|

市場調査レポート

商品コード

1237852

酢酸ビニルエチレン(VAE)市場- 成長、動向、および予測(2023年-2028年)Vinyl Acetate Ethylene (Vae) Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 酢酸ビニルエチレン(VAE)市場- 成長、動向、および予測(2023年-2028年) |

|

出版日: 2023年03月03日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

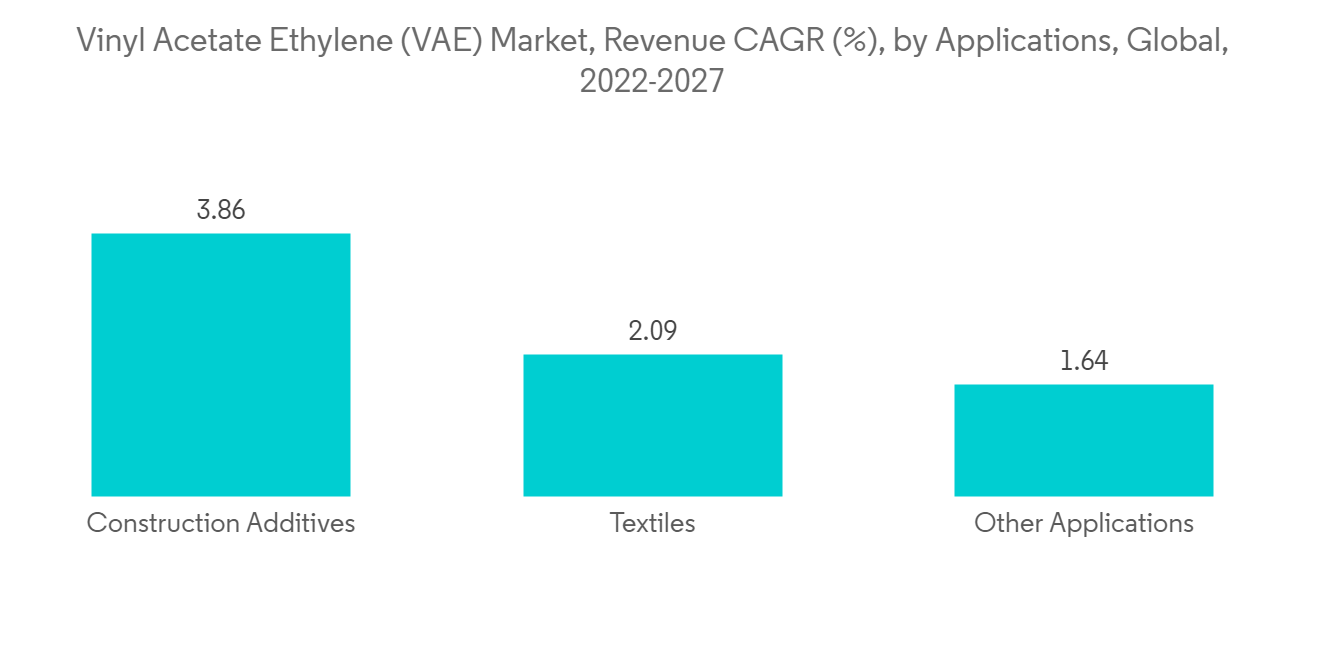

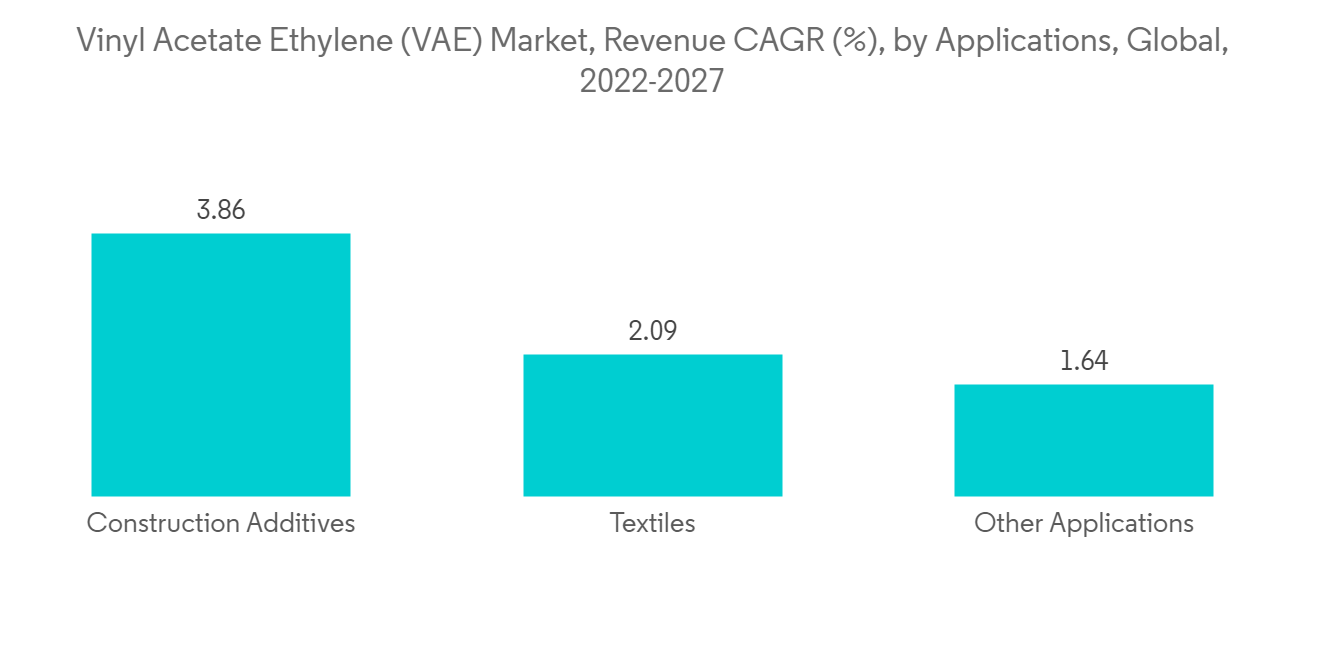

世界の酢酸ビニルエチレン(VAE)市場は、予測期間中に4%以上のCAGRで推移すると予測されます。

COVID-19は、建設部門が完全に混乱したため、VAE市場に悪影響を及ぼしました。現在、VAE市場はパンデミックから回復し、かなりの速度で成長しています。

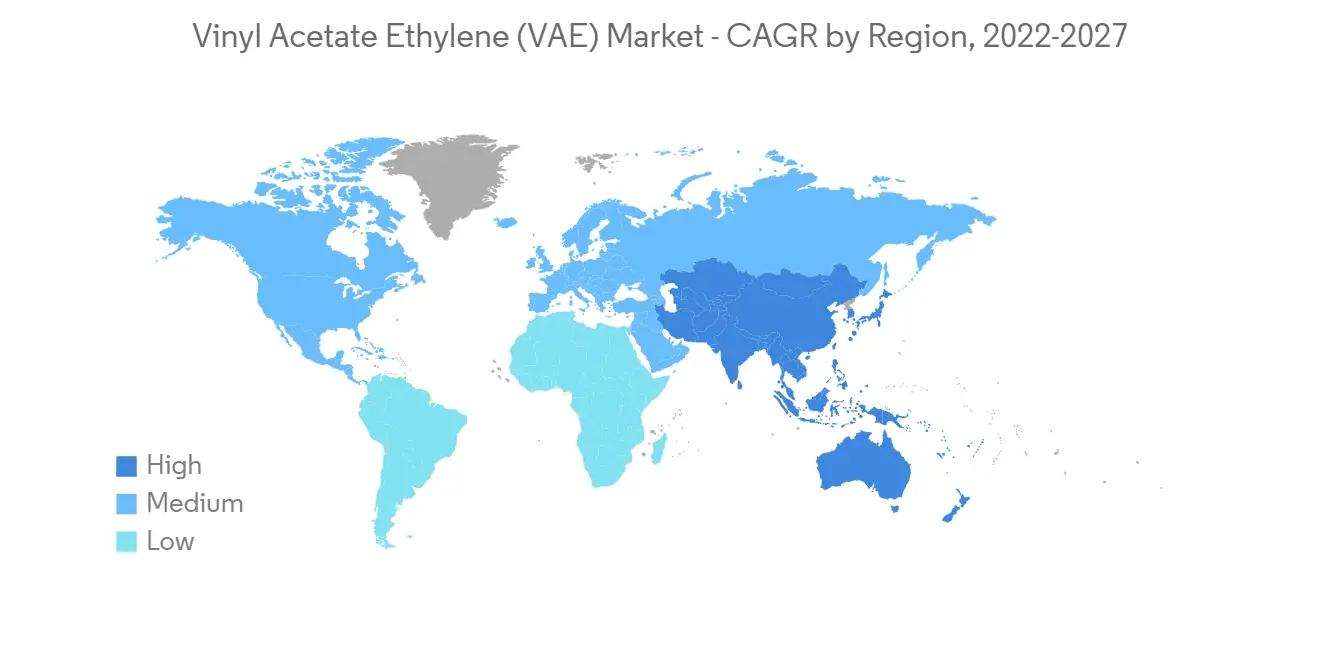

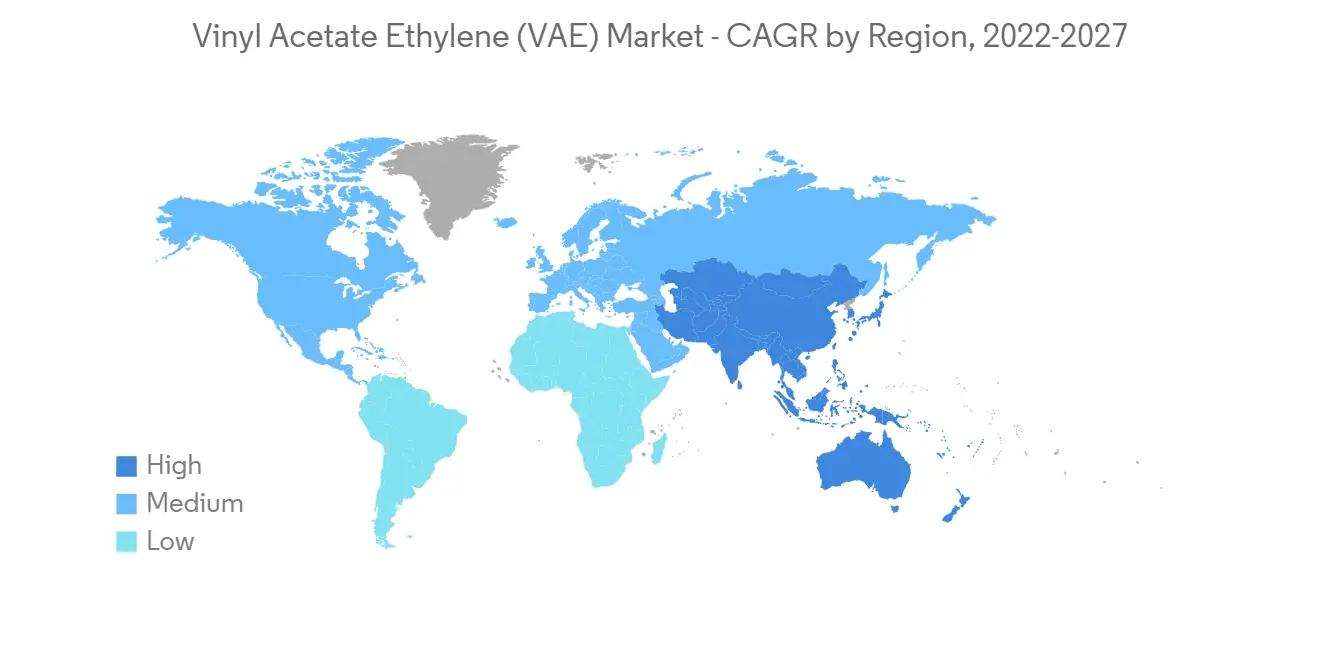

短期的には、建設業界からの需要増が市場を牽引してきました。しかし、原料価格の変動により、まもなく酢酸ビニルエチレン(VAE)の需要が減少すると推定され、予測期間中の世界の酢酸ビニルエチレン(VAE)市場の成長を阻害すると予想されます。とはいえ、包装業界からの需要の高まりは、将来的に十分な成長機会をもたらすと予想されます。予測期間中、市場に有利な機会が生まれると思われます。予測期間中、アジア太平洋は世界の酢酸ビニルエチレン(VAE)市場で最も高い市場シェアを獲得し、世界市場を独占すると予想されます。

酢酸ビニルエチレン(VAE)市場動向

接着剤分野での需要の高まり

- 酢酸ビニルエチレン(VAE)は、紙・包装(食品包装、封筒製造、紙へのフィルムラミネーション)、木材(木材へのフィルムラミネーション、3Dメンブレンプレス、EPIシステム)、床材(繊維床材、フレキシブルカバー)等の用途で接着剤に加工することができます。

- VAE系接着剤は、PVA系接着剤と同等の加工性を持ちながら、コーティング、プラスチックラミネート、ビニール、金属、ガラス、アルミニウムなどの無孔質表面への接着性に優れています。

- また、VAEを用いた共重合体接着剤は、より柔軟な接着シート、高い耐水性、優れた加工性を提供します。VAE接着剤は、耐熱性、可塑性に優れ、さまざまな支持体に強力に接着することができます。

- eコマースや小売りの拡大により、VAEベースの接着剤の需要が高まると予測されています。これらの接着剤は、パッケージング、木工、家具、自動車などの用途にも活用されています。

- 包装・加工技術の団体であるPMMI(Packaging Machinery Manufacturers Institute)が発行したレポートによると、世界の包装業界の成長は、人口の増加、持続可能性への関心の高まり、発展途上地域における消費力の増加、スマートパッケージングの需要の高まりなどにより、2016年の368億米ドルから、2021年には422億米ドルに達しました。

- 国内または家庭市場と商業またはオフィス市場は、家具産業の一次需要情報です。さらに、インドでは家具市場全体の約65%を木材が占めています。

- 中国は世界第2位の木材使用国です。China Association of Forest Products Industryによると、同国の木材消費量は過去10年間で170%以上急増しました。

- さらに、英国の建設業界全体では、商業建築は2番目に大きな価値提供者であり、修理やメンテナンスを考慮すると、市場シェアの25%近くを占めています。オフィス空間における木材のインテリアデザインの増加は、市場の需要を促進する主要な要素です。

- 以上のような要因が家具業界を牽引し、予測期間中にVAE系接着剤の需要に影響を与える可能性があると考えられます。

中国がアジア太平洋地域を支配する

- 酢酸ビニルエチレン(VAE)市場は、中国が市場シェアと市場収益の面で優位を占めています。この地域は、予測期間中もその優位性を発揮し続けることになるでしょう。

- European Coatingsによると、中国には約10,000社のコーティングメーカーが存在します。日本ペイント、アクゾノーベル、中国海洋塗料、PPGインダストリーズ、BAF SE、アクサルタコーティングスなど、世界の大手塗料メーカーの大半は中国に製造拠点を置いています。塗料・コーティングメーカー各社は、同国への投資を増やしています。

- 酢酸ビニルエチレンの需要は、建設、包装、繊維、その他のエンドユーザー分野からの需要が増加しているため、予測期間中に増加すると予想されます。

- 現在、中国では建設業が盛んです。同国は世界最大の建設市場であり、世界の建設投資全体の20%を占めています。2030年までには、約13兆米ドルの建設投資が行われる予定です。

- 中国国家統計局によると、2021年の中国の建設生産高は約29兆3,100億人民元相当でした。その結果、検討中の市場に対して大きな需要を生み出しています。

- 同国の拡大は、経済の拡大に後押しされた住宅および商業建設分野の数多くの発展によってもたらされています。中国では、香港の住宅当局が低コストの住宅建設を開始するためにいくつかのイニシアチブを開始しました。当局は、2030年までの今後10年間に301,000戸の公共住宅を建設することを望んでいます。

- 中国国家統計局によると、2022年1~4月の中国の繊維生産量は124億メートルで、前年同時期の118億メートルを上回っています。

- さらに、中国政府は新疆ウイグル自治区を繊維・衣料品製造の「温床」と想定しており、80億米ドルを投じています。2030年には、中国北西部が最も広大な繊維生産拠点となることが予想されています。

- このように、上記のような要因が、予測期間中に酢酸ビニルエチレン市場の需要を押し上げると考えられます。

酢酸ビニルエチレン(VAE)市場の競合他社分析

世界の酢酸ビニルエチレン(VAE)市場は、その性質上、断片化されています。市場の主要メーカーには、DCC、SINOPEC、Wacker Chemie AG、Gantrade Corporation、VINAVIL SpAなどがあります(順不同)。

その他の特典です。

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件条件

- 調査対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 建設業界からの需要増

- その他の促進要因

- 抑制要因

- 原材料価格の変動

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品・サービスの脅威

- 競合の度合い

第5章 市場セグメンテーション

- 用途別

- 塗料・コーティング

- 粘着剤

- 建設用添加剤

- テキスタイル

- その他の用途

- 地域別に見る

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- 中東・アフリカ地域

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約など

- 市場シェア(%)**/順位分析

- 主要なプレーヤーが採用した戦略

- 企業プロファイル

- Celanese Corporation

- Cheng Lung Chemical Co. Ltd

- DCC

- Gantrade Corporation

- Hope Way Chemical Industrial Co. Ltd

- Parkash Group

- Shaanxi Xutai Technology Co. Ltd

- SINOPEC

- VINAVIL SpA

- Wacker Chemie AG

第7章 市場機会と今後の動向

- パッケージング業界の需要拡大が今後の成長機会につながる

The global vinyl acetate-ethylene (VAE) market is anticipated to register a CAGR of over 4% during the forecast period. COVID-19 negatively affected the VAE market as the construction sector was completely disrupted. Currently, the VAE market has recovered from the pandemic and is growing at a significant rate.

Over the short term, the market has been driven by the increase in demand from the construction industry. However, it is estimated that the demand for vinyl acetate-ethylene (VAE) will decrease shortly due to fluctuations in raw material prices, which are expected to hamper the global vinyl acetate-ethylene (VAE) market growth over the forecast period. Nevertheless, the growing demand from the packaging industry is expected to provide ample growth opportunities in the future. It is likely to create lucrative opportunities for the market over the forecast period. Asia-Pacific is expected to dominate the global market during the forecast period, with the highest market share in the global vinyl acetate-ethylene (VAE) market.

Vinyl Acetate Ethylene (VAE) Market Trends

Blooming Demand in the Adhesives segment

- Vinyl acetate-ethylene (VAE) can be formed into adhesives for a range of applications, including paper and packaging (food packaging, envelope production, film lamination onto paper), wood (film lamination onto wood, 3D membrane pressing, EPI systems), and flooring (textile flooring, flexible coverings), among others.

- VAE adhesives have processing qualities comparable to PVA'c but bind better to non-porous surfaces, such as coatings, plastic laminates, vinyl, metals, glass, aluminum, and others.

- Copolymeric adhesives based on VAE also provide a more flexible adhesive sheet, higher water resistance, and superior processing qualities. VAE adhesives provide great temperature resistance, plasticizers, and strong adherence to a variety of supports.

- The expansion of e-commerce and retail sales is predicted to enhance the demand for VAE-based adhesives. These adhesives are also utilized in packaging, woodworking, furniture, and automotive applications.

- According to a report published by Packaging Machinery Manufacturers Institute (PMMI), an association for packaging and processing technologies, growth in the global packaging industry reached USD 42.2 billion in 2021, up from USD 36.8 billion in 2016, owing to the rising population, growing sustainability concerns, increased spending power in developing regions, rising demand for smart packaging, and other factors.

- The domestic or home market and the commercial or office market are the primary sources of demand for the furniture industry. Furthermore, wood accounted for around 65% of all furniture markets in India.

- China is the world's second-largest user of wood. According to the China Association of Forest Products Industry, the country's wood consumption surged by more than 170% during the last decade.

- Furthermore, commercial construction is the second-largest value supplier for the overall construction industry in the United Kingdom, accounting for nearly 25% of the market share when repair and maintenance are factored in. The rise in wood interior design in office spaces is a major component driving the demand in the market .

- All the aforementioned factors are expected to drive the furniture industry, which may also impact the demand for VAE-based adhesives during the forecast period.

China to Dominate the Asia-Pacific Region

- China dominates the Vinyl Acetate Ethylene (VAE) market in terms of market share and market revenue. The region is set to continue to flourish in its dominance over the forecast period.

- According to European Coatings, China is home to almost 10,000 coatings manufacturers. The majority of the world's leading coating manufacturers, including Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BAF SE, and Axalta Coatings, have manufacturing facilities in China. Paint and coatings manufacturers have increased their investments in the country.

- The demand for vinyl acetate-ethylene is expected to rise over the projected period because of the rising demand from the construction, packaging, textile, and other end-user sectors.

- Currently, the construction industry is flourishing in China. The country is the world's largest construction market, accounting for 20% of all global construction investments. By 2030, the country will have spent approximately USD 13 trillion on construction.

- According to the National Bureau of Statistics of China, construction output in China was worth approximately CNY 29.31 trillion in 2021. As a result, it has generated significant demand for the market under consideration.

- The country's expansion has been fueled by numerous developments in the residential and commercial construction sectors, which have been aided by the expanding economy. In China, the Hong Kong housing authorities launched several initiatives to begin the construction of low-cost housing. Officials hope to build 301,000 public housing units over the next ten years, until 2030.

- According to the National Bureau of Statistics of China, the amount of textile output in China was 12.4 billion meters in the first four months of 2022, up from 11.8 billion meters at the same time in the previous year.

- Furthermore, the Chinese government envisions Xinjiang as a "hotbed" for textile and clothing manufacturing and has spent USD 8 billion in the region. By 2030, it is expected that China's northwest region will have become the country's most extensive textile production base .

- Thus, all the above-mentioned factors are likely to boost the demand for the vinyl acetate-ethylene market during the forecast period.

Vinyl Acetate Ethylene (VAE) Market Competitor Analysis

The Global Vinyl Acetate Ethylene (VAE) market is fragmented in nature. Some of the major manufacturers in the market include DCC, SINOPEC, Wacker Chemie AG, Gantrade Corporation, and VINAVIL SpA, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Demand from the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Applications

- 5.1.1 Paints and Coatings

- 5.1.2 Adhesives

- 5.1.3 Construction Additives

- 5.1.4 Textiles

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Rank Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Cheng Lung Chemical Co. Ltd

- 6.4.3 DCC

- 6.4.4 Gantrade Corporation

- 6.4.5 Hope Way Chemical Industrial Co. Ltd

- 6.4.6 Parkash Group

- 6.4.7 Shaanxi Xutai Technology Co. Ltd

- 6.4.8 SINOPEC

- 6.4.9 VINAVIL SpA

- 6.4.10 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Packaging Industry will Provide Ample Growth Opportunities in the Future