|

|

市場調査レポート

商品コード

1247346

農業用化学品の世界市場:種類別 (肥料、農薬)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・肥料の種類別・農薬の種類別 (殺虫剤、除草剤、殺菌剤、殺線虫剤)・地域別の将来予測 (2028年まで)Agrochemicals Market by Type (Fertilizers, Pesticides), Crop Type (Cerelas & Grains, Oilseeds & Pulses, Fruits & Vegetables), Fertilizers Type, Pesticide Type (Insecticides, Herbicides, Fungicides, Nematicides) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 農業用化学品の世界市場:種類別 (肥料、農薬)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・肥料の種類別・農薬の種類別 (殺虫剤、除草剤、殺菌剤、殺線虫剤)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月20日

発行: MarketsandMarkets

ページ情報: 英文 375 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の農業用化学品の市場規模は、2023年に2,352億米ドルに達し、2023年から2028年の間に3.7%のCAGRで成長する、と予測されています。

農業用化学品市場は、食糧需要の拡大や、気候変動による害虫被害、人口増加、耕地面積の減少、高い作物収量の需要などの要因により、飛躍的に成長すると予測されます。

"除草剤分野は2023年に3.6%のCAGRで成長し、最大のシェアを占める"

除草剤は、安価なコストで雑草を効果的に管理するために広く使用されています。これらは、すべての地域のほとんどの国において、作物保護化学物質の主要なセクションを構成しています。さらに、農業における農薬の使用は、遺伝子組み換え作物のために変化しています。除草剤耐性がある遺伝子組み換え (GM) 作物のために、除草剤の使用量が増加しています。

世界の除草剤市場を牽引している主な原因は、気候条件の変化、耕地面積の減少、食料消費の増加です。総合的害虫管理は、除草剤の使用を制限するいくつかの規制があるにもかかわらず、環境を危険にさらすことなく害虫駆除を行う道を開いています。これは、除草剤メーカーにとって、より急速に拡大しつつある環境に優しい除草剤を製造するための、市場の潜在力を活用する素晴らしい機会となっています。

"リン酸肥料は、予測期間中に3.9%のCAGRで成長する"

植物の生育に必要な重要な栄養素がリンです。土壌にリンが不足すると、肥料として添加しない限り、食糧生産は制限されます。食糧生産量を増やすためには、リンが十分な量で存在する必要があります。種子、植物、根の成長は、すべてリンによって助けられます。植物の生命にとって最も重要な要素の中で、リンは窒素、カリウムと並んで重要な位置を占めています。土壌中のリンは、雨で流されるなどさまざまな理由で減少します。そのため、リン系肥料は現代の農業に欠かせないものとなっています。市販のリン酸肥料を作るには、リン酸塩岩が使われます。

2020年の米国地質調査所 (USGS) によると、リン酸肥料の世界消費量は、2019年の栄養豊富な岩石4,700万メートルトン (MT) から2023年には5,000万MTに増加すると予測されています。アフリカ、インド、南米が、そのリン酸塩需要の伸びの約4分の3を占めることになります。

"2023年には、肥料が農業用化学品市場を独占する"

農業分野では、人口増加に伴う食糧消費の増加により、肥料の需要が急速に高まっています。このため、肥料需要は増加すると予想されています。また、肥料業界は細分化されており、数多くの肥料事業者が世界的に活動しています。肥料は農作物の収穫量を高めるため、業界関係者は合弁事業や戦略的提携を結んでいます。肥料のニーズは、特にNPK肥料のニーズが高まると予想されます。

当レポートでは、世界の農業用化学品の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別 (肥料、農薬)・作物の種類別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 規制の枠組み

- 特許分析

- バリューチェーン分析

- バイヤーに影響を与える動向/混乱

- エコシステム分析

- 貿易分析

- 主な会議とイベント (2023年~2024年)

- ケーススタディ分析

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 農業用化学品市場:作物の種類別

- イントロダクション

- 穀物

- トウモロコシ

- 小麦

- 米

- その他の穀物

- 油糧種子・豆類

- 大豆

- ひまわり

- その他の油糧種子・豆類

- 果物・野菜

- リンゴ

- キュウリ

- ブドウ

- 洋ナシ

- ポテト

- バナナ

- アボカド

- トマト

- ウリ科

- その他の果物・野菜

- その他の種類の作物

第8章 農業用化学品市場:肥料の種類別

- イントロダクション

- 窒素肥料

- 尿素

- 硝酸アンモニウム

- 硫酸アンモニウム

- アンモニア

- 硝酸アンモニウムカルシウム

- その他の窒素肥料

- リン酸肥料

- リン酸二アンモニウム

- リン酸一アンモニウム (MAP)

- 三重過リン酸塩 (TSP)

- その他のリン酸肥料

- カリウム肥料

- 塩化カリウム

- 硫酸カリウム

- その他のカリウム肥料

第9章 農業用化学品市場:農薬の種類別

- イントロダクション

- 殺虫剤

- 除草剤

- 殺菌剤

- 殺線虫剤

- その他の種類の農薬

第10章 農業用化学品市場:種類別

- イントロダクション

- 肥料

- 農薬

第11章 農業用化学品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業の収益分析

- 主要企業の評価クアドラント (2022年)

- 主要企業の製品フットプリント

- スタートアップ/中小企業の評価クアドラント (2022年)

- 中小企業/スタートアップ/その他の企業の競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第13章 企業プロファイル

- 主要企業

- BAYER AG

- BASF SE

- SYNGENTA

- EUROCHEM GROUP

- CORTEVA

- UPL

- COMPASS MINERALS

- K+S AKTIENGESELLSCHAFT

- SOCIEDAD QUIMICA Y MINERA DE CHILE

- SUMITOMO CHEMICALS CO., LTD.

- ADAMA

- NUFARM

- NUTRIEN LTD.

- YARA

- ICL

- ISAGRO S.P.A.

- スタートアップ/中小企業/その他の企業

- OCP GROUP

- VERDESIAN LIFE SCIENCES

- JIANGSU YANGNONG CHEMICAL CO., LTD.

- AGROLAC

- ATTICUS, LLC

- LIANYUNGANG LIBEN CROP SCIENCE CO., LTD.

- VALENT U.S.A. LLC

- LIER CHEMICAL CO., LTD.

- SIPCAM OXON

第14章 隣接・関連市場

- イントロダクション

- 隣接市場

- 農業用生物製剤市場:機能別

- 農業用生物製剤市場:地域別

- 作物保護市場

第15章 付録

The global market for agrochemicals has been estimated to be USD 235.2 billion in 2023 and is projected to grow at a rate of 3.7% between 2023 and 2028.

The agrochemicals market is projected to grow at an exponential rate due to factors such as rising demands for food, climate change induced pest damage, growing population, declining arable land and demand for high crop yields.

Key players in the agrochemicals market include Bayer AG (Germany), BASF (Germany), UPL (India), Syngenta (Switzerland), EuroChem Group (Switzerland), Nufarm (Australia), K+S aktiengesellschaft (Germany), Corteva (US), Sumitomo Chemicals Co., Ltd. (Japan), ADAMA (Israel), Compass Minerals (US), Nutrien Ltd (Canada), Sociedad Quimica y Minera de Chile (Chile), Yara (Norway), Isagro S.P.A (Italy), OCP Group (Casablanca), Verdesian Life Sciences (US), Jiangsu Yangnong Chemical Co., Ltd (China), Agrolac (Spain), Atticus, LLC (US), Lianyungang Liben Crop Science Co., Ltd (China), Valent USA. LLC (US), Lier Chemicals Co., Ltd. (China), and Spicam Oxon (Italy).

"Herbicides segment is estimated to account for the largest share in 2023 with a CAGR of 3.6%."

Herbicides are widely used to effectively manage weeds at a cheap cost. They make up the main section of crop protection chemicals for most countries in all regions. Additionally, the use of Pesticides in agriculture has changed because of GMOs. Herbicide use has increased because of genetically modified (GM) crops that are herbicide resistant.

The main causes driving the worldwide herbicide market are changing climatic conditions, dwindling arable land, and rising food consumption. Integrated pest management is opening the door for pest control without endangering the environment, despite several regulatory norms limiting the use of Herbicides. This presents a fantastic opportunity for herbicide producers to capitalize on the market potential to produce green Herbicides, which are expanding more quickly.

As per USDA in 2021, broadleaf weeds can be controlled annually and perennially with the help of the herbicide dicamba. Farmers may adopt genetically modified dicamba-tolerant (DT) seeds despite federal and state bans on their use. For instance, federal regulations in 2019 mandated that fields in areas with endangered plant species maintained buffers on all sides of the field and restricted the use of dicamba to cotton fields from one hour after dawn to two hours before sunset, 60 days after cotton was planted. Some states placed additional limitations or extensions for the use of dicamba.

"Phosphatic Fertilizers is projected to witness the growth of 3.9% during the forecast period."

A crucial nutrient needed for plant growth is phosphorus. Food production is restricted if soils lack phosphorus unless the nutrient is added as fertiliser. In order to increase food production, phosphorus needs to be present in sufficient amounts. The growth of seeds, plants, and roots are all aided by it. Among the most crucial elements for plant life, phosphorus ranks with nitrogen and potassium. Phosphorus in soil is depleted for a number of reasons, including being washed away by rain. Therefore, phosphorus-based fertilisers are essential to modern agriculture. Phosphate rock is used to make commercial phosphate fertilisers.

According to the US Geological Survey's (USGS) in 2020, the world consumption of phosphate fertilizers is projected to increase from 47 million metric tons (MT) of nutrient-rich rock in 2019 to 50 million MT in 2023. Africa, India, and South America will account for about three-quarters of that growth in phosphate demand.

"Fertilizers to dominate the agrochemicals market in 2023."

The fertilizers market is becoming extremely popular since they are critical for increasing crop output by giving crops vital nutrients, such as nitrogen, phosphate, potassium, and others. The demand for fertilizers, particularly in the agricultural sector, has risen quickly because of rising food consumption brought on by a growing population. Fertilizer demand is anticipated to rise because of this. Additionally, the fertilizer industry is fragmented, with numerous fertilizer businesses active globally. Industry participants establish joint ventures and strategic alliances because fertilizers enhance agricultural yield.

Pesticide and fertilizer use, production, and consumption have risen exponentially globally over the past few decades, according to a 2022 UNEP report on "Environmental and health implications of Pesticides and fertilizers and means of limiting them." As a result, the need for fertilizers is anticipated to increase, particularly for NPK fertilizers.

Break-up of Primaries:

By Value Chain: Demand side - 41%, Supply side - 59%

By Designation: Managers - 24%, CXOs - 31%, and Executives- 45.0%

By Region: Europe - 29%, Asia Pacific - 32%, North America - 24%, RoW - 15%

Leading players profiled in this report:

- Bayer AG (Germany)

- BASF SE (Germany)

- Syngenta (Switzerland)

- UPL (India)

- Compass Minerals (US)

- EuroChem Group (Switzerland)

- OCP Group (Casablanca)

- K+S AKTIENGESELLSCHAFT (Germany)

- Sociedad Quimica y Minera de Chile (Chile)

- Sumitomo Chemicals (Japan)

- ADAMA Ltd (Israel)

- Nufarm (Australia)

- Nutrien Ltd (Canada)

- Yara (Norway)

- ICL (Israel)

- Corteva (US)

- Marrone Bio Innovations, Inc. (US)

- The Mosaic Company (China)

- Jiangsu Yangnong Chemical Co., Ltd (China)

- Agrolac (Spain)

- FMC Corporation (US)

- Nippon Soda Co. Ltd (Japan)

- Isagro SPA (Italy)

- Nissan Chemicals Corporation (Japan)

- Terramera Inc. (Canada)

Research Coverage:

The report segments the agrochemicals market based on core phase, shell material, application, method, technology and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the agrochemicals market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the agrochemicals market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them.

- To gain insights about the major countries/regions in which the agrochemicals market is flourishing.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2017-2022

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (FERTILIZERS)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (PESTICIDES)

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (DEMAND-SIDE)

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY, BY TYPE (SUPPLY-SIDE)

- 2.3 GROWTH RATE FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT

- 2.7.1 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 10 RECESSION INDICATORS

- FIGURE 11 GLOBAL INFLATION RATES, 2011-2021

- FIGURE 12 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON AGROCHEMICALS MARKET

- FIGURE 14 AGROCHEMICALS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 4 AGROCHEMICALS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 15 AGROCHEMICALS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 AGROCHEMICALS MARKET, BY CROP TYPE, 2023 VS. 2028

- FIGURE 17 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN AGROCHEMICALS MARKET

- FIGURE 20 RISE IN GLOBAL FOOD DEMAND AND DECLINING SOIL FERTILITY TO DRIVE MARKET GROWTH

- 4.2 AGROCHEMICALS MARKET, BY TYPE AND REGION

- FIGURE 21 ASIA PACIFIC TO LEAD MARKET IN 2023

- 4.3 ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE AND KEY COUNTRIES

- FIGURE 22 CHINA AND FERTILIZERS SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.4 AGROCHEMICALS MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 23 CHINA ACCOUNTED FOR LARGEST SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 REDUCTION IN ARABLE LAND

- FIGURE 24 CROPLAND AREA PER CAPITA, BY REGION, 2000-2020 (HA)

- FIGURE 25 GLOBAL PER CAPITA ARABLE LAND, 2002-2022 (HA)

- 5.2.2 GROWING ADOPTION OF PESTICIDES AGAINST PEST ATTACKS AND CROP DAMAGE

- FIGURE 26 PESTICIDE USAGE PER HECTARE OF CROPLAND, BY COUNTRY, 2019 (TONS)

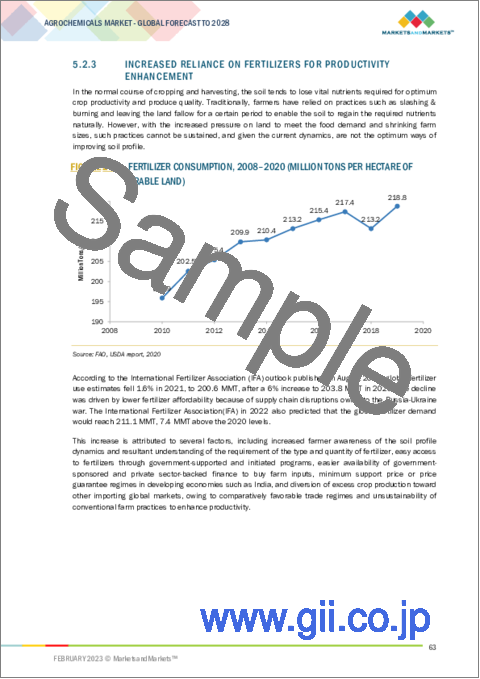

- 5.2.3 INCREASED RELIANCE ON FERTILIZERS FOR PRODUCTIVITY ENHANCEMENT

- FIGURE 27 FERTILIZER CONSUMPTION, 2008-2020 (MILLION TONS PER HECTARE OF ARABLE LAND)

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- FIGURE 28 MARKET DYNAMICS

- 5.3.2 DRIVERS

- 5.3.2.1 Impact of abiotic stressors and growing cases of plant diseases

- 5.3.2.2 Rising demand for high crop productivity

- 5.3.2.3 Favorable government policies, subsidies, and regulations

- 5.3.3 RESTRAINTS

- 5.3.3.1 Increasing resistance of insect pests against agrochemicals

- 5.3.3.2 High cost associated with liquid agrochemicals

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Increasing research and development on innovative adjuvant products

- 5.3.4.2 Drift potential of UAVs with adjuvants in aerial application

- 5.3.4.3 Crop-specific nutrient management through precision farming

- 5.3.5 CHALLENGES

- 5.3.5.1 Rising cost of raw materials

- FIGURE 29 PRICE OF FERTILIZERS, BY TYPE, 2016-2023 (USD PER METRIC TON)

- 5.3.5.2 Reluctant adoption of chemical pesticides

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3 REGULATORY FRAMEWORK

- 6.3.1 NORTH AMERICA

- 6.3.1.1 US

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 EUROPE

- 6.3.2.1 Data requirements for plant protection products

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Germany

- 6.3.2.6 Spain

- 6.3.2.7 Italy

- 6.3.3 ASIA PACIFIC

- 6.3.3.1 China

- 6.3.3.2 Australia & New Zealand

- 6.3.3.2.1 Approval of active constituents

- 6.3.3.3 Japan

- 6.3.3.4 India

- 6.3.3.4.1 Data requirements for technical ingredients

- 6.3.4 SOUTH AMERICA

- 6.3.4.1 Argentina

- 6.3.4.2 Brazil

- 6.3.5 REST OF THE WORLD

- 6.3.5.1 Middle East

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Nigeria

- 6.3.5.4 Kenya

- 6.3.5.5 Egypt

- 6.3.5.6 UAE

- 6.3.5.7 South Africa

- 6.3.1 NORTH AMERICA

- 6.4 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS APPROVED GLOBALLY, 2012-2022

- TABLE 10 LIST OF MAJOR PATENTS GRANTED, 2012-2022

- FIGURE 31 JURISDICTIONS WITH HIGHEST PATENT APPROVALS, 2012-2022

- 6.5 VALUE CHAIN ANALYSIS

- FIGURE 32 VALUE CHAIN ANALYSIS

- 6.5.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.5.2 MATERIAL SOURCING AND ACQUISITIONS

- 6.5.3 AGROCHEMICAL MANUFACTURING

- 6.5.4 DISTRIBUTION AND SALES MANAGEMENT

- 6.5.5 END-USER INDUSTRY

- 6.6 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 33 YC-YCC: REVENUE SHIFT FOR AGROCHEMICALS MARKET

- 6.7 ECOSYSTEM ANALYSIS

- FIGURE 34 ECOSYSTEM ANALYSIS

- 6.7.1 UPSTREAM

- 6.7.1.1 Active ingredient manufacturers and agrochemical raw material providers and manufacturers

- 6.7.2 DOWNSTREAM

- 6.7.2.1 Startups/Emerging companies

- 6.7.2.2 Regulatory bodies

- 6.7.2.3 End users

- TABLE 11 ECOSYSTEM ANALYSIS

- 6.8 TRADE ANALYSIS

- TABLE 12 IMPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS, BY COUNTRY, 2022 (USD THOUSAND)

- FIGURE 35 IMPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 13 EXPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS, BY COUNTRY, 2022 (USD THOUSAND)

- FIGURE 36 EXPORT VALUE OF INSECTICIDES, FUNGICIDES, HERBICIDES, NEMATICIDES, AND PLANT GROWTH REGULATORS FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 14 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY COUNTRY, 2021 (USD THOUSAND)

- FIGURE 37 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 15 EXPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY COUNTRY, 2022 (USD THOUSAND)

- FIGURE 38 EXPORT VALUE OF CHEMICAL OR MINERAL FERTILIZERS FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- 6.9 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 16 CONFERENCES & EVENTS, 2023-2024

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 USE CASE 1: BAYER LAUNCHED LUNA FLEX IN US TO CONTROL CROP DISEASES

- 6.10.2 USE CASE 2: BASF LAUNCHED VORAXOR TO PROTECT CEREAL CROPS FROM WEED DAMAGE IN AUSTRALIA

- 6.11 PRICING ANALYSIS

- 6.11.1 INTRODUCTION

- 6.11.2 AVERAGE SELLING PRICE FOR KEY PLAYERS, BY TYPE (USD/KG)

- FIGURE 39 AVERAGE SELLING PRICE FOR KEY PLAYERS, BY TYPE (USD/KG)

- FIGURE 40 AVERAGE SELLING PRICE, BY TYPE, 2018-2022 (USD/KG)

- FIGURE 41 AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/KG)

- 6.12 TECHNOLOGY ANALYSIS

- 6.12.1 RNA-BASED PESTICIDES

- 6.12.2 NANO-AGROCHEMICALS

- 6.12.3 PESTICIDE SPRAYING TECHNOLOGY IN AGRICULTURE

- 6.12.3.1 Robotics leading to innovations in agrochemicals market

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT FROM NEW ENTRANTS

- 6.13.5 THREAT FROM SUBSTITUTES

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- 6.14.2 BUYING CRITERIA

- FIGURE 43 KEY BUYING CRITERIA FOR AGROCHEMICALS

- TABLE 19 KEY BUYING CRITERIA FOR AGROCHEMICALS

7 AGROCHEMICALS MARKET, BY CROP TYPE

- 7.1 INTRODUCTION

- FIGURE 44 AGROCHEMICALS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 20 AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 21 AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 7.2 CEREALS & GRAINS

- TABLE 22 CEREALS & GRAINS: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 23 CEREALS & GRAINS: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 24 CEREALS & GRAINS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 CEREALS & GRAINS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 CORN

- 7.2.1.1 Growing demand for pesticides to address problems related to corn growth

- 7.2.2 WHEAT

- 7.2.2.1 Decreasing crop quality

- 7.2.3 RICE

- 7.2.3.1 Rising fungal diseases in rice

- 7.2.4 OTHER CEREALS & GRAINS

- 7.3 OILSEEDS & PULSES

- TABLE 26 OILSEEDS & PULSES: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 27 OILSEEDS & PULSES: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 28 OILSEEDS & PULSES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 OILSEEDS & PULSES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1 SOYBEAN

- 7.3.1.1 Rise in seedling diseases

- 7.3.2 SUNFLOWER

- 7.3.2.1 Fertilizers enrich soil quality of sunflower crops

- 7.3.3 OTHER OILSEEDS & PULSES

- 7.4 FRUITS & VEGETABLES

- TABLE 30 FRUITS & VEGETABLES: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 31 FRUITS & VEGETABLES: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 32 FRUITS & VEGETABLES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 FRUITS & VEGETABLES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.1 APPLES

- 7.4.1.1 Fertilizers combat scab problems in apples

- 7.4.2 CUCUMBER

- 7.4.2.1 Growing demand for cucumber due to its nutritional value

- 7.4.3 GRAPES

- 7.4.3.1 Growing fungal infection in grapes

- 7.4.4 PEARS

- 7.4.4.1 Increasing insect infestation in pears

- 7.4.5 POTATOES

- 7.4.5.1 High nutrient requirement of potato crops

- 7.4.6 BANANA

- 7.4.6.1 Growing problem of weeds in banana cultivation

- 7.4.7 AVOCADO

- 7.4.7.1 Rising need to address mineral deficiency

- 7.4.8 TOMATOES

- 7.4.8.1 Increasing prevalence of pests such as fruit worms

- 7.4.9 CUCURBITS

- 7.4.9.1 High potassium requirement of cucurbits

- 7.4.10 OTHER FRUITS & VEGETABLES

- 7.5 OTHER CROP TYPES

- TABLE 34 OTHER CROP TYPES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 OTHER CROP TYPES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AGROCHEMICALS MARKET, BY FERTILIZER TYPE

- 8.1 INTRODUCTION

- FIGURE 45 AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 36 AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 37 AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- 8.2 NITROGENOUS FERTILIZERS

- TABLE 38 NITROGENOUS FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 39 NITROGENOUS FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 40 NITROGENOUS FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 NITROGENOUS FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 UREA

- 8.2.1.1 Cheap availability of urea in developing nations

- 8.2.2 AMMONIUM NITRATE

- 8.2.2.1 Plants readily consume nitrogen in nitrate form

- 8.2.3 AMMONIUM SULFATE

- 8.2.3.1 Easy utilization and mixing ability of ammonium sulfate

- 8.2.4 AMMONIA

- 8.2.4.1 High affordability of blended ammonia-based fertilizers

- 8.2.5 CALCIUM AMMONIUM NITRATE

- 8.2.5.1 Enhanced water ventilation and permeability offered to crops

- 8.2.6 OTHER NITROGENOUS FERTILIZERS

- 8.3 PHOSPHATIC FERTILIZERS

- TABLE 42 PHOSPHATIC FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 43 PHOSPHATIC FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 44 PHOSPHATIC FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 PHOSPHATIC FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1 DIAMMONIUM PHOSPHATE

- 8.3.1.1 pH regulation property of diammonium phosphate enhances soil quality

- 8.3.2 MONOAMMONIUM PHOSPHATE (MAP)

- 8.3.2.1 Increasing application of MAP as under-root fertilizer

- 8.3.3 TRIPLE SUPERPHOSPHATE (TSP)

- 8.3.3.1 Rising demand for improved soil fertility

- 8.3.4 OTHER PHOSPHATIC FERTILIZERS

- 8.4 POTASSIC FERTILIZERS

- TABLE 46 POTASSIC FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 47 POTASSIC FERTILIZERS: AGROCHEMICALS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 48 POTASSIC FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 POTASSIC FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1 POTASSIUM CHLORIDE

- 8.4.1.1 Growing need to build disease-resistant crops

- 8.4.2 POTASSIUM SULFATE

- 8.4.2.1 Increasing use of potassium sulfate in optimum crop development

- 8.4.3 OTHER POTASSIC FERTILIZERS

9 AGROCHEMICALS MARKET, BY PESTICIDE TYPE

- 9.1 INTRODUCTION

- FIGURE 46 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 50 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 51 AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 9.2 INSECTICIDES

- 9.2.1 RISING NEED TO IMPROVE AGRICULTURAL PRODUCTIVITY

- TABLE 52 INSECTICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 INSECTICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 HERBICIDES

- 9.3.1 GROWING NEED TO ADDRESS CROP DAMAGE

- TABLE 54 HERBICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 HERBICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 FUNGICIDES

- 9.4.1 CLIMATE CHANGES TO LEAD TO FUNGAL DISEASES

- TABLE 56 FUNGICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 FUNGICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 NEMATICIDES

- 9.5.1 RISING APPLICATION OF NEMATICIDES TO INCREASE CROP YIELD

- TABLE 58 NEMATICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 NEMATICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 OTHER PESTICIDE TYPES

- TABLE 60 OTHER PESTICIDE TYPES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER PESTICIDE TYPES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 AGROCHEMICALS MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 47 AGROCHEMICALS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 62 AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 63 AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 65 AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- 10.2 FERTILIZERS

- 10.2.1 INCREASING GOVERNMENT SUPPORT TO DEVELOP INNOVATIVE FERTILIZERS

- TABLE 66 FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 69 FERTILIZERS: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (KILOTONS)

- 10.3 PESTICIDES

- 10.3.1 GROWING NEED TO PREVENT FOOD SHORTAGE

- TABLE 70 PESTICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 PESTICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 72 PESTICIDES: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 73 PESTICIDES: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (KILOTONS)

11 AGROCHEMICALS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 48 AGROCHEMICALS MARKET: GEOGRAPHICAL ANALYSIS

- TABLE 74 AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 76 AGROCHEMICALS MARKET, BY REGION, 2018-2022 (KILOTONS)

- TABLE 77 AGROCHEMICALS MARKET, BY REGION, 2023-2028 (KILOTONS)

- 11.2 NORTH AMERICA

- TABLE 78 NORTH AMERICA: AGROCHEMICALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: AGROCHEMICALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 83 NORTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- TABLE 84 NORTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 49 NORTH AMERICA: INFLATION RATES IN KEY COUNTRIES, 2017-2021

- FIGURE 50 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- 11.2.2 US

- 11.2.2.1 High intensification and sub-optimal frequency of crop rotation

- TABLE 90 US: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 91 US: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 92 US: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 93 US: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Growing food supply requirements and increase in cultivable land

- TABLE 94 CROPS INFESTED BY INSECT PESTS IN CANADA

- TABLE 95 CANADA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 96 CANADA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 97 CANADA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 98 CANADA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Rising demand for genetically modified corn

- TABLE 99 MEXICO: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 100 MEXICO: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 MEXICO: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 102 MEXICO: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3 ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: AGROCHEMICALS MARKET SNAPSHOT

- TABLE 103 ASIA PACIFIC: AGROCHEMICALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AGROCHEMICALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 108 ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- TABLE 109 ASIA PACIFIC: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 11.3.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 52 ASIA PACIFIC: INFLATION RATES IN KEY COUNTRIES, 2017-2021

- FIGURE 53 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 11.3.2 CHINA

- 11.3.2.1 Limited land area and unsuitable climate

- TABLE 115 CHINA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 116 CHINA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 CHINA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 118 CHINA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.3 JAPAN

- 11.3.3.1 Growing technological advancements in pest management

- TABLE 119 JAPAN: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 120 JAPAN: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 JAPAN: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 122 JAPAN: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.4 INDIA

- 11.3.4.1 Increased pressure to improve farm yield

- TABLE 123 INDIA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 124 INDIA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 INDIA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 126 INDIA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.5 AUSTRALIA & NEW ZEALAND

- 11.3.5.1 Rising need to combat pesticide-resistant weeds

- TABLE 127 AUSTRALIA & NEW ZEALAND: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 AUSTRALIA & NEW ZEALAND: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 130 AUSTRALIA & NEW ZEALAND: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.3.6 REST OF ASIA PACIFIC

- TABLE 131 REST OF ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- TABLE 135 EUROPE: AGROCHEMICALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 136 EUROPE: AGROCHEMICALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 137 EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 138 EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 139 EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 140 EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- TABLE 141 EUROPE: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 142 EUROPE: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 143 EUROPE: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 144 EUROPE: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- TABLE 145 EUROPE: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 146 EUROPE: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 11.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 54 EUROPE: INFLATION RATES IN KEY COUNTRIES, 2017-2021

- FIGURE 55 EUROPE: RECESSION IMPACT ANALYSIS

- 11.4.2 GERMANY

- 11.4.2.1 Rising demand for food grains from beer industry

- TABLE 147 GERMANY: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 148 GERMANY: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 149 GERMANY: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 150 GERMANY: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Declining soil quality

- TABLE 151 UK: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 152 UK: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 153 UK: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 154 UK: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.4 FRANCE

- 11.4.4.1 Increasing need for enhanced agricultural productivity

- TABLE 155 FRANCE: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 156 FRANCE: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 157 FRANCE: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 158 FRANCE: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.5 ITALY

- 11.4.5.1 Boost in utilization of yield-enhancing agricultural inputs

- TABLE 159 ITALY: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 160 ITALY: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 ITALY: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 162 ITALY: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.6 SPAIN

- 11.4.6.1 Surge in demand for fruits, cereals, and vegetables

- TABLE 163 SPAIN: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 164 SPAIN: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 165 SPAIN: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 166 SPAIN: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF EUROPE

- TABLE 167 REST OF EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 168 REST OF EUROPE: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 170 REST OF EUROPE: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- FIGURE 56 SOUTH AMERICA: AGROCHEMICALS MARKET SNAPSHOT

- TABLE 171 SOUTH AMERICA: AGROCHEMICALS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 172 SOUTH AMERICA: AGROCHEMICALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 173 SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 174 SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 176 SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- TABLE 177 SOUTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 178 SOUTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 57 SOUTH AMERICA: INFLATION RATES IN KEY COUNTRIES, 2017-2021

- FIGURE 58 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- 11.5.2 BRAZIL

- 11.5.2.1 High demand for soybean in Europe and Asian countries

- TABLE 183 BRAZIL: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 184 BRAZIL: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 185 BRAZIL: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 186 BRAZIL: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Ease in regulatory frameworks

- TABLE 187 ARGENTINA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 188 ARGENTINA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 189 ARGENTINA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 190 ARGENTINA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 191 REST OF SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 192 REST OF SOUTH AMERICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 194 REST OF SOUTH AMERICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD (ROW)

- TABLE 195 REST OF THE WORLD: AGROCHEMICALS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 196 REST OF THE WORLD: AGROCHEMICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 197 REST OF THE WORLD: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 198 REST OF THE WORLD: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 199 REST OF THE WORLD: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (KILOTONS)

- TABLE 200 REST OF THE WORLD: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (KILOTONS)

- TABLE 201 REST OF THE WORLD: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 202 REST OF THE WORLD: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 203 REST OF THE WORLD: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2018-2022 (USD MILLION)

- TABLE 204 REST OF THE WORLD: AGROCHEMICALS MARKET, BY FERTILIZER TYPE, 2023-2028 (USD MILLION)

- TABLE 205 REST OF THE WORLD: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018-2022 (USD MILLION)

- TABLE 206 REST OF THE WORLD: AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2023-2028 (USD MILLION)

- 11.6.1 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 59 REST OF THE WORLD: INFLATION RATES IN KEY COUNTRIES, 2017-2021

- FIGURE 60 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- 11.6.2 AFRICA

- 11.6.2.1 Growing demand for improved productivity and output

- TABLE 207 AFRICA: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 208 AFRICA: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 209 AFRICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 210 AFRICA: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 11.6.3 MIDDLE EAST

- 11.6.3.1 Increasing government subsidies

- TABLE 211 MIDDLE EAST: AGROCHEMICALS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST: AGROCHEMICALS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 MIDDLE EAST: AGROCHEMICALS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 214 MIDDLE EAST: AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 215 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- TABLE 216 INTENSITY OF COMPETITIVE RIVALRY

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 61 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD BILLION)

- 12.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 62 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 12.6 PRODUCT FOOTPRINT FOR KEY PLAYERS

- TABLE 217 COMPANY FOOTPRINT, BY TYPE

- TABLE 218 COMPANY FOOTPRINT, BY CROP TYPE

- TABLE 219 COMPANY FOOTPRINT, BY REGION

- TABLE 220 OVERALL COMPANY FOOTPRINT

- 12.7 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 63 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 12.8 COMPETITIVE BENCHMARKING OF SMES/STARTUPS/OTHER PLAYERS

- TABLE 221 DETAILED LIST OF OTHER PLAYERS

- TABLE 222 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- TABLE 223 PRODUCT LAUNCHES, 2019-2022

- 12.9.2 DEALS

- TABLE 224 DEALS, 2018-2023

- 12.9.3 OTHERS

- TABLE 225 OTHERS, 2019-2020

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)*

- 13.1.1 BAYER AG

- TABLE 226 BAYER AG: BUSINESS OVERVIEW

- FIGURE 64 BAYER AG: COMPANY SNAPSHOT

- TABLE 227 BAYER AG: PRODUCT LAUNCHES

- TABLE 228 BAYER AG: DEALS

- 13.1.2 BASF SE

- TABLE 229 BASF SE: BUSINESS OVERVIEW

- FIGURE 65 BASF SE: COMPANY SNAPSHOT

- TABLE 230 BASF SE: PRODUCT LAUNCHES

- TABLE 231 BASF SE: DEALS

- TABLE 232 BASF SE: OTHERS

- 13.1.3 SYNGENTA

- TABLE 233 SYNGENTA: BUSINESS OVERVIEW

- FIGURE 66 SYNGENTA: COMPANY SNAPSHOT

- TABLE 234 SYNGENTA: PRODUCT LAUNCHES

- TABLE 235 SYNGENTA: DEALS

- TABLE 236 SYNGENTA: OTHERS

- 13.1.4 EUROCHEM GROUP

- TABLE 237 EUROCHEM GROUP: BUSINESS OVERVIEW

- FIGURE 67 EUROCHEM GROUP: COMPANY SNAPSHOT

- TABLE 238 EUROCHEM GROUP: DEALS

- 13.1.5 CORTEVA

- TABLE 239 CORTEVA: BUSINESS OVERVIEW

- FIGURE 68 CORTEVA: COMPANY SNAPSHOT

- TABLE 240 CORTEVA: PRODUCT LAUNCHES

- TABLE 241 CORTEVA: DEALS

- 13.1.6 UPL

- TABLE 242 UPL: BUSINESS OVERVIEW

- FIGURE 69 UPL: COMPANY SNAPSHOT

- TABLE 243 UPL: PRODUCT LAUNCHES

- TABLE 244 UPL: DEALS

- 13.1.7 COMPASS MINERALS

- TABLE 245 COMPASS MINERALS: BUSINESS OVERVIEW

- FIGURE 70 COMPASS MINERALS: COMPANY SNAPSHOT

- TABLE 246 COMPASS MINERALS: PRODUCT LAUNCHES

- TABLE 247 COMPASS MINERALS: DEALS

- 13.1.8 K+S AKTIENGESELLSCHAFT

- TABLE 248 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 71 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 249 K+S AKTIENGESELLSCHAFT: DEALS

- TABLE 250 K+S AKTIENGESELLSCHAFT: OTHERS

- 13.1.9 SOCIEDAD QUIMICA Y MINERA DE CHILE

- TABLE 251 SOCIEDAD QUIMICA Y MINERA DE CHILE: BUSINESS OVERVIEW

- FIGURE 72 SOCIEDAD QUIMICA Y MINERA DE CHILE: COMPANY SNAPSHOT

- 13.1.10 SUMITOMO CHEMICALS CO., LTD.

- TABLE 252 SUMITOMO CHEMICALS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 73 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 253 SUMITOMO CHEMICALS CO., LTD.: PRODUCT LAUNCHES

- TABLE 254 SUMITOMO CHEMICALS CO., LTD.: DEALS

- 13.1.11 ADAMA

- TABLE 255 ADAMA: BUSINESS OVERVIEW

- FIGURE 74 ADAMA: COMPANY SNAPSHOT

- TABLE 256 ADAMA: PRODUCT LAUNCHES

- TABLE 257 ADAMA: DEALS

- 13.1.12 NUFARM

- TABLE 258 NUFARM: BUSINESS OVERVIEW

- FIGURE 75 NUFARM: COMPANY SNAPSHOT

- TABLE 259 NUFARM: PRODUCT LAUNCHES

- 13.1.13 NUTRIEN LTD.

- TABLE 260 NUTRIEN LTD.: BUSINESS OVERVIEW

- FIGURE 76 NUTRIEN LTD.: COMPANY SNAPSHOT

- 13.1.14 YARA

- TABLE 261 YARA: BUSINESS OVERVIEW

- FIGURE 77 YARA: COMPANY SNAPSHOT

- TABLE 262 YARA: OTHERS

- 13.1.15 ICL

- TABLE 263 ICL: BUSINESS OVERVIEW

- FIGURE 78 ICL: COMPANY SNAPSHOT

- 13.1.16 ISAGRO S.P.A.

- TABLE 264 ISAGRO S.P.A.: BUSINESS OVERVIEW

- FIGURE 79 ISAGRO S.P.A.: COMPANY SNAPSHOT

- 13.2 STARTUPS/SMES/OTHER PLAYERS

- 13.2.1 OCP GROUP

- TABLE 265 OCP GROUP: BUSINESS OVERVIEW

- TABLE 266 OCP GROUP: DEALS

- TABLE 267 OCP GROUP: OTHERS

- 13.2.2 VERDESIAN LIFE SCIENCES

- TABLE 268 VERDESIAN LIFE SCIENCES: BUSINESS OVERVIEW

- TABLE 269 VERDESIAN LIFE SCIENCES: PRODUCTS OFFERED

- 13.2.3 JIANGSU YANGNONG CHEMICAL CO., LTD.

- TABLE 270 JIANGSU YANGNONG CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 13.2.4 AGROLAC

- TABLE 271 AGROLAC: BUSINESS OVERVIEW

- 13.2.5 ATTICUS, LLC

- TABLE 272 ATTICUS, LLC: BUSINESS OVERVIEW

- 13.2.6 LIANYUNGANG LIBEN CROP SCIENCE CO., LTD.

- TABLE 273 LIANYUNGANG LIBEN CROP SCIENCE CO., LTD.: BUSINESS OVERVIEW

- 13.2.7 VALENT U.S.A. LLC

- TABLE 274 VALENT U.S.A. LLC: BUSINESS OVERVIEW

- 13.2.8 LIER CHEMICAL CO., LTD.

- TABLE 275 LIER CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 13.2.9 SIPCAM OXON

- TABLE 276 SIPCAM OXON: BUSINESS OVERVIEW

- Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 ADJACENT MARKETS

- 14.2.1 LIMITATIONS

- 14.2.2 MARKET DEFINITION

- 14.2.3 MARKET OVERVIEW

- 14.2.4 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION

- TABLE 277 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017-2020 (USD MILLION)

- TABLE 278 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2021-2027 (USD MILLION)

- 14.2.5 AGRICULTURAL BIOLOGICALS MARKET, BY REGION

- TABLE 279 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 280 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 14.3 CROP PROTECTION MARKET

- 14.3.1 LIMITATIONS

- 14.3.2 MARKET DEFINITION

- 14.3.3 MARKET OVERVIEW

- 14.3.4 CROP PROTECTION CHEMICALS MARKET, BY TYPE

- TABLE 281 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 282 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020-2025 (USD MILLION)

- 14.3.5 CROP PROTECTION CHEMICALS MARKET, BY REGION

- TABLE 283 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 284 CROP PROTECTION CHEMICALS MARKET, BY REGION, 2020-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS