|

市場調査レポート

商品コード

1849850

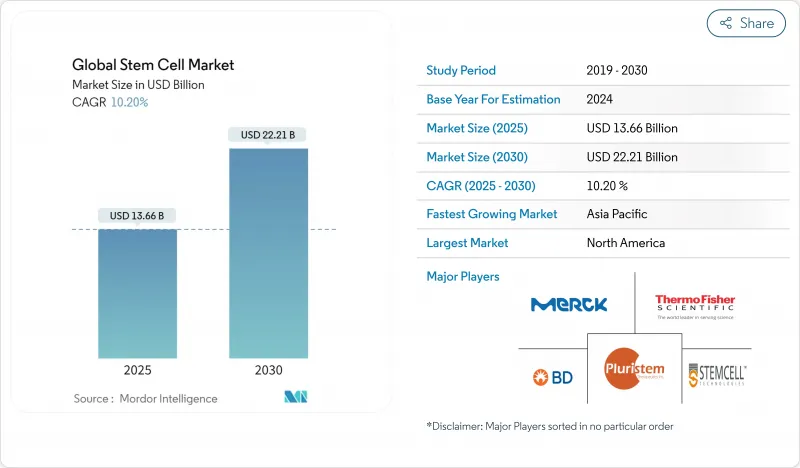

幹細胞:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Stem Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 幹細胞:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月04日

発行: Mordor Intelligence

ページ情報: 英文 118 Pages

納期: 2~3営業日

|

概要

幹細胞市場は、2025年に171億3,000万米ドル、2030年には298億8,000万米ドルに達し、CAGR 11.77%で成長すると予測されています。

新たに承認された間葉系間質細胞療法が商業的リードタイムを短縮し、人工多能性幹細胞(iPSC)プラットフォームに投資が集中し、専門のCDMOが製造能力を拡大しています。特に米国と日本では、薬事規制の早期化が進み、治療薬がより早く患者に提供されるようになり、CRISPRを利用した編集とAI誘導による製造ワークフローが製品の品質を高め、治療範囲を広げています。地域的な勢いはアジア太平洋へとシフトしており、各国の政策によって幹細胞は戦略的技術として位置づけられています。生体内投与を容易にする送達手段を確保するため、大手バイオファーマがイノベーターを買収し、競合の激しさが増しています。

世界の幹細胞市場の動向と洞察

慢性疾患と変性疾患の高い負担

人口動態の高齢化により、再生医療に対する需要が拡大しています。パーキンソン病は2050年までに2,520万人に影響を及ぼすと予測されており、人口高齢化がその増加の89%を占める要因となっています。間葉系幹細胞(MSCs)は炎症を抑え、組織の破壊を抑制し、修復を促進するため、慢性疾患管理のための費用対効果の高いツールとして位置づけられています。間葉系幹細胞(MSC)は炎症を抑え、組織の破壊を抑制し、修復を促進するため、慢性疾患管理の費用対効果に優れたツールとなります。医療システムは、高額な長期療養を先延ばしできる治療法に予算を再配分しており、MSCベースの製品の調達を強化し、幹細胞市場を強化しています。

急速に拡大する再生医療パイプライン

4,000以上の遺伝子、細胞、RNA治療が開発中であり、フェーズiプログラムは2024年初頭に11%増加。CRISPR編集によりCAR-Tの性能が向上し、自己免疫疾患の適応が広がります。AIを活用した分析により細胞の表現型解析が自動化され、リリーステストが数日から数時間に短縮されました。網膜細胞移植は視力を回復させ、iPSC由来のコンストラクトは1型糖尿病において有望な血糖コントロールを示しました。このような進歩は対処可能な集団を拡大し、幹細胞市場の見通しを引き上げています。

安全性と有効性の不確実性

多能性細胞については、腫瘍原性と免疫原性が依然として中心的な懸念事項です。バッチのばらつきは効力アッセイを複雑にし、規制当局に監視の強化を促しています。研究グループは、NK細胞の検出を回避しながら宿主組織に統合する免疫クローク移植片を設計してきました。FDAの細胞治療に対する権限を肯定する第9巡回区判決は、コンプライアンス義務を明確にしたが、タイムラインを長くする可能性があります。

セグメント分析

成体幹細胞は、安全性が十分に立証されており、治療の幅も広いことから、2024年の幹細胞市場シェアの55.0%を占めました。MSCに特化した品質管理ガイドラインは現在、力価測定法を標準化し、広範な臨床利用を支えています。成体幹細胞製品の幹細胞市場規模は、整形外科、心臓、免疫学的プログラムが成熟するにつれて着実に成長すると予測されます。一方、iPS細胞は、初期化効率の向上とGMP生産能力の拡大に後押しされ、CAGR10.43%で進展しています。アスペン・ニューロサイエンス社は、2025年1月にパーキンソン病治療薬ANPD001の生産を自動化し、クローズドシステムのワークフローが自己幹細胞のリードタイムを短縮できることを実証しました。VSELは奇形腫リスクのない多系統の可能性が注目されているfrontiersin.org投資家の関心は、免疫回避のために操作された既製のiPS細胞株へとシフトしており、2030年まで資金流入が続くことを示しています。

凍結保護剤カクテルの進歩により解凍後のアポトーシスが減少し、成体由来とiPSC由来の両方で生存率が向上しています。規制機関は、リリース仕様の調和を奨励しており、これによって2つの製品クラス間のコスト格差は徐々に縮小していくと思われます。これらのイノベーションが日常診療に統合されるにつれて、使用事例、特に個別化治療の迅速な拡大が求められる使用事例が収束していくことが予想されます。

2024年の幹細胞市場規模の23.0%は整形外科の適応症であり、これはMSC注射が変形性関節症の疼痛スコアを改善し、脊椎固定を促進するというエビデンスに支えられています。MSC療法は、再生整形外科的選択肢の中で最も高い疼痛軽減係数を記録しました。高齢化によって関節修復の需要が高まる中、同分野は引き続き底堅いです。一方、神経疾患はCAGR 11.23%で成長する見込みです。ドパミン作動性ニューロンの置換術の進歩により、パーキンソン病のコホートでは測定可能な運動機能の向上が見られました。血液脳関門通過技術の向上と免疫クローク細胞株は、アルツハイマー病と脳卒中の臨床パイプラインを広げています。心血管プログラムも同様に拡大しており、セリポンのcGMPパートナーシップは心臓前駆細胞の供給をターゲットにしています。

臨床試験の多様性も高まっています。血液がんは引き続き移植の中心的存在であり、糖尿病に対するβ細胞補充療法は第II相評価に入りつつあります。これらの動向は、バランスの取れたアプリケーションミックスを強化し、幹細胞市場全体の継続的な収益成長を支えています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 慢性疾患および変性疾患の負担が大きい

- 急速に拡大する再生医療パイプライン

- 好ましい規制促進経路

- 公的および私的臍帯血・組織バンキングおよび個別化医療プログラムの普及率向上

- 既製の治療法を可能にする技術革新

- 分野におけるイノベーションと開発のための市場プレーヤー間の連携強化

- 市場抑制要因

- 治療法に関連する安全性と有効性の不確実性

- 制限的な払い戻しポリシー

- 製造規模の課題と製品および手順の高コスト

- 根強い道徳的懸念による倫理と政策の相違

- バリュー/サプライチェーン分析

- 規制の見通し

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- 成体幹細胞

- 間葉系幹細胞

- 造血幹細胞

- 神経幹細胞

- ヒト胚性幹細胞

- 人工多能性幹細胞(iPSC)

- 非常に小さな胚様幹細胞

- その他の製品タイプ(例:がん幹細胞)

- 成体幹細胞

- 用途別

- 神経疾患

- 整形外科治療

- 腫瘍疾患

- 心血管疾患および心筋梗塞

- 糖尿病と代謝疾患

- 創傷と熱傷

- その他の用途

- 治療タイプ別

- 同種異系幹細胞療法

- 自家移植療法

- 同系幹細胞療法

- エンドユーザー別

- 学術調査機関

- 病院と外科センター

- 製薬およびバイオテクノロジー企業

- 幹細胞銀行と凍結保存施設

- 契約開発製造組織(CDMO)

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ATCC

- Thermo Fisher Scientific Inc.

- Merck KGaA

- STEMCELL Technologies

- Takara Bio Inc.

- Miltenyi Biotec

- Pluri Inc.

- AllCells LLC

- International Stem Cell Corp.

- ReNeuron Group plc

- Bio-Techne Corp.

- Gamida Cell Ltd.

- Fate Therapeutics Inc.

- Cynata Therapeutics Ltd

- BioRestorative Therapies Inc.

- BrainStorm Cell Therapeutics

- Lineage Cell Therapeutics

- Regenexx LLC

- Orchard Therapeutics plc

- Mesoblast Ltd

- Athersys Inc.

- Medipost Co. Ltd.

- PromoCell GmbH