|

市場調査レポート

商品コード

1686628

錫:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Tin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 錫:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

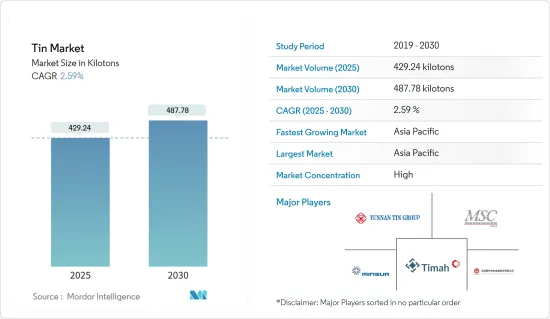

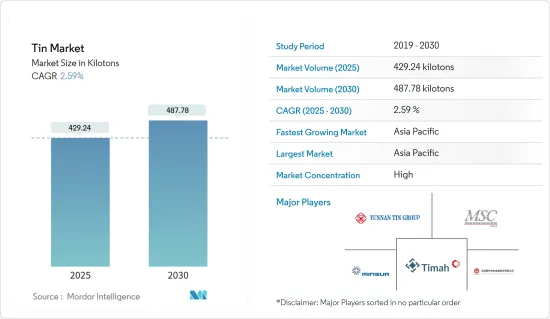

錫市場規模は2025年に429.24キロトンと推定され、予測期間(2025-2030年)のCAGRは2.59%で、2030年には487.78キロトンに達すると予測されます。

主なハイライト

- 電気自動車市場の需要急増と電気・電子産業での用途拡大が予測期間中の市場を牽引するとみられます。

- 容器のような金属製品の生産にはアルミニウムや錫フリー鋼のような代替品の存在が市場の成長を妨げています。

- 錫のリサイクルに重点を移しつつあることは、今後数年間で市場に機会をもたらすと予想されます。

- アジア太平洋は市場を独占し、予測期間中に最も高いCAGRを示すと予想されます。

錫市場の動向

市場成長を支配する電子産業セグメント

- 錫はエレクトロニクス産業ではんだとして使用され、一般に鉛やインジウムと様々な純度や合金で使用されることが多いです。生産される錫全体の約50~70%は、電子・電気産業で、携帯電話、タブレット端末、コンピューター、時計、その他の民生用電子機器など、さまざまな製品に使用されています。

- 例えば、日本電子情報技術産業協会(JEITA)によると、2023年の世界の電子・IT産業の生産高は3兆3,826億米ドルと推定され、2022年と比較して前年比3%のマイナスCAGRを記録しました。しかし、2024年には9%成長し、3兆6,868億米ドルに達すると予想されています。

- 世界的に、スマートフォンの需要は大幅に増加しています。TelefonaktiebolagetLM Ericssonによると、2023年のスマートフォン契約数は69億7,000万件で、2022年比で約5.3%増加します。また、スマートフォンの契約数は2029年には80億6,000万に達し、エレクトロニクス・アプリケーションによる錫の消費が拡大します。

- また、アジア太平洋地域におけるエレクトロニクス製品の需要は、主に中国、インド、日本からもたらされます。中国は、人件費の安さと柔軟な政策により、エレクトロニクスメーカーにとって堅調で有利な市場です。中国国家統計局によると、同国のエレクトロニクス製造業の付加価値額の年間成長率は、2023年には前年比3.4%増となりました。

- ドイツのエレクトロニクス産業は欧州で最大です。ZVEIによると、ドイツのエレクトロニクス・デジタル産業の売上高は2023年に2,420億ユーロ(2,619億4,000万米ドル)を占め、2022年と比較してCAGRは7.56%でした。また、エレクトロ・デジタル産業の生産高は、2021年と比較して2022年のCAGRは1.4%でした。

- したがって、上記の要因により、錫の使用はエレクトロニクス産業で増加しています。

アジア太平洋が市場を独占する

- アジア太平洋が錫市場を独占しています。中国は世界最大の錫生産国・消費国のひとつです。

- 錫市場と自動車産業への主要な貢献者の一つである自動車産業は、製品の進化のためにシェイプアップしています。中国は、国内における公害の深刻化による環境問題への懸念の高まりから、燃費を確保し、排出ガスを最小限に抑える製品の製造に注力しています。

- 錫は他の金属とともに、燃料タンク、シーリング材、配線、ラジエーター、シートクッション、継ぎ目と溶接、ファスナー、ネジ、ナット、ボルト、屋根材など、数多くの自動車用途に使用されています。

- アジア太平洋は、世界で最も価値のある自動車メーカーの本拠地です。中国、インド、日本、韓国などの新興諸国は、製造基盤を強化し、効率的なサプライ・チェーンを開発することで、収益性を高めるべく努力してきました。

- 中国は、年間販売台数と製造生産高において、依然として世界最大の自動車市場です。OICAによると、中国の自動車生産台数は2023年に3,016万台に達し、毎年16%の2桁増となります。

- インド自動車工業会(SIAM)によると、2022~2023年度(2022年4月~2023年3月)の同国自動車産業の生産台数は合計25億9,931万8,867台で、2021~2022年度と比較して約12.55%増加しました。OICAによると、2023年度の自動車生産台数は2022年度比で33%増と過去最高を記録しました。

- さらに、錫の他の主要なエンドユーザー産業には、電気・電子、重工業、包装が含まれます。中国の情報通信技術(ICT)セクターは、政府の支援と有利なデジタル化計画・政策により、過去10年間で急成長しました。

- そのため、この地域の錫市場は予測期間中に安定した成長が見込まれます。

錫産業の概要

錫市場は高度に統合されています。主要企業(順不同)には、YUNNAN TIN COMPANY GROUP LIMITED、Timah、MINSUR、Malaysia Smelting Corporation Berhad、Yunnan Chengfeng Nonferrous Metalsが含まれます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 電気自動車市場の需要急増

- 電気・電子産業におけるアプリケーションの増加

- その他の促進要因

- 抑制要因

- 代替品の存在

- その他の抑制要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競合の程度

- 価格分析

第5章 市場セグメンテーション

- 製品タイプ

- 金属

- 合金

- 化合物

- 用途

- はんだ

- 錫めっき

- 化学薬品

- その他の用途(特殊合金、鉛蓄電池)

- エンドユーザー産業

- 自動車

- エレクトロニクス

- 包装(飲食品)

- ガラス

- その他のエンドユーザー産業(化学、工具製造、医療機器)

- 地域

- 生産分析

- オーストラリア

- ボリビア

- ブラジル

- ビルマ

- 中国

- コンゴ(キンシャサ)

- インドネシア

- マレーシア

- ペルー

- ベトナム

- その他の国

- 消費分析

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- オーストリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 南アフリカ

- アラブ首長国連邦

- その他中東とアフリカ

- 生産分析

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- ArcelorMittal

- Aurubis AG

- Avalon Advanced Materials Inc.

- Indium Corporation

- Jiangxi New Nanshan Technology Co. Ltd

- Malaysia Smelting Corporation Berhad

- MINSUR

- Thailand Smelting and Refining Co. Ltd

- Timah

- Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- YUNNAN TIN COMPANY GROUP LIMITED

第7章 市場機会と今後の動向

- 錫のリサイクルへのシフト

- その他の機会

目次

Product Code: 53430

The Tin Market size is estimated at 429.24 kilotons in 2025, and is expected to reach 487.78 kilotons by 2030, at a CAGR of 2.59% during the forecast period (2025-2030).

Key Highlights

- Surging demand from the electric vehicle market and increasing applications in the electrical and electronics industry are expected to drive the market during the forecast period.

- The presence of substitutes like aluminum and tin-free steel for producing metallic products like containers is hindering the market's growth.

- Shifting focus toward recycling tin is expected to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market and witness the highest CAGR during the forecast period.

Tin Market Trends

The Electronic Segment to Dominate the Market Growth

- Tin is used in the electronics industry as a solder and is often used in various purities and alloys, generally with lead and indium. About 50-70% of the overall tin produced is used in the electronics and electrical industry in various products, such as mobiles, tablets, computers, watches, clocks, and other consumer electronic devices.

- For instance, according to the Japan Electronics and Information Technology Industries Association (JEITA), the global electronics and IT industry's production was estimated at USD 3,382.6 billion in 2023, registering a negative CAGR of 3% Y-o-Y compared to 2022. However, in 2024, it is expected to grow by 9% and reach USD 3,686.8 billion.

- Globally, smartphone demand is increasing significantly. According to TelefonaktiebolagetLM Ericsson, smartphone subscriptions accounted for 6,970 million in 2023, an increase of about 5.3% compared to 2022. Also, the subscription will reach 8,060 million by 2029, enhancing tin consumption from electronics applications.

- Also, the demand for electronics products in Asia-Pacific mainly comes from China, India, and Japan. China is a robust and favorable market for electronics producers, owing to the country's low labor cost and flexible policies. According to the National Bureau of Statistics of China, the annual growth rate of value added in the electronics manufacturing industry in the country increased by 3.4% Y-o-Y in 2023.

- The German electronics industry in Europe is the largest in the region. According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 242 billion (USD 261.94 billion) in 2023, witnessing a CAGR of 7.56% compared to 2022. Also, in terms of production, the electro and digital industries registered a CAGR of 1.4% in 2022 compared to 2021.

- Hence, due to the factors mentioned above, the use of tin is increasing in the electronics industry.

Asia-Pacific to Dominate the Market

- Asia-Pacific has dominated the tin market. China is one of the largest producers and consumers of tin globally.

- The automotive industry, one of the major contributors to the tin market and the automotive sector, has been shaping up for product evolution. China is focusing on manufacturing products to ensure fuel economy and minimize emissions owing to the growing environmental concerns due to mounting pollution in the country.

- Tin, along with other metals, is used in numerous automotive applications, including fuel tanks, sealants, wiring, radiator, seat cushions, seams and welds, fasteners, screws, nuts, bolts, and roofing.

- Asia-Pacific is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- China remains the world's largest automotive market in annual sales and manufacturing output. According to OICA, vehicle production in China reached a total of 30.16 million units in 2023, a double-digit increase of 16% annually.

- According to the Society of Indian Automobile Manufacturers (SIAM), in FY 2022-2023 (April 2022 to March 2023), the country's automotive industry produced a total of 2,59,31,867, an increase of about 12.55% compared to FY 2021-2022. As per OICA, the country registered a record increase of 33% in vehicle production in 2023 compared to 2022.

- In addition, the other major end-user industries for tin include electrical and electronics, heavy engineering, and packaging. China's information and communication technology (ICT) sector has grown rapidly in the past decade, owing to the government's support and favorable digitization plans and policies.

- Therefore, due to all such factors, the market for tin in the region is expected to have steady growth during the forecast period.

Tin Industry Overview

The Tin market is highly consolidated. The major players (not in any particular order) include YUNNAN TIN COMPANY GROUP LIMITED, Timah, MINSUR, Malaysia Smelting Corporation Berhad, and Yunnan Chengfeng Nonferrous Metals Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Electric Vehicle Market

- 4.1.2 Increasing Applications in the Electrical and the Electronics Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Presence of Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Product Type

- 5.1.1 Metal

- 5.1.2 Alloy

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Solder

- 5.2.2 Tin Plating

- 5.2.3 Chemicals

- 5.2.4 Other Applications (Specialized Alloys and Lead-acid Batteries)

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Electronics

- 5.3.3 Packaging (Food and Beverage)

- 5.3.4 Glass

- 5.3.5 Other End-user Industries (Chemical, Tool Making, Medical Devices)

- 5.4 Geography

- 5.4.1 Production Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Bolivia

- 5.4.1.3 Brazil

- 5.4.1.4 Burma

- 5.4.1.5 China

- 5.4.1.6 Congo (Kinshasa)

- 5.4.1.7 Indonesia

- 5.4.1.8 Malaysia

- 5.4.1.9 Peru

- 5.4.1.10 Vietnam

- 5.4.1.11 Other Countries

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 India

- 5.4.2.1.3 Japan

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 Italy

- 5.4.2.3.4 France

- 5.4.2.3.5 Austria

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 South Africa

- 5.4.2.5.2 United Arab Emirates

- 5.4.2.5.3 Rest of Middle East and Africa

- 5.4.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Aurubis AG

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Indium Corporation

- 6.4.5 Jiangxi New Nanshan Technology Co. Ltd

- 6.4.6 Malaysia Smelting Corporation Berhad

- 6.4.7 MINSUR

- 6.4.8 Thailand Smelting and Refining Co. Ltd

- 6.4.9 Timah

- 6.4.10 Yunnan Chengfeng Non-ferrous Metals Co. Ltd

- 6.4.11 YUNNAN TIN COMPANY GROUP LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Recycling of Tin

- 7.2 Other Opportunities