした。

*英国自動車工業会(SMMT)によると、2023年11月の英国における乗用車販売台数は、10月比9.5%増の15万6,525台でした。さらに、同国の2023年1~11月の乗用車販売台数は170万台に達し、前年同期比18.6%の伸びを示しました。

欧州各国の自動車メーカーやティア1サプライヤーは、モビリティマネジメントやナビゲーション技術などの分野でデジタルサービスを開発するため、データに基づくソリューションでナビゲーションプラットフォームプロバイダーの強みを一貫して試しています。欧州のさまざまな自動車メーカーが、顧客の運転体験を向上させ、エコシステムにおける競合優位性を獲得するために、先進的なナビゲーションソリューションの提供に積極的に取り組んでいます。

*2023年5月、中国の自動車メーカーであるLynk & Co.は、革新的なwhat3wordsナビゲーションシステムを欧州の車両に採用することを発表しました。what3wordsの斬新なシステムは、世界を57兆個の3m四方に分割し、それぞれの四方に3つの単語のユニークな組み合わせを与え、what3wordsの住所を形成しています。

電気自動車への需要の高まり、無線通信技術の高い普及率、高度な通信インフラの利用可能性の増加が、欧州各国における自律走行車と依存型ナビゲーションシステム市場を牽引する主な要因のひとつです。

自動車用ナビゲーションシステム産業の概要

自動車用ナビゲーションシステム市場は、エコシステムで事業を展開する様々な国際的・地域的プレーヤーによって断片化され、競争が激しいです。主なプレーヤーには、Panasonic Holdings Corporation、Robert Bosch GmbH、Harman International Industries、LG Electronics Inc.、Denso Corporation, Aisin Corporation, Mitsubishi Electric Corporation, Garmin Ltd.などがあります。これらの企業は、AI(人工知能)やAR(拡張現実)などの新技術を統合することで、ナビゲーションシステムの機能性を向上させ、世界的に高まる自動車の高度なナビゲーションシステムの需要に対応することにますます注力しています。

*2023年12月、Genesys Internationalは、ADAS Show 2023において、ADASマップの最新開発を発表しました。Genesysのショーケースのハイライトは、830万kmの道路をカバーし、4,000万以上のPOI(Point of Interest)を備えたインドの高忠実度2D標準定義(SD)地図でした。

*2022年4月、Mapboxは北米トヨタ自動車が開発した次世代マルチメディアシステムを一部のトヨタ車とレクサス車向けに発売し、顧客の期待を超えるドライブ体験を提供すると発表しました。Mapbox Mapsソフトウェア開発キットは、トヨタの次世代マルチメディアシステムを補完する地図デザインを組み込んでおり、ターンバイターンのナビゲーションを 促進要因に直感的に提供します。

同市場は、自律走行車のエコシステムへの統合により、自動車用ナビゲーションシステム技術が急速に強化されると予想されます。主要企業は、産業における競争力を獲得するために、自動車メーカーと積極的に戦略を練り、長期的なパートナーシップを結ぶと予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 自家用交通手段に対する消費者の嗜好の変化

- 市場抑制要因

- 高い購入・設置コスト

- 産業の魅力 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模:金額ベース - 米ドル)

- 自動車タイプ別

- 乗用車

- 商用車

- 販売チャネル別

- 相手先商標製品メーカー(OEM)

- アフターマーケット

- 画面サイズ別

- 6インチ未満

- 6~10インチ

- 10インチ以上

- 地域別

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Harman International Industries

- LG Electronics Inc.

- Denso Corporation

- Aisin Corporation

- Mitsubishi Electric Corporation

- Garmin Ltd

- Visteon Corporation

- TomTom International BV

- Faurecia Clarion Electronics Co. Ltd

- JVC Kenwood Corporation

第7章 市場機会と今後の動向

- 人工知能(AI)やモノのインターネット(IoT)などの先進技術のナビゲーションシステムへの統合が市場需要を促進

第8章 サプライヤー情報

The Automotive Navigation System Market size is estimated at USD 35.89 billion in 2024, and is expected to reach USD 51.89 billion by 2029, growing at a CAGR of 7.65% during the forecast period (2024-2029).

Over the coming years, the integration of real-time traffic data, map updates, and smartphone usage in automotive navigation systems will serve as major factors for attracting significant customer demand. Further, rapid enhancement in autonomous vehicles and connected vehicle technology is expected to fuel the demand for advanced automotive navigation systems as they heavily rely on real-time information concerning other vehicles on the road. However, increasing cybersecurity issues and the high cost of navigation systems are a few factors that are likely to hinder the market's growth during the forecast period.

Moreover, consumers' shifting preference toward availing private transportation mediums and the expanding logistics industry worldwide are contributing to the growth of the passenger and commercial vehicle segments, which, in turn, positively impacts the penetration of automotive navigation systems. Commercial vehicles are required to travel for a longer duration for cargo and passenger transportation purposes, and therefore, the drivers of these vehicles require swift knowledge of the faster routes to reduce travel downtime. Such factors are expected to impact the growth of the automotive navigation system market.

* According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger vehicle sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a Y-o-Y growth of 1.9%.

* Similarly, new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7%.

Asia-Pacific is projected to emerge as the key regional market for automotive navigation systems, with Japan, India, and China developing as major automotive manufacturing hubs during the forecast period. The demand across North American and European countries is likely to increase due to the penetration of automobile micro-electro-mechanical systems (MEMS) sensors. These sensors are among the most prominent emerging applications and are increasingly being used in electronic control units and tire pressure monitoring systems in the automotive navigation systems market.

Automotive Navigation System Market Trends

Aftermarket Segment to Gain Traction during the Forecast Period

Apart from the factory fitment of the navigation system from the original equipment manufacturer's end, the fitment rate from the aftermarket channels is also likely to witness considerable growth during the forecast period.

Growth in the e-commerce industry worldwide has resulted in increased pressure on e-commerce companies to deliver products to customers on time. Due to this requirement, many e-commerce companies are forming alliances with existing logistic providers for business-to-customer (B2C) deliveries. To cater to the demand, logistics companies have been expanding their services by entering more vehicles into service. These vehicles are primarily equipped with satellite navigation systems to reach customers as per schedule. Furthermore, e-commerce companies have introduced offers like 'anywhere delivery,' 'same day delivery,' and even 'same hour delivery' to attract a larger number of consumers.

* The number of e-commerce users in the United States reached 240.72 million units in 2022 compared to 223.76 million units in 2021, showcasing a Y-o-Y growth of 7.5%.

* According to the India Brand Equity Foundation (IBEF), India gained 125 million shoppers between 2019 and 2022, with another 80 million expected by the end of 2025.

Most vehicles rolled out in recent years have been equipped with navigation systems that assist drivers in reaching their destinations while also entertaining their occupants. Older cars that were not originally manufactured with a factory-fitted navigation system can have aftermarket navigation systems fitted to their dashboards, or drivers can even use portable navigation systems. Moreover, customers looking to integrate advanced navigation systems that are not equipped in vehicle models offered by OEMs are also increasingly preferring to avail themselves of aftermarket sales channels for purchasing these products. Therefore, consumers' preference toward availing electric vehicles owing to an aggressive government push toward reducing carbon emissions is leading to the expansion of the aftermarket sales channel.

* According to the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 58.6%.

With various navigation system suppliers listing their products on e-commerce platforms, the aftermarket segment of the market is expected to register surging growth during the forecast period.

Europe Leading the Automotive Navigation System Market

In recent years, the European automotive industry has emerged as a major exporter of automobiles worldwide, and European vehicle owners consider navigation a key safety measure in vehicles. Government authorities across regional countries are aiming to ensure that all cars must be connected with GPS systems over the coming years. The European Committee for Standardization (CEN) and the European Telecommunications Standards Institute (ETSI) recently issued an initial set of standards prescribed for cooperative intelligent transport systems.

The region is actively witnessing a surge in sales. It also has a notable presence of automotive OEMs like Renault, Mitsubishi Electric Corporation, Denso, Bosch, Nissan, Garmin, Hyundai, and Toyota. Safety and security service is the largest contributor to the automotive industry across the European market, with navigation considered a crucial safety measure for vehicles.

* According to the Germany Federal Motor Vehicle Office (KBA), in October 2023, new passenger car registrations in the country increased by 4.9% Y-o-Y to 218,959 units. During the first ten months of 2023, 2,257,025 new cars were registered (up 13.5% Y-o-Y).

* According to the Society of Motor Manufacturers and Traders (SMMT), in November 2023, passenger vehicle sales in the United Kingdom increased by 9.5% to 156,525 units compared to October 2023. Furthermore, passenger car sales in the country touched 1.7 million units in the first 11 months of 2023, showcasing a Y-o-Y growth of 18.6% compared to the same period in 2022.

Automakers and tier-1 suppliers across European countries are also consistently testing the strength of navigation platform providers in data-based solutions to develop digital services in fields such as mobility management and navigation technology. Various automakers in Europe are actively engaged in offering advanced navigation solutions to customers to enhance their driving experience and gain a competitive edge in the ecosystem. For instance,

* In May 2023, Lynk & Co., a China-based car manufacturer, announced the adoption of an innovative what3words navigation system for its European fleet, providing customers with an alternative to traditional systems such as Google Maps. The what3words' novel system has divided the world into 57 trillion 3 m squares, and each square has been given a unique combination of three words, forming its what3words address.

Growing demand for electric vehicles, high penetration of wireless communication technology, and increasing availability of advanced telecom infrastructure are among the major factors driving the market for autonomous cars and dependent navigation systems across European countries.

Automotive Navigation System Industry Overview

The automotive navigation system market is fragmented and highly competitive due to various international and regional players operating in the ecosystem. Some of the major players include Panasonic Holdings Corporation, Robert Bosch GmbH, Harman International Industries, LG Electronics Inc., Denso Corporation, Aisin Corporation, Mitsubishi Electric Corporation, and Garmin Ltd. These companies are increasingly focusing on improving their navigation system functionalities through the integration of emerging technologies, such as AI (artificial intelligence) and AR (augmented reality), to cater to the growing demand for advanced navigation systems in vehicles worldwide.

* In December 2023, Genesys International announced its latest development in ADAS Maps at the ADAS Show 2023, which comprises solutions that enhance the safety and support for autonomous vehicles with highly detailed road information. The highlight of Genesys' showcase was their high fidelity 2D Standard Definition (SD) map for India, which covers 8.3 million km of roads and features over 40 million Points of Interest.

* In April 2022, Mapbox announced the launch of the next-generation multimedia system developed by Toyota Motor North America for select Toyota and Lexus vehicles to offer a driving experience exceeding customer expectations. The Mapbox Maps software development kit incorporates a map design that complements Toyota's next-generation multimedia system, making turn-by-turn navigation intuitive for drivers.

The market is anticipated to witness rapid enhancements in automotive navigation system technology owing to the integration of autonomous vehicles into the ecosystem. Major players are expected to actively strategize and form long-term partnerships with automakers to gain a competitive edge in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Shifting Preference of Consumers to Avail Private Medium of Transportation

- 4.2 Market Restraints

- 4.2.1 High Purchase and Installation Costs

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Sales Channel

- 5.2.1 Original Equipment Manufacturers (OEMs)

- 5.2.2 Aftermarket

- 5.3 By Screen Size

- 5.3.1 Less than 6 Inches

- 5.3.2 6-10 Inches

- 5.3.3 More than 10 Inches

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Panasonic Holdings Corporation

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Harman International Industries

- 6.2.4 LG Electronics Inc.

- 6.2.5 Denso Corporation

- 6.2.6 Aisin Corporation

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.8 Garmin Ltd

- 6.2.9 Visteon Corporation

- 6.2.10 TomTom International BV

- 6.2.11 Faurecia Clarion Electronics Co. Ltd

- 6.2.12 JVC Kenwood Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Advanced Technologies such as Artificial Intelligence (AI) and Internet of Things (IoT) into Navigation Systems Propelling Market Demand