|

|

市場調査レポート

商品コード

1692137

半導体産業用フロー制御- 市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Flow Control In The Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体産業用フロー制御- 市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 191 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

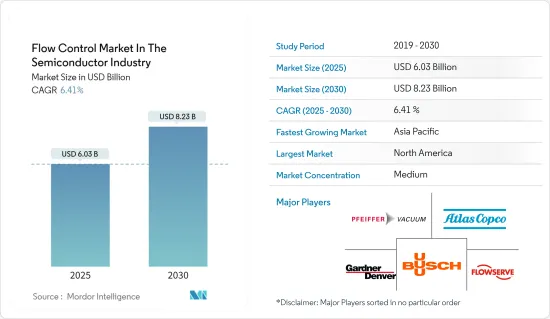

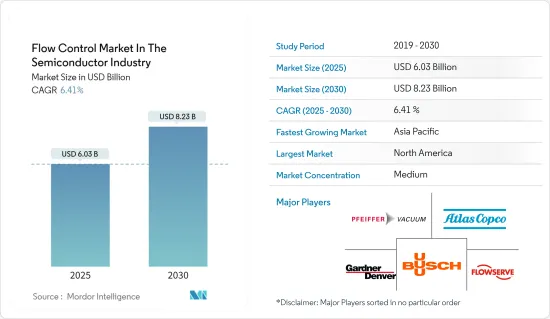

半導体産業用フロー制御市場は、予測期間(2025年~2030年)のCAGR 6.41%で、2025年の60億3,000万米ドルから2030年には82億3,000万米ドルに成長すると予測されます。

主なハイライト

- 厳格なプロセス制御の必要性を強調する需要の高まりが、新しい半導体製造施設への投資を後押ししています。半導体産業では、正確なフロー制御が極めて重要です。プラズマエッチングや化学気相成長法(CVD)のようなプロセスでは、複数のガスが正確に相互作用して本質的な層や膜が形成されます。ガスの流量はわずかな偏差でもプロセスの失敗の原因となるため、正確なガス計量が不可欠です。

- 半導体およびエレクトロニクス産業における著しい進歩が、産業の成長を促進すると予想されます。在宅勤務のライフスタイルの定着も、COVID-19の大流行による電子機器需要の急増に拍車をかける可能性があります。さらに、技術の進歩と確立された流通網により、欧米の電子機器メーカーは新興国での事業拡大に努めています。さらに、中国やインドの若者の間でコンシューマー・エレクトロニクスの人気が高まっていることも、半導体チップの需要を押し上げ、ひいては市場の成長に好影響を与えると予想されます。

- 半導体産業の需要拡大が市場の成長を支えています。例えば、2024年5月、半導体産業協会は、予測期間中の世界の半導体市場の成長に伴い、米国は2032年までに半導体製造能力を3倍に引き上げると予測していると報告しました。このことは、半導体産業におけるフロー制御装置の需要を高めることにより、調査された市場を支援するであろう。

- しかし、半導体製造に関わる高コストは、市場成長の主要な課題として残ると予想されます。さらに、半導体産業に関連するアプリケーションの重要な性質を考慮すると、フロー制御装置/コンポーネントの設計に関わる複雑さも、調査した市場の成長に対する課題となっています。市場は統合され、大手企業は買収戦略をとっているため、小規模企業の成長が課題となり、市場全体の成長に影響を与えると思われます。

- COVID-19パンデミックの初期段階において、市場は世界のロックダウンを含む混乱に直面し、チップメーカーのサプライチェーンと生産能力に著しい支障をきたしました。しかし、半導体チップの需要はパンデミックの最中とその後に急増し、この動向は予測期間中も続くと予想されます。このような需要の増加は、新たな生産設備への投資に拍車をかけ、フロー制御ソリューションの必要性を煽っています。

フロー制御市場の動向

メカニカルシールが最速の市場成長を記録

- メカニカルシールの主な機能は、シャフトと容器の隙間から流体やガスが漏れるのを防ぐことです。メカニカルシールは、カーボンリングで隔てられた2つの面で構成されています。回転する機器は据置型である最初の面に接触します。さらに、シールリング(最初の面)は、バネ、ベローズ、または機器内の流体によって発生する機械的な力が作用するシールの主な構成要素です。半導体産業では、シールは必ず、腐食性の高いガス、液体、気体、プラズマに耐える必要がある処理システムの領域に収容され、多くの場合、真空状態や高温状態にあります。

- メカニカルシールの分野は近年大きく成長しており、主に半導体製造設備への投資の増加により、今後も成長が続くと予想されています。新興国では、AI、ML、IoTの台頭、スマートフォンや家電製品の開発により、半導体産業のさらなる発展政策と投資が促されると予測されます。カートリッジシール、バランスシール、アンバランスシール、プッシャーシール、ノンプッシャーシール、従来型シールは、市場拡大を牽引するメカニカルシールの一例です。

- 半導体製品の製造において、シールの信頼性とコンタミネーションの低減は極めて重要です。薬液ろ過、薬液移送、AODDポンプ用シール、シリコンウエハー製造は、メカニカルシールが最良の選択肢であることが証明されている重要な半導体アプリケーションです。

- 蒸着、エッチング、アッシュ/ストリップ、プラズマ、熱処理またはアニーリングは、エラストマーシール材料にとって最も困難な環境を構成する相乗的なプロセス技術です。これらは半導体集積回路の製造時に頻繁に遭遇します。クリーンルームで製造されたシールは、微粒子や微量金属汚染が少なく、歩留まり損失や化学的侵食率を最小限に抑えることができます。これらのシールは、システム稼働時間の延長、平均故障間隔(MTBF)の延長、ウェット・クリーンやメカニカル・クリーンの頻度の減少、消耗品コスト(CoC)の低減による所有コスト(CoO)の削減などのメリットをもたらします。

- デジタル化と自動化の動向は、半導体の需要を大幅に高めています。例えば、2023年9月、Guangzhou JST Seals Technologyは、すべてのゴム製Oリングおよびガスケット材料の中で最高温度(最高620°F)と最も一般的な耐薬品性を提供するFFKM Oリングを発売しました。これらは、半導体製造工程の高温熱風の環境下で使用でき、最高使用温度は315℃です。このような開発は、半導体産業におけるメカニカルシール装置の需要の伸びを示しており、これは半導体製造への投資の増加と世界の売上の増加に沿ったものです。

市場成長に大きく貢献する米国

- 米国では、米国CHIPS・科学法が提案されて以来、国内チップ製造施設の提案が増加しています。新工場の開発や研究開発プロジェクトは、OCM(Original Chip Manufacturer)を国内に誘致するための投資を受けており、米国各州は追加融資を義務付ける法律を施行し、市場開拓におけるフロー制御部品の需要を支えています。

- 米国は、チップ設計、電子設計自動化(EDA)、半導体製造装置など、半導体技術の高付加価値分野で強力なリーダーシップを発揮し、世界のバリューチェーンに貢献し続ける計画を発表しました。これは、国内の半導体製造装置の事業所の成長を支え、市場の成長を促進すると思われます。

- 世界の半導体企業は米国での事業拠点を拡大しており、これは米国市場に成長機会をもたらすと思われます。例えば、2024年4月、チップ企業の台湾積体電路製造(TSMC)はアリゾナ州に第3工場を建設する計画を発表し、米国への総投資額を400億米ドルから650億米ドルに引き上げました。

- 同国政府は米国での半導体製造を優先し、チップサプライチェーンを強化しています。また、サプライチェーンをさらに強化し、R&Dとチップ設計を支援し、半導体労働力を成長させ、CHIPSが同国の経済と国家安全保障に最大限の利益をもたらすようにする政策行動を明らかにしており、これは同国の半導体エコシステムを助け、将来の市場成長を促進することになります。

- 米国消費者技術協会は、パーソナルコンピュータ、スマートフォン、その他のガジェットの販売増加に支えられ、米国の消費者技術の小売売上高は2.8%増加し、2024年には5,120億米ドルに達すると推定しています。民生用電子機器、スマートフォン、パーソナル・コンピューティング・デバイスの製造に半導体が応用されるため、半導体市場の需要を煽ることになります。これにより、予測期間中、米国の半導体産業におけるフロー制御市場に成長機会が生まれると思われます。

フロー制御業界の概要

フロー制御機器プロバイダー間の競争企業間の敵対関係は、世界的に市場シェアを争う様々な有力ブランドの存在により、緩やかです。近年の真空ポンプの需要は、新興諸国における家電やスマートフォンの普及により急増しています。このため、主要戦略として顧客獲得と販売チャネルの形成に重点が置かれるようになっています。主な市場参入企業には、Pfeiffer Vacuum GmbH、Atlas Copco AB、Gardner Denver、Busch Holding GmbHなどがあります。

- 2024年2月Busch Holding GmbHのBusch Vacuum Solutionsセグメントは、O11Oデジタルサービスの範囲を真空システムにも拡大しました。システム用O11Oにより、真空システム内の複数の真空発生器を同時に監視し、生産プロセスが適切な真空レベルで確実に稼動するよう監視することが可能になります。これにより、生産ダウンタイムのリスクを効果的に最小化し、大幅なコスト削減につながります。PCまたはモバイル機器からアクセス可能なO11O IoTダッシュボードは、包括的なシステム監視のためのユーザーフレンドリーなインターフェースを提供し、市場におけるフロー制御コンポーネントのクロスセリング機会をサポートします。こうした開発は、市場競争力を維持するためにベンダーが製品イノベーションに投資していることを示しています。

- 2023年12月アトラスコプコグループは、外付けギアポンプ、流体計測、バルブ、油圧ドライブ、吐出システムなどの高品質技術を提供するKRACHT GmbH(クラヒト)の買収計画を発表しました。これにより、フロー制御機器市場における今後の成長が期待されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業分析-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- IIoTデジタル化によるエレクトロニクス産業の成長

- 市場の課題

- 市場統合の進展による競争の激化

第6章 半導体産業における真空ポンプとバルブの主な用途

- 真空ポンプ

- 物理蒸着/スパッタリング

- 化学蒸着(プラズマ/亜大気圧)

- 拡散/低圧化学蒸着(LPCVD)

- 原子層蒸着

- ドライストリップとクリーニング

- 誘電体エッチング

- 導体およびポリシリコンエッチング

- 原子層エッチング

- イオン注入

- ロードロックと転送

- 臨界寸法走査電子顕微鏡

- フロントオープニングユニバーサルポッドでの粒子モニタリング

- 空気中の分子汚染

- バルブ

- 薬液供給

- ポリシリコン・プロセス

- ウエハー製造

- 化学薬品製造

- スラリー供給

- 溶剤供給

- 水治療

- リソグラフィー

- エッチング

- CMP

- 化学薬品とスラリーの回収

第7章 市場セグメンテーション

- コンポーネントのタイプ

- 真空

- バルブ

- ボール

- バタフライ

- ゲート

- グローブ

- その他のバルブ

- メカニカルシール

- 国別

- 米国

- 中国

- 台湾

- 韓国

- 日本

- 世界のその他の地域

第8章 競合情勢

- 企業プロファイル- 真空ポンプ

- Pfeiffer Vacuum GmbH

- Atlas Copco AB

- Gardner Denver(ingersoll Rand Inc.)

- Flowserve Corporation

- Busch Holding Gmbh

- Kurt J. Lesker Company

- 企業プロファイル- バルブ

- Fujikin Incorporation

- GEMU Holding GmbH & Co.KG

- VAT Vakuumventile AG

- Swagelok Company

- Festo SE & Co. KG

- GCE Group

- 企業プロファイル- メカニカルシール

- DuPont De Nemours Inc.

- EKK Eagle SC Inc.

- EnPro Industries Inc.

- Freudenberg Group

- AESSEAL PLC

- Parker-Hannifin Corporation

- Greene, Tweed & Co. Inc.

第9章 投資と将来展望

The Flow Control Market In The Semiconductor Industry is expected to grow from USD 6.03 billion in 2025 to USD 8.23 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Key Highlights

- Increased demand highlighting the need for stringent process control drives investments in new semiconductor production facilities. Precise flow control is crucial in the semiconductor industry. Processes like plasma etch and chemical vapor deposition (CVD) depend on the exact interaction of multiple gases to create essential layers or films. Even a slight deviation in gas flow can cause process failure, making accurate gas metering essential.

- Significant advancements in the semiconductor and electronics industries are expected to drive industrial growth. The strong adoption of the work-from-home lifestyle may also add to the surge in demand for electronic equipment caused by the COVID-19 pandemic. Furthermore, with technological advancements and well-established distribution networks, European and US electronics manufacturers strive to expand operations in emerging nations. Furthermore, the increasing popularity of consumer electronics among China's and India's youth is expected to boost the demand for semiconductor chips, which, in turn, will have a positive impact on the market's growth.

- The growing demand for the semiconductor industry supports the market's growth. For instance, in May 2024, the Semiconductor Industry Association reported that the United States is projected to triple its semiconductor manufacturing capacity by 2032, in line with the semiconductor market's growth worldwide during the forecast period. This would support the market studied by enhancing the demand for flow control equipment in the semiconductor industry.

- However, the higher cost involved with semiconductor manufacturing is anticipated to remain among the major challenging factors for the growth of the market. Additionally, the complexity involved in designing flow control devices/components, considering the critical nature of applications associated with the semiconductor industry, also challenges the growth of the market studied. The market has become consolidated, and significant players are following an acquisition strategy, creating a challenge for the growth of small companies, which would impact the overall market growth.

- During the initial phase of the COVID-19 pandemic, the market faced disruptions, including global lockdowns, which notably hampered chip manufacturers' supply chains and production capacities. Yet, the demand for semiconductor chips surged during and after the pandemic, a trend expected to persist through the forecast period. This increasing demand is poised to spur investments in new production facilities, fueling the need for flow control solutions.

Flow Control Market Trends

Mechanical Seals to Register the Fastest Market Growth

- A mechanical seal's primary function is to prevent fluid or gas leakage through the clearance between the shaft and the container. Mechanical seals are made up of two faces separated by carbon rings. The revolving equipment comes in touch with the initial face, which is stationary. Furthermore, the seal ring (first face) is the main component of the seal on which the mechanical force generated by springs, bellows, or fluids in the equipment acts. In the semiconductor industry, seals are invariably housed in areas of the processing system where they need to withstand highly corrosive gases, liquids, gases, and plasmas, often in vacuum conditions or at elevated temperatures.

- The mechanical seal segment has grown substantially in recent years and is expected to continue growing over the coming years, primarily due to increasing investments in semiconductor manufacturing facilities. In emerging nations, the rise of AI, ML, and IoT, as well as smartphone and consumer electronics development, is predicted to prompt further development policies and investments in the semiconductor industry. Cartridge seals, balanced and unbalanced seals, pusher and non-pusher seals, and conventional seals are examples of mechanical seals driving the market's expansion.

- In the fabrication of semiconductor products, seal reliability and contamination reduction are crucial. Chemical filtration, chemical transfer, AODD pump sealing, and silicon wafer fabrication are essential semiconductor applications where mechanical seals have proven to be the best option.

- Deposition, etch, ash/strip, plasma, and heat processing or annealing are synergistic process technologies that constitute some of the most difficult environments for elastomer seal materials. These are frequently encountered during the fabrication of semiconductor-integrated circuits. Clean-room manufactured seals with low particle and trace metal contamination are used to minimize yield loss and chemical erosion rates. These seals can provide benefits such as increased system up-time, increased mean time between failure (MTBF), decreased wet clean or mechanical clean frequency, and reduced cost of ownership (CoO) through lower consumable costs (CoC).

- The digitization and automation trends have significantly enhanced the demand for semiconductors. For instance, in September 2023, Guangzhou JST Seals Technology Co. Ltd launched its FFKM O-rings to provide the highest temperature (up to 620 °F) and the most common chemical resistance among all rubber O-ring and gasket materials. These can be used in the environment of high-temperature hot air in the semiconductor manufacturing process, and the maximum operating temperature is 315 °C. Such developments show the growth in the demand for mechanical sealing equipment in the semiconductor industry, which is in line with the growing investments in semiconductor manufacturing and their increasing sales worldwide.

The United States Expected to Contribute Significantly to Market Growth

- The United States has registered increased domestic chip manufacturing facility proposals since the US CHIPS and Science Act was proposed. Developing new plants and research and design projects have received investments to entice original chip manufacturers (OCMs) to the country, and US states have implemented legislation requiring them to provide additional financing, which would support the demand for flow control components in the market.

- The United States has announced plans to continue contributing to the global value chain with strong leadership positions in high-value-added areas of semiconductor technology, including chip design, electronic design automation (EDA), and semiconductor manufacturing equipment. This would support the growth of semiconductor manufacturing units' establishments in the country and fuel market growth.

- Global semiconductor companies are expanding their footprints in the country, which would create a growth opportunity for the US market. For instance, in April 2024, chip company Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to build a third factory in Arizona, raising its total investment in the United States from USD 40 billion to USD 65 billion, which shows future market growth opportunities for flow control components in the country.

- The country's government has prioritized semiconductor manufacturing in the United States and reinforced chip supply chains. It also identifies policy actions that will further strengthen supply chains, support R&D and chip design, grow the semiconductor workforce, and ensure CHIPS delivers maximum benefits to the country's economic and national security, which would help the semiconductor ecosystems in the country and fuel market growth in the future.

- The Consumer Technology Association estimated US retail sales of consumer technologies to rise 2.8% and reach USD 512 billion in 2024, supported by the increasing sales of personal computers, smartphones, and other gadgets. This would fuel the demand for the semiconductor market due to the application of semiconductors in manufacturing consumer electronics, smartphones, and personal computing devices. This would create growth opportunities for the flow control market in the semiconductor industry in the United States during the forecast period.

Flow Control Industry Overview

The competitive rivalry among flow control equipment providers is moderate, owing to the presence of various dominant brands competing for market share globally. The demand for vacuum pumps has spiked in recent years due to the massive penetration of consumer electronics and smartphones across developing countries. This has led to an increased focus on customer acquisition and formulating distribution channels as key strategies. Some key market players include Pfeiffer Vacuum GmbH, Atlas Copco AB, Gardner Denver, and Busch Holding GmbH.

- February 2024: Busch Holding GmbH's Busch Vacuum Solutions segment expanded its range of O11O Digital Services to include vacuum systems. O11O for systems enables the simultaneous monitoring of multiple vacuum generators in a vacuum system and the supervision of the production process to ensure it runs reliably and with the correct vacuum levels. This effectively minimizes production downtime risk and leads to significant cost savings. Accessible via a PC or a mobile device, the O11O IoT dashboard presents a user-friendly interface for comprehensive system monitoring and to support the company's cross-selling opportunity for flow control components in the market. Such developments demonstrate market vendors' investments in product innovations to remain competitive.

- December 2023: Atlas Copco Group announced plans to acquire KRACHT GmbH (Kracht), a manufacturer of high-quality technologies, including external gear pumps, fluid measurement, valves, hydraulic drives, and dosing systems. This is expected to support the company's future growth in the flow control equipment market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Analysis - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Electronics Industry Driven by IIoT Digitalization

- 5.2 Market Challenges

- 5.2.1 Increasing Market Consolidation Expected to Create Stiff Competition

6 MAJOR APPLICATIONS OF VACUUM PUMPS AND VALVES IN THE SEMICONDUCTOR INDUSTRY

- 6.1 Vacuum Pumps

- 6.1.1 Physical Vapor Deposition/Sputtering

- 6.1.2 Chemical Vapor Deposition (Plasma/Sub-atmospheric)

- 6.1.3 Diffusion/Low Pressure Chemical Vapor Deposition (LPCVD)

- 6.1.4 Atomic Layer Deposition

- 6.1.5 Dry Stripping and Cleaning

- 6.1.6 Dielectric Etch

- 6.1.7 Conductor and Polysilicon Etch

- 6.1.8 Atomic Layer Etching

- 6.1.9 Ion Implantation

- 6.1.10 Load Lock and Transfer

- 6.1.11 Critical Dimension Scanning Electron Microscope

- 6.1.12 Particle Monitoring in Front Opening Universal Pods

- 6.1.13 Airborne Molecular Contamination

- 6.2 Valves

- 6.2.1 Chemical Supply

- 6.2.2 Polysilicon Process

- 6.2.3 Wafer Manufacturing

- 6.2.4 Chemical Manufacturing

- 6.2.5 Slurry Supply

- 6.2.6 Solvent Supply

- 6.2.7 Water Treatment

- 6.2.8 Lithography

- 6.2.9 Etching

- 6.2.10 CMP

- 6.2.11 Chemical and Slurry Recovery

7 MARKET SEGMENTATION

- 7.1 Type of Component

- 7.1.1 Vacuum

- 7.1.2 Valves

- 7.1.2.1 Ball

- 7.1.2.2 Butterfly

- 7.1.2.3 Gate

- 7.1.2.4 Globe

- 7.1.2.5 Other Valves

- 7.1.3 Mechanical Seals

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 China

- 7.2.3 Taiwan

- 7.2.4 South Korea

- 7.2.5 Japan

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Vacuum Pumps

- 8.1.1 Pfeiffer Vacuum GmbH

- 8.1.2 Atlas Copco AB

- 8.1.3 Gardner Denver (ingersoll Rand Inc.)

- 8.1.4 Flowserve Corporation

- 8.1.5 Busch Holding Gmbh

- 8.1.6 Kurt J. Lesker Company

- 8.2 Company Profiles - Valves

- 8.2.1 Fujikin Incorporation

- 8.2.2 GEMU Holding GmbH & Co.KG

- 8.2.3 VAT Vakuumventile AG

- 8.2.4 Swagelok Company

- 8.2.5 Festo SE & Co. KG

- 8.2.6 GCE Group

- 8.3 Company Profiles - Mechanical Seals

- 8.3.1 DuPont De Nemours Inc.

- 8.3.2 EKK Eagle SC Inc.

- 8.3.3 EnPro Industries Inc.

- 8.3.4 Freudenberg Group

- 8.3.5 AESSEAL PLC

- 8.3.6 Parker-Hannifin Corporation

- 8.3.7 Greene, Tweed & Co. Inc.