|

市場調査レポート

商品コード

1637851

エンタープライズリソースプランニング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エンタープライズリソースプランニング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

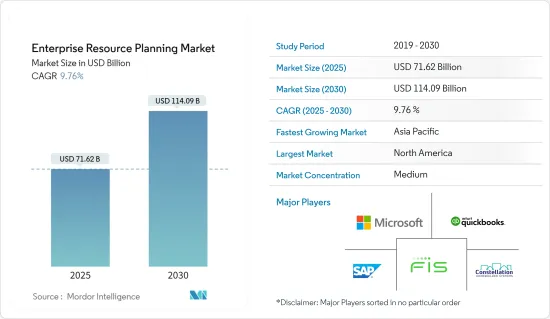

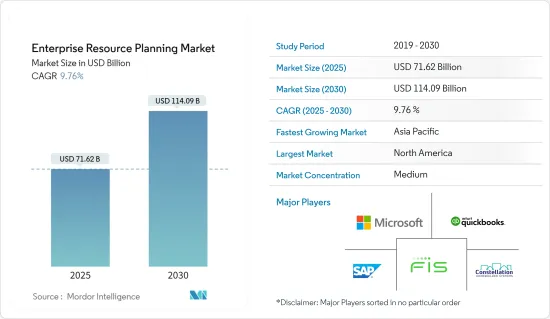

エンタープライズリソースプランニング市場規模は2025年に716億2,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは9.76%で、2030年には1,140億9,000万米ドルに達すると予測されます。

主要ハイライト

- ERPソフトウェアは、組織の財務計画、予算編成、予測、決算報告を支援します。世界の企業数の急増とクラウドベースのERPプラットフォームへの要求により、サプライヤー関係管理と顧客関係管理のニーズが高まっており、市場の成長を後押ししています。

- 革新的で進歩的な技術の採用が増加しているため、既存のERPシステムの価値が拡大し、サードパーティへの依存が最小限に抑えられ、高度に保護されたリソースが利用できるようになり、財務システムが進歩するなど、特にクラウドベースのERPソフトウェアの需要を促進する顕著な要因となっています。

- 顧客中心戦略の必要性の高まりも、ERP市場を後押ししています。顧客満足度、ロイヤルティ、ビジネス全体の成功を高めるために、顧客を業務の中心に据えることがいかに重要であるかを、企業はますます認識するようになっています。ERPシステムは、企業が生産性を向上させ、ワークフローを最適化し、より良い顧客サービスを提供できるよう、あらゆる統合アプリケーションを提供するため、この目的を達成するために不可欠です。

- モバイルデバイスの普及により、モバイルフレンドリーなERPソリューションの需要が高まっています。移動中にワークフローの承認、重要な企業データへのアクセス、意思決定を行えるようにすることで、モバイルERPアプリケーションはオペレーションの俊敏性を向上させます。例えば、スマートフォンやタブレットのユーザーは、SAP ERPのモバイルアプリを使用して、必要不可欠なERP機能にアクセスできます。これにより、リアルタイムの意思決定が容易になり、チームワークが向上し、変化する企業ニーズへの適応性が高まっている

- 柔軟性に欠けるERPシステムでは、ビジネスの変化や拡大に合わせて進化したり適応したりすることが難しくなる可能性があります。この制約により、企業が新しい製品ラインを導入したり、新しい市場に参入したり、組織構造の変化に適応したりすることが難しくなる可能性があります。たとえば、急拡大しているビジネスでは、ERPシステムを拡大してより大量のトランザクションを処理することが難しくなり、パフォーマンスに問題が生じたり、ビジネスにボトルネックが生じたりする可能性があります。

- COVID-19後の時代における「ビジネスオンライン」コンセプトの台頭は、非接触トランザクションへの需要を高め、製造業の中小企業を競争に苦戦させています。このため、すべての活動をリアルタイムで実行できるようにする製造業向けERPの必要性が生まれている

エンタープライズリソースプランニング市場の動向

中小企業セグメントが市場で最も高い成長を遂げる見込み

- 中小企業とは、従業員規模が250人以下の企業を指します。ERPの導入により、中小企業はビジネスプロセスの自動化と統合をより簡単に、低コストで利用できるようになりました。スケーラブルで柔軟なERPソフトウェアは、中小企業に高度に統合されたアプリケーションへのアクセスを記載しています。中小企業向けのERPシステムは、コスト削減や業務改善に直接影響し、望ましいビジネス成果の達成を支援します。

- 中小企業は、デジタルスケジューリングや分析など、ERPの自動化に急速にシフトしています。過去10年間にERPソフトウェアとサービスが登場したことで、業務が容易になりました。中小企業は、プロセスの合理化と自動化のためにERPソフトウェアを採用し、手入力の必要性を排除してきました。

- ワークフローの簡素化、納期の短縮、高い生産能力といった利点が透明性をもたらし、管理者はより良い洞察を得て、効果的な意思決定を行うことができます。中小企業にリアルタイムの財務データを提供することで、競争上の優位性を確保し、コスト削減を実現します。

- 2024年5月、欧州の中堅・中小企業向けERPソフトウエア・プロバイダーであるフォルテロ(Forterro)は、エントリーレベルのクラウドベースERPソリューションであるフォルティ(Fortee)の英国での発売を発表しました。すぐに使えるSaaSソリューションとして設計されたForteeは、ERP導入が初めての企業を対象にしています。Forteeは、ForterroのクラウドERPであるSylobの基盤に基づき、調達、生産、CRM、サプライチェーン管理などの主要な機能に特化した設計となっています。

- 世界中の中小企業がデジタルトランスフォーメーションのメリットを認識しており、予算やビジネスニーズに合わせてクラウドベースのERPソリューションへの移行を進めています。複雑なプロセスを合理化し、顧客の要求に迅速に対応するという需要の高まりが、調査対象セグメントにおける市場導入を後押ししています。

北米が市場で最大のシェアを占める見込み

- 米国で最も普及しているERPソリューションには、Oracle NetSuite、Oracle ERP Cloud、Microsoft Dynamics 365などがあります。米国でERPソフトウェアの導入が増加している背景には、OracleやMicrosoftなどの大企業があり、部門を統合することで市場での競合を高めたいという企業のニーズがあります。

- さらに、これらの企業は、財務や運用などの複雑な機能を支援するために、中堅・大企業向けに構築されたERPソフトウェアソリューションを提供しています。多くのプロバイダーは、数十年の専門知識と産業知識のおかげで成熟したERPソリューションを提供し、米国でそのようなソリューションの需要を促進しています。

- Oracle Netsuite、Oracle ERP Cloud、Microsoft D365、AcumaticaなどのERPソリューションは、基本的な会計システムをアップグレードし、デジタルトランスフォーメーションによって進化しようとしている中小企業を対象にしています。また、市場で突出したニッチを定義している企業もあり、製造業の流通組織に焦点を当て、投資収益率(ROI)が非常に高い費用対効果の高いソリューションを提供しています。

- さらに、2023年7月、サンフランシスコを拠点とするEvergreen Services Groupは、プライベート・エクイティの支援を受けたマネージドITソリューション企業ファミリーで、Microsoftのゴールドクラウドパートナーであり、MicrosoftのERPシステムの再販業者であるウエスタンコンピュータを買収しました。この買収は、米国全域でB2Bサービス企業を買収するエバーグリーンサービスグループの戦略の一環でした。

- ERPソフトウェアは、ビジネスプロセスを統合することで重複したデータ入力を減らし、カナダの組織に利益をもたらします。時間を短縮し、部門の精度を高めたいという顧客ニーズの高まりが、カナダにおけるERPソリューションの必要性を高めています。トロントとモントリオールは、カナダのビジネスと技術の進歩のための中心的なハブとして上昇しています。これらの地域では、地域のERP市場で多くの既存と新興参入企業を確認しています。

エンタープライズリソースプランニング産業概要

エンタープライズリソースプランニング(ERP)市場は、多くの地域と世界参入企業が存在し、半固体化しています。市場ベンダーは、海外における顧客基盤の拡大に注力し、戦略的協業イニシアティブを活用して市場シェアと収益性を高めています。参入企業としては、SAP SE、Intuit、Microsoft Corporation、Constellation Softwareなどが挙げられます。

- 2024年5月Amazon Web Services(AWS)とSAPは、ビジネスポートフォリオ全体の機能に統合できる生成AI機能を導入するため、既存の提携関係を拡大しました。この拡大により、ZapposのようなSAPソフトウェアを使用している企業は、クラウドベースの企業資源計画(ERP)プラットフォーム内で生成AIツールセットを利用できるようになります。

- 2024年4月Nuveiは、加盟店が企業資源計画(ERP)システムを介して請求書融資ソリューションに直接アクセスできるサービスを導入しました。この統合により、総勘定元帳の融資・返済項目がシステムで自動的に反映され、それぞれの融資対象請求書と整合します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- COVID-19パンデミックの後遺症とその他のマクロ経済要因が市場に与える影響

第5章 市場力学

- 市場促進要因

- 顧客中心主義に対する需要の高まり

- クラウドとモバイルアプリケーションの急増

- データ集約型アプローチと意思決定の採用増加

- 市場課題

- 柔軟性の欠如と統合の課題

- メンテナンスコスト

- エコシステム分析

- 価格設定と価格モデルの分析

第6章 市場セグメンテーション

- サービス別

- ソリューション

- サービス別

- 機能別

- 人事

- サプライチェーン

- ファイナンス

- マーケティング

- その他

- 展開別

- オンプレミス

- ハイブリッド

- 組織規模別

- 中小企業

- 大企業

- 産業別

- BFSI

- 使用事例

- ITと電気通信

- 使用事例

- 政府機関

- 使用事例

- 小売業とeコマース

- 使用事例

- 製造業

- 使用事例

- 石油・ガスエネルギー

- 使用事例

- その他の産業別事例

- 使用事例

- BFSI

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- SAP SE

- Intuit

- Microsoft Corporation

- Constellation Software

- FIS

- Oracle Corporation

- IBM Corporation

- Infor Inc.

- Adobe Inc.

- Sage Group PLC

第8章 ベンダーシェア分析

第9章 地域別ベンダーランキング

第10章 投資分析

第11章 投資分析市場の将来

The Enterprise Resource Planning Market size is estimated at USD 71.62 billion in 2025, and is expected to reach USD 114.09 billion by 2030, at a CAGR of 9.76% during the forecast period (2025-2030).

Key Highlights

- ERP software aids in planning, budgeting, forecasting, and reporting an organization's financial results. Due to a steep surge in the number of businesses worldwide and the requirement for cloud-based ERP platforms, the growing need for supplier-relationship management and customer-relationship management is augmenting the market's growth.

- The increasing adoption of innovative and advancing technologies is broadening the value of existing ERP systems, minimizing third-party dependencies, advancing highly secured resources, and advancing financial systems, among other notable factors driving the demand for ERP software, especially cloud-based.

- The growing need for a customer-centric strategy partly drives the enterprise resource planning (ERP) market. Businesses increasingly realize how crucial it is to put the customer at the heart of their operations to increase customer satisfaction, loyalty, and overall business success. ERP systems are essential to reaching this objective because they offer a full range of integrated applications that let businesses increase productivity, optimize workflows, and provide better customer service.

- Demand for mobile-friendly ERP solutions has increased due to the widespread use of mobile devices. By enabling people to approve workflows, access vital company data, and make decisions while on the move, mobile ERP apps help improve operational agility. For instance, users of smartphones or tablets can access essential ERP capabilities with SAP ERP mobile apps. This facilitates real-time decision-making, improves teamwork, and increases adaptability to shifting company needs.

- ERP systems that aren't flexible may find it difficult to evolve and adapt as businesses alter or expand. This restriction may make it more difficult for companies to introduce new product lines, enter new markets, or adapt to organizational structure changes. For instance, a business that is expanding quickly could find it difficult to scale its ERP system to handle higher transaction volumes, which could cause problems with performance and create bottlenecks in the business.

- The rise of the" business online" concept in the post-COVID-19 era increases the demand for contactless transactions, making manufacturing SMEs struggle to compete. This has created the need for ERP for manufacturing companies to enable them to run all activities in real time.

Enterprise Resource Planning Market Trends

The Small and Medium-sized Enterprises Segment is Expected to Witness Highest Growth in the Market

- SMEs are enterprises that have an employee size of fewer than 250 employees. ERP implementations have made it easier and less expensive for small and medium-sized businesses to use business process automation and integration. Scalable and flexible ERP software gives small and medium enterprises access to highly integrated applications. The ERP system for SMEs directly impacts cost savings and operational improvements, helping them achieve desired business outcomes.

- Small businesses rapidly shift to ERP automation, including digital scheduling and analysis. The emergence of ERP software and services over the last decade has made business operations easier. SMEs have been embracing ERP software to streamline and automate processes, eliminating the need for manual input.

- Benefits like ease of workflow, less turnaround time, and high production capability provide transparency, allowing managers to gain better insights and make effective decisions. It provides SMEs with real-time financial data that offers a competitive advantage and helps ensure cost savings.

- In May 2024, Forterro, a European ERP software provider for the industrial mid-market, announced the UK launch of Fortee, its entry-level cloud-based ERP solution. Designed as an out-of-the-box SaaS solution, Fortee targets organizations new to ERP adoption. Drawing from the foundation of Forterro's cloud ERP, Sylob, Fortee is tailored to focus on key functionalities for its intended audience, including procurement, production, CRM, and supply chain management.

- Small and medium enterprises across the world acknowledge the benefits of digital transformation, which drives the transition to cloud-based ERP solutions to meet their budget and business needs. The increasing demand to streamline complex processes and respond to customer demands more quickly would likely boost market adoption in the segment studied.

North America is Expected to Hold the Largest Share in the Market

- The most popular ERP solutions in the United States include Oracle NetSuite, Oracle ERP Cloud, and Microsoft Dynamics 365. The increasing adoption of ERP software in the United States is attributed to large enterprises such as Oracle and Microsoft and the need for businesses to gain a competitive edge in the market by integrating business functions.

- Moreover, these companies provide ERP software solutions built for mid and large-sized companies to assist them in complex functions such as finance and operations. Many providers offer mature ERP solutions owing to their decades of expertise and industry knowledge, promoting demands for such solutions in the United States.

- ERP solutions such as Oracle Netsuite, Oracle ERP Cloud, Microsoft D365, and Acumatica target small and mid-market companies looking to upgrade their basic accounting system and evolve through digital transformation. Others have defined a prominent niche in the marketplace, focusing on manufacturing distribution organizations and offering cost-effective solutions with a very high return on investment (ROI).

- Moreover, in July 2023, San Francisco-based Evergreen Services Group, a private equity-backed family of managed IT solutions companies, acquired Western Computer, a Microsoft Gold Cloud partner and reseller of Microsoft's ERP systems. The acquisition was part of Evergreen Services Group's strategy to acquire B2B services companies across the United States.

- ERP software benefits Canadian organizations by reducing duplicated data entry by integrating business processes. Increasing customer demand to reduce time and increase the accuracy of business functionalities is driving the need for ERP solutions in Canada. Toronto and Montreal are rising as central hubs for business and tech advancements in Canada. These areas are witnessing many established and emerging players in the regional ERP market.

Enterprise Resource Planning Industry Overview

The enterprise resource planning (ERP) market is semi-consolidated, with many regional and global players. Market vendors focus on expanding their customer base across foreign countries and leveraging strategic collaborative initiatives to increase the market's share and profitability. Some players include SAP SE, Intuit, Microsoft Corporation, and Constellation Software.

- May 2024: Amazon Web Services (AWS) and SAP expanded their existing partnership to introduce generative AI capabilities that can integrate into functions across entire business portfolios. The expansion will allow companies using SAP software like Zappos to access generative AI toolsets within the cloud-based enterprise resource planning (ERP) platform.

- April 2024: Nuvei introduced a service allowing merchants to directly access its invoice financing solutions via enterprise resource planning (ERP) systems. This integration ensures that the system automatically mirrors loan and repayment entries in the general ledger, aligning them with the respective financed invoice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 The Impact of Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Customer Centric Approach

- 5.1.2 Rapid Increase in Cloud and Mobile Application

- 5.1.3 Increase in Adoption of Data-intensive Approach and Decisions

- 5.2 Market Challenges

- 5.2.1 Lack of Flexibility and Integration Challenges

- 5.2.2 Maintenance Costs

- 5.3 Ecosystem Analysis

- 5.4 Analysis of Pricing and Pricing Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Function

- 6.2.1 HR

- 6.2.2 Supply Chain

- 6.2.3 Finance

- 6.2.4 Marketing

- 6.2.5 Other Functions

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Hybrid

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By Industry Verticals

- 6.5.1 BFSI

- 6.5.1.1 Use Cases

- 6.5.2 IT and Telecom

- 6.5.2.1 Use Cases

- 6.5.3 Government

- 6.5.3.1 Use Cases

- 6.5.4 Retail and E-commerce

- 6.5.4.1 Use Cases

- 6.5.5 Manufacturing

- 6.5.5.1 Use Cases

- 6.5.6 Oil, Gas, and Energy

- 6.5.6.1 Use Cases

- 6.5.7 Other Industry Verticals

- 6.5.7.1 Use Cases

- 6.5.1 BFSI

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Intuit

- 7.1.3 Microsoft Corporation

- 7.1.4 Constellation Software

- 7.1.5 FIS

- 7.1.6 Oracle Corporation

- 7.1.7 IBM Corporation

- 7.1.8 Infor Inc.

- 7.1.9 Adobe Inc.

- 7.1.10 Sage Group PLC