|

市場調査レポート

商品コード

1406910

EV用固体電池:市場シェア分析、産業動向・統計、成長予測、2024~2029年EV Solid-state Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| EV用固体電池:市場シェア分析、産業動向・統計、成長予測、2024~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

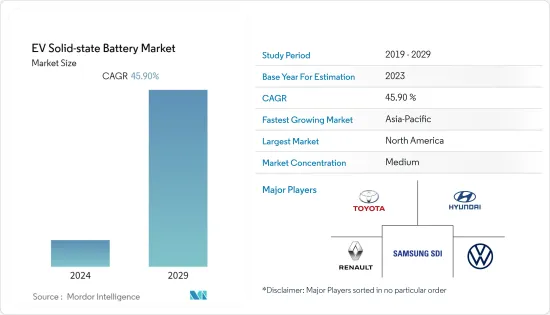

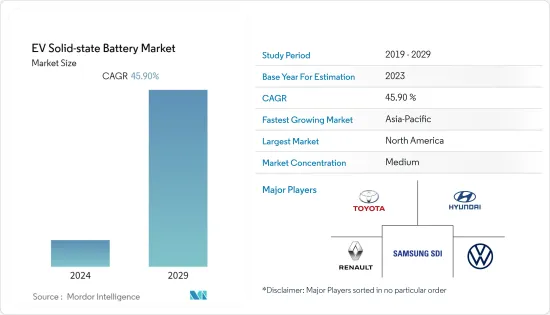

EV用固体電池市場の市場規模は1億8,300万米ドルで、予測期間中のCAGRは45.9%を超え、5年間で12億1,400万米ドルに達すると予測されています。

主なハイライト

- COVID-19パンデミックは当初、製造ユニットの操業停止や施錠により2020年上半期の売上が減少し、市場にマイナスの影響を与えました。しかし、規制の緩和と奨励金や救済措置といった政府の注目すべき取り組みが相まって、2021年までに市場は勢いを取り戻すことができました。さらに、市場の需要増加を受けて、各社は新たな施設への投資にも力を入れています。例えば

- 2023年6月、ユミコアはベルギーのオレンに世界最大級かつ最先端の固体電池材料試作ラボを開設しました。最先端の設備と技術を備えた600平方メートルの施設は、固体電池研究の全チェーンをサポートします。

- 中期的には、低燃費・高性能・低排出ガス車に対する需要の増加、自動車の排出ガスに関する法規制の厳格化、電池コストの低下などが、予測期間中の市場成長を促進する主な要因として作用すると予想されます。

- 現在のところ、電気自動車市場は、トヨタ自動車、テスラ・モーターズ、フォルクスワーゲンAG、本田技研工業、ゼネラル・モーターズ・グループ、現代起亜自動車グループなどが86%以上のシェアを占めています。さらに、これらの企業は、固体電池市場の早期参入者であり、今後も市場の大部分を占めると予想されます。例えば、2023年2月、日産は2025年にパイロットプロジェクトを開始し、2028年までに固体電池を搭載した初の電気自動車を投入すると発表しました。

- アジア太平洋地域が最も急成長し、次いで欧州、北米が続くと予想されています。中国、インド、日本、韓国などの国々の自動車産業は、技術革新、テクノロジー、先進的な電気自動車とバッテリーの開発に傾斜しています。二酸化炭素排出量の削減と、より高度なバッテリー技術の開発に対する需要の高まりが、予測期間中の市場成長を促進すると予想されます。例えば

- 2023年6月、トヨタは電気自動車の航続距離と性能を向上させ、コストを削減するため、高性能の固体電池やその他の技術を導入する予定です。

EV用固体電池の市場動向

電気自動車の販売拡大

- 小型乗用車用電気自動車(EV)の普及を加速させ、従来の内燃機関を搭載した自動車を段階的に廃止する動きが世界中で活発化しています。平均燃料価格の上昇は、欧州の電気自動車新規登録台数のシェアが他の地域よりも高いという事実を反映しています。したがって、燃料価格の上昇に起因する電気自動車の大量導入は、電動パワートレイン市場において世界的に急増すると予想されます。

- 欧州は電動パワートレインにとって重要な市場であり、自動車生産のかなりのシェアを占めています。フィンランド、ノルウェー、スウェーデン、オランダといった国々は、世界で最もEVの普及率が高いです。同年の販売台数が6.2台近くに達した中国は、2022年のプラグイン電気自動車販売台数で世界最大の市場となった。中欧と西欧は2位で、その年の電気自動車販売台数は約2.7台だった。

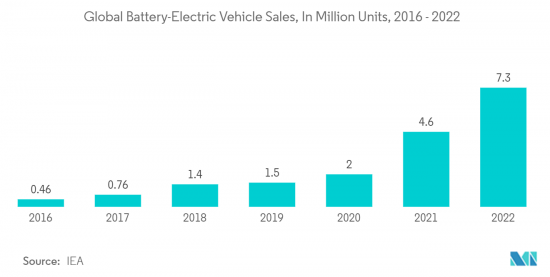

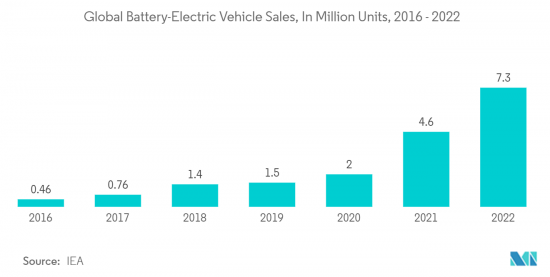

- バッテリー電気乗用車の年間販売台数は、2022年に700万台を突破します。2026年末には、自動車販売台数全体の約15%を占めるようになると予想されています。したがって、電気自動車の登録台数の増加は、電気自動車パワートレインの増産につながった。

- 電気自動車は、初期費用が少ないことに加え、運転経費が低いため、幅広い顧客、特に低所得者層にとって魅力的です。現在、交通費は家計支出全体のかなりの部分を占めており、低所得世帯は、よりリーズナブルで利用しやすいこの選択肢から最も恩恵を受けることになります。

- 電気自動車に対する需要の増加と固体電池の利点が、予測期間中の需要を牽引すると予想されます。

アジア太平洋が著しい成長を示す可能性

アジア太平洋市場は、中国、インド、日本といった国々が牽引しています。アジア太平洋はまだ未成熟な市場であり、計り知れない潜在力が秘められています。

中国政府は電気自動車の導入を奨励しています。同国はすでに、トラックなど現世代の商用車を動かしているディーゼル燃料を段階的に廃止する計画を立てています。2050年までにディーゼル車とガソリン車を完全に禁止する計画です。そのため、新興国市場は最大の成長市場の1つであり、商用車の新規開拓と受注とともに、中国の電気自動車市場を牽引する可能性が高いです。

インドの電気自動車市場は成長段階にあります。TATA、Mahindra、Maruti Suzuki、Hyundai Motorsなど、インドの自動車大手は、インドで電気自動車に手頃な選択肢を提供する取り組みを行っています。さらに、政府はインドで電気モビリティを導入するための補助金や制度を提供しています。

政府は国内の公害を削減するために様々な戦略を策定しています。例えば、FAMEとFAME II政策により、同国は顧客にインセンティブを提供し、投資家やメーカーにEV工場を設立する魅力的な選択肢を提供することで、グリーンカーの迅速な普及を推進しています。

さらに、タタ・ネクソンのように、手頃な価格の電気自動車が消費者を惹きつけています。最近発売されたこのミッドサイズSUVは、インドで最も売れている車のひとつで、1年以内に4,000台以上が販売されました。同様に、MGの電気自動車がリーズナブルな価格で3,000台を販売したことも、インドで電気自動車の販売を伸ばしている要因のひとつです。

日本政府はまた、2050年までに二酸化炭素排出量ゼロを達成するという「カーボンニュートラル」目標を提唱しています。ハウステンボスは環境保護目標を達成するため、COVID-19パンデミックの混乱にもかかわらず、純電気バスを導入しました。さらに、プラグインハイブリッド車、燃料電池電気自動車、バッテリー電気自動車といった代替動力車の需要は、ここ数年で大幅に増加しています。全国の自動車メーカーが電気トラックの可能性をテストしており、ICエンジン車からの移行を支援し、それによって環境を保護する可能性があります。

このような事例が電気自動車市場の成長軌道を後押しし、ひいては今後10年間の固体電池の需要を促進する可能性があります。

EV用固体電池産業の概要

EV用固体電池市場は、トヨタ自動車、ルノー・グループ、ステランティスNV、ゼネラル・モーターズ、三菱自動車、フォルクスワーゲンAG、フォード・モーター、現代グループ、サムスンSDI、パナソニック、LG Chemが独占すると予想されます。各社は注力しています。

中国では2022年2月、東風E70がタクシー用電気セダン50台を納入しました。この車両は、商業的に利用可能な最初の固体電池車としてマークされています。

2022年1月、日産、ルノー、三菱の3社は、電気自動車市場での地位を強化するために戦略的提携を結びました。この提携では、三菱はマーケティングを強化し、日産は固体電池技術を開発し、ルノーは自動車の電気・電子アーキテクチャを開発します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 電気自動車販売の増加が市場を牽引する見込み

- 市場抑制要因

- EV用固体電池の高コストが市場成長の妨げになる可能性

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 自動車タイプ

- 乗用車

- 商用車

- 推進力

- プラグインハイブリッド電気自動車

- ハイブリッド電気自動車

- バッテリー電気自動車

- 地域

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- インド

- 中国

- 日本

- 韓国

- その他アジア太平洋

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Toyota Motor Corporation

- Hyundai Motor Company

- Renault Group

- Samsung SDI Co. Ltd

- Volkswagen AG

- Mitsubishi Motors

- Ford Motor Company

- General Motors

- Stellantis NV

- LG Chem Ltd

第7章 市場機会と今後の動向

The EV solid-state battery market was valued at USD 183 million, and it is expected to reach USD 1,214 million over the period of five years, registering a CAGR of over 45.9% during the forecast period.

Key Highlights

- The COVID-19 pandemic initially had a negative impact on the market as the shutdown of manufacturing units, and lockdowns resulted in a decrease in sales during the first half of 2020. However, eased restrictions coupled with notable initiatives of the government in the form of incentives and relief packages helped the market regain momentum by 2021. Further, the companies are also focusing on investing in new facilities due to the increasing demand in the market. For instance,

- In June 2023, In Olen, Belgium, Umicore opened one of the world's largest and most advanced solid-state battery material prototyping labs. The 600-square-meter facility, outfitted with cutting-edge installations and technology, supports the entire chain of solid-state battery research.

- Over the medium term, increased demand for fuel-efficient, high-performance, and low-emission vehicles, increasingly strict laws and regulations on vehicle emissions, declining battery costs, etc., are expected to act as primary factors driving the market growth over the forecast period.

- As of now, the electric vehicle market is dominated by Toyota Motor Corporation, Tesla Motors Inc., Volkswagen AG, Honda Motor Company Ltd., General Motors Group, Hyundai Kia Automotive Group, etc., with more than 86% of the market share. Further, these companies are expected to be early movers in the solid-state battery market and are likely to remain to hold the larger chunk of the market. For instance, In February 2023, Nissan announced that the company is going to start a pilot project in 2025 to bring its first electric car with a solid-state battery by 2028.

- The Asia-Pacific region is expected to witness the fastest growth, followed by Europe and North America. The automotive industry in countries such as China, India, Japan, and South Korea is inclined toward innovation, technology, and the development of advanced electric vehicles and batteries. The increasing demand for reducing carbon emissions and developing more advanced battery technology is expected to propel the market growth during the forecast period. For instance,

- In June 2023, To improve the range and performance and to cut costs of its electric vehicles, Toyota is planning to introduce high-performance, solid-state batteries and other technologies.

EV Solid-state Battery Market Trends

Increasing Sales of Electric Vehicle

- The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe has a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to proliferate globally in the electric powertrain market.

- Europe is a crucial market for electric powertrains and holds a substantial share of automotive production. Countries such as Finland, Norway, Sweden, and the Netherlands have the highest adoption rate of EVs in the world. With nearly 6.2 sales that year, China was the world's largest market for plug-in electric car sales in 2022. Central and Western Europe came in second, with approximately 2.7 electric vehicles sold that year.

- The annual sales volume of battery-electric passenger cars will cross the 7 million mark in 2022. It is expected to account for about 15% of the overall vehicle sales by the end of 2026. Hence, the increase in electric car registrations resulted in an increased production of electric vehicle powertrains.

- Lower operating expenses, along with lower up-front expenditures, make electric vehicles more appealing to a wider range of customers, particularly low-income customers. Currently, transportation expenditures account for a significant portion of overall household expenses, and low-income households will gain the most from this more reasonable, accessible option.

- The increasing demand for electric vehicles and the benefits of solid-state batteries are expected to drive the demand over the forecast period.

Asia-Pacific May Illustrate Enormous Growth

The Asia-Pacific market is led by countries like China, India, and Japan. Asia-Pacific is still an immature market with immense hidden potential.

The government of China is encouraging people to adopt electric vehicles. The country has already made plans to phase out diesel fuel, which runs the current generation of commercial vehicles, such as trucks. The country is planning to completely ban diesel and petrol vehicles by 2050. Therefore, the country, being one of the largest growing electric markets, along with new developments and orders for commercial vehicles, is likely to drive the Chinese electric vehicle market.

The electric vehicle market in India is in the growing stage. Automobile giants in India, including TATA, Mahindra, Maruti Suzuki, and Hyundai Motors, are taking initiatives to provide affordable options for electric vehicles in India. Moreover, the government is providing subsidies and schemes to adopt electric mobility in India.

The government has been formulating various strategies to reduce pollution in the country. For instance, with its FAME and FAME II policies, the country has been providing incentives to customers and attractive options for investors and manufacturers to set up EV plants to propel the nation toward the faster adoption of green vehicles.

Moreover, electric cars at reasonable prices are attracting consumers, such as Tata Nexon. The recently launched mid-size SUV is one of the hot-selling cars in India, and more than 4,000 units have been sold within the year. Similarly, the 3,000 units sold by MG electric cars at a reasonable price is one of the factors increasing the sales of electric cars in India.

The Japanese government also proposed a 'carbon neutral' goal of achieving zero carbon emissions by 2050. To achieve its environmental protection goals, Huis Ten Bosch introduced pure electric buses, despite disruptions of the COVID-19 pandemic. Moreover, the demand for alternatively powered vehicles, such as plug-in hybrids, fuel cell electric vehicles, and battery electric vehicles, has increased significantly over the past few years. Vehicle manufacturers across the country are testing the possibilities of electric trucks, which may support the government's move from IC engine vehicles, thereby protecting the environment.

Such instances may aid the growth trajectory of the electric vehicle market, which, in turn, may propel the demand for solid-state batteries over the coming decade.

EV Solid-state Battery Industry Overview

The EV solid-state battery market is expected to be dominated by Toyota Motor Corporation, Renault Group, Stellantis NV, General Motors, Mitsubishi Motors, Volkswagen AG, Ford Motor Company, Hyundai Group, Samsung SDI, Panasonic, and LG Chem. The companies are focused.

In February 2022, in China, Dongfeng E70 delivered 50 electric sedans for taxis. This vehicle is marked as the first commercially available solid-state battery vehicle.

In January 2022, Nissan, Renault, and Mitsubishi came under a strategic alliance to strengthen their position in the electric vehicle market. In this alliance, Mitsubishi will reinforce marketing, Nissan will develop solid-state battery technology, and Renault will develop electrical and electronics architecture for vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Sales of Electric Vehicle is Expected to Drive the Market

- 4.2 Market Restraints

- 4.2.1 High Cost of EV Solid-State Battery May Hamper the Growth of the Market

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion

- 5.2.1 Plug-in Hybrid Electric Vehicle

- 5.2.2 Hybrid Electric Vehicle

- 5.2.3 Battery Electric Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Hyundai Motor Company

- 6.2.3 Renault Group

- 6.2.4 Samsung SDI Co. Ltd

- 6.2.5 Volkswagen AG

- 6.2.6 Mitsubishi Motors

- 6.2.7 Ford Motor Company

- 6.2.8 General Motors

- 6.2.9 Stellantis NV

- 6.2.10 LG Chem Ltd