|

市場調査レポート

商品コード

1850119

ユーバイオティクス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Eubiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ユーバイオティクス:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

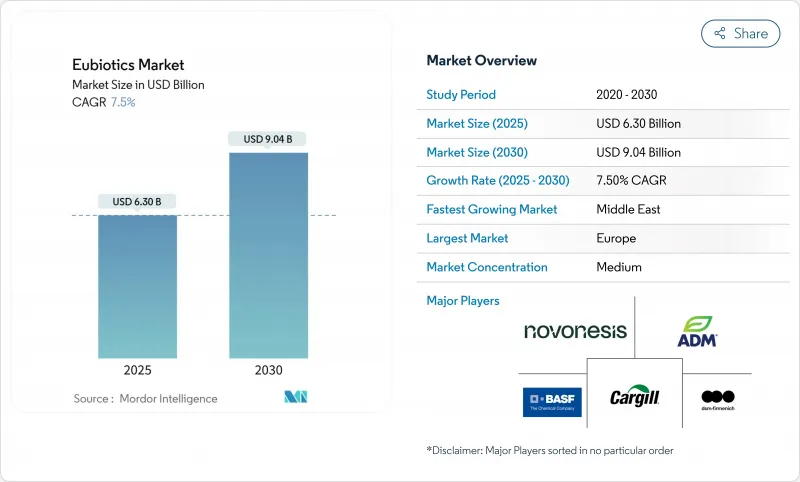

ユーバイオティクス市場規模は2025年に63億米ドルと推定・予測され、予測期間(2025-2030年)のCAGRは7.50%で、2030年には90億4,000万米ドルに達すると予測されます。

抗生物質成長促進剤に対する規制の高まり、水産養殖生産高の着実な増加、精密栄養技術により、すべての家畜セグメントでプロバイオティクス、有機酸、プレバイオティクス、植物性添加物の採用が加速しています。抗生物質不使用のサプライ・チェーンを義務付ける大手小売業者は需要の勢いを強め、デジタル畜産システムは、的を絞ったユーバイオティクス・プログラムと組み合わせることで、測定可能な飼料コストの節約と窒素排泄量の減少を示します。サプライチェーンの強靭性と循環型エコノミー調達は競争力を強化し、北米とアジア太平洋における規制の収束は、グローバルに調和した製品上市のための承認の複雑さを軽減します。市場の集中が緩やかであれば、地域の原料ベースや環境圧力に合わせて製剤を調整できる地域の専門家が活躍できる余地があります。すべての動向において、ユーバイオティクス市場は、広域抗生物質から、農場レベルのリターンを定量化できる持続可能な腸内健康ソリューションへと軸足を移し続けています。

世界のユーバイオティクス市場の動向と洞察

抗生物質成長促進剤の規制制限

主要な畜産地域全体で抗生物質成長促進剤が正式に段階的に廃止され、ユーバイオティクスへの不可逆的なシフトが始まりました。規則(EC)No 1831/2003は厳格な安全性書類プロセスを作り出し、他の多くの国もそれを真似るようになり、その結果、より明確で標準化された承認パスが確立され、強固な臨床データパッケージを持つサプライヤーが報われるようになりました。米国FDAの革新的FEED法(Innovative FEED Act)が同様の合理化を導入しているように、多国籍の生産者は資料提出を調整し、市場投入までの時間を短縮し、共通の安全基準値を満たす調和のとれた製剤を展開することができます。

抗生物質不使用の畜産物に対する消費者の需要の高まり

抗生物質不使用の肉や乳製品に対する需要は、ニッチから主流へと移行しています。大手食料品チェーンは、抗生物質の使用を排除するサプライヤー方針を課しており、添加物コストが高いにもかかわらず、生産者をユーバイオティクスに向かわせる。特に消費者が抗生物質スチュワードシップを健康や食の安全と結びつけている欧州、北米、アジアの先進国では、プレミアムな商品棚価格がこうしたコストを相殺し、説得力のある経済的ケースを作り出しています。

高いコストと複雑な承認プロセス

高いコストと複雑な規制当局の承認プロセスは、製品の上市を遅らせ、小規模サプライヤーにとっては参入障壁となります。EFSAに安全性に関する書類を提出するには数百万ユーロの費用がかかり、スケジュールは3~4年に延長されます。ブレグジット後の規則が乖離しているため、企業はEUと英国で別々の申請書類を準備しなければならず、書類や実験室での研究が重複することになります。こうした負担は、薬事専門チームを擁する多国籍企業に競争優位を傾けるものであり、早期承認への明確な道筋がない新規作用機序への投資を抑制しかねないです。

セグメント分析

プロバイオティクスの2024年の売上高シェアは41.7%で、ユーバイオティクス市場で最大のシェアを占めています。プロバイオティクスの優位性は、広範な臨床検証、気候に左右されない信頼性の高い性能、承認取得を迅速化する規制上の前例などに起因しています。このセグメントのバチルス菌胞子はペレット化温度に耐えるため、競合排除の効果を発揮する腸管への送達を確実にします。プロバイオティクスとフラクトオリゴ糖プレバイオティクスをブレンドしたシンバイオティクス製剤は、飼料要求率が3~4%改善し、補完的なメカニズムが実証されました。

エッセンシャルオイルは2030年までのCAGRで最速の9.80%を記録します。植物由来の抗菌剤に対する消費者の嗜好と、腸内微生物に対する化合物の多層的な作用が、取り込みを促進します。チモール、カルバクロール、シンナムアルデヒドのマイクロカプセル化は揮発性化合物を安定化させ、100ppmという低い含有率で測定可能な病原体抑制を実現します。有機酸とプレバイオティクスは、酸性化と基質供給というニッチな役割を維持し、マルチモーダルブレンドは相乗効果を狙っています。製剤科学の集団的進歩により、ユーバイオティクス市場は腸内健康イノベーションの中心的プラットフォームとして確固たる地位を築いています。

家禽類は2024年の売上高の34.5%を占め、ブロイラーとレイヤーにおける数十年にわたる抗生物質代替プログラムを反映しています。配合率は飼料1トン当たり平均500gで、生涯にわたる累積飼料転換利益率は高い費用対効果をもたらしています。水産養殖の予想CAGRは8.60%で、相対的な成長が海洋種と淡水種にシフトします。エビ、ティラピア、ハイブリッドハタの試験では、正確な水安定性プロバイオティクスを自動給餌器を通して投与することで、病原体の負荷が30%以上減少することが示されています。

養豚事業では、腸管毒素原性大腸菌を抑制するために、離乳後に多系統のプロバイオティクスを統合しています。反芻動物はルーメンの動態が複雑なため導入が遅れているが、揮発性脂肪酸比率を調整するプロピオニバクテリウムのブレンドがメタン削減ツールとして支持を集めています。コンパニオンアニマル・フォーミュレーション(伴侶動物用製剤)セグメントは、ペットフードのマーケティング担当者が高価格帯を正当化するためにヒューマニゼーション傾向を活用するプレミアム層を追加します。全体として、動物に特化した最適化はユーバイオティクス市場規模を拡大させるとともに、専門サプライヤーが独自の菌株を通じて利幅を獲得することを可能にします。

地域分析

2024年における欧州の売上高シェア34.9%は、厳しい飼料添加物規制、生産者の高い意識、確立された流通インフラに起因します。製品開発者は、独自菌株のスクリーニングを迅速化する発酵インプット、獣医系大学、委託研究ラボに近いという利点があります。EUオーガニック行動計画は、ビタミンとアミノ酸の不足に対処しながらオーガニック家畜の飼料を補完する認証ユーバイオティクスに対する需要の増加を誘発します。ブレグジットに伴う規制の乖離は、二重登録のコストをもたらすが、英国のガイドラインに基づく迅速な承認というニッチな機会ももたらします。

中東は、サウジ・ビジョン2030の下での水産養殖メガプロジェクトに支えられ、CAGR最速の7.90%を達成します。湾岸協力会議諸国は、国内のタンパク質不足を解消するために、単細胞タンパク質とユーバイオティクスを組み合わせた砂漠気候の水産飼料施設に投資します。政府の飼料補助金制度は、残留抗生物質を最小限に抑え、ハラール基準やグリーンラベル基準に沿った持続可能な腸内衛生ソリューションを統合する地元生産者に報います。

アジア太平洋は異質なパターンを示しています。日本や韓国のような先進市場は、付加価値の高い配合とトレーサビリティを重視する一方、中国とインドは規模の大きさからコスト効率の高い配合に重点を置いています。中国での規制クリアランスは依然遅いが、山東省や福建省の現地生産クラスターがサプライチェーンを短縮しています。南米の生産者は、豊富な植物原料を活用して国内でエッセンシャルオイル・ブレンドを開発し、輸出志向の牛肉・鶏肉部門にコスト優位性をもたらしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 抗生物質成長促進剤に対する規制

- 抗生物質不使用の動物性食品に対する消費者の需要の高まり

- 世界の養殖生産の拡大

- 精密栄養・供給システムにおける技術の進歩

- 動物のパフォーマンスにおける腸の健康の重要性に対する認識の高まり

- 持続可能で循環型経済の実践への注目が高まる

- 市場抑制要因

- 高コストと複雑な規制承認プロセス

- サプライチェーンの不安定性と原材料調達の課題

- 新興国市場における認識と技術的専門知識の不足

- 一貫性のない有効性結果と標準化の欠如

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- タイプ別

- プロバイオティクス

- 乳酸菌

- ビフィズス菌

- その他のプロバイオティクス(枯草菌、サッカロミセス・ボウラディなど)

- プレバイオティクス

- イヌリン

- フルクトオリゴ糖

- ガラクトオリゴ糖

- その他のプレバイオティクス(マンナンオリゴ糖、ベータグルカンなど)

- 有機酸

- エッセンシャルオイル(植物由来成分)

- プロバイオティクス

- 動物タイプ別

- 反芻動物

- 家禽

- 豚

- 水産養殖業

- その他の動物タイプ(コンパニオンアニマル、馬など)

- 形態別

- 乾燥(粉末、顆粒)

- 液体(溶液、懸濁液、乳化液)

- 機能別(主な目的)

- 腸の健康とパフォーマンスの向上

- 免疫力の強化

- 病原体制御/病気の緩和

- 飼料効率の改善

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東

- サウジアラビア

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- BASF SE

- dsm-firmenich

- Cargill, Incorporated

- Novonesis

- ADM

- Kemin Industries, Inc.

- Lallemand Inc.

- Evonik Industries AG

- Alltech

- Adisseo

- Huvepharma

- Phibro Animal Health Corporation

- Novus International, Inc.

- Marubeni Corporation(Orffa)

- VetAgro S.p.A.