|

市場調査レポート

商品コード

1640348

農業廃水処理-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Agricultural Wastewater Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 農業廃水処理-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

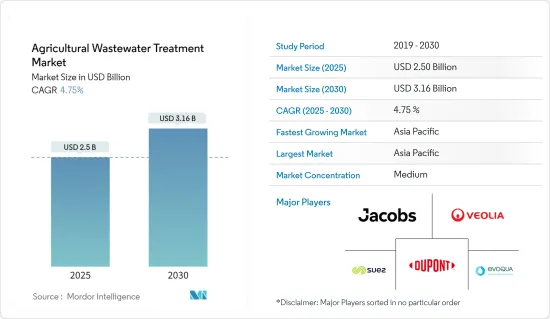

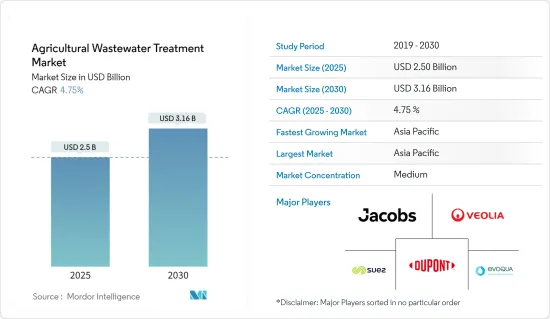

農業廃水処理市場規模は2025年に25億米ドルと推定され、予測期間(2025~2030年)のCAGRは4.75%で、2030年には31億6,000万米ドルに達すると予測されます。

COVID-19の発生は、農業や水処理などさまざまな産業に短期的・長期的な影響をもたらし、市場に影響を与えました。農業は、サプライチェーンの混乱や化学品製造会社の生産停止により、広く影響を受けました。これはロックダウンと労働力不足によるもので、そのため市場に悪影響を及ぼしています。例えば、世界的に見ると、欧州でのロックダウンは食品のサプライチェーンを大きく混乱させました。シンジェンタによると、欧州の大規模農業企業の約46%がCOVID-19パンデミックの影響を受けました。

主要ハイライト

- 急速に減少する淡水資源と農業用水需要の増加が、研究市場の需要を牽引すると考えられます。

- その反面、農業廃水処理に関する意識の低さが市場成長の妨げになると予想されます。

- 水処理技術に関する投資の成長と活発な研究は、調査対象市場に大きな成長機会をもたらすと予想されます。

農業廃水処理市場の動向

非農作物セグメントが市場を独占する

- 非農作物セグメントは、農業廃水処理の世界最大の用途であり、安定したペースで増加しています。このセグメントには主に飼料生産、酪農場、養鶏場が含まれます。植物性食品に比べてカロリーとタンパク質の供給量が少ないにもかかわらず、家畜、肉、乳製品は依然として消費量の点で最大のシェアを占めています。

- アジア太平洋は、鶏肉という点では、加工食品にとって世界で2番目に活発な地域です。新製品開発(NPD)は、中国、タイ、韓国、ベトナム、フィリピンが主導するこの地域の加工肉、鶏肉、魚製品のイノベーションの24%を占めています。

- アフリカ豚コレラ熱(ASF)は、アジアにおける鶏肉の拡大をさらに刺激しました。東南アジアの鶏肉生産は過去10年間で56%拡大し、2028年には1,230万トンに達すると予想されています。

- カナダ統計局によると、カナダにおける鶏肉の総売上高は前年比14.0%増の42億米ドル(2022年)でした。カナダでは、鶏肉生産が鶏肉生産全体の90.1%を占めています。

- 上記のすべての要因が、予測期間中に非農作物用途セグメントを牽引しています。

中国がアジア太平洋市場を独占する

- 中国は世界全体の農地面積の約7%を占め、世界人口の22%を養っています。同国は、米、綿花、ジャガイモ、その他の野菜など、様々な作物の最大の生産国です。そのため、農業廃水処理の需要が急速に高まっています。

- 中国の人口は過去10年間で驚異的なスピードで増加し、現在では人口の半数以上が都市部に住んでいます。政府が経済成長を推進する中、都市化が進んでいます。このため、農業用廃水インフラの改善需要が高まると予想されます。

- 中国国家統計局(CNBS)によると、中国の夏作の播種面積は前年比0.3%増の2,653万ヘクタールに達しました。これは前年比9万2100ヘクタールの増加です。

- 米国農務省(USDA)は、鶏肉製品、特に白色ブロイラー製品の需要が2023年には1,447万5,000トンに達すると予測しています。

- 経済複雑性観測所(OEC)の報告によると、2023年3月、中国の鶏肉輸出額は6,300万米ドル、輸入額は4億1,000万米ドルに達しました。鶏肉の主要輸出先は香港、マカオ、バーレーン、グルジア、モンゴルです。

- 以上の点から、中国がアジア太平洋を支配すると予想されます。

農業廃水処理産業概要

農業廃水処理市場はセグメント化されており、大手多国籍企業が存在します。市場の主要参入企業(順不同)には、Veolia Environnement SA、Suez SA、Evoqua Water Technologies LLC、DuPont、Jacobsなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 急速に減少する淡水リソース

- 農業用水需要の増加

- その他の促進要因

- 抑制要因

- 農業廃水処理に関する意識の低さ

- その他の抑制要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(市場規模(金額ベース))

- 技術

- 物理的ソリューション

- 化学的ソリューション

- 生物学的ソリューション

- 汚染源

- 点源

- 非点源

- 用途

- 作物

- 非農作物

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- AECOM

- Aquatech International LLC

- BASF SE

- DuPont

- Evoqua Water Technologies LLC

- IDE

- Jacobs

- Lindsay Corporation

- Louis Berger International

- Nouryon

- Organo Corporation

- OriginClear

- SUEZ

- Veolia

第7章 市場機会と今後の動向

- 水処理技術への投資の拡大と活発な研究

- その他の機会

The Agricultural Wastewater Treatment Market size is estimated at USD 2.50 billion in 2025, and is expected to reach USD 3.16 billion by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

The COVID-19 outbreak brought several short-term and long-term consequences in various industries, such as agriculture, and water treatment affecting the market. The agriculture industry was widely impacted due to supply chain disruption and a halt in the production of chemical manufacturing companies. It is due to lockdown and workforce shortages, thus, adversely affecting the market. For instance, worldwide, the lockdowns in Europe greatly disrupted food supply chains. According to Syngenta, about 46% of large European farming businesses were impacted by the COVID-19 pandemic.

Key Highlights

- Rapidly diminishing freshwater resources and rising agricultural water demand are likely to drive the demand for the studied market.

- On the flip side, a dearth of awareness regarding agriculture wastewater treatment is expected to hinder the market growth.

- Growing investments and active research on water treatment technologies are expected to provide a major growth opportunity for the market studied.

Agricultural Wastewater Treatment Market Trends

Non-Crop Segment to Dominate the Market

- Non-crop is the largest application for agricultural wastewater treatment across the world and is increasing at a steady rate. This segment primarily includes feed production and also dairy farms, and poultry. Despite low calorie and protein supply as compared to plant-based food, livestock, meat, and dairy still hold the largest share in terms of consumption.

- Asia-Pacific is the second-most active region for processed food globally in terms of poultry. New product development (NPD) accounts for 24% of processed meat, poultry, and fish product innovations in the region, led by China, Thailand, South Korea, Vietnam, and the Philippines.

- African swine fever (ASF) further stimulated chicken expansion in Asia. Southeast Asia's poultry production expanded by 56% in the last decade and is expected to reach 12.3 million metric tons by 2028.

- According to Statistics Canada, the total sales of poultry in Canada increased by 14.0% from the previous year to USD 4.2 billion in 2022. In Canada, chicken production accounted for 90.1% of the total poultry production.

- All the above-mentioned factors are driving the non-crop application segment during the forecast period.

China to Dominate the Asia-Pacific Market

- China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world population. The country is the largest producer of various crops, including rice, cotton, potatoes, and other vegetables. Hence, the demand for agricultural wastewater treatment is rapidly increasing in the country.

- The population of China has grown at a staggering rate in the past decade, and more than half of the population now lives in cities. With the government promoting economic growth, urbanization is on the rise. This is expected to increase the demand for improvement in agricultural wastewater infrastructure.

- According to the Chinese National Bureau of Statistics (CNBS), China's summer crop sown area increased by 0.3% year on year, reaching 26.53 million hectares. This represents an increase of 92,100 hectares compared to the previous year.

- The United States Department of Agriculture (USDA) projects that the demand for poultry products, particularly white broiler products, will reach 14.475 million metric tons in 2023.

- In March 2023, China's poultry meat exports amounted to USD 63 million, while imports reached USD 410 million, as reported by Observatory of Economic Complexity (OEC). The main destinations for poultry meat exports were Hong Kong, Macau, Bahrain, Georgia, and Mongolia.

- Based on the aforementioned aspects, China is expected to dominate the Asia-Pacific region.

Agricultural Wastewater Treatment Industry Overview

The agriculture wastewater treatment market is fragmented, with the presence of majorly multinational players. Some of the major players in the market (not in any particular order) include Veolia Environnement SA, Suez SA, Evoqua Water Technologies LLC, DuPont, and Jacobs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Diminishing Fresh Water Resources

- 4.1.2 Rising Agricultural Water Demand

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Dearth of Awareness regarding Agriculture Wastewater Treatment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Physical Solutions

- 5.1.2 Chemical Solutions

- 5.1.3 Biological Solutions

- 5.2 Pollutant Source

- 5.2.1 Point Source

- 5.2.2 Nonpoint Source

- 5.3 Application

- 5.3.1 Crop

- 5.3.2 Non-Crop

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AECOM

- 6.4.2 Aquatech International LLC

- 6.4.3 BASF SE

- 6.4.4 DuPont

- 6.4.5 Evoqua Water Technologies LLC

- 6.4.6 IDE

- 6.4.7 Jacobs

- 6.4.8 Lindsay Corporation

- 6.4.9 Louis Berger International

- 6.4.10 Nouryon

- 6.4.11 Organo Corporation

- 6.4.12 OriginClear

- 6.4.13 SUEZ

- 6.4.14 Veolia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investments and Active Research on Water Treatment Technologies

- 7.2 Other Opportunities