|

市場調査レポート

商品コード

1686219

アクリル酸-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Acrylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アクリル酸-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

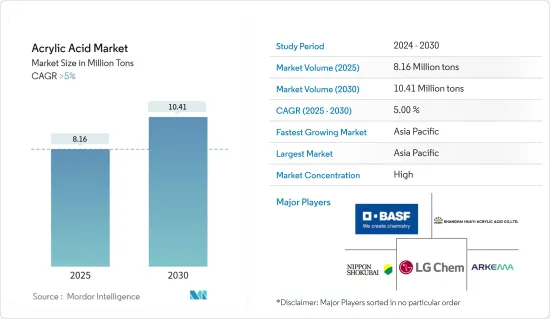

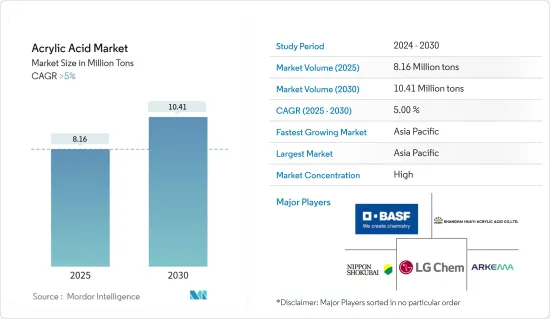

アクリル酸市場規模は2025年に816万トンと推計され、予測期間中(2025年~2030年)のCAGRは5%を超え、2030年には1,041万トンに達すると予測されます。

COVID-19パンデミックは市場にマイナスの影響を与えました。しかし2021年には、個人の衛生と清潔な環境に関する意識と意識の高まりにより、ランドリーケア製品の需要が増加しました。アクリル酸は洗濯用液体洗剤の製造に使用され、アクリル酸市場の需要を刺激しています。

主なハイライト

- 短期的には、アクリル酸ベースの高吸水性ポリマーの用途拡大と化学合成の利用増加が市場の成長を牽引するとみられます。

- アクリル酸に関連する健康被害が市場の成長を阻害する可能性があります。

- バイオベースポリマーに対する需要の高まりは、予測期間中、市場の成長機会として機能すると思われます。

- アジア太平洋が最大の市場シェアを占めており、予測期間中も市場を独占する可能性が高いです。

アクリル酸市場の動向

塗料・コーティング剤におけるアクリル酸の使用量増加

- アクリル酸はアクリル酸エステルの製造に使用され、塗料やコーティング剤など様々な用途に使用されます。

- アクリル酸は建築用塗料、自動車(OEM)および再塗装を含む相手先商標製品メーカー向け製品の仕上げ、特殊用途塗料に使用されています。

- アクリル粉体塗料は、自動車ボディのクリアコートとして導入されています。アクリル粉体塗料は多くの用途に理想的なソリューションですが、硬化は高温のオーブンで行われます。そのため、汎用性はない(木材やプラスチックの塗装など)。

- 建築用塗料は表面の保護や装飾を目的としており、建物や住宅の塗装に使用されます。そのほとんどは、屋根用塗料、壁用塗料、デッキ用仕上げ材など、特定の用途に指定されています。それぞれの建築塗料は、その用途にもかかわらず、一定の装飾性、耐久性、保護機能を備えていなければならないです。

- ほとんどの住宅所有者は、居間や寝室の壁に好みの色を好みます。アクリル塗料は、色や陰影の面で多様な選択肢を提供するため、好ましい選択です。天井の大部分は、フラットホワイトに塗装され、部屋の周囲の光の大部分を反射して、居住者に部屋が広々としてリラックスしているように感じさせる。地下の石積みの壁には、しばしば水がしみ込むことがあります。

- 2022年5月、グラシム・インダストリーズ(アディティヤ・ビルラ・グループ)は、2025年度までに塗料事業に10,000カロールインドルピー(12億947万米ドル)を投資する計画です。2021年1月、同社は今後3年間で5,000カロールインドルピー(6億473万米ドル)を投じて塗料事業に参入する計画を発表しました。同社は2024年度第4四半期までに、年間生産能力13億3,200万リットル(MLPA)の塗料工場を稼働させるようです。

- インドの塗料・コーティング産業は、インドの様々なエンドユーザー産業の重要なバロメーターとしての役割を果たし、技術の進歩とマクロ経済の拡大に大きく貢献しています。近年、このセクターは、より広範な業界動向を反映し、大幅な成長を遂げています。

- European Coatingsによると、インドの塗料産業は2023年にほぼ95億ユーロ(102億2,000万米ドル)に達し、今後数年間で14%の成長が見込まれています。これにより、同国における特殊効果顔料の需要が増加すると予想されます。

- インドの塗料産業は、設備投資に3,500億インドルピー(41億9,000万米ドル)から4,500億インドルピー(52億9,000万米ドル)を投資すると予測されています。インドの塗料・コーティング産業における様々な投資は以下の通りである:

- 米国塗料協会によると、2023年の米国建築用塗料は市場全体の49%を占め、OEM塗料は30%、特定用途塗料は21%です。2023年、米国の塗料・コーティング産業の生産高は約13億1,000万ガロンと推定され、2024年には13億4,000万ガロンを超えると収益予測されています。

- ドイツは、欧州における塗料・コーティング剤の主要生産国のひとつであり、約300社の塗料・印刷インキメーカーを擁し、その多くは中小企業です。BASF SE、ダウ、Beckers Group、Brillux、Altana Chemie、Meffert、Mankiewiczといった著名な塗料メーカーがドイツに本社を構えており、同国では市場の需要が拡大すると予想されます。

- 2023年6月、オーストリアの塗料会社アドラーは、約1,000万ユーロ(1,086万米ドル)を投じてドイツのヘルフォルトに新しいサービス施設の建設を開始しました。正式な開所式と落成式は2025年初頭に予定されており、工事は2024年夏の終わりまで続けられる予定です。

- 全体として、アクリル酸の需要は初期の回復期を経て、この地域では中程度から高い成長が見込まれます。

アジア太平洋が市場を独占する見込み

- アジア太平洋は、中国、インド、日本などの国々からの高い需要によって市場を独占しています。

- 中国はアジア太平洋最大のアクリル酸消費国であり、その需要は予測期間中に伸びると予想されています。中国では、建設やインフラ分野への投資が増加しているため、接着剤、塗料、コーティング剤の需要も大幅に増加しています。

- 中国は、個人向け衛生用品の世界の主要消費国のひとつです。同国の個人向け衛生製品に対する需要は、乳幼児人口の多さと可処分所得の増加により、個人向けケアや衛生ケアへの支出が増加していることに起因しています。そのため、アクリル酸市場は予測期間中に成長すると見込まれています。

- 中国は工業化と製造業で知られ、塗料やコーティング剤が広く必要とされています。同国で塗料やコーティング剤が使用されている主な分野には、自動車、工業、建設などがあります。中国は世界の塗料市場の4分の1以上を占めています。中国塗料工業協会によると、同産業は近年7%の成長を記録しており、塗料用途のアクリル酸市場を牽引しています。

- 中国には10,000社近くの塗料メーカーが進出しています。日本ペイント、アクゾノーベル、中国海洋塗料、PPGインダストリーズ、BASF SE、アクサルタ・コーティングスなど、世界の大手塗料メーカーのほとんどが中国に製造拠点を置いています。塗料会社は中国への投資をますます増やしています。これにより、自動車用塗料やコーティング剤の製造に使用されるアクリル酸市場が活性化する可能性が高いです。

- 中国政府は、今後10年間で2億5,000万人を新たな巨大都市に移住させるなど、大規模な建設計画を打ち出しています。そのため、アクリル酸は建築物の建設時に様々な用途で使用される塗料やコーティング剤に使用され、建築物の特性を向上させる可能性があります。

- インドの建設産業は、2025年までに1兆4,000億米ドルに達すると予測されています。2030年までに、推定6億人が都市中心部に住むようになり、その結果、中・超高級住宅を2,500万戸追加する必要が生じる。国家投資計画(NIP)のもと、インドでは1兆4,000億米ドルのインフラ投資予算が組まれており、その24%が再生可能エネルギー、道路・高速道路、都市インフラ、12%が鉄道に割り当てられています。

- そのため、予測期間中、アジア太平洋がアクリル酸市場を独占する可能性が高いです。

アクリル酸業界の概要

アクリル酸市場は統合された性質を持っています。市場の主要企業には、BASF SE、アルケマ、日本触媒、LG Chem、Shanghai Huayi Acrylic Acidなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 高吸水性ポリマーの用途拡大

- 化学合成における用途の増加

- 抑制要因

- アクリル酸の健康被害

- バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション

- 誘導体別

- アクリル酸メチル

- アクリル酸ブチル

- アクリル酸エチル

- アクリル酸2-エチルヘキシル

- 氷河アクリル酸

- 高吸水性ポリマー

- 用途別

- 塗料およびコーティング剤

- 接着剤とシーリング剤

- 界面活性剤

- 衛生製品

- 繊維製品

- その他の用途

- 地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧諸国

- トルコ

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 中東・アフリカ

- サウジアラビア

- カタール

- アラブ首長国連邦

- ナイジェリア

- エジプト

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- 合併、買収、合弁事業、提携、協定

- 市場シェア(%)分析

- 主要企業の戦略

- 企業プロファイル

- Arkema

- BASF SE

- China Petroleum & Chemical Corporation(SINOPEC)

- Dow

- Formosa Plastics Corporation

- LG Chem

- Merck KGaA

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO. LTD

- Sasol

- Shanghai Huayi Acrylic Acid Co. Ltd

- Satellite Chemical Co. Ltd

- Wanhua

第7章 市場機会と今後の動向

- バイオベースポリマーの需要増加

The Acrylic Acid Market size is estimated at 8.16 million tons in 2025, and is expected to reach 10.41 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. However, in 2021, the demand for laundry care products increased due to the increased awareness and consciousness regarding personal hygiene and clean surroundings. Acrylic acid is used to produce liquid laundry detergent, stimulating the demand for the acrylic acid market.

Key Highlights

- Over the short term, the rising applications of acrylic acid-based super absorbent polymers and the increasing use of chemical synthesis are expected to drive the growth of the market.

- Health hazards associated with acrylic acid may hinder the growth of the market.

- The rising demand for bio-based polymers is likely to act as a growth opportunity for the market during the forecast period.

- The Asia-Pacific accounted for the largest market share, and it is likely to dominate the market during the forecast period.

Acrylic Acid Market Trends

The Usage of Acrylic Acid in Paints and Coatings is Increasing

- Acrylic acid is used to make acrylate esters, which are used in various applications, including paints and coatings.

- Acrylics are used in architectural coatings, finishes for products for original equipment manufacturers, including automotive (OEM) and refinishes, and special-purpose coatings.

- Acrylic powder coatings have been introduced as clear coats on car bodies. Although it is an ideal solution for many applications, curing is achieved at a high temperature in an oven. It is, therefore, not universally applicable (e.g., painting of wood and plastics).

- Architectural coatings are meant to protect and decorate surface features and are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. Each architectural coating must provide certain decorative, durable, and protective functions despite their use.

- Most homeowners prefer the color of their choice for the living room and bedroom walls. Acrylic paints are the preferred choice as they offer a wide variety of choices in terms of color and shade. A vast majority of ceilings are painted flat white so that they may reflect the majority of the ambient light in the room to make the resident feel that the room is spacious and relaxed. Basement masonry walls can often weep water.

- In May 2022, Grasim Industries (Aditya Birla Group) planned to invest INR 10,000 crore (USD 1,209.47 million) in its paint business by FY 2025. In January 2021, the company announced plans to enter the paints business with INR 5,000 crore (USD 604.73 million) in the next three years. The company will likely commission a paint plant with a production capacity of 1,332 million liters per annum (MLPA) by Q4 FY 2024.

- The paints and coatings industry in India serves as a crucial barometer of the country's various end-user industries, significantly contributing to both technological advancements and macroeconomic expansion. In recent years, this sector has witnessed substantial growth, reflecting broader industry trends.

- According to European Coatings, the Indian paint industry amounted to nearly EUR 9.5 billion in 2023 (USD 10.22 billion), and it is expected to grow by 14% over the coming years. This is expected to increase the demand for special-effect pigments in the country.

- The Indian paint Industry is projected to invest INR 350,000 million (USD 4.19 billion) to INR 450,000 million (USD 5.29 billion) in capital expenditure. Various investments in the Indian paints and coating industry are as follows:

- According to the American Coatings Association, US architectural coatings accounted for 49% of the total market in 2023, while OEM and particular purpose coatings comprised 30% and 21%, respectively. In 2023, the production revenue of the paint and coatings industry in the United States was estimated at approximately 1.31 billion gallons, with forecasts predicting that production will exceed 1.34 billion gallons in 2024.

- Germany stands among the leading producers of paints and coatings in Europe, boasting approximately 300 manufacturers of paints and printing ink, many of which are small- and medium-sized enterprises. With prominent paint manufacturers such as BASF SE, Dow, Beckers Group, Brillux, Altana Chemie, Meffert, and Mankiewicz headquartered in Germany, the demand for the market is expected to escalate in the country.

- In June 2023, Adler, an Austrian paint company, commenced construction on its new service facility in Herford, Germany, with an investment of roughly EUR 10 million (USD 10.86 million). The official opening and inauguration are scheduled for early 2025, with construction set to continue until late summer 2024.

- Overall, the demand for acrylic acid is expected to witness moderate to high growth in the region after the initial recovery period.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific dominated the market due to the high demand from countries like China, India, and Japan.

- China is the largest consumer of acrylic acid in the Asia-Pacific region, and its demand is expected to grow during the forecast period. The demand for adhesives, paints, and coatings in China is also increasing significantly due to the growing investments in the construction and infrastructure sectors.

- China is one of the major consumers of personal hygiene products globally. The country's demand for personal hygiene products is attributed to a large infant population and increasing disposable income, leading to increased spending on personal and hygiene care. Thus, the market for acrylic acid is expected to grow during the forecast period.

- China is known for its industrialization and manufacturing sector, where paints and coatings are widely required. Some of the major sectors where paints and coatings are used in the country are the automotive, industrial, and construction sectors, among others. China accounted for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years, driving the acrylic acid market in coatings application.

- Nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BASF SE, and Axalta Coatings, have manufacturing bases in China. Paints and coatings companies have been increasingly growing investments in the country. This is likely to fuel the market for acrylic acid used to manufacture automotive paints and coatings.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years. Thus, this may create a major scope for acrylic acid in paints and coatings used in various applications during building construction, enhancing the building properties.

- India's construction Industry is projected to reach a value of USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, urban infrastructure, and 12% for railways.

- Hence, due to these factors, the Asia-Pacific region is likely to dominate the acrylic acid market during the forecast period.

Acrylic Acid Industry Overview

The acrylic acid market is consolidated in nature. Some major players in the market include BASF SE, Arkema, NIPPON SHOKUBAI CO. LTD, LG Chem, and Shanghai Huayi Acrylic Acid Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications of Super Absorbent Polymers

- 4.1.2 Increasing Usage in Chemical Synthesis

- 4.2 Restraints

- 4.2.1 Health Hazards of Acrylic Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Derivative

- 5.1.1 Methyl Acrylate

- 5.1.2 Butyl Acrylate

- 5.1.3 Ethyl Acrylate

- 5.1.4 2-Ethylhexyl Acrylate

- 5.1.5 Glacial Acrylic Acid

- 5.1.6 Superabsorbent Polymer

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Surfactants

- 5.2.4 Sanitary Products

- 5.2.5 Textiles

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 China Petroleum & Chemical Corporation (SINOPEC)

- 6.4.4 Dow

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 LG Chem

- 6.4.7 Merck KGaA

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NIPPON SHOKUBAI CO. LTD

- 6.4.10 Sasol

- 6.4.11 Shanghai Huayi Acrylic Acid Co. Ltd

- 6.4.12 Satellite Chemical Co. Ltd

- 6.4.13 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polymers