|

市場調査レポート

商品コード

1690940

オフハイウェイホイール:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Off-Highway Wheels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| オフハイウェイホイール:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

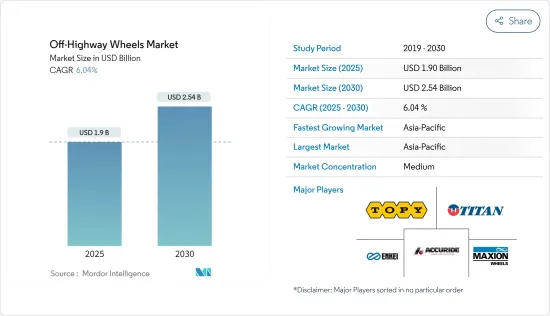

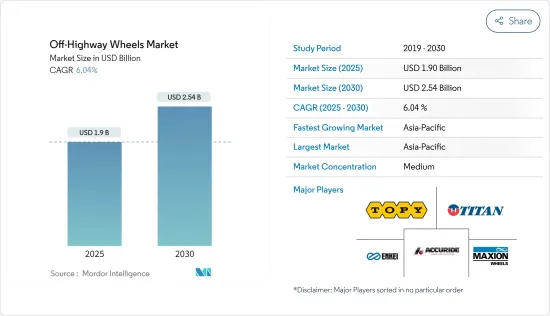

オフハイウェイホイール市場規模は2025年に19億米ドルと推定・予測され、予測期間中(2025~2030年)のCAGRは6.04%で、2030年には25億4,000万米ドルに達すると予測されます。

オフハイウェイホイール市場は、ホイール技術の進歩、インフラプロジェクトへの投資増加、農業・建設・鉱業セクターにおける耐久性と効率性に優れたホイールへの需要の高まりなど、いくつかの主要要因によって力強い成長を遂げています。当レポートでは、市場に影響を与える主な促進要因と最近の動向を分析しています。

技術革新がオフハイウェイホイール市場を大きく推進しています。メーカーは、性能と燃費効率を向上させた軽量で耐久性のあるホイールの開発に注力しています。例えば

主なハイライト

- Maxion Wheelsは、2022年11月に新世代の軽量スチール製トラック用ホイールを発売し、ホイール1本当たり最大3kgの軽量化を実現しました。これらの進歩は、燃費を向上させるだけでなく、オフハイウェイ用途に不可欠な積載量の増加も可能にします。

さらに、世界のインフラ開発はオフハイウェイホイール市場の主要な促進要因です。特に新興経済諸国における大規模な建設プロジェクトは、先進的なホイールを装備した堅牢なオフハイウェイ車両への需要を高めています。世界中のいくつかのメガプロジェクトは、オフハイウェイ・ホイール市場に大きな影響を与えています。例えば

主なハイライト

- 2013年に開始された中国による「一帯一路構想(BRI)」は、アジア、欧州、アフリカ全域での大規模なインフラ開発を通じて世界貿易ルートの強化を目指すもので、建設・鉱山機械の需要を促進しています。2017年に開始されたインドのBharatmala Pariyojanaは、2025年までに段階的に完成が見込まれる全国的な高速道路開発プロジェクトであり、建設車両と建設機械のニーズを押し上げています。

- 同様に、2017年に発表され、2030年までに完成が見込まれているサウジアラビアのネオム・シティ・プロジェクトは、膨大な量の建設機械を必要とする野心的なスマートシティ構想です。

一帯一路構想、Bharatmala Pariyojana、Neom Cityといったこれらの大規模インフラプロジェクトは、オフハイウェイホイール市場の大幅な成長を牽引することになると思われます。

オフハイウェイホイール市場の動向

建設部門が市場を独占する見通し

建設セクターは非常にダイナミックであり、経済全体、予算、世界経済シナリオなど数多くの要因が市場の成長に影響を与えています。こうした側面の変動は建設機械OEMの事業に影響を与え、ひいてはオフハイウェイホイールの需要にも影響を与えます。

オフハイウェイホイールの需要は、世界のインフラストラクチャー・プロジェクトにおける土木機械の広範なニーズにより、このセクターが支配的です。中国のBelt and Road InitiativeやインドのBharatmala Pariyojanaのような大規模な構想では、掘削機、ローダー、ブルドーザー、バックホウを含む膨大な数の建設機械が必要となります。これらのプロジェクトでは大量の土砂移動が行われるため、課題となっている地形での効率性と信頼性を確保するため、耐久性に優れた高性能の車輪が必要となります。各国がインフラの建設とアップグレードに投資を続けているため、建設機械用ホイールの需要は引き続き堅調に推移する可能性があります。

いくつかの国では、投資の増加によりインフラが著しく成長しています。建物、トンネル、鉄道網、道路、橋の建設は、国全体で大規模な投資を集めています。全国的なインフラ開発の拡大は、予測期間中に建設機械の需要を増加させる可能性が高いです。例えば

- 2024年3月、インド政府は、約120億4,000万米ドル相当の各州にまたがる112の国道プロジェクトを発足させ、その基礎を築いた。これらのプロジェクトには、高速道路の大規模な拡張や、バリアフリー料金徴収のためのGNSSのような新技術の導入が含まれます。

さらに、インドネシア国家中期開発計画(4,600億米ドル)、ベトナム社会経済開発計画(615億米ドル)、フィリピン開発計画「Build, Build, and Build」(718億米ドル)など、官民を問わずインフラへの投資は、この地域におけるオフハイウェイ車の需要を増加させると予想されます。

世界の建設開発の増加は、建設機械の需要を高める可能性が高く、ひいては今後数年間の車輪の需要を高める可能性が高いです。

アジア太平洋地域が市場を独占すると予想される

アジア太平洋(APAC)は、建設、農業、工業分野の成長を促進するいくつかの重要な要因により、オフハイウェイホイール市場をリードし続けています。道路と鉄道インフラの顕著な開発は、新規プロジェクトへの多額の投資と相まって、地域全体の建設セクターの大幅な成長をもたらしました。その結果、オフハイウェイ車とホイールの需要が増加しています。

APAC諸国は、成長する産業とサービス部門を支えるため、インフラに多額の投資を行っています。例えば中国は、新規プロジェクトと既存の建設努力のスピードアップを目的として、約4兆8,000億米ドルの投資予算を伴う重要なインフラ計画を発表しました。この投資は、道路、鉄道、都市開発などのインフラ網を強化する中国の広範な戦略の一環であり、堅牢で信頼性の高いオフハイウェイホイールの需要を後押ししています。

APAC、特にインドの農業セクターもオフハイウェイホイール市場の主要な促進要因です。同部門のインドのGDPへの寄与は著しく増加し、トラクターの販売台数は2023年度に90万台を超えました。このトラクター販売台数の急増は、農業機械に対する需要の高まりを浮き彫りにしており、ひいてはオフハイウェイホイールのニーズを押し上げる可能性があります。多くのAPAC諸国の経済において農業が重要な役割を果たしているため、オフハイウェイホイールの需要は今後も伸び続けると予想されます。

APACの建設部門は、民間企業と国有企業の両方によって支配されており、商業プロジェクト、再生可能エネルギー、公共インフラへの支出が増加しています。日本、中国、インドのような国々は、進行中および計画中のメガプロジェクトによって、建設機械と掘削機の市場が強化されています。

オフハイウェイホイール業界の概要

Titan International Inc.、Moveero Limited、Yokohama、Accuride Corporation、Rimex、Steel Strips Wheels Ltd、Maxion Wheelsなどの主要企業が、オフハイウェイホイール市場を独占しています。市場で事業を展開するプレーヤーは、他のプレーヤーよりも競争優位に立つため、いくつかの成長戦略に注力しています。例えば

- 2022年3月、Titan International Inc.は、オーストラリアのホイール事業を、オフハイウェイ車両用タイヤ、ホイール、関連サービスの著名な現地プロバイダーであるOTR Tyresに売却することで最終合意したと発表しました。この戦略的な動きは、タイタンが世界な事業を合理化し、中核市場に集中するための努力の一環です。売却にはタイタンのオーストラリアにおける生産設備、在庫、顧客契約が含まれ、OTRタイヤは市場での存在感とサービス提供を強化することができます。

- 2022年2月、タイタン・インターナショナルはクボタ・トラクター・コーポレーション(KTC)と、クボタのユーティリティ・トラクターとコンパクト・トラクターのモデル向けに新しいTrac Loader IIタイヤを供給する重要な契約を締結しました。このタイヤは軽建設、農業、商業、住宅向けに設計されており、優れた性能と耐久性を発揮します。Trac Loader IIタイヤは、トラクションを向上させ、土壌の圧縮を減らし、様々なオフハイウェイ環境におけるトラクターの全体的な効率を高める先進的なトレッド設計と素材を特徴としています。クボタとのパートナーシップは、タイタンのオフハイウェイホイールおよびタイヤにおける技術革新へのコミットメントを強調するものであり、多様な用途における顧客の進化するニーズに応えることを目指しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ別

- 合金ホイール

- スチールホイール

- 用途別

- 農業

- 建設(土木機械)

- マテリアルハンドリング(移動式クレーンおよびフォークリフト)

- 鉱業(移動鉱山機械)

- 地域別

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Titan International Inc.

- Moveero Limited

- Accuride Corporation

- Rimex

- Steel Strips Wheels Ltd

- Maxion Wheels

- OTR Wheel Engineering

- Carrier Wheels Private Limited

- Bohnenkamp AG

- Citic Dicastal Co. Ltd

- Trident International

- Levypyora Oy

- JS Wheels

- Anyang Rarlong Machinery Co. Ltd

- STARCO

- Sun Tyre and Wheel Systems

- Baluchistan Wheels Limited

- Topy Industries Ltd

- SAF Holland Group

- Bhagwati Wheels

- Pronar Wheels

- Tej Wheels

- Camso Wheels

第7章 市場機会と今後の動向

The Off-Highway Wheels Market size is estimated at USD 1.90 billion in 2025, and is expected to reach USD 2.54 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

The off-highway wheel market is experiencing robust growth driven by several key factors, including advancements in wheel technology, increased investment in infrastructure projects, and the growing demand for durable and efficient wheels in the agriculture, construction, and mining sectors. The report analyzes the primary drivers and recent developments influencing this market.

Technological innovations are significantly propelling the off-highway wheel market. Manufacturers are focusing on developing lightweight, durable wheels that offer enhanced performance and fuel efficiency. For example,

Key Highlights

- Maxion Wheels, in November 2022, launched a new generation of lightweight steel truck wheels, which provide weight savings of up to 3 kg per wheel. These advancements not only improve fuel efficiency but also allow for increased payload capacities, which is crucial for off-highway applications.

Furthermore, global infrastructure development is a major driver of the off-highway wheel market. Large-scale construction projects, particularly in developing economies, are increasing the demand for robust off-highway vehicles equipped with advanced wheels. Several mega projects around the world are significantly impacting the off-highway wheel market. For instance,

Key Highlights

- The Belt and Road Initiative (BRI) by China, launched in 2013, aims to enhance global trade routes through extensive infrastructure development across Asia, Europe, and Africa, driving demand for construction and mining equipment. India's Bharatmala Pariyojana, initiated in 2017, is a nationwide highway development project expected to be completed in phases by 2025, boosting the need for construction vehicles and equipment.

- Similarly, the Neom City Project in Saudi Arabia, announced in 2017 and expected to be completed by 2030, is an ambitious smart city initiative requiring vast quantities of construction machinery.

These large-scale infrastructure projects, such as the Belt and Road Initiative, Bharatmala Pariyojana, and Neom City, are set to drive substantial growth in the off-highway wheel market.

Off-Highway Wheels Market Trends

The Construction Segment is Expected to Dominate the Market Studied

The construction sector is highly dynamic, and numerous factors, such as the overall economy, budgets, and global economic scenario, are influencing the market's growth. Volatility in these aspects affects the businesses of construction equipment OEMs, which will, in turn, affect the demand for off-highway wheels.

The sector's demand for off-highway wheels is dominant due to the extensive need for earth-moving machinery in global infrastructure projects. Large-scale initiatives such as China's Belt and Road Initiative and India's Bharatmala Pariyojana necessitate a vast array of construction equipment, including excavators, loaders, bulldozers, and backhoes. These projects involve massive amounts of earth moving, which requires durable and high-performance wheels to ensure efficiency and reliability in challenging terrains. As countries continue to invest in building and upgrading their infrastructure, the demand for construction equipment wheels may remain robust.

Several countries are witnessing significant infrastructure growth owing to the increase in investments. The construction of buildings, tunnels, rail networks, roads, and bridges is attracting major investments across the country. Growing infrastructure development across the country is likely to increase the demand for construction equipment during the forecast period. For instance,

- In March 2024, the Indian government inaugurated and laid the foundation for 112 national highway projects across various states worth approximately USD 12.04 billion. These projects include major highway expansions and the introduction of new technologies like GNSS for barrier-free tolling.

In addition, the investments in infrastructure, both public and private, such as the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan "Build, Build, and Build" (USD 71.8 billion), are expected to increase the demand for off-highway vehicles in this region.

The increase in construction development across the globe is likely to enhance the demand for construction machinery, which, in turn, is likely to enhance the demand for wheels in the coming years.

Asia-Pacific is Anticipated to Dominate the Market

Asia-Pacific (APAC) continues to lead the off-highway wheel market due to several key factors driving growth in the construction, agricultural, and industrial sectors. The noteworthy development of road and rail infrastructure, coupled with significant investments in new projects, has resulted in substantial growth in the construction sector across the region. This has consequently increased the demand for off-highway vehicles and wheels.

APAC countries have been heavily investing in infrastructure to support their growing industrial and service sectors. For instance, China announced significant infrastructure plans involving an investment budget of approximately USD 4.8 trillion, aimed at new projects and speeding up existing construction efforts. This investment is part of China's broader strategy to enhance its infrastructure network, including roads, railways, and urban development, which drives the demand for robust and reliable off-highway wheels.

The agricultural sector in APAC, particularly in India, is another major driver of the off-highway wheel market. The sector's contribution to India's GDP increased significantly, with tractor sales reaching over 900 thousand units in FY 2023. This surge in tractor sales highlights the rising demand for agricultural machinery, which, in turn, may boost the need for off-highway wheels. With agriculture playing a crucial role in the economies of many APAC countries, the demand for off-highway wheels is expected to continue growing.

The construction sector in APAC is dominated by both private and state-owned enterprises, with increased spending on commercial projects, renewable energy, and public infrastructure. Countries like Japan, China, and India are seeing strengthening markets for construction machinery and excavators, driven by ongoing and planned mega-projects.

Off-Highway Wheels Industry Overview

Several key players, such as Titan International Inc., Moveero Limited, Yokohama, Accuride Corporation, Rimex, Steel Strips Wheels Ltd, and Maxion Wheels, dominate the off-highway wheels market. The players operating in the market are concentrating on several growth strategies to gain a competitive edge over other players. For instance,

- In March 2022, Titan International Inc. announced a definitive agreement to sell its Australian wheel business to OTR Tyres, a prominent local provider of tires, wheels, and related services for off-highway vehicles. This strategic move was part of Titan's efforts to streamline its global operations and focus on core markets. The sale included Titan's production facilities, inventory, and customer contracts in Australia, allowing OTR Tyres to enhance its market presence and service offerings.

- In February 2022, Titan International Inc. signed a significant agreement with Kubota Tractor Corporation (KTC) to supply its new Trac Loader II tires for Kubota's utility and compact tractor models. These tires are designed for light construction, agricultural, commercial, and residential applications, providing superior performance and durability. The Trac Loader II tires feature advanced tread designs and materials that improve traction, reduce soil compaction, and enhance the overall efficiency of tractors in various off-highway environments. This partnership with Kubota underscores Titan's commitment to innovation in off-highway wheels and tires, aiming to meet the evolving needs of customers in diverse applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Product Type

- 5.1.1 Alloy Wheels

- 5.1.2 Steel Wheels

- 5.2 By Application Type

- 5.2.1 Agriculture

- 5.2.2 Construction (Earth-moving Machinery)

- 5.2.3 Material Handling (Mobile Cranes and Forklift Trucks)

- 5.2.4 Mining (Mobile Mining Equipment)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Titan International Inc.

- 6.2.2 Moveero Limited

- 6.2.3 Accuride Corporation

- 6.2.4 Rimex

- 6.2.5 Steel Strips Wheels Ltd

- 6.2.6 Maxion Wheels

- 6.2.7 OTR Wheel Engineering

- 6.2.8 Carrier Wheels Private Limited

- 6.2.9 Bohnenkamp AG

- 6.2.10 Citic Dicastal Co. Ltd

- 6.2.11 Trident International

- 6.2.12 Levypyora Oy

- 6.2.13 JS Wheels

- 6.2.14 Anyang Rarlong Machinery Co. Ltd

- 6.2.15 STARCO

- 6.2.16 Sun Tyre and Wheel Systems

- 6.2.17 Baluchistan Wheels Limited

- 6.2.18 Topy Industries Ltd

- 6.2.19 SAF Holland Group

- 6.2.20 Bhagwati Wheels

- 6.2.21 Pronar Wheels

- 6.2.22 Tej Wheels

- 6.2.23 Camso Wheels