|

市場調査レポート

商品コード

1686633

医薬品包装:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医薬品包装:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 201 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

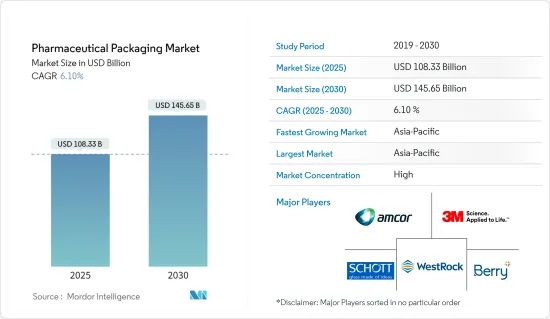

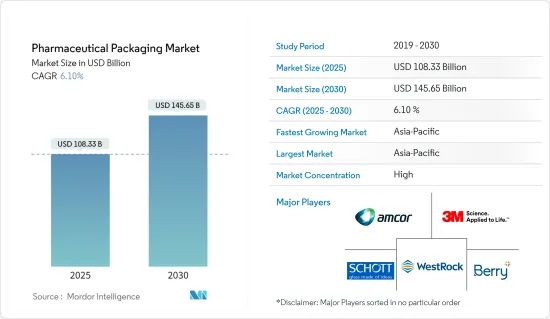

医薬品包装の市場規模は2025年に1,083億3,000万米ドルと推計され、予測期間(2025~2030年)のCAGRは6.1%で、2030年には1,456億5,000万米ドルに達すると予測されます。

規制状況が包装イノベーションを形作る:

医薬品包装市場は、厳しい規制基準と偽造品対策によって大きな成長を遂げています。世界各国の政府は、製品の安全性を確保し、偽造医薬品と闘うために厳しい規制を実施しています。欧州連合(EU)の指令では、すべての医薬品にシリアルナンバーを付けることが義務付けられており、米国、中国、インド、トルコにも同様の規制が存在します。こうした措置が先進パッケージング・ソリューションの採用を後押ししています。

主なハイライト

- FDAガイドライン:FDAは、OTC製品の小児用包装と耐タンパー性包装に関するガイドラインを制定しています。

- 認証技術:製薬会社はホログラムや隠しバッチ番号などの認証技術に投資しています。

- シリアル化方法:シリアル化方法には、リニアバーコード、二次元バーコード、無線自動識別(RFID)などがあります。

- スマート包装:RFIDやNFCタグを使ったスマート包装は、製品追跡や患者エンゲージメントのために普及しつつあります。

ナノテクノロジーが包装ソリューションに革命を起こす:

ナノテクノロジーが医薬品包装に与える影響は、革新的な新世代ソリューションによって業界を変革しつつあります。これらの進歩は偽造品対策だけでなく、サプライチェーン全体を通じて製品の安全性とトレーサビリティを強化します。

主なハイライト

- 追跡能力:ナノテクノロジーは、製造からエンドユーザーまで製品を追跡できるスマート包装の創出を可能にします。

- スマート包装の開発:Schott AGのような企業は、明確な容器ベースのトレーサビリティを実現するスマートパッケージング封入ソリューションを開発しています。

- 製品の発売:ENTOD Pharmaceuticals社は、ナノテクノロジーを利用した眼科用美容製品シリーズをインドで発売し、ナノ包装の多用途性を示しました。

- 生物医学への応用:ナノ粒子は、病気の検出、予防、薬物送達のために生物医学で利用されています。

市場動向と成長促進要因:

医薬品包装市場は、いくつかの主要促進要因によって力強い成長を遂げています。新興国における医薬品産業の拡大とヘルスケア支出の増加が市場成長を後押ししています。

主なハイライト

- プラスチックセグメント:プラスチックセグメントは2028年までに544億5,000万米ドルに達し、CAGR 6.17%で成長すると予測されます。

- ボトル部門:ボトル分野は2022年に182億4,000万米ドルと評価され、2028年には273億米ドルに達すると予測されます。

- FDIの成長:インドのような新興国は著しい成長を遂げており、2020~2021年には医薬品業界へのFDIが200%増加します。

- アジア太平洋地域の成長:アジア太平洋地域は、2023年から2028年にかけてCAGR 6.99%で成長し、2028年には545億9,000万米ドルに達すると予想されます。

競合情勢と主要企業:

医薬品包装市場は断片化されており、複数の大手企業が業界を支配しています。これらの企業は市場ポジションを維持するため、技術革新、持続可能性、戦略的拡大に注力しています。

主なハイライト

- Amcor PLC:1860年設立。経口投与フォーマットや医療機器パッケージなど、幅広いパッケージングソリューションを提供。

- ショットAG:1853年に設立され、医薬品チューブや薬剤封入ソリューションに特化しています。

- ベリー世界グループ:1967年設立。医療用包装、ボトル、バイアルを提供。

- ゲレスハイマーAG:ゲレスハイマーAGは、バイアルの生産能力を増強するため、米国の生産施設に9,400万米ドルを投資すると発表しました。

持続可能性と今後の動向:

医薬品包装業界では、持続可能性と環境に優しいソリューションへの注目が高まっています。この動向は、規制による圧力と、より環境に配慮した包装を求める消費者の要求の両方によってもたらされています。

主なハイライト

- GSKの取り組みグラクソ・スミスクライン・コンシューマー・ヘルスケアはPulpex紙ボトル・パートナー・コンソーシアムに参加し、リサイクル可能な紙ボトルを模索しています。

- バイオプラスチックへの投資:企業は、従来のプラスチックに代わるものとして、バイオプラスチックやその他の生分解性素材に投資しています。

- 先端印刷技術:Essentra PackagingのLanda S10ナノグラフィック印刷機などの先進印刷技術は、パッケージング能力を向上させています。

- 3次元視覚化:3Dビジュアライゼーションと印刷戦略の採用は、一次包装と二次包装の設計の限界を押し広げつつあります。

医薬品包装市場の動向

プラスチックセグメントが素材カテゴリーを支配

プラスチックセグメントは医薬品包装市場最大の材料カテゴリーとして浮上しています。2022年、このセグメントは市場シェアの41.84%を占め、380億3,000万米ドルとなりました。このセグメントは、予測期間中にCAGR 6.17%で成長し、2028年までに541億5,000万米ドルに達すると予測されています。この成長は、このセグメントの汎用性、費用対効果、プラスチック包装ソリューションの継続的な技術革新など、いくつかの要因によってもたらされます。

- 市場シェア2022年の医薬品包装市場の41.84%をプラスチックが占める。

- 費用対効果:プラスチックは手頃な価格であるため、医薬品包装の人気商品となっています。

- 革新的なソリューション:企業は持続可能性基準を満たすため、生分解性やリサイクル可能なプラスチック・ソリューションを導入しています。

- 今後の成長:この分野は2028年までに541億5,000万米ドルに達すると予測されています。

- 規制基準がプラスチック包装の革新を促進する:厳しい規制基準や偽造品に対する規範が、プラスチック製医薬品パッケージングの進歩を後押ししています。企業はこれらの要件を満たすために革新的なソリューションを開発しています。例えば、ボルミオリファーマは2022年5月、再生プラスチック、バイオベース、生分解性、堆肥化可能なプラスチックソリューションなど、持続可能なパッケージング製品のラベルであるEcoPositiveを立ち上げました。このイニシアチブは、規制の圧力と持続可能な包装オプションに対する需要の高まりに対する業界の対応を示しています。

- エコポジティブ・イニシアチブボルミオリファーマのEcoPositiveは、バイオベースや堆肥化可能なプラスチックを含む持続可能なパッケージングオプションを紹介しています。

- 偽造防止:プラスチック包装の偽造防止対策は、世界スタンダードに対応するため、ますます高度化しています。

- 規制圧力:世界の規制基準の高まりが、医薬品プラスチック包装セグメントを形成しています。

- 持続可能性への取り組み:生分解性プラスチックソリューションへの投資の増加は、環境規制に沿ったものです。

- ナノテクノロジーのプラスチック包装開発への影響:ナノテクノロジーの影響は、プラスチックセグメントにおける新世代パッケージングソリューションの開発を促進しています。この技術的進歩により、バリア機能や抗菌機能の向上など、特性が強化されたパッケージング材料の創出が可能になりつつあります。プラスチック製医薬品包装におけるナノテクノロジーの統合は、今後数年間の同セグメントの成長と市場の優位性に大きく貢献すると予想されます。

- バリア機能:ナノテクノロジーは、プラスチック製医薬品包装において強化されたバリア特性の創出を可能にします。

- 抗菌ソリューション:企業は、包装の安全性と寿命を向上させるために抗菌ナノテクノロジーを統合しています。

- 特性の強化:ナノテクノロジーの革新は、プラスチック包装をよりスマートで効率的なものにするために利用されています。

- 将来の展望:ナノテクノロジーの統合は、プラスチック包装分野の成長を促進します。

アジア太平洋地域が大きなシェアを占める

アジア太平洋地域は医薬品包装市場で最も急成長しているセグメントとして際立っています。2022年、この地域の市場シェアは40.12%で、市場規模は366億米ドルでした。同市場は2028年までに545億9,000万米ドルに達すると予測され、予測期間中のCAGRは6.99%と堅調です。この成長率は他地域を凌駕しており、アジア太平洋地域は世界の医薬品包装市場の重要な牽引役となっています。

- 市場シェア:アジア太平洋地域は世界の医薬品包装市場の40.12%を占める。

- 成長率:同地域は2023年から2028年にかけてCAGR 6.99%で成長すると予測されます。

- 地域の優位性:中国とインドがアジア太平洋地域の医薬品包装市場をリードしています。

- 新たな動向:この地域の急成長は、革新的で持続可能なパッケージングに対する需要の増加が原動力となっています。

医薬品包装業界の概要

世界プレーヤーが統合市場を独占

医薬品包装市場は、多様な製品ポートフォリオを持つ世界プレーヤーが支配的であることが特徴です。Amcor PLC、Schott AG、Berry Global Group Inc.などの企業が市場をリードし、ボトルやバイアルからブリスターパックやシリンジまで幅広いパッケージング・ソリューションを提供しています。市場構造はかなり統合されているようで、これらの大手企業は広範な製品ライン、世界のプレゼンス、技術力により、大きな市場シェアを握っています。

Amcor PLC:医薬品包装の世界リーダーで、ブリスターパックから小児用ボトルまで幅広いソリューションを提供。

ショットAG:ガラスベースのパッケージングと医薬品チューブに特化し、封じ込めソリューションのイノベーションを推進。

ベリー世界グループボトルからプレフィラブルシリンジまで幅広いプラスチックパッケージングソリューションを提供。

連結市場:市場は、技術的な専門知識と製品の多様性を備えた大企業によって支配されています。

イノベーションと持続可能性が市場のリーダーシップを牽引:

市場をリードする企業は、革新性と持続可能性に重点を置いています。例えばAmcor PLCは、22年度に紙ベースのAmFiberファミリーとヘルスケア用途のPVCフリーAmSkyブリスター・システムを発表しました。ベリー世界グループは、耐小児用で改ざん防止のシロップや液体医薬品包装用の完全なバンドルソリューションを発売しました。これらの企業はまた、持続可能なパッケージング・ソリューションに多額の投資を行っており、Amcorは2030年までにポートフォリオ全体で30%のリサイクル材料を目標としています。市場でのリーダーシップは、インドのバンガロールにあるベリー世界の新しい製造施設のような戦略的な拡張によってさらに強固なものとなり、先進的なヘルスケアソリューションへの地域的、世界のアクセスを強化しています。

持続可能性の重視:企業は持続可能性の目標を達成するため、リサイクル可能で環境に優しい素材を優先しています。

革新的ソリューション:PVCフリーのブリスターパックや耐小児用ボトルは、より安全で持続可能な代替品として人気を集めています。

戦略的拡大:新興市場に新たな施設を設けることで、世界企業は地域の需要を取り込み、市場シェアを拡大することができます。

研究開発投資:主要企業は研究開発に投資し、医薬品包装の持続可能なイノベーションを推進しています。

市場における将来の成功要因:

市場プレーヤーが成功を収め、市場シェアを拡大するためには、いくつかの重要な要因が浮かび上がってくる。まず、Amcorの革新的な製品の導入に代表されるように、研究開発への投資が重要です。第二に、インドにおけるベリー世界の新施設のように、新興市場における製造能力の拡大が、拡大する需要を取り込むために不可欠です。第三に、Klockner Pentaplast社がリサイクル可能なPETブリスターフィルムを導入するなど、持続可能性への注目はますます重要になっています。最後に、Aptar PharmaによるMetaphase Design Groupの買収のような戦略的買収や提携は、製品提供やサービス能力を強化することができます。このような戦略は、今後数年間で、自社の地位を強化したり、市場を混乱させたりしようとする企業にとって極めて重要です。

研究開発投資:急速に進化する業界で競争力を維持するためには、企業は技術革新を続けなければならないです。

新興市場:アジア太平洋のような高成長地域への進出は、将来の市場成功に不可欠です。

持続可能性:企業は、リサイクル可能な素材や生分解性素材を優先的に使用することで、環境問題に対処しなければならないです。

戦略的買収:買収やパートナーシップは、医薬品包装の製品ラインナップを拡大し、イノベーションを加速するのに役立ちます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- 包装に関する規制基準と偽造品に対する厳しい規範

- 革新的な新世代包装ソリューションによるナノテクノロジーの影響

- 規制状況が包装イノベーションを形作る

- 市場の課題

- 供給企業の交渉力による原材料コストの変動

第6章 市場セグメンテーション

- 材料別

- プラスチック

- ガラス

- その他の材料

- 製品タイプ別

- ボトル

- シリンジ

- バイアル・アンプル

- チューブ

- キャップと栓

- ラベル

- その他の製品タイプ

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Amcor PLC

- 3M Company

- Schott AG

- WestRock Company

- Berry Global Group Inc.

- McKesson Corporation

- AptarGroup Inc.

- Klockner Pentaplast Group

- CCL Industries Inc.

- FlexiTuff International Ltd

- Gerresheimer AG

- West Pharmaceutical Services Inc.

- Becton, Dickinson and Company

- Vetter Pharma International GmbH

- Catalent Inc.

- W. L. Gore & Associates Inc.

- Nipro Corporation

第8章 投資分析

第9章 市場機会と今後の動向

The Pharmaceutical Packaging Market size is estimated at USD 108.33 billion in 2025, and is expected to reach USD 145.65 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

Regulatory Landscape Shapes Packaging Innovation:

The pharmaceutical packaging market is experiencing significant growth driven by stringent regulatory standards and anti-counterfeit measures. Governments worldwide are implementing strict regulations to ensure product safety and combat counterfeit drugs. The European Union's Directive mandates serialization numbers on all pharmaceutical products, while similar regulations exist in the United States, China, India, and Turkey. These measures are propelling the adoption of advanced packaging solutions.

Key Highlights

- FDA Guidelines: The FDA has established guidelines for child-resistant packaging and tamper-resistant packaging for OTC products.

- Authentication Technologies: Pharmaceutical companies are investing in authentication technologies like holograms and hidden batch numbers.

- Serialization Methods: Serialization methods include linear barcodes, two-dimensional barcodes, and radio frequency identification (RFID).

- Smart Packaging: Smart packaging with RFID and NFC tags is gaining traction for product tracking and patient engagement.

Nanotechnology Revolutionizes Packaging Solutions:

The impact of nanotechnology on pharmaceutical packaging is transforming the industry with innovative and new-generation solutions. These advancements not only combat counterfeiting but also enhance product safety and traceability throughout the supply chain.

Key Highlights

- Tracking Capability: Nanotechnology enables the creation of smart packaging that can track products from manufacturing to end-user.

- Smart Packaging Development: Companies like Schott AG are developing smart packaging containment solutions for clear container-based traceability.

- Product Launches: ENTOD Pharmaceuticals launched a nanotechnology-based ocular aesthetic range in India, showcasing the versatility of nano-packaging.

- Biomedicine Applications: Nanoparticles are being utilized in biomedicine for disease detection, prevention, and drug delivery.

Market Drivers and Growth Trends:

The pharmaceutical packaging market is witnessing robust growth, fueled by several key drivers. The expansion of the pharmaceutical industry in emerging economies, coupled with increasing healthcare spending, is propelling market growth.

Key Highlights

- Plastics Segment: The plastics segment is expected to reach USD 54.45 billion by 2028, growing at a CAGR of 6.17%.

- Bottles Segment: The bottles segment was valued at USD 18.24 billion in 2022 and is projected to reach USD 27.30 billion by 2028.

- FDI Growth: Emerging economies like India are experiencing significant growth, with a 200% increase in FDI in the pharmaceutical industry in 2020-2021.

- Asia-Pacific Growth: The Asia-Pacific region is expected to grow at a CAGR of 6.99% from 2023 to 2028, reaching USD 54.59 billion by 2028.

Competitive Landscape and Key Players:

The pharmaceutical packaging market is fragmented, with several major players dominating the industry. These companies are focusing on innovation, sustainability, and strategic expansions to maintain their market positions.

Key Highlights

- Amcor PLC: Established in 1860, Amcor offers a wide range of packaging solutions, including oral dose formats and medical device packaging.

- Schott AG: Founded in 1853, Schott specializes in pharmaceutical tubing and drug containment solutions.

- Berry Global Group: Established in 1967, Berry Global provides medical packaging, bottles, and vials.

- Gerresheimer AG: Gerresheimer AG announced a USD 94 million investment in a US production facility to increase its vial production capacity.

Sustainability and Future Trends:

The pharmaceutical packaging industry is increasingly focusing on sustainability and eco-friendly solutions. This trend is driven by both regulatory pressures and consumer demand for more environmentally responsible packaging.

Key Highlights

- GSK's Initiative: GlaxoSmithKline Consumer Healthcare joined the Pulpex paper bottle partner consortium to explore recyclable paper bottles.

- Bioplastics Investment: Companies are investing in bioplastics and other biodegradable materials as alternatives to traditional plastics.

- Advanced Printing Technologies: Advanced printing technologies, such as Essentra Packaging's Landa S10 Nanographic Printing Machine, are enhancing packaging capabilities.

- 3-D Visualization: The adoption of 3-D visualization and printing strategies is pushing the boundaries of both primary and secondary packaging design.

Pharmaceutical Packaging Market Trends

Plastics Segment Dominates Material Category

The Plastics segment emerges as the largest material category in the Pharmaceutical Packaging Market. In 2022, this segment accounted for 41.84% of the market share, valued at USD 38.03 billion. The segment is projected to reach USD 54.15 billion by 2028, growing at a CAGR of 6.17% during the forecast period. This growth is driven by several factors, including the segment's versatility, cost-effectiveness, and ongoing innovations in plastic packaging solutions.

- Market Share: Plastics accounted for 41.84% of the pharmaceutical packaging market in 2022.

- Cost-Effectiveness: The affordability of plastics makes it a popular choice in pharmaceutical packaging.

- Innovative Solutions: Companies are introducing biodegradable and recyclable plastic solutions to meet sustainability standards.

- Future Growth: The segment is projected to reach USD 54.15 billion by 2028.

- Regulatory Standards Drive Plastic Packaging Innovation: Stringent regulatory standards and norms against counterfeit products are propelling advancements in plastic pharmaceutical packaging. Companies are developing innovative solutions to meet these requirements. For instance, Bormioli Pharma launched EcoPositive in May 2022, a label for sustainable packaging offerings, including recycled plastics, bio-based, biodegradable, and compostable plastic solutions. This initiative demonstrates the industry's response to regulatory pressures and the growing demand for sustainable packaging options.

- EcoPositive Initiative: Bormioli Pharma's EcoPositive showcases sustainable packaging options, including bio-based and compostable plastics.

- Counterfeit Prevention: Anti-counterfeit measures in plastic packaging are becoming increasingly sophisticated to meet global standards.

- Regulatory Pressure: The rise of global regulatory standards is shaping the pharmaceutical plastic packaging segment.

- Sustainability Efforts: Increased investment in biodegradable plastic solutions aligns with environmental regulations.

- Nanotechnology Impacts Plastic Packaging Development: The impact of nanotechnology is driving the development of new-generation packaging solutions in the plastics segment. This technological advancement is enabling the creation of packaging materials with enhanced properties, such as improved barrier functions and antimicrobial capabilities. The integration of nanotechnology in plastic pharmaceutical packaging is expected to contribute significantly to the segment's growth and market dominance in the coming years.

- Barrier Functions: Nanotechnology enables the creation of enhanced barrier properties in plastic pharmaceutical packaging.

- Antimicrobial Solutions: Companies are integrating antimicrobial nanotechnology to improve the safety and longevity of packaging.

- Enhanced Properties: Nanotech innovations are being used to make plastic packaging smarter and more efficient.

- Future Prospects: The integration of nanotechnology is set to propel growth in the plastic packaging sector.

Asia-Pacific to Occupy Major Share

The Asia-Pacific region stands out as the fastest-growing segment in the Pharmaceutical Packaging Market. In 2022, this region held a 40.12% market share, valued at USD 36.60 billion. The market is projected to reach USD 54.59 billion by 2028, exhibiting a robust CAGR of 6.99% during the forecast period. This growth rate outpaces other regions, positioning Asia-Pacific as a key driver of the global pharmaceutical packaging market.

- Market Share: Asia-Pacific holds 40.12% of the global pharmaceutical packaging market.

- Growth Rate: The region is expected to grow at a CAGR of 6.99% from 2023 to 2028.

- Regional Dominance: China and India lead the pharmaceutical packaging market in Asia-Pacific.

- Emerging Trends: The region's rapid growth is driven by increasing demand for innovative and sustainable packaging.

Pharmaceutical Packaging Industry Overview

Global Players Dominate Consolidated Market:

The pharmaceutical packaging market is characterized by the dominance of global players with diverse product portfolios. Companies like Amcor PLC, Schott AG, and Berry Global Group Inc. lead the market, offering a wide range of packaging solutions from bottles and vials to blister packs and syringes. The market structure appears fairly consolidated, with these major players holding significant market share due to their extensive product lines, global presence, and technological capabilities.

Amcor PLC: A global leader in pharmaceutical packaging, with solutions ranging from blister packs to child-resistant bottles.

Schott AG: Specializes in glass-based packaging and pharmaceutical tubing, driving innovation in containment solutions.

Berry Global Group Inc.: Offers extensive plastic packaging solutions, from bottles to prefillable syringes, and is expanding in emerging markets.

Consolidated Market: The market is dominated by large companies with significant technological expertise and product diversity.

Innovation and Sustainability Drive Market Leadership:

Market leaders are distinguished by their focus on innovation and sustainability. Amcor PLC, for instance, introduced the AmFiber family of paper-based products and the PVC-free AmSky blister system for healthcare applications in FY22. Berry Global Group launched a complete bundle solution for child-resistant and tamper-evident syrup and liquid medicine packaging. These companies are also investing heavily in sustainable packaging solutions, with Amcor targeting 30% recycled material across its portfolio by 2030. Their market leadership is further solidified by strategic expansions, such as Berry Global's new manufacturing facility in Bangalore, India, enhancing regional and global access to advanced healthcare solutions.

Sustainability Focus: Companies are prioritizing recyclable and eco-friendly materials to meet sustainability goals.

Innovative Solutions: PVC-free blister packs and child-resistant bottles are gaining traction as safer, sustainable alternatives.

Strategic Expansions: New facilities in emerging markets enable global players to tap into regional demand and grow market share.

R&D Investment: Leading companies invest in R&D to drive sustainable innovation in pharmaceutical packaging.

Factors for Future Success in the Market:

For market players to succeed and grow their market share, several key factors emerge. Firstly, investment in research and development is crucial, as exemplified by Amcor's introduction of innovative products. Secondly, expanding manufacturing capabilities in emerging markets, like Berry Global's new facility in India, is essential for tapping into growing demand. Thirdly, a focus on sustainability is becoming increasingly important, with companies like Klockner Pentaplast introducing recyclable PET blister films. Lastly, strategic acquisitions and partnerships, such as Aptar Pharma's acquisition of Metaphase Design Group, can enhance product offerings and service capabilities. These strategies will be critical for companies looking to strengthen their position or disrupt the market in the coming years.

R&D Investment: Companies must continue to innovate to stay competitive in a rapidly evolving industry.

Emerging Markets: Expansion in high-growth regions like Asia-Pacific is crucial for future market success.

Sustainability Mandate: Companies must address environmental concerns by prioritizing recyclable and biodegradable materials.

Strategic Acquisitions: Acquisitions and partnerships will help expand product offerings and accelerate innovation in pharmaceutical packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Assessment of Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards on Packaging and Stringent Norms Against Counterfeit Products

- 5.1.2 Impact of Nanotechnology due to Innovative and New- generation Packaging Solutions

- 5.1.3 Regulatory Landscape Shapes Packaging Innovation

- 5.2 Market Challenges

- 5.2.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastics

- 6.1.2 Glass

- 6.1.3 Other Materials

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Syringes

- 6.2.3 Vials and Ampoules

- 6.2.4 Tubes

- 6.2.5 Caps and Closures

- 6.2.6 Labels

- 6.2.7 Other Product Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 3M Company

- 7.1.3 Schott AG

- 7.1.4 WestRock Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 McKesson Corporation

- 7.1.7 AptarGroup Inc.

- 7.1.8 Klockner Pentaplast Group

- 7.1.9 CCL Industries Inc.

- 7.1.10 FlexiTuff International Ltd

- 7.1.11 Gerresheimer AG

- 7.1.12 West Pharmaceutical Services Inc.

- 7.1.13 Becton, Dickinson and Company

- 7.1.14 Vetter Pharma International GmbH

- 7.1.15 Catalent Inc.

- 7.1.16 W. L. Gore & Associates Inc.

- 7.1.17 Nipro Corporation