|

市場調査レポート

商品コード

1639517

コイルコーティング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Coil Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コイルコーティング:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

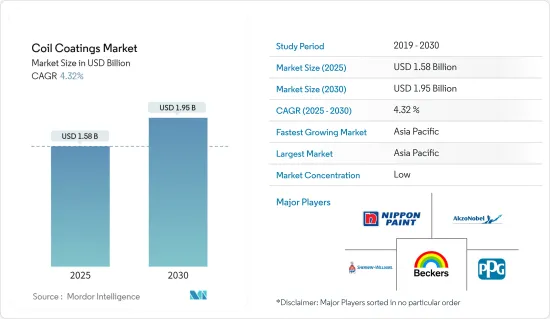

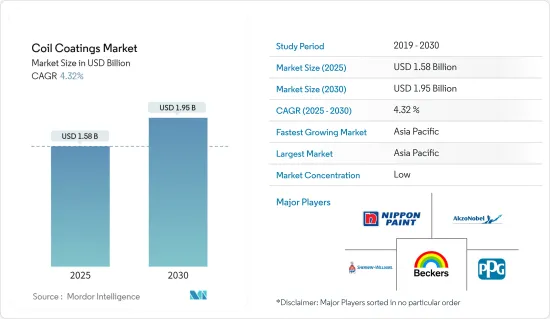

コイルコーティングの市場規模は2025年に15億8,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは4.32%で、2030年には19億5,000万米ドルに達すると予測されます。

COVID-19パンデミックは市場にマイナスの影響を与えました。パンデミックは世界中の建築建設とエンジニアリングプロジェクトを様々な形で危険にさらし、多くのプロジェクトが閉鎖または中止されたため、パンデミック危機の間、コイルコーティング市場の成長は減速しました。しかし、2021年には業界は回復し、市場の需要は回復しました。

主なハイライト

- 短期的には、建築・建設業界からの需要増、環境への影響拡大、技術の進歩が市場を牽引する主な要因です。

- 逆に、自動車産業における軽量材料への需要の増加は市場成長の妨げになると予想されます。

- しかし、建築用途のフッ素樹脂塗料に対する需要の増加は、好機となる可能性が高いです。

- アジア太平洋地域は、完成鋼の生産量とエンドユーザー製品の製造量が多いため、プレコート金属板の生産と輸出が増加しており、消費量では市場を独占しています。

コイルコーティング市場動向

建築・建設業界からの需要増加

- 建築・建設業界は、コイル塗料の最大消費者です。建築で多用される主な樹脂は、ポリエステル樹脂、シリコン変性ポリエステル、ポリフッ化ビニリデン(PVDF)、フッ素樹脂などです。エネルギー効率の高い構造を推進する建築基準法の増加に伴い、住宅建設業者と消費者は、長期的に性能とエネルギー節約を実現する建築戦略へと徐々に移行しています。

- 建設業界からの需要の高まりは、コイルコーティング市場を牽引する重要な要因です。世界各地で進行中の大規模なビル建設プロジェクトには、2025年第1四半期に完成予定のテキサス州マグノリア複合施設プロジェクト(10億米ドル相当)などがあります。東京の南小岩六丁目地区第一種市街地再開発プロジェクトも2026年の完成が見込まれています。このように、このような建設プロジェクトでは、屋根、スチールドア、アルミパネル、ゴム、金属積層接着、改修工事などにコイル製品が使用されると推定されます。

- さらに、コイルコーティングは、その可鍛性により、屋内外の建設用途にも広く使用されています。住宅建設業者と消費者は、性能と長期的なエネルギー節約をもたらす建築技術にますますシフトしています。そのため、エネルギー効率の高い構造の開発に注力しています。

- コイルコーティングは、建物の室内温度を下げるのに役立つ赤外線反射顔料技術を提供します。この技術により、冷房に消費されるエネルギーが削減されるため、コイルコーティングはエネルギー効率に優れ、建築・建設工事で使用されるコイル製品として選ばれています。また、雨どいや樋の防水施工にも利用されています。

- 北米の建設業界は、商業用不動産セクターの改善や、公共建築物や施設建築物に対する連邦政府や州政府の投資の増加により、着実に成長しています。北米の主要なビル建設プロジェクトには、25億米ドル相当のイースト・リバー複合施設開発プロジェクトなどがあります。このプロジェクトは、テキサス州により良い住宅とオフィス施設を提供することを目的としており、2040年に完成する予定です。従って、建築・建設業界への投資の増加は、コイルコーティングにとってプラスに働くと予想されます。

- フランス、ドイツ、英国、イタリアなどの西欧主要国は、コイルコーティング市場に積極的に貢献しています。同地域の建築建設活動の活発化に伴い、コイルコーティングの需要は大幅に増加しています。例えば、Trading Economicsによると、フランスの建設生産高は2022年7月と比較して2022年12月に3.1%増加しました。

- さらに、その高級な美観と長持ちする価値により、コイル塗料は建築・建設業界で天井格子、ドア、屋根やサイディング、窓などに使用されています。現在進行中の建設プロジェクトには、米国ワシントン州ベルビューに25階建てのオフィスタワーを建設する、4億7,600万米ドル相当のエイト・オフィス・タワー・プロジェクトなどがあります。2024年完成予定。東京の浜松町芝浦1丁目再開発プロジェクト(31億7,000万米ドル)も進行中のプロジェクトです。

- このプロジェクトでは2つのビルが建設され、2030年までに完成する予定です。オーストラリアにおける8億4,100万米ドル相当のエリザベス・キー・ロットVおよびロットVI複合施設建設プロジェクトも、2025年完成予定のプロジェクトです。これらのプロジェクトは、今後数年間、住宅や商業ビルの建設におけるプレコート金属の需要を増加させると予想されます。

- このような要因から、建築・建設業界のコイルコーティング市場は予測期間中に安定した成長が見込まれます。

アジア太平洋地域が市場を独占

- アジア太平洋地域が世界市場シェアを独占。その高級な美観と長持ちする価値から、コイル塗料は建築・建設業界の天井格子、ドア、屋根、サイディング、窓などに使用されています。

- アジア太平洋地域のコイルコーティング市場は、予測期間中に大きく成長すると予想されており、中国が建設拡大と急速な産業開拓により市場をリードしています。同地域では建築物の建設や改修活動が活発化しており、コイルコーティングの消費が急増すると予想されます。

- 例えば、アジア太平洋地域で進行中のビル建設プロジェクトには、日本の東京で2030年に完成予定の31億7,000万米ドルの浜松町芝浦1丁目再開発プロジェクトがあります。また、中国の武漢で建設が予定されている武漢佛山外灘中心T1プロジェクトもそのひとつです。したがって、建築物建設プロジェクトの増加が、この地域におけるコイルコーティングの成長を促進すると予想されます。

- さらに、輸送車両の需要の増加がコイルコーティング市場を牽引しています。2023年には、旺盛な需要と公共交通機関よりも自家用車を好む消費者のため、インドの自動車部門がアジア太平洋地域で最も強くなると予測されています。例えばOICAによると、2022年の同国の自動車生産台数は545万6,857台で、2020年比で24%の増加を示しました。したがって、この地域のコイルコーティング産業は、自動車生産全体の増加により拡大する可能性が高いです。

- このような要因により、同地域のコイルコーティング需要は増加すると予想されます。

コイルコーティング業界の概要

コイルコーティング市場は細分化されています。この市場の主要企業(順不同)には、Akzo Nobel N.V.、Beckers Group、PPG Industries, Inc.、The Sherwin-Williams Company、日本ペイントホールディングスなどが含まれます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 建築・建設業界からの需要の高まり

- 環境影響の拡大と技術の進歩

- その他の促進要因

- 抑制要因

- 自動車産業における軽量材料の需要増加

- その他の阻害要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(金額ベース市場規模)

- 樹脂タイプ別

- ポリエステル

- ポリフッ化ビニリデン(PVDF)

- ポリウレタン(PU)

- プラスチゾル

- その他の樹脂タイプ

- エンドユーザー産業別

- 建築・建設

- 産業および家庭用電化製品

- 輸送

- 家具

- その他のエンドユーザー産業

- 地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア分析(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- コイルコーター

- ArcelorMittal

- Arconic

- BDM Coil Coaters

- CENTRIA

- Chemcoaters

- Dura Coat Products

- Goldin Metals Inc.

- Jupiter Aluminum Corporation

- Norsk Hydro ASA

- Novelis

- Ralco Steels

- Rautaruukki Corporation

- Salzgitter Flachstahl GmbH

- Tata Steel

- Tekno Kroma

- thyssenkrupp AG

- UNICOIL

- United States Steel Corporation

- 塗料サプライヤー

- Akzo Nobel N.V.

- Axalta Coatings System LLC

- Beckers Group

- Brillux GmbH & Co. KG

- Hempel A/S

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd

- NOROO Coil Coatings Co., Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Yung Chi Paint & Varnish Mfg Co. Ltd

- 前処理、樹脂、顔料、機器

- Arkema

- Bayer AG

- Covestro AG

- Evonik Industries AG

- Henkel AG & Co. KgaA

- Solvay

- Wacker Chemie AG

- コイルコーター

第7章 市場機会と今後の動向

- 建築用途でのフッ素樹脂塗料需要の増加

- その他の機会

The Coil Coatings Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 1.95 billion by 2030, at a CAGR of 4.32% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. The pandemic jeopardized building construction and engineering projects worldwide in numerous ways, and many projects were closed or halted, decelerating the growth of the coil coatings market during the pandemic crisis. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, rising demand from the building and construction industry and growing environmental influences, and advancing technology are the major factors driving the market studied.

- Conversely, increasing demand for lightweight materials in the automobile industry is expected to hinder the studied market's growth.

- However, increasing demand for fluoropolymer coatings for architectural applications will likely act as an opportunity.

- Asia-Pacific dominated the market in terms of consumption due to the rise in the production and export of pre-coated metal sheets in the region due to the high production of finished steel and the high manufacturing of end-user products.

Coil Coatings Market Trends

Rising Demand from the Building and Construction Industry

- The building and construction industry is by far the largest consumer of coil coatings. The main resins used extensively in construction are polyester resin, silicone-modified polyester, polyvinylidene fluorides (PVDF), or fluoropolymer. With the rising number of building codes that promote energy-efficient structures, home builders and consumers are gradually moving toward building strategies that deliver performance and energy savings in the long run.

- The rising demand from the construction industry is a key factor driving the coil coatings market. Some of the large ongoing building construction projects worldwide include the Magnolia Mixed-Use Complex project worth USD 1 billion in Texas, which is expected to be completed in Q1 2025. The Minamikoiwa 6-Chome District Type One Urban Redevelopment project in Tokyo, Japan, is another project expected to be completed in 2026. Thus, such construction projects are estimated to use coil products for roofing, steel doors, aluminum panels, rubber, metal lamination bonding, renovation work, and others.

- Furthermore, coil coatings are also widely used for interior and exterior construction applications due to their malleability. Home builders and consumers increasingly shift towards building techniques that impart performance and long-term energy savings. Hence, they are focusing on developing energy-efficient structures.

- Coil coatings provide infrared reflective pigment technology that helps in lowering the indoor temperature of the building. This technique reduces the energy consumed for cooling, making coil coatings energy efficient and the preferred choice for coil products used in building and construction work. It is also utilized to construct gutters and downspouts for waterproof installations.

- The construction industry in North America is growing steadily due to the improving commercial real estate sector and increased federal and state investment in public construction and institutional buildings. Some of North America's major building construction projects include the East River Mixed-Use Development project worth USD 2.5 billion. The project aims to provide better residential and office facilities in Texas, which is expected to be completed in 2040. Therefore, increasing building and construction industry investments are expected to create an upside for coil coatings.

- The major Western European countries, including France, Germany, the United Kingdom, and Italy, are actively contributing to the coil coatings market. With growing building construction activities in the region, the demand for coil coatings increased significantly. For instance, according to Trading Economics, construction output in France increased by 3.1% in December 2022 compared to July 2022.

- Moreover, due to its high-end aesthetics and long-lasting value, coil coatings are used in the building and construction industry in ceiling grids, doors, roofing and siding, windows, etc. Some of the ongoing construction projects include the Eight Office Tower project worth USD 476 million, which involves the construction of a 25-story office tower in Bellevue, Washington, United States. It is expected to be completed in 2024. The Hamamatsucho Shibaura 1 Chome Redevelopment Project, worth USD 3.17 billion in Tokyo, Japan, is another ongoing project.

- The project involves the construction of two buildings and is expected to be finished by 2030. The Elizabeth Quay Lot V and Lot VI Mixed-Use Complex construction project worth USD 841 million in Australia is yet another project likely to be completed in 2025. These projects are expected to increase the demand for pre-coated metals in the construction of residential and commercial buildings in the coming years.

- Due to all such factors, the building and construction industry's coil coatings market is expected to grow steadily during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. Due to their high-end aesthetics and long-lasting value, coil coatings are used in the building and construction industry in ceiling grids, doors, roofing and siding, windows, etc.

- The Asia-Pacific coil coatings market is anticipated to grow significantly during the forecast period, with China leading the market owing to expanding construction and rapid industrial development. The growing building construction and renovation activities in the region are expected to surge the consumption of coil coatings.

- For instance, some of the ongoing building construction projects in the Asia-Pacific include the Hamamatsucho Shibaura 1 Chome Redevelopment project worth USD 3.17 billion, expected to be completed in 2030 in Tokyo, Japan. Another such project is the Wuhan Fosun Bund Center T1 project, which involves the construction of the Fosun Bund Center T1 in Wuhan, China. Therefore, increasing building construction projects are expected to drive the growth of coil coatings in the region.

- Furthermore, the growing demand for transport vehicles is driving the coil coatings market. In 2023, India's automotive sector is predicted to be the strongest in the Asia-Pacific region, owing to strong demand and consumers' preference for personal vehicles over public transportation. For instance, according to OICA, in 2022, automobile production in the country amounted to 5,456,857 units, which showed an increase of 24% compared to 2020. Therefore, the region's coil coatings industry will likely expand due to the rise in overall automobile manufacturing.

- All such factors are expected to increase the demand for coil coatings in the region.

Coil Coatings Industry Overview

The coil coatings market is fragmented in nature. The major players in this market (not in a particular order) include Akzo Nobel N.V., Beckers Group, PPG Industries, Inc., The Sherwin-Williams Company, and Nippon Paint Holdings Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Building and Construction Industry

- 4.1.2 Growing Environmental Influences and Advancing Technology

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Demand for Lightweight Materials in Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Polyester

- 5.1.2 Polyvinylidene Fluorides (PVDF)

- 5.1.3 Polyurethane(PU)

- 5.1.4 Plastisols

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Industrial and Domestic Appliances

- 5.2.3 Transportation

- 5.2.4 Furniture

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Coil Coaters

- 6.4.1.1 ArcelorMittal

- 6.4.1.2 Arconic

- 6.4.1.3 BDM Coil Coaters

- 6.4.1.4 CENTRIA

- 6.4.1.5 Chemcoaters

- 6.4.1.6 Dura Coat Products

- 6.4.1.7 Goldin Metals Inc.

- 6.4.1.8 Jupiter Aluminum Corporation

- 6.4.1.9 Norsk Hydro ASA

- 6.4.1.10 Novelis

- 6.4.1.11 Ralco Steels

- 6.4.1.12 Rautaruukki Corporation

- 6.4.1.13 Salzgitter Flachstahl GmbH

- 6.4.1.14 Tata Steel

- 6.4.1.15 Tekno Kroma

- 6.4.1.16 thyssenkrupp AG

- 6.4.1.17 UNICOIL

- 6.4.1.18 United States Steel Corporation

- 6.4.2 Paint Suppliers

- 6.4.2.1 Akzo Nobel N.V.

- 6.4.2.2 Axalta Coatings System LLC

- 6.4.2.3 Beckers Group

- 6.4.2.4 Brillux GmbH & Co. KG

- 6.4.2.5 Hempel A/S

- 6.4.2.6 Kansai Paint Co.,Ltd.

- 6.4.2.7 Nippon Paint Holdings Co., Ltd

- 6.4.2.8 NOROO Coil Coatings Co., Ltd.

- 6.4.2.9 PPG Industries, Inc.

- 6.4.2.10 The Sherwin-Williams Company

- 6.4.2.11 Yung Chi Paint & Varnish Mfg Co. Ltd

- 6.4.3 Pretreatment, Resins, Pigments, Equipment

- 6.4.3.1 Arkema

- 6.4.3.2 Bayer AG

- 6.4.3.3 Covestro AG

- 6.4.3.4 Evonik Industries AG

- 6.4.3.5 Henkel AG & Co. KgaA

- 6.4.3.6 Solvay

- 6.4.3.7 Wacker Chemie AG

- 6.4.1 Coil Coaters

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Fluoropolymer Coatings for Architectural Applications

- 7.2 Other Opportunities