|

市場調査レポート

商品コード

1910441

ダイナミックランダムアクセスメモリ(DRAM):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Dynamic Random Access Memory (DRAM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ダイナミックランダムアクセスメモリ(DRAM):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

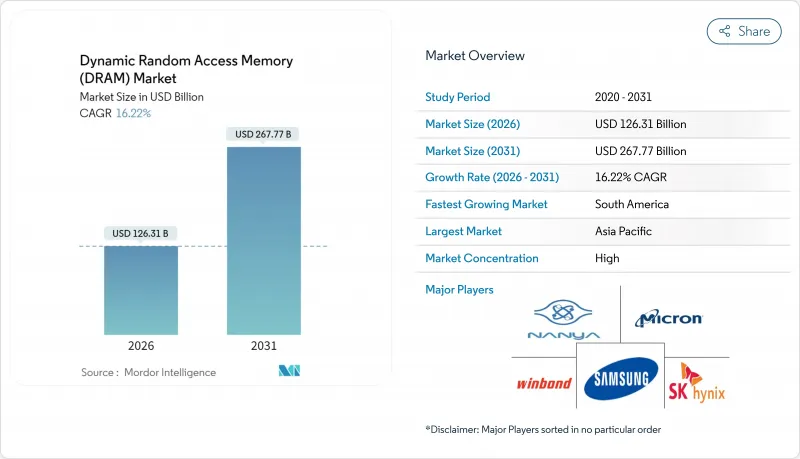

ダイナミックランダムアクセスメモリ(DRAM)市場は、2025年に1,086億8,000万米ドルと評価され、2026年の1,263億1,000万米ドルから2031年までに2,677億7,000万米ドルに達すると予測されています。

予測期間(2026年~2031年)におけるCAGRは16.22%と見込まれます。

AI中心サーバーの採用加速、高帯域幅メモリの急激な普及拡大、自動車向け認証要件の厳格化により、購入基準は容量のみから、帯域幅・電力消費・熱性能をバランスよく重視する方向にシフトしています。ハイパースケールクラウド事業者は2024年中にDDR5およびHBM3Eモジュールによるラック更新を開始し、アジアの携帯電話OEMメーカーは主力機種およびミドルレンジ機種の大半をLPDDR5Xへ移行させたため、2025年半ばまでファブ稼働率は全体で95%以上を維持しました。ゾーン別アーキテクチャが従来のECUネットワークに取って代わったことで、電気自動車(EV)1台あたりのメモリ搭載量は急速に増加し、自動車用DRAMの需要は数ギガバイト規模へと拡大しました。同時に、収益性の高いHBM3Eと従来型DDR4ライン間の供給配分をめぐる競合が価格急騰を引き起こし、PC、スマートフォン、産業用IoTボードにおけるコストパフォーマンスのトレードオフ関係が再構築されました。

世界のDRAM市場の動向と洞察

ハイパースケールデータセンターにおけるAIおよび生成AIワークロードの増加傾向

NVIDIAの2025年型Blackwell GP-AIプラットフォームは、従来のDDRアーキテクチャを凌駕する帯域幅の基準を確立し、サーバーメモリの平均搭載容量を2024年の256GBから2025年半ばまでにマルチテラバイト規模へと引き上げました。各HBM3Eスタックが1TB/sを超える性能を発揮する中、クラウド事業者はメモリ中心のトポロジーに基づきラックの再設計を進めました。サムスンが量産対応のCXL 2.0 DRAMを提供したことで、Azureをはじめとするプロバイダーはホスト間でメモリをプール可能となり、利用率向上と追加コンピューティングノードへの設備投資の先送りを実現しました。これを受けサプライヤーはウエハー生産をDDR4からHBMへシフトさせ、従来グレードの供給逼迫を招くと同時にプレミアムセグメントの利益成長を加速させました。

アジア太平洋地域における5GフラッグシップおよびミッドレンジスマートフォンでのLPDDR採用が急拡大

マイクロンの1Y LPDDR5Xサンプル(9,200 MT/s動作)は2025年第1四半期に携帯電話メーカーへ納入され、消費電力を20%削減するとともに、中国・インド向けモデルの標準構成を8GBから12GB RAMへ引き上げました。シャオミ、OPPO、トランスシオンなどの新興ブランドは、アジア太平洋地域のファブ生産能力の拡大する割合を消費する先渡契約を締結しており、サプライヤーはモバイルとデータセンターのライン間のコミットメントを調整せざるを得ません。この変化により、LPDDRは2015年にLPDDR4が量産開始されて以来、他のモバイルメモリよりも急激な成長曲線を描いています。

需給の循環性が極端な平均販売価格(ASP)変動を招く

高マージンのHBM需要の引き上げにより、ファブは2025年初頭にDDR4の生産開始を延期し、5月には主流モジュールのスポット価格が50%急騰しました。DDR5契約価格も15~20%上昇したため、OEMメーカーは製品BOMの再設計や過剰発注により、さらなる価格急騰へのヘッジを図りました。このフィードバックループが変動性を増幅させ、生産計画の見通しを悪化させ、DRAM市場の予測CAGRを2ポイント以上押し下げました。

セグメント分析

2025年時点ではDDR5のDRAM市場におけるシェアはごく僅かでしたが、JEDECのJESD79-5C規格更新により性能上限が8,800Mbpsに引き上げられたことを背景に、予測CAGR29.1%という最速の成長率を示しました。この技術的飛躍により、ティア1クラウドベンダーはDDR5とHBM3Eを混在させた構成を実現し、ソケットあたりの実効帯域幅を倍増させることが可能となりました。マイクロンの1Y DDR5は2025年2月に9,200 MT/sを達成し、この画期的な進展がサーバーOEMメーカーのプラットフォーム刷新を前倒しさせる要因となりました。一方、DDR4は2025年を通じて44.78%のDRAM市場シェアを維持しました。これは企業IT予算が依然としてコスト最適化構成を優先したためです。レガシーなDDR3およびDDR2のシェアは、産業用・自動車用設計が新規格へ移行するにつれ縮小を続けました。

サプライヤーはバランス調整に直面しました。DDR5に割り当て直されたウエハー1枚ごとにPC向けDDR4チップの供給が減少し、コスト急騰が中国ノートPC組立メーカーへ波及したのです。長期在庫保有者は裁定取引を活用し、2017年以来のプレミアム価格で蓄積されたDDR4を売却しました。JEDECの新たなCAMM2フォームファクターはSO-DIMMの高さ制約を解消し、ノートPCやエッジサーバーがより高密度の片面積層を採用することを可能にしました。こうしたパッケージング技術の進歩は、民生用・企業用デバイスを問わず、ダイナミックランダムアクセスメモリ(DRAM)市場における高帯域幅規格への移行を後押ししました。

2025年時点で19nm~10nmプロセス帯はDRAM市場規模の41.85%を占め、サプライヤーが10nm未満プロセスの歩留まりリスクに陥ることなくウエハー当たりのダイ数を増加させることで、2031年までに24.4%の成長が見込まれています。EUV技術を活用した1Yプロセスによる量産は2025年第1四半期に収益化ユニットの出荷を開始しましたが、ライン歩留まりは成熟した1zラインを少なくとも8ポイント下回りました。このため、多くのデバイスメーカーがコストリスクを緩和するため1zおよび1yグレードの契約を更新し、ミッドノードプロセスに生産量の押し上げ効果をもたらしました。

SKハイニックスは2027年以降にウエハーレベル積層を実現する垂直ゲートDRAMロードマップを提示し、横方向の微細化から3D構造への長期的な転換を示唆しました。平面微細化の度重なる縮小では、マスクセット・材料費・減価償却を考慮すると12%未満のコスト削減しか得られず、ファブは幾何学的縮小のみならず構造的な再設計を模索せざるを得ません。モバイルおよび民生電子機器におけるコスト感応度の高さから、価格重視のSKU向けに20nm以上のノードが維持され、生産ミックスの階層化が実現されました。これによりファブ生産の多様化が図られ、全体的な収益の回復力が支えられています。

ダイナミックランダムアクセスメモリ(DRAM)市場は、アーキテクチャ(DDR2以前、DDR3、DDR4、DDR5、LPDDR、GDDR)、技術ノード(20nm以上、19nm-10nm、10nm未満)、容量(4GB以下、4-8GB、8-16GB、16GB以上)、最終用途(スマートフォンおよびタブレット、PCおよびノートパソコン、サーバーおよびハイパースケールデータセンター、その他)、地域(北米、欧州、アジア太平洋、南米、中東およびアフリカ)によって区分されます。

地域別分析

アジア太平洋地域は、韓国、台湾、中国本土に集積したファブを背景に、2025年においても30.88%の収益シェアを維持しました。韓国のサプライヤーは、HBMおよび従来型DRAM生産における主導権維持を目的として、2028年までに120兆ウォン(840億米ドル)の生産能力拡張を約束しました。一方、台湾の受託組立メーカーは、ロジックノードのフロントエンド技術を活用し、熱抵抗を低減するスルーシリコンビア(TSV)技術を導入することで、高まるHBM4需要に対応するため、先進パッケージングラインを拡充しました。

北米は最大の消費市場を形成しました。ハイパースケール事業者によるラック更新の加速と、米国自動車メーカーによるゾーンコントローラーの統合が進んだためです。マイクロン社は新たなメガファブ建設に向け、CHIPS法に基づく61億米ドルの資金調達を確保しました。これは地政学的リスクの軽減と国内顧客へのリードタイム短縮を目的とした動きです。欧州は自動車・産業用途への技術的注力を維持し、ドイツのOEMメーカーは拡張温度保証と長寿命保証を要求。これによりプレミアム価格が実現しました。

ブラジル、アルゼンチン、メキシコが、供給の現地化に向けて電子機器組立のエコシステムを育成しているため、南米は21.6%のCAGRで成長すると予測されています。政策インセンティブにより、国内で組み立てられたメモリ部品の輸入関税が引き下げられ、調達戦略にささやかながらも有意義な変化が生まれています。中東およびアフリカは、湾岸協力会議加盟国におけるデータセンターの建設、ならびにナイジェリアおよびケニアにおけるスマートフォンの普及率の上昇により、1桁台半ばの成長率を示しましたが、政情不安が広範な普及の妨げとなり続けています。これらの地域的な状況から、製造は東アジアに集中しているにもかかわらず、ダイナミックランダムアクセスメモリ(DRAM)市場が収益源を多様化させていることがわかります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ハイパースケールデータセンターにおけるAIおよび生成AIワークロードの増加傾向

- アジア太平洋地域における5GフラッグシップおよびミッドレンジスマートフォンでのLPDDR採用の急増

- 自動車用ゾーン/ドメインコントローラーのNORから高温DRAMへの移行

- 拡張温度対応DRAMモジュールを必要とするエッジAIおよび産業用IoTボード

- クラウドサービスプロバイダーにおけるCXL接続メモリプールの移行

- 市場抑制要因

- 需給の循環性が極端な平均販売価格(ASP)変動を促進

- 10nm以下のEUVプロセスにおける歩留まり低下の課題

- 中国に対する地政学的輸出規制による高密度サーバーDRAM出荷の制限

- バリューチェーン分析

- テクノロジーの展望

- 規制の見通し

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 価格分析

- DRAMスポット価格(GBあたり)

- 価格動向分析

- マクロ経済の影響分析

第5章 市場規模と成長予測

- アーキテクチャ別

- DDR2およびそれ以前の世代

- DDR3

- DDR4

- DDR5

- LPDDR

- GDDR

- 技術ノード別

- 20nm以上

- 19nm-10nm

- 10 nm(EUV)未満

- 容量別

- 4 GB以下

- 4-8 GB

- 8-16 GB

- 16GB以上

- 最終用途

- スマートフォンおよびタブレット

- PCおよびノートパソコン

- サーバーおよびハイパースケールデータセンター

- グラフィックスおよびゲーム機

- 自動車用電子機器

- 民生用電子機器(セットトップボックス、スマートテレビ、VR/AR)

- 産業用およびIoTデバイス

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- 北欧諸国

- その他欧州地域

- アジア太平洋地域

- 中国

- 台湾

- 韓国

- 日本

- インド

- その他アジア太平洋地域

- 南米

- ブラジル

- チリ

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology Inc.

- ChangXin Memory Technologies Inc.(CXMT)

- Nanya Technology Corporation

- Winbond Electronics Corporation

- Powerchip Semiconductor Manufacturing Corp.(PSMC)

- Fujian Jinhua Integrated Circuit Co., Ltd.(JHICC)

- GigaDevice Semiconductor(Beijing)Inc.

- Etron Technology Inc.

- Integrated Silicon Solution Inc.(ISSI)

- Elite Semiconductor Memory Technology Inc.(ESMT)

- Zentel Electronics Corporation

- Alliance Memory, Inc.

- AP Memory Technology Corp.

- Phison Electronics Corporation

- JSC Mikron(Mikron Group)

- AMIC Technology Corporation

- Utron Technology Inc.

- Hua Hong Semiconductor Limited