|

市場調査レポート

商品コード

1444940

Eマウンテンバイク:市場シェア分析、業界動向と統計、成長予測(2024~2029年)E-Mountain Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| Eマウンテンバイク:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 90 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

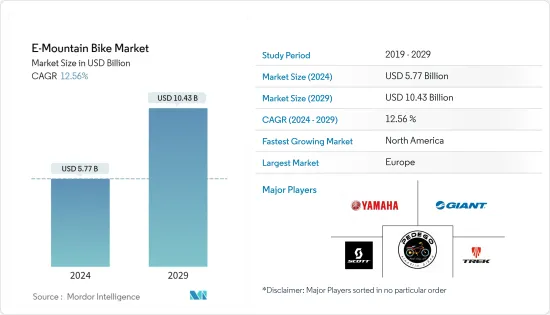

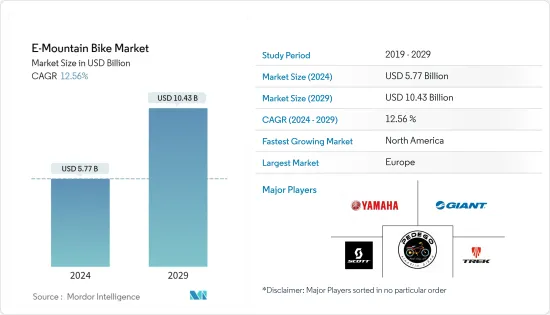

Eマウンテンバイクの市場規模は、2024年に57億7,000万米ドルと推定され、2029年までに104億3,000万米ドルに達すると予測されており、予測期間(2024年~2029年)中に12.56%のCAGRで成長する見込みです。

主なハイライト

- より広範なスケールで見ると、COVID-19は他の市場に多大な悪影響を与えたのに比べ、Eマウンテンバイク市場への影響はわずかでした。個人のモビリティへの関心が高まり、交通渋滞を克服する必要があるため、個人用車両の需要は増加すると考えられます。また、環境への影響が増大し、排気ガスによる気温上昇が懸念される中、電動自転車は従来の自転車やオートバイに代わる優れた代替品となっています。

- しかし、COVID-19により人の移動がゼロになり、業界は後退し、新しい電動自転車の製造が停止されました。COVID-19後、消費者のレクリエーション活動や健康意識の高まりにより、市場は経済面で大幅に上昇するとみられています。

- 若い世代がトレッキングやレクリエーション活動に高い関心を示しているため、長期的にはe-マウンテンは急速に成長しています。ただし、これらの自転車に関連する速度と安全性の問題に関する政府の規制などの要因が市場の成長を妨げる可能性があります。たとえば、国際自転車競技連合(UCI)は、Eマウンテンバイクの電気モーターに関して、250ワットを超えてはいけないという厳しい規制を採用しました。ペダリング補助は最高時速25キロまでのみ許可されます。

- 欧州は、Eマウンテンバイクの最も高い普及率を記録すると予想されており、グローバルスタンスをリードしています。

Eマウンテンバイク(EMTB)市場動向

持続可能な交通への需要の高まり

- 私たちが住んでいる現在の社会において、モビリティは重要な役割を果たしています。主に天然資源の不足と環境問題の増大により、モビリティを将来の世代のために保存し維持することへの関心が高まる中、環境の保護は社会と世界中の政府にとって重大な課題となっています。

- その結果、Eマウンテンバイクに対する需要の高まりは、この課題に対する理想的な解決策となります。排出レベルの上昇により環境と健康への懸念が高まり続ける中、世界中の政府や国際機関は炭素排出レベルを削減するために厳しい排出基準を制定しています。

- このため、世界中の一部の国際機関は車両に厳しい基準を課しています。たとえば、欧州連合は2020年1月に規制(EU)2019/631を施行し、新しい乗用車およびバンのCO2排出性能基準を設定しました。欧州で登録された新車乗用車の平均CO2排出量は前年比12%減少し、電気自動車のシェアは3倍になりました。

- さらに、化石燃料のレベルが驚くべき速度で減少しているため、将来の世代の持続可能性に対する懸念が生じています。この要因は、政府と社会にとって大きな課題となっています。

- ここ数年、燃料費の高騰により電動自転車の売上が急速に増加しており、日常の交通手段として電動自転車の導入が進んでいます。スイスは最高のトレッキング場所のひとつと考えられています。市場のプレーヤーは、顧客ベースを拡大するために、大容量バッテリー、優れた快適性、航続距離の向上、優れた機能を搭載した、軽量で頑丈なe-MTBを発売しています。

- たとえば、2022年10月に、Ibis Osoは新しいEマウンテンバイクを発売しました。この自転車は重量を軽減するためにフルカーボンファイバーフレームを採用しています。重さは53ポンド(24kg)です。Osoによると、これは同社のアッパーリンクサスペンションデリンク技術を採用した最初のバイクだといいます。Bosch Performance Line CXモーターは、バッテリーやディスプレイを含むeMTBに電力を供給します。

- これらの要因と開発を考慮すると、Eマウンテンバイクの需要は、予測期間中により高い成長率を記録すると予想されます。

欧州がEマウンテンバイク市場をリード

- 欧州のEマウンテンバイク/E-MTBは、より軽量・小型で性能の高いバイクが求められていることから、eバイクの需要が再び業界の動向となっており、最も貢献すると予想されています。販売台数を見ると、eバイクがトレッキング後に疲れることなく長距離のライドを楽しみたいレクリエーションサイクリストの間で人気が高まっていることがわかります。

- さらに、政府の姿勢は欧州全土で長期的にEマウンテンバイクの成長を支持しています。たとえば、英国政府は国内での電動自転車やオートバイの導入を強化するための措置を講じ始めています。同国は国家的奨励金の支給を開始し、電動自転車の利用を促進するために電動自転車に対する補助金を増額することも計画しています。政府は、内燃機関(ICE)を搭載したすべての新型二輪車を2035年までに段階的に廃止する目標を設定する決定を発表しました。

- 2021年4月、フランス議会はeバイクを支持する法案を可決しました。フランスでは、環境を汚染している旧式車両の所有者が廃棄することを選択した場合、奨励金が提供されることになります。フランス国会は最近、eバイク購入のインセンティブとして老朽車を2,500ユーロ(2,660米ドル)で取引することを許可する法案を可決しました。この法案の主な目的は、環境を汚染している古い車両が廃棄される場合、電動アシスト自転車を購入するための資金援助を提供することです。

- フランスのEマウンテンバイク市場も同様に成長しています。市場を牽引する主な要因としては、電動カーゴおよびEマウンテンバイクのカテゴリーの増加、交通量の増加、排気ガス削減への注目の高まりなどが挙げられます。プレーヤーは、消費者層と成長の可能性を拡大するために、欧州でEマウンテンバイクを導入しています。

Eマウンテンバイク(EMTB)業界の概要

Eマウンテンバイク市場は成長しており、市場の主要企業にはYamaha Motor、Pedego Electric Bikes、BH Bikes、CUBEなどがあります。両社は、最新技術を搭載した新製品を発売することで世界中で存在感を拡大しています。市場が成長するにつれて、他の業界分野からさまざまな大手企業が市場に参入しています。

プレイヤーは、さまざまな地形に快適で信頼性が高く効率的なマウンテンバイクを構築することに重点を置いています。これは、企業が長期予測期間にわたって消費者の立場を獲得するのに役立ちました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 業界の魅力 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション(市場規模:金額別)

- 推進タイプ別

- ペダルアシスト

- スロットルアシスト

- 用途別

- レジャー

- 通勤

- 地域別

- 北米

- 米国

- カナダ

- その他北米

- 欧州

- ドイツ

- 英国

- イタリア

- スイス

- 欧州の残りの地域

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Giant Manufacturing Co. Ltd

- Pivot Cycles

- Scott Sports SA

- Trek Bicycle Corporation

- Trinx Bikes

- CUBE GmbH &Co. KG

- Yamaha Motor Co. Ltd

- Pedego Electric Bikes

- BH Bikes

第7章 市場機会と将来の動向

The E-Mountain Bike Market size is estimated at USD 5.77 billion in 2024, and is expected to reach USD 10.43 billion by 2029, growing at a CAGR of 12.56% during the forecast period (2024-2029).

Key Highlights

- On a broader scale, COVID-19 had a marginal impact on the e-mountain bike market compared to the adverse effects it vastly had on different markets. With the preference for personal mobility that is to rise and the need to overcome traffic congestion, the demand for personal vehicles will increase. Also, with the growing environmental impact and concerns over rising temperatures due to emissions, e-bikes are a great alternative to conventional bicycles and motorcycles.

- However, COVID-19 set back the industry with zero mobility of people and halted the manufacturing of new e-bikes. Post COVID-19, with the recreational activities and health awareness among consumers, the market is set to a good rise in terms of economy.

- Over the longer term, the e-mountain is growing rapidly as the younger generation shows excellent interest in trekking and recreational activities. However, factors like government regulations regarding speed and safety issues associated with these bikes are likely to hinder the market's growth. For instance, The Union Cycliste Internationale (UCI) adopted strict regulations regarding the electric motors on e-mountain bikes, which must not exceed 250 watts. Pedaling assistance is only permitted to a maximum speed of 25 kph.

- Europe is anticipated to register the highest adoption rate for E-mountain bikes which is leading the global stance from the front.

E-Mountain Bike (EMTB) Market Trends

Growing Demand for Sustainable Transportation

- Mobility plays a vital role in the current society that we live in. With the growing concern for preserving and sustaining it for future generations, mainly because of the increasing scarcity of natural resources and environmental concerns, protecting the environment poses a significant challenge to society and governments worldwide.

- As a result, the rising demand for e-mountain bikes is an ideal solution to the challenge. With the continually growing environmental and health concerns due to the increasing emission levels, governments and international organizations worldwide are enacting stringent emission norms to reduce carbon emission levels.

- Owing to this, some international organizations worldwide are implanting strict criteria for vehicles. For instance, In January 2020, European Union implemented Regulation (EU) 2019/631, setting CO2 emission performance standards for new passenger cars and vans. The average CO2 emissions from new passenger cars registered in Europe have decreased by 12% compared to the previous year, and the share of electric vehicles tripled.

- Additionally, the depletion of fossil fuel levels at an alarming rate has been creating concerns for sustainability for future generations. This factor is posing a huge challenge for governments and society.

- Over the years, the sales of e-bikes have increased rapidly due to the rise in fuel costs, which has led to the growth of the implementation of electric bicycles as a daily means of transport. Switzerland is considered one of the best trekking places. Players in the market are launching lighter and rugged e-MTBs with massive batteries, better comfort, improved range, and better features to widen their customer base.

- For instance, in October 2022, the Ibis Oso launched a new e-mountain bike. The bicycle has a full-carbon-fiber frame to reduce its weight; it weighs 53 pounds (24 kg). Oso says this is the first bike to use its upper-link suspension de-link technology. The Bosch Performance Line CX motor powers the eMTB, including a battery and display.

- Considering these factors and development, demand for e-mountain bikes is anticipated to register a higher growth rate during the forecast period.

Europe is Leading the E-mountain Bike Market

- The e-mountain bikes/E-MTB in Europe are expected to contribute most to the development of the overall market as demand from e-bikes is again setting trends in the industry, as there is a great demand for lighter and smaller bikes with more performance. The sales figures show that e-bikes are becoming popular among recreational cyclists who prefer to enjoy longer rides without getting exhausted after trekking.

- In addition, the government stance has favored the growth of e-mountain bikes over the longer term across Europe. For instance, the United Kingdom government has started taking steps to enhance the adoption of e-Bikes and motorcycles in the country. The country started providing national incentives and is also planning to increase the financial subsidies on e-bikes to promote their usage. The government announced the decision to set a 2035 target for phasing out all new motorcycles equipped with an internal combustion engine (ICE).

- In April 2021, the French assembly passed a bill favoring e-bikes. Owners of outdated, polluting vehicles in France would be offered incentives if they chose to discard them. The French National Assembly recently adopted draft legislation permitting clunkers to be traded for a EUR 2,500 (USD 2,660) incentive to purchase an electric bicycle. The draft bill's principal goal is to provide financial help to buy electrically assisted bicycles if a polluting old vehicle is scrapped.

- The market for e-mountain bikes in France is also equally growing. Some of the major factors driving the market are the rise in the e-cargo and e-mountain bikes category, increasing traffic, and increasing focus on reducing exhaust emissions. Players are introducing e-mountain bikes in Europe to expand their consumer base and growth potential.

E-Mountain Bike (EMTB) Industry Overview

The e-mountain bike market is growing, and some of the major players in the market are Yamaha Motor, Pedego Electric Bikes, BH Bikes, and CUBE. The companies are expanding their presence worldwide by launching new products with the latest technology. As the market is growing, various major players from other sectors of industries are entering the market.

Players are focusing on building reliable and efficient mountain bikes comfortable with different terrains. This has helped the companies to gain consumer stances over the longer-term forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Propulsion Type

- 5.1.1 Pedal -assisted

- 5.1.2 Throttle-Assisted

- 5.2 By Application

- 5.2.1 Leisure

- 5.2.2 Commuting

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 Switzerland

- 5.3.2.5 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Giant Manufacturing Co. Ltd

- 6.2.2 Pivot Cycles

- 6.2.3 Scott Sports SA

- 6.2.4 Trek Bicycle Corporation

- 6.2.5 Trinx Bikes

- 6.2.6 CUBE GmbH & Co. KG

- 6.2.7 Yamaha Motor Co. Ltd

- 6.2.8 Pedego Electric Bikes

- 6.2.9 BH Bikes