|

市場調査レポート

商品コード

1686523

無人航空機- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Unmanned Aerial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 無人航空機- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 176 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

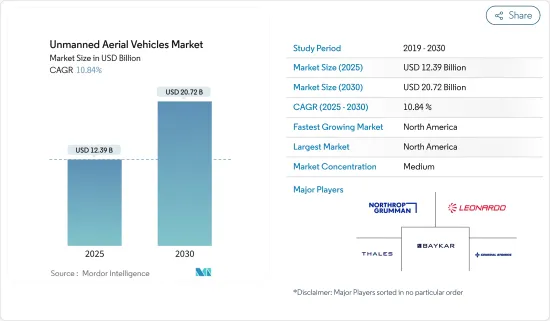

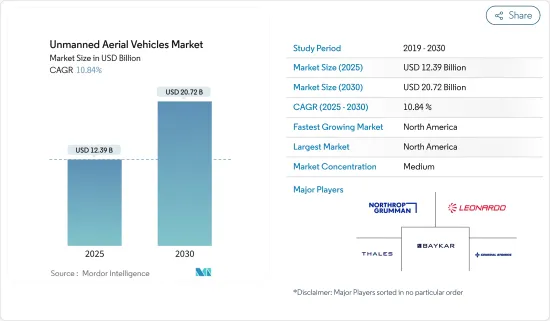

無人航空機市場規模は2025年に123億9,000万米ドルと推定・予測され、予測期間(2025年~2030年)のCAGRは10.84%で、2030年には207億2,000万米ドルに達すると予測されています。

UAVは主に、人間が操縦するのが困難な地域に到達し、横断するために登場しました。UAV市場はここ数年黎明期にあり、商業分野での導入は進んでいませんでした。当初、UAVは軍事用機器と見なされていたが、過去5年間で商業の世界でも大きな存在感を確立しました。

米国連邦航空局(FAA)や欧州連合航空安全局(EASA)のような管理機関から何百もの適用除外を受け、UAVの需要は、インフラ、農業、輸送、娯楽、セキュリティ、保険など、さまざまな業界から生まれています。したがって、企業向けUAVは消費者向けUAVよりも予測期間中に大きく成長すると予想されます。

UAV技術の進歩により、メーカーはさまざまなセンサーペイロードを搭載できるさまざまなサイズ、重量、形状のモデルを製造できるようになり、幅広い用途で有利になっています。しかし、世界のいくつかの国では、目視外でのUAVの飛行に関する規制や制限がないため、市場の潜在的な成長が抑制されています。セキュリティや安全性への懸念、訓練を受けたパイロットの不足といったその他の要因も、UAV市場の開拓に一定の課題を課すと予想されます。

無人航空機市場の動向

小型UAVセグメントが市場で上位を占める

小型UAVは長さ2メートルまでの無人航空機です。これらのUAVは通常、回転翼または固定翼のいずれかのスタイルを特徴としています。小型のため、ほとんどの小型UAVは高度125メートル付近で秒速50メートル以下で飛行します。数カ国が軍事監視能力の強化に注力する中、小型無人機の開発に巨額の投資が行われています。世界中の軍隊がさまざまな軍事任務のためにナノドローンを調達しています。空撮、3Dマッピング、測量、石油・ガスパイプライン監視など、小型UAVの用途が拡大していることが、小型UAV市場の成長を後押ししています。このように、様々な防衛やアプリケーションのための小型無人機の需要の高まりは、予測期間中のセグメントの成長を推進しています。

また、情報・監視・偵察(ISR)や戦闘任務への小型UAVの採用拡大、防衛分野への支出増加が予測期間中の市場成長を後押ししています。また、様々な商用および軍事用途の小型UAVを設計・開発するための新興企業や政府・投資家からの資金調達の増加も市場成長を後押ししています。

例えば、2023年10月、Teledyne FLIR LLCは、センサーをアップグレードしたBlack Hornetナノドローンの最新版を発売しました。新たに発売されたBlack Hornet 4は、全長1フィート未満、重さ1ポンドの僅かなものです。30分以上の飛行が可能で、航続距離は2kmを超えます。高感度の昼間カメラ、ビデオや画像を撮影できる赤外線イメージャー、ソフトウェア定義のデータシステムを搭載しています。このような開発は、今後数年間の同分野の成長を牽引すると思われます。

北米が予測期間中に最も高い成長を示すと予測される

北米はUAV市場で最も高いシェアを占めており、予測期間中もその支配が続きます。成長の背景には、商用および軍事用途のUAV需要の高まりと自律型ドローンの調達に対する支出の増加があります。連邦航空局(FAA)によると、米国では2023年7月時点で約90万機のドローンが登録されています。登録されたドローンのうち、41万6095機がレクリエーション用で、36万9528機が商業用として登録されています。また、FAAは33万1573件の遠隔操縦証明書を授与しています。

さらに、米国国防総省は、その能力を強化し、ロシアや中国などの敵対国からの脅威に対抗するために、革新的で低コストのソリューションを常に求めています。例えば、2023年4月、米国防総省は、米国が中国の膨大な軍事力増強に対抗するため、UAVを含む何千もの自律型システムの構築に焦点を当てた新たなプログラムを発表しました。2023年3月、米国陸軍は5社に将来の戦術UAV契約を発注しました。選ばれたのは、エアロビロンメント社、グリフォン・エアロスペース社、ノースロップ・グラマン社、シエラネバダ社、テキストロン・システムズ社です。

また、カナダ国防軍も防衛力強化に投資し、UAVを調達しています。カナダ空軍のMALE(中高度低耐久)UAVプロジェクトは、運用分析の段階に入りましたた。遠隔操縦航空機システム(RPAS)プロジェクトの名称が変更されました。カナダが発表した国家防衛戦略は、軍事作戦を実施するための重要な開発として、RPASを現代軍に組み込むことにつながりました。このようなプログラムは、この地域の市場成長を後押しすると思われます。

無人航空機産業の概要

UAV市場は半固定的であり、いくつかのローカルおよび世界企業が大きなシェアを占めています。市場の主要企業には、Northrop Grumman Corporation、THALES、Leonardo S.p.A.、General Atomics、BAYKAR TECHなどがあります。防衛・国土安全保障分野では、厳しい安全・規制政策が新規参入を制限しています。しかし、商業・民生分野では、規模の経済がこの分野を支配していないため、多くの企業の参入により急速な成長が見込まれます。

優れた技術力を持つ開発企業は、UAVの推進システムやペイロード特性の技術的進歩に大きく貢献し、その結果、開発サイクルが短縮され、ミニUAVの運用能力が大幅に増強されると予想されます。UAVプラットフォームのペイロード、耐久性、飛行距離はOEMやオペレーターの最大の関心事であるため、代替燃料を動力源とするUAVの出現は競合シナリオに大きな変化をもたらすと予想されます。UAVの重要な構成要素や部品の構築に複合ベースの材料を使用することで、UAVプラットフォームの能力が向上し、さまざまな産業で広く採用される可能性があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- UAVサイズ別

- 小型UAV

- 中型UAV

- 大型UAV

- タイプ別

- 固定翼(MALE、HALE、TUAV)

- VTOL(シングルローター、マルチローター)

- 飛行距離別

- 目視範囲(VLOS)

- 目視外範囲(BVLOS)

- 用途別

- 戦闘

- 非戦闘(貨物輸送、ISR、戦闘被害管理)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- ウクライナ

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- マレーシア

- フィリピン

- インドネシア

- その他のアジア太平洋

- ラテンアメリカ

- メキシコ

- ブラジル

- アルゼンチン

- コロンビア

- その他のラテンアメリカ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- イスラエル

- エジプト

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- SZ DJI Technology Co. Ltd.

- Parrot SAS

- Delair SAS

- AeroVironment, Inc.

- Northrop Grumman Corporation

- Elbit Systems Ltd.

- General Atomics

- Israel Aerospace Industries Ltd.

- THALES

- The Boeing Company

- Microdrones GmbH(mdGroup Germany GmbH)

- BAYKAR TECH

- Leonardo S.p.A

- Textron Inc.

第7章 市場機会

The Unmanned Aerial Vehicles Market size is estimated at USD 12.39 billion in 2025, and is expected to reach USD 20.72 billion by 2030, at a CAGR of 10.84% during the forecast period (2025-2030).

UAVs have come into existence mainly to reach and traverse areas that are arduous for humans to maneuver. The UAV market was nascent for several years, and there was a lack of adoption in the commercial sector. Initially viewed as a military device, UAVs have established a significant presence in the commercial world over the past five years.

Over the years, with hundreds of exemptions from governing bodies like the US Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), the demand for UAVs has emerged from various industries, like infrastructure, agriculture, transport, entertainment, security, insurance, and many more. Hence, enterprise UAVs are expected to grow more during the forecast period than consumer UAVs.

Advancements in UAV technologies have allowed manufacturers to produce various models in different sizes, weights, and shapes that can carry different sensor payloads, making them favorable across a broad application base. However, the lack of regulations and restrictions on flying UAVs beyond the visual line of sight in several countries worldwide has restrained the market's growth to its full potential. Other factors, such as security and safety concerns and scarcity of trained pilots, are also anticipated to challenge the development of the UAV market to a certain extent.

Unmanned Aerial Vehicles Market Trends

Small UAV Segment Held Highest Shares in the Market

Small UAVs are unmanned aerial vehicles that can span up to 2 meters long. These UAVs typically feature either a rotary-wing or fixed-wing style. Because of their small size, most small UAVs are flown at altitudes near 125 meters at speeds less than 50 meters per second. As several countries focus on enhancing their military surveillance capability, huge investments are being made in developing small drones. Militaries across the world have been procuring nano drones for different military missions. Growing applications of small UAVs in aerial photography, 3D mapping, surveying, and oil and gas pipeline monitoring, among others, have been propelling the growth of the small UAV market. Thus, the growing demand for small drones for various defense and applications drives the segment's growth during the forecast period.

Also, the growing adoption of small UAVs for intelligence, surveillance, and reconnaissance (ISR) and combat missions and rising spending on the defense sector drive the market growth during the forecast period. Increased start-ups and fundraising from governments and investors to design and develop small UAVs for various commercial and military applications have also boosted the market growth.

For instance, in October 2023, Teledyne FLIR LLC launched the latest edition of the Black Hornet nano-drone with upgraded sensors. The newly launched Black Hornet 4 is less than a foot long and weighs a fraction of a pound. It can fly for over 30 minutes and has a range of more than 2 kilometers (1.24 miles). It has a sensitive daytime camera, a thermal imager that can capture videos and images, and a software-defined data system. Such developments will drive the segment growth in the coming years.

North America is Projected to Show Highest Growth During the Forecast Period

North America held the highest shares in the UAV market and continued its domination during the forecast period. The growth is due to growing demand for UAVs for commercial and military applications and rising spending on procurement of autonomous drones. According to the Federal Aviation Administration (FAA), almost 900,000 drones were registered in the US as of July 2023. Of the registered drones, 416,095 were for recreational purposes, and 369,528 were registered for commercial operations. Also, the FAA awarded 331,573 remote pilot certificates.

Additionally, the US DoD constantly seeks innovative and low-cost solutions to enhance its capabilities and counter threats from adversaries like Russia and China. For instance, in April 2023, the Pentagon announced a new program focused on building thousands of autonomous systems, including UAVs, as the US seeks to better counter China's vast military buildup. In March 2023, the US Army awarded five companies future tactical UAV contracts. The companies selected were AeroVironment, Griffon Aerospace, Northrop Grumman, Sierra Nevada Corporation, and Textron Systems.

Also, the Canadian Defense Forces are investing in enhancing their defense capabilities and procuring UAVs. The MALE (medium-altitude low-endurance) UAV project of the Royal Canadian Air Force has entered the phase of operation analyses. The Remotely Piloted Aircraft Systems (RPAS) Project has been renamed. The national defense strategy released by Canada has led to the inclusion of RPAS into the modern military as a significant development for conducting military operations. Such programs will boost market growth across the region.

Unmanned Aerial Vehicles Industry Overview

The UAV market is semi-consolidated, with several local and global players holding significant shares. Some of the key players in the market are Northrop Grumman Corporation, THALES, Leonardo S.p.A., General Atomics, and BAYKAR TECH. The stringent safety and regulatory policies in the defense and homeland security segment are expected to restrict the entry of new players. However, the commercial and civil segment is expected to witness rapid growth due to the entry of many players, as economies of scale do not govern the segment.

Companies with superior technical capabilities are expected to contribute significantly toward technological advances in the propulsion systems and payload characteristics of UAVs, resulting in a shorter development cycle time and considerably augmenting the operational capabilities of mini-UAVs. Since a UAV platform's payload, endurance, and flight range are the primary concerns of OEMs and operators, the emergence of alternative fuel-powered UAVs is expected to cause significant changes in the competitive scenario. The use of composite-based materials for constructing critical components and parts of UAVs may increase the capabilities of the UAV platforms and fuel their widespread adoption across different industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By UAV Size

- 5.1.1 Small UAV

- 5.1.2 Medium UAV

- 5.1.3 Large UAV

- 5.2 By Type

- 5.2.1 Fixed-wing (MALE, HALE, and TUAV)

- 5.2.2 VTOL (Single Rotor and Multi Rotor)

- 5.3 By Range

- 5.3.1 Visual Range of Sight (VLOS)

- 5.3.2 Beyond Visual Line of Sight (BVLOS)

- 5.4 By Application

- 5.4.1 Combat

- 5.4.2 Non-combat (Cargo Delivery, ISR, and Battle Damage Management)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Ukraine

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Philippines

- 5.5.3.7 Indonesia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Israel

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 SZ DJI Technology Co. Ltd.

- 6.2.2 Parrot SAS

- 6.2.3 Delair SAS

- 6.2.4 AeroVironment, Inc.

- 6.2.5 Northrop Grumman Corporation

- 6.2.6 Elbit Systems Ltd.

- 6.2.7 General Atomics

- 6.2.8 Israel Aerospace Industries Ltd.

- 6.2.9 THALES

- 6.2.10 The Boeing Company

- 6.2.11 Microdrones GmbH (mdGroup Germany GmbH)

- 6.2.12 BAYKAR TECH

- 6.2.13 Leonardo S.p.A

- 6.2.14 Textron Inc.