|

|

市場調査レポート

商品コード

1444058

バイオ医薬品:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Biopharmaceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バイオ医薬品:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 208 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

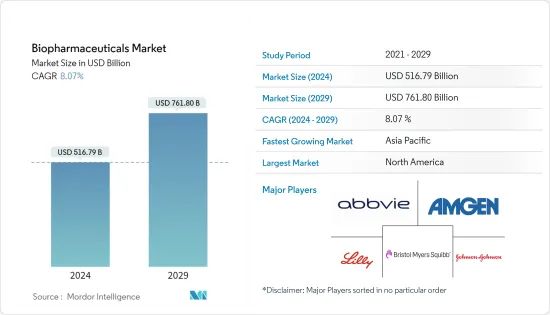

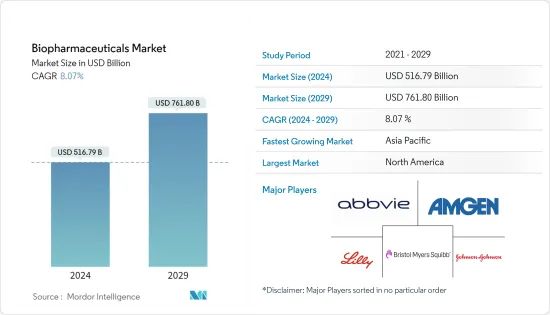

バイオ医薬品市場規模は2024年に5,167億9,000万米ドルと推定され、2029年までに7,618億米ドルに達すると予測されており、予測期間(2024年から2029年)中に8.07%のCAGRで成長します。

COVID-19のパンデミックはバイオ医薬品業界に大きな影響を与えました。ほとんどのバイオ医薬品企業は、SARS-CoV-2ウイルスに対するワクチンの開発に多大な努力を払ってきました。たとえば、2021年 4月にインド政府は、インド固有の新型コロナウイルスワクチンの開発と生産を加速するミッションCOVID Surakshaを発表し、バイオテクノロジー省がこれを実施しました。

コヴァキシンの生産能力は、2021年4月の10億回分のワクチン投与量から、2021年7月から8月にかけて月あたり60億~70億回分のワクチン投与量に増加しました。また、2021年9月中には月あたり100億回分のワクチン投与量に達する予定です。 2022年6月、ファイザーは、カラマズー(ミシガン州)の施設に1億2,000万米ドルを投資して米国での製造に取り組むことを発表し、COVID-19経口治療薬であるパクスロビッド(ニルマトレルビル[PF-07321332]錠剤およびリトナビル錠剤)の米国での生産を可能にします。

この投資は、米国における重要なバイオ医薬品の製造量を拡大するというファイザーの取り組みにおけるさらなる重要な一歩を表し、米国および世界中の患者に治療薬や医薬品を製造および提供するファイザーの能力を強化します。同様に、2021年8月にカナダ政府は、COVID-19ワクチン開発大手モデルナ社とカナダにmRNAワクチン施設を建設する合意を発表しました。最近発表されたバイオ製造およびライフサイエンス戦略の目標は、カナダにmRNAワクチン製造施設を建設するというモデルナの願望と一致していました。この措置により、カナダの全体的な産業能力が向上し、人材の獲得と維持から臨床試験能力の向上に至るまで、バイオ製造およびライフサイエンス産業のバリューチェーン全体が強化されるでしょう。COVID-19ワクチンの製造に対する関心の高まりにより、バイオ医薬品市場の成長が大幅に促進されました。

バイオ医薬品の受け入れの増加とその巨大な市場需要、以前は治療不可能だった疾患を治療するバイオ医薬品の能力などの要因が市場の成長を推進しています。アルツハイマー病協会の2021年報告書によると、米国食品医薬品局(FDA)はアルツハイマー病の治療薬5種類を承認しました。それらは、リバスチグミン、ガランタミン、ドネペジル、メマンチン、およびドネペジルと組み合わせたメマンチンです。同じ情報源によると、アルツハイマー型認知症を発症する人の大多数は65歳以上です。それは遅発性アルツハイマー病と呼ばれます。

米国では、65歳から74歳の人の約5.3%、75歳から84歳の人の13.8%、85歳以上の人の34.6%がアルツハイマー型認知症を患っています。さらに、2021年には65歳以上のアメリカ人 620万人がアルツハイマー型認知症を患っており、2050年までに1,350万人に達すると予測されています。このような病気の有病率の上昇により、今後数年間で患者集団の間でAPIの需要が高まるでしょう。

以前は治療できなかった症状に対処できるバイオ医薬品製品の能力により、革新的な医薬品を市場に導入する道が開かれました。たとえば、2022年9月、ブルーバード・バイオ社のSKYSONA(エリバドジェネ・オートテムセル)は、早期の活動性脳副腎白質ジストロフィー(CALD)を患う4~17歳の男児の神経機能不全の進行を遅らせることがCBERによって承認されました。同様に、2022年 6月にCBERは、GSK plcが製造する麻疹、おたふく風邪、風疹用の生ワクチンPRIORIXを承認しました。

また、2022年2月、ジョンソン・エンド・ジョンソンと中国を中心とするパートナー企業レジェンド・バイオテック社は、米国食品医薬品局(FDA)によって承認された白血球がんタイプを治療する治療法を開発しました。腫瘍性疾患の治療に役立つ新しい治療法は、予測期間中に市場の成長をさらに加速させるでしょう。

ただし、ハイエンドの製造と複雑で面倒な規制要件は、予測期間中の市場の成長を妨げるでしょう。

バイオ医薬品市場の動向

モノクローナル抗体は予測期間中に高い成長が見込まれる

モノクローナル抗体(moAbまたはmAbとも呼ばれます)は、私たちのシステム内で抗体と同様に動作する、研究室で作られたタンパク質です。治療におけるモノクローナル抗体および抗体誘導体の使用の成功は、研究分野の急速な成長の主な推進力です。モノクローナル抗体の治療用途には、がん、関節リウマチ、多発性硬化症、心血管疾患などがあります。

承認数の増加、臨床試験、調査支出の増加は、この部門の成長にとって重要な要素です。 2022年 10月、二重特異性抗デルタ様リガンド 3(DLL3)/抗分化クラスター47(CD47)抗体であるPT217が、Phanes Therapeutics, Inc.によって開発されました。同社は、腫瘍学に焦点を当てた臨床段階のバイオテクノロジー企業です。小細胞肺がん(SCLC)およびその他の神経内分泌がんの患者。米国食品医薬品局(FDA)からフェーズ1の認可を受けています。さらに、FDAの承認の増加とさまざまな適応症に対する新製品の発売がこの分野を推進すると考えられます。たとえば、2022年2月、米国食品医薬品局は、オミクロン変異体に対する活性を保持するCOVID-19治療用の新しいモノクローナル抗体の緊急使用許可(EUA)を発行しました。ベブテロビマブのEUAは、入院や死亡を含む重度のCOVID-19への進行リスクが高い、COVID-19検査陽性の成人および小児患者における軽度から中等度のCOVID-19を治療するものです。また、FDAによって承認または認可された代替のCOVID-19治療オプションが利用できない、または臨床的に適切ではない人も対象となります。

したがって、モノクローナル抗体セグメントは、上記の要因により、予測期間中に大幅な成長を遂げるでしょう。

北米がバイオ医薬品市場を独占すると予想される

米国における慢性疾患の負担の増大と研究開発活動への投資の増加が、北米のバイオ医薬品市場を牽引する主な要因となっています。米国のバイオ医薬品市場は、慢性疾患の発生率の増加、確立されたバイオ医薬品企業の存在感、バイオテクノロジー企業の増加により成長すると予想されます。国内の高齢者人口の増加と調査開発の増加も市場の成長を促進します。

さらに、2022年 7月に更新された疾病管理予防センター(CDC)のデータによると、冠状動脈性心疾患は最も一般的なタイプの心疾患であり、米国では20歳以上の成人約2,010万人がこの病気に苦しんでいます。さらに、CDCのデータによると、40秒ごとに誰かが心臓発作を起こしており、米国では毎年 805,000人近くが心臓発作を起こしています。したがって、心血管疾患の負担が大きいため、治療用の先進的な薬剤の利用が求められています。

2022年 5月、イーライリリーアンドカンパニーは、米国インディアナ州での製造拠点を拡大するために21億米ドルの投資を発表しました。同様に、2022年5月にロッテはニューヨーク州イーストシラキュースにあるブリストル・マイヤーズスクイブ社の製造施設を購入しました。イーストシラキュースの施設は、米国におけるロッテの新しい生物製剤受託開発製造組織(CDMO)ビジネスの北米事業のロッテセンターとして機能します。

したがって、上記の要因を考慮すると、調査対象の市場は、予測期間中に北米で大幅に成長すると予想されます。

バイオ医薬品業界の概要

バイオ医薬品市場は、複数の企業が事業を展開しているため、本質的に細分化されています。競合情勢には、市場シェアを保持し有名な数社の国際企業および国内企業の分析が含まれます。

2022年3月、BioNTech SEは、進行性非小細胞肺がん(NSCLC)におけるPD-1阻害剤であるLibtayo(セミプリマブ)との併用による同社のFixVac候補BNT116の開発を進めるため、Regeneronとの戦略的提携の拡大を報告しました。契約条件に基づき、両社は共同で臨床試験を実施し、進行性NSCLCのさまざまな患者集団での併用を評価する予定です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- バイオ医薬品の受け入れの拡大と巨大な市場需要

- これまで治療不可能だった疾患を治療するバイオ医薬品の能力

- 市場抑制要因

- ハイエンドの製造要件

- 複雑で面倒な規制要件

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品タイプ別

- モノクローナル抗体

- 抗がんモノクローナル抗体

- 抗炎症モノクローナル抗体

- その他

- 組換え成長因子

- エリスロポエチン

- 顆粒球コロニー刺激因子

- 精製タンパク質

- 白血病抑制因子(LIF)

- P53タンパク質

- P38タンパク質

- その他

- 組換えタンパク質

- 血清アルブミン

- アミロイドタンパク質

- ディフェンシン

- トランスフェリン

- 組換えホルモン

- 組換えヒト成長ホルモン

- 組換えインスリン

- その他

- ワクチン

- 組換えワクチン

- がんワクチン

- マラリアワクチン

- エボラワクチン

- B型肝炎ワクチン

- 破傷風ワクチン

- ジフテリアワクチン

- コレラワクチン

- その他の組換えワクチン

- 従来型ワクチン

- ポリオワクチン

- ポックスワクチン

- その他の従来型ワクチン

- 組換え酵素

- エンテロキナーゼ

- シクラーゼ

- カスパーゼ

- カテプシン

- 細胞・遺伝子治療

- 同種異系製品

- 自家製品

- 無細胞製品

- 合成免疫調整薬

- サイトカイン、インターフェロン、インターロイキン

- その他

- 血液因子

- その他

- モノクローナル抗体

- 治療用途別

- 腫瘍

- 炎症性疾患・感染症

- 自己免疫疾患

- 代謝障害

- ホルモン障害

- 心血管疾患

- 神経疾患

- その他

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Abbvie Inc.

- Amgen Inc.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Johnson &Johnson

- Novartis AG

- Novo Nordisk AS

- Pfizer Inc.

- GlaxoSmithKline PLC

- F. Hoffmann-La Roche AG

- Merck Co. &Inc.

- Sanofi SA

- AstraZeneca PLC

- Bayer AG

- Takeda Pharmaceutical Company Limited

第7章 市場機会と将来の動向

The Biopharmaceuticals Market size is estimated at USD 516.79 billion in 2024, and is expected to reach USD 761.80 billion by 2029, growing at a CAGR of 8.07% during the forecast period (2024-2029).

The COVID-19 pandemic had a significant impact on the biopharmaceutical industry. Most biopharmaceutical companies strived extensively to develop vaccines against the SARS-CoV-2 virus. For example, in April 2021, Mission COVID Suraksha was announced by the Government of India to accelerate the development and production of indigenous COVID vaccines, which the Department of Biotechnology implemented.

The production capacity of Covaxin increased from 1 crore vaccine doses in April 2021 to 6-7 crore vaccine doses per month between July/August 2021. Also, it will reach nearly ten crore doses per month during September 2021. On the other hand, in June 2022, Pfizer announced its commitment to US manufacturing with a USD 120 million investment at its Kalamazoo (Michigan) facility, enabling United States-based production for its COVID-19 oral treatment, PAXLOVID (nirmatrelvir [PF-07321332] tablets and ritonavir tablets).

The investment represents yet another significant step in Pfizer's initiative to expand the amount of critical biopharmaceutical manufacturing in the US, enhancing Pfizer's capacity to manufacture and provide treatments and medications for patients in the US and around the world. Similarly, in August 2021, the Government of Canada announced an agreement with leading COVID-19 vaccine developer Moderna, Inc. to build an mRNA vaccine facility in Canada. The goals of the recently unveiled biomanufacturing and life science strategy were in line with Moderna's aspirations to build an mRNA vaccine manufacturing facility in Canada. The action will improve Canada's overall industrial competence and boost the whole value chain of the biomanufacturing and life sciences industry, from talent acquisition and retention to greater clinical trial capacity. The increased interest in manufacturing COVID-19 vaccines has significantly added to the growth of the biopharmaceutical market during the COVID-19 pandemic.

Factors like increasing acceptance of and huge market demand for biopharmaceuticals and the biopharmaceuticals' ability to treat previously untreatable diseases are driving the market's growth. According to the Alzheimer's Association 2021 report, the US Food and Drug Administration (FDA) approved five drugs for treating Alzheimer's. They are rivastigmine, galantamine, donepezil, memantine, and memantine, combined with donepezil. As per the same source, the vast majority of people who develop Alzheimer's dementia are 65 years and above. It is called late-onset Alzheimer's.

In the US, nearly 5.3% of people aged 65 to 74 years, 13.8% of people aged 75 to 84 years, and 34.6% of people aged 85 years or above have Alzheimer's dementia. Additionally, 6.2 million Americans aged 65 years and above are living with Alzheimer's dementia in 2021 and projected to reach 13.5 million by 2050. Such a higher disease prevalence will bolster the demand for API among the patient population over the coming years.

The biopharmaceutical products' capability to address previously untreatable conditions has paved the way for introducing innovative drugs in the market. For instance, in September 2022, bluebird bio, Inc.'s SKYSONA (elivaldogene autotemcel) slows the progression of neurologic dysfunction in boys 4-17 years of age with early, active cerebral adrenoleukodystrophy (CALD), was approved by CBER. Similarly, in June 2022, CBER approved PRIORIX, a live vaccine for measles, mumps, and rubella, manufactured by GSK plc.

Also, in February 2022, Johnson and Johnson and its China-focused partner company Legend Biotech Corp developed a therapy to treat white blood cell cancer type approved by the US Food and Drug Administration (FDA). New therapies that aid in treating oncologic disorders will add to the market growth over the forecast period.

However, high-end manufacturing and complicated and cumbersome regulatory requirements will hinder market growth over the forecast period.

Biopharmaceutical Market Trends

Monoclonal Antibodies is Expected to Witness High Growth Over the Forecast Period

Monoclonal antibodies (also called moAbs or mAbs) are proteins made in laboratories that behave like the antibodies in our systems. The successful use of monoclonal antibodies and antibody derivatives in therapeutics is the primary driver for the rapid growth of the studied segment. The therapeutic applications of monoclonal antibodies include cancer, rheumatoid arthritis, multiple sclerosis, and cardiovascular diseases.

Growing approvals, clinical trials, and increasing research expenditure are critical factors in this segment's growth. In October 2022, PT217, a bispecific anti-Delta-like ligand 3 (DLL3)/anti-Cluster of Differentiation 47 (CD47) antibody, was developed by Phanes Therapeutics, Inc. It is a clinical-stage biotech company focused on oncology for patients with small cell lung cancer (SCLC) and other neuroendocrine cancers. It received Phase 1 clearance from the US Food and Drug Administration (FDA). Additionally, the growing FDA approvals and new product launches for various indications will drive the segment. For instance, in February 2022, the US Food and Drug Administration issued an Emergency Use Authorization (EUA) for a new monoclonal antibody to treat COVID-19 that retains activity against the omicron variant. The EUA for bebtelovimab treats mild to moderate COVID-19 among adults and pediatric patients with a positive COVID-19 test who are at high risk for progression to severe COVID-19, including hospitalization or death. It is also for those for whom alternative COVID-19 treatment options approved or authorized by the FDA are not accessible or clinically appropriate.

Thus, the monoclonal antibodies segment will witness significant growth over the forecast period due to the abovementioned factors.

North America is Expected to Dominate the Biopharmaceuticals Market

The growing burden of chronic diseases and increasing investments in research and development activities in the US are the major factors driving the biopharmaceuticals market in North America. The US market for biopharmaceuticals will grow due to increasing chronic disease incidences, well-established biopharmaceutical companies' presence, and an increase in biotech companies. The rising geriatric population and increased research and developments in the country also drive market growth.

In addition, the Centers for Disease Control and Prevention's (CDC) data updated in July 2022 shows that coronary heart disease is the most common type of heart disease, and approximately 20.1 million adults of age 20 and older suffer from the ailment in the US. Additionally, per the CDC data, every 40 seconds, someone suffers from a heart attack, and nearly 805,000 people in the US have a heart attack annually. Thus, the high burden of cardiovascular diseases demands the availability of advanced drugs for treatment.

In May 2022, Eli Lilly and Company announced an investment of USD 2.1 billion to expand its manufacturing footprint in Indiana, US. Similarly, in May 2022, LOTTE purchased Bristol Myers Squibb's manufacturing facility in East Syracuse, New York. The East Syracuse site will serve as the LOTTE Center for North America Operations for LOTTE's new biologics contract development and manufacturing organization (CDMO) business in the US.

Thus, given the factors mentioned above, the studied market is expected to grow significantly in North America over the forecast period.

Biopharmaceutical Industry Overview

The biopharmaceuticals market is fragmented in nature due to the presence of several companies operating. The competitive landscape includes analyzing a few well-known international and local companies that hold market shares and are famous, including Amgen Inc., Eli Lily and Company, Johnson and Johnson, Sanofi SA, AstraZeneca PLC, and Pfizer Inc., among others.

In March 2022, BioNTech SE reported the expansion of its strategic collaboration with Regeneron to advance the Company's FixVac candidate BNT116 in combination with Libtayo (cemiplimab), a PD-1 inhibitor, in advanced non-small cell lung cancer (NSCLC). Under the terms of the agreement, the companies plan to jointly conduct clinical trials to evaluate their combination in different patient populations with advanced NSCLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Acceptance of and Huge Market Demand for Biopharmaceuticals

- 4.2.2 Ability of Biopharmaceuticals to Treat Previously Untreatable Diseases

- 4.3 Market Restraints

- 4.3.1 High-end Manufacturing Requirements

- 4.3.2 Complicated and Cumbersome Regulatory Requirements

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Monoclonal Antibodies

- 5.1.1.1 Anti-cancer Monoclonal Antibodies

- 5.1.1.2 Anti-inflammatory Monoclonal Antibodies

- 5.1.1.3 Other Monoclonal Antibodies

- 5.1.2 Recombinant Growth Factors

- 5.1.2.1 Erythropoietin

- 5.1.2.2 Granulocyte Colony Stimulating Factor

- 5.1.3 Purified Proteins

- 5.1.3.1 Leukemia Inhibitory Factor (LIF)

- 5.1.3.2 P53 Protein

- 5.1.3.3 P38 Protein

- 5.1.3.4 Other Purified Proteins

- 5.1.4 Recombinant Proteins

- 5.1.4.1 Serum Albumin

- 5.1.4.2 Amyloid Protein

- 5.1.4.3 Defensin

- 5.1.4.4 Transferrin

- 5.1.5 Recombinant Hormones

- 5.1.5.1 Recombinant Human Growth Hormones

- 5.1.5.2 Recombinant Insulin

- 5.1.5.3 Other Recombinant Hormones

- 5.1.6 Vaccines

- 5.1.6.1 Recombinant Vaccines

- 5.1.6.1.1 Cancer Vaccine

- 5.1.6.1.2 Malaria Vaccine

- 5.1.6.1.3 Ebola Vaccine

- 5.1.6.1.4 Hepatitis-B Vaccine

- 5.1.6.1.5 Tetanus Vaccine

- 5.1.6.1.6 Diptheria Vaccine

- 5.1.6.1.7 Cholera Vaccine

- 5.1.6.1.8 Other Recombinant Vaccines

- 5.1.6.2 Conventional Vaccines

- 5.1.6.2.1 Polio Vaccine

- 5.1.6.2.2 Pox Vaccine

- 5.1.6.2.3 Other Conventional Vaccines

- 5.1.7 Recombinant Enzymes

- 5.1.7.1 Enterokinase

- 5.1.7.2 Cyclase

- 5.1.7.3 Caspase

- 5.1.7.4 Cathepsin

- 5.1.8 Cell and Gene Therapies

- 5.1.8.1 Allogenic Products

- 5.1.8.2 Autologous Products

- 5.1.8.3 Acellular Products

- 5.1.9 Synthetic Immunomodulators

- 5.1.9.1 Cytokines, Interferons, and Interleukins

- 5.1.10 Other Product Types

- 5.1.10.1 Blood Factors

- 5.1.10.2 Other Product Types

- 5.1.1 Monoclonal Antibodies

- 5.2 By Therapeutic Application

- 5.2.1 Oncology

- 5.2.2 Inflammatory and Infectious Diseases

- 5.2.3 Autoimmune Disorders

- 5.2.4 Metabolic Disorders

- 5.2.5 Hormonal Disorders

- 5.2.6 Cardiovascular Diseases

- 5.2.7 Neurological Diseases

- 5.2.8 Other Therapeutic Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbvie Inc.

- 6.1.2 Amgen Inc.

- 6.1.3 Bristol-Myers Squibb Company

- 6.1.4 Eli Lilly and Company

- 6.1.5 Johnson & Johnson

- 6.1.6 Novartis AG

- 6.1.7 Novo Nordisk AS

- 6.1.8 Pfizer Inc.

- 6.1.9 GlaxoSmithKline PLC

- 6.1.10 F. Hoffmann-La Roche AG

- 6.1.11 Merck Co. & Inc.

- 6.1.12 Sanofi SA

- 6.1.13 AstraZeneca PLC

- 6.1.14 Bayer AG

- 6.1.15 Takeda Pharmaceutical Company Limited