|

市場調査レポート

商品コード

1686555

デジタル署名:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Digital Signatures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタル署名:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

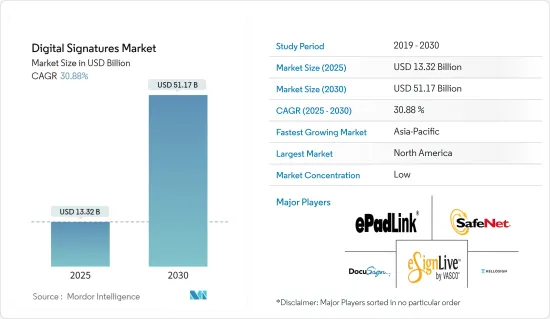

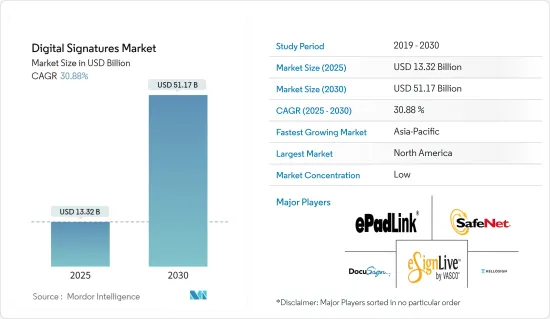

デジタル署名の市場規模は2025年に133億2,000万米ドルと推計され、予測期間(2025-2030年)のCAGRは30.88%で、2030年には511億7,000万米ドルに達すると予測されます。

企業が従来の署名からデジタル署名に移行しているのは、法的紛争のリスクを軽減し、より強力な証拠を提供するためです。

主なハイライト

- 機密情報を送信する際のデータセキュリティは常に求められています。eコマースやオンラインバンキングの台頭により、企業は顧客の信頼を得るためにネットワークの安全性を確保する必要があります。このため、あらゆる電子文書に送信者の認証印として機能するデジタル署名の採用率が高まり、その普及が加速しています。

- 技術の進化に伴い、文書の執行プロセスも進化しています。電子契約と電子署名は、拘束力のある取引を行うための近代的で便利な方法に対する需要の高まりとともに、近年大いに勢いを増しています。このような開発により、取引の入力方法や執行プロセスは大きく変化しています。

- 若い消費者もまた、金融サービス業界におけるデジタル署名増加の原動力となっています。世界中のさまざまなZ世代やミレニアル世代が、銀行口座開設、ローン契約、投資、資産管理、住宅ローン契約などの金融文書に署名し、その結果、デジタル署名の需要が急増しています。また、陸運局や入国管理局のような政府機関も、重要文書に対する電子署名のサポートを強化しています。

- COVID-19の発生に伴い、紙ベースの文書に頼ることから取引プロセスのデジタル化を進めるリモートワークの増加により、デジタル署名市場はプラスの成長率を示すと予想されます。企業は、シームレスで効率的な、どこからでもできるビジネス方法を求めています。また、文書プロセスのオンライン化も検討されています。

デジタル署名市場の動向

大きな成長が期待される政府部門

- デジタル署名ソリューションの採用は、連邦政府、州政府、地方自治体にとって、幅広い文書処理と自動化機能に役立ち、重要データへのアクセスを改善すると同時に、その入手に関連するコストを削減します。署名・検証ソリューションが役立つ政府の重要なアプリケーションには、請願書の自動化、郵便投票、フォームデータの抽出、郵便処理などがあります。

- 自治体、州、地方自治体では、偽造署名による詐欺事件が増加しています。州や地方自治体は、何千もの異なる団体と多額の資金を費やしており、取引を追跡するには労力がかかります。

- 政府によるデジタルインフラの開発には様々な努力が払われており、蓄積されたデータに対するソフトウェアベースのソリューションの必要性が生じています。米国政府はすでに、デジタルエクスペリエンス、アイデンティティ、クレデンシャル、アクセス管理(ICAM)、デジタル戦略などのITイニシアチブをとっています。

- この法律の重要な内容には、電子署名認証に関わる施設の基準やデータ保護方法、電子署名や電子文書の偽造・改ざん対策、電子署名認証サービスへの登録・利用手続き、加入者の確認方法などがあります。

北米が最も高い市場シェアを占める

- 北米地域は、主にクラウドベースのソリューション採用への組織シフトの増加、モバイルの急速な普及、重要な市場シェアを占める著名プレイヤーの存在により、最も高い収益を生み出している市場の1つとなっています。

- 例えば、Ciscoによると、この地域は昨年末までに最もクラウド対応が進んだ地域の1つになると予想されています。これは、企業がクラウドベースのサービスを好むようになったためで、セキュアクラウドにおけるデジタルソリューションの成長を促進すると期待されています。

- 統一電子取引法(Uniform Electronic Transactions Act:UETA)や電子署名法(Electronic Signatures in Global and National Commerce Act:E-SIGN)など、電子署名に関連する政府のイニシアチブは、あらゆる取引で電子署名の使用を許可しており、市場牽引に重要な役割を果たしています。米国・メキシコ・カナダ協定(USMCA)のような貿易協定も電子署名の利用を奨励しています。

- 大手ベンダーは市場での競争力を維持するため、革新的な製品を展開しています。米国を拠点とする署名検証プラットフォームであるMitekのCheck Intelligenceが2021年6月に発表されたように、各社は技術的な進歩に取り組んでいます。このような急速な技術進歩に加え、2020年のデジタルID改善法などの政府による規制強化により、同国は調査対象市場の成長にとってより安全な環境を目の当たりにすることになると予想されます。

- 同地域では、ソフトウェアソリューションの使用率が例外的に高く、COVID-19の大流行により数百万人の有権者の移動が制限されたため、政府は有権者にデジタル投票の導入を奨励せざるを得なくなりました。これはデジタル署名ソフトウェアの使用に直接影響し、政府と署名検証開発企業の協力を促しました。

デジタル署名業界の概要

デジタル署名市場は、費用対効果の高いソリューションを求める企業の需要や政府の取り組みにより、非常に細分化されています。しかし、革新的で先進的なソリューションにより、多くの企業が新たな契約を獲得し、新たな市場を開拓することで、市場での存在感を高めています。同市場の主要企業には、DocuSign、HelloSign、SunGard Signix Inc.、SafeNet Inc.、ePadLinkなどがあります。

- 2022年9月:欧州の主要な身元証明プラットフォームプロバイダーであるIDnowは、有効な署名のための身元確認を簡素化し、より安全にするために、世界有数のPDFおよび電子署名ツールソリューションであるAdobe Document Cloudとの世界な協業を発表しました。新しい認証機能は、Workday、Salesforce、Microsoft、Googleなどのプラットフォーム上のネイティブ統合を通じて、Acrobat Signを使用している顧客も利用できるようになります。

- 2022年2月:Smart CommunicationsとOneSpanは、電子署名統合による顧客との会話の価値の拡大、業務効率の創出、デジタル契約プロセスの合理化による顧客体験の向上、顧客満足度の向上、収益までの時間を短縮する申請完了率の向上、コンプライアンスを実証するための提携を行っています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の業界への影響評価

第5章 市場力学

- 市場促進要因

- 電子署名の増加・クラウドベースサービスの採用

- リモートワーク文化・海外契約の増加

- 市場抑制要因

- サイバー攻撃や詐欺に関する脆弱性の増加

第6章 市場セグメンテーション

- 展開別

- オンプレミス

- クラウド

- 提供別

- ソフトウェア

- ハードウェア

- サービス

- エンドユーザー産業別

- BFSI

- 政府機関

- ヘルスケア

- 石油・ガス

- 軍事・防衛

- 物流・運輸

- 調査・教育

- その他のエンドユーザー産業(不動産、製造、法律、IT、通信)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- SunGard Signix Inc.

- DocuSign

- Silanis-eSignLive

- SafeNet Inc.

- ePadLink

- Topaz systems

- Ascertia

- DigiStamp Inc.

- GMO GlobalSign Inc.

- RightSignature

- HelloSign

- Wacom

- Adobe Sign

- airSlate Inc.

- PandaDoc Inc.

- SignEasy

第8章 投資分析

第9章 市場の将来

The Digital Signatures Market size is estimated at USD 13.32 billion in 2025, and is expected to reach USD 51.17 billion by 2030, at a CAGR of 30.88% during the forecast period (2025-2030).

Enterprises are shifting from traditional to digital signatures because they reduce the risk of legal disputes and provide stronger evidence.

Key Highlights

- There has been a constant need for data security while transmitting sensitive information. Due to the e-commerce and online banking boom, companies needed to secure their networks to gain customer confidence. This has led to a greater and faster rate of adoption rates of digital signatures, which act as the sender's seal of authenticity over any electronic document.

- With the evolution of technology, the way of executing documents has also evolved. Electronic agreements and digital signatures have gained much momentum in recent years with the increasing demand for modern, convenient methods for entering binding transactions. Such developments have significantly changed how these transactions are entered and the execution processes.

- Younger consumers have also been a driving force behind the rise in digital signatures in the financial services industry. Various Gen Z and Millennials worldwide signed financial documents, such as opening a bank account, loan agreement, investment, wealth management, and mortgage agreements during the pandemic, resulting in a burgeoning digital signature demand. Also, government agencies, like the DMV and immigration, have provided more e-signature support for critical documents.

- With the outbreak of COVID-19, the digital signature market is anticipated to exhibit a positive growth rate due to the rise in remote working that shifted the focus from relying on paper-based documentation and increasing the digitalization of the transaction process. Enterprises are seeking business methods that are seamless and efficient and can be done from anywhere. Enterprises are also considering taking document processes online.

Digital Signatures Market Trends

Government Sector Expected to Witness Significant Growth

- Adopting digital signature solutions helps in a wide range of document processing and automation capabilities for federal, state, and local governments, improving access to critical data while reducing costs associated with obtaining it. Some of the essential applications of government where signature and verification solutions are helpful include petition automation, vote-by-mail, form data extraction, and mail processing.

- There have been increasing fraud cases of forged signatures in municipalities, states, and local governments. State and local governments spend significant money with thousands of different entities, and keeping track of the transactions takes effort.

- Various efforts by the government have been put into developing a digital infrastructure that triggers the need for software-based solutions for the data accumulated. The US government already has IT initiatives, such as digital experience, identity, credentials, access management (ICAM), and digital strategy.

- Some of the important contents of the act include standards for facilities involved with digital signature certification and data protection methods, countermeasures against counterfeiting and falsification of electronic signatures and electronic documents, procedures for signing up for and using the digital signature authentication service, and methods of verifying subscribers.

North America to Hold the Highest Market Share

- The North American region has been one of the highest revenue-generating markets primarily due to the increased shift of organizations toward cloud-based solution adoption, rapid mobile adoption, and the presence of prominent players occupying a significant market share.

- For instance, as per Cisco, the region was anticipated to be one of the most cloud-ready regions by the end of last year. This was due to the increased preference of companies towards cloud-based services, which is expected to propel the growth of digital solutions in the secure cloud.

- Government initiatives related to e-signatures, such as the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (E-SIGN), permitted the usage of e-sign for every transaction, thereby playing a crucial role in driving the market. Trade deals, like the United States-Mexico-Canada Agreement (USMCA), also encourage the usage of e-signatures.

- Major vendors are rolling out innovative offerings to remain competitive in the market. Companies have been involved in technological advancements, like the launch of Check Intelligence by Mitek, a US-based signature verification platform, in June 2021. With such rapid technological advancements, alongside increased regulation by the government, such as the Improving Digital Identity Act of 2020, the country is expected to witness a more secure environment for the growth of the studied market.

- The region witnessed exceptionally higher usage of software solutions, and the COVID-19 pandemic restricted the movement of millions of voters, which compelled the government to encourage voters to adopt digital voting. This directly impacted the usage of digital signature software, prompting government collaboration with signature verification developer companies.

Digital Signatures Industry Overview

The digital signatures market is highly fragmented due to the demand from companies seeking cost-effective solutions and government initiatives. However, with innovative and advanced solutions, many companies are increasing their market presence by securing new contracts and tapping new markets. Some major players in the market are DocuSign, HelloSign, SunGard Signix Inc., SafeNet Inc., and ePadLink.

- September 2022: IDnow, a leading identity-proofing platform provider in Europe, announced a global collaboration with Adobe Document Cloud, the world's leading PDF and e-signature tools solution, to simplify identity verification for validated signatures and more secure. The new authentication capabilities will also be available to customers using Acrobat Sign through native integrations on platforms such as Workday, Salesforce, Microsoft, or Google.

- February 2022: Smart Communications and OneSpan partner to expand the value of customer conversations with Electronic Signature Integration, create operational efficiencies as well as improves the customer experience by streamlining digital agreement processes; joint customers achieve higher customer satisfaction and increase application completions that shorten time to revenue, all while demonstrating compliance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in E-signatures and Adoption of Cloud-based Services

- 5.1.2 Increse in Remote Work Culture and Overseas Contracts

- 5.2 Market Restraints

- 5.2.1 Increasing Vulnerability Related to Cyber Attacks and Frauds

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Offering

- 6.2.1 Software

- 6.2.2 Hardware

- 6.2.3 Service

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Government

- 6.3.3 Healthcare

- 6.3.4 Oil and Gas

- 6.3.5 Military and Defense

- 6.3.6 Logistics and Transportation

- 6.3.7 Research and Education

- 6.3.8 Other End-user Industries (Real Estate, Manufacturing, Legal, IT, and Telecom)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SunGard Signix Inc.

- 7.1.2 DocuSign

- 7.1.3 Silanis-eSignLive

- 7.1.4 SafeNet Inc.

- 7.1.5 ePadLink

- 7.1.6 Topaz systems

- 7.1.7 Ascertia

- 7.1.8 DigiStamp Inc.

- 7.1.9 GMO GlobalSign Inc.

- 7.1.10 RightSignature

- 7.1.11 HelloSign

- 7.1.12 Wacom

- 7.1.13 Adobe Sign

- 7.1.14 airSlate Inc.

- 7.1.15 PandaDoc Inc.

- 7.1.16 SignEasy