|

|

市場調査レポート

商品コード

1690148

直流サーキットブレーカ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)DC Circuit Breaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 直流サーキットブレーカ:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 220 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

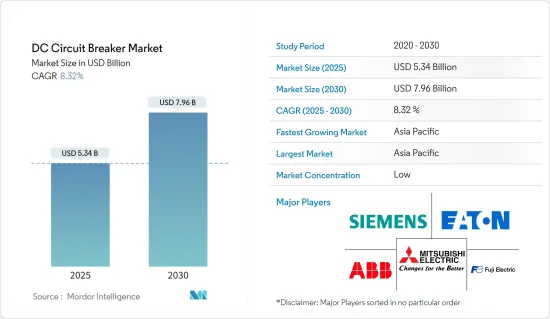

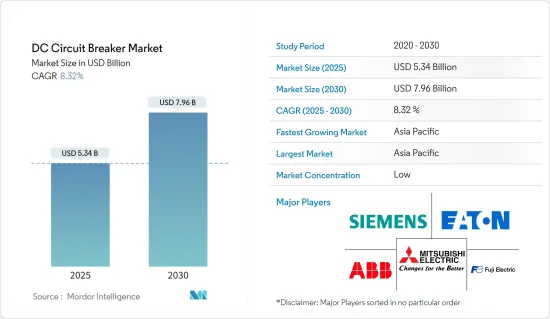

直流サーキットブレーカの市場規模は2025年に53億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは8.32%で、2030年には79億6,000万米ドルに達すると予測されます。

主なハイライト

- 中期的には、エネルギーミックスにおける再生可能エネルギー源の増加、HVDC送電の採用増加、老朽インフラのアップグレードと近代化などの要因が、予測期間中の市場を牽引すると予想されます。

- 一方、電力供給の安定性が高まることでサーキットブレーカの必要性が低下し、今後数年間は直流サーキットブレーカ市場の成長が抑制される可能性が高いです。

- とはいえ、クリーンエネルギープロジェクトへの投資や再生可能エネルギー分野の開発に注目が集まっています。その結果、新たな再生可能エネルギープロジェクトの広範な開拓と電力使用量の増加は、将来的に直流サーキットブレーカ市場に絶好の機会をもたらす可能性が高いです。

直流サーキットブレーカ市場の動向

ソリッドステートセグメントが市場を独占する見込み

- ソリッドステート直流サーキットブレーカは、電気機械式サーキットブレーカの従来の部品を高度なソフトウェア・アルゴリズムと半導体で置き換えたもので、数ミリ秒を利用する電気機械式のものよりも、数マイクロ秒以内に電力を制御し、電力系統を遮断することができます。内部故障の場合、エネルギー貯蔵システムと電気DCグリッド・サービスは、ダウンタイムの影響を強く受ける。ソリッドステート直流サーキットブレーカは、故障ゾーンの迅速な切り離しに役立ち、システムのシャットダウンを防ぐことができます。

- さらに、ソリッドステート直流サーキットブレーカは、アークを発生させることなく直流電流を遮断でき、メンテナンスフリーです。トリップユニットとスイッチユニットはソリッドステートで、精密な保護要件を満たし、スイッチとしてカソード、アノード、3つのゲート電極を含むエミッタターンオフ(ETO)サイリスタを使用します。

- 風力発電や太陽光発電などの再生可能エネルギー設備の開発が、HVDCトランスミッションの発展を後押ししています。HVDCは、さまざまな交流送電網を接続し、大容量の再生可能エネルギーを長距離、特に遠隔地で経済的にトランスミッションするための重要な技術です。

- 国際再生可能エネルギー機関によると、2022年の世界の再生可能エネルギー設備容量は3371.79GWで、前年比年間成長率は9.6%です。

- さらに、直流短絡故障は、電力変換器やその他の電気機器に損傷を与える可能性があるため、HVDCトランスミッションにとって重大な課題です。そのため、ソリッドステート直流サーキットブレーカは、これらのシステムで重要な技術として使用され、故障した送電線を迅速に遮断し、電圧を許容範囲に保つことができます。

- さらに、ソリッドステート直流サーキットブレーカは、機械式直流ブレーカよりも高速で、柔軟性が高く、連続的であり、コストも低いです。また、ハイブリッド直流サーキットブレーカよりもトポロジーが少ないです。

- さらに、ほとんどの船舶では電力供給がDCグリッドを介して行われるため、ソリッドステート 直流サーキットブレーカは船舶でも使用されます。ソリッドステート直流サーキットブレーカは、短絡電流をマイクロ秒単位で遮断し、アーク放電を防止します。

- 全体として、ソリッドステート直流サーキットブレーカセグメントは、主に欧州、北米、アジア太平洋など再生可能エネルギーの導入が盛んな地域でのHVDCトランスミッションと配電産業への投資の増加と、海洋産業での電力消費の増加により成長が見込まれています。

市場を独占するアジア太平洋地域

- アジア太平洋地域は、主に同地域全体の電力需要の伸びと、それに関連する電気インフラの必要性から、直流サーキットブレーカの大幅な需要が見込まれています。

- 環境汚染は世界の重大な関心事のひとつであり、中国やインドなどのアジア太平洋諸国は、世界でも有数の温室効果ガス排出国です。

- アジア太平洋諸国の政府機関は、再生可能エネルギー源の研究開発への投資を増やすことで、二酸化炭素排出量を徐々に削減するための数多くの戦略を開始しています。例えば、アジア太平洋地域の太陽光発電設備容量は、2015年の96.66GWから2020年には624.97GWに増加しました。

- 太陽エネルギーの急速な普及は、この地域における継続的な研究開発の取り組みと生産活動の拡大により、太陽エネルギー機器のコストが低下していることに起因しています。

- 例えば、2022年2月、中国の国家エネルギー局は、2060年までにカーボンニュートラルを達成するという政府の目標に沿って、中国のエネルギーミックスにおける再生可能エネルギーの割合を2025年までに25%に引き上げるという目標を修正したと発表しました。

- 中国では数多くのプロジェクトが建設されており、直流サーキットブレーカの需要を押し上げると期待されています。例えば、2022年7月、中国国家発展改革委員会は、2025年までに都市部の新築公共建築物や工場をソーラーパネルで50%カバーする計画を発表しました。

- 2022年3月、中国政府は、全国で高まる電気自動車需要を支えるため、全国に多数の電気自動車充電ステーションを建設する計画を発表しました。例えば、2021年には約300万台の新エネルギー自動車が販売され、中国から輸出されました。

- さらに、インド政府は国内の再生可能エネルギー源の採用を増やすため、数多くの戦略にも着手しています。

- 例えば、同国におけるグリーン革命に追随するため、インド政府は2030年までに再生可能エネルギーの導入量を500GWとすることを目指しており、これには280GWの太陽光発電と140GWの風力発電の導入が含まれます。

- 以上のことから、予測期間中、アジア太平洋地域が市場を独占すると予想されます。

直流サーキットブレーカ産業の概要

直流サーキットブレーカ市場は細分化されています。この市場の主要企業(順不同)には、ABB Ltd、Eaton Corporation PLC、Mitsubishi Electric Corporation、Fuji Electric、Siemens AGなどがあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2028年までの市場規模および需要予測(単位:米ドル)

- 最近の動向と開発

- 市場力学

- 促進要因

- 再生可能エネルギー源の台頭

- HVDCトランスミッションの採用増加

- 抑制要因

- 電力供給の安定性向上によるサーキットブレーカの必要性低下

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション

- タイプ

- ソリッドステート

- ハイブリッド

- 絶縁

- ガス

- 真空

- 電圧

- 低電圧

- 中電圧

- 高電圧

- エンドユーザー

- トランスミッションと配電

- 再生可能エネルギーとエネルギー貯蔵システム

- 商業用

- その他

- 地域

- 北米

- 米国

- カナダ

- その他北米地域

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- その他中東とアフリカ

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 主要企業の戦略

- 企業プロファイル

- ABB Ltd

- Larsen & Toubro Limited

- Mitsubishi Electric Corporation

- GEYA Electrical Co.

- Entec Electric & Electronic Co Ltd

- Hyundai Electric & Energy Systems Company

- Rockwell Automation

- Eaton Corporation PLC

- Siemens AG

- Nader Electrical

- Fuji Electric Co Ltd

- Powell Industries, Inc.

- Schneider Electric SE

第7章 市場機会と今後の動向

- 新たな再生可能エネルギー・プロジェクトの開発と電力使用量の増加

目次

Product Code: 70275

The DC Circuit Breaker Market size is estimated at USD 5.34 billion in 2025, and is expected to reach USD 7.96 billion by 2030, at a CAGR of 8.32% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as the rise of an influx of renewable sources in the energy mix, rising adoption of HVDC transmission, and the upgradation and modernization of aging infrastructure are expected to drive the market in the forecast period.

- On the other hand, a rise in the stability of electricity supply, thereby reducing the need for circuit breakers, is likely to restrain the growth of the DC circuit breaker market in the coming years.

- Nevertheless, the focus has increased on investments in clean energy projects and the development of the renewable energy sector. As a result, the extensive development of new renewable projects and rising electricity usage is likely to create an excellent opportunity for the DC circuit breaker market in the future.

DC Circuit Breaker Market Trends

Solid-State Segment Expected to Dominate the Market

- Solid-State DC circuit breaker replaces traditional parts of electromechanical circuit breakers with advanced software algorithms and semiconductors that may control power and interrupt power systems faster within a few microseconds than electromechanical ones that utilize a few milliseconds. In the case of internal fault, energy storage systems and electrical DC grid services are strongly affected by downtime. A solid-state DC circuit breaker may help disconnection of fault zones rapidly and prevent the system's shutdown.

- In addition, a solid-state DC circuit breaker may interrupt DC current without generating an arc and is maintenance-free. The tripping and switch units are solid-state, which meets precise protection requirements, and it uses an emitter turn-off (ETO) thyristor as the switch, which contains a cathode, anode, and three gate electrodes.

- The growth of renewable energy installations such as wind and solar power has driven the development of HVDC transmission. It is a crucial technology to connect various AC grids and economical transmission of large-capacity renewable energy over long distances, especially in remote areas.

- According to the International Renewable Energy Agency, the world's total renewable energy installed capacity accounted for 3371.79 GW in 2022, an annual growth rate of 9.6% compared to the previous year.

- Further, a DC short-circuit fault is a significant challenge to the HVDC transmission system as it may cause damage to the power converter and other electrical instruments, so a solid-state DC circuit breaker is used in these systems as a key technology so it may quickly switch off faulty lines and keep the voltage in acceptable ranges.

- Moreover, the solid-state DC circuit breaker is faster, more flexible, and more continuous than the mechanical DC breaker, which costs less. It covers less topology than the hybrid DC circuit breaker.

- Furthermore, a solid-state DC circuit breaker is also used in ships as the power supply is through DC grids in most marine vessels. A solid-state DC circuit breaker interrupts short-circuit current in microseconds, preventing arcing, and covers less topology.

- Overall, the solid-state DC circuit breaker segment is expected to grow due to increasing investment in the HVDC transmission and distribution industry, primarily in regions with significant renewable energy adoption, such as Europe, North America, and Asia-Pacific, coupled with increasing power consumption among the marine industry.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to witness substantial demand for DC circuit breakers, primarily due to the growth in electricity demand across the region and the related requirement of electrical infrastructure.

- Environmental pollution is among the significant world concerns, and countries in Asia-Pacific such as China and India are among some of the largest producers of greenhouse gases across the globe.

- Government bodies across countries in the Asia Pacific region have initiated numerous strategies to gradually reduce carbon emissions by increasing investments in the research and development of renewable energy sources. For instance, the installed solar capacity in Asia-Pacific grew from 96.66 GW in 2015 to 624.97 GW in 2020.

- The rapid rise in the adoption of solar energy is attributed to the declining cost of solar energy equipment, which has been fuelled by continuous research and development initiatives and scaling of production activities in the region.

- For instance, in February 2022, China's National Energy Administration announced that it had revised the target of increasing the share of renewable energy in China's energy mix to 25% by 2025, in line with the government's objectives to achieve carbon neutrality by 2060.

- Numerous projects in China are being constructed and are expected to boost the country's demand for DC circuit breakers. For instance, In July 2022, the National Development and Reform Commission of China announced a plan for new-build public buildings and factories in towns and cities to be covered at 50% by solar panels by 2025, which is expected to be a significant driver for the solar energy market in the country.

- In March 2022, the Chinese government announced that it is planning to construct numerous electric vehicle charging stations across the country to support the growing demand for electric vehicles across the country. For instance, in 2021, approximately 3 million new energy vehicles were sold and exported from China.

- Further, the Government of India has also initiated numerous strategies to increase the adoption of renewable energy sources in the country.

- For instance, to follow the green revolution in the country, the Indian government aims to 500 GW of installed renewable energy by 2030, which includes the installation of 280 GW of solar power and 140 GW of wind power.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate the market during the forecast period.

DC Circuit Breaker Industry Overview

The DC circuit breaker market is fragmented. Some of the key players in this market (not in any particular order) include ABB Ltd, Eaton Corporation PLC, Mitsubishi Electric Corporation, Fuji Electric Co Ltd, and Siemens AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.1.1 The Rise of an Influx of Renewable Sources

- 4.4.1.2 Rising Adoption of HVDC Transmission

- 4.4.2 Restraints

- 4.4.2.1 A Rise in the Stability of Electricity Supply, thereby Reducing the Need for Circuit Breakers

- 4.4.1 Drivers

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solid-State

- 5.1.2 Hybrid

- 5.2 Insulation

- 5.2.1 Gas

- 5.2.2 Vacuum

- 5.3 Voltage

- 5.3.1 Low Volatage

- 5.3.2 Medium Voltage

- 5.3.3 High Voltage

- 5.4 End-User

- 5.4.1 Transmission and Distribution

- 5.4.2 Renewables and Energy Storage Systems

- 5.4.3 Commercial

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States of America

- 5.5.1.2 Canada

- 5.5.1.3 Rest of the North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of the Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 South Korea

- 5.5.3.4 Rest of the Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of the South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of the Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Larsen & Toubro Limited

- 6.3.3 Mitsubishi Electric Corporation

- 6.3.4 GEYA Electrical Co.

- 6.3.5 Entec Electric & Electronic Co Ltd

- 6.3.6 Hyundai Electric & Energy Systems Company

- 6.3.7 Rockwell Automation

- 6.3.8 Eaton Corporation PLC

- 6.3.9 Siemens AG

- 6.3.10 Nader Electrical

- 6.3.11 Fuji Electric Co Ltd

- 6.3.12 Powell Industries, Inc.

- 6.3.13 Schneider Electric SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of New Renewable Projects and Rising Electricity Usage