|

市場調査レポート

商品コード

1910811

シリカ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| シリカ:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

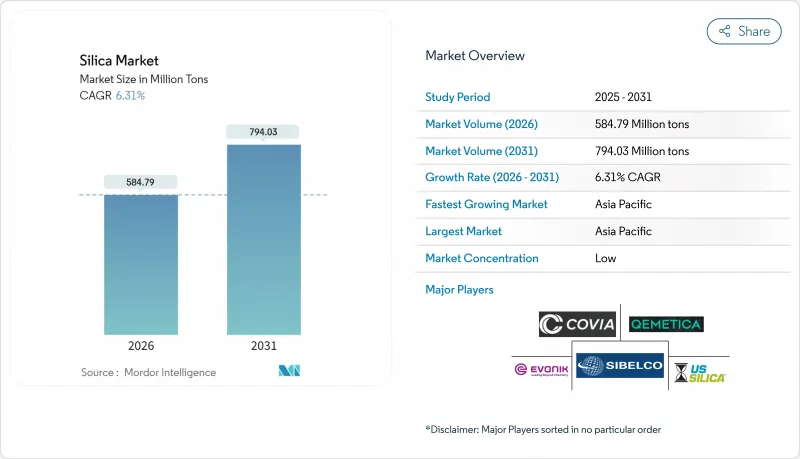

シリカ市場は、2025年の5億5,008万トンから2026年には5億8,479万トンへ成長し、2026年から2031年にかけてCAGR6.31%で推移し、2031年までに7億9,403万トンに達すると予測されています。

この堅調な拡大は、建設資材、省エネタイヤ、太陽電池用ガラス、半導体基板における同鉱物の中心的な役割を反映しています。アジア太平洋地域におけるインフラ投資の増加、世界の低転がり抵抗タイヤの普及推進、太陽光発電設備の加速的な拡大が需要を押し上げる一方、特殊グレードの供給業者は高純度製品や表面改質製品を通じて価格プレミアムを確保しています。輸送コストの変動や労働衛生規制が成長を抑制する一方、バイオベース加工技術への投資や地域的な選鉱の強化が、シリカ市場の長期的な回復力ある見通しを支えています。

世界のシリカ市場動向と洞察

省エネ型グリーンタイヤにおける沈殿シリカの堅調な需要

低転がり抵抗タイヤは燃費を3~7%改善し、欧州のタイヤ効率表示義務化規制によりトレッドコンパウンドへのシリカ配合量が増加しています。高級乗用車用タイヤには現在、最大90 phr(フィート/時間)の沈殿シリカが含有されており、これは2020年の標準レベルの2倍に相当します。商用車フリートもディーゼルコスト削減のため同様の配合を採用し、電気自動車メーカーは航続距離延長のためこの動向をさらに強化しています。

太陽光発電用ガラス製造能力の継続的拡大

太陽光発電設備1ギガワットあたり、鉄分含有量が120ppm未満の超透明シリカベースガラスが15,000~2万トン必要となります。中国は世界の太陽光発電用ガラス生産能力の85%以上を占めており、原料品質を保証するため、新たなフロートガラス製造ラインと自社用シリカ選鉱プラントを組み合わせています。両面受光型パネル用ガラスの薄型化により純度仕様がさらに厳格化され、高度な選鉱技術への投資が促進されています。

アルミノケイ酸塩およびケイ酸カルシウム系充填材による競合上の脅威

焼成粘土およびメタカオリン製品は、コンクリートやポリマー複合材において同等の補強効果を提供しながら、汎用品グレードのシリカを最大25%下回る価格で提供されています。サプライヤーは粒子表面処理技術への投資により、従来性能差を縮めており、微粉化アルミナシリケートはコスト重視の建設用混合材市場でシェアを拡大中です。

セグメント分析

2025年時点で結晶質グレードはシリカ市場の99.15%を占め、2031年までCAGR6.22%で拡大しています。石英は熱安定性と確立されたサプライチェーンにより、コンクリート、ガラス、鋳造用鋳型において不可欠な存在です。トリディマイトおよびクリストバライトは高温セラミックスのニッチ市場を占めますが、複雑な相転移処理が規模拡大を制限しています。非晶質グレードは生産量は少ないもの、グリーンタイヤコンパウンド、高固形分バッテリースラリー、半導体CMPスラリーにおいてプレミアム価格を実現しています。専門サプライヤーは親水性・疎水性表面処理技術を活用し、大量生産を超えた付加価値を創出しています。

環境規制の強化により、採掘された結晶性原料から、吸入性粉塵リスクの低い設計された非晶質形態への移行が促進されています。バイオベースの籾殻シリカはこの要件を満たすとともに、ライフサイクルにおける炭素削減効果とアジアのタイヤ製造拠点への近接性を提供します。真空フラッシュ反応器や低アルカリ精製ラインへの投資は、コモディティの大量生産を追うのではなく、小規模で高マージンの製品群をターゲットとする戦略を裏付けています。その結果、シリカ市場は高純度・用途特化グレードと建設用バルク砂へと二極化を続け、価格差は2030年まで拡大すると予想されます。

本シリカ報告書は、タイプ別(非晶質(ヒュームド/パイロジェニック、水和物)、結晶質(石英、トリディマイト、クリストバライト))、エンドユーザー産業別(建築・建設、シェールオイル・ガス、ガラス製造、水処理、その他)、地域別(アジア太平洋、北米、欧州、南米、中東・アフリカ)に分類されています。市場予測は数量(トン)単位で提供されます。

地域別分析

アジア太平洋地域は、2025年に41.00%のシェアを占め、2031年までCAGR8.10%で成長し、シリカ市場を独占しています。中国は、戦略的備蓄と統合された選鉱拠点に支えられ、建設、太陽光発電用ガラス、化学派生製品において年間2億トン以上を消費しています。インドでは高速道路網の拡充やスマートシティ計画が国内需要を押し上げており、政府補助金が籾殻シリカ事業の拡大を促進。これにより現地タイヤ工場と輸出市場の両方に供給が行われています。

北米はシェールプロパント供給において中核的な位置を占めており、ウィスコンシン州、テキサス州、アルバータ州の鉱床は厳しい破砕強度仕様を満たしています。地域の加工プラントはメキシコ湾岸のガラス溶解炉向けサプライチェーンを短縮し、カナダの生産者はLNG建設やグリーン水素インフラからの需要を獲得しています。規制要因、特にOSHAの吸入性シリカ制限は、鉱山業者に湿式処理や密閉型処理システムへの移行を促しており、設備投資は増加するもの保険責任は低減されます。

欧州では、ドイツ、フランス、英国を中心とした安定的な付加価値需要が存在します。自動車・化学ユーザーは高純度グレードを要求し、EU循環経済指令は再生材・バイオベース原料の利用を促進しています。東欧の供給業者(特にQemetica社の拡張したポーランド拠点)は、西欧のOEM企業と成長するトルコ・北アフリカ建設市場の両方への近接性を活かしています。省エネルギー型キルン技術や現地太陽光発電設備への投資は、EUの脱炭素化規制に沿うものであり、地域の長期的な競争力の基盤となります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 省エネ型「グリーン」タイヤ向け沈殿シリカの堅調な需要

- 太陽光発電用ガラス製造能力の継続的な拡充

- 先進的な半導体製造プロセスにおける高純度シリカの採用拡大

- アジア地域におけるカーボンフットプリント削減のため、バイオベースの籾殻シリカへの移行が進んでいます

- 高固形分電池スラリーにおけるヒュームドシリカの急速な普及

- 市場抑制要因

- アルミノケイ酸塩およびケイ酸カルシウム系充填剤による競合上の脅威

- バルク珪砂の輸送コストの変動性

- 呼吸性結晶性シリカ曝露限界値の厳格化(OSHA、EU)

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測(金額および数量)

- タイプ別

- 不定形

- ヒュームド/パイロジェニック

- 水和

- クリスタリン

- クォーツ

- トリダイマイト

- クリストバライト

- 不定形

- エンドユーザー業界別

- 建築・建設

- シェールオイル・ガス

- ガラス製造

- 水処理

- その他

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- 北欧諸国

- トルコ

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- ナイジェリア

- カタール

- アラブ首長国連邦

- エジプト

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/順位分析

- 企業プロファイル

- AGSCO Corp

- AMS Applied Material Solutions

- Cabot Corporation

- China-Henan Huamei Chemical Co. Ltd

- Covia Holdings LLC

- Denka Company Limited

- Evonik Industries AG

- Heraeus Holding

- Kemitura Group

- Madhu Silica Pvt. Ltd

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Nouryon

- OCI Company Ltd

- QEMETICA

- Sibelco

- Tokuyama Corporation

- U.S. Silica(Apollo Funds)

- W.R. Grace and Co.

- Wacker Chemie AG