|

市場調査レポート

商品コード

1436023

バーチャル臨床試験:世界市場シェア分析、業界動向と統計、成長予測(2024~2029年)Global Virtual Clinical Trials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バーチャル臨床試験:世界市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

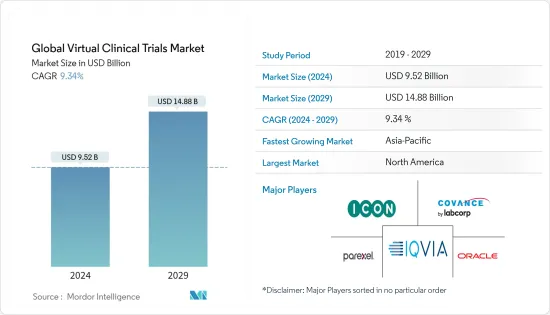

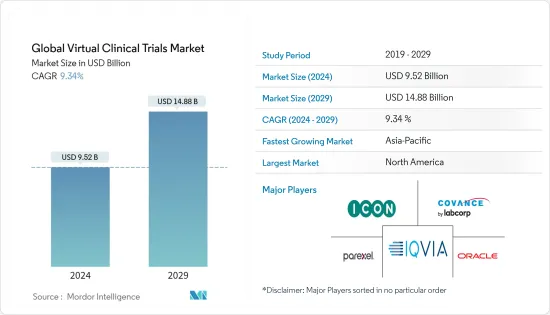

世界のバーチャル臨床試験市場規模は、2024年に95億2,000万米ドルと推定され、2029年までに148億8,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に9.34%のCAGRで成長します。

COVID-19のパンデミックにより、世界の大部分で人口移動と輸送システムが遮断され、多くの治験患者が治験施設に出席できなくなり、主任研究者(PI)やその他の臨床スタッフの自宅待機が制限されました。そのため、裁判の延期や中止が相次いでいます。ブリストル・マイヤーズスクイブ社、ファイザー社、メルク社、イーライリリー社は、今後数週間の新規治験の開始や既存の研究への募集の停止を発表する企業のリストの中で増えています。 2020年4月に発表されたContinuum Clinical Analysisレポートによると、調査対象となった臨床試験実施地の約30%は、新たな治験への患者の登録と、現在登録している患者の試験スケジュールを順調に進めることの両方に大きな影響を与えると予想されています。議会予算局が発表した報告書によると、2020年4月に約30社の製薬会社またはバイオテクノロジー会社が治験の中断を報告しました。ここで、臨床試験の中断を軽減するために製薬会社やバイオテクノロジー企業が開発した遠隔医療やデジタル技術を活用した仮想治験が活躍します。

バーチャル臨床試験市場は、医療分野におけるデジタル化の進展、研究開発活動の成長、遠隔医療の導入によって牽引されています。たとえば、ジョンソン・エンド・ジョンソンは2020年2月に、Apple Watchと新しいiPhoneアプリが不整脈を検出することで脳卒中のリスクを軽減できるかどうかを確認するハートライン仮想試験設計研究を開始しました。バーチャル臨床試験は、採用率が高く、コンプライアンスが向上し、脱落率が低く、従来の臨床試験よりも迅速に実施されます。

さらに、ウェブベースの臨床試験の開始、臨床調査会社、バイオテクノロジー企業、製薬会社間のコラボレーション、政府による支援イニシアチブなどのテクノロジーの進歩が市場を押し上げると予想されます。たとえば、2020年 11月に、パレクセルは臨床試験センター(CTC)と協力しました。この協力により、初期段階の臨床試験を実施する調査能力が向上する可能性があります。また、パンデミック下での初期臨床研究の需要の高まりと継続も後押しする可能性が高いです。同様に、2020年10月にオラクルはFHI Clinicalと協力して臨床試験の効率を向上させ、治療薬のより迅速な市場投入を支援しました。

さらに、心臓病、感染症、神経疾患などの慢性疾患に苦しむ人々の発生の増加、および高齢者人口の増加も、バーチャル臨床試験市場の成長を推進する要因となっています。たとえば、疾病管理予防センター(2021)によると、米国では平均して10人中6人が慢性疾患に苦しんでおり、10人中4人が2つ以上の慢性疾患に苦しんでおり、その結果、この国の主な死因となっています。 WHOによると、2020年には世界中で慢性疾患が死亡者のほぼ4分の3を占め、死亡者の71%が虚血性心疾患(IHD)によるもの、死亡者の75%が脳卒中によるもの、死亡者の70%が脳卒中によるものでした。新興諸国では糖尿病が原因で発生する可能性があります。病気の負担が増大するにつれ、新薬の開発に対する需要が高まることが予想されます。これにより、医療業界の技術開発が促進され、市場の成長が促進されるとさらに予想されます。

ただし、収集データの量が増えると、規制当局に対する信頼性、技術の障害、データの正確性が証明および管理され、これらは世界のバーチャル臨床試験市場の成長を妨げると予想される課題の一部です。

バーチャル臨床試験市場の動向

腫瘍セグメントは、予測期間中に市場のかなりのシェアを占めると予想される

腫瘍セグメントは、政府によるがん啓発への取り組みの強化、がん罹患率の上昇、抗がん剤開発の研究開発活動の増加により、腫瘍学試験の数が増加することにより、予測期間にわたって市場を独占すると予想されています。 Globocan 2020のファクトシートによると、推定19,292,789人のがん症例が診断され、9,958,130人ががんにより死亡しています。

世界のがんの負担は世界中で増加しています。バーチャル臨床試験は、がん患者のリスク(免疫抑制のリスク、移動の負担、治療の多様性、規制の複雑さ)を最小限に抑え、対面での治験訪問に費やす時間を短縮します。患者の安全を守るために、腫瘍学の臨床試験の研究者とスポンサーは、すぐにバーチャル臨床試験と遠隔臨床試験を取り入れました。 2019年10月、ジョージタウン大学医療センターは、がん患者のプロファイルにアクセスする時間を差し引くためにクラウドベースの仮想相互接続コンピューティング技術を使用しました。これは、仮想的に評価された症例数が、従来の3件の評価と比較して46件から622件に増加したことを示しています。 2014年から2017年までに14件に増加。

National Clinical Trialsによると、2020年 4月に、開発のさまざまな段階にわたって腫瘍学に関する約8,306件の臨床試験が実施されました。臨床試験の数が増加するにつれて、バーチャル臨床試験の需要が増加する可能性が高くなります。したがって、上記の要因が予測期間中にこのセグメントを推進すると予想されます。

現在、北米はバーチャル臨床試験市場を独占しており、予測期間中もその傾向が続くと予想

地理的には、北米は医薬品を製造する大手企業の存在に加え、新薬の開発への投資に注力する政府や企業の台頭により、世界のバーチャル臨床試験市場で最大の収益源の1つを占めています。 2019年11月、ジョンソン・エンド・ジョンソンの製薬子会社であるヤンセンは、PRAヘルスサイエンスと協力して、完全に分散化された適応探索型のモバイル臨床試験であるデジタル臨床試験セットアップCHIEF-HFを開始しました。同社は、ウェアラブルデバイスとスマートテクノロジーを活用して、2型糖尿病の有無を伴う心不全患者におけるカナグリフロジンの有効性を評価するための証拠を効率的に収集および分析することを目指しています。

さらに、この地域は予測期間中引き続きその優位性を維持すると予想されます。これは、この地域での研究開発の増加と、臨床調査および政府の支援における新技術の採用に起因すると考えられます。さらに、市場関係者はデジタル技術を利用して顧客のニーズに応えています。たとえば、2020年にパレクセルは、ハイブリッドおよび仮想/分散型アプローチを含む100件を超える分散型トライアルを実行しました。ただし、がん症例やその他の慢性疾患の増加により、バーチャル臨床試験市場は予測期間を通じて大幅に増加する可能性があります。

バーチャル臨床試験業界の概要

バーチャル臨床試験市場は競争が激しく、複数の大手企業で構成されています。市場で活動しているプレーヤーは、製薬分野での経験、臨床試験での経験、テクノロジーへの投資など、さまざまな競合要因に基づいて活動しています。市場参入企業が採用する戦略は、パートナーシップ、コラボレーション、合意、製品の発売、製品の拡大です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 医療分野におけるデジタル化の進展

- バーチャル臨床試験における技術の進歩

- 慢性疾患の有病率

- 市場抑制要因

- バーチャル臨床試験に伴う課題

- 業界の魅力- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 研究デザイン別

- 観察

- 介入

- 拡張アクセス

- 適応症タイプ別

- 循環器疾患

- 腫瘍

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東とアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Clinical Ink Inc.

- Laboratory Corporation of America Holdings(Covance Inc.)

- ICON PLC

- IQVIA Inc.

- LEO Innovation Lab

- Medable Inc.

- Dassault Systemes SE(Medidata Solutions Inc.)

- Medpace Holdings Inc.

- Oracle Corporation

- Parexel International Corporation

- Signant Health

第7章 市場機会と将来の動向

The Global Virtual Clinical Trials Market size is estimated at USD 9.52 billion in 2024, and is expected to reach USD 14.88 billion by 2029, growing at a CAGR of 9.34% during the forecast period (2024-2029).

The COVID-19 pandemic has shut down population movements and transport systems across large parts of the world, preventing many clinical trial patients from attending trial sites and restricting principal investigators (PIs) and other clinical staff to their homes. Hence, the flurry of trial delays and cancellations. Bristol Myers Squibb Co., Pfizer Inc., Merck & Co., and Eli-Lilly & Co. are among the growing list of companies to have announced a stop to new trial starts and pauses to recruitment into existing studies for the next several weeks. According to Continuum Clinical analysis reports published in April 2020, around 30% of the surveyed clinical trial locations are expected to have a significant impact on both enrolling patients for new trial studies and keeping patients who are currently enrolled on track with their study schedules. According to a report published by Congressional Budget Office, in April 2020, approximately 30 pharmaceutical or biotech companies had reported a trial disruption. This is where the virtual trial comes into play with telemedicine and digital technologies developed by pharmaceutical and biotech companies to reduce the clinical trials disruption.

The virtual clinical trials market is driven by the growing digitization in the healthcare sector, growth in R&D activities, and the adoption of telehealth. For example, in February 2020, Johnson & Johnson launched the Heartline virtual trial design study to see if the Apple Watch and new iPhone app may reduce the risk of stroke by detecting cardiac arrhythmia. Virtual clinical trials have higher recruitment rates, better compliance, lower drop-out rates, and are conducted faster than traditional clinical trials.

Moreover, advancements in technology, such as the launch of web-based clinical trials, collaborations between clinical research companies, biotechnology companies and pharmaceutical, and support initiatives from governments are expected to boost the market. For example, in November 2020, Parexel collaborated with the Clinical Trial Center (CTC). This collaboration may increase the research capacity of delivering early phase clinical trials. It is likely to also support the rising demand and continuation of early phase clinical studying during the pandemic. Similarly, in October 2020, Oracle collaborated with FHI Clinical for improving the efficiency of the clinical trial and helped in getting therapies to market faster.

Additionally, the increasing occurrence of people suffering from chronic diseases, such as heart diseases, infectious diseases, neurological diseases, and the rising geriatric population, are factors that propel the growth virtual clinical market. For instance, according to the Center for Disease Control and Prevention (2021), in the United States, on average, 6 out of 10 people are suffering from a chronic disease, and 4 out of 10 people are suffering from two or more, resulting in the leading cause of death in the country. According to the WHO, in 2020, chronic diseases accounted for almost three-quarters of all deaths, worldwide, and that 71% of deaths due to ischaemic heart disease (IHD), 75% of deaths due to stroke, and 70% of deaths due to diabetes may occur in developing countries. With the increasing burden of diseases, it is expected to increase the demand for the development of new drugs. This is further anticipated to fuel the technological development in the healthcare industry, thereby, augmenting the market growth.

However, a greater amount of collection data prove and manage reliability to regulators, technology failure, and data accuracy, which are some of the challenges anticipated to hamper the growth of the global virtual clinical trials market.

Virtual Clinical Trials Market Trends

The Oncology Segment is Expected to Occupy a Significant Share of the Market Over the Forecast Period

The oncology segment is expected to dominate the market over the forecast period due to increasing government initiatives for cancer awareness, rising in the prevalence of cancer, and increasing R&D activities on the development of cancer drugs, thus, increasing the number of oncological trials. According to Globocan 2020 fact sheet, an estimated 19,292,789 cancer cases were diagnosed with 9,958130 death due to cancer.

The worldwide cancer burden is rising, worldwide. Virtual clinical trials minimize the cancer patient's risk (risk of Immunosuppression, travel burden, therapeutic diversity, and regulatory complexity) and decrease time spent on face-to-face trial visits. To keep patients safe, oncology clinical trial investigators and sponsors have quickly incorporated virtual and remote trials. In October 2019, the Georgetown University Medical Center used cloud-based virtual interconnected computing techniques for deducting the time in accessing cancer patients' profiles, which indicates that the number of cases virtually assessed augmented from 46 to 622 as compared to the conventional assessments from 3 to 14 cases from 2014-2017.

According to the National Clinical Trials, in April 2020, around 8,306 clinical trials on oncology across the various phases of development were conducted. As the number of clinical trials increased, there are higher chances of increasing the demand for virtual clinical trials. Thus, the factors mentioned above are expected to drive the segment over the forecast period.

North America is Currently Dominating the Virtual Clinical Trials Market and is Expected to Continue in the Forecast Period

Geographically, North America accounts for one of the largest revenue holders in the global virtual clinical trials market due to the presence of major companies that manufacture pharmaceuticals, coupled with rising government and companies, which focus on investment in the development of new medicines. In November 2019, Janssen, a pharmaceutical subsidiary of Johnson & Johnson, in collaboration with the PRA Health Sciences, launched a digital clinical trial set-up CHIEF-HF a completely decentralized, indication-seeking, mobile clinical study. The company aims to utilize wearable devices and smart technology to efficiently gather and analyze evidence for assessing the effectiveness of Canagliflozin in the populace with heart failure with the presence or absence of Type 2 diabetes.

Moreover, the region is expected to continue its dominance over the forecast period. This can be attributed to increasing R&D in the region and the adoption of new technologies in clinical research and government support. Furthermore, market players are using digital technologies to meet client needs. For instance, in 2020, Parexel performed more than 100 decentralized trials, including hybrid and virtual/decentralized approaches. However, due to an increase in cancer cases and other chronic diseases, the virtual clinical trials market is likely to boost significantly throughout the forecast period.

Virtual Clinical Trials Industry Overview

The virtual clinical trials market is highly competitive and consists of several major players. The players operating in the market are operating on different competitive factors, such as experience in the pharmaceutical, experience in clinical trials, and investment in technology. The strategies adopted by the market participants are partnerships, collaborations, agreement, product launch, and product expansion. The players include Clinical Ink inc., IQVIA Holdings Inc., ICON PLC, Laboratory Corporation of America Holdings (Covance Inc.), LEO Innovation Lab., Dassault Systemes SE (Medidata Solutions Inc.), Oracle Corporation, Parexel International Corporation, Medable Inc., and Signant Health.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Digitization in Healthcare Sector

- 4.2.2 Technological Advancements in Virtual Clinical Trials

- 4.2.3 Prevalence of Chronic Disease

- 4.3 Market Restraints

- 4.3.1 Challenges Associated with the Virtual Clinical Trials

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Study Design

- 5.1.1 Observational

- 5.1.2 Intervensional

- 5.1.3 Expanded Access

- 5.2 By Indication Type

- 5.2.1 Cardiovascular Disease

- 5.2.2 Oncology

- 5.2.3 Other Indication Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Clinical Ink Inc.

- 6.1.2 Laboratory Corporation of America Holdings (Covance Inc.)

- 6.1.3 ICON PLC

- 6.1.4 IQVIA Inc.

- 6.1.5 LEO Innovation Lab

- 6.1.6 Medable Inc.

- 6.1.7 Dassault Systemes SE (Medidata Solutions Inc.)

- 6.1.8 Medpace Holdings Inc.

- 6.1.9 Oracle Corporation

- 6.1.10 Parexel International Corporation

- 6.1.11 Signant Health