|

|

市場調査レポート

商品コード

1566486

商業ビル用HVAC最適化向けエネルギー管理ソフトウェアの世界市場 - 市場規模、競合情勢(2024年~2029年)Energy Management Software for HVAC Optimization in Commercial Buildings - Market Sizing & Competitive Landscape 2024-2029 |

||||||

|

|||||||

| 商業ビル用HVAC最適化向けエネルギー管理ソフトウェアの世界市場 - 市場規模、競合情勢(2024年~2029年) |

|

出版日: 2024年10月09日

発行: Memoori

ページ情報: 英文 227 Pages, 19 Charts, Spreadsheet, Presentation Slides

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

サンプルビュー

世界の商業ビル用HVAC最適化向けエネルギー管理ソフトウェアの市場規模は、2023年のベースライン金額である36億5,000万米ドルから、2029年までに58億3,000万米ドルに達すると予測され、CAGRで8.1%の成長が見込まれます。

データセンターは、その床面積に対し市場の収益割合が大きく、2024年にHVAC最適化ソフトウェア全体の収益の11.4%(4億4,900万米ドル)を占めます。HVACによる冷却は、データセンターの総エネルギー使用の最大40%を占める可能性があり、効率的なHVAC管理が極めて重要になります。データセンターのAI駆動型HVACソリューションは、サーバー負荷レベル、外部気候条件、内部温度などのリアルタイムデータに基づいて冷却出力を動的に調整できます。

商業ビル用HVAC最適化向けエネルギー管理ソフトウェア市場は、技術の進歩、規制圧力、エネルギー効率の必要性に対する意識の高まりにより、今後5年間で大きく成長する見通しです。

当レポートでは、世界の商業ビル用HVAC最適化向けエネルギー管理ソフトウェア市場について調査分析し、市場規模、動向と促進要因、課題と障壁、競合情勢などの情報を提供しています。また、AIを活用したエネルギー管理技術がHVACシステムの運用方法をどのように変革し、運用効率と持続可能性を向上させるかを詳細に検討しています。

サンプルビュー

取り上げるエネルギー管理ソフトウェア企業の例

|

|

目次

序文

調査範囲

調査手法

定義

第1章 イントロダクション

第2章 コア技術

- センサー、コネクテッドデバイス、IoT

- アナリティクス、AI、機械学習

- エッジ/クラウドコンピューティング

- AIを活用したHVAC最適化技術スタック

第3章 商業ビルにおけるエネルギー管理の現状

- 商業ビルのエネルギー消費の概要

- 商業ビルにおけるエネルギー使用パターン

- 商業ビルからの二酸化炭素排出

- 技術採用率

- HVACエネルギー管理ソリューション成熟度モデル

第4章 主なユースケースと用途

- エネルギー性能の向上

- 二酸化炭素排出の削減

- 予知保全と故障検出

- 占有率に基づくHVAC制御

- 季節や天候に応じた最適化

- 室内空気質(IAQ)とHVACの最適化

第5章 垂直市場の用途と機会

- 垂直市場の概要

- オフィス

- 小売

- ホスピタリティ・フードサービス

- 倉庫

- データセンター

第6章 市場の動向と促進要因

- 世界のエネルギー情勢

- 再生可能エネルギー、エネルギー転換

- 建物からグリッドへの統合

- 規制と政策の情勢

- 経済要因と不動産の動向

- 職場力学の変化

- 都市化とスマートシティの取り組み

- 持続可能性、ESG、グリーンファイナンス

- 認証と産業標準

第7章 課題と障壁

- 財政上の障壁

- レガシーシステムとの統合

- スキルと労働力の障壁

- データプライバシーとセキュリティ

- 改修と老朽化した建物

第8章 世界市場の予測(2024年~2029年)

- 世界市場の予測

- 市場の内訳:業界別

第9章 地域市場の内訳と分析

- 市場の内訳:地域別

- 地域特有の市場の促進要因と障壁

第10章 AIを活用したHVACソフトウェアの競合情勢

- 企業の地域分布

- 企業の分布:規模別

- 企業の分布:年数別

第11章 主要企業の戦略的ポジショニング

- ビルディングオートメーション企業

- HVACの専門家

- 革新的なスタートアップと新興企業

第12章 投資動向とM&A

- 合併と買収

- パートナーシップと提携

- 投資の概要

- 地理的投資動向

- 注目すべき投資取引

List of Charts and Figures

- Fig 2.1 - Installed Base of IoT Devices in Commercial Smart Buildings 2020 - 2028 (Millions)

- Fig 2.2 - The Internet of Things in Smart Commercial Buildings 2023 v5.1

- Fig 2.3 - AI & Machine Learning Techniques and their Smart Building Applications

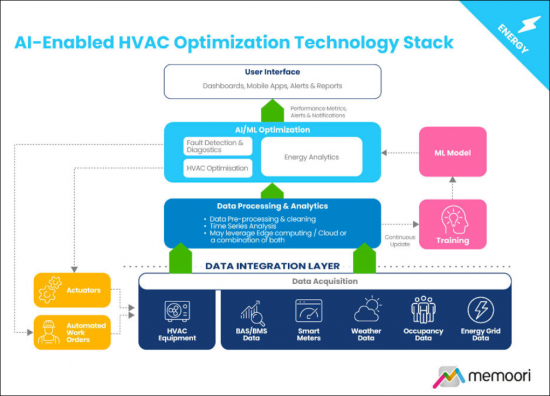

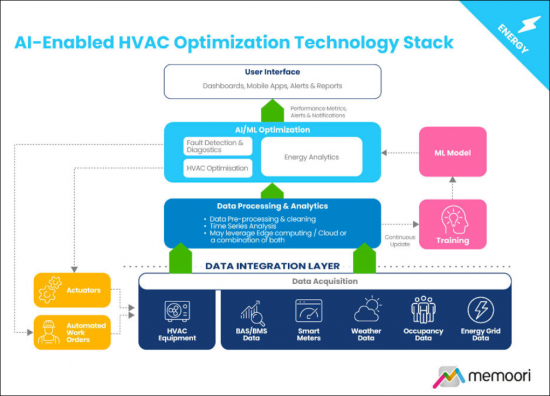

- Fig 2.4 - AI-Enabled HVAC Optimization Technology Stack

- Fig 3.1 - Share of Buildings in Total Final Energy Consumption and Global Energy Emissions in 2022

- Fig 3.2 - Major Fuels Consumption by End Use in US Commercial Buildings 2018

- Fig 3.3 - Total Final Energy Consumption in Buildings by Region 2010 to 2022

- Fig 3.4 - Share of U.S. Commercial Floorspace that Incorporates Selected Sensor and Control Technologies 2012 to 2050

- Fig 3.5 - HVAC Energy Management Solution Maturity

- Fig 4.1 - AI's Energy-Saving Potential by Application Area

- Fig 5.1 - HVAC Energy Intensity by Building Type in US Buildings 2018

- Fig 6.1 - Commercial Sector Construction Growth Estimates by Region 2024 to 2029

- Fig 8.1 - The Global Market for Energy Management Software for HVAC Optimization in Commerical Buildings 2023 to 2029

- Fig 8.2 - Energy Management Software for HVAC Optimization by Vertical Market 2024

- Fig 9.1 - Energy Management Software for HVAC Optimization by Region 2024 to 2029

- Fig 10.1 - Regional Distribution of HVAC Optimization Software Companies

- Fig 10.2 - Distribution of HVAC Optimization Software Companies by Size, Number of Employees

- Fig 10.3 - Distribution of HVAC Optimization Software Companies by Age

- Fig 12.1 - Global Investment Landscape of HVAC Optimization Software Companies, Average Funding and Number of Funded Companies in Leading Countries

This report is a new 2024 study that provides a detailed market forecast to 2029, broken down by region and vertical market.

In today's complex commercial real estate landscape, energy management has become a critical focus for property and facilities managers. Optimizing energy use is not just about lowering costs, it has become a key factor in achieving sustainability and resource efficiency.

This new research takes an in-depth look at how artificial intelligence-driven energy management technologies will transform the way HVAC systems operate, enhancing both operational efficiency and sustainability. The report includes, at no extra cost, a spreadsheet containing the data from the report and high-resolution presentation charts showing the key findings. It is the first in a 2-part series of reports, with the second report on building-to-grid interaction software being published later this year.

Both these reports are included in Memoori's 2024 Premium Subscription Service, which also gives access to our chatbot AIM, where you can query all our research using the power of Large Language Models (LLMs).

SAMPLE VIEW

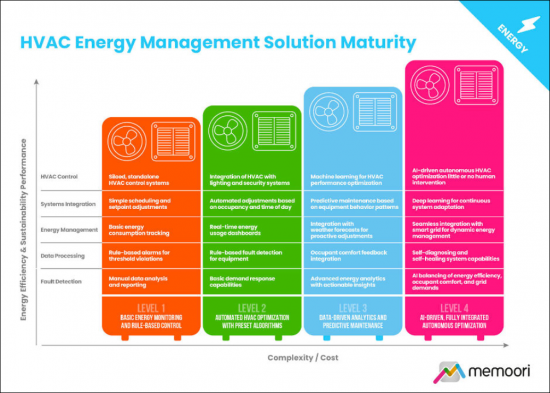

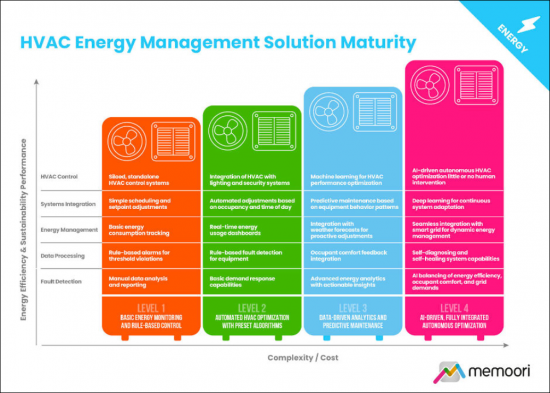

HVAC Energy Management Solution Maturity Model

To better understand the landscape of HVAC energy management solutions and their relative maturity, Memoori has developed a model categorizing these solutions into four distinct tiers.

- Tier 1 represents basic energy monitoring and rule-based control, with limited automation and integration.

- Tier 2 introduces semi-automated control and basic data-driven analytics, allowing for more comprehensive energy management.

- Tier 3 transitions to data-driven optimization incorporating machine learning and predictive analytics, enabling dynamic optimization based on real-time and predictive data.

- Tier 4 represents the pinnacle of HVAC energy management, with predominantly autonomous and AI-driven systems capable of optimizing performance without human intervention.

Based on an assessment of available data on technology adoption, the report develops a theoretical model of the global distribution across the HVAC Energy Management Solution Maturity tiers.

Scope

This report focuses specifically on next-generation software solutions that leverage AI and IoT technologies to track, analyze, automate, and optimize HVAC energy consumption and performance. Software solutions included in the scope of the research for this report include:

- Software solutions directly supporting HVAC automation and optimization.

- Energy performance optimization and carbon emissions reduction solutions.

- Automated HVAC fault detection & diagnostics solutions.

- Data integration and interoperability solutions integral to HVAC optimization.

- AI-enabled occupancy-based HVAC control solutions.

Technology out of the scope of this report includes, broader energy management systems incorporating non-HVAC elements, energy data visualization and reporting tools, sustainability or ESG solutions, grid interaction software, and any hardware revenues related to energy management.

WITHIN ITS 227 PAGES AND 19 CHARTS, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY HOW ENERGY MANAGEMENT TECHNOLOGY IS IMPACTING HVAC SYSTEMS AND WHY;

- The market for Energy Management Software for HVAC Optimization in Commercial Buildings is projected to grow from a baseline value of $3.65 billion in 2023 to $5.83 billion by 2029, representing a compound annual growth rate (CAGR) of 8.1%. Our projection accounts for regional disparities in adoption rates, macroeconomic influences, and technology-driven shifts to deliver a comprehensive and realistic market outlook.

- Data centers account for an outsized proportion of market revenues relative to their floorspace, representing 11.4% of overall HVAC optimization software revenues ($449 million) in 2024. HVAC cooling can account for up to 40% of a data center's total energy use, making efficient HVAC management crucial. AI-driven HVAC solutions in data centers can dynamically adjust cooling outputs based on real-time data such as server load levels, external weather conditions, and internal temperatures.

- The market for Energy Management Software for HVAC Optimization in Commercial Buildings is poised for significant growth over the next five years, driven by technological advancements, regulatory pressures, and increasing awareness of the need for energy efficiency.

This report provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their energy management software business. The final part of the report provides a thorough competitive landscape analysis, profiling key players, market leaders, and emerging startups. This includes an overview of strategic partnerships, mergers, and acquisitions in the sector.

SAMPLE VIEW

The infographic above visualizes the flows of data that occur between different technologies to enable the AI HVAC Optimization Technology Stack. By integrating AI, IoT, and data analytics, this system can dynamically enhance HVAC performance, reflecting the core concepts discussed in this report.

WHO SHOULD BUY THIS ENERGY MANAGEMENT REPORT?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in Commercial Buildings (and their Advisors) around the world. The report aims to help stakeholders make informed decisions that will drive the future of HVAC optimization and energy management.Energy Management Software Companies Mentioned INCLUDE (but NOT limited to):

|

|

Table of Contents

Preface

Research Scope

Methodology

Definitions

1. Introduction

- 1.1. The Evolution of Building Energy Management Systems (BEMS)

- 1.2. Factors Influencing Energy Consumption in HVAC

2. Core Technologies

- 2.1. Sensors, Connected Devices, and IoT

- 2.2. Analytics, AI & Machine Learning

- 2.3. Edge and Cloud Computing

- 2.4. The AI-Enabled HVAC Optimization Technology Stack

3. The Current State of Energy Management in Commercial Buildings

- 3.1. Overview of Energy Consumption in Commercial Buildings

- 3.2. Energy Use Patterns in Commercial Buildings

- 3.3. Carbon Emissions from Commercial Building

- 3.4. Technology Adoption Rates

- 3.5. HVAC Energy Management Solution Maturity Model

4. Key Use Cases and Applications

- 4.1. Energy Performance Improvements

- 4.2. Carbon Emissions Reduction

- 4.3. Predictive Maintenance and Fault Detection

- 4.4. Occupancy-Based HVAC Control

- 4.5. Seasonal and Weather-Driven Optimization

- 4.6. Indoor Air Quality (IAQ) and HVAC Optimization

5. Vertical Market Applications & Opportunities

- 5.1. Vertical Market Overview

- 5.2. Offices

- 5.3. Retail

- 5.4. Hospitality & Food Services

- 5.5. Warehouses

- 5.6. Data Centers

6. Market Trends & Drivers

- 6.1. Global Energy Landscape

- 6.2. Renewables and the Energy Transition

- 6.3. Building-to-Grid Integration

- 6.4. Regulatory and Policy Landscape

- 6.5. Economic Factors and Real Estate Trends

- 6.6. Changing Workplace Dynamics

- 6.7. Urbanization and Smart City Initiatives

- 6.8. Sustainability, ESG, and Green Financing

- 6.9. Certifications and Industry Standards

7. Challenges and Barriers

- 7.1. Financial Barriers

- 7.2. Integration with Legacy Systems

- 7.3. Skills and Workforce Barriers

- 7.4. Data Privacy and Security

- 7.5. Retrofit and Ageing Building Stocks

8. Global Market Forecasts 2024 to 2029

- 8.1. Global Market Forecasts

- 8.2. Market Breakdown by Vertical

9. Regional Market Breakdown & Analysis

- 9.1. Regional Market Breakdown

- 9.2. Region Specific Market Drivers & Barriers

10. The Competitive Landscape in AI-Enabled HVAC Software

- 10.1. Regional Distribution of Companies

- 10.2. Distribution of Companies by Size

- 10.3. Distribution of Companies by Age

11. The Strategic Positioning of Key Players

- 11.1. Building Automation Firms

- 11.2. HVAC Specialists

- 11.3. Innovative Startups and Emerging Players

12. Investment Trends and M&A

- 12.1. Mergers and Acquisitions

- 12.2. Partnerships & Alliances

- 12.3. Investments Summary

- 12.4. Geographic Investment Trends

- 12.5. Notable Investment Deals