|

市場調査レポート

商品コード

1849830

養豚用飼料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Swine Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 養豚用飼料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月27日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

概要

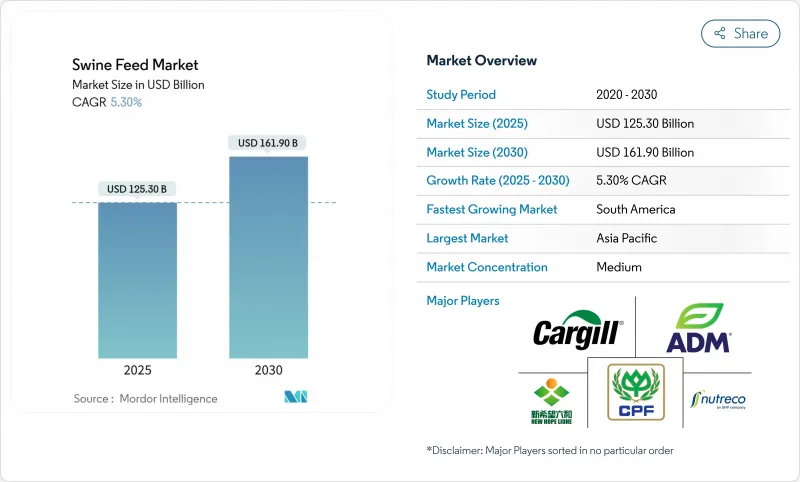

養豚用飼料市場規模は2025年に1,253億米ドルに達し、2030年にはCAGR 5.3%で成長し1,619億米ドルに達すると予測されます。

中国の回復力、ブラジルの輸出主導の拡大、精密栄養の持続的導入が、養豚用飼料市場の健全な軌道を支えています。欧州のCAGR 3.1%は、持続可能性規制の強化とコストインフレが利幅を圧迫しながらも技術革新に拍車をかけていることを反映しています。南米は、ブラジルの豚肉輸出能力の拡大と穀物供給を確保する新しい粉砕プラントを背景に、CAGR 5.4%を記録します。機能性添加物、昆虫タンパク質、単細胞タンパク質は、生産者が腸の健康増進、抗生物質の代替、二酸化炭素排出量の削減を求めるにつれて勢いを増しています。一方、中国産リジンの輸入に対する反ダンピング関税はアミノ酸価格を引き上げ、現地調達または発酵させた代替品への需要を強化し、養豚用飼料市場に新たな複雑さを加えます。

世界の養豚用飼料市場の動向と洞察

高付加価値動物性タンパク質への需要の高まり

新興市場の消費者は豚肉へのシフトを続けており、疾病の発生で供給が一時的に抑制されても配合飼料の生産量を引き上げています。米国農務省は、2025年の世界の豚肉生産量はアジアを中心に1.7%増加すると予想しており、その結果、飼料需要も拡大します。ブラジルはその乗数効果を示しています。2025年に輸出が6.6%増の122万トンになると予測されることは、国内の飼料工場が畜舎の在庫を確保するために生産能力を拡大しなければならないことを意味します。商業畜舎では、豚肉生産高が1%ポイント上昇するごとに飼料量が1.5~2ポイント増加します。成熟経済におけるプレミアム製品の位置付けは、利幅に見合ったプレミアムを要求する特殊配合の必要性を強めています。

畜産業の工業化

大規模な商業農場は、標準化された栄養密度の高い飼料を指示し、投入量を安定させながらもメーカーのマージンを圧縮するような長期契約を交渉します。2024年の豚肉生産量が全体として1.5%減少したにもかかわらず、商業用畜舎は拡大し、規模の効率化が進んでいることを裏付けています。精密ディスペンサーと電子母豚給餌器は、農場が豚1頭当たり15~20%多く給餌することを可能にし、しかも転換率を最大30%改善します。ある研究では、泌乳雌豚の精密給餌は、従来の慣行に対して0.33キロの離乳体重を押し上げることがわかりました。

原材料価格の乱高下と供給ショック

穀物の乱高下は、洪水が穀粒の品質を低下させ、貯蔵費用を膨張させるため、利幅を圧迫します。2024年米国産トウモロコシは大雨に見舞われ、カビ毒のリスクが高まり、乾燥と洗浄のコストが増加しました。エジプトの飼料価格の高騰は、輸入の多い地域が、家畜のコストに直接波及する通貨の下落にいかに耐えているかを示しています。ヘッジ・プログラムのない小規模工場が最初にピンチを感じ、減産やレシピの格下げを促し、業績を危うくします。

セグメント分析

穀類は養豚用飼料の基幹製品であり続け、競争力のある価格設定とどこにでもあるサプライチェーンにより、2024年には養豚用飼料市場の42%を占める。小麦ミドリングやジスチラーズ・グレインなどの穀物製品別は、エタノールの拡大や費用対効果の高い繊維源の探索に後押しされ、CAGR 6.1%の成長軌道にあります。油糧種子ミールは、南米で破砕能力が拡大し、近代的な遺伝学に沿ったより高リシンの大豆ミールが供給されるため、CAGR 7.4%の伸びを示します。油脂はエネルギー密度の高い飼料に配合されるため、CAGR 5.0%の安定した伸びを示します。糖蜜は嗜好性とダストコントロールというニッチな役割を維持し、数量は安定しています。全体として、原材料の多様化は、製造業者が価格変動をヘッジし、持続可能性の誓約に沿うことを支援し、養豚用飼料市場の適応力を強化しています。

地域分析

アジア太平洋地域は、中国、インド、東南アジア諸国における大規模な養豚生産能力と商業的農業経営の拡大を反映して、2024年の市場シェア46%で世界の養豚用飼料市場を独占しています。中国の豚肉生産量は2024年に4年ぶりに1.5%減少するが、この縮小は飼料効率と生産システムの根本的な構造改善を覆い隠しており、市場の持続的成長を可能にしています。この地域の飼料消費パターンは、アフリカ豚熱の圧力にもかかわらず回復力を示しており、中国の飼料生産量は2024年に660万トン減少する一方、商業事業者は小規模生産者から市場シェアを獲得するために生産能力の拡大を続けています。精密畜産技術の導入は地域全体で加速しており、スマート養豚技術はベトナムの零細農家から商業経営への移行で特に有望視されています。

南米は2030年までのCAGRが5.4%で、最も急成長する地域市場に浮上します。これはブラジルの豚肉輸出能力の拡大とアルゼンチンの動物栄養規制の近代化が後押ししています。ブラジルの豚肉輸出量は2025年には6.6%増の122万トンになると予測され、飼育事業を支え、国内外からの需要を満たすために、国内飼料生産量を約2.8%増加させる必要があります。この地域の競争優位性は、労働コストと飼料コストの低さに起因しており、GSIのような企業は、ポストハーベスト・システムの自動化ソリューションの拡大を通じて、5年以内に2億米ドル近い収益を目標としています。南米が2023年に15万5,875トン(豚用8万9,067トンを含む)で世界最大の飼料生産国に浮上するのは、この地域が世界のタンパク質サプライ・チェーンにおいて戦略的に重要であり、従来のサプライヤーに影響を及ぼす貿易の混乱から利益を得る可能性があることを反映しています。

北米と欧州のCAGRはそれぞれ4.2%と3.1%と、より緩やかな成長率を示しているが、これは市場の成熟度と規制の複雑さを反映しており、数量拡大よりも技術革新が優先されるためです。米国の豚肉業界は、生産量の増加が予測される2025年に向けて慎重な楽観論を示しているが、生産費の66%を占める飼料コストは引き続き利幅を圧迫しています。欧州市場は、持続可能性規制とASF対策による特別な課題に直面しており、EUの豚肉価格は、生産コストが高水準で安定するにつれて、2025年まで高止まりすると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 高価値の動物性タンパク質の需要増加

- 畜産の工業化

- 豚肉の品質と安全性に対する意識の高まり

- 機能性飼料添加物の急速な導入

- 遺伝子によるアミノ酸必要量の急増

- ASFとPEDに対する飼料バイオセキュリティの革新

- 市場抑制要因

- 原材料価格の変動と供給ショック

- 厳格な抗生物質および添加物規制

- アフリカ豚コレラに関連した集団の収縮

- 反ダンピング関税がリジン価格を高騰させる

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 材料別

- 穀類

- 穀類副産物

- 油糧種子粕

- オイル

- 糖蜜

- その他の材料

- サプリメント

- 抗生物質

- ビタミン

- 抗酸化物質

- アミノ酸

- 酵素

- 酸性化剤

- その他のサプリメント

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Cargill Inc.

- Charoen Pokphand Foods

- Archer Daniels Midland Company

- New Hope Group

- Nutreco NV

- DSM-Firmenich

- BASF SE

- Evonik Industries

- ForFarmers BV

- De Heus BV

- Alltech Inc.

- Ajinomoto Animal Nutrition

- Guangdong Haid Group

- KENT Nutrition Group

- J.D. Heiskell and Co.

- Phibro Animal Health