|

市場調査レポート

商品コード

1644456

流量計-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Flow Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 流量計-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

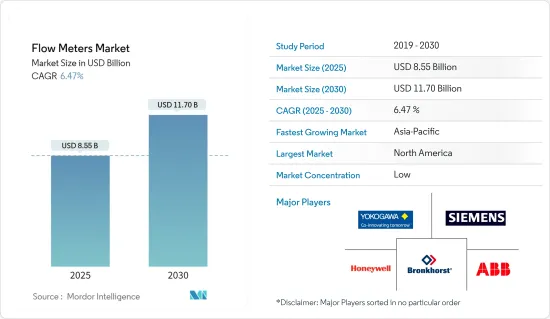

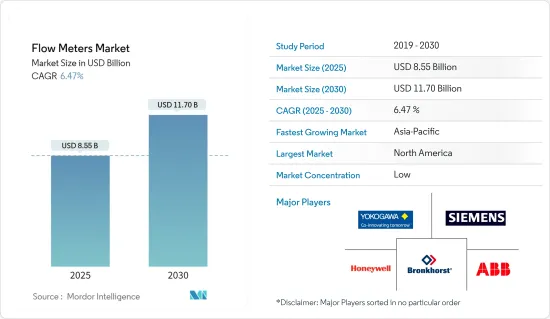

流量計の市場規模は2025年に85億5,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは6.47%で、2030年には117億米ドルに達すると予測されます。

流量センサと呼ばれる流量計は、主にパイプや管内の液体や気体の流量を測定または調整する電子機器です。HVACシステム、医療機器、化学工場、浄化システムなどで一般的に使用されています。これらの流量計は、主に漏れ、詰まり、パイプの破裂、汚染や公害による液体濃度の変化を検出することができます。

主要ハイライト

- 流量センサ/デバイスは一般的にゲージに接続され測定値を表示するが、コンピュータやデジタルインターフェースに接続することもできます。流量計は接触式と非接触式に分けられます。非接触流量計は、モニタリング対象の液体や気体(一般的には食品)が可動部品に接触することで汚染されたり、物理的に変化したりする場合に使用されます。

- IIoT、資産管理、高度診断など、複数の新興技術も、ユーザーとサプライヤー間の新たな協力関係の形成に役立っています。さらに、エンドユーザーとサプライヤー双方の戦略は、ネットワーキングとクラウドプラットフォームの進歩と、データと分析を含むサービス提供を活用しています。流量計は、蒸気、石油・ガス、水、化学品、鉱物油などの流量をモニタリング・測定するための需要も着実に増加しています。これらの流量計は、流量測定時に理想的かつ経済的な量に関する本質的な精度を記載しています。また、処理制御の面でもメリットがあります。

- 流量計技術の主要動向には、流量計のデジタル信号、複数の測定形式、オンライン診断とトラブルシューティング、遠隔校正と設定、オンライン警告付きスマートセンサなどがあります。堅実な研究開発による技術の進歩により、産業は複雑な運用上の問題に対する適切なソリューションを開発することも可能になりました。自動洗浄もまた、市場に見られる革命的な動向のひとつです。この動向は、上下水道管理などの産業にとって有利です。

- しかし、市場拡大を妨げる要因もあると予測されています。市場にある既存の流量計は、最新の機械やインフラに対応していないことがあります。そのため、既存の旧式のものを、より新しく効率的で互換性のある計器に置き換える必要があります。古い機器を新世代の機器に交換するための費用は、高額になる可能性があります。そのため、流量計の市場は確実に制限されます。

- 石油・ガス、化学、パルプ・製紙、金属・鉱業などの産業部門は、COVID-19パンデミックの影響を最も受け、そのためこれらの産業が提供する製品に対する需要がその後減少しました。しかし、製薬、エネルギー、公益事業用途の多くの産業部門では需要が大幅に急増しました。さらに、パンデミックは産業オートメーション導入にも大きく拍車をかけ、その結果、パンデミックと技術革新の間に製品発売が増加しました。

流量計市場動向

電磁流量計が大きな市場シェアを占める

- 電磁流量計はファラデーの誘導の法則を利用して流れを検出します。電磁コイルが磁界を発生させ、電磁流量計内に電圧(起電力)を取り込む電極があります。コイルと電極があるため、電磁流量計の流路管内には何もなく、流量を計測することができます。

- ファラデーの誘導の法則により、磁界の中で導電性の液体を動かすと電圧が発生します。配管内径、磁場強度、平均流速はすべて比例します。また、電磁流量計と他の流量計との決定的な違いは、電磁流量計は電磁誘導を利用しているため、流量を検出できる液体は導電性液体だけであることです。

- 電磁流量計は、食品産業、化学用途、天然ガス供給、廃水、鉱業、電力事業など幅広い用途に使用されています。電磁流量計は、液体の温度、圧力、密度、粘度の影響をほとんど受けないです。

- 米国地質調査所によると、昨年度の世界の銅鉱山生産量は推定2,100万トン。世界の銅生産量は過去10年間着実に伸びており、2010年の1,600万トンから増加しています。

- 電磁流量計は体積流量計としてスタートしたが、製品の密度を差し込むことで質量流量を測定することができます。精度を維持するためには密度値が安定していなければならないです。密度計を電磁流量計と併用して質量流量を測定する場合もあります。

- 例えば、鉱業会社では、摩耗を減らすために特定のライナーでスラリー流量を測定するために電磁流量計を使用することがよくあります。密度計は、電磁流量計がオンライン質量流量測定に変換するためのデータを送信します。世界の鉱業活動の成長が電磁流量計の使用を後押ししています。EIAによると、米国の原油生産量は、掘削活動の増加により、今年度40万b/d増加すると予想され、流量計の採用につながります。

北米が最大市場を記録する見込み

- 北米地域は、主に石油・ガス、化学、発電産業が著しく開拓されているため、大きな市場シェアを占めると予想されます。また、北米の再生可能エネルギー発電産業は、新規プロジェクトに大規模な投資を続けると予想されています。IRENAによると、昨年の世界の再生可能エネルギー設備容量は3.1テラワットとなり、前年比9.3%増となります。再生可能エネルギー部門は、再生可能技術の価格低下や、より伝統的エネルギー源が環境に与える影響への懸念から、ここ数十年で拡大を続けています。

- 昨年発行されたPipeline and Gas Journalのレポートによると、ダイヤフラム式容積計は、米国で商業用と公益事業用のガス流量測定に広く使用されています。これらのメーターは、ガス消費量を測定するために、レストランやその他の小規模事業所の外で使用されることが多いです。大規模な事業所でもガス消費量の測定にダイヤフラムメーターを使用しているが、多くの場合、メーターは電力会社が所有しています。最近では、ダイヤフラムメーターに代わってロータリーメーターが使われることもあります。

- このように、廃水システムの確立と組織を維持するために、多くの企業が必要な技術的専門知識を得るために戦略的買収を行っています。例えば、2021年5月、TASIグループ企業は、TASI Flowの既存のアセットマネジメントとワイヤレス接続戦略を補完するために、ミッション・コミュニケーションとノークロスGAを買収し、上下水道市場での強力なプレゼンスを可能にしました。

- 各社はまた、研究セグメントにおいて革新的なデジタルインターフェースとソフトウェアソリューションを導入しています。例えば、Emersonは2021年2月、石油・ガス産業向けにRoxar 2600 Multiphase Flow Meter(MPFM)を応用したプロセスの自動化を促進する新しいソフトウェアを発表しました。そのRapid Adaptive Measurementソフトウェアアーキテクチャは、Roxar 2600が10Hzで並列計算を行い、特定の時間に最適な構成を自動的に選択するのに役立ちます。

流量計産業概要

流量計市場は、Yokogawa Electric Corporation、ABB Ltd、Siemens AG、Bronkhorst High-Tech BV、Honeywell International Inc.などの大手企業が存在し、非常にセグメント化されています。同市場の参入企業は、製品ラインナップを強化し、サステイナブル競争優位性を獲得するために、提携、技術革新、買収などの戦略を採用しています。

2022年9月、Yokogawa Electric CorporationはOpreXTM磁気流量計CAシリーズの発売を発表しました。この新製品シリーズはADMAG CAシリーズを継承し、OpreX Field Instrumentsファミリーの一部として導入されました。この新シリーズは、すべて静電容量式の磁気流量計で、測定管を通る導電性流体の流量を、装置の電極に接触することなく測定することができます。このシリーズは、非濡れ電極アーキテクチャに加え、使いやすさ、保守性、運用効率を高める斬新な機能性を備えています。

2022年 6月、Sensirionはマスフローコントローラの製品ラインをSFC5500で拡充しました。この高性能マスフローコントローラとメータは、多数のガス用に校正されています。この機能にはプッシュイン・フィッティングが含まれており、適切なコンポーネント一覧からユーザが容易に交換することができます。各装置は従来の装置に存在する様々な流量レンジをカバーすることができます。SFC5500は多くの用途に対応できる軟質なSFC5500です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターファイブフォース

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 最近の技術動向

- COVID-19の産業への影響評価

第5章 市場力学

- 市場促進要因

- 流量測定用途におけるIoTと自動化の浸透

- 安全性と効率性に関する産業需要の高まり

- 市場課題

- 製品の進化に伴うコスト上昇

第6章 市場セグメンテーション

- 技術

- コリオリ式

- 電磁式

- インライン磁気流量計

- 小流量磁気流量計

- 挿入式

- 差圧式

- 超音波式

- クランプ式

- インライン

- その他

- エンドユーザー産業

- 石油・ガス

- 上下水道

- 化学・石油化学

- 飲食品

- パルプ・製紙

- その他

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Yokogawa Electric Corporation

- ABB Ltd

- Siemens AG

- Bronkhorst High-Tech BV

- Honeywell International Inc.

- Emerson Electric Co.

- SICK AG

- OMEGA Engineering

- Christian Burkert GmbH & Co. KG

- TSI incorporated

- Keyence Corporation

- Sensirion AG

- Azbil Corporation

- Endress+Hauser AG

- Krohne Messtechnik GmbH

第8章 投資分析

第9章 将来展望

The Flow Meters Market size is estimated at USD 8.55 billion in 2025, and is expected to reach USD 11.70 billion by 2030, at a CAGR of 6.47% during the forecast period (2025-2030).

Flow meters, called flow sensors, are electronic devices that primarily measure or regulate the flow rate of liquids and gases within pipes and tubes. They are commonly used in HVAC systems, medical devices, chemical factories, and septic systems. These meters can primarily detect leaks, blockages, pipe bursts, and liquid concentration changes owing to contamination or pollution.

Key Highlights

- The flow sensors/devices are generally connected to the gauges to render their measurements; however, they can also be connected to computers and digital interfaces. Flow meters can be divided into two groups, contact, and non-contact flow meters. Non-contact flow meters are used when the liquid or gas (generally, a food product) being monitored would be otherwise contaminated or physically altered by coming in contact with the moving parts.

- Multiple emerging technologies, such as IIoT, asset management, and advanced diagnostics, are also helping in forming new collaborations among users and suppliers. Moreover, the strategies for both end users and suppliers have been leveraging advancements in networking and cloud platforms and service offerings that include data and analytics. Flow meters are also witnessing a steady rise in the demand for monitoring and measuring the flow of steam, gas, water, chemicals, and mineral oil, among others. These meters offer essential precision regarding ideal and economic quantity during flow measurement. They offer advantages when it comes to processing control.

- Major trends in flow meter technology include digital signals for flow meters, multiple measurement formats, online diagnosis and troubleshooting, remote calibration and configuration, and smart sensors with online alerts. The technological advancements via robust research and development have also enabled the industry to develop appropriate solutions to complex operational problems. Automated cleaning is also one of the revolutionary trends observed in the market. This trend is advantageous for industries such as water and wastewater management.

- However, certain factors are projected to hinder market expansion. The existing flowmeters in the market are only sometimes compatible with modern machines and infrastructure. Therefore, there is a need to replace the existing outdated versions with newer, efficient, and compatible instruments. The expense of replacing the old instruments with the new generation of equipment might be a costly procedure. This will most certainly limit the market for Flow Meters.

- Industrial sectors, such as oil and gas, chemicals, pulp and paper, and metals and mining, were most affected due by the Covid-19 pandemic, thus witnessing a subsequent decline in the demand for products offered by these industries. However, demand significantly surged in many industrial sectors serving the pharmaceutical, energy, and utility applications. Furthermore, the pandemic also significantly fueled industrial automation adoption, resulting in increased product launches during the pandemic and innovation.

Flow Meters Market Trends

Electromagnetic Flow Meter Holds Significant Market Share

- Electromagnetic flow meters detect flow using Faraday's law of induction. An electromagnetic coil generates a magnetic field and electrodes that capture voltage (electromotive force) within an electromagnetic flowmeter. Due to the presence of coil and electrodes, there is nothing inside the flow pipes of an electromagnetic flow meter, and flow can be measured.

- According to Faraday's law of induction, moving conductive liquids inside the magnetic field generates voltage. The inner pipe diameter, magnetic field strength, and average flow velocity are all proportional. Also, an essential difference between electromagnetic and other flow meters is that because electromagnetic flowmeters work on electromagnetic induction, conductive liquids are the only liquids for which flow can be detected.

- Electromagnetic flowmeters have a wide range of applications in food industries, chemical applications, natural gas supplies, wastewater, mining, and power utilities. They are largely unaffected by the liquid's temperature, pressure, density, and viscosity.

- According to US Geological Survey, global copper mine production amounted to an estimated 21 million metric tons in the last year. Global copper production has steadily grown over the past decade, rising from 16 million metric tons in 2010.

- Electromagnetic flowmeters start as volumetric flow devices but can measure mass flow by plugging the product's density. The density value must remain stable for accuracy. In a few cases, a density meter is also used with electromagnetic meters to provide mass flow readings.

- For instance, mining companies often use an electromagnetic flow meter to measure slurry flow with specific liners to reduce abrasion. A densimeter sends data for the electromagnetic flowmeter to translate into an online mass flow measurement. The growth in mining activities globally is encouraging the use of electromagnetic flowmeters. According to EIA, crude oil production in the United States is expected to increase in the current year by 0.4 million b/d due to increased drilling activities, leading to flow meter adoption.

North America is Expected to Register the Largest Market

- The North American region is expected to hold a significant market share, primarily owing to the significantly developed oil and gas, chemicals, and power generation industries. The North American renewable power generation industry is also expected to continue to invest significantly in new projects. According to IRENA, In the last year, the global installed renewable energy capacity will be 3.1 terawatts, a 9.3 percent increase over the previous year. The renewable energy sector has undergone an expansion over recent decades due to decreasing pricing in renewable technologies as well as concerns about the environmental impact of more traditional sources.

- Diaphragm-positive displacement meters are widely used in the United States for commercial and utility gas flow measurement, per the Pipeline and Gas Journal report published last year. These meters are often used outside restaurants and other small businesses to measure gas consumption. Larger business establishments also use diaphragm meters to measure gas consumption, although, in many cases, the utility owns the meter. Recently, rotary meters have been replacing diaphragm meters in some applications.

- Thus, to maintain the establishment and organization of the wastewater system, many companies are making strategic acquisitions to gain the technical expertise required. For instance, in May 2021, The TASI Group of Companies acquired Mission Communication and Norcross GA to complement TASI Flow's existing Asset Management and Wireless Connectivity Strategy, enabling a strong presence in the Water and Wastewater market.

- Companies are also introducing innovative digital interfaces and software solutions in the studied segment. For instance, in February 2021, Emerson launched new software that boosts process automation with the application of the Roxar 2600 Multiphase Flow Meter (MPFM) for the oil and gas industry. Its Rapid Adaptive Measurement software architecture helps the Roxar 2600 to do the parallel calculation at 10Hz and automatically select the optimal configuration for a particular time.

Flow Meters Industry Overview

The flow meters market is highly fragmented with the presence of major players like Yokogawa Electric Corporation, ABB Ltd, Siemens AG, Bronkhorst High-Tech BV, and Honeywell International Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2022, Yokogawa Electric Corporation announced the launch of the OpreXTM Magnetic Flowmeter CA Series. This new product series succeeded the ADMAG CA Series and was introduced as part of the OpreX Field Instruments family. The items in this new series are all capacitance-type magnetic flowmeters that can measure the flow of conductive fluids through a measurement tube without contacting the device's electrodes. This series has novel functionalities that increase user-friendliness, maintainability, and operational efficiency, in addition to the non-wetted electrode architecture.

In June 2022, Sensirion expanded its mass flow controller line with the SFC5500. The high-performance mass flow controllers and meters are calibrated for numerous gases. The feature includes push-in fittings, which the user from the list of suitable components can readily replace. Each device may cover a variety of flow ranges present in traditional devices. The SFC5500 is a flexible SFC5500 that can handle many applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Recent Technological Developments

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Penetration of IoT and Automation in Flow Rate Measurement Applications

- 5.1.2 Growing Industrial Demand regarding Safety and Efficiency Concerns

- 5.2 Market Challenges

- 5.2.1 Rising Cost With Product Advancement

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Coriolis

- 6.1.2 Electromagnetic

- 6.1.2.1 In-line Magnetic Flowmeters

- 6.1.2.2 Low Flow Magnetic Flowmeters

- 6.1.2.3 Insertion

- 6.1.3 Differential Pressure

- 6.1.4 Ultrasonic

- 6.1.4.1 Clamp-on

- 6.1.4.2 In-line

- 6.1.5 Other Technologies

- 6.2 End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Water and Wastewater

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Food & Beverage

- 6.2.5 Pulp and Paper

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Yokogawa Electric Corporation

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 Bronkhorst High-Tech BV

- 7.1.5 Honeywell International Inc.

- 7.1.6 Emerson Electric Co.

- 7.1.7 SICK AG

- 7.1.8 OMEGA Engineering

- 7.1.9 Christian Burkert GmbH & Co. KG

- 7.1.10 TSI incorporated

- 7.1.11 Keyence Corporation

- 7.1.12 Sensirion AG

- 7.1.13 Azbil Corporation

- 7.1.14 Endress+Hauser AG

- 7.1.15 Krohne Messtechnik GmbH