|

市場調査レポート

商品コード

1444014

遺伝子検査:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Genetic Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 遺伝子検査:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

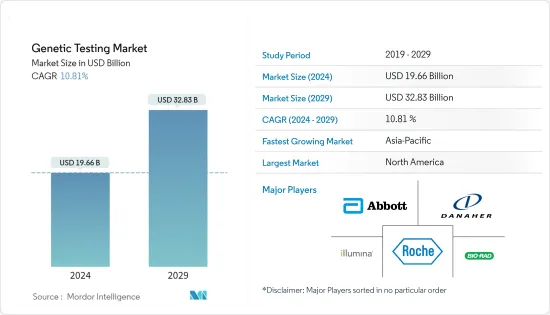

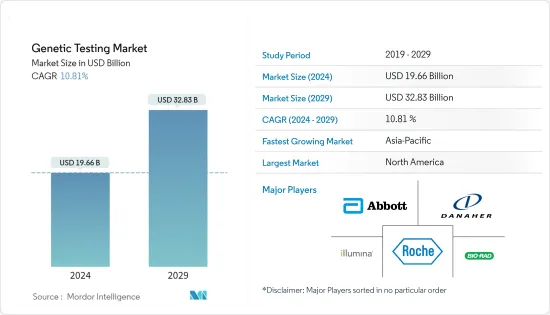

遺伝子検査市場規模は2024年に196億6,000万米ドルと推定され、2029年には328億3,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは10.81%で成長する見込みです。

COVID-19パンデミックは遺伝子検査市場の成長に大きな影響を残しました。Prenatal Diagnosis Journalの2021年3月号のデータによると、COVID-19の大流行は妊婦の出生前遺伝子検査に関する意思決定に影響を与えました。患者の出生前遺伝学的検査へのアクセスと利用もパンデミックの影響を受けました。しかし、COVID-19診断のための遺伝子検査はパンデミック中に増加しました。したがって、COVID-19は遺伝子検査市場に大きな影響を与えました。しかし、現在、遺伝子検査市場は、世界中で遺伝子検査の需要がパンデミック以前の水準に達しており、今後数年間は健全な成長を記録すると考えられています。

さらに、過去数年間の技術進歩の増加は、市場拡大のためのいくつかの機会を開いています。慢性疾患の有病率の上昇や、ニッチな治療領域向けにカスタマイズされた検査キットの市場開拓が、市場の急成長を後押ししています。各国の政府が遺伝子検査に関する規制や意識作りに力を入れるようになったことが、世界中で遺伝子検査が急速に普及するきっかけとなった。研究開発資金の増加は、市場における大手企業の強力な存在感とともに、新規参入企業にとって強力な参入障壁となっています。製品設計の革新、品質の向上、強力な流通パートナーシップは、市場で競争力を維持するための重要なパラメーターです。例えば、2021年7月、Avellino Labs社は、米国で遺伝子眼科検査AvaGenの発売を発表しました。AvaGenは、患者の円錐角膜やその他の角膜ジストロフィーのリスクを判定するのに役立つように設計されています。主要な市場参入企業によるこうした取り組みは、市場の成長を促進すると予想されます。

さらに、技術の発達により、医師はより精度の高い検査を行うことができ、一度に複数の遺伝子情報を調べることができます。多くの国々が市場認可を与えることで、こうした新しいアプローチの市場浸透を促進しています。例えば、米国食品医薬品局は2021年2月、遺伝性発達遅滞や知的障害の一般的な原因の一つである脆弱X症候群(FXS)として知られる遺伝子疾患を検出する初の検査の販売を許可しました。

このように、慢性疾患の負担の増大は、技術の進歩や個別化医療への傾倒と相まって、予測期間中に遺伝子検査市場を大きく成長させると予想されます。

遺伝子検査市場の動向

がんは予測期間中に力強い成長が見込まれる

遺伝子検査は、個人の一生の間に発症する可能性のあるさまざまな種類のがんのリスクを特定するのに役立ちます。遺伝学的検査は、過剰な細胞増殖につながり、腫瘍やがんを引き起こす可能性のあるDNA配列の遺伝的変異や突然変異を検査するために利用できます。例えば、PALB2(乳がんおよび膵臓がんのリスク上昇に関連)、CHEK2(乳がんおよび大腸がん)、BRIP1(卵巣がん)、RAD51CおよびRAD51D(卵巣がん)の同定のための遺伝子検査があります。

世界のがん負担の増加、予防診断や個別化医療に対する世界人口の意識の高まりが、予測期間中にがんセグメントを牽引する主な要因です。米国がん協会によると、2021年には米国で約1,898,160人の新規がん罹患者と608,570人のがん死亡者が発生すると予測されています。さらに、国際がん研究機関(IARC)によると、がんの新規発生は2040年までに3,020万人に達すると推定されています。したがって、がんの発生率の増加は、このセグメントの成長に大きく貢献すると予想されます。

遺伝子検査は、がんの家族歴のある人において、がんが家系にあるかどうかや、将来のがん発症に関連する危険因子に関する情報を提供するのに役立ちます。また、化学療法に反応しない患者では、治療抵抗性の腫瘍における後天的変異の存在を特定するために遺伝子検査が実施されます。

技術の進歩や製品の発売は、調査対象セグメントの成長を促進すると予想されます。例えば、2021年8月、Myriad Genetics社は、多遺伝子乳がんリスク評価スコアであるMyRisk Hereditary Cancer test with RiskScoreをラテンアメリカを含む全世界で発売し、あらゆる家系の女性に対して検証を行い、遺伝子検査へのアクセスを拡大しました。この検査により、遺伝性疾患の現状と合併症の可能性を容易に理解することができます。したがって、遺伝子検査に適したアプローチとして広く受け入れられています。したがって、前述の要因により、がん分野は予測期間中に大きな成長を遂げると予想されます。

北米が最大の市場シェアを獲得し、予測期間中もその優位性を維持する見込み

北米は、同地域における個別化された遺伝子検査サービスに対する需要の増加と、慢性疾患および遺伝性疾患の有病率の上昇により、現在遺伝子検査市場を独占しています。

米国がん協会の2022年報告書によると、2022年末までに米国で新たに発生すると推定されるがんは191万8030人に達します。すべてのがんの中で、乳がんの罹患率が最も高く290,560件、次いで肺がん(236,740件)、前立腺がん(268,690件)、結腸がん(106,180件)となっています。

米国疾病予防管理センター(CDC)によると、ほとんどの診療所や病院では、COVID-19の感染を最小限に抑えるため、遺伝カウンセリングを含む必要でないヘルスケアサービスの対面提供を制限しています。しかし、遺伝カウンセリングを延期することは、遺伝学的検査が期限内に実施されない場合、妊娠中やがん治療中の意思決定に影響を及ぼすため、困難を伴う可能性があります。したがって、COVID-19パンデミックの間、市場調査は妨げられたが、状況は徐々に改善すると予想されます。

米国食品医薬品局(FDA)による製品認可の増加とその後の発売は、新規遺伝子検査製品の革新のための研究活動に携わる主要企業の集中とともに、北米の市場成長を促進すると予想されます。例えば、2021年10月、F. Hoffmann-La Roche Ltdは、オーダーメイドのがん研究をより身近なものにするための包括的ゲノムプロファイリングキットであるAVENIO Tumor Tissue CGP Kitを発売しました。このキットは、ホルマリン固定パラフィン包埋(FFPE)組織サンプルからの固形腫瘍の包括的ゲノムプロファイリングを提供します。さらに、買収と主な発展が、ラテンアメリカにおけるキャリア検査分野の発展の主な理由です。例えば、2021年6月、EurofinsはDNA Diagnostics Centerを買収し、遺伝子検査能力を拡張し、消費者検査業界に参入しました。このように、がん罹患率の増加と、この地域の主要企業が先手を打った戦略により、遺伝子検査市場は北米で予測期間中に大きく成長すると予想されます。

遺伝子検査業界の概要

遺伝子検査市場は競争が激しく、複数の大手企業で構成されています。市場シェアの面では、現在、少数の主要企業が市場を独占しています。Abbott Laboratories社、BioRad Laboratories Inc.社、F Hoffmann-La Roche社、Illumina Inc.社などの主要市場プレイヤーの存在が、市場全体の競争企業間の敵対関係を高めています。主要企業による遺伝子検査プラットフォームの製品の進歩や改良が競争企業間の敵対関係を高めています。

さらに、主要企業は、世界的にプレゼンスを拡大するために、自社の製品ポートフォリオを補完する企業との買収や提携などの戦略的提携に関与しています。2021年9月、MedGenome LabsはGenessenseというブランド名で消費者直販のカテゴリーを立ち上げました。将来的には、Genessenseのウェブサイトやeコマース・プラットフォームを通じてオンラインで注文できる、エビデンスに基づく専門的な遺伝子スクリーニング検査を提供する予定です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 疾病の早期発見と予防の重要性の高まり

- 個別化医療への需要の高まり

- 腫瘍学における遺伝子検査の応用拡大

- 市場抑制要因

- 遺伝子検査の高額な費用

- 遺伝子検査の社会的・倫理的影響

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ別

- キャリア検査

- 診断検査

- 新生児スクリーニング

- 出生前検査

- 出生前検査

- その他のタイプ

- 疾患別

- アルツハイマー病

- がん

- 嚢胞性線維症

- 鎌状赤血球貧血

- デュシェンヌ型筋ジストロフィー

- サラセミア

- ハンチントン病

- 希少疾患

- その他の疾患

- 技術別

- 細胞遺伝学的検査

- 生化学検査

- 分子検査

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- 23&Me Inc.

- Abbott Laboratories

- Myriad Genetics Inc.

- Danaher Corporation

- Illumina Inc.

- DiaSorin Spa(Luminex Corporation)

- BioRad Laboratories Inc.

- PerkinElmer Inc.

- Quest Diagnostics Incorporated

- F. Hoffmann-La Roche Ltd

- Eurofins Scientific

- Qiagen NV

第7章 市場機会と今後の動向

The Genetic Testing Market size is estimated at USD 19.66 billion in 2024, and is expected to reach USD 32.83 billion by 2029, growing at a CAGR of 10.81% during the forecast period (2024-2029).

The COVID-19 pandemic left a significant impact on the growth of the genetic testing market. According to the data from the March 2021 edition of the Prenatal Diagnosis Journal, the COVID-19 pandemic influenced pregnant women's decisions about prenatal genetic testing. Patients' access to and use of prenatal genetic tests was also impacted by the pandemic. However, genetic testing for COVID-19 diagnosis increased during the pandemic. Hence, COVID-19 had a significant impact on the genetic testing market. However, currently, the genetic testing market has reached pre-pandemic levels in terms of demand for genetic tests around the world and is believed to register healthy growth during the coming years.

Moreover, the increasing technological advancements over the past few years have opened several opportunities for market expansion. The rise in the prevalence of chronic diseases and the development of customized testing kits for niche therapeutic areas are aiding the rapid growth of the market. The increasing focus by governments of various countries to regulate and create awareness regarding genetic tests has successfully resulted in the faster adoption of these tests across the world. The increasing R&D funding, along with the strong market presence by major players in the market, has created a strong entry barrier for new entrants. Innovation in product design, improvement in quality, and strong distribution partnerships are key parameters to retain a competitive edge in the market. For instance, in July 2021, Avellino Labs announced the launch of AvaGen, the genetic eye test, in the United States, which is designed to help determine a patient's risk of keratoconus and other corneal dystrophies. These initiatives by key market players are anticipated to drive the growth of the market.

Additionally, with the development of technology, physicians can perform tests with better accuracy and can look at multiple genetic information at a time. Many countries are facilitating the market penetration of these novel approaches by granting market approvals. For instance, in February 2021, the United States Food and Drug Administration authorized the marketing of the first test to detect a genetic condition known as Fragile X Syndrome (FXS), one of the common causes of inherited developmental delay and intellectual disability.

Thus, the growing burden of chronic diseases, coupled with technological advancements and the inclination toward personalized medicine, is expected to significantly grow the genetic testing market over the forecast period.

Genetic Testing Market Trends

Cancer is Expected to Witness Strong Growth During the Forecast Period

Genetic testing helps identify the risk of various types of cancers that may develop during an individual's lifetime. Genetic tests are available to test inherited variants and mutations in the DNA sequence, which could lead to excessive cell growth and result in tumors or cancer. For instance, genetic testing for the identification of PALB2 (associated with increased risks of breast and pancreatic cancers), CHEK2 (breast and colorectal cancers), BRIP1 (ovarian cancer), and RAD51C and RAD51D (ovarian cancer).

The increasing burden of cancers worldwide and the growing awareness among the global population about preventive diagnosis and personalized medicine are the major factors driving the cancer segment during the forecast period. According to the American Cancer Society, in 2021, approximately 1,898,160 new cancer cases and 608,570 cancer deaths were projected to occur in the United States. Additionally, new cancer incidences were estimated to reach 30.2 million by 2040, as per the International Agency for Research on Cancer (IARC). Hence, an increase in the incidence of cancer is expected to contribute significantly to the growth of the segment.

Genetic tests aid in providing information on whether cancer runs in the family and the risk factors associated with the development of cancers in the future among individuals with a family history of cancers. Also, genetic testing is performed in patients who do not respond to chemotherapy to identify the presence of acquired mutations in tumors that are resistant to therapy.

Technological advancements and product launches are expected to drive the growth of the segment studied. For instance, in August 2021, Myriad Genetics launched a polygenic breast cancer risk assessment score, MyRisk Hereditary Cancer test with RiskScore, globally, including in Latin America, validated for women of all ancestries and expanded access to genetic testing. This test makes it easier to understand the current and possible complications of the genetic disorder. Hence, it is widely accepted as a suitable approach for genetic testing. Thus, due to the aforementioned factors, the cancer segment is expected to witness significant growth over the forecast period.

North America Captured the Largest Market Share and is Expected to Retain its Dominance During the Forecast Period

North America dominates the market for genetic testing currently due to the increasing demand for personalized genetic testing services in the region and the rise in the prevalence of chronic and genetic disorders.

According to the American Cancer Society's 2022 report, estimated new cancer cases will reach up to 1,918,030 in the United States by the end of 2022. Among all cancers, breast cancer has the highest incidence, with 290,560 cases, followed by lung cancer (236,740 cases), prostate cancer (268,690 cases), and colon cancer (106,180 cases).

According to the Centers for Disease Control and Prevention (CDC), most clinics and hospitals have restricted in-person delivery of non-essential healthcare services, including genetic counseling, to minimize the transmission of COVID-19. However, deferring genetic counseling can impose difficulties because if genetic testing is not performed on time, it will affect the decision-making during pregnancy or cancer treatment. Hence, though the market studied was hampered during the COVID-19 pandemic, the situation is expected to improve gradually.

The increasing product approvals by the US Food and Drug Administration (FDA) and subsequent launches, along with the high concentration of key players involved in research activities for the innovation of novel genetic testing products, are anticipated to drive market growth in North America. For instance, in October 2021, F. Hoffmann-La Roche Ltd launched AVENIO Tumor Tissue CGP Kit, a comprehensive genomic profiling kit to make tailored cancer research more accessible. This kit provides comprehensive genomic profiling of solid tumors from formalin-fixed paraffin-embedded (FFPE) tissue samples. Additionally, acquisitions and expansions are key reasons for the development of the carrier testing segment in Latin America. For instance, in June 2021, Eurofins acquired DNA Diagnostics Center to extend its genetic testing capabilities and join the consumer testing industry. Thus, due to the growing cancer incidence and strategies taken ahead by key players in the region, the genetic testing market is expected to grow significantly over the forecast period in North America.

Genetic Testing Industry Overview

The genetic testing market is highly competitive and consists of several major players. In terms of market share, a few major players currently dominate the market. The presence of major market players, such as Abbott Laboratories, BioRad Laboratories Inc., F Hoffmann-La Roche, and Illumina Inc., is increasing the overall competitive rivalry of the market. The product advancements and improvements in genetic testing platforms by the major players are increasing competitive rivalry.

Additionally, the key players are involved in strategic alliances, such as acquisitions and partnerships, with companies that complement their product portfolio to expand their presence globally. In September 2021, MedGenome Labs launched its direct-to-consumer category under the brand name Genessense. It will offer specialized, evidence-based genetic screening tests that can be ordered online through the Genessense website or via e-commerce platforms in the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Emphasis on Early Disease Detection and Prevention

- 4.2.2 Growing Demand for Personalized Medicine

- 4.2.3 Increasing Application of Genetic Testing in Oncology

- 4.3 Market Restraints

- 4.3.1 High Costs of Genetic Testing

- 4.3.2 Social and Ethical Implications of Genetic Testing

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Type

- 5.1.1 Carrier Testing

- 5.1.2 Diagnostic Testing

- 5.1.3 New-born Screening

- 5.1.4 Predictive and Presymptomatic Testing

- 5.1.5 Prenatal Testing

- 5.1.6 Other Types

- 5.2 By Disease

- 5.2.1 Alzheimer's Disease

- 5.2.2 Cancer

- 5.2.3 Cystic Fibrosis

- 5.2.4 Sickle Cell Anemia

- 5.2.5 Duchenne Muscular Dystrophy

- 5.2.6 Thalassemia

- 5.2.7 Huntington's Disease

- 5.2.8 Rare Diseases

- 5.2.9 Other Diseases

- 5.3 By Technology

- 5.3.1 Cytogenetic Testing

- 5.3.2 Biochemical Testing

- 5.3.3 Molecular Testing

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 23&Me Inc.

- 6.1.2 Abbott Laboratories

- 6.1.3 Myriad Genetics Inc.

- 6.1.4 Danaher Corporation

- 6.1.5 Illumina Inc.

- 6.1.6 DiaSorin Spa (Luminex Corporation)

- 6.1.7 BioRad Laboratories Inc.

- 6.1.8 PerkinElmer Inc.

- 6.1.9 Quest Diagnostics Incorporated

- 6.1.10 F. Hoffmann-La Roche Ltd

- 6.1.11 Eurofins Scientific

- 6.1.12 Qiagen NV