|

市場調査レポート

商品コード

1907272

エアゾール缶:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エアゾール缶:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

概要

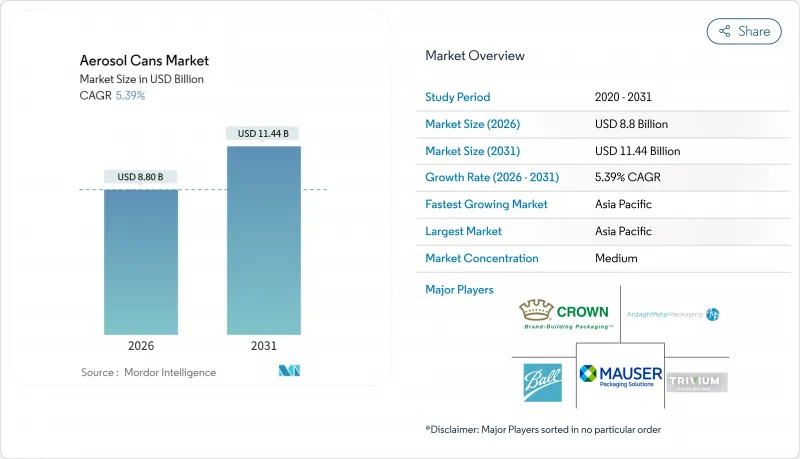

エアゾール缶市場の規模は、2026年には88億米ドルと推定されており、2025年の83億5,000万米ドルから成長が見込まれます。

2031年の予測では114億4,000万米ドルに達し、2026年から2031年にかけてCAGR5.39%で成長すると見込まれています。

持続的な成長は、包装業界における再生可能素材への転換、循環型経済目標との規制整合性、そしてアルミニウム容器がより厳格な揮発性有機化合物(VOC)制限を満たす実証済み能力によって形作られています。Eコマースの拡大は、複雑な物流ネットワークに耐えうる漏れ防止・棚出し可能な包装形態を求めるブランドにより、さらなる勢いを加えています。低GWP(地球温暖化係数)推進剤や単一素材缶設計における革新は、市場リーダーの競争上の差別化を強化しています。一方で、原材料コストの変動性や急速に普及する詰め替え可能なコンセプトが、短期的な利益率を抑制する要因となっています。

世界のエアゾール缶市場の動向と洞察

リサイクル性と循環型経済への適合性

アルミニウムの無限リサイクル性は、拡大生産者責任制度のもとで製品寿命終了時の性能を文書化する必要があるブランドオーナーにとって、決定的な素材へと変貌させました。ボール社のReAl合金は、強度を維持しながら缶本体のカーボンフットプリントを50%削減し、これまでに生産されたアルミニウムの75%が現在も流通している既存の世界のリサイクルインフラのクローズドループ利点を強化しています。こうした実績が、気候変動報告要件やプラスチック削減目標に直面する消費財大手企業との長期供給契約を支えています。

急増するパーソナルケア・化粧品分野の需要

高級パーソナルケア製品ラインでは、ユーザー体験を向上させ高価格化を可能にするブラッシュドメタル調の美観や特殊バルブがますます指定されています。ボール社とメドウ社が2025年に発売予定の詰め替え式「MEADOW KAPSUL」カートリッジは、高級スキンケア・ヘアケアブランドが持続可能性とデザインで差別化を図るため、洗練されたアルミ製エアゾール容器を採用する事例を示しています。Eコマースはこの動向を加速させています。金属容器はラストマイル配送時のへこみや漏れに強く、デジタル販売促進のための360度撮影にも対応できるためです。

厳格なVOC規制と廃棄物処理規制

2025年7月施行のEPA改正法では、製品加重反応性上限値が義務付けられ、高反応性溶剤の代替が求められています。欧州のFガス規制も並行して施行され、コンプライアンス対応が複雑化。中小メーカーは研究開発の外部委託や対象ラインからの撤退を迫られています。廃棄規則では使用済み缶の通気・圧縮梱包が文書化プロトコル下で義務化され、処理コストが増加する一方、リパブリック・サービス社の専用施設など、専門的なリサイクルソリューションの需要も高まっています。

セグメント分析

2025年の市場規模においてアルミニウムが84.72%を占め、その確立されたインフラと大半のリサイクル規定下での受容性を裏付けております。この主導的地位はコスト効率の高いクローズドループ供給を支え、EUで既に施行されている拡大生産者責任制度とも整合します。エアゾール缶市場はReAl合金の進歩により恩恵を受けており、へこみ抵抗性を損なうことなく板厚重量を15%削減。単位当たりの経済性を維持しつつ炭素排出指標を低減しております。

プラスチック製エアゾールは年率8.18%で成長し、完全な透明性、耐衝撃性、酸性処方に適合するといったブランド要件に対応しています。プラスティパック社の金属不使用「SprayPET Revolution」は、樹脂メーカーが高度なバリア層を展開する中で、ポリマーが圧力閾値を満たし、主流のPETリサイクルインフラとの互換性を維持できることを実証しました。プラスチックは、金属臭や冷間衝撃が懸念されるパーソナルケア製品や食品スプレー用途において確固たる地位を築いています。こうした勢いがあるにもかかわらず、単一素材規制や金属価格の変動により、アルミはエアゾール缶市場戦略の中核であり続けております。

単一ストローク衝撃押出成形により溶接シームを最小化し品質管理を簡素化するワンピースモノブロックラインは、2025年生産量の64.58%を占めます。均一な肉厚構造は落下試験耐性と高内圧性能で定評があり、ヘアスプレーや自動車用ブレーキクリーナーSKUの可燃性推進剤に不可欠です。

一方、2ピース缶はCAGR7.05%で拡大傾向にあります。サーボ制御ボディメーカー技術による側面シーム強度の向上と、材料使用量を削減するハイブリッド金属ゲージの採用が背景にあります。ブランドオーナー様は、背が高くスリムな形状の製造や、円筒形本体を歪みなく覆う高精細リソグラフィーを高く評価されています。季節商品の発売に伴う迅速なデザイン変更の需要に対応するため、メーカー様はモノブロックとツーピースの生産を切り替え可能なモジュラー式金型に投資し、市場嗜好の変化に備えています。

地域別分析

アジア太平洋地域は2025年の消費量の39.62%を占め、7.86%のCAGRで成長しています。これは、中国が主要な消費地かつ生産拠点という二重の役割を担っていることに支えられています。都市化と可処分所得の増加がパーソナルケア用エアゾール製品の普及を後押しする一方、地域当局はアルミニウムのクローズドループ利点と相乗効果を発揮するリサイクル義務を課しています。日本のブランドオーナーは単一素材設計を推進し、インドの美容セグメントの加速は現地充填業者の生産量拡大につながっています。

欧州は技術と規制の面で引き続き先導的立場にあります。フロンガス規制やVOC上限値により、環境に配慮した推進剤への移行が加速し、規制対応製品ポートフォリオを有する既存企業が優位性を発揮しています。ドイツと英国は軽量缶の研究開発を主導し、東欧の工場は低コスト充填能力を拡大し、地域横断的なFMCG契約に対応しています。市場成長はプレミアム製品と持続可能な製品に傾いており、従来カテゴリーの需要飽和が拡大を制限しています。

北米では、イノベーション主導の安定した需要が持続しております。EPA反応性規制により処方の再設計が求められる一方、堅調な研究開発資金により現地コンバーターは製品ポートフォリオの柔軟性を維持しております。米国はOTC医療品とDIY用塗料エアゾールで主導的立場にあり、メキシコはニアショア製造拠点として存在感を高めています。カナダ消費者層では低臭気家庭用スプレーへの関心が高まっており、水系推進剤の採用を後押ししています。これらの動向が相まって、成熟しつつも収益性の高い地域市場全体で、中程度の単一桁成長が持続しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- リサイクル可能性と循環型経済への適合性

- パーソナルケアおよび化粧品分野における需要の急増

- 低VOC/グリーン推進剤への移行

- 電子商取引における「棚出し即販売」の差別化

- 単一素材包装への規制推進

- ニュートラシューティカル/OTCエアゾール製品の台頭

- 市場抑制要因

- 厳格なVOC規制および廃棄物処理規制

- アルミニウム及び鋼材価格の変動性

- 詰め替え式および濃縮タイプの台頭

- エアゾール製品に対する消費者の環境意識

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- ライフサイクルおよびカーボンフットプリント分析

第5章 市場規模と成長予測

- 素材タイプ別

- アルミニウム

- 鉄鋼

- ブリキ

- プラスチック

- その他の素材タイプ

- 缶の種類別

- 一体型(モノブロック)

- ツーピース

- スリーピース

- 推進剤の種類別

- 圧縮ガス

- 液化ガス

- 炭化水素

- DME

- その他の液化ガス

- バッグ・オン・バルブ

- 容量別(ml)

- 100未満

- 101-300

- 301-500

- 500以上

- エンドユーザー業界別

- パーソナルケアおよび化粧品

- 家庭用品

- 自動車および産業用

- 医療・製薬

- 食品・飲料

- 塗料およびワニス

- その他のエンドユーザー産業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリアおよびニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 中東

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Metal Packaging SA

- Trivium Packaging

- Mauser Packaging Solutions

- Toyo Seikan Co. Ltd

- CCL Container

- Colep Packaging Portugal SA

- CPMC Holdings Limited

- Nampak Ltd

- Graham Packaging Company

- SGD Pharma

- Silgan Holdings

- DS Containers

- Montebello Packaging

- Tubex GmbH

- Grupo Zapata(Exal)

- Hindustan Tin Works

- Thai Beverage Can

- Bharat Containers