|

市場調査レポート

商品コード

1639430

OLEDパネル:市場シェア分析、産業動向・統計、成長予測(2025~2030年)OLED Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| OLEDパネル:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

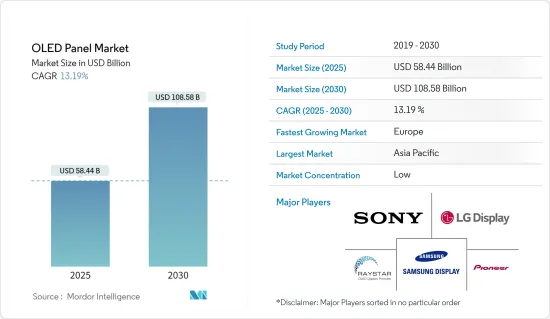

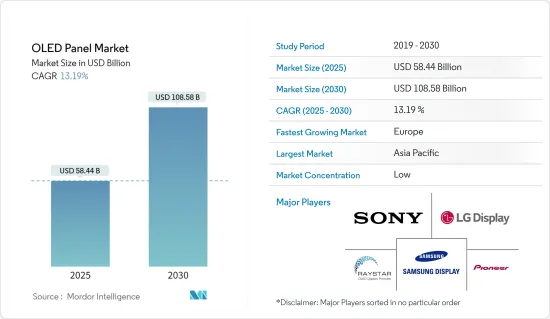

OLEDパネルの市場規模は2025年に584億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは13.19%で、2030年には1,085億8,000万米ドルに達すると予測されます。

OLEDは、画面サイズの大型化、8K(7680×4320ピクセル)解像度の向上、比較的新しいフォームファクターなど、重要なディスプレイ技術動向です。かなり以前から、サムスンやLGといった企業がフレキシブルOLEDディスプレイの実験を行ってきました。特にサムスンは現在、すべてのフラッグシップ機に曲面フレキシブルOLEDパネルを採用しています。

主なハイライト

- OLEDは、各ピクセルが独立して制御され、光を発生する発光型ディスプレイを可能にする(バックライトユニットから光を得るLCDとは異なる)。OLEDディスプレイは、鮮やかな色彩、素早い動き、そして最も重要な高コントラスト比など、優れたビジュアル品質を提供します。最も特筆すべきは、「本物の」黒だ(LCDは照明の関係で黒を表現できない)。さらに、単純なOLEDアーキテクチャは、フレキシブルで透明なパネルの製造を非常に簡単にしています。

- 視野角と黒レベルに関する複数の利点により、OLEDテレビはいくつかの地域で需要が急増しています。ICDMによると、テレビの解像度を決定する際のコントラスト変調は、純粋な画素数よりも重要であり、OLEDテレビ・ディスプレイはこの需要に対応しています。

- 市場普及モデルに基づくと、フレキシブルOLEDは予測される期間に高い市場浸透率を示すと予想されます。中国など多くの主要市場でスマートフォンが成熟しているため、スマートフォン・メーカーはフレキシブルOLEDを組み込んだ折りたたみ可能な新機種を開発しており、今後数年間は大きな成長の可能性を秘めています。

- 大量生産によって企業は規模の経済を達成することができ、それによってデバイスの全体的な価格を下げることによってデバイスメーカーに利益をもたらします。現在、OLEDを採用しているテレビメーカーはわずかで、その理由は、この技術がミッドレンジ市場には高価すぎると考えられているからです。フィットネス・バンドやシンプルなスマートウォッチの多くはPMOLEDディスプレイを採用しています。

- 例えば、Fitbit社のChargeバンドは、小型のモノクロ(白色)PMOLEDディスプレイを使用しています。OLEDの厚さ、柔軟性、外観は、LCDよりもウェアラブル・アプリケーションに有望な技術であることを示しています。さらに、単純な決定論的外挿に基づけば、量子ドットベースのOLEDディスプレイパネルの需要は、予測期間中に指数関数的に急増すると予想されます。

OLEDパネル市場動向

スマートフォンのAMOLEDディスプレイが高成長の見込み

- AMOLEDは、タブレット、スマートウォッチ、ゲーム機、デジタルカメラ、携帯音楽プレーヤー、音楽機器などに使用されるOLEDディスプレイ技術です。薄膜トランジスタ(TFT)とストレージ・コンデンサを使って、ライン・ピクセルの状態を保存します。AMOLEDパネルは、パッシブ・マトリクス有機発光ダイオード(PMOLED)よりもはるかに高速で、どんなサイズのディスプレイにも簡単に装着できます。加えて、以前のディスプレイ技術よりもエネルギー効率が高く、より鮮やかな画質と広い視野角を提供し、動きに素早く反応します。

- 世界的には、急速な都市化、所得水準の向上、レジャー・娯楽需要の拡大が、家電製品の販売に好影響を与えています。これはAMOLEDディスプレイ分野の拡大を促進する最も重要な要因の一つです。スーダン、シリア、ジンバブエなど数ヵ所のインフレの結果、製造の営業費用は上昇すると予想されます。しかし、AMOLEDディスプレイには、画質の向上や高解像度ディスプレイなど、他のディスプレイ技術にはない利点が数多くあり、その両方が市場の拡大を後押ししています。

- フレキシブルAMOLEDディスプレイは、携帯電話、モニター、ウェアラブル・テクノロジーの製造によく使用されるが、これは消費エネルギーが少なく、他のディスプレイよりも手頃な価格だからです。スーダン、シリア、インド、その他の国々を含む多くの場所でインフレが起きているため、製造にかかる運営費は上昇すると予想されます。

- 技術の進歩とスマートフォンにおけるOLEDディスプレイの使用の増加は、有利な成長機会を提供します。さらに、LG、フィリップス、ソニーなどの著名なエレクトロニクス企業によるOLED開発への投資の増加は、成長期における業界の進化を促進すると思われます。例えば、2022年6月、LG Displayは韓国のベーカリーParis Baguetteと協力し、デジタルスクリーンとして使用する38台の透明OLEDディスプレイを設置しました。

- さらに、OLEDパネルは追加のバックライトを必要とせず、発光性であるため、従来スマートフォンで使用されてきたフラットパネルディスプレイの影を落としています。加えて、薄型で明るい出力といった優れた特性により、携帯電話メーカーがAMOLEDパネルを製品に採用するケースが増えており、これが市場の成長を後押ししています。

- さらに、OLEDパネル市場のリーダーの1つであるサムスンは、AMOLEDとSuper AMOLEDディスプレイ技術をスマートフォンのほとんどに搭載しています。

- 多くのディスプレイ工場がAMOLED生産ラインを拡張するために継続的な投資を行っていることが、市場におけるAMOLED普及率を押し上げると思われます。さらに、スマートフォンの普及率の上昇により、世界中でスマートフォン用ディスプレイの需要が増加していることも、AMOLEDパネルの需要を押し上げると予想されます。

アジア太平洋が最大の市場シェアを占める

- アジア太平洋はOLEDパネルの最大市場です。LGやSamsungを含むほとんどの主要企業がこの地域に製造施設を有しているからです。また、テレビやサイネージのディスプレイ・メーカーやその他のベンダーもAPAC地域に本社を置いています。

- 米国と中国の貿易戦争により、中国政府が計画している予算の大部分がディスプレイ産業に浸透しています。対照的に、集中投資促進産業の1つである半導体産業は困難を予感させる。

- 韓国は国土が狭いにもかかわらず、OLED技術の学術研究開発に投資しています。韓国は、LGやサムスンといったエレクトロニクス大手の巨額投資を目の当たりにしています。

- 中国は世界のOLEDパネル製造能力の43%を掌握する勢いであり、韓国のライバルに肉薄しています。多額の国家補助金を得て、BOE Technology GroupとTCL China Star Optoelectronics Technology(TCL CSOT)は、2019年頃から生産量を増やしている2つの中国パネルメーカーです。

- アメリカの市場情報会社ディスプレイ・サプライチェーン・コンサルタンツ(DSCC)が10月に発表した予測によると、2022年末の生産能力シェアは55%に達するとされている韓国を、中国が追い抜きつつあります。有機発光ダイオードを使用するOLEDパネルは、液晶ディスプレイパネルと同じように開発・生産されるが、より深い技術的知識を持つエンジニアが必要とされます。

- 中国は世界の製造拠点です。消費財の最大輸出国のひとつであり、世界で最も急成長している消費者市場でもあります。同国は世界最大級のテレビ市場を誇っています。例えば、LGはOLEDパネル事業を拡大するため、中国の小売業者やテレビメーカーと協力する計画です。OLEDディスプレイパネルの売上は、この地域で飛躍的に伸びると予想されます。

OLEDパネル産業の概要

OLEDパネル市場は、国内外に多数のプレーヤーが存在するため、断片化され競合が激しいです。また、パネルメーカー各社は様々なプレーヤー向けの代替技術に投資しており、プレーヤー間の熾烈な競争が繰り広げられています。市場の主要企業は、Samsung Display、LG Display、ソニー株式会社です。

サムスンディスプレイは2023年5月、タブレットPCやノートPCの機動性に革命を起こすローラブルフレックスと、血圧センサーや指紋センサーを別モジュールを取り付けることなくパネルに組み込むことでさらなる利便性を提供するセンサーOLEDディスプレイを発表します。サムスンは、これらのOLEDやその他のOLEDの画期的な技術により、新たな市場分野を確立し、支配する意欲を示しています。

2023年3月、最高のホームエンタテインメント体験を提供するため、ソニー・エレクトロニクスはテレビ「ブラビアXR」のラインアップを発表しました。ブラビアXRのラインナップは、X95L、X93L Mini LED、X90L Full Array LED、A95L QD-OLED、A80L OLEDの5モデルです。すべてのモデルに、臨場感あふれる映像、ストリーミング・アプリケーション、ゲーム、その他の活動を楽しめる機能が搭載されています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界バリューチェーン分析

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- スマートフォンへのOLED採用の増加

- 各国におけるOLED技術開発への政府支援

- 市場の課題

- 量子ドット技術とマイクロLED技術の進化

第6章 市場セグメンテーション

- タイプ別

- フレキシブル

- 硬質

- 透明

- ディスプレイアドレス方式別

- PMOLEDディスプレイ

- AMOLEDディスプレイ

- サイズ別

- 小型OLEDパネル

- 中型OLEDパネル

- 大型OLEDパネル

- 製品別

- モバイル・タブレット

- テレビ

- 車載

- ウェアラブル

- その他(照明、ヘルスケア、家電)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- イタリア

- フランス

- アジア

- 中国

- インド

- 日本

- 韓国

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- 北米

第7章 ベンダー市場シェア

第8章 競合情勢

- 企業プロファイル

- Samsung Display Co. Ltd

- LG Display Co., Ltd

- Sony Corporation

- Pioneer Corporation

- Raystar Optronics Inc.

- Ritek Corporation

- OSRAM OLED GmbH

- WiseChip Semiconductor Inc.

- Winstar Display Co. Ltd

- Visionox Co. Ltd

第9章 投資分析

第10章 市場の将来

The OLED Panel Market size is estimated at USD 58.44 billion in 2025, and is expected to reach USD 108.58 billion by 2030, at a CAGR of 13.19% during the forecast period (2025-2030).

OLED is a significant display technology trend, with larger screen sizes, improved 8K (7680 x 4320 pixels) resolution, and relatively new form factors. For quite some time, companies like Samsung and LG have experimented with flexible OLED displays. Samsung, in particular, uses curved flexible OLED panels for all of its flagship devices now.

Key Highlights

- OLEDs make it possible for emissive displays, where each pixel is independently controlled and generates its light (unlike LCDs, which get their light from a backlighting unit). OLED displays provide excellent visual quality, including vivid colors, quick motion, and, most significantly, a high contrast ratio. Most notably, "real" blacks (LCDs can't produce due to the illumination). Additionally, the straightforward OLED architecture makes it very simple to manufacture flexible and transparent panels.

- Due to multiple advantages with viewing angles and black levels, OLED Televisions are surging in demand in several regions. According to the ICDM, contrast modulation in qualifying a TV resolution is more critical than pure pixel count, and OLED TV displays cater to this demand.

- Based on market diffusion models, flexible OLEDs are anticipated to observe a high market penetration in the foreseen period. With the maturity of smartphones in many significant markets, such as China, smartphone manufacturers are developing new, foldable phone models that incorporate flexible OLEDs and further have a massive potential for growth over the next few years.

- Mass production enables companies to reach economies of scale, thereby benefiting the device manufacturers by reducing the overall price of the device. Only a few TV manufacturers currently use OLEDs, as the technology is considered too expensive for the mid-range market. Many fitness bands and simple smartwatch devices adopt PMOLED displays.

- For instance, Fitbit's Charge band uses a small monochrome (white) PMOLED display. The thickness, flexibility, and appearance of OLEDs show make it a promising technology for wearable applications over LCDs. Further, based on simple deterministic extrapolation, the demand for quantum dots-based OLED display panels is anticipated to surge exponentially in the forecast period.

OLED Panel Market Trends

AMOLED Display in Smartphone is Expected to Witness High Growth

- AMOLED is an OLED display technology used in tablets, smartwatches, game consoles, digital cameras, portable music players, and music-making equipment. The line pixel states are stored using a thin-film transistor (TFT) and a storage capacitor. AMOLED panels are far quicker than their passive matrix organic light-emitting diode (PMOLED) and can easily fit into displays of any size. In addition, they are more energy-efficient than previous display technologies, offer more vivid image quality and a broader viewing angle, and respond to motion more quickly.

- Globally, rapid urbanization, growing income levels, and expanding leisure and entertainment demand favorably impact consumer electronics sales. This is one of the most significant factors promoting the expansion of the AMOLED display sector. The operating expenses of manufacturing are anticipated to rise as a result of inflation in several places, including Sudan, Syria, Zimbabwe, etc. However, there are a number of benefits that AMOLED displays offer over other display technologies, including enhanced picture quality and a high-resolution display, both of which are propelling the market's expansion.

- Flexible AMOLED displays are often used in the creation of mobile phones, monitors, and wearable technology because they consume less energy and are more affordable than other displays. The operating expenses of manufacturing are anticipated to rise as a result of inflation in numerous places, including Sudan, Syria, India, and other countries.

- Technological advancements and the increasing use of OLED displays in smartphones provide lucrative growth opportunities. Furthermore, growing investments in OLED development by prominent electronics companies such as LG, Philips, and Sony will drive industry evolution during the growing period. For instance, in June 2022, LG Display collaborated with the Korean bakery Paris Baguette to install 38 transparent OLED displays for use as digital screens.

- Further, the OLED panel requires no additional backlighting, and it is emissive, due to which overshadows the flat panel displays traditionally used in smartphones. Additionally, owing to the superior properties, such as less thickness and bright output, mobile manufacturers have been increasingly incorporating AMOLED panels in their products, which is likely to drive market growth.

- Additionally, Samsung, one of the leaders in the OLED panels market, incorporates AMOLED and Super AMOLED display technologies in most of its smartphones.

- Continuous investment undertaken by numerous display factories to expand AMOLED production lines will boost the AMOLED penetration rate in the market. Moreover, the increasing demand for smartphone displays across the globe, owing to the increasing smartphone penetration rates, is expected to propel the demand for AMOLED panels in the market.

Asia Pacific Occupies the Largest Market Share

- Asia-Pacific is the biggest market for OLED panels as most key players, including LG and Samsung, have manufacturing facilities in the region. Additionally, several TV and signage display manufacturers and other vendors have headquarters in the APAC region.

- Due to the trade war between the United States and China, a large portion of the budget planned by the Chinese government is percolating into the display industry. In contrast, the semiconductor industry, one of the intensive investment promotion industries, foreshadows difficulties.

- Despite its small size, South Korea invests in academic R&D for OLED technology. The country is witnessing huge investments from electronics giants like LG and Samsung.

- China is on track to control 43% of the capacity for manufacturing OLED panels globally, putting it in striking reach of South Korea's rival. With hefty state subsidies, BOE Technology Group and TCL China Star Optoelectronics Technology (TCL CSOT) are two Chinese panel manufacturers that have increased output since around 2019.

- China is overtaking South Korea, whose capacity share, according to a projection made in October by the American market intelligence firm Display Supply Chain Consultants (DSCC), is supposed to reach 55% at the end of 2022. OLED panels, which employ organic light-emitting diodes, are developed and produced in many ways as liquid crystal display panels but need engineers with more in-depth technical knowledge.

- China is the global hub for manufacturing. It is one of the largest exporters of consumer goods and the fastest-growing consumer market in the world. The country boasts one of the world's largest television markets. For instance, LG plans to collaborate with retailers and TV makers in China to expand its OLED panel business. The sales of OLED display panels are expected to grow exponentially in the region.

OLED Panel Industry Overview

The OLED Panel Market is fragmented and competitive because of the presence of many players conducting business on a national and an international scale. Also, panel manufacturers are investing in alternative technologies for various players, which showcases an intense rivalry among the players. The major players in the market are Samsung Display Co. Ltd., LG Display Co. Ltd., and Sony Corporation.

In May 2023, Samsung Display is introducing Rollable Flex, which intends to revolutionize the mobility of tablet computers or laptops, and Sensor OLED display, which offers additional usefulness by incorporating blood pressure and fingerprint sensors in panels without attaching separate modules. With these and other OLED breakthroughs, Samsung is showcasing its desire to establish and dominate new market sectors.

In March 2023, to provide the best possible home entertainment experience, Sony Electronics Inc. introduced its BRAVIA XR TV lineup. The BRAVIA XR lineup has five new models: the X95L and X93L Mini LED, X90L Full Array LED, A95L QD-OLED, and A80L OLED. All models come with features that let customers enjoy immersive video, streaming applications, gaming, and other activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of OLEDs in Smartphones

- 5.1.2 Government Support for the Development of OLED Technology in Various Countries

- 5.2 Market Challenges

- 5.2.1 Evolution of Quantum Dot Technology and Micro LED Technology

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Flexible

- 6.1.2 Rigid

- 6.1.3 Transparent

- 6.2 By Display Address Scheme

- 6.2.1 PMOLED Display

- 6.2.2 AMOLED Display

- 6.3 By Size

- 6.3.1 Small-sized OLED Panel

- 6.3.2 Medium-sized OLED Panel

- 6.3.3 Large-sized OLED Panel

- 6.4 By Product

- 6.4.1 Mobile and Tablet

- 6.4.2 Television

- 6.4.3 Automotive

- 6.4.4 Wearable

- 6.4.5 Other Products (Lighting Products, Healthcare, and Home Appliances)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 Italy

- 6.5.2.4 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.5.1 Brazil

- 6.5.5.2 Mexico

- 6.5.6 Middle East and Africa

- 6.5.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Samsung Display Co. Ltd

- 8.1.2 LG Display Co., Ltd

- 8.1.3 Sony Corporation

- 8.1.4 Pioneer Corporation

- 8.1.5 Raystar Optronics Inc.

- 8.1.6 Ritek Corporation

- 8.1.7 OSRAM OLED GmbH

- 8.1.8 WiseChip Semiconductor Inc.

- 8.1.9 Winstar Display Co. Ltd

- 8.1.10 Visionox Co. Ltd