|

市場調査レポート

商品コード

1522877

アダプティブクルーズコントロール(ACC)と死角検出(BSD)-市場シェア分析、産業動向、成長予測(2024年~2029年)Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アダプティブクルーズコントロール(ACC)と死角検出(BSD)-市場シェア分析、産業動向、成長予測(2024年~2029年) |

|

出版日: 2024年07月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

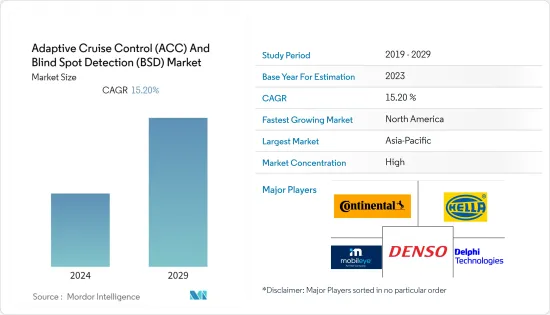

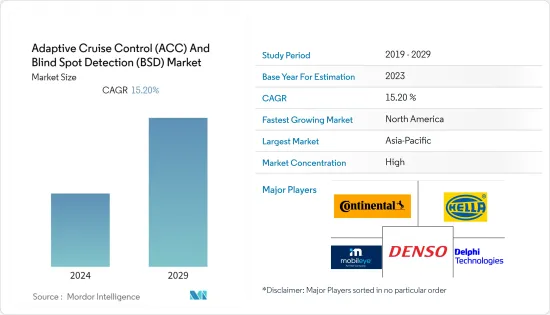

アダプティブクルーズコントロールと死角検出の市場規模は2024年に35億8,000万米ドルと推定され、2029年には72億7,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは15.20%で成長する見込みです。

アダプティブ・クルーズ・コントロールと死角検出の市場は、近年著しい急成長を遂げています。自動車の安全性に対する意識の高まりが、アダプティブ・クルーズ・コントロールや死角検知といった先進安全システムの開発に不可欠な要因の一つとなっています。

さらに、世界の高級車の販売台数の増加も、ACCとBSDの市場を牽引しています。2023年には、2022年の15万7,000台に対し、18万3,000台以上の高級車が世界で販売されました。これは16%以上の大幅な急増を示しています。

さらに、厳しい安全規制が制定され、消費者の間で自動車の安全性に対する関心が高まっていることも、ACCとBSDの市場を後押ししています。世界保健機関(WHO)によると、交通事故が原因で年間135万人近くが死亡しています。こうした事故の原因のほとんどは、運転手が特定の状況を判断できず、正しい判断を下せないことに起因しています。交通事故による死者を減らすための政府の努力により、新車への安全システムの搭載が増加しています。

調査対象の市場の90%以上はOEMメーカーが占めており、死角検出システムのアフターマーケットは限定的で未組織です。市場の成長機会に着目した大手企業は、消費者の需要に応えるため、こうした機能を自動車に搭載する動きを強めています。

これらすべての要因が相まって、予測期間中のACCおよびBSD市場の潜在的な成長を示しています。

アダプティブクルーズコントロール(ACC)と死角検知(BSD)市場動向

乗用車セグメントが最大の車種セグメント

アダプティブ・クルーズ・コントロール(ACC)および死角検知(BSD)の市場規模は、車種別では乗用車セグメントが最大です。最近の乗用車では、安全性の重視や運転体験の向上に対する消費者のニーズの高まりを受けて、ADAS(先進運転支援システム)の統合が広く行われています。

乗用車メーカーは、安全性と利便性の両方を高める最先端の機能を提供しています。ACCシステムは高速道路走行に適しているため、乗用車を使用する毎日の通勤者や長距離旅行者にとって特に魅力的です。乗用車におけるACCの主流採用は、センサー技術の進歩、手頃な価格、半自動運転機能へのシフトによって促進されています。

同様に、死角検出機能も、特に交通量の多い都市環境では重要な安全機能となっています。乗用車セグメントは、自動車市場で最大の台数を占めており、車線変更や合流動作の発生率が高いです。BSDは、死角にある車両を検出するセンサーを使用することで、 促進要因の視界の制限に対処し、乗用車の使用で一般的なシナリオである車線変更時の事故リスクを低減します。

さらに、先進安全機能を搭載した車両を優先的に評価する規制イニシアチブと安全格付けが、乗用車におけるACCとBSDの普及に寄与しています。北米では、米国交通安全局(NHTSA)の主要プログラムである米国新車アセスメントプログラム(US NCAP)が、これらの安全システムの搭載に重点を置き、購入者の安全関連の懸念を軽減するために導入されました。

自動車メーカー各社は、これらの技術を乗用車モデルに組み込むことで、より幅広い顧客層への訴求力を高めています。市場のプレーヤーは、自動車の自律走行機能に関連する複数の有効な特許を登録しています。2022年には、トヨタが1,823件と最も多く、百度、ホンダがこれに続いた。

乗用車とは別に、商用車、特に大型トラックも、高度な運転支援システムや衝突回避システムに対する需要が増加しています。商用車は乗用車よりも車体が長く車幅が広いため、死角が大きくなります。そのため、安全性を高め死角をなくすために、各企業は商用車メーカーと協議しながら、これらの車両に適した死角検出システムを開発しています。

車両の安全性に対する懸念の高まりや死角に関連する事故の増加は、予測期間中にACCおよびBSDシステム市場を牽引する要因のひとつです。

アジア太平洋と北米が市場を牽引

アジア太平洋地域は、BSDとACCの両産業の成長に大きく寄与し、最も急成長している地域市場になると予測され、北米がこれに続く。これらの地域の成長を牽引しているのは、高級車を中心とした自動車販売の増加や、自動車1台当たりの安全装備の増加といった要因です。

インドや韓国など新興国市場の発展が著しい国々の存在と、同地域の自動車に課される安全規制が、アジア太平洋地域の運転支援システム市場に大きな影響を与えています。これらの規制は、欧州や北米と同様に厳しいものです。

- Bharat New Car Assessment Program(通称Bharat NCAP)は世界で10番目のNCAPで、インド政府によって設立されました。プログラムは2023年10月に開始されました。このプログラムは、インドで販売される自動車の安全性能を評価し、その安全機能と性能に基づいて星評価を与えることを目的としています。バーラトNCAPはテストした自動車に1から5までの星評価を与え、1が最低評価となります。これらの評価には、成人乗員保護(AOP)、小児乗員保護(COP)、安全支援技術の装着が含まれます。

さらに、インド、タイ、インドネシアにおける社会経済状況の改善も、高級乗用車セグメントの需要を生み出し、これらの国々におけるACCとBSDの需要を増加させています。

さらに、 促進要因の安全システムに対する意識の高まりが、アジア太平洋諸国におけるADAS搭載車の市場を拡大しています。政府の規制により、自動車メーカーは先進的なADASモジュールを搭載した車両を設計する必要に迫られています。さらに、この地域における自律走行車の進化は、ティア1メーカーが最新技術とユーザーフレンドリーなシステムを備えたADASを設計し提供する機会を生み出しています。

これらすべての発展が、アジア太平洋地域のアダプティブ・クルーズ・コントロール(ACC)と死角検知(BSD)市場を牽引すると予想されます。

アダプティブ・クルーズ・コントロール(ACC)と死角検出(BSD)産業の概要

アダプティブ・クルーズ・コントロール(ACC)および死角検知(BSD)市場はかなり統合されています。Continental AG、Hella KGaA Hueck &Co.、Mobileye、Denso Corporation、Delphi Automotive PLCなどの企業が市場の主要企業です。

自動車の安全機能に関する基準の高まりに対応するため、市場の主要なACCおよびBSDメーカーは研究開発活動への投資を開始しています。例えば

*2023年7月、三菱自動車工業はタイのバンコクで1トンピックアップトラック「トライトン」のデザインを一新して初公開しました。トラック会社は2024年初めに12年ぶりに日本での発売を予定しています。アダプティブ・クルーズ・コントロール(ACC)をはじめとする新たな安全装備やコネクテッド・カー技術を活用した緊急時サポートなどを採用し、安全性と快適性が大幅に向上しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 自動車の安全性に対する消費者の関心の高まりが市場を牽引

- 市場抑制要因

- ACCとBSDの初期導入コストの高さが課題

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(金額単位)

- タイプ

- アダプティブ・クルーズ・コントロール(ACC)

- 死角検知(BSD)

- 車両タイプ

- 乗用車

- 商用車

- 販売チャネル

- OEM

- アフターマーケット

- 秘術

- 赤外線

- レーダー

- 画像

- その他の技術

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋

- 世界のその他の地域

- ブラジル

- アルゼンチン

- その他の国

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Continental AG

- Delphi Technologies PLC

- DENSO Corp

- Autoliv Inc.

- Magna International

- WABCO Vehicle Control Services

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Bendix Commercial Vehicle Systems LLC(Knorr-Bremse AG)

- Mobileye

- Mando-Hella Electronics Corp.

第7章 市場機会と今後の動向

- 自動車におけるADAS機能の利用拡大が十分な成長機会をもたらす

第8章 数量ベースの市場規模と予測

第9章 ACCとBSD技術の技術的進歩の分析

第10章 地域/国レベルでの自動車の安全性とADAS機能の搭載に関する規制に関する洞察

The Adaptive Cruise Control And Blind Spot Detection Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 7.27 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

The market for adaptive cruise control and blind spot detection has witnessed a significant surge in recent years. The growing awareness about vehicle safety has been one of the vital factors in the development of advanced safety systems, such as adaptive cruise control and blind-spot detection.

Additionally, the increase in the sales of luxury vehicles worldwide is also driving the market for ACC and BSD. In 2023, over 183 thousand units of luxury cars were sold worldwide, compared to 157 thousand units in 2022. This indicated a significant surge of over 16%.

Further, the enactment of stringent safety regulations and increasing vehicle safety concerns among consumers have also propelled the market for ACC and BSD. According to the World Health Organization, nearly 1.35 million people die annually due to road accidents. The cause of these accidents is mostly attributed to the driver's inability to judge certain conditions and make the right decisions. The efforts of governments to reduce fatalities due to road accidents have led to increased installation of safety systems in new vehicles.

More than 90% of the market studied is captured by OEMs, with a limited and unorganized aftermarket for the blind spot detection system. Eyeing the growth opportunities present in the market, the leading players are increasingly incorporating these features in their vehicles to cater to consumer demand.

All these factors combined indicate potential growth for the ACC and BSD market during the forecast period.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Market Trends

Passenger Car Segment is The Largest Vehicle Type Segment

The passenger car segment is the largest market segment for adaptive cruise control (ACC) and blind spot detection (BSD) among vehicle types. There has been a widespread integration of advanced driver assistance systems (ADAS) in modern passenger cars, driven by a growing emphasis on safety and the increasing consumer demand for enhanced driving experiences.

Passenger car manufacturers are largely offering cutting-edge features that enhance both safety and convenience. ACC systems are well-suited for highway driving, making them particularly attractive for daily commuters and long-distance travelers using passenger cars. The mainstream adoption of ACC in passenger cars is fuelled by advancements in sensor technologies, affordability, and a shift toward semi-autonomous driving features.

Similarly, blind spot detection has also become a crucial safety feature, especially in urban environments with dense traffic. The passenger car segment, being the largest volume contributor in the automotive market, experiences a higher incidence of lane changes and merging movements. BSD addresses the limitations of driver visibility by using sensors to detect vehicles in blind spots, reducing the risk of accidents during lane changes-a common scenario in passenger car usage.

Furthermore, regulatory initiatives and safety ratings that prioritize vehicles equipped with advanced safety features contribute to the prevalence of ACC and BSD in passenger cars. In North America, the United States New Car Assessment Program (US NCAP), a flagship program of the country's National High Traffic Safety Administration (NHTSA), focused on the incorporation of these safety systems, was introduced to reduce the safety-related concerns of buyers.

Automakers are integrating these technologies into their passenger car models, making them more appealing to a broader customer base. Market players have multiple active patents registered to their name related to autonomous features in their vehicles. In 2022, Toyota had the most number of active patents, amounting to 1,823, followed by Baidu and Honda Motors.

Apart from passenger cars, commercial vehicles, particularly large trucks, are also seeing an increase in demand for sophisticated driver assistance systems and collision avoidance systems. Commercial vehicles are longer and broader than passenger vehicles, resulting in substantially greater blind areas. Thus, to enhance safety and eliminate blind spots, companies, in consultation with commercial vehicle manufacturers, are developing blind spot detection systems that are suitable for these vehicles.

The rising vehicle safety concerns and a growing number of blind spot-related accidents are some of the factors that will drive the market for ACC and BSD systems during the forecast period.

Asia-Pacific and North America Driving the Market

Asia-Pacific is projected to be the fastest-growing regional market, contributing significantly to the growth of both the BSD and ACC industries, followed by North America. The growth in these regions is driven by factors such as increasing vehicle sales, particularly of luxury cars, and an increase in safety installations per vehicle.

The presence of fast-developing countries, like India and South Korea, and the safety regulations imposed on vehicles in the region have influenced the Asia-Pacific market for driving assistance systems significantly. These regulations are as stringent as those of Europe and North America.

- The Bharat New Car Assessment Program, commonly known as Bharat NCAP, is the 10th NCAP in the world and has been set up by the Government of India. The program commenced in October 2023. The program aims to evaluate the safety performance of cars sold in India and assign star ratings based on their safety features and performance. Bharat NCAP will assign star ratings ranging from 1 to 5 for cars tested, with 1 being the lowest rating. These ratings cover Adult Occupant Protection (AOP), Child Occupant Protection (COP), and Fitment of Safety Assist Technologies.

Additionally, the improvement in socioeconomic conditions in India, Thailand, and Indonesia has also created a demand for the premium passenger cars segment, thereby increasing the demand for ACC and BSD in these countries.

Further, the rising awareness of driver safety systems is enhancing the market for ADAS-equipped vehicles in Asia-Pacific countries. Government regulations are compelling car manufacturers to design their vehicles with advanced ADAS modules. Moreover, the evolution of autonomous cars in this region is creating the opportunity for tier-1 manufacturers to design and deliver ADAS with the latest technologies and user-friendly systems.

All these developments combined are expected to drive the market for adaptive cruise control (ACC) and blind spot detection (BSD) in Asia-Pacific.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Industry Overview

The adaptive cruise control (ACC) and blind spot detection (BSD) market is fairly consolidated. Companies such as Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, and Delphi Automotive PLC are some of the major players in the market.

To meet the increasing standards for safety features in the vehicles, major ACC and BSD manufacturers in the market have started investing in R&D activities. For instance,

* In July 2023, Mitsubishi Motors Corporation premiered the completely redesigned Triton 1-ton pickup truck in Bangkok, Thailand. The truck company scheduled a launch in Japan in early 2024 for the first time in 12 years. Safety and comfort have been greatly improved in the vehicle with the adoption of Adaptive Cruise Control (ACC), among other new safety features and emergency support using connected car technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Increasing Concern of Consumers Toward Vehicle Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Costs of ACC and BSD Act as a Major Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD Billion)

- 5.1 Type

- 5.1.1 Adaptive Cruise Control (ACC)

- 5.1.2 Blind Spot Detection (BSD)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Technology

- 5.4.1 Infrared

- 5.4.2 Radar

- 5.4.3 Image

- 5.4.4 Other Technologies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corp

- 6.2.4 Autoliv Inc.

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Robert Bosch GmbH

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

- 6.2.10 Mobileye

- 6.2.11 Mando-Hella Electronics Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of ADAS Features in Vehicles Presents Ample Growth Opportunities