|

市場調査レポート

商品コード

1402968

アンテナ:市場シェア分析、産業動向・統計、成長予測、2024~2029年Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アンテナ:市場シェア分析、産業動向・統計、成長予測、2024~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 195 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

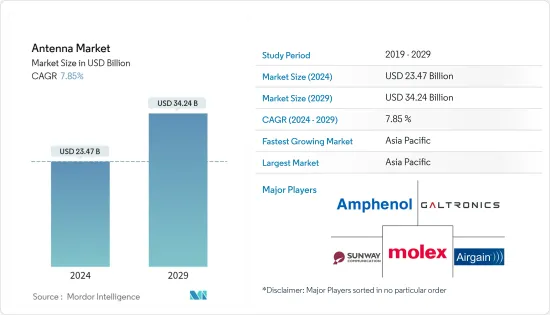

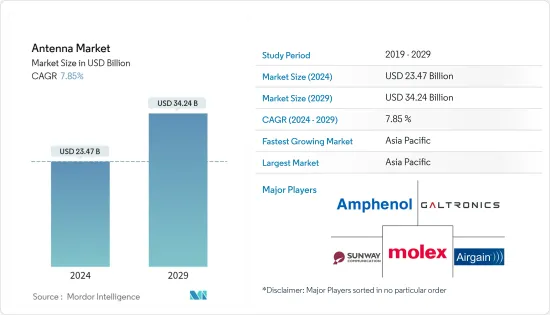

アンテナ市場規模は2024年に234億7,000万米ドルと推定・予測され、2029年には342億4,000万米ドルに達し、予測期間中(2024-2029年)のCAGRは7.85%で成長すると予測されます。

主なハイライト

- 無線通信の増加、インターネット利用の増加、スマートシティの市場開拓、ADAS(先進運転支援システム)自動車などにより、市場は予測期間中に大きな成長が見込まれます。こうしたニーズに対応するため、新興国市場のプレーヤーは市場シェアを獲得すべく新製品を開発しています。

- アンテナ市場は、デジタルトランスフォーメーションによるワイヤレス接続ソリューションの利用増加により、上向きの成長を見せています。予測期間中、アンテナ市場は、ワイヤレスシステム、ワイヤレス通信、ラップトップ、タブレット、ウェアラブル、スマートフォン、その他のデバイスなどの民生用電子製品におけるアンテナの使用の増加によって牽引されると予想されます。

- 衛星通信の採用増加もアンテナ市場を牽引すると予想されます。アンテナ市場の成長を促進する重要な側面の1つは、宇宙分野の拡大です。宇宙探査ミッションの増加、費用対効果の高い衛星打ち上げ作戦、衛星支援戦闘の需要増加、小型衛星配備の強化などの結果、市場は拡大しています。米国宇宙軍(USSF)は、軍の戦闘員のために68億米ドルの衛星管制ネットワーク(SCN)を運営しており、これは190以上の軍および政府衛星を指揮するための7カ所の固定アンテナからなる国際的な地上ネットワークで構成されています。

- アンテナは、スマートシティにおける無線接続の提供に不可欠です。アンテナは、センサー、カメラ、街灯、車両などのデバイスやインフラ・コンポーネント間の効率的で信頼性の高い通信を可能にします。アンテナは、無線ネットワークを確立し、データ転送を可能にするために使用され、さまざまなシステムのリアルタイムの監視と制御を容易にします。スマートシティの台頭は、調査対象市場を牽引すると予想されます。

- 一方、アンテナは複雑な設計が必要であり、特に高性能でマルチバンドなアンテナを開発する場合には、その設計が重要になります。スタンピングプロセスの制約の中で所望の性能特性を達成するのは難しい課題です。さらに、スタンピング材料の選択はアンテナ性能に大きな影響を与えます。導電性、機械的強度、コストのバランスが取れた適切な材料を見つけることは困難です。

- パンデミック後、市場のプレーヤーは顧客からの需要の増加により、持続可能な新製品を開発しています。例えば、トッパンは2023年1月、従来のポリエチレンテレフタレート(PET)フィルムではなく、紙素材をアンテナの基材として利用した環境に優しい近距離無線通信(NFC)タグラベルを設計しました。この新タグラベルの販売が開始され、環境意識の高い欧州が有利な市場として期待されています。紙への切り替えによりプラスチック消費量をゼロにするほか、新たな回路形成技術によりNFCデバイスとして十分な通信性能を確保しています。

アンテナ市場動向

調査対象市場で最大の製品セグメントとなる電話

- GSM協会によると、世界のモバイルインターネット加入者は2022年に44億人に達します。世界中で電話ネットワークインフラへの投資が拡大し、過去10年間でモバイルブロードバンドネットワークの格差は大幅に縮小しました。

- 携帯電話のアンテナ性能は、低信号エリアで十分な通信範囲を確保するために不可欠です。5G技術の成熟により、5Gの大規模な展開と商業化が中所得者層市場でも可能になった。これにより、モバイル加入者の増加がさらに促進される可能性があります。

- GSM協会は、2025年までに世界の5人に2人以上が5Gネットワークの届く範囲に住むようになると述べています。5Gのイントロダクションは、アクティブ・アンテナ・システムの使用を拡大しました。携帯電話の登場により、エンジニアは複数のアンテナを小さなフォームファクタのデバイスに統合することでアンテナソリューションを開発し、マルチ無線環境における課題に対処しています。

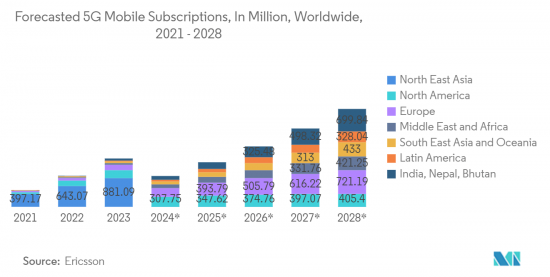

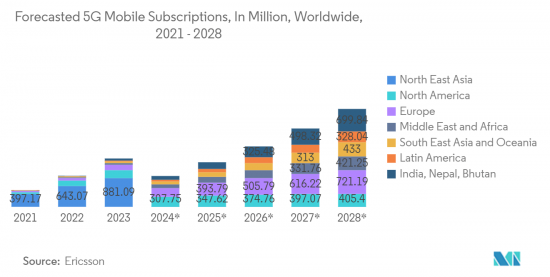

- 5Gサブスクリプションの開拓と採用は、この地域の市場プレーヤーにとって、サービスの円滑な機能を強化する新製品を開発する機会を生み出すと思われます。エリクソン社によると、5Gの契約数は2021年から2028年にかけて世界中で大幅に増加し、5億962万件以上から46億2,000万件以上になると予測されています。地域別では、東南アジア、北東アジア、ネパール、インド、ブータンの加入数が最も多くなると予想されています。

- 従来の測定ツールよりも技術的に進んだシミュレーション・ソフトウェアの利点により、携帯電話メーカーは5G携帯電話をより効率的に製造することができ、顧客の競争優位性を強化することができます。さらに、5G技術の登場により、携帯電話メーカーやモバイルネットワーク事業者は、消費者のリアルタイムの需要に応えるため、5Gアンテナ技術の採用を促しています。

アジア太平洋地域が大きな成長を遂げる見込み

- アジア太平洋地域は、情報共有、車内エンターテインメント、モノのインターネット(IoT)の拡大を進める市場の成長を目の当たりにしています。アンテナは、高速通信システムのシームレスなワイヤレス接続のために非常に重要になっています。その結果、アジア太平洋で最大かつ最も信頼されているアンテナイノベーターは、産業、セルラー、5G、自動車、全地球航法衛星システム/全地球測位システム(GNSS/GPS)、ヘルスケアなどのアプリケーション向けの広範なアンテナソリューションで顧客を支援するよう努めています。

- 堅牢な熱可塑性プラスチック製筐体でクラス最高の無線周波数(RF)性能を提供する有線外部アンテナの採用が増加しています。外部アンテナは湿気、極端な温度条件、振動に強く、様々な場所への取り付けに便利であるため、アジア太平洋地域の市場需要を牽引しています。

- アジア太平洋地域のアンテナメーカーは、業界をリードする専門知識と能力を活用し、小型のマルチバンドとコンプリメンタリアンテナに重点を置き、レーザーダイレクト構造化(LDS)、フレックス、スタンピング、セラミック技術を採用したカスタムソリューションを設計・製造しています。

- 小型化は、ワイヤレスやコンシューマーエレクトロニクスなどの先進的なアプリケーションにおいて、小型で軽量なアンテナインフラを実現する一方で、その支配力を強めています。設計者は、ユーザーの期待に応えるために、より高い機能密度と戦わなければなりません。小型化によって、より小さなスペースに大きな機能を詰め込むことが可能になります。コラボレーションとパートナーシップは、製品設計の進歩と、新興技術による生産前の潜在的な問題の解決を可能にしました。また、クラウドコラボレーションにより、製造の専門家がコストのかかる手戻りのサイクルを回避することができます。最先端のシミュレーションツールの助けを借りて、メーカーは正確な性能と信頼性の予測を行うことができます。

- 中国の電子部品メーカーであるLuxshare Technologyは、中国でデータ通信設備やエンタープライズレベルの5G関連製品を提供しています。同社の主力製品ポートフォリオには、アンテナ、コネクター、ケーブル、光モジュール、相互接続製品などがあります。

- 2023年2月、同社はPOET Technologies Inc.と提携し、データセンター向けの400Gおよび800Gトランシーバー・ソリューションの電力効率とコスト効率に優れたポートフォリオを開発しました。同社は、インテリジェントな製造技術を通じて、単一のマルチチップモジュールへのシームレスな電子部品の統合を提供することに注力しています。

- 日本の製造会社である村田製作所は、磁場ベースの通信用低周波無線周波数識別(LF RFID)アンテナを提供しています。同社の製品は、自動車やインテリジェント・ホームキーのアプリケーション向けに設計されています。LF RFIDアンテナは車載規格に準拠しており、自動車のスマートキーに使用されます。自動車用インテリジェントキー向けのハイエンドアンテナコイルに対する需要の高まりが、同地域での製品需要を押し上げる可能性が高いです。自動車、スマートシティ、建設機械におけるIoTの進展も、同地域におけるアンテナ市場の需要を促進しています。

アンテナ産業概要

アンテナ市場は、Molex LLC、Amphenol Corporation、Airgain Inc.、Galtronics USA Inc.、Sunway Communicationなどの主要プレイヤーを特徴とする著しい断片化が特徴です。これらの市場参入企業は、製品ポートフォリオを強化し、持続可能な競争優位性を獲得するために、提携や買収などさまざまな戦略を採用しています。

2023年4月、Amphenol Corporationの子会社であるAmphenol Airwave Communication Electronicsは、ワイヤレスパワーシステムの世界的リーダーであるNuCurrentとの戦略的提携を発表しました。この提携は、新しいQi2規格(「チー・ツー」と発音)への移行という業界全体の差し迫った需要に対応することを目的としています。この提携は、ニューカレント社のワイヤレス・パワーに関する知的財産、システム技術、設計能力に関する専門知識と、アンフェノール社のアンテナ技術、設計、製造に関する能力を活用するものです。

2023年3月、コネクターとセンサーで有名なTEコネクティビティ(TE)の一部となったリンクステクノロジーズは、セルラー用粘着フレキシブルプリント回路(FPC)アンテナの新シリーズを発表しました。これらのアンテナは、コスト効率と汎用性の高いアンテナソリューションを必要とする5G新無線、LTE、セルラーIoT(LTE-M、NB-IoT)アプリケーション向けに設計されています。ANT-5GW-FPCアンテナは、柔軟なグランドプレーン非依存のダイポール内蔵/埋め込みアンテナソリューションを提供します。その柔軟性と粘着性により、RF透明筐体(プラスチックなど)への取り付けが容易になり、環境密閉とアンテナ損傷からの保護が可能になります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 消費者の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- COVID-19がアンテナ市場に与える影響

第5章 市場力学

- 市場促進要因

- 途上国における様々な分野での自動化の急増

- インターネットの普及とIoTの到来

- 市場抑制要因

- 効率化と帯域幅改善の必要性

第6章 市場セグメンテーション

- タイプ別

- スタンピングアンテナ

- FPCアンテナ

- LDSアンテナ

- LCPアンテナ

- MPIアンテナ

- アプリケーション別

- メインアンテナ

- Bluetoothアンテナ

- WiFiアンテナ

- GPSアンテナ

- NFCアンテナ

- 製品別

- 電話

- ノートPC

- タブレット

- ウェアラブル

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 世界のアンテナ市場のエンドユーザー産業分析

- コンシューマーエレクトロニクス

- 軍事・防衛

- ヘルスケア

- 自動車

- その他のエンドユーザー産業

第8章 技術のディスラプション

- アンテナ市場を変革するアンテナ・オン・チップとアンテナ・イン・パッケージ

- ディスラプターのプロファイル

- MediaTek Inc.

- Qualcomm Technologies Inc.

- TDK Corporation

- Nordic Semiconductor ASA

- Johanson Technology Inc.

- Vishay Intertechnology Inc.

- Microchip Technology Inc.

- Intel Corporation

- 5Gアンテナ市場

- ケーブルアンテナ

- RFID/UHFアンテナ

第9章 競合情勢

- 企業プロファイル

- Molex LLC

- Amphenol Corporation

- Airgain Inc.

- Galtronics USA Inc

- Sunway Communication

- Luxshare Precision

- Murata Manufacturing Co. Ltd.

- Huizhou SPEED Wireless Technology Co. Ltd

- Fujikura Electronics

- Xinwei Communication

- HOLITECH Technology Co. Ltd

- AAC Technologies

- TE Connectivit Ltd

- Qualcomm Technologies Inc

- Texas Instruments Incorporated

- Linx Technologies

第10章 ベンダーのポジショニング分析

第11章 投資分析

第12章 今後の動向

The Antenna Market size is estimated at USD 23.47 billion in 2024, and is expected to reach USD 34.24 billion by 2029, growing at a CAGR of 7.85% during the forecast period (2024-2029).

Key Highlights

- The market is expected to observe significant growth over the forecasted period due to the rise in wireless communication, the rise in internet usage, the development of smart cities, advanced driver assistance systems (ADAS) vehicles, and many more. To cater to those needs, the players in the market are developing new products to capture the market share.

- The antenna market is showing upward growth due to the increasing usage of wireless connectivity solutions due to digital transformation. During the forecast period, the antenna market is expected to be driven by the growing use of wireless systems, wireless communications, and the increased use of antennas in consumer electronic products, such as laptops, tablets, wearables, smartphones, and other devices.

- The rise in the adoption of satellite communications is expected to drive the antenna market. One of the key aspects driving the growth of the Antenna market is the expansion of the space sector. The market is expanding as a result of an increase in space exploration missions, cost-effective satellite launch operations, increased demand for satellite-assisted combat, and enhanced small satellite deployment. The United States Space Force (USSF) operates the USD 6.8 billion satellite control network (SCN) for military warfighters, which consists of an international ground network of fixed antennas at seven locations to command more than 190 military and government satellites.

- Antennas are essential for providing wireless connectivity in smart cities. They enable efficient and reliable communication between devices and infrastructure components such as sensors, cameras, streetlights, and vehicles. Antennas are used to establish wireless networks and enable data transfer, facilitating real-time monitoring and control of different systems. The rise in smart cities is expected to drive the studied market.

- On the contrary, antennas require intricate designs, especially when developing high-performance and multi-band antennas. Achieving the desired performance characteristics within the constraints of the stamping process can be challenging. Further, the choice of stamping material can significantly impact antenna performance. Finding the right material that balances electrical conductivity, mechanical strength, and cost can be challenging.

- Post-pandemic, the players in the market are developing new sustainable products due to the rise in the demand from customers. For instance, in January 2023, Toppan designed an eco-friendly near-field communication (NFC) tag label that utilizes paper material as the substrate for the antenna rather than conventional polyethylene terephthalate (PET) film. The sales of the new tag label have been launched, with Europe anticipated to be a favorable market due to the high level of environmental consciousness. In addition to reducing plastic consumption to zero by switching to paper, a new circuit fabrication technology ensures sufficient communication performance as an NFC device.

Antenna Market Trends

Phone to be the Largest Product Segment in the Studied Market

- According to the GSM Association, global mobile internet subscribers reached 4.4 billion in 2022. Growing investments in phone network infrastructure across the globe have narrowed down the mobile broadband network gap significantly over the last decade.

- The antenna performance of a phone is vital to ensure adequate communication coverage in low-signal areas. With the maturity of 5G technology, large-scale deployments and commercialization of 5G have become possible in modest-income markets. This could further bolster the mobile subscriber growth.

- The GSM Association states that more than two in five people across the world will live within the 5G network reach by 2025. The introduction of 5G has expanded the use of active antenna systems. With the advent of phones, engineers are developing antenna solutions by integrating multiple antennas into small form-factor devices to address the challenges in multi-radio environments.

- The developments and adoption of 5G subscriptions would create an opportunity for the market players in the region to develop new products to enhance the smooth functioning of services. According to Ericsson, 5G subscriptions are forecast to increase drastically worldwide from 2021 to 2028, from over 509.62 million to over 4.62 billion subscriptions. Southeast Asia, Northeast Asia, Nepal, India, and Bhutan are expected to have the most subscriptions by region.

- The advantages of technologically advanced simulation software over traditional measurement tools enable mobile phone manufacturers to produce 5G phones more efficiently and reinforce customers' competitive advantages. Further, the advent of 5G technologies is encouraging phone manufacturers and mobile network operators to adopt 5G antenna technology to meet the real-time demands of consumers.

Asia Pacific is Expected to Register Major Growth

- Asia-Pacific is witnessing a growing market for advancing information sharing, in-car entertainment, and Internet of Things (IoT) expansion. Antennas have become incredibly important for seamless wireless connectivity for high-speed communication systems. As a result, Asia-Pacific's largest and most trusted antenna innovators strive to empower customers with an extensive range of antenna solutions for applications, including industrial, cellular, 5G, automotive, global navigation satellite system/global positioning system (GNSS/GPS), healthcare, etc.

- A rise in the adoption of cabled external antennas has been observed that offer best-in-class radio frequency (RF) performance in ruggedized thermoplastic enclosures. External antennas are resistant to moisture, extreme thermal conditions, and vibration for convenient mounting in various locations, driving the market demand in the Asia-Pacific region.

- Antenna manufacturers across the Asia-Pacific region utilize their industry-leading expertise and capabilities to design and manufacture custom solutions emphasizing small multiband and complementary antennas and employing laser direct structuring (LDS), flex, stamped, and ceramic technologies.

- Miniaturization strengthens its hold in advanced applications such as wireless and consumer electronics while enabling small, lighter antenna infrastructures. Designers must contend with greater feature density to meet user expectations. Miniaturizations enable packing greater functionality into smaller spaces. Collaboration and partnerships enabled advances in product design and solutions to potential issues before production through emerging technologies. Cloud collaboration also brings manufacturing experts to avoid costly rework cycles. With the help of state-of-the-art simulation tools, manufacturers can make accurate performance and reliability predictions.

- Luxshare Technology Co. Ltd., a Chinese electronic components manufacturer, provides data-communication facilities and enterprise-level 5G-related products in China. The company's core product portfolio includes antennas, connectors, cables, optical modules, and interconnection products.

- In February 2023, the company partnered with POET Technologies Inc. to develop a power-efficient and cost-effective portfolio of 400G and 800G transceiver solutions for data centers. The company focuses on offering seamless electronic component integration into a single multi-chip module through intelligent manufacturing techniques.

- Murata, a Japanese manufacturing company, offers a low-frequency radio frequency identification (LF RFID) antenna for magnetic field-based communication. The company products are designed for automotive and intelligent home key applications. An LF RFID antenna complies with vehicle-mounting standards and is used in vehicle smart keys. Rising demand for high-end antenna coils for intelligent keys for automobiles is likely to boost product demand in the region. The advancement of IoT in automotive, smart cities, and construction machinery also propels the market demand for antennas in the region.

Antenna Industry Overview

The Antenna Market is characterized by significant fragmentation, featuring key players such as Molex LLC, Amphenol Corporation, Airgain Inc., Galtronics USA Inc., and Sunway Communication. These market participants employ various strategies, including partnerships and acquisitions, to bolster their product portfolios and attain a sustainable competitive advantage.

In April 2023, Amphenol Airwave Communication Electronics Co. Ltd., a subsidiary of Amphenol Corporation, announced a strategic partnership with NuCurrent, a global leader in wireless power systems. This collaboration aims to address the pressing industry-wide demand for a transition to the new Qi2 standard (pronounced "chee tu"). It will leverage NuCurrent's expertise in wireless power intellectual property, systems technology, and design capabilities, along with Amphenol's proficiency in antenna technology, design, and manufacturing.

In March 2023, Linx Technologies, now a part of TE Connectivity (TE), a renowned leader in connectors and sensors, introduced a new series of cellular adhesive flexible printed circuit (FPC) antennas. These antennas are designed for 5G New Radio, LTE, and cellular IoT (LTE-M, NB-IoT) applications that require a cost-effective and versatile antenna solution. The ANT-5GW-FPC antennas offer a flexible ground plane-independent dipole internal/embedded antenna solution. Their flexibility and adhesive backing facilitates easy mounting within RF transparent enclosures (e.g., plastic), enabling environmental sealing and protection against antenna damage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID -19 on the Antenna Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Automation in Developing Countries Across Various Verticals

- 5.1.2 Penetration of the Internet and the Advent of IoT

- 5.2 Market Restraints

- 5.2.1 Need for Efficiency and Bandwidth Improvements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Stamping Antenna

- 6.1.2 FPC Antenna

- 6.1.3 LDS Antenna

- 6.1.4 LCP Antenna

- 6.1.5 MPI Antenna

- 6.2 By Application

- 6.2.1 Main Antenna

- 6.2.2 Bluetooth Antenna

- 6.2.3 WiFi Antenna

- 6.2.4 GPS Antenna

- 6.2.5 NFC Antenna

- 6.3 By Product

- 6.3.1 Phone

- 6.3.2 Laptop

- 6.3.3 Tablet

- 6.3.4 Wearables

- 6.3.5 Other Products

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 GLOBAL ANTENNA MARKET END-USER INDUSTRY ANALYSIS

- 7.1 Consumer Electronics

- 7.2 Military and Defense

- 7.3 Healthcare

- 7.4 Automotive

- 7.5 Other End-user Industries

8 TECHNOLOGY DISRUPTION

- 8.1 Antenna on Chip and Antenna in Package to Disrupt the Antenna Market

- 8.2 Disruptors Profiles

- 8.2.1 MediaTek Inc.

- 8.2.2 Qualcomm Technologies Inc.

- 8.2.3 TDK Corporation

- 8.2.4 Nordic Semiconductor ASA

- 8.2.5 Johanson Technology Inc.

- 8.2.6 Vishay Intertechnology Inc.

- 8.2.7 Microchip Technology Inc.

- 8.2.8 Intel Corporation

- 8.3 5G Antenna Market

- 8.4 Cable Antenna

- 8.5 RFID/UHF Antenna

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles*

- 9.1.1 Molex LLC

- 9.1.2 Amphenol Corporation

- 9.1.3 Airgain Inc.

- 9.1.4 Galtronics USA Inc

- 9.1.5 Sunway Communication

- 9.1.6 Luxshare Precision

- 9.1.7 Murata Manufacturing Co. Ltd.

- 9.1.8 Huizhou SPEED Wireless Technology Co. Ltd

- 9.1.9 Fujikura Electronics

- 9.1.10 Xinwei Communication

- 9.1.11 HOLITECH Technology Co. Ltd

- 9.1.12 AAC Technologies

- 9.1.13 TE Connectivit Ltd

- 9.1.14 Qualcomm Technologies Inc

- 9.1.15 Texas Instruments Incorporated

- 9.1.16 Linx Technologies