|

市場調査レポート

商品コード

1435801

エンジニアリングプラスチックリサイクル:市場シェア分析、産業動向と統計、成長予測(2024年~2029年)Engineering Plastic Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エンジニアリングプラスチックリサイクル:市場シェア分析、産業動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

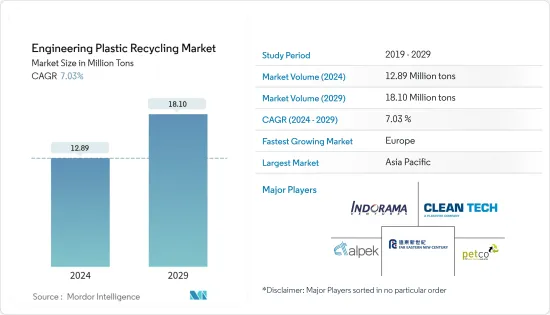

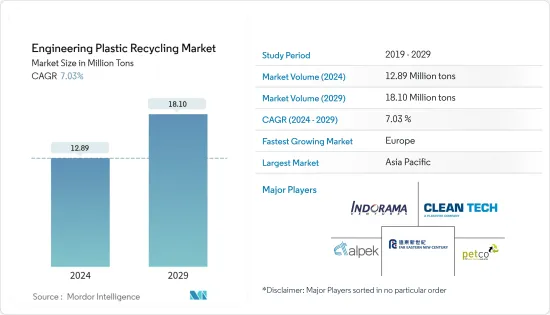

エンジニアリングプラスチックリサイクル市場規模は、2024年に1,289万トンと推定され、2029年までに1,810万トンに達すると予測されており、予測期間(2024年から2029年)中に7.03%のCAGRで成長します。

新型コロナウイルス感染症(COVID-19)のパンデミックは、エンジニアリングプラスチックリサイクル部門に打撃を与えました。世界のロックダウンと各国政府による厳格な規制により、ほとんどの生産拠点が閉鎖され、壊滅的な打撃を被った。それにもかかわらず、ビジネスは2021年以降回復しており、今後数年間で大幅に増加すると予想されています。

主なハイライト

- 調査対象の市場の成長を促進する主な要因は、消費者と包装製品の間で持続可能性に対する重要性が高まっていることと、リサイクルポリエステルの使用が増加していることです。

- 一方で、混合プラスチックの収集と分別の難しさが市場の成長を妨げると予想されます。

- プラスチックの自動処理と分別のためのリサイクル技術の革新は、世界のエンジニアリングプラスチックリサイクル市場に十分な機会を提供すると期待されています。

- アジア太平洋地域が最大のシェアを占めました。ただし、欧州は予測期間中に最も高いCAGRで推移すると予想されます。

エンジニアリングプラスチックリサイクル市場の動向

市場を独占する包装業界

- PETは、包装用途に最も広く使用されているプラスチックの1つです。PETは食品に安全であるだけでなく、強度が高く、軽量で、透明で、飛散しにくいという特徴もあります。さらに、PETは二酸化炭素に対する効果的なバリアとしての特性を備えているため、飲料や硬質食品の包装に比類のない選択肢となっています。

- 英国プラスチック連盟(BPF)は、現在、ソフトドリンク(炭酸飲料、発泡性飲料、発泡性飲料、フルーツジュース、ボトル入り飲料水)のほぼ70%がPETプラスチックボトルで包装されていると述べています。

- さらに、BP plcは、PETは通常食品の硬質包装に使用されており、世界中で年間約2,700万トンのPETがこれらの用途に使用されており、その大部分の約2,300万トンがボトルに使用されていると述べています。リサイクルPETは、新しい包装製品のバージンPETポリマーのすべてまたは一部を置き換えることができます。

- 多くの大手包装会社が廃棄物管理への取り組みを計画しており、リサイクルが注目を集めています。多くの企業が家庭の廃棄物管理からペットボトルを回収し、プラスチックフレークに加工して包装用途にさらに使用しています。

- 世界中の多くの大手ブランドが、飲料製品の二酸化炭素排出量を削減するためにリサイクルPETの使用に取り組んでいます。その中には、コカ・コーラ、ネスレウォーターズ、ペプシコ、ダノンなどが含まれ、その他のソフトドリンクやボトル入り飲料水の販売会社は、2030年までに使い捨てプラスチックの使用を中止することを約束しています。

- フレキシブル・パッケージング・アソシエーション(FPA)によると、米国のパッケージング産業は、フレキシブル・パッケージング分野で2022年に1,850億米ドルと評価され、市場全体の約20%を占めています。 2022年の軟包装の前年比成長率は12.1%増加しました。

- したがって、包装業界は市場を独占すると予想され、エンジニアリングプラスチックリサイクル市場で活動するプレーヤーに多くの成長機会を提供すると予想されます。

アジア太平洋地域が市場を独占

- アジア太平洋地域は、中国、日本、インドからのプラスチックリサイクル需要により、エンジニアリングプラスチックリサイクル市場を独占しました。

- 中国は世界最大のポリエチレンテレフタレート(PET)消費国の一つです。原材料の豊富な入手可能性と生産コストの低さにより、ここ数年、国内におけるPETなどのエンジニアリングプラスチックの生産成長が支えられてきました。

- 中国国家統計局によると、2022年上半期の中国のプラスチック製品生産量は約3,821万トン、2021年には約8,004万トンとなった。

- インド・ブランド・エクイティ財団(IBEF)によると、2022年4月から2023年2月までのインドのプラスチック輸出は109億米ドルだった。さらに、PET包装クリーン環境協会(PACE)と国立化学研究所(NCL)によると、インドのリサイクルPETプラスチック産業の規模は約4億~5億5,000万米ドルと推定されています。このように、プラスチックの輸出とリサイクル活動の増加により、エンジニアリングプラスチックのリサイクル市場が拡大しています。

- さらに、包装、自動車、電気、電子などの多くの最終用途産業における再生プラスチックに対する大きな需要が市場の成長をさらに推進しています。

- 例えば、OICAによると、2022年のアジア太平洋の自動車総生産台数は5,002万793台となり、2021年の4,676万8,800台と比較して7%増加しました。

- したがって、プラスチック生産の増加、リサイクル活動の顕著な成長、およびいくつかのエンドユーザー産業の大きな需要により、エンジニアリングプラスチックリサイクル市場の成長が推進されています。

プラスチックリサイクル業界の概要

エンジニアリングプラスチックリサイクル市場は、地域の市場プレーヤーの支配力が非常に高いため、非常に細分化されています。市場の主要企業には(順不同)、Indorama Ventures Public Company Limited、Clean Tech UK Ltd、Far Eastern New Century Corporation(Phoenix Technologies)、Alpek SAB de CV、Petcoなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 消費者製品および包装製品における持続可能性の重視の高まり

- 再生ポリエステルの使用の増加

- その他の促進要因

- 抑制要因

- 混合プラスチックの回収・分別の困難さ

- その他の阻害要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(市場規模:数量ベース)

- プラスチックの種類

- ポリカーボネート

- ポリエチレンテレフタレート(PET)

- スチレンコポリマー(ABS、SAN)

- ポリアミド

- その他

- エンドユーザー産業

- 包装

- 工業用糸

- 電気・電子

- その他

- 地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 世界のその他の地域

- 南米

- 中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア分析(%)/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- Alpek S.A.B. de C.V.

- Clean Tech UK Ltd

- Euresi Plastics SL

- EF Plastics UK Ltd

- Far Eastern New Century Corporation(Phoenix Technologies)

- Indorama Ventures Public Company Limited

- JFC Group

- Krones AG

- Petco

- Placon

- PolyClean Technologies

- Reliance Industries Limited

- REPRO-PET

- TEIJIN LIMITED

- UltrePET LLC

第7章 市場機会と今後の動向

The Engineering Plastic Recycling Market size is estimated at 12.89 Million tons in 2024, and is expected to reach 18.10 Million tons by 2029, growing at a CAGR of 7.03% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the engineering plastic recycling sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factor driving the growth of the market studied is the growing emphasis on sustainability among consumers and packaging products and the increasing use of recycled polyester.

- On the flip side, difficulty in collecting and sorting mixed plastic is expected to hinder the market's growth.

- Innovations in recycling technologies for the automatic processing and sorting of plastics are expected to provide ample opportunities in the global engineering plastic recycling market.

- The Asia-Pacific region accounted for the largest share; however, Europe is expected to register the highest CAGR during the forecast period.

Plastic Recycling Market Trends

Packaging Industry to Dominate the Market

- PET is one of the most widely used plastics for packaging applications. Apart from being food-safe, PET is also strong, lightweight, transparent, and shatter-resistant. Moreover, the characteristics of PET, as an effective barrier to carbon dioxide, make it an unrivaled choice for beverage and rigid food packaging.

- British Plastics Federation (BPF) stated that, at present, nearly 70% of soft drinks (carbonated drinks, still and dilatable drinks, fruit juices, and bottled water) are packaged in PET plastic bottles.

- Further, BP p.l.c. stated that PET is usually used in rigid food packaging, and per year, nearly 27 million metric tons of PET are used in these applications globally, with the majority, around 23 million tons, used in bottles. Recycled PET can replace all or a proportion of virgin PET polymer in new packaging products.

- Recycling has been gaining traction as many major packaging companies are planning initiatives for waste management. Many companies are collecting PET bottles from domestic waste management and then processed into plastic flakes to further use in packaging applications.

- Numerous major brands worldwide are committed to using recycled PET to reduce the carbon footprint of their drink products. Some of these include Coca-Cola, Nestle Waters, PepsiCo, and Danone, others that sell soft drinks and bottled water, have committed to stop using single-use plastics by 2030.

- According to Flexible Packaging Association (FPA), the United States packaging industry was valued at USD 185 billion in 2022 in flexible packaging, accounting for around 20% of the total market share. The year-on-year growth of flexible packaging in 2022 was up 12.1%.

- Hence, the packaging industry is expected to dominate the market and expect to provide numerous growth opportunities to the players operating in the engineering plastic recycling market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the engineering plastic recycling market owing to the demand for plastic recycling from China, Japan, and India.

- China is one of the largest global polyethylene terephthalate (PET) consumers. The abundant availability of raw materials and the low cost of production have supported the production growth of engineering plastics, such as PET, in the country for the past few years.

- According to the National Bureau of Statistics of China, in H1 2022, China produced plastic products to nearly 38.21 million metric tons, around 80.04 million metric tons in 2021.

- According to the Indian Brand Equity Foundation (IBEF), India's plastic export from April-2022 to February 2023 stood at USD 10.9 billion. Further, according to PET Packaging Association for Clean Environment (PACE) and National Chemical Laboratory (NCL), the Indian recycled PET plastic industry was estimated to be around USD 400-550 million. Thus, increasing plastic export and recycling activities is boosting the engineering plastic recycling market.

- Further, the significant demand for recycled plastic in numerous end-use industries, such as packaging, automotive, electrical, and electronics, is further propelling the market growth.

- For instance, according to OICA, in 2022, the total production of motor vehicles in Asia-Pacific amounted to 50,020,793 units which was increased by 7% compared to 2021, which accounted for 46,768,800 units.

- Thus, the rise in plastic production, remarkable growth in recycling activities, and significant demand for several end-user industries is propelling the growth of the engineering plastic recycling market.

Plastic Recycling Industry Overview

The engineering plastic recycling market is highly fragmented as the dominance of regional market players is extremely high. Some of the major players in the market (in no particular order) include Indorama Ventures Public Company Limited, Clean Tech U.K. Ltd, Far Eastern New Century Corporation (Phoenix Technologies), Alpek S.A.B. de C.V., and Petco.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Emphasis on Sustainability among Consumer and Packaging Products

- 4.1.2 Increasing Use of Recycled Polyester

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Difficulty in Collecting and Sorting Mixed Plastic

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Plastic Type

- 5.1.1 Polycarbonate

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Styrene Copolymers (ABS and SAN)

- 5.1.4 Polyamide

- 5.1.5 Other Engineering Plastics

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Industrial Yarn

- 5.2.3 Electrical and Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek S.A.B. de C.V.

- 6.4.2 Clean Tech UK Ltd

- 6.4.3 Euresi Plastics SL

- 6.4.4 EF Plastics UK Ltd

- 6.4.5 Far Eastern New Century Corporation (Phoenix Technologies)

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 JFC Group

- 6.4.8 Krones AG

- 6.4.9 Petco

- 6.4.10 Placon

- 6.4.11 PolyClean Technologies

- 6.4.12 Reliance Industries Limited

- 6.4.13 REPRO-PET

- 6.4.14 TEIJIN LIMITED

- 6.4.15 UltrePET LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Recycling Technologies for Automatic Processing and Sorting of Plastics

- 7.2 Other Opportunities