|

|

市場調査レポート

商品コード

1092299

DaaS (Data as a Service) の世界市場 - 企業・産業・公共・政府別:データの活用とサービス (2022年~2027年)Data as a Service Market by Enterprise, Industrial, Public, and Government Data Applications and Services 2022 - 2027 |

||||||

| DaaS (Data as a Service) の世界市場 - 企業・産業・公共・政府別:データの活用とサービス (2022年~2027年) |

|

出版日: 2022年06月20日

発行: Mind Commerce

ページ情報: 英文 321 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

当レポートでは、世界のDaaS (Data as a Service) 市場について分析し、DaaS技術の概略や構成要素、主な活用領域や利用事例、主な市場促進・抑制要因、全体的な市場規模の動向見通し (2022年~2027年)、部門別 (企業、公共、政府など)・地域別の詳細動向、主要企業のプロファイル、今後の成長機会と取るべき戦略、といった情報を取りまとめてお届けいたします。

目次

第1章 エグゼクティブサマリー

- 世界のDaaS (Data as a Service) 市場

- DaaS市場:データの種類別

- DaaS市場:地域別

第2章 DaaS技術

- クラウドコンピューティングとDaaS

- データベースのアプローチとソリューション

- RDBMS (リレーショナルデータベース管理システム)

- NoSQL

- Hadoop

- HPC (ハイパフォーマンスコンピューティング) クラスター

- OpenStack

- DaaS・XaaSのエコシステム

- オープン・データセンター・アライアンス

- 部門別の市場規模

第3章 DaaS市場の利点・利用事例・フレームワーク

- DaaSの利点

- DaaSに関連する批判

- 利用事例

- DaaSの価格モデル

- DaaSに使用されるツール

第4章 DaaS市場

- 市場概要

- DaaSの理解

- データ構造

- 専門分野

- DaaSベンダー

- ベンダーの分析と展望

- 大手ベンダー

- 中規模ベンダー

- 小規模ベンダー

- 市場規模

- DaaS市場の促進・抑制要因

- DaaS導入の障壁と課題

- 変化に消極的な企業

- 外部化されたデータセキュリティの責任

- セキュリティ上の懸念

- サイバー攻撃

- 不明確な合意

- 複雑さの抑止効果

- クラウドの相互運用性の欠如

- 監査に対するサービスプロバイダーの抵抗

- サードパーティプロバイダーの実行可能性

- コスト無しでのシステムとデータの移動

- パブリッククラウドでの統合機能の欠如:機能の低下

- 市場シェアと地理的影響

- DaaSベンダーの分析

- 企業の戦略的分析

- 1010data

- 3i Data Scraping

- Accenture PLC

- Actifio

- Acxiom Corporation

- Alteryx Ltd.

- Amazon Web Services, Inc.

- Apaleo Marketplace

- Appier

- AtScale Inc.

- Bloomberg Finance L.P.

- Cazena Inc

- Cisco Systems Inc.

- ClickFox

- Column Technologies

- comScore Inc.

- Continental vAnalytics

- Coriolis Technologies

- Corporate360

- Crunchbase Inc.

- CTERA

- Datameer

- Datasift Inc.

- DataStax Inc.

- Dawex Systems

- DC Frontiers Pte. Ltd.

- Dell EMC

- Demandbase (Whotoo)

- Denodo Technologies

- Dow Jones & Company, Inc.

- Dremio

- Equifax, Inc.

- ESRI, Inc.

- Experian

- Facebook Inc.

- Factiva

- FICO

- GE Predix

- getsix Group

- GigaSpaces

- Google Inc.

- Guavus Inc.

- Hewlett Packard Enterprise

- HG Data Company

- Hitachi Data Systems

- Hoovers

- Hortonworks

- IBM Corporation

- IHS Inc.

- Infochimps

- Infogix Inc.

- Informatica Corporation

- Information Builders Inc.

- Information Resources, Inc.

- Infosys

- Intel

- Intercontinental Exchange,Inc.

- Intuit

- IOTA Foundation

- IQM Corporation

- K2View

- KBC Global

- LexisNexis Group

- LinkedIn Corporation

- MapR Technologies Inc.

- MariaDB

- MasterCard Advisors

- Microsoft Corporation

- Mighty AI, Inc.

- Mindtree

- Mobilewalla

- Moody's Corporation

- Morningstar, Inc.

- Nielsen Holdings Plc

- Opera Solutions LLC

- Optum Inc.

- Oracle Corporation

- Pentaho

- PlaceIQ Inc.

- Protel I/O

- Qlik Technologies Inc.

- Qubole

- Quest Software

- Rackspace

- Red Hat

- Salesforce.com

- SAP SE

- SAS Institute

- SiteMinder Exchange

- SlamData

- SMARTe Inc.

- SnapLogic

- Snapshot

- Snowflake Computing

- Splunk

- Talend

- Teradata

- Terbine

- Terracotta

- The Dun & Bradstreet Corporation

- The Weather Company LLC

- Thomson Reuters Corp.

- ThoughtSpot Inc.

- TIBCO Software Inc.

- Tresata

- Twitter, Inc.

- Urban Mapping

- Wisers Information Limited

- Wolters Kluwer N.V.

- Workday

- Xignite

- Zerto

第5章 DaaS戦略

- 一般的な戦略

- 階層型データへの注力

- 価値ベースの価格設定

- オープンな開発環境

- 新興市場の機会のための戦略

- 通信サービスプロバイダーとDaaS

- IoTとDaaS

- エッジネットワークとDaaS

- サービスプロバイダーの戦略

- 通信ネットワーク事業者

- データセンタープロバイダー

- マネージドサービスプロバイダー

- インフラプロバイダーの戦略

- 新しいビジネスモデルの実現

- アプリケーション開発企業の戦略

第6章 DaaSの活用領域

- ビジネスインテリジェンス (BI)

- 開発環境

- 検証・承認

- レポート・分析

- 医療向けDaaS

- DaaSとウェアラブルテクノロジー

- 政府部門向けDaaS

- メディア・エンターテインメント向けDaaS

- 通信向けDaaS

- 保険向けDaaS

- ユーティリティ・エネルギー部門向けDaaS

- 医薬品向けDaaS

- 金融サービス向けDaaS

第7章 市場の見通しとDaaSの将来

- セキュリティ上の懸念

- クラウドの動向

- ハイブリッドコンピューティング

- マルチクラウド

- クラウドの急拡大

- 汎用データの動向

- 企業側での独自データ・通信の活用

- Web API

- SOA (サービス指向アーキテクチャ) とエンタープライズAPI

- クラウドAPI

- テレコムAPI

- データフェデレーション:DaaSに登場

第8章 DaaS市場の分析と予測 (2022年~2027年)

- DaaS市場:部門別 (企業、公共、政府)

- 公共データ向けDaaS市場

- ビジネスデータ向けDaaS市場(企業・産業)

- 政府データ向けDaaS市場

- DaaS市場:ソース別 (マシン/非マシンデータ)

- DaaS市場:データ収集法別 (IoT/非IoTデータ)

- DaaS市場:ホスティングの種類別 (プライベート、パブリック、ハイブリッド)

- DaaS市場:価格モデル別

- DaaS市場:サービス別

- DaaS市場:業種別

第9章 DaaS市場の分析と予測:地域別 (2022年~2027年)

- 北米市場 (2022年~2027年)

- 南米市場 (2022年~2027年)

- 西欧市場 (2022年~2027年)

- 中東欧市場 (2022年~2027年)

- アジア太平洋市場 (2022年~2027年)

- 中東・アフリカ市場 (2022年~2027年)

第10章 結論・提言

第11章 付録

Figures

- Figure 1: Global Market for Data as a Service

- Figure 2: Data as a Service Market by Data Type

- Figure 3: Data as a Service Market by Region

- Figure 4: Cloud Computing Service Model

- Figure 5: Data as a Service Vertical and Horizontal Markets

- Figure 6: Data as a Service Revenue by Region

- Figure 7: DaaS Types and Functions

- Figure 8: Ecosystem and Platform Models

- Figure 9: Data as a Service need for Data Mediation

- Figure 10: Data as a Service Mediation Use Case: Smart Grids

- Figure 11: Internet of Things and Data as a Service

- Figure 12: Telecom API Value Chain for DaaS

- Figure 13: DaaS Verification and Authorization

- Figure 14: Data as a Service Foundation is SOA

- Figure 15: Cloud Services rely upon DaaS and APIs

- Figure 16: Federated Data vs. Non-Federated Models

- Figure 17: Federated Data at Functional Level

- Figure 18: Federated Data at City Level

- Figure 19: Federated Data at Global Level

- Figure 20: Federation Requires Mediation Data

- Figure 21: Mediation Data Synchronization

- Figure 22: DaaS Market by Sector (Business, Public, and Government)

- Figure 23: DaaS Market by Public Data sourced Solution

- Figure 24: DaaS Market by Public Data sourced Solution

- Figure 25: DaaS Market for Business Data

- Figure 26: DaaS Market by Solution using Business Data

- Figure 27: DaaS Market for Government Data

- Figure 28: DaaS Market by Source (Machine vs. Non-machine Data)

- Figure 29: DaaS Market by Data Collection (IoT vs. Non-IoT Data)

- Figure 30: DaaS Market by Hosting Type (Private, Public, and Hybrid)

- Figure 31: DaaS Market by Pricing Model

- Figure 32: DaaS Market by Service Type

- Figure 33: DaaS Market Industry Vertical

- Figure 34: North America DaaS by Sector

- Figure 35: North America DaaS Market by Public Data Type

- Figure 36: North America DaaS Market by Solution using Public Data

- Figure 37: North America DaaS Market by Enterprise and Industrial Data

- Figure 38: North America DaaS Market by Business Data Solution

- Figure 39: North America: DaaS Market by Data Source Type

- Figure 40: North America DaaS Market by Data Collection Type

- Figure 41: North America DaaS Market by Hosting Type

- Figure 42: North America DaaS Market by Pricing Model

- Figure 43: North America DaaS Market by Service

- Figure 44: North America DaaS Market by Industry Vertical

- Figure 45: South America DaaS Market by Sector

- Figure 46: South America DaaS Market by Public Data Type

- Figure 47: South America DaaS Market by Solution using Public Data

- Figure 48: South America DaaS Market by Enterprise and Industrial Data

- Figure 49: South America DaaS Market by Solution using Business Data

- Figure 50: South America DaaS Market by Data Source Type

- Figure 51: South America DaaS Market by Data Collection Type

- Figure 52: South America DaaS Market by Hosting Type

- Figure 53: South America DaaS Market by Pricing Model

- Figure 54: South America DaaS Market by Service

- Figure 55: South America DaaS Market by Industry Vertical

- Figure 56: Western Europe DaaS Market by Sector

- Figure 57: Western Europe DaaS Market by Public Data Type

- Figure 58: Western Europe DaaS Market by Solution using Public Data

- Figure 59: Western Europe DaaS Market by Enterprise and Industrial Data

- Figure 60: Western Europe DaaS Market by Solution using Business Data

- Figure 61: Western Europe DaaS Market by Data Source Type

- Figure 62: Western Europe DaaS Market by Data Collection Type

- Figure 63: Western Europe DaaS Market by Hosting Type

- Figure 64: Western Europe: DaaS Market by Pricing Model

- Figure 65: Western Europe DaaS Market by Services

- Figure 66: Western Europe DaaS Market by Industry Vertical

- Figure 67: Central & Eastern Europe DaaS Market by Sector

- Figure 68: Central & Eastern Europe DaaS Market by Public Data Type

- Figure 69: Central & Eastern Europe DaaS Market by Solution using Public Data

- Figure 70: Central & Eastern Europe DaaS Market for Business Data

- Figure 71: Central & Eastern Europe DaaS Market by Solution using Business Data

- Figure 72: Central & Eastern Europe DaaS Market by Data Source Type

- Figure 73: Central & Eastern Europe DaaS Market by Data Collection Type

- Figure 74: Central & Eastern Europe DaaS Market by Hosting Type

- Figure 75: Central & Eastern Europe DaaS Market by Pricing Model

- Figure 76: Central & Eastern Europe DaaS Market Service

- Figure 77: Central & Eastern Europe DaaS Market by Industry Vertical

- Figure 78: Asia Pacific DaaS Market by Sector

- Figure 79: Asia Pacific DaaS Market by Public Data Type

- Figure 80: Asia Pacific DaaS Market by Solution using Public Data

- Figure 81: Asia Pacific DaaS Market for Business Data

- Figure 82: Asia Pacific DaaS Market by Solution using Business Data

- Figure 83: Asia Pacific DaaS Market by Data Source Type

- Figure 84: Asia Pacific DaaS Market by Data Collection Type

- Figure 85: Asia Pacific DaaS Market by Hosting Type

- Figure 86: Asia Pacific DaaS Market by Pricing Model

- Figure 87: Asia Pacific DaaS Market by Service

- Figure 88: Asia Pacific DaaS Market by Industry Vertical

- Figure 89: Middle East & Africa DaaS Market by Sector

- Figure 90: Middle East & Africa DaaS Market by Public Data Type

- Figure 91: Middle East & Africa DaaS Market by Solution using Public Data

- Figure 92: Middle East & Africa DaaS Market for Business Data

- Figure 93: Middle East & Africa DaaS Market by Solution using Business Data

- Figure 94: Middle East & Africa DaaS Market by Data Source Type

- Figure 95: Middle East & Africa DaaS Market by Data Collection Type

- Figure 96: Middle East & Africa DaaS Market by Hosting Type

- Figure 97: Middle East & Africa DaaS Market by Pricing Model

- Figure 98: Middle East & Africa DaaS Market by Service

- Figure 99: Middle East & Africa DaaS Market Industry Vertical

- Figure 100: Hybrid Data in Next Generation Applications

- Figure 101: Traditional Data Architecture

- Figure 102: Data Architecture Modeling

- Figure 103: DaaS Data Architecture

- Figure 104: Location Data Mediation

- Figure 105: Data Mediation in IoT

- Figure 106: Data Mediation for Smart Grids

- Figure 107: Enterprise Data Types

- Figure 108: Data Governance

- Figure 109: Data Flow in DaaS

- Figure 110: Processing Streaming Data

Tables

- Table 1: Global Market for Data as a Service

- Table 2: DaaS Market by Data Type

- Table 3: DaaS Market by Regions

- Table 4: DaaS Market by Sector (Business, Public, and Government)

- Table 5: DaaS Market for Public Data Type

- Table 6: DaaS Market by Public Data sourced Solution

- Table 7: DaaS Market for Business Data

- Table 8: DaaS Market by Solution Type using Business Data

- Table 9: DaaS Market by Source (Machine vs. Non-Machine Data)

- Table 10: DaaS Market by Data Collection Type (IoT vs. Non-IoT)

- Table 11: DaaS Market by Hosting Type

- Table 12: DaaS Market by Pricing Model

- Table 13: DaaS Market by Service

- Table 14: DaaS Market by Industry Vertical

- Table 15: North America DaaS Market by Sector

- Table 16: North America DaaS Market for Type of Public Data

- Table 17: North America DaaS Market by Solution using Public Data

- Table 18: North America DaaS Market by Enterprise and Industrial Data

- Table 19: North America DaaS Market by Solution using Business Data

- Table 20: North America DaaS Market by Data Source (Machine vs. Non-machine)

- Table 21: North America DaaS Market by Data Collection Type

- Table 22: North America DaaS Market by Hosting Type

- Table 23: North America DaaS Market by Pricing Model

- Table 24: North America DaaS Market by Service

- Table 25: North America DaaS Market by Industry Vertical

- Table 26: South America DaaS Market by Sector

- Table 27: South America DaaS Market by Public Data Type

- Table 28: South America DaaS Market by Solution using Public Data

- Table 29: South America DaaS Market by Enterprise and Industrial Data

- Table 30: South America DaaS Market by Solution using Business Data

- Table 31: South America DaaS Market by Data Source Type

- Table 32: South America DaaS Market by Data Collection Type

- Table 33: South America DaaS Market by Hosting Type

- Table 34: South America DaaS Market by Pricing Model

- Table 35: South America DaaS Market by Service

- Table 36: South America DaaS Market by Industry Vertical

- Table 37: Western Europe DaaS Market by Sector

- Table 38: Western Europe DaaS Market by Public Data Type

- Table 39: Western Europe DaaS Market by Solution using Public Data

- Table 40: Western Europe: DaaS Market for Business Data

- Table 41: Western Europe: DaaS Market by Solution using Business Data

- Table 42: Western Europe DaaS Market by Data Source Type

- Table 43: Western Europe DaaS Market by Data Collection Type

- Table 44: Western Europe DaaS Market by Hosting Type

- Table 45: Western Europe DaaS Market by Pricing Model

- Table 46: Western Europe DaaS Market by Service

- Table 47: Western Europe DaaS Market by Industry Vertical

- Table 48: Central & Eastern Europe DaaS Market by Sector

- Table 49: Central & Eastern Europe DaaS Market by Public Data Type

- Table 50: Central & Eastern Europe DaaS Market by Solution using Public Data

- Table 51: Central & Eastern Europe DaaS Market for Business Data

- Table 52: Central & Eastern Europe DaaS Market by Solution using Business Data

- Table 53: Central & Eastern Europe DaaS Market by Data Source Type

- Table 54: Central & Eastern Europe DaaS Market by Data Collection Type

- Table 55: Central & Eastern Europe DaaS Market by Hosting Type

- Table 56: Central & Eastern Europe DaaS Market by Pricing Model

- Table 57: Central & Eastern Europe DaaS Market by Service

- Table 58: Central & Eastern Europe DaaS Market by Industry Vertical

- Table 59: Asia Pacific DaaS Market by Sector

- Table 60: Asia Pacific DaaS Market by Public Data Type

- Table 61: Asia Pacific DaaS Market by Solution using Public Data

- Table 62: Asia Pacific DaaS Market for Business Data

- Table 63: Asia Pacific DaaS Market by Solution using Business Data

- Table 64: Asia Pacific DaaS Market by Data Source Type

- Table 65: Asia Pacific DaaS Market by Data Collection Type

- Table 66: Asia Pacific DaaS Market by Hosting Type

- Table 67: Asia Pacific DaaS Market by Pricing Model

- Table 68: Asia Pacific DaaS Market by Service

- Table 69: Asia Pacific DaaS Market by Industry Vertical

- Table 70: Middle East & Africa DaaS Market by Sector

- Table 71: Middle East & Africa DaaS Market by Public Data Type

- Table 72: Middle East & Africa DaaS Market by Solution using Public Data

- Table 73: Middle East & Africa DaaS Market for Business Data

- Table 74: Middle East & Africa DaaS Market by Solution using Business Data

- Table 75: Middle East & Africa DaaS Market by Data Source Type

- Table 76: Middle East & Africa DaaS Market by Data Collection Type

- Table 77: Middle East & Africa DaaS Market by Hosting Type

- Table 78: Middle East & Africa DaaS Market by Pricing Model

- Table 79: Middle East & Africa DaaS Market by Service

- Table 80: Middle East & Africa DaaS Market by Industry Vertical

Overview:

This Data as a Service market report evaluates the technologies, companies, strategies, and solutions for DaaS. The report assesses business opportunities for enterprise use of own data, others' data, and a combination of both. The report also analyzes opportunities for enterprises to monetize their own data through various third-party DaaS offerings.

The report evaluates opportunities for DaaS in major industry verticals as well as the future outlook for emerging data monetization. Forecasts include global and regional projections by Sector, Data Collection, Source, and Structure from 2022 to 2027.

Select Report Findings:

- North America and Western Europe represent the two largest regional markets for DaaS

- IoT DaaS is growing nearly three times as fast as non-IoT DaaS, with much of its streaming data

- Structured data market remains greater than unstructured, but the latter will overtake the former

- Machine-sourced data is growing twice as fast as non-machine data, largely due to IoT apps and services

- Analytics as a Service is the largest opportunity and also one of the fastest-growing segments through 2027

- The DaaS market will receive a huge boost in both usage and revenue from edge computing and real-time data analytics

- Corporate data syndication will become a major driver of DaaS growth, but data security and privacy challenges will limit the expansion

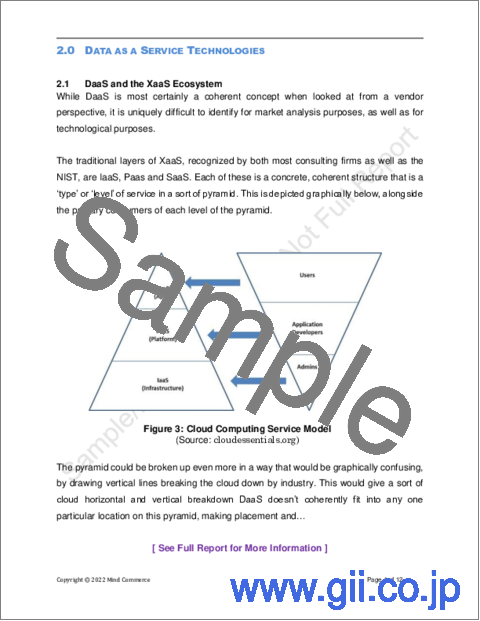

Data by itself is useless. Data needs to be managed and presented in a manner that is useful as information. Data as a Service (DaaS) represents a service model in which data is transformed into useful information. DaaS is one part of the larger Everything as a Service (XaaS) cloud computing-based services model, including the traditional three horizontals of SaaS (Software as a Service), PaaS (Platform as a Service), and IaaS (Infrastructure as a Service). It intersects with all three and derives value from a number of different horizontals and verticals.

There is considerable competition in the market, happening at a variety of different levels, with features highly variable between vendors. This causes confusion for the enterprise and causes them to often choose two or more providers. Barriers to enterprise adoption of the DaaS model include security concerns, reliability, regulation, vendor lock-in/interoperability, IT management overhead, and other costs.

However, the reasons for implementing DaaS far outweigh the concerns, especially when it comes to IoT data, which must have flexible and scalable platforms for storage, processing, and distribution. Accordingly, enterprise organizations are five times more likely to implement DaaS for machine-generated IoT data than for static data located in corporate repositories or data lakes. The DaaS market must support both static and dynamic data, but the latter will benefit significantly more, especially as edge computing is implemented and real-time data is available.

A surprising number of enterprises do not realize they have options for solutions that involve combinations of different data types including (1) their own data, (2) other companies' data, (3) public data, or a combination of all three. Accordingly, it was not surprising for the publisher of this report to find confusion even for many of those enterprise organizations already considering or implementing Data as a Service.

Another important opportunity area for DaaS is enterprise data syndication, which is the opportunity for companies of various sizes to syndicate (e.g. share and monetize) their data. This is one of the biggest opportunities for the Data as a Service market as a whole. However, there remain challenges above and beyond the core adoption barriers, which include specific security, privacy, and care of custody concerns.

Data as a Service Market Segmentation

The Data as a Service market is broadly divided by Data Structure into Structured Data and Unstructured Data, with the latter always requiring Big Data technologies, and the former often requiring the same tools and techniques due to factors other than structure such as data volume and velocity.

The Data as a Service market is also segmented by sectors including Public Data, Business Data, and Government Data.

Public Data consists of Communications and Internet Data (broadcast media, social media, texting, voice, video/picture sharing, etc.), Government Tracked Data (public records such as vehicle and home title, licensing, public resource usage including roadway usage), User Generated Data (consumer and business data made public [may be anonymized or not] such as vehicle usage, appliance data, etc.), and Other Data category.

Business Data consists of Enterprise Data and Industrial Data across various industry verticals. This data comes from many different business-related activities. Some of this data may be static and/or stored in data lakes. Some of this data may be generated and used in real-time.

Government Data is data that the government collects about itself such as Government Services Administration (GSA), essential services (such as public safety), military, homeland security, etc. This is not to be confused with the government collecting certain public data (such as highway usage).

The Data as a Service market is also segmented by Source Type. As it is prohibitively difficult to identify all of the sources and source types, the author has broadly segmented Source by Machine Data (consumer appliances, vehicles [ cars, trucks, planes, trains, ships, etc. ], robots and industrial equipment, etc.) and Non-machine Data (everything else including people texting/talking/etc., enterprise data collected by humans, etc.).

It is important to note that the DaaS also includes data sourced from a machine (such as from a jet engine) that is not "Internet-connected" and thus limited in utility without the Internet of Things (IoT) to collect, relay, and provide opportunities for feedback loops. Accordingly, the author has also segmented the Data as a Service Market by Data Collection Type, which includes IoT DaaS data and Non-IoT DaaS data. Machine Data that does not use IoT, by definition, will not be streaming data or allow for real-time analytics.

This research covers all of the aforementioned DaaS market segments including the following:

- DaaS by Sector: Public, Business, and Government Data

- DaaS by Data Collection Type: IoT Data and Non-IoT Data

- DaaS by Data Source Type: Machine Data and Non-machine Data

- DaaS by Data Structure Type: Structured Data and Unstructured Data

It is also important to note that there are three core types of data from an overall perspective:

- Raw Data: This is data in its unchanged form. It is un-manipulated but may be formatted

- Meta Data: This is data about data. Metadata defines data attributes/categories such as Raw, Machine, Business, etc.

- Value-added Data: This is data that has been changed/manipulated with the intention to add some value

In addition to leveraging Big Data Analytics, another approach to transform data into useful information is through the use of Artificial Intelligence (AI). One useful AI technique is Machine Learning, which may further convert Value-added Data into actionable decisions. We cover the use of AI in big data and IoT in various reports including Artificial Intelligence in Big Data Analytics and IoT: Market for Data Capture, Information, and Decision Support Services 2022 to 2027. One of the important growth areas for the Data as a Service market is to leverage AI to offer Value-added Data in a "Decisions as a Service" model.

Companies in Report:

|

|

Table of Contents

1.0. Executive Summary

- 1.1. Global Data as a Service Market

- 1.2. DaaS Market by Data Type

- 1.3. DaaS Market by Region

2.0. Data as a Service Technologies

- 2.1. Cloud Computing and DaaS

- 2.2. Database Approaches and Solutions

- 2.2.1. Relational Database Management System

- 2.2.2. NoSQL

- 2.2.3. Hadoop

- 2.2.4. High Performance Computing Cluster

- 2.2.5. OpenStack

- 2.3. DaaS and the XaaS Ecosystem

- 2.4. Open Data Center Alliance

- 2.5. Market Sizing by Horizontal

3.0. Data as a Service Market Advantages, Use Cases and Framework

- 3.1. Benefits of data as a service

- 3.2. Criticisms Related to Data-as-a-Service

- 3.3. Use Cases

- 3.4. Pricing models for Data as a Service

- 3.5. Tools used for DaaS

4.0. Data as a Service Market

- 4.1. Market Overview

- 4.1.1. Understanding Data as a Service

- 4.1.2. Data Structure

- 4.1.3. Specialization

- 4.1.4. DaaS Vendors

- 4.2. Vendor Analysis and Prospects

- 4.2.1. Large Vendors

- 4.2.2. Mid-sized Vendors

- 4.2.3. Small Vendors

- 4.2.4. Market Sizing

- 4.3. Data as a Service Market Drivers and Constraints

- 4.3.1. Data as a Service Market Drivers

- 4.3.1.1. Business Intelligence and DaaS Integration

- 4.3.1.2. The Cloud Enabler DaaS

- 4.3.1.3. XaaS Drives DaaS

- 4.3.2. Data as a Service Market Constraints

- 4.3.2.1. Need for Data Integration

- 4.3.2.2. Issues Relating to Data-as-a-Service Integration

- 4.3.1. Data as a Service Market Drivers

- 4.4. Barriers and Challenges to DaaS Adoption

- 4.4.1. Enterprises Reluctance to Change

- 4.4.2. Responsibility of Data Security Externalized

- 4.4.3. Security Concerns

- 4.4.4. Cyber Attacks

- 4.4.5. Unclear Agreements

- 4.4.6. Complexity is a Deterrent

- 4.4.7. Lack of Cloud Interoperability

- 4.4.8. Service Provider Resistance to Audits

- 4.4.9. Viability of Third-party Providers

- 4.4.10. No Move of Systems and Data is without Cost

- 4.4.11. Lack of Integration Features in the Public Cloud = Reduced Functionality

- 4.5. Market Share and Geographic Influence

- 4.6. DaaS Vendor Analysis

- 4.6.1. Strategic Analysis of Players

- 4.6.2. 1010data

- 4.6.3. 3i Data Scraping

- 4.6.4. Accenture PLC

- 4.6.5. Actifio

- 4.6.6. Acxiom Corporation

- 4.6.7. Alteryx Ltd.

- 4.6.8. Amazon Web Services, Inc.

- 4.6.9. Apaleo Marketplace

- 4.6.10. Appier

- 4.6.11. AtScale Inc.

- 4.6.12. Bloomberg Finance L.P.

- 4.6.13. Cazena Inc

- 4.6.14. Cisco Systems Inc.

- 4.6.15. ClickFox

- 4.6.16. Column Technologies

- 4.6.17. comScore Inc.

- 4.6.18. Continental vAnalytics

- 4.6.19. Coriolis Technologies

- 4.6.20. Corporate360

- 4.6.21. Crunchbase Inc.

- 4.6.22. CTERA

- 4.6.23. Datameer

- 4.6.24. Datasift Inc.

- 4.6.25. DataStax Inc.

- 4.6.26. Dawex Systems

- 4.6.27. DC Frontiers Pte. Ltd.

- 4.6.28. Dell EMC

- 4.6.29. Demandbase (Whotoo)

- 4.6.30. Denodo Technologies

- 4.6.31. Dow Jones & Company, Inc.

- 4.6.32. Dremio

- 4.6.33. Equifax, Inc.

- 4.6.34. ESRI, Inc.

- 4.6.35. Experian

- 4.6.36. Facebook Inc.

- 4.6.37. Factiva

- 4.6.38. FICO

- 4.6.39. GE Predix

- 4.6.40. getsix Group

- 4.6.41. GigaSpaces

- 4.6.42. Google Inc.

- 4.6.43. Guavus Inc.

- 4.6.44. Hewlett Packard Enterprise

- 4.6.45. HG Data Company

- 4.6.46. Hitachi Data Systems

- 4.6.47. Hoovers

- 4.6.48. Hortonworks

- 4.6.49. IBM Corporation

- 4.6.50. IHS Inc.

- 4.6.51. Infochimps

- 4.6.52. Infogix Inc.

- 4.6.53. Informatica Corporation

- 4.6.54. Information Builders Inc.

- 4.6.55. Information Resources, Inc.

- 4.6.56. Infosys

- 4.6.57. Intel

- 4.6.58. Intercontinental Exchange,Inc.

- 4.6.59. Intuit

- 4.6.60. IOTA Foundation

- 4.6.61. IQM Corporation

- 4.6.62. K2View

- 4.6.63. KBC Global

- 4.6.64. LexisNexis Group

- 4.6.65. LinkedIn Corporation

- 4.6.66. MapR Technologies Inc.

- 4.6.67. MariaDB

- 4.6.68. MasterCard Advisors

- 4.6.69. Microsoft Corporation

- 4.6.70. Mighty AI, Inc.

- 4.6.71. Mindtree

- 4.6.72. Mobilewalla

- 4.6.73. Moody's Corporation

- 4.6.74. Morningstar, Inc.

- 4.6.75. Nielsen Holdings Plc

- 4.6.76. Opera Solutions LLC

- 4.6.77. Optum Inc.

- 4.6.78. Oracle Corporation

- 4.6.79. Pentaho

- 4.6.80. PlaceIQ Inc.

- 4.6.81. Protel I/O

- 4.6.82. Qlik Technologies Inc.

- 4.6.83. Qubole

- 4.6.84. Quest Software

- 4.6.85. Rackspace

- 4.6.86. Red Hat

- 4.6.87. Salesforce.com

- 4.6.88. SAP SE

- 4.6.89. SAS Institute

- 4.6.90. SiteMinder Exchange

- 4.6.91. SlamData

- 4.6.92. SMARTe Inc.

- 4.6.93. SnapLogic

- 4.6.94. Snapshot

- 4.6.95. Snowflake Computing

- 4.6.96. Splunk

- 4.6.97. Talend

- 4.6.98. Teradata

- 4.6.99. Terbine

- 4.6.100. Terracotta

- 4.6.101. The Dun & Bradstreet Corporation

- 4.6.102. The Weather Company LLC

- 4.6.103. Thomson Reuters Corp.

- 4.6.104. ThoughtSpot Inc.

- 4.6.105. TIBCO Software Inc.

- 4.6.106. Tresata

- 4.6.107. Twitter, Inc.

- 4.6.108. Urban Mapping

- 4.6.109. Wisers Information Limited

- 4.6.110. Wolters Kluwer N.V.

- 4.6.111. Workday

- 4.6.112. Xignite

- 4.6.113. Zerto

5.0. Data as a Service Strategies

- 5.1. General Strategies

- 5.1.1. Tiered Data Focus

- 5.1.2. Value-based Pricing

- 5.1.3. Open Development Environment

- 5.2. Strategies for Emerging Market Opportunities

- 5.2.1. Communication Service Providers and DaaS

- 5.2.1.1. Service Ecosystem and Platforms

- 5.2.1.2. Bringing to Together Multiple Sources for Mash-ups

- 5.2.1.3. Developing Value-added Services as Proof Points

- 5.2.1.4. Open Access to all Entities including Competitors

- 5.2.2. Internet of Things and Data as a Service

- 5.2.2.1. Data as a Service is a Perfect Match for IoT

- 5.2.2.2. IoT Management for DaaS

- 5.2.2.3. Integrating IoT Data for DaaS

- 5.2.2.4. IoT Data as a Service requires Data Mediation

- 5.2.3. Edge Networks and Data as a Service

- 5.2.3.1. Mobile Edge Computing

- 5.2.3.2. Data from the Edge: MEC and Data as a Service

- 5.2.1. Communication Service Providers and DaaS

- 5.3. Service Provider Strategies

- 5.3.1. Telecom Network Operators

- 5.3.2. Data Center Providers

- 5.3.3. Managed Service Providers

- 5.4. Infrastructure Provider Strategies

- 5.4.1. Enable New Business Models

- 5.5. Application Developer Strategies

6.0. Data as a Service Applications

- 6.1. Business Intelligence

- 6.2. Development Environments

- 6.3. Verification and Authorization

- 6.4. Reporting and Analytics

- 6.5. DaaS in Healthcare

- 6.6. DaaS and Wearable Technology

- 6.7. DaaS in the Government Sector

- 6.8. DaaS for Media and Entertainment

- 6.9. DaaS for Telecoms

- 6.10. DaaS for Insurance

- 6.11. DaaS for Utilities and Energy Sector

- 6.12. DaaS for Pharmaceuticals

- 6.13. DaaS for Financial Services

7.0. Market Outlook and Future of DaaS

- 7.1. Security Concerns

- 7.2. Cloud Trends

- 7.2.1. Hybrid Computing

- 7.2.2. Multi-Cloud

- 7.2.3. Cloud Bursting

- 7.2.4. General Data Trends

- 7.3. Enterprise Leverages own Data and Telecom

- 7.3.1. Web APIs

- 7.3.2. SOA and Enterprise APIs

- 7.3.3. Cloud APIs

- 7.3.4. Telecom APIs

- 7.4. Data Federation Emerges for DaaS

8.0. Data as a Service Market Analysis and Forecasts 2022 - 2027

- 8.1. DaaS Market by Sector: Business, Public, and Government

- 8.1.1. DaaS Market for Public Data

- 8.1.2. DaaS Market for Business Data (Enterprise and Industrial)

- 8.1.3. DaaS Market for Government Data

- 8.2. DaaS Market by Source: Machine and Non-Machine Data

- 8.3. DaaS Market by Data Collection: IoT and Non-IoT Data

- 8.4. DaaS Markets by Hosting Type: Private, Public, and Hybrid

- 8.5. DaaS Markets by Pricing Model

- 8.6. DaaS Market by Service

- 8.7. DaaS Markets by Industry Vertical

9.0. Regional DaaS Market Analysis and Forecasts 2022 - 2027

- 9.1. North America Data as a Service Market 2022 - 2027

- 9.1.1. North America: DaaS Market by Sector (Business, Public, and Government)

- 9.1.2. North America: DaaS Market for Public Data

- 9.1.2.1. North America: DaaS Markets by Solution using Public Data

- 9.1.3. North America: DaaS Market for Business Data

- 9.1.3.1. DaaS Markets by Solution using Business Data

- 9.1.4. North America: DaaS Market by Data Source (Machine and Non-machine)

- 9.1.5. North America: DaaS Market by Data Collection Type

- 9.1.6. North America: DaaS Markets by Hosting Type

- 9.1.7. North America: DaaS Markets by Pricing Model

- 9.1.8. North America: DaaS Market by Service

- 9.1.9. North America: DaaS Market by Industry Vertical

- 9.2. South America Data as a Service Market 2022 - 2027

- 9.2.1. South America: DaaS Market by Sector (Business, Public, and Government)

- 9.2.2. South America: DaaS Market for Public Data

- 9.2.2.1. South America: DaaS Market Solution using Public Data

- 9.2.3. South America: DaaS Market for Business Data

- 9.2.3.1. DaaS Market by Solution using Business Data

- 9.2.4. South America: DaaS Market by Data Source Type

- 9.2.5. South America: DaaS Market by Data Collection Type

- 9.2.6. South America: DaaS Market by Hosting Type

- 9.2.7. South America: DaaS Market by Pricing Model

- 9.2.8. South America: DaaS Market by Service Type

- 9.2.9. South America: DaaS Market by Industry Vertical

- 9.3. Western Europe Data as a Service Market 2022 - 2027

- 9.3.1. Western Europe: DaaS Market by Sector (Business, Public, and Government)

- 9.3.2. Western Europe: DaaS Market for Public Data

- 9.3.2.1. Western Europe: DaaS Market by Solution using Public Data

- 9.3.3. Western Europe: DaaS Market for Business Data

- 9.3.3.1. DaaS Market by Solution using Business Data

- 9.3.4. Western Europe: DaaS Market by Data Source Type

- 9.3.5. Western Europe: DaaS Market by Data Collection Type

- 9.3.6. Western Europe: DaaS Market by Hosting Type

- 9.3.7. Western Europe: DaaS Market by Pricing Model

- 9.3.8. Western Europe: DaaS Market by Service

- 9.3.9. Western Europe: DaaS Market by Industry Vertical

- 9.4. Central & Eastern European Data as a Service Market 2022 - 2027

- 9.4.1. Central & Eastern Europe: DaaS Market by Sector (Business, Public, and Government)

- 9.4.2. Central and Eastern Europe: DaaS Market for Public Data

- 9.4.2.1. Central and Eastern Europe: DaaS Market by Solution using Public Data

- 9.4.3. Central and Eastern Europe: DaaS Market for Business Data

- 9.4.3.1. DaaS Market by Solution using Business Data

- 9.4.4. Central and Eastern Europe: DaaS Market by Data Source Type

- 9.4.5. Central and Eastern Europe: DaaS Market by Data Collection Type

- 9.4.6. Central and Eastern Europe: DaaS Markets by Hosting Type

- 9.4.7. Central and Eastern Europe: DaaS Markets by Pricing Model

- 9.4.8. Central and Eastern Europe: DaaS Markets by Service

- 9.4.9. Central and Eastern Europe: DaaS Markets by Industry Vertical

- 9.5. Asia Pacific Data as a Service Market 2022 - 2027

- 9.5.1. Asia Pacific: DaaS Market by Sector (Business, Public, and Government)

- 9.5.2. Asia Pacific: DaaS Market for Public Data

- 9.5.2.1. Asia Pacific: DaaS Market by Solution using Public Data

- 9.5.3. Asia Pacific: DaaS Market for Business Data

- 9.5.3.1. DaaS Market by Solution using Business Data

- 9.5.4. Asia Pacific: DaaS Market by Data Source Type

- 9.5.5. Asia Pacific: DaaS Market by Data Collection Type

- 9.5.6. Asia Pacific: DaaS Market by Hosting Type

- 9.5.7. Asia Pacific: DaaS Markets by Pricing Model

- 9.5.8. Asia Pacific: DaaS Markets by Service

- 9.5.9. Asia Pacific: DaaS Market by Industry Vertical

- 9.6. Middle East and Africa Data as a Service Market 2022 - 2027

- 9.6.1. Middle East and Africa: DaaS Market by Sector (Business, Public, and Government)

- 9.6.2. Middle East & Africa: DaaS Market for Public Data

- 9.6.2.1. Middle East & Africa: DaaS Market by Solution using Public Data

- 9.6.3. Middle East & Africa: DaaS Market for Business Data

- 9.6.3.1. DaaS Market by Solution using Business Data

- 9.6.4. Middle East & Africa: DaaS Market by Data Source Type

- 9.6.5. Middle East & Africa: DaaS Market by Data Collection Type

- 9.6.6. Middle East & Africa: DaaS Markets by Hosting Type

- 9.6.7. Middle East & Africa: DaaS Markets by Pricing Model

- 9.6.8. Middle East & Africa: DaaS Markets by Service

- 9.6.9. Middle East & Africa: DaaS Markets by Industry Vertical

10.0. Conclusions and Recommendations

- 10.1.1. DaaS and IoT

- 10.1.2. DaaS and CSP Data

- 10.1.3. DaaS and Enterprise

11.0. Appendix

- 11.1. Structured vs. Unstructured Data

- 11.1.1. Structured Database Services in Telecom

- 11.1.2. Unstructured Database Services in Telecom and Enterprise

- 11.1.3. Emerging Hybrid (Structured/Unstructured) Database Services

- 11.2. Data Architecture and Functionality

- 11.2.1. Data Architecture

- 11.2.1.1. Data Models and Modelling

- 11.2.1.2. DaaS Architecture

- 11.2.2. Data Mart vs. Data Warehouse

- 11.2.3. Data Gateway

- 11.2.4. Data Mediation

- 11.2.1. Data Architecture

- 11.3. Data Governance

- 11.3.1. Data Security

- 11.3.2. Data Quality

- 11.3.3. Data Integration

- 11.4. Master Data Management

- 11.4.1. Understanding MDM

- 11.4.1.1. Transactional vs. Non-transactional Data

- 11.4.1.2. Reference vs. Analytics Data

- 11.4.2. MDM and DaaS

- 11.4.2.1. Data Acquisition and Provisioning

- 11.4.2.2. Data Warehousing and Business Intelligence

- 11.4.2.3. Analytics and Virtualization

- 11.4.2.4. Data Governance

- 11.4.1. Understanding MDM

- 11.5. Data Mining

- 11.5.1. Data Capture

- 11.5.1.1. Event Detection

- 11.5.1.2. Capture Methods

- 11.5.2. Data Mining Tools

- 11.5.1. Data Capture