|

市場調査レポート

商品コード

1850178

スマートホーム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スマートホーム:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

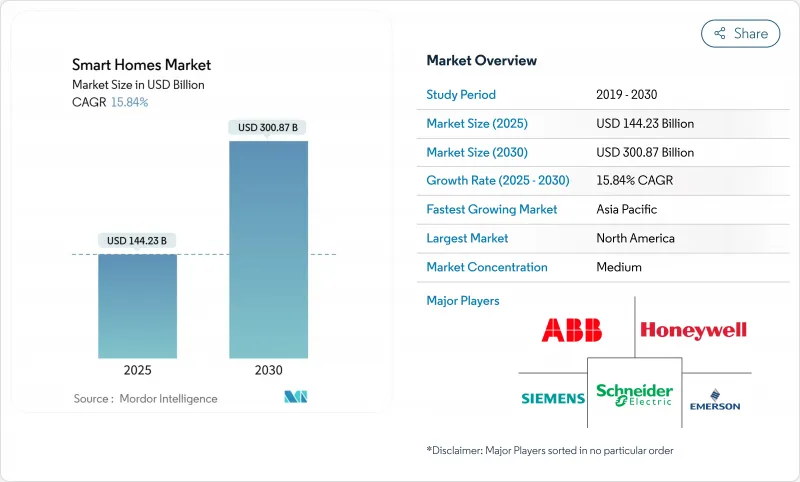

スマートホームの市場規模は、2025年に1,442億3,000万米ドル、2030年には3,008億7,000万米ドルに達すると予測され、CAGRは15.8%で推移します。

この成長は、エネルギーコストのインフレ、脱炭素化政策、テクノロジーの融合によって、コネクテッドリビングがプレミアムな目新しさから基本的な住宅インフラへとシフトしていることに起因しています。大規模な連邦政府の優遇措置が北米のリーダーシップを支える一方、アジア太平洋は都市化とスマートシティプログラムを背景に最も急速に拡大しています。5G、人工知能、Matter相互運用性プロトコルの融合は、コストと複雑性の障壁を侵食し、裕福な初期ユーザー以外にも採用を広げています。デバイスのエコシステムは断片化されたままだが、建設業者が新築にコネクテッド・インフラを導入し、集合住宅事業者がスマート・ソリューションを採用して物件を差別化するにつれて、プラットフォームの統合は加速しています。

世界のスマートホーム市場の動向と洞察

エネルギー効率の高いスマート家電への需要の高まり

電気料金の上昇と気候変動目標により、消費者は消費量を最適化し、手厚い税額控除を受けられるコネクテッド・デバイスへと向かっています。米国ではインフレ抑制法により、対象となるヒートポンプ、給湯器、省エネ制御機器の購入費用の30%が控除され、投資回収期間が大幅に短縮されます。GEアプライアンスのEcoBalanceプラットフォームは、屋上太陽光発電、蓄電池、EV充電器を統合し、家庭全体のオーケストレーションを可能にすることで、電力使用量を20~35%削減し、連邦政府の効率化プログラムを通じて住宅所有者に最大4,000米ドルのリベートを得ることができます。送電網の不安定性に直面している電力会社は、需要対応イベントへの参加に対してコネクテッド・アプライアンスの所有者に支払うことが増えており、キッチンやHVACシステムを分散型エネルギー資産に変えています。その結果得られる収入源は、負荷削減の機会を予測し、家電の生涯価値を高めるAIを組み込む動機付けとなります。

ブロードバンドと5Gの普及

高速接続は信頼性の高い機器性能を支えます。5G固定無線アクセスはすでに米国で400万世帯以上にサービスを提供しており、リアルタイムのセキュリティ・フィードや音声アシスタントを維持するファイバー・クラスの速度を提供しています。5Gによるエッジ処理は、セーフティ・クリティカルな機能の待ち時間を削減し、安価なIoTセンサーの普及を可能にします。地方のコミュニティが最も恩恵を受けるのは、コストのかかるラスト・マイル・ファイバーを回避し、従来は取り残されていた層のためのスマートホーム市場を解放することです。インドやブラジルで周波数帯のオークションが加速するにつれ、新興市場全体でスマートホームへのアクセスが拡大することが予想されます。

高い初期導入費用と改修費用

トータルホームシステムは通常15,000~4万米ドルであり、生涯エネルギー節約効果があるにもかかわらず、中間所得層にとっては導入のハードルとなっています。古い住宅では、パネルのアップグレードや配線の変更が必要となり、プロジェクト予算が膨らみます。電気や空調の技能労働者不足は、コストをさらに上昇させる。リベートは、低所得世帯に対しては80%もの相殺が可能であるが、事務処理の複雑さと払い戻しの遅れが、有効性を制限しています。請求書による返済やグリーン・モーゲージのような資金調達の革新は、初期支出を和らげ、スマートホーム市場への浸透を加速させる。

セグメント分析

アクセス制御、安全、セキュリティは2024年の売上高の22.1%を占め、住宅所有者が盗難抑止と保険料節約を優先する中、スマートホーム市場を下支えしています。スマートロックは現在、生体認証情報を統合し、配達員の監査証跡を生成しています。ヘルスケアコンポーネントのスマートホーム市場規模は、慢性疾患管理が住宅に移行するにつれてCAGR 16.2%で上昇し、最も急速に拡大すると予測されます。音声制御ハブは服薬指導を兼ね、接続された聴診器は臨床医にリアルタイムのバイタルを配信します。ユーティリティ企業は、自動化されたデマンドレスポンスに対する請求クレジットを提供することで、エネルギー管理システムを促進し、スマートHVACは、グリッド状況を伝達するAI最適化ヒートポンプによって牽引力を増しています。コントローラとハブは、ベンダー間のペアリングを可能にするMatter認証によってコモディティ化に直面し、差別化はメンテナンスを予測し、快適性アルゴリズムを改良する組み込み分析に軸足を移しています。

新たなカテゴリーとしては、AIが食事の目標や在庫に合わせたレシピを推奨するスマートキッチンなどがあります。GEアプライアンスのFlavorlyサービスは、食料品の注文と家電製品の設定をリンクさせ、食品小売と住宅IoTの融合を示しています。照明はイルミネーションだけでなく、サーカディアンフレンドリーなスペクトルや、電池なしで動作するエネルギーハーベスティングスイッチに移行しつつあり、大規模住宅のメンテナンスコストを引き下げています。

一戸建て物件は、個々の住宅所有者が自由にデバイス・エコシステムを選択し、全戸パッケージを導入するため、2024年には64.5%の収益を支配します。スマートメーター、屋上ソーラー、蓄電池は、EV充電器と同期して自己完結型のエネルギー・ノードを形成します。集合住宅の普及はCAGR16.9%でその差を縮めつつあり、入居率の向上と運営効率の向上を求める資産管理会社が後押ししています。スマートロックは住戸の入れ替えを簡素化し、エネルギーダッシュボードはサブメーターデータを公開してテナントへの請求の透明性を向上させる。ハイテク設備を備えたアパートの賃料プレミアムは5~25%で、継続的な投資の動機付けとなっています。入居者が管理するアクセスログなどのプライバシー保護は、入居者に受け入れられるための中心的な要素です。中央管理ダッシュボードにより、オペレーターはポートフォリオ全体を可視化することができ、予知保全が可能になるため、運用経費を抑制することができます。

スマートホーム市場レポートは、コンポーネント別(家電、入退室管理、安全、セキュリティ、照明、エネルギー管理、スマートHVAC/空調制御、コントローラー/ハブ、スマートホームヘルスケア、スマートキッチン)、住宅タイプ別(一戸建て、集合住宅)、設置タイプ別(新築、改修)、販売チャネル別(オンライン、オフライン)、地域別に分類されています。

地域分析

北米は2024年の売上高の36.4%を占め、政策的インセンティブとブロードバンド普及に支えられました。コネクテッド・コントロールを含むエネルギー効率の高い改修には、1世帯あたり最大1万4,000米ドルが回収可能となり、主流への取り込みを後押ししています。カナダの州プログラムは連邦政府の支援を反映し、接続型ヒートポンプと監視ダッシュボードを優先した1万カナダドルの補助金とゼロ金利ローンを発行しています。サムスンのSmartThings Energyのような、電気自動車とホームグリッドのバランスをリンクさせるエコシステム提携は、エコシステム全体の統合における地域のリーダーシップを示すものです。

アジア太平洋地域は、急速な都市化と政府主導のスマートシティの青写真に牽引され、CAGR16.5%で最も急成長している分野です。シャオミのような中国の国産ブランドは、手頃な価格の家庭用バンドル製品を提供し、大衆市場への普及を促しています。インドでは光ファイバーと5Gの導入で対応可能な世帯が拡大し、シンガポールでは介護者に異常を知らせるアンビエント・センシング機能を備えた高齢者向け介護アパートを試験的に建設しています。同地域に製造拠点が集中しているため材料費が抑えられ、エントリー・レベルのソリューションが新興中産階級でも利用可能になり、スマートホーム市場の裾野が広がっています。

欧州は、厳しいエネルギー指令とプライバシー重視の規制により、安定した普及を示しています。家庭へのスマートホーム普及率は、2022年までに1億1,200万世帯を突破し、2027年には47%に達する見込みです。シュナイダーエレクトリックのWiser Homeプラットフォームは、AI予測を適用して料金ピーク時の消費量を削減し、送電網の安定性を重視する大陸を反映しています。GDPRはローカルデータ処理を促し、ベンダーにエッジインテリジェント機器の設計を促しています。Fit-for-55パッケージのインセンティブは、太陽光発電の余剰電力をデマンドレスポンス市場に統合することで、家庭の所有者が系統連系機器を購入した場合に支払われます。中東とアフリカは、まだ始まったばかりではあるが、サウジアラビアのNEOMのような代表的なスマートシティ構築の恩恵を受けています。ラテンアメリカは、接続インフラが成熟し、ブラジルの全国的なスマートメーターの展開により、消費者が接続された生活に慣れ親しむようになるにつれて進歩しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- エネルギー効率の高いスマート家電の需要増加

- ブロードバンドと5Gの普及拡大

- 住宅の脱炭素化とエネルギー管理に対するインセンティブ

- 高齢者向け住宅と在宅医療の統合が急増

- 相互運用性標準(Matter)によるエコシステムの加速

- Gen Z世代の住宅所有が自動化支出を促進

- 市場抑制要因

- 初期設置および改修コストが高め

- サイバーセキュリティとデータプライバシーに関する懸念

- 断片化されたデバイスエコシステムが普及を阻害

- 半導体サプライチェーンの不安定さ

- バリューチェーン分析

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- マクロ経済動向の市場への影響評価

第5章 市場規模と成長予測

- コンポーネント別

- 家電

- スマートスピーカー

- スマートホームシアター

- スマート浄水器

- その他の家電製品

- アクセス制御、安全性、セキュリティ

- スマートアラーム

- スマートロック

- スマートセンサー

- 煙/危険検知器

- スマートカメラと監視

- ガレージドア開閉装置など

- 点灯

- スマート照明

- スマートランプと照明器具

- アンビエント照明

- その他の照明製品

- エネルギー管理

- 照明エネルギーコントローラー

- 中央制御システム

- HVACエネルギー制御

- スマートHVAC/気候制御

- ファン

- ラジエーター

- サーモスタット

- エアコン

- コントローラー/ハブ

- DIYハブとパネル

- プロフェッショナルハブとパネル

- スマートホームヘルスケア

- 医療警報システム

- スマート血糖モニター

- スマート心臓モニター

- スマートキッチン

- スマート冷蔵庫

- スマート調理器具とコンロ

- スマート食器洗い機

- スマートオーブン

- その他

- 家電

- 住宅タイプ別

- 一戸建て住宅

- 集合住宅

- 設置タイプ別

- 新築

- 改造

- 販売チャネル別

- オンライン

- オフライン

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- ASEAN

- オーストラリアとニュージーランド

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ABB Ltd

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- LG Electronics Inc.

- Cisco Systems Inc.

- Google LLC

- Microsoft Corporation

- General Electric Company

- IBM Corporation

- Legrand SA

- Lutron Electronics Co. Inc.

- Samsung Electronics Co., Ltd.

- Control4 Corporation

- Assa Abloy AB

- Amazon.com, Inc.

- Apple Inc.

- Bosch Smart Home GmbH

- Sony Group Corporation

- Faststream Technologies

- Simplisafe Inc.

- Ecobee Inc.

- Signify N.V.

- ADT Inc.

- Arlo Technologies, Inc.

- Vivint Smart Home, Inc.

- Ring LLC