|

|

市場調査レポート

商品コード

1331457

血液培養検査の世界市場:方法別(従来型、自動化)、製品別(消耗品、機器)、技術別(培養、分子、プロテオミクス)、用途別(菌血症、真菌症)、エンドユーザー別(病院、リファレンスラボ)、地域別-2028年までの予測Blood Culture Tests Market by Method (Conventional, Automated), Product (Consumables, Instruments), Technology (Culture, Molecular, Proteomics), Application (Bacteremia, Fungemia), End User (Hospitals, Reference Labs) & Region- Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 血液培養検査の世界市場:方法別(従来型、自動化)、製品別(消耗品、機器)、技術別(培養、分子、プロテオミクス)、用途別(菌血症、真菌症)、エンドユーザー別(病院、リファレンスラボ)、地域別-2028年までの予測 |

|

出版日: 2023年08月07日

発行: MarketsandMarkets

ページ情報: 英文 272 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の血液培養検査の市場規模は、予測期間中に8.0%のCAGRで拡大し、2023年の52億米ドルから2028年には76億米ドルに達すると予測されています。

この市場の成長の主な要因は、高齢者人口の増加、敗血症の罹患率の増加と治療費の高騰、血流感染症の罹患率の高さ、迅速診断技術に対する需要の高まり、感染症の有病率の高さです。しかし、自動化機器のコストの高さと訓練された検査技師の不足が、今後数年間の市場成長を抑制すると予想されます。

血液培養検査市場は、自動血液培養法と従来型/手動血液培養法に区分されます。自動血液培養検査セグメントは予測期間中に最も高いCAGRで成長すると予測されています。自動血液培養装置の収益成長を促進する主な要因は、感染症の同定と治療を迅速に行う能力、迅速なターンアラウンドタイム、手動介入が少ないことによる汚染リスクの低減です。その結果、タイムリーな同定により標的治療の迅速な開始が可能となり、患者の転帰の改善や在院日数の短縮につながります。

製品別に見ると、血液培養検査は機器、消耗品、ソフトウェアおよびサービスに大別されます。消耗品セグメントは最大のシェアを占めており、これは酵母、細菌、真菌の検出のために培地を繰り返し購入すること、メチシリン耐性黄色ブドウ球菌(MRSA)や広域βラクタマーゼ(ESBL)産生菌などの薬剤耐性感染症が増加していることに起因しています。

技術別では、血液培養検査はプロテオミクス、培養ベース技術、分子技術に大別されます。最大かつ最も急速に成長しているセグメントがマイクロアレイであるため、分子技術市場は血液培養検査市場で第2位のシェアを占めています。この背景には、敗血症の発生率の増加があり、血液サンプルから細菌、真菌、マイコバクテリアの存在を検出するための迅速な診断技術が求められています。

用途別では、血液培養検査はマイコバクテリア検出、菌血症、真菌血症に大別されます。菌血症セグメントは血液培養検査市場で最大のシェアを占めています。その主な理由は、血流感染症の増加と世界の敗血症患者数の増加です。敗血症や敗血症性ショックは、高い罹患率(入院期間の延長や関連ヘルスケアコストの増大を招く)と死亡率を伴う。移植器具、気管内チューブ、糖尿病、がん、腎臓や肝臓の疾患などの慢性ヘルスケア疾患、免疫系が抑制されている患者は敗血症を発症しやすくなっています。

エンドユーザー別に見ると、血液培養検査市場は、学術研究機関、病院検査室、リファレンスラボ、その他の検査室(独立研究機関、病理検査室、細菌検査室、POLを含む)に分けられます。この市場では、リファレンスラボ部門が最も高い成長率を示すと予測されています。これは、病院による血液培養検査のリファレンスラボへのアウトソーシングが増加しているためです。

欧州は、血液培養検査市場の第2位のシェアを占めました。欧州市場の成長の促進因子は、敗血症患者数の増加、高いヘルスケア支出、急速に増加する老人人口、規制認可の増加、この地域の強力な政府支援です。欧州ではヘルスケアコストが急激に上昇しており、ヘルスケアコストをカバーするための資金調達のためのさまざまな取り組みが不十分であることが判明しています。

当レポートでは、世界の血液培養検査市場について調査し、方法別、製品別、技術別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 業界の動向

- 技術分析

- タイプ別の平均販売価格

- バリューチェーン分析

- サプライチェーン分析

- 生態系マッピング

- ポーターのファイブフォース分析

- 関税と規制の分析

- 特許分析

- 2023年~2024年の主な会議とイベント

- 主要な利害関係者と購入基準

第6章 血液培養検査市場、方法別

- イントロダクション

- 従来型/手動血液培養

- 自動化血液培養

第7章 血液培養検査市場、製品別

- イントロダクション

- 消耗品

- 装置

- ソフトウェアとサービス

第8章 血液培養検査市場、技術別

- イントロダクション

- 培養に基づく技術

- トップオブフォーム

- プロテオミクス

第9章 血液培養検査市場、用途別

- イントロダクション

- 菌血症

- 真菌血症

- マイコバクテリアの検出

第10章 血液培養検査市場、エンドユーザー別

- イントロダクション

- 病院検査室

- リファレンスラボ

- 学術研究機関

- その他

第11章 血液培養検査市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 市場概要

- 主要な市場参入企業の収益シェア分析

- 市場シェア分析

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリックス(2022年)

- 企業のフットプリント

- 競争シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- BECTON, DICKINSON AND COMPANY

- BIOMERIEUX

- THERMO FISHER SCIENTIFIC INC.

- DANAHER

- LUMINEX CORPORATION

- BRUKER

- ROCHE DIAGNOSTICS

- IRIDICA

- T2 BIOSYSTEMS, INC.

- BINDER GMBH

- BIOBASE BIOTECH(JINAN)CO., LTD.

- SCENKER BIOLOGICAL TECHNOLOGY CO., LTD.

- BULLDOG BIO

- ANAEROBE SYSTEMS, INC.

- HIMEDIA LABORATORIES PVT. LTD.

- AUTOBIO DIAGNOSTICS CO., LTD.

- AXIOM LABORATORIES

- MIKROSCAN TECHNOLOGIES, INC.

- LABOTRONICS LTD.

- HARDY DIAGNOSTICS

- その他の企業

- OPGEN, INC.

- MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITED

- CARL ZEISS AG

- NIKON CORPORATION

- TERUMO CORPORATION

第14章 付録

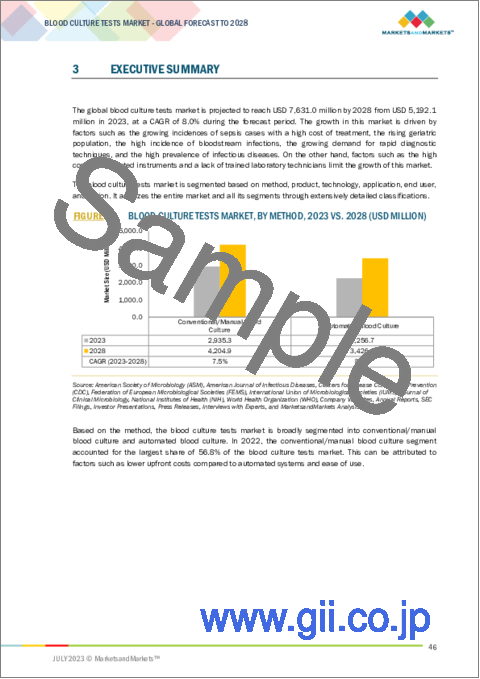

The global blood culture tests is projected to reach USD 7.6 billion by 2028 from USD 5.2 billion in 2023, at a CAGR of 8.0% during the forecast period. Growth in this market is majorly driven by the rising geriatric population, growing incidence of sepsis cases and high cost treatment, high incidence of blood stream infections, growing demand for rapid diagnostic techniques and high prevalence of infectious diseases. However, high cost of automated instruments and lack of trained laboratory technicians are expected to restrain the market growth in the upcoming years.

The automated blood culture tests segment is projected to grow at the highest CAGR during the forecast period.

Based on method, the market for blood culture tests is divided into segments for automated blood culture method and conventional/manual blood culture method. The automated blood culture tests segment is projected to grow at the highest CAGR during the forecast period. Key factors driving revenue growth for automated blood culture equipment is the ability to expedite infection identification and treatment, quick turnaround time and reduced risk of contamination due to low manual intervention. Consequently, timely identification allows for prompt initiation of targeted treatments, leading to improved patient outcomes and shorter hospital stays.

The consumables segment is the largest share of the market during the forecast period.

Based on product, the blood culture tests is broadly segmented into, instruments, consumables, and software and services. The consumables segment accounted for the largest share and this is attributed to the repeated purchase of media for the detection of yeast, bacteria and fungi and increase in drug-resistant infections, such as methicillin-resistant Staphylococcus aureus (MRSA) and extended-spectrum beta-lactamase (ESBL)-producing bacteria.

The molecular technology segment accounted for the second largest share of the market.

Based on technology, the blood culture tests is broadly segmented into proteomics, culture-based technologies and molecular technologies. Due to its largest and fastest growing segment which is the microarray segment, the molecular technologies market is accounted for the second largest share of the blood culture tests market. This can be attributed to the increasing incidence of sepsis, which demands rapid diagnostic techniques for detecting the presence of bacteria, fungi, and mycobacteria from blood samples.

The bacteremia segment accounted for the largest share of the market.

Based on applications, the blood culture tests is broadly segmented into mycobacterial detection, bacteremia and fungemia. Bacteremia segment has accounted for the largest share of the blood culture tests market. The main reason for this is the increasing number of bloodstream infections and the growing number of sepsis cases worldwide. Sepsis and septic shock is associated with a high morbidity rate (which can result in a prolonged hospital stay and increase the associated healthcare costs) and mortality rate. Patients with implanted devices; endotracheal tubes; chronic healthcare conditions such as diabetes, cancer, and diseases of the kidney and liver; and those with suppressed immune systems are more prone to developing sepsis.

The reference laboratories segment is projected to have the highest CAGR.

Based on end users, the bloodculture tests market is divided into academic research laboratories, hospital laboratories, reference laboratories, and other laboratories (involves independent research laboratories, pathology laboratories, bacteriological laboratories, and physician office laboratories (POLs). The reference laboratories segment is projected to grow at the highest rate in this market. This is due to the increasing outsourcing of blood culture tests by hospitals to reference laboratories.

Europe accounted for the second largest share of the blood culture tests market.

Europe accounted for the second largest share of the blood culture tests . Growth in the European market is driven by the increasing number of sepsis cases, high healthcare expenditure, rapidly growing geriatric population, growing regulatory approvals, and strong government support in this region. Healthcare costs have risen exponentially in Europe, and various initiatives to raise funds to cover healthcare costs have proven inadequate.

The break-up of the profile of primary participants in the blood culture tests market:

- By Company Type: Tier 1- 60%, Tier 2- 30%, and Tier 3- 10%

- By Designation: C-Level Executives- 50%, Directors-40%, and Others-10%

- By Region: North America- 45% , Europe- 35%, Asia-Pacific- 15%, and Rest of the World- 5%

Key players in the Blood culture tests

The key players operating in the blood culture tests include Danaher (US), Luminex Corporation (US), Bruker (US), Roche Diagnostics (Switzerland), Carl Zeiss AG (Germany), Nikon Corporation (Japan), Terumo Corporation (Japan), Becton, Dickinson and Company (US), BioMerieux (France), Himedia Laboratories Pvt. Ltd. (India), Autobio Diagnostics Co., Ltd. (China), Axiom Laboratories (India), Mikroscan Technologies, Inc. (US), Labotronics Ltd. (UK), Hardy Diagnostics (US), OpGen, Inc. (US), Meditech Technologies India Private Limited (India), Iridica (US), Thermo Fisher Scientific Inc. (US), Biosystems, Inc (US), BINDER GmBH (Germany), Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio (England), and Anaerobe Systems, Inc. (US).

Research Coverage:

The report analyzes the blood culture tests and aims at estimating the market size and future growth potential of this market based on various segments such as method, product, technology, application, end user, and region. The report also includes a product portfolio matrix of various blood culture tests products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, service offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Analysis of Key drivers (growing incidences of sepsis cases and high cost of treatment, rising geriatric population, high incidence of bloodstream infections, growing demand for rapid diagnostic techniques, and the high prevalence of infectious diseases), restraints (high cost of automated instruments and lack of trained laboratory technicians are limiting the growth of this market), opportunities (growth opportunities in emerging economies, identification of antibiotic resistance microorganisms), and challenges ( market cannibalization, survival of new entrants).

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global blood culture tests . The report analyzes this market by. method, product, technology, application, end user.

- Service Enhancement/Innovation: Detailed insights on upcoming trends in the global blood culture tests.

- Market Development: Comprehensive information on the lucrative emerging markets by method, product, technology, application, end user.

- Market Diversification: Exhaustive information about new services or service enhancements, growing geographies, recent developments, and investments in the global blood culture tests.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global blood culture tests.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 IMPACT OF RECESSION: BLOOD CULTURE TESTS MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 SEGMENTAL EXTRAPOLATION: GLOBAL BLOOD CULTURE TESTS MARKET (2022)

- FIGURE 6 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023-2028)

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3 APPROACH TO DETERMINE IMPACT OF ECONOMIC RECESSION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 MARKET DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: BLOOD CULTURE TESTS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 BLOOD CULTURE TESTS MARKET, BY METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 BLOOD CULTURE TESTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF BLOOD CULTURE TESTS MARKET

4 PREMIUM INSIGHTS

- 4.1 BLOOD CULTURE TESTS MARKET OVERVIEW

- FIGURE 15 GROWING INCIDENCE OF SEPSIS CASES AND HIGH COST OF TREATMENT TO DRIVE MARKET

- 4.2 BLOOD CULTURE TESTS MARKET, BY PRODUCT

- FIGURE 16 CONSUMABLES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD AND COUNTRY (2022)

- FIGURE 17 CONVENTIONAL/MANUAL BLOOD CULTURE SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC BLOOD CULTURE TESTS MARKET IN 2022

- 4.4 BLOOD CULTURE TESTS MARKET: REGIONAL MIX

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING STUDY PERIOD

- 4.5 BLOOD CULTURE TESTS MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 20 BLOOD CULTURE TESTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing number of sepsis patients and rising cost of treatment

- TABLE 3 US: FIVE MOST EXPENSIVE CONDITIONS TREATED IN HOSPITALS

- 5.1.1.2 Rapid growth in geriatric population with chronic diseases

- TABLE 4 GERIATRIC POPULATION: KEY STATISTICS

- 5.1.1.3 High incidence of nosocomial bloodstream infections

- 5.1.1.4 Growing demand for rapid diagnostic techniques with faster turnaround times

- 5.1.1.5 High prevalence of infectious diseases globally

- 5.1.2 RESTRAINTS

- 5.1.2.1 High cost of automated blood culture instruments

- 5.1.2.2 Lack of trained laboratory technicians

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Growth opportunities in emerging economies

- 5.1.3.2 Increased need to identify antibiotic-resistant microorganisms

- 5.1.4 CHALLENGES

- 5.1.4.1 Market cannibalization for conventional products

- 5.1.4.2 Difficulty in survival of new entrants

- 5.2 INDUSTRY TRENDS

- 5.2.1 LABORATORY AUTOMATION FOR INCREASED EFFICIENCY AND ACCURATE DIAGNOSIS

- 5.2.2 FOCUS ON ANTIMICROBIAL STEWARDSHIP

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 ADVANCED FLUORESCENCE DETECTION TECHNOLOGY

- 5.4 AVERAGE SELLING PRICE, BY TYPE

- 5.4.1 AVERAGE SELLING PRICE FOR BLOOD CULTURE TEST PRODUCTS, BY KEY PLAYER (2022)

- TABLE 5 REGIONAL PRICING ANALYSIS OF BLOOD CULTURE TEST PRODUCTS, BY TYPE, 2021 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS: BLOOD CULTURE TESTS MARKET

- 5.7 ECOSYSTEM MAPPING

- FIGURE 23 ECOSYSTEM MAPPING: BLOOD CULTURE TESTS MARKET

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS: BLOOD CULTURE TESTS MARKET

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 TARIFF AND REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY ANALYSIS

- 5.9.2.1 North America

- 5.9.2.1.1 US

- 5.9.2.1 North America

- TABLE 8 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 9 US: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.9.2.1.2 Canada

- TABLE 10 CANADA: CLASSIFICATION OF PRODUCTS

- TABLE 11 CANADA: TIME, COST, AND COMPLEXITY OF REGISTRATION

- 5.9.2.2 Europe

- TABLE 12 EUROPE: ACCREDITATION BODIES FOR MEDICAL LABORATORIES

- 5.9.3 ASIA PACIFIC

- 5.9.3.1 Japan

- 5.9.3.2 China

- 5.9.3.3 India

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR BLOOD CULTURE TESTS MARKET

- FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2011-JUNE 2023)

- 5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 25 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR BLOOD CULTURE TEST PATENTS (JANUARY 2011-JUNE 2023)

- FIGURE 26 TOP APPLICANTS FOR BLOOD CULTURE TEST PATENTS (COUNTRY/REGION) (JANUARY 2011-JULY 2023)

- TABLE 13 BLOOD CULTURE TESTS MARKET: LIST OF PATENTS (2020-2023)

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 14 BLOOD CULTURE TESTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023-2024

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BLOOD CULTURE TESTS MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN BLOOD CULTURE TESTS MARKET (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR BLOOD CULTURE TEST METHODS

- TABLE 16 KEY BUYING CRITERIA FOR BLOOD CULTURE TEST METHODS

6 BLOOD CULTURE TESTS MARKET, BY METHOD

- 6.1 INTRODUCTION

- TABLE 17 BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- 6.2 CONVENTIONAL/MANUAL BLOOD CULTURE

- 6.2.1 CONVENTIONAL/MANUAL BLOOD CULTURE METHOD TO ACCOUNT FOR LARGER SHARE OF BLOOD CULTURE TESTS MARKET

- TABLE 18 EXAMPLES OF CONVENTIONAL/MANUAL BLOOD CULTURE PRODUCTS

- TABLE 19 BLOOD CULTURE TESTS MARKET FOR CONVENTIONAL/MANUAL BLOOD CULTURE, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 AUTOMATED BLOOD CULTURE

- 6.3.1 INCREASED R&D INVESTMENTS BY MANUFACTURERS FOR DEVELOPING NOVEL PRODUCTS TO DRIVE MARKET

- TABLE 20 EXAMPLES OF AUTOMATED BLOOD CULTURE PRODUCTS

- TABLE 21 BLOOD CULTURE TESTS MARKET FOR AUTOMATED BLOOD CULTURE, BY COUNTRY, 2021-2028 (USD MILLION)

7 BLOOD CULTURE TESTS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 22 BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 7.2 CONSUMABLES

- TABLE 23 BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 24 BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1 BLOOD CULTURE MEDIA

- TABLE 25 EXAMPLES OF BLOOD CULTURE MEDIA

- TABLE 26 BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 27 BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.1 Aerobic blood culture media

- 7.2.1.1.1 Aerobic blood culture media to be fastest-growing segment of blood culture media market during forecast period

- 7.2.1.1 Aerobic blood culture media

- TABLE 28 AEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.2 Pediatric aerobic blood culture media

- 7.2.1.2.1 Increased need to recover pathogens from bloodstream of children to drive segment

- 7.2.1.2 Pediatric aerobic blood culture media

- TABLE 29 PEDIATRIC AEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.3 Anaerobic blood culture media

- 7.2.1.3.1 Increased need for routine diagnosis of bacteria in blood culture to drive segment

- 7.2.1.3 Anaerobic blood culture media

- TABLE 30 ANAEROBIC BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1.4 Mycobacterial blood culture media

- 7.2.1.4.1 Rising prevalence of tuberculosis to drive segment

- 7.2.1.4 Mycobacterial blood culture media

- TABLE 31 MYCOBACTERIAL BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

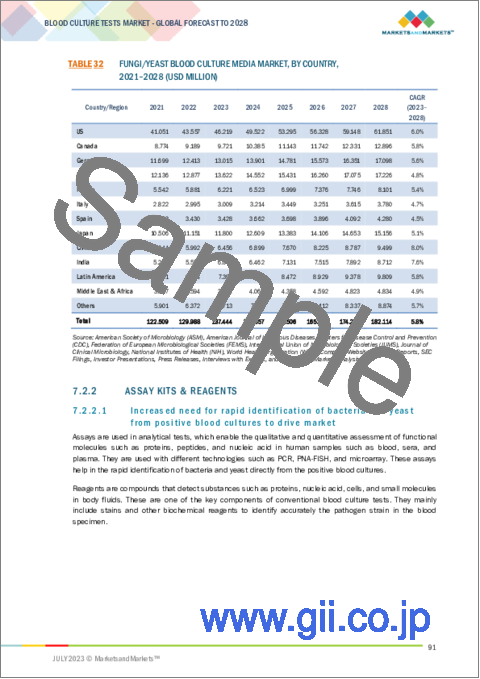

- 7.2.1.5 Fungi/yeast blood culture media

- 7.2.1.5.1 Easy identification and characterization of special fungal species to drive segment

- 7.2.1.5 Fungi/yeast blood culture media

- TABLE 32 FUNGI/YEAST BLOOD CULTURE MEDIA MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2 ASSAY KITS & REAGENTS

- 7.2.2.1 Increased need for rapid identification of bacteria and yeast from positive blood cultures to drive market

- TABLE 33 EXAMPLES OF BLOOD CULTURE ASSAY KITS & REAGENTS

- TABLE 34 ASSAY KITS & REAGENTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.3 BLOOD CULTURE ACCESSORIES

- 7.2.3.1 Growing number of blood culture tests to drive market

- TABLE 35 EXAMPLES OF BLOOD CULTURE ACCESSORIES

- TABLE 36 BLOOD CULTURE ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 INSTRUMENTS

- TABLE 37 BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- 7.3.1 AUTOMATED BLOOD CULTURE SYSTEMS

- 7.3.1.1 Need for automated imaging systems and advanced algorithms to drive market

- TABLE 38 EXAMPLES OF AUTOMATED BLOOD CULTURE SYSTEMS

- TABLE 39 AUTOMATED BLOOD CULTURE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 SUPPORTING LABORATORY EQUIPMENT

- TABLE 40 SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 41 SUPPORTING LABORATORY EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2.1 Incubators

- 7.3.2.1.1 Incubators to provide optimal environment with adequate temperature and oxygen levels for microbial growth

- 7.3.2.1 Incubators

- TABLE 42 INCUBATORS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2.2 Colony counters

- 7.3.2.2.1 Colony counters to increase direct image scanning and analysis capability

- 7.3.2.2 Colony counters

- TABLE 43 COLONY COUNTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2.3 Microscopes

- 7.3.2.3.1 Favorable funding scenario for R&D and technological advancements to drive segment

- 7.3.2.3 Microscopes

- TABLE 44 MICROSCOPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2.4 Gram stainers

- 7.3.2.4.1 Gram strainers to guide initial antibiotic section and appropriate empirical therapy

- 7.3.2.4 Gram stainers

- TABLE 45 GARAM STAINERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 SOFTWARE & SERVICES

- 7.4.1 INCREASED NEED FOR AUTOMATED SYSTEMS IN HOSPITAL-BASED LABORATORIES TO DRIVE MARKET

- TABLE 46 BLOOD CULTURE TESTS MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

8 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- TABLE 47 BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 8.2 CULTURE-BASED TECHNOLOGIES

- 8.2.1 DRAWBACKS ASSOCIATED WITH TRADITIONAL CULTURE-BASED TECHNOLOGIES TO LIMIT MARKET

- 8.3 TOP OF FORM

- TABLE 48 BLOOD CULTURE TESTS MARKET FOR CULTURE-BASED TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3.1 MOLECULAR TECHNOLOGIES

- TABLE 49 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3.2 MICROARRAYS

- 8.3.2.1 Determination of better genotyping characterization and identification of bacterial infections to drive segment

- TABLE 51 MICROARRAYS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3.3 PCR

- 8.3.3.1 Reduced risk of contaminations and easy detection of bloodstream infections to drive segment

- TABLE 52 PCR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3.4 PNA-FISH

- 8.3.4.1 PNA-FISH to use genetic markers for analysis of pathogens directly from whole blood samples

- TABLE 53 PNA-FISH MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 PROTEOMICS

- 8.4.1 PROTEOMICS TO CONTROL INFECTIOUS DISEASES AND ANALYZE COMPLEX MICROBIAL SYSTEMS WITHIN HUMAN FLUIDS

- TABLE 54 BLOOD CULTURE TESTS MARKET FOR PROTEOMICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 EXAMPLES OF MALDI-TOF MS SYSTEMS

9 BLOOD CULTURE TESTS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 56 BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028(USD MILLION)

- 9.2 BACTEREMIA

- 9.2.1 GROWING INCIDENCE OF SEPSIS CASES GLOBALLY TO DRIVE MARKET

- TABLE 57 BLOOD CULTURE TESTS MARKET FOR BACTEREMIA, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 FUNGEMIA

- 9.3.1 INCREASING INCIDENCE OF BLOODSTREAM INFECTIONS TO DRIVE MARKET

- TABLE 58 BLOOD CULTURE TESTS MARKET FOR FUNGEMIA, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 MYCOBACTERIAL DETECTION

- 9.4.1 RISING GERIATRIC POPULATION WITH TUBERCULOSIS TO DRIVE MARKET

- TABLE 59 BLOOD CULTURE TESTS MARKET FOR MYCOBACTERIAL DETECTION, BY COUNTRY, 2021-2028 (USD MILLION)

10 BLOOD CULTURE TESTS MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 60 BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 HOSPITAL LABORATORIES

- 10.2.1 INCREASED ABILITY TO CONDUCT LARGE VOLUME OF BLOOD CULTURE TESTS TO DRIVE MARKET

- TABLE 61 BLOOD CULTURE TESTS MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3 REFERENCE LABORATORIES

- 10.3.1 INCREASING REQUIREMENT OF ROUTINE AND SPECIALTY TESTS TO DRIVE MARKET

- TABLE 62 BLOOD CULTURE TESTS MARKET FOR REFERENCE LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4 ACADEMIC RESEARCH LABORATORIES

- 10.4.1 INCREASING FOCUS ON R&D OF INNOVATIVE TESTS FOR BLOODSTREAM INFECTIONS TO DRIVE MARKET

- TABLE 63 BLOOD CULTURE TESTS MARKET FOR ACADEMIC RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5 OTHER LABORATORIES

- TABLE 64 BLOOD CULTURE TESTS MARKET FOR OTHER LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

11 BLOOD CULTURE TESTS MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 65 BLOOD CULTURE TESTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: BLOOD CULTURE TESTS MARKET SNAPSHOT

- TABLE 66 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 US to dominate blood culture tests market during study period

- TABLE 77 US: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 78 US: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 79 US: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 US: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 US: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 US: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 US: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 84 US: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 US: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 86 US: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Increasing incidence of bloodstream infections to drive market

- TABLE 87 CANADA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 88 CANADA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 CANADA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 CANADA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 CANADA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 94 CANADA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 CANADA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 96 CANADA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.3 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- TABLE 97 EUROPE: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 99 EUROPE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 EUROPE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 EUROPE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 EUROPE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 EUROPE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 105 EUROPE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 107 EUROPE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Germany commanded largest share of European blood culture tests market in 2022

- TABLE 108 GERMANY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 109 GERMANY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 110 GERMANY: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 GERMANY: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 GERMANY: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 GERMANY: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 GERMANY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 115 GERMANY: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 GERMANY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 117 GERMANY: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 High burden of sepsis and increased geriatric population to drive market

- TABLE 118 UK: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 119 UK: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 120 UK: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 UK: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 UK: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 UK: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 UK: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 125 UK: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 UK: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 UK: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Rising geriatric population and favorable government regulations to drive market

- TABLE 128 FRANCE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 129 FRANCE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 130 FRANCE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 FRANCE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 FRANCE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 FRANCE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 FRANCE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 135 FRANCE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 FRANCE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 137 FRANCE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Slow growth in healthcare sector with increased health expenditure to limit market

- TABLE 138 ITALY: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 139 ITALY: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 140 ITALY: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 ITALY: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 ITALY: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 ITALY: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 ITALY: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 145 ITALY: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 ITALY: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 147 ITALY: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Rapid increase in diagnostic procedures and improved healthcare infrastructure to drive market

- TABLE 148 SPAIN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 149 SPAIN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 150 SPAIN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 SPAIN: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 SPAIN: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 SPAIN: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 SPAIN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 155 SPAIN: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 SPAIN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 157 SPAIN: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 158 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 160 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 REST OF EUROPE: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET SNAPSHOT

- TABLE 168 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.1 JAPAN

- 11.4.1.1 Japan to be largest market for blood culture tests in Asia Pacific

- TABLE 179 JAPAN: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 180 JAPAN: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 181 JAPAN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 JAPAN: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 JAPAN: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 JAPAN: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 JAPAN: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 186 JAPAN: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 JAPAN: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 188 JAPAN: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Rapid economic growth and rising disposable income of middle-class population to drive market

- TABLE 189 CHINA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 190 CHINA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 191 CHINA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 CHINA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 CHINA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 CHINA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 195 CHINA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 196 CHINA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 CHINA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 198 CHINA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Rising prevalence of infectious diseases and growing geriatric population to drive market

- TABLE 199 INDIA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 200 INDIA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 201 INDIA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 INDIA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 INDIA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 INDIA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 INDIA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 206 INDIA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 207 INDIA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 208 INDIA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.4 REST OF ASIA PACIFIC

- TABLE 209 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.5 ASIA PACIFIC: RECESSION IMPACT

- 11.5 LATIN AMERICA

- 11.5.1 FAVORABLE GOVERNMENT INITIATIVES TO DRIVE MARKET

- 11.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 219 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: BLOOD CULTURE TESTS MARKET FOR MOLECULAR TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 INFRASTRUCTURAL DEVELOPMENTS AND ADVANCED HEALTHCARE FACILITIES TO DRIVE MARKET

- 11.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 229 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY METHOD, 2021-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: BLOOD CULTURE MEDIA MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: SUPPORTING LABORATORY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MOLECULAR TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: BLOOD CULTURE TESTS MARKET, BY END USER, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 MARKET OVERVIEW

- TABLE 239 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BLOOD CULTURE TESTS MARKET

- 12.2 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 31 BLOOD CULTURE TESTS MARKET: REVENUE SHARE ANALYSIS OF MAJOR PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 32 BLOOD CULTURE TESTS MARKET SHARE ANALYSIS, BY KEY PLAYER (2022)

- TABLE 240 BLOOD CULTURE TESTS MARKET: DEGREE OF COMPETITION

- 12.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 33 BLOOD CULTURE TESTS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 12.5 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 STARTING BLOCKS

- 12.5.3 RESPONSIVE COMPANIES

- 12.5.4 DYNAMIC COMPANIES

- FIGURE 34 BLOOD CULTURE TESTS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 12.6 COMPANY FOOTPRINT

- TABLE 241 BLOOD CULTURE TESTS MARKET: COMPANY FOOTPRINT ANALYSIS

- 12.6.1 METHOD FOOTPRINT

- TABLE 242 BLOOD CULTURE TESTS MARKET: METHOD FOOTPRINT ANALYSIS

- 12.6.2 PRODUCT FOOTPRINT

- TABLE 243 BLOOD CULTURE TESTS MARKET: PRODUCT FOOTPRINT ANALYSIS

- 12.6.3 TECHNOLOGY FOOTPRINT

- TABLE 244 BLOOD CULTURE TESTS MARKET: TECHNOLOGY FOOTPRINT ANALYSIS

- 12.6.4 APPLICATION FOOTPRINT

- TABLE 245 BLOOD CULTURE TESTS MARKET: APPLICATION FOOTPRINT ANALYSIS

- 12.6.5 END USER FOOTPRINT

- TABLE 246 BLOOD CULTURE TESTS MARKET: END USER FOOTPRINT ANALYSIS

- 12.6.6 REGIONAL FOOTPRINT

- TABLE 247 BLOOD CULTURE TESTS MARKET: REGIONAL FOOTPRINT ANALYSIS

- 12.7 COMPETITIVE SCENARIOS AND TRENDS

- 12.7.1 KEY PRODUCT LAUNCHES AND APPROVALS

- TABLE 248 KEY PRODUCT LAUNCHES AND APPROVALS (JANUARY 2020-JULY 2023)

- 12.7.2 KEY DEALS

- TABLE 249 KEY DEALS (JANUARY 2020-JULY 2023)

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 BECTON, DICKINSON AND COMPANY

- TABLE 250 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 35 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 13.1.2 BIOMERIEUX

- TABLE 251 BIOMERIEUX: COMPANY OVERVIEW

- FIGURE 36 BIOMERIEUX: COMPANY SNAPSHOT (2022)

- 13.1.3 THERMO FISHER SCIENTIFIC INC.

- TABLE 252 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 13.1.4 DANAHER

- TABLE 253 DANAHER: COMPANY OVERVIEW

- FIGURE 38 DANAHER: COMPANY SNAPSHOT (2022)

- 13.1.5 LUMINEX CORPORATION

- TABLE 254 LUMINEX CORPORATION: COMPANY OVERVIEW

- FIGURE 39 LUMINEX CORPORATION: COMPANY SNAPSHOT (2022)

- 13.1.6 BRUKER

- TABLE 255 BRUKER: COMPANY OVERVIEW

- FIGURE 40 BRUKER: COMPANY SNAPSHOT (2022)

- 13.1.7 ROCHE DIAGNOSTICS

- TABLE 256 ROCHE DIAGNOSTICS: COMPANY OVERVIEW

- FIGURE 41 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT (2022)

- 13.1.8 IRIDICA

- TABLE 257 IRIDICA: COMPANY OVERVIEW

- FIGURE 42 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- 13.1.9 T2 BIOSYSTEMS, INC.

- TABLE 258 T2 BIOSYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 43 T2 BIOSYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- 13.1.10 BINDER GMBH

- TABLE 259 BINDER GMBH: COMPANY OVERVIEW

- 13.1.11 BIOBASE BIOTECH (JINAN) CO., LTD.

- TABLE 260 BIOBASE BIOTECH (JINAN) CO., LTD.: COMPANY OVERVIEW

- 13.1.12 SCENKER BIOLOGICAL TECHNOLOGY CO., LTD.

- TABLE 261 SCENKER BIOLOGICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 13.1.13 BULLDOG BIO

- TABLE 262 BULLDOG BIO: COMPANY OVERVIEW

- 13.1.14 ANAEROBE SYSTEMS, INC.

- TABLE 263 ANAEROBE SYSTEMS, INC.: COMPANY OVERVIEW

- 13.1.15 HIMEDIA LABORATORIES PVT. LTD.

- TABLE 264 HIMEDIA LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- 13.1.16 AUTOBIO DIAGNOSTICS CO., LTD.

- TABLE 265 AUTOBIO DIAGNOSTICS CO., LTD.: COMPANY OVERVIEW

- 13.1.17 AXIOM LABORATORIES

- TABLE 266 AXIOM LABORATORIES: COMPANY OVERVIEW

- 13.1.18 MIKROSCAN TECHNOLOGIES, INC.

- TABLE 267 MIKROSCAN TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 13.1.19 LABOTRONICS LTD.

- TABLE 268 LABOTRONICS LTD.: COMPANY OVERVIEW

- 13.1.20 HARDY DIAGNOSTICS

- TABLE 269 HARDY DIAGNOSTICS: COMPANY OVERVIEW

- 13.2 OTHER PLAYERS

- 13.2.1 OPGEN, INC.

- 13.2.2 MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITED

- 13.2.3 CARL ZEISS AG

- 13.2.4 NIKON CORPORATION

- 13.2.5 TERUMO CORPORATION

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS