|

市場調査レポート

商品コード

1640323

風力タービン用ギアボックス:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Wind Turbine Gearbox - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 風力タービン用ギアボックス:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

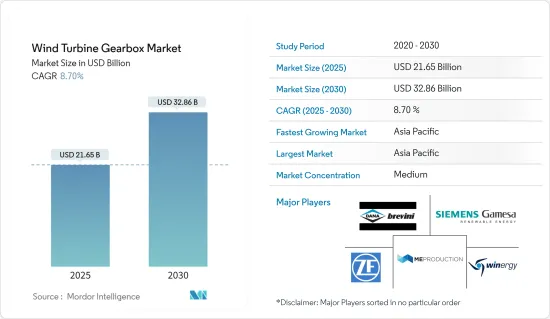

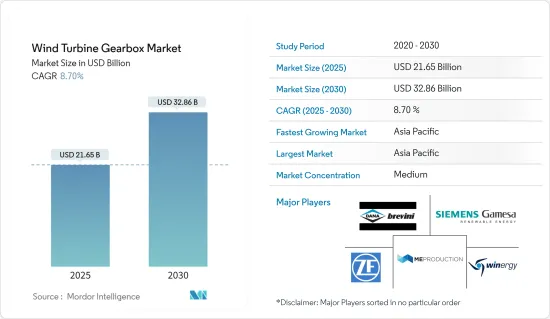

風力タービン用ギアボックス市場規模は2025年に216億5,000万米ドルと推定され、2030年には328億6,000万米ドルに達すると予測され、予測期間中(2025~2030年)のCAGRは8.7%です。

主要ハイライト

- 中期的には、風力エネルギー需要の拡大や風力エネルギープロジェクトへの投資の増加といった要因が、予測期間中の風力タービン用ギアボックス市場の最も大きな促進要因の1つになると予想されます。

- その一方で、太陽光、水力など他の再生可能エネルギー源の普及が進んでいます。これは予測期間中、風力タービン用ギアボックス市場にとって脅威となります。

- 風力エネルギーとエネルギー貯蔵の統合や、世界各地の野心的な風力エネルギー建設は、将来的に市場にいくつかの機会を生み出すと期待される重要な要因です。

- アジア太平洋は、風力発電の面で大きなシェアを占め、中国、インド、日本などの国に製造技術拠点が存在するため、最大かつ最も急成長している市場になると予想されています。

風力タービン用ギアボックス市場動向

オフショア部門が高い成長を記録

- オフショア風力発電セグメントは世界的に急成長を遂げています。政府とエネルギー企業は、海上で利用可能な強力で安定した風力資源を活用するため、オフショア風力プロジェクトへの投資を増やしています。

- 2022年、世界風力エネルギー協議会(Global Wind Energy Council)は、8GWのオフショア風力発電容量の追加を報告し、その結果、世界の設備容量は64GWとなりました。これは、2021年の設置容量56GWに比べて増加したことを意味します。オフショア風力発電容量の拡大は、オフショア風力発電所の開発をサポートする風力タービン用ギアボックスの需要増につながります。

- 多くの国々は、地理的な位置と良好な風況により、大きなオフショア風力エネルギーの潜在力を有しています。北欧、米国、中国、台湾などの地域では、オフショア風力資源を積極的に開発しています。これらの地域は、オフショア風力開発による需要の増加に対応するため、風力タービン用ギアボックスメーカーにとって大きな市場機会を提供しています。

- 例えば、ドイツは2023年1月、2030年までに30ギガワット(GW)の風力発電設備容量の目標を達成するため、オフショア風力タービン用地の新たな開発戦略の策定を発表しました。連邦海事水路庁(BSH)は、設定された目標を確実に達成するため、これらの計画を策定しました。

- 同様に、インドは、7,600kmに及ぶ広大な海岸線に広がる未開発のオフショア風力発電の可能性を活用することで、グリーンエネルギーポートフォリオの多様化を目指しています。新・再生可能エネルギー省は、2030年までに30GWのオフショア風力発電容量を達成するという目標を掲げています。こうした野心的な目標は、大規模なオフショア風力発電プロジェクトの開発に拍車をかけ、風力タービン用ギアボックスの需要を促進すると予測されています。

- したがって、上記の点から、予測期間中はオフショアセグメントが市場を独占すると予想されます。

アジア太平洋が著しい成長を遂げる

- アジア太平洋は、風力発電設備容量が大幅に増加しています。中国、インド、日本、オーストラリアなどの国々は、増大する電力需要を満たし、温室効果ガスの排出を削減するために、風力発電プロジェクトに多額の投資を行っています。この地域の風力発電容量の拡大は、風力タービン用ギアボックスの需要を促進しています。

- Global Wind Energy Councilによると、アジア太平洋は2022年だけで約37GWの風力発電容量を追加し、この地域における風力エネルギーの著しい成長を示しています。

- アジア太平洋の多くの国は、風力発電を含む再生可能エネルギーを促進するための支援施策やインセンティブを実施しています。これらの施策は、風力エネルギー開発のための環境を整え、風力タービン設置への投資を誘致しています。

- 例えば、ASEAN各国政府は、2021~2025年までのエネルギー協力のためのASEAN行動計画(APAEC)の第2段階の一環として、野心的な5年間の持続可能性計画を発表しました。この計画に基づき、ASEAN諸国のエネルギー相は、2025年までにASEAN全体の一次エネルギー供給量に占める再生可能エネルギーの割合を23%、またASEANの発電設備容量に占める再生可能エネルギーの割合を35%にするという目標に合意しました。これらの目標を達成するには、2025年までに約35GW~40GWの再生可能エネルギー容量を追加する必要があります。大半の国で風力発電のポテンシャルが高いため、この地域では風力発電の設置が増加すると予想されます。

- 今後10年間で、風力タービン用ギアボックスの修理・改修市場は、アジア太平洋における急速に拡大する設置ベースと政府の支援施策に後押しされ、大きな成長機会を目の当たりにすると予測されています。

風力タービン用ギアボックス産業概要

風力タービン用ギアボックス市場は適度に統合されています。主要企業(順不同)には、Siemens Gamesa Renewable Energy SA、Dana Brevini SpA、ME Production A/S、Winergy Group、ZF Friedrichshafen AGなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模と需要予測(単位:米ドル)

- 最近の動向と開発

- 政府の規制と施策

- 市場力学

- 促進要因

- 風力エネルギー導入の増加

- 風力エネルギーへの投資の増加

- 抑制要因

- その他の再生可能エネルギー源の普及拡大

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 展開場所

- オンショア

- オフショア

- 2028年までの市場規模・需要予測(地域別)

- 北米

- 米国

- カナダ

- その他の北米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他の中東

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- Dana Brevini SpA

- Siemens Gamesa Renewable Energy SA

- ME Production AS

- Stork Gears & Services BV

- Winergy Group

- ZF Friedrichshafen AG

- Turbine Repair Solutions

- Elecon Engineering Company Limited

第7章 市場機会と今後の動向

- エネルギー貯蔵の統合

目次

Product Code: 51400

The Wind Turbine Gearbox Market size is estimated at USD 21.65 billion in 2025, and is expected to reach USD 32.86 billion by 2030, at a CAGR of 8.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as growing demand for wind energy and increasing investment in wind energy projects are expected to be one of the most significant drivers for the wind turbine gearbox market during the forecast period.

- On the other hand, increasing penetration of other sources of renewable energy such as solar, hydro and others. This poses a threat to the wind turbine gearbox market during the forecast period.

- Nevertheless, energy storage integration with wind energy and ambitious wind energy tsrgets acrossb the globe are significant factors expected to create several opportunities for the market in the future.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the significant share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Wind Turbine Gearbox Market Trends

Offshore Segment to Register Higher Growth

- The offshore wind sector has been experiencing rapid growth worldwide. Governments and energy companies increasingly invest in offshore wind projects to harness the strong and consistent wind resources available at sea.

- In 2022, the Global Wind Energy Council reported the addition of 8 GW of offshore wind energy capacity, resulting in a global installed capacity of 64 GW. This marks an increase compared to the 56 GW installed capacity in 2021. The expansion of offshore wind capacity translates into higher demand for wind turbine gearboxes to support the development of offshore wind farms.

- Many countries possess significant offshore wind energy potential due to their geographical location and favorable wind conditions. Regions such as Northern Europe, the United States, China, and Taiwan are actively developing their offshore wind resources. These regions offer substantial market opportunities for wind turbine gearbox manufacturers to cater to the growing demand driven by offshore wind development.

- For instance, in January 2023, Germany announced the formulation of new development strategies for offshore wind turbine sites in order to achieve a target of 30 gigawatts (GW) of installed wind power capacity by 2030. The Federal Maritime and Hydrographic Agency (BSH) has devised these plans to ensure the successful attainment of the set target.

- In a similar vein, India aims to diversify its green energy portfolio by tapping into the untapped offshore wind energy potential across its extensive 7,600-kilometer coastline. The Ministry of New and Renewable Energy has established a target of achieving 30 GW of offshore wind capacity by 2030. These ambitious goals are projected to spur the development of large-scale offshore wind projects, thereby driving the demand for wind turbine gearboxes.

- Therefore as per the above-mentioned points the offshore segment is expected to dominate the market during the forecasted period.

Asia-Pacific to Witness Significant Growth

- The Asia Pacific region has been witnessing substantial growth in wind power capacity installations. Countries like China, India, Japan, and Australia are making significant investments in wind energy projects to meet their growing electricity demands and reduce greenhouse gas emissions. This region's expansion of wind power capacity drives the demand for wind turbine gearboxes.

- According to Global Wind Energy Council the Asia-Pacific region added almost 37GW of wind energy capacity in 2022 alone signifying significant growth of wind energy in the region with China contributing 87% of its 2022 additions consequently driving the demand for wind turbine gearboxes.

- Many countries in the Asia Pacific region have implemented supportive policies and incentives to promote renewable energy, including wind power. These policies create a conducive environment for wind energy development and attract investments in wind turbine installations.

- For instance, ASEAN governments have unveiled an ambitious five-year sustainability plan as part of the second phase of the ASEAN Plan of Action for Energy Cooperation (APAEC) from 2021 to 2025. As per this plan, energy ministers from ASEAN countries have agreed to a target of achieving a 23% share of renewable energy in the total primary energy supply across the region, along with a 35% share in ASEAN's installed power capacity by 2025. Meeting these targets would necessitate the addition of approximately 35GW-40GW of renewable energy capacity by 2025. This is expected to increase the installations of wind energy in the region due to the high wind energy potential in the majority of the countries.

- Over the next decade, the wind turbine gearbox repair and refurbishment market is anticipated to witness substantial growth opportunities driven by the rapidly expanding installed base in the Asia-Pacific region and supportive government policies.

Wind Turbine Gearbox Industry Overview

The wind turbine gearbox market is moderately consolidated. Some of the major companies (in no particular order) include Siemens Gamesa Renewable Energy SA, Dana Brevini SpA, ME Production A/S, Winergy Group, and ZF Friedrichshafen AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Wind Energy

- 4.5.1.2 Growing Investments in Wind Energy

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Other Sources of Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Asutralia

- 5.2.2.5 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 Germany

- 5.2.3.3 France

- 5.2.3.4 Spain

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dana Brevini SpA

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 ME Production AS

- 6.3.4 Stork Gears & Services BV

- 6.3.5 Winergy Group

- 6.3.6 ZF Friedrichshafen AG

- 6.3.7 Turbine Repair Solutions

- 6.3.8 Elecon Engineering Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Energy Storage Integration