|

市場調査レポート

商品コード

1639478

海洋掘削リグ:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Offshore Drilling Rigs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 海洋掘削リグ:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

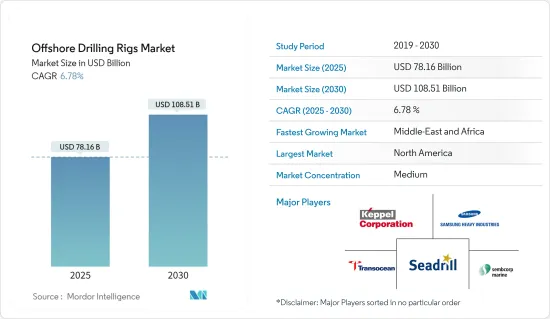

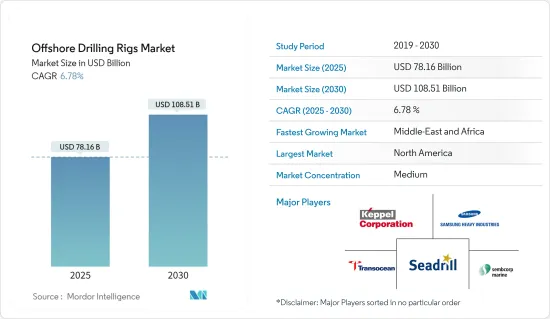

海洋掘削リグの市場規模は2025年に781億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは6.78%で、2030年には1,085億1,000万米ドルに達すると予測されます。

主要ハイライト

- 長期的には、世界のエネルギー需要の増加や未開拓地域の探査活動などの要因が、予測期間中の市場を牽引するとみられます。

- その一方で、海洋掘削に対する環境問題の高まりや水生環境への影響は、市場の成長を阻害すると予想されます。

- 深海や超深海での探査・生産活動の増加は、将来的にいくつかの市場機会を生み出すと予想されます。

- 北米は、海洋活動のための最新技術とインフラが整っているため、主要市場になると予想されます。

海洋掘削リグの市場動向

深海と超深海セグメントが大きな成長を遂げる

- 深海と超深海地域には、膨大な未開発の石油・ガス埋蔵量があります。陸上や浅海の埋蔵量が枯渇するにつれて、石油・ガス会社は深海や超深海での炭化水素資源の探査・抽出にますます力を入れるようになっています。そのため、このような厳しい環境でも稼働可能な掘削リグの需要が高まっている

- 掘削技術、機器、海底システムの進歩は、深海・超深海地域での掘削作業の実現可能性と効率を大幅に向上させました。ダイナミック・ポジショニングシステム、先進的掘削技術、遠隔操作船(ROV)などの課題により、これらの厳しい海洋環境において、より安全で効率的な掘削が可能になりました。先端技術が利用可能になったことで、以前はアクセスできなかった深海の埋蔵量が開拓され、このセグメントの成長を牽引しています。

- さらに、深海と超深海地域には、かなりの石油・ガス埋蔵量があることが知られています。これらの埋蔵量には、陸上や浅海の油田に比べて高い生産ポテンシャルが含まれていることが多いです。こうした海洋地域の埋蔵量が多いため、石油・ガス会社にとっては魅力的な投資機会となり、こうした環境で操業可能な海洋掘削リグの需要が高まっている

- さらに、政府やエネルギー企業は、将来のエネルギー供給を確保するため、海洋での探査・生産活動に投資しています。メキシコ湾、ブラジルのプレソルト埋蔵地、西アフリカ、アジア太平洋など、世界各地で深海・超深海地域の探査・開発が活発に行われています。こうした投資は、深海・超深海掘削リグの需要拡大に寄与しています。

- Baker Hughesのリグ数調査によると、オフショアリグ数は2023年10月から2022年5月にかけて大幅に増加しました。2022年5月には193リグしかなかったが、2023年10月には219リグとなり、1年間でオフショア活動が増加したことになります。

- 2022年7月、Jindal Drilling &IndustriesはOil & Natural Gas Corporatio(ONGC)からジャックアップ型リグDiscovery Iの配備契約を獲得したことを明らかにしました。前述のとおり、Rig Discovery Iは、ONGCがJindal Drilling &Industriesに発注した既存契約に基づき操業しています。

- したがって、上記の通り、深海と超深海のセグメントは予測期間中に大きく成長すると予想されます。

著しい成長を遂げる中東・アフリカ

- 中東・アフリカは、特にオフショアにおける炭化水素の埋蔵量が豊富なことで知られています。サウジアラビア、アラブ首長国連邦、カタール、ナイジェリア、アンゴラ、エジプトなどの国々には、相当量のオフショア石油・ガスが埋蔵されています。これらの地域の探査・生産活動は、海洋掘削リグの需要を牽引しています。

- 中東・アフリカの多くの国々は、石油・ガス生産能力を強化するため、新たな海洋油田の探査・開発に積極的に取り組んでいます。例えば、中東のペルシャ湾や紅海では進行中のプロジェクトが存在します。アンゴラ、ナイジェリア、モザンビークといった国々は、アフリカの海上油田に投資しています。こうした新たな開発は、海洋掘削リグ・オペレーターやサービスプロバイダーに機会をもたらします。

- さらに、中東・アフリカの政府は、オフショア石油・ガス投資を誘致するために、有利な施策と施策を実施しました。こうした施策には、税制優遇措置、許可プロセスの合理化、国際石油会社との提携などが含まれます。このような政府の支援策は、同地域の海洋掘削リグ市場の成長に貢献しています。

- 例えば、2022年11月、アラブ首長国連邦を拠点とするADNOC Drillingは、シンガポールに本社を置くKeppel Offshore & Marineから、新たに建設された3基のジャッキアップ掘削リグの初期ユニットを受領しました。これら3基は、Keppel FELSがBorrDrillingのために建設した5基の大型リグの一部です。

- 中東・アフリカは、港湾、パイプライン、貯蔵施設などの海洋インフラ開発にも投資しています。こうしたインフラ開発は海洋掘削活動の成長を支え、採掘した資源の効率的な物流・輸送を可能にします。整備されたインフラの存在は、海洋掘削リグオペレーターをこの地域に引きつける。

- したがって、上記の点から、中東・アフリカは予測期間中に大きく成長すると予想されます。

海洋掘削リグ産業概要

海洋掘削リグ市場は半固体化しています。主要参入企業(順不同)としては、Keppel Corporation Limited、Samsung Heavy Industries、Sembcorp Marine Ltd、Transocean Ltd、Seadrill Ltd.などが挙げられます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模と需要予測(単位:10億米ドル)

- 2022年までのフローターとジャッキアップリグの過去の平均稼働日数

- 主要オフショア上流プロジェクト

- 最近の動向と開発

- 市場力学

- 促進要因

- 世界のエネルギー需要の増加

- 未開発のオフショア埋蔵量の探査

- 抑制要因

- 環境問題と規制

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ

- ジャッキアップ

- 半潜水船

- ドリルシップ

- その他

- 水深

- 浅海

- 深海・超深海

- 2028年までの市場規模・需要予測(地域別)

- 北米

- 米国

- カナダ

- その他の北米地域

- 欧州

- 英国

- ロシア

- ノルウェー

- オランダ

- その他の欧州

- アジア太平洋

- 中国

- インド

- オーストラリア

- マレーシア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- ベネズエラ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- ナイジェリア

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Offshore Rig Manufacturers

- Keppel Corporation Limited

- Samsung Heavy Industries Co. Ltd

- Sembcorp Marine Ltd

- Daewoo Shipbuilding & Marine Engineering Co. Ltd

- Hyundai Heavy Industries Co. Ltd

- Friede & Goldman Ltd

- Damen Shipyards Group

- Irving Shipbuilding Inc.

- Offshore Drilling Contractors

- Transocean Ltd

- Seadrill Ltd

- ENSCO PLC

- Noble Drilling PLC

- Diamond Offshore Drilling Inc.

- Offshore Rig Manufacturers

第7章 市場機会と今後の動向

- 深海発見に対する需要の高まり

目次

Product Code: 50319

The Offshore Drilling Rigs Market size is estimated at USD 78.16 billion in 2025, and is expected to reach USD 108.51 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increased global energy demand and exploration activities for untapped regions are expected to drive the market during the forecasted period.

- On the other hand, the rising environmental concerns over offshore drilling and its impact on the aquatic environment are expected to hinder the market's growth.

- Nevertheless, increasing deepwater and ultra-deepwater activities for exploration and production are expected to create several future market opportunities.

- North America is expected to be a major market due to the latest technology and infrastructure for offshore activities.

Offshore Drilling Rigs Market Trends

Deepwater and Ultra-deepwater Segment to Witness Significant Growth

- Deepwater and ultra-deepwater regions hold vast untapped oil and gas reserves. As onshore and shallow-water reserves deplete, oil and gas companies increasingly focus on exploring and extracting hydrocarbon resources from these deepwater and ultra-deepwater locations. It drives the demand for drilling rigs capable of operating in such challenging environments.

- Advances in drilling technologies, equipment, and subsea systems significantly improved the feasibility and efficiency of drilling operations in deepwater and ultra-deepwater areas. Innovations such as dynamic positioning systems, advanced drilling techniques, and remotely operated vehicles (ROVs) enable safer and more efficient drilling in these challenging offshore environments. The availability of advanced technology opened up previously inaccessible deepwater reserves, thereby driving the segment's growth.

- Moreover, deepwater and ultra-deepwater regions are known to host sizable oil and gas reserves. These reserves often include higher production potential compared to onshore and shallow-water fields. The large reserves in these offshore areas make them attractive investment opportunities for oil and gas companies, driving the demand for offshore drilling rigs capable of operating in these environments.

- Furthermore, governments and energy companies invest in offshore exploration and production activities to secure future energy supplies. Deepwater and ultra-deepwater regions are actively explored and developed in various parts of the world, including the Gulf of Mexico, Brazil's pre-salt reserves, West Africa, and the Asia-Pacific region. These investments contribute to the growing demand for deepwater and ultra-deepwater drilling rigs.

- According to Baker Hughes Rig Count, the offshore rig counts increased significantly between Oct 2023 and May 2022. In May 2022, there were only 193 rigs, while in October 2023, there were 219, signifying increased offshore activities in one year.

- In July 2022, Jindal Drilling & Industries revealed that it had secured a contract from Oil & Natural Gas Corporation (ONGC) to deploy the Jack-up Rig Discovery I. It is on a three-year charter hire basis, with an Estimated Daily Rate (EDR) of USD 46,907.57. The Jack-up, as mentioned above, Rig Discovery I, is engaged in operations under an existing contract awarded by ONGC to Jindal Drilling & Industries.

- Therefore, as per the above points, deepwater and ultra-deepwater segments are expected to grow significantly during the forecasted period.

Middle-East and Africa to Witness Significant Growth

- The Middle East and Africa region are known for their rich hydrocarbon reserves, particularly in offshore locations. Countries such as Saudi Arabia, United Arab Emirates, Qatar, Nigeria, Angola, and Egypt include substantial offshore oil and gas reserves. These regions' exploration and production activities drive the demand for offshore drilling rigs.

- Many countries in the Middle East and Africa are actively exploring and developing new offshore fields to enhance their oil and gas production capacities. For example, ongoing projects in the Persian Gulf and the Red Sea in the Middle East exist. Countries like Angola, Nigeria, and Mozambique invest in offshore fields in Africa. These new developments create opportunities for offshore drilling rig operators and service providers.

- Moreover, governments in the Middle East and Africa implemented favorable policies and regulations to attract offshore oil and gas investments. These policies include tax incentives, streamlined permitting processes, and partnerships with international oil companies. Such supportive government initiatives contribute to the growth of the offshore drilling rigs market in the region.

- For instance, in November 2022, ADNOC Drilling, based in the UAE, received the initial unit of a trio of newly constructed jack-up drilling rigs from Keppel Offshore & Marine, headquartered in Singapore. These three rigs were part of a larger batch of five rigs constructed by Keppel FELS for BorrDrilling.

- The Middle East and Africa regions also invest in developing offshore infrastructure, including ports, pipelines, and storage facilities. This infrastructure development supports offshore drilling activities' growth, enabling efficient logistics and transportation of extracted resources. The presence of well-developed infrastructure attracts offshore drilling rig operators to the region.

- Therefore, per the above points, the Middle East and Africa region are expected to grow significantly during the forecasted period.

Offshore Drilling Rigs Industry Overview

The offshore drilling rig market is semi-consolidated. Some major players (in no particular order) include Keppel Corporation Limited, Samsung Heavy Industries Co. Ltd, Sembcorp Marine Ltd, Transocean Ltd, and Seadrill Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Historical Average Day Rates of Floaters and Jackup Rigs, till 2022

- 4.4 Major Offshore Upstream Projects

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Global Energy Demand

- 4.6.1.2 Exploration of Untapped Offshore Reserves

- 4.6.2 Restraints

- 4.6.2.1 Environmental Concerns and Regulations

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Jackups

- 5.1.2 Semisubmersibles

- 5.1.3 Drill Ships

- 5.1.4 Other Types

- 5.2 Water Depth

- 5.2.1 Shallow Water

- 5.2.2 Deepwater and Ultra-deepwater

- 5.3 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Russia

- 5.3.2.3 Norway

- 5.3.2.4 Netherlands

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Venezuela

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Offshore Rig Manufacturers

- 6.3.1.1 Keppel Corporation Limited

- 6.3.1.2 Samsung Heavy Industries Co. Ltd

- 6.3.1.3 Sembcorp Marine Ltd

- 6.3.1.4 Daewoo Shipbuilding & Marine Engineering Co. Ltd

- 6.3.1.5 Hyundai Heavy Industries Co. Ltd

- 6.3.1.6 Friede & Goldman Ltd

- 6.3.1.7 Damen Shipyards Group

- 6.3.1.8 Irving Shipbuilding Inc.

- 6.3.2 Offshore Drilling Contractors

- 6.3.2.1 Transocean Ltd

- 6.3.2.2 Seadrill Ltd

- 6.3.2.3 ENSCO PLC

- 6.3.2.4 Noble Drilling PLC

- 6.3.2.5 Diamond Offshore Drilling Inc.

- 6.3.1 Offshore Rig Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Deepwater Discoveries