|

|

市場調査レポート

商品コード

1073224

可変周波数ドライブ (VFD) の世界市場 - 2027年までの予測:タイプ別 (AC、DC、サーボ) 、用途別 (ポンプ、ファン、コンプレッサー、コンベヤー) 、エンドユーザー別、出力定格別、電圧別、地域別Variable Frequency Drive Market by Type (AC, DC, Servo), Application (Pumps, Fans, Compressors, Conveyors), End User (Industrial, Infrastructure, Oil & Gas, Power), Power Rating (Micro, Low, Medium, High), Voltage and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 可変周波数ドライブ (VFD) の世界市場 - 2027年までの予測:タイプ別 (AC、DC、サーボ) 、用途別 (ポンプ、ファン、コンプレッサー、コンベヤー) 、エンドユーザー別、出力定格別、電圧別、地域別 |

|

出版日: 2022年05月02日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の可変周波数ドライブ (VFD) の市場規模は、2022年の推定212億米ドルから、2027年には268億米ドルに達し、予測期間中のCAGRで4.8%の成長が予測されています。

可変周波数ドライブ (VFD) の使用に関連する利点には、エネルギー消費とコストの削減、エネルギー効率の向上、機器の寿命の延長、メンテナンスコストの削減が含まれます。これらの要因が、市場の成長を促進すると予想されます。

当レポートでは、世界の可変周波数ドライブ (VFD) 市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主要ステークホルダーと購入基準

- COVID-19の影響分析

- 平均販売価格の動向

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 主要会議とイベント

- 市場マップ

- イノベーションと特許登録

- 貿易データ統計

- ケーススタディ分析

- 規制当局、政府機関、その他の組織

第6章 可変周波数ドライブ (VFD) 市場:タイプ別

- ACドライブ

- DCドライブ

- サーボドライブ

第7章 可変周波数ドライブ (VFD) 市場:電圧別

- 低電圧

- 中電圧

第8章 可変周波数ドライブ (VFD) 市場:出力定格別

- マイクロパワードライブ

- 低出力ドライブ

- 中出力ドライブ

- 高出力ドライブ

第9章 可変周波数ドライブ (VFD) 市場:用途別

- ポンプ

- ファン

- コンプレッサー

- コンベヤー

- その他

第10章 可変周波数ドライブ (VFD) 市場:エンドユーザー別

- 石油・ガス

- 工業

- 電力

- インフラ

第11章 可変周波数ドライブ (VFD) 市場:地域別

- アジア太平洋地域

- 北米

- 欧州

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 主要企業の戦略

- 上位企業5社の市場シェア分析

- 上位企業5社の収益分析

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- 可変周波数ドライブ (VFD) 市場:企業のフットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ABB

- SIEMENS

- SCHNEIDER ELECTRIC

- DANFOSS

- ROCKWELL AUTOMATION

- EATON

- FUJI ELECTRIC

- HITACHI

- GENERAL ELECTRIC

- NIDEC

- WEG SA

- YASKAWA

- HONEYWELL INTERNATIONAL

- CG POWER AND INDUSTRIAL SOLUTIONS LIMITED

- TMEIC

- その他の企業

- ANAHEIM AUTOMATION

- SEW-EURODRIVE

- DELTA ELECTRONICS

- PARKER HANNIFIN

- NORD DRIVE SYSTEMS

- INOVANCE TECHNOLOGY

- TECHSUPPEN

- SHENZHEN GOZUK

- SAKSUN INDUSTRIES

- A.S. AUTOMATION & CONTROLS

第14章 付録

The variable frequency drive market is anticipated to grow from an estimated USD 21.2 billion in 2022 to USD 26.8 billion in 2027, at a CAGR of 4.8% during the forecast period. The advantages associated with the use of variable frequency drives include reduced energy consumption and costs, increased energy efficiency, extended equipment life, and low maintenance costs. They are used for variable torque applications in the oil & gas, power, infrastructure, and industrial sectors. These factor would drive the growth of variable frequency drive.

"Pumps: The fastest-growing segment of the variable frequency drive market, by application"

The pumps segment is estimated to grow from USD XX million in 2022 to USD XX million by 2027, at a CAGR of X%. The growing need for enhancing energy efficiency and performance of pumps under different load conditions is likely to fuel the growth of the variable frequency drive market for pumps.

"Industrial segment is expected to emerge as the largest segment based on end-user industry"

The market for the industrial segment is projected to be valued at USD XX million in 2022 and reach USD XX billion by 2027, at a CAGR of XX%. The growing adoption of variable frequency drives in various industries, such as chemical, petrochemical, pulp & paper, and food & beverage is driving the growth of the industrial segment.

" Europe is expected to account for the second-largest market size during the forecast period."

North America is expected to be the second largest and fastest-growing market due to the presence of industrialized countries such as the UK, Russia, Germany, Italy, France, and Spain. Increasing investments, growing adoption of renewable energy, and rising focus on modernization of legacy infrastructure are factors projected to fuel the regional market's growth.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 60%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: Europe- 20%, Asia Pacific- 33%, North America- 27%, the Middle East & Africa- 12%, and South America- 8%

Note: Others includes product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The variable frequency drive market is dominated by a few major players that have a wide regional presence. The leading players in the variable frequency drive market are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Danfoss (Denmark), and Rockwell Automation (US).

Research Coverage:

The report defines, describes, and forecasts the global variable frequency drive market, by type, voltage type, power rating, application, end-user industry, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the variable frequency drive market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for variable frequency drive, which would help equipment manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.2.1 VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

- 1.2.2 VARIABLE FREQUENCY DRIVE MARKET, BY END USER: INCLUSIONS AND EXCLUSIONS

- 1.2.3 VARIABLE FREQUENCY DRIVE MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- 1.2.4 VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- 1.2.5 VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 VARIABLE FREQUENCY DRIVE MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 KEY DATA FROM SECONDARY SOURCES

- 2.2.2 PRIMARY DATA

- 2.2.2.1 KEY DATA FROM PRIMARY SOURCES

- 2.2.2.2 BREAKDOWN OF PRIMARIES

- 2.3 MATRIX CONSIDERED FOR DEMAND SIDE ASSESSMENT

- FIGURE 3 MAIN MATRIX CONSIDERED WHILE ASSESSING DEMAND FOR VARIABLE FREQUENCY DRIVES

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 DEMAND SIDE MATRIX

- FIGURE 4 VARIABLE FREQUENCY DRIVE MARKET: INDUSTRY-REGION/ COUNTRY-WISE ANALYSIS

- 2.4.1.1 CALCULATION FOR DEMAND SIDE ANALYSIS

- 2.4.1.2 KEY ASSUMPTIONS WHILE CALCULATING DEMAND SIDE MARKET SIZE

- 2.4.2 SUPPLY SIDE MATRIX

- FIGURE 5 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF VARIABLE FREQUENCY DRIVES

- 2.4.2.1 CALCULATIONS FOR SUPPLY SIDE ANALYSIS

- FIGURE 6 VARIABLE FREQUENCY DRIVE MARKET: SUPPLY SIDE ANALYSIS

- 2.4.2.2 ASSUMPTIONS WHILE CALCULATING SUPPLY SIDE MARKET SIZE

- FIGURE 7 COMPANY REVENUE ANALYSIS, 2021

- 2.4.3 FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 VARIABLE FREQUENCY DRIVE MARKET SNAPSHOT

- FIGURE 8 AC DRIVE SEGMENT TO LEAD VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, DURING FORECAST PERIOD

- FIGURE 9 LOW VOLTAGE SEGMENT TO LEAD VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, DURING FORECAST PERIOD

- FIGURE 10 LOW POWER DRIVE SEGMENT TO LEAD VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, DURING FORECAST PERIOD

- FIGURE 11 PUMPS SEGMENT TO LEAD VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 12 INDUSTRIAL SEGMENT TO LEAD VARIABLE FREQUENCY DRIVE MARKET, BY END USER, DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO DOMINATE VARIABLE FREQUENCY DRIVE MARKET BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN VARIABLE FREQUENCY DRIVE MARKET

- FIGURE 14 GROWING NEED FOR ENHANCING ENERGY EFFICIENCY AND ACHIEVING COST SAVINGS TO DRIVE GROWTH OF VARIABLE FREQUENCY DRIVE MARKET, 2022-2027

- 4.2 VARIABLE FREQUENCY DRIVE MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC VARIABLE FREQUENCY DRIVE MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 VARIABLE FREQUENCY DRIVE MARKET, BY TYPE

- FIGURE 16 AC DRIVES SEGMENT DOMINATED VARIABLE FREQUENCY DRIVE MARKET IN 2021

- 4.4 VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE

- FIGURE 17 LOW VOLTAGE SEGMENT DOMINATED VARIABLE FREQUENCY DRIVE MARKET IN 2021

- 4.5 VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING

- FIGURE 18 LOW POWER DRIVE SEGMENT HELD LARGEST SHARE OF VARIABLE FREQUENCY DRIVE MARKET IN 2021

- 4.6 VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION

- FIGURE 19 PUMPS SEGMENT HELD LARGEST SHARE OF VARIABLE FREQUENCY DRIVE MARKET IN 2021

- 4.7 VARIABLE FREQUENCY DRIVE MARKET, BY END USER

- FIGURE 20 INDUSTRIAL SEGMENT DOMINATED VARIABLE FREQUENCY DRIVE MARKET IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 VARIABLE FREQUENCY DRIVE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 INCREASING INDUSTRIALIZATION AND GROWING DEMAND FOR ENERGY EFFICIENCY

- 5.2.1.2 RISING NEED FOR ENHANCING ENERGY EFFICIENCY AND DECREASING ENERGY CONSUMPTION

- TABLE 2 ENERGY SAVINGS USING VARIABLE FREQUENCY DRIVES (VFDS), 2021

- FIGURE 22 GLOBAL DOMESTIC ELECTRICITY CONSUMPTION, 2015-2020

- 5.2.1.3 SUPPORTIVE REGULATORY ENVIRONMENT FOR EFFICIENT AND EFFECTIVE ENERGY UTILIZATION

- 5.2.2 RESTRAINTS

- 5.2.2.1 STAGNANT GROWTH OF OIL & GAS INDUSTRY AND DECLINE IN EXPLORATION AND PRODUCTION ACTIVITIES

- FIGURE 23 CRUDE OIL PRICE TREND, 2017-2022 (USD PER BARREL)

- 5.2.2.2 INCREASE IN MAINTENANCE COST OF SYSTEMS AFTER IMPLEMENTATION OF VARIABLE FREQUENCY DRIVES (VFDS)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 MODERNIZATION OF POWER INFRASTRUCTURE

- 5.2.3.2 GROWING USE OF INDUSTRIAL INTERNET OF THINGS (IOT) AND ROBOTICS TECHNOLOGIES

- 5.2.4 CHALLENGES

- 5.2.4.1 AVAILABILITY OF LOW-COST PRODUCTS IN GRAY MARKET

- 5.2.4.2 SHORTAGE OF COMPONENTS AND PARTS DUE TO SUPPLY CHAIN DISRUPTIONS

- TABLE 3 REGION-/COUNTRY-WISE PERCENTAGE DEVIATIONS FROM BENCHMARKS DUE TO COVID-19

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 VARIABLE FREQUENCY DRIVE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY END USER (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR END USERS

- TABLE 6 KEY BUYING CRITERIA, BY END USER

- 5.5 COVID-19 IMPACT ANALYSIS

- 5.5.1 COVID-19 HEALTH ASSESSMENT

- FIGURE 27 COVID-19 GLOBAL PROPAGATION

- FIGURE 28 COVID-19 PROPAGATION IN SELECTED COUNTRIES

- 5.5.2 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 29 REVISED GDP FORECASTS FOR SELECTED G20 COUNTRIES IN 2020

- 5.6 AVERAGE SELLING PRICE TREND

- FIGURE 30 AVERAGE SELLING PRICES OF KEY PLAYER OFFERINGS FOR POWER RATING

- TABLE 7 AVERAGE SELLING PRICES OF KEY PLAYER OFFERINGS FOR POWER RATING (USD)

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 31 VARIABLE FREQUENCY DRIVE MARKET: VALUE CHAIN

- 5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.7.2 COMPONENT MANUFACTURERS

- 5.7.3 ASSEMBLERS/MANUFACTURERS

- 5.7.4 DISTRIBUTORS/END USERS AND POST-SALES SERVICES

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR VARIABLE FREQUENCY DRIVE MANUFACTURERS

- FIGURE 32 REVENUE SHIFT FOR VARIABLE FREQUENCY DRIVE MANUFACTURERS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 PERMANENT MAGNET MOTORS

- 5.9.2 WIRELESS DIAGNOSTIC

- 5.9.3 MODULAR MEMORY

- 5.9.4 PREDICTIVE MAINTENANCE

- 5.10 KEY CONFERENCES AND EVENTS BETWEEN 2022 AND 2023

- TABLE 8 VARIABLE FREQUENCY DRIVE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.11 MARKET MAP

- FIGURE 33 MARKET MAP FOR VARIABLE FREQUENCY DRIVES

- 5.12 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 9 VARIABLE FREQUENCY DRIVE MARKET: PATENTS AND INNOVATIONS

- 5.13 TRADE DATA STATISTICS

- TABLE 10 ELECTRIC MOTOR: IMPORT STATISTICS, 2018-2021 (USD MILLION)

- TABLE 11 ELECTRIC MOTOR: EXPORT STATISTICS, 2018-2021 (USD MILLION)

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 ABB'S ULTRA-LOW HARMONIC DRIVES IMPROVED ENERGY EFFICIENCY OF ICE-MAKING PROCESS AT OULU ENERGY ARENA, 2021

- 5.14.2 DANFOSS DELIVERED ENERGY-EFFICIENT DRIVES FOR IMPROVING INDOOR AIR QUALITY IN DELHI METRO, 2021

- 5.14.3 ABB'S VARIABLE FREQUENCY DRIVE SUCCESS, 2018

- 5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.1 CODES AND REGULATIONS RELATED TO VARIABLE FREQUENCY DRIVES

- TABLE 17 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 18 EUROPE AND NORTH AMERICA: CODES AND REGULATIONS

- TABLE 19 GLOBAL: CODES AND REGULATIONS

6 VARIABLE FREQUENCY DRIVE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 34 VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2021

- TABLE 20 VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 AC DRIVE

- 6.2.1 EASY AVAILABILITY AND HIGH ENERGY EFFICIENCY ARE FACTORS DRIVING MARKET GROWTH

- TABLE 21 AC DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 DC DRIVE

- 6.3.1 ADVANTAGES SUCH AS SPEED CONTROL AND HIGH-SPEED REGULATION TO PROPEL DEMAND FOR DC DRIVES

- TABLE 22 DC DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 SERVO DRIVE

- 6.4.1 INCREASING APPLICATIONS IN CLOSED-LOOP CONTROL AND I/O PROCESSING FOR SAFETY COMPONENTS TO BOOST GROWTH OF SEGMENT

- TABLE 23 SERVO DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

7 VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- FIGURE 35 VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2021

- TABLE 24 VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

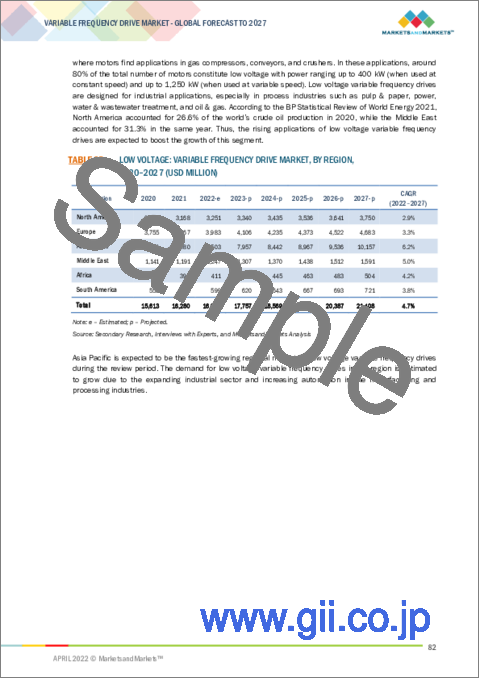

- 7.2 LOW VOLTAGE

- 7.2.1 RISING APPLICATIONS OF LOW VOLTAGE VARIABLE FREQUENCY DRIVES TO FUEL MARKET GROWTH

- TABLE 25 LOW VOLTAGE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 MEDIUM VOLTAGE

- 7.3.1 GROWING USE OF MEDIUM VOLTAGE VARIABLE FREQUENCY DRIVES TO MINIMIZE OPERATING AND MAINTENANCE COSTS TO DRIVE MARKET GROWTH

- TABLE 26 MEDIUM VOLTAGE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

8 VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- FIGURE 36 VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2021

- TABLE 27 VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 8.2 MICRO POWER DRIVE

- 8.2.1 RAPID INDUSTRIAL AND URBAN DEVELOPMENTS TO DRIVE MARKET GROWTH

- TABLE 28 MICRO POWER DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.3 LOW POWER DRIVE

- 8.3.1 EXPANDING WATER & WASTEWATER TREATMENT INDUSTRY TO BOOST DEMAND FOR LOW POWER VARIABLE FREQUENCY DRIVES

- TABLE 29 LOW POWER DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.4 MEDIUM POWER DRIVE

- 8.4.1 GROWING DEMAND FOR MEDIUM POWER DRIVES IN OIL & GAS INDUSTRY TO DRIVE MARKET GROWTH

- TABLE 30 MEDIUM POWER DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.5 HIGH POWER DRIVE

- 8.5.1 GROWING METAL & MINING INDUSTRY TO DRIVE MARKET GROWTH

- TABLE 31 HIGH POWER DRIVE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

9 VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 PUMPS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 32 VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2 PUMPS

- 9.2.1 GROWING NEED TO REDUCE ENERGY CONSUMPTION AND MAINTENANCE COSTS TO DRIVE MARKET GROWTH

- TABLE 33 PUMPS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 FANS

- 9.3.1 INCREASING ENERGY COSTS TO FUEL MARKET GROWTH

- TABLE 34 FANS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.4 COMPRESSORS

- 9.4.1 GROWING AWARENESS REGARDING ENERGY SAVING AND INCREASING IMPLEMENTATION OF ENERGY-EFFICIENT SOLUTIONS TO BOOST DEMAND FOR VARIABLE FREQUENCY DRIVES

- TABLE 35 COMPRESSORS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.5 CONVEYORS

- 9.5.1 RISING NEED FOR PROCESS INTEGRATION OF CONVEYORS TO FUEL DEMAND FOR VARIABLE FREQUENCY DRIVES

- TABLE 36 CONVEYORS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.6 OTHERS

- TABLE 37 OTHERS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

10 VARIABLE FREQUENCY DRIVE MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 38 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- TABLE 38 VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 10.2 OIL & GAS

- 10.2.1 RISING FOCUS ON ACHIEVING ENERGY EFFICIENCY AND GROWING USAGE OF MOTORS ON LARGE SCALE TO DRIVE MARKET GROWTH

- TABLE 39 OIL & GAS: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.3 INDUSTRIAL

- 10.3.1 MOTORIZED AUTOMATION AND OPTIMUM UTILIZATION OF MACHINES AND POWER TO FUEL DEMAND FOR VARIABLE FREQUENCY DRIVES

- TABLE 40 INDUSTRIAL: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.4 POWER

- 10.4.1 INCREASING EMPHASIS ON ENERGY EFFICIENCY AND COST REDUCTION TO DRIVE MARKET GROWTH

- TABLE 41 POWER: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.5 INFRASTRUCTURE

- 10.5.1 GROWING NEED FOR ENERGY OPTIMIZATION AND ENHANCING ENERGY EFFICIENCY TO DRIVE MARKET GROWTH

- TABLE 42 INFRASTRUCTURE: VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

11 VARIABLE FREQUENCY DRIVE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2021 (%)

- FIGURE 40 ASIA PACIFIC VARIABLE FREQUENCY DRIVE MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- TABLE 43 VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 44 VARIABLE FREQUENCY DRIVE MARKET, BY REGION, 2020-2027 (THOUSAND UNITS)

- 11.2 ASIA PACIFIC

- FIGURE 41 SNAPSHOT: VARIABLE FREQUENCY DRIVE MARKET IN ASIA PACIFIC

- 11.2.1 BY TYPE

- TABLE 45 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.2.2 BY VOLTAGE

- TABLE 46 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.2.3 BY POWER RATING

- TABLE 47 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.2.4 BY APPLICATION

- TABLE 48 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 11.2.5 BY END USER

- TABLE 49 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6 BY COUNTRY

- TABLE 50 ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.2.6.1 CHINA

- 11.2.6.1.1 Rising investments in oil & gas industry and industrial sector to fuel demand for variable frequency drives

- 11.2.6.1 CHINA

- TABLE 51 CHINA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.2 INDIA

- 11.2.6.2.1 Government-led investments in industrial sector and expanding chemical and metal & mining industries to fuel growth of variable frequency drive market

- 11.2.6.2 INDIA

- TABLE 52 INDIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.3 AUSTRALIA

- 11.2.6.3.1 Favorable government policies for lithium mining and increasing investments in wind development projects to drive market growth in Australia

- 11.2.6.3 AUSTRALIA

- TABLE 53 AUSTRALIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.4 JAPAN

- 11.2.6.4.1 Increasing investments in power sector and growing demand for LNG to drive market growth in Japan

- 11.2.6.4 JAPAN

- TABLE 54 JAPAN: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.5 SOUTH KOREA

- 11.2.6.5.1 Expanding steel and construction industries to drive market growth in South Korea

- 11.2.6.5 SOUTH KOREA

- TABLE 55 SOUTH KOREA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.6 INDONESIA

- 11.2.6.6.1 Development of petrochemical products and renewable power generation to drive market growth in Indonesia

- 11.2.6.6 INDONESIA

- TABLE 56 INDONESIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.2.6.7 REST OF ASIA PACIFIC

- TABLE 57 REST OF ASIA PACIFIC: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3 NORTH AMERICA

- FIGURE 42 NORTH AMERICA VARIABLE FREQUENCY DRIVE MARKET: SNAPSHOT

- 11.3.1 BY TYPE

- TABLE 58 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.3.2 BY VOLTAGE

- TABLE 59 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.3.3 BY POWER RATING

- TABLE 60 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.3.4 BY APPLICATION

- TABLE 61 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 11.3.5 BY END USER

- TABLE 62 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3.6 BY COUNTRY

- TABLE 63 NORTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.3.6.1 US

- 11.3.6.1.1 Increasing investments in oil & gas and chemical industries and rising mining exploration activities to drive US market growth

- 11.3.6.1 US

- TABLE 64 US: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3.6.2 CANADA

- 11.3.6.2.1 Increasing focus on development of oil & gas and power industries to boost demand for variable frequency drives in Canada

- 11.3.6.2 CANADA

- TABLE 65 CANADA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.3.6.3 MEXICO

- 11.3.6.3.1 Increasing investments in oil & gas industry and development of water and wastewater treatment infrastructure to drive market growth in Mexico

- 11.3.6.3 MEXICO

- TABLE 66 MEXICO: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 BY TYPE

- TABLE 67 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.4.2 BY VOLTAGE

- TABLE 68 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.4.3 BY POWER RATING

- TABLE 69 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.4.4 BY APPLICATION

- TABLE 70 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 11.4.5 BY END USER

- TABLE 71 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6 BY COUNTRY

- TABLE 72 EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.4.6.1 UK

- 11.4.6.1.1 Growing demand for wind energy to increase deployment of variable frequency drives in UK

- 11.4.6.1 UK

- TABLE 73 UK: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.2 RUSSIA

- 11.4.6.2.1 Surging investments in oil & gas industry to boost market growth in Russia

- 11.4.6.2 RUSSIA

- TABLE 74 RUSSIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.3 GERMANY

- 11.4.6.3.1 Increasing focus on expanding power sector and infrastructure development to fuel demand for variable frequency drives in Germany

- 11.4.6.3 GERMANY

- TABLE 75 GERMANY: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.4 ITALY

- 11.4.6.4.1 Expanding industrial sector and power industry to drive market growth in Italy

- 11.4.6.4 ITALY

- TABLE 76 ITALY: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.5 FRANCE

- 11.4.6.5.1 Growing demand for variable frequency drives in mining industry and renewable energy projects to fuel market growth

- 11.4.6.5 FRANCE

- TABLE 77 FRANCE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.6 SPAIN

- 11.4.6.6.1 Growing industrial sector to fuel demand for variable frequency drives in Spain

- 11.4.6.6 SPAIN

- TABLE 78 SPAIN: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.4.6.7 REST OF EUROPE

- TABLE 79 REST OF EUROPE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 BY TYPE

- TABLE 80 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.5.2 BY VOLTAGE

- TABLE 81 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.5.3 BY POWER RATING

- TABLE 82 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.5.4 BY APPLICATION

- TABLE 83 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 11.5.5 BY END USER

- TABLE 84 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5.6 BY COUNTRY

- TABLE 85 SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.5.6.1 BRAZIL

- 11.5.6.1.1 Increasing investment due to privatization in oil & gas and power industries to propel demand for variable frequency drives in Brazil

- 11.5.6.1 BRAZIL

- TABLE 86 BRAZIL: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5.6.2 ARGENTINA

- 11.5.6.2.1 Favorable government policies along with investments in oil & gas, mining, and renewable energy to fuel demand for variable frequency drives in Argentina

- 11.5.6.2 ARGENTINA

- TABLE 87 ARGENTINA: VARIABLE FREQUENCY MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5.6.3 CHILE

- 11.5.6.3.1 Developments in infrastructure projects and mining sector in Chile to drive market growth

- 11.5.6.3 CHILE

- TABLE 88 CHILE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.5.6.4 REST OF SOUTH AMERICA

- TABLE 89 REST OF SOUTH AMERICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6 MIDDLE EAST

- 11.6.1 BY TYPE

- TABLE 90 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.6.2 BY VOLTAGE

- TABLE 91 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.6.3 BY POWER RATING

- TABLE 92 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.6.4 BY APPLICATION

- TABLE 93 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 94 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6.5 BY COUNTRY

- TABLE 95 MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.6.5.1 SAUDI ARABIA

- 11.6.5.1.1 Rising investments in infrastructure development and power sector to fuel demand for variable frequency drives

- 11.6.5.1 SAUDI ARABIA

- TABLE 96 SAUDI ARABIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6.5.2 UAE

- 11.6.5.2.1 Developing manufacturing sector and HVAC infrastructure to increase demand for variable frequency drives

- 11.6.5.2 UAE

- TABLE 97 UAE: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6.5.3 QATAR

- 11.6.5.3.1 Rising investments in development of power sector to drive demand for variable frequency drives

- 11.6.5.3 QATAR

- TABLE 98 QATAR: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6.5.4 OMAN

- 11.6.5.4.1 Healthy growth of oil & gas sector to drive market growth

- 11.6.5.4 OMAN

- TABLE 99 OMAN: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.6.5.5 REST OF MIDDLE EAST

- TABLE 100 REST OF MIDDLE EAST: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.7 AFRICA

- 11.7.1 BY TYPE

- TABLE 101 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 11.7.2 BY VOLTAGE

- TABLE 102 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY VOLTAGE, 2020-2027 (USD MILLION)

- 11.7.3 BY POWER RATING

- TABLE 103 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING, 2020-2027 (USD MILLION)

- 11.7.4 BY APPLICATION

- TABLE 104 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 11.7.5 BY END USER

- TABLE 105 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.7.6 BY COUNTRY

- TABLE 106 AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 11.7.6.1 EGYPT

- 11.7.6.1.1 Active upstream operations funded by international oil companies to fuel growth of variable frequency drive market

- 11.7.6.1 EGYPT

- TABLE 107 EGYPT: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.7.6.2 NIGERIA

- 11.7.6.2.1 Rise in exploration activities to boost market growth

- 11.7.6.2 NIGERIA

- TABLE 108 NIGERIA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.7.6.3 SOUTH AFRICA

- 11.7.6.3.1 Increasing investments in mining sector and oil & gas industry to fuel demand for variable frequency drives

- 11.7.6.3 SOUTH AFRICA

- TABLE 109 SOUTH AFRICA: VARIABLE FREQUENCY DRIVE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 11.7.6.4 REST OF AFRICA

- TABLE 110 REST OF AFRICA: VARIABLE FREQUENCY MARKET, BY END USER, 2020-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYERS STRATEGIES

- TABLE 111 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018-2022

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 112 VARIABLE FREQUENCY DRIVE MARKET: DEGREE OF COMPETITION

- FIGURE 43 VARIABLE FREQUENCY DRIVE MARKET SHARE ANALYSIS, 2021

- 12.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 44 TOP PLAYERS IN VARIABLE FREQUENCY DRIVE MARKET FROM 2017 TO 2021

- 12.4 COMPANY EVALUATION QUADRANT

- 12.4.1 STAR

- 12.4.2 PERVASIVE

- 12.4.3 EMERGING LEADER

- 12.4.4 PARTICIPANT

- FIGURE 45 VARIABLE FREQUENCY DRIVE MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

- 12.5 START-UP/SME EVALUATION QUADRANT, 2021

- 12.5.1 PROGRESSIVE COMPANY

- 12.5.2 RESPONSIVE COMPANY

- 12.5.3 DYNAMIC COMPANY

- 12.5.4 STARTING BLOCK

- FIGURE 46 VARIABLE FREQUENCY DRIVE MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- 12.5.5 COMPETITIVE BENCHMARKING

- TABLE 113 VARIABLE FREQUENCY DRIVE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 114 VARIABLE FREQUENCY DRIVE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.6 VARIABLE FREQUENCY DRIVE MARKET: COMPANY FOOTPRINT

- TABLE 115 POWER RATING: COMPANY FOOTPRINT

- TABLE 116 TYPE: COMPANY FOOTPRINT

- TABLE 117 APPLICATION: COMPANY FOOTPRINT

- TABLE 118 REGION: COMPANY FOOTPRINT

- TABLE 119 COMPANY FOOTPRINT

- 12.7 COMPETITIVE SCENARIO

- TABLE 120 VARIABLE FREQUENCY DRIVE MARKET: PRODUCT LAUNCHES, JANUARY 2018- MARCH 2022

- TABLE 121 VARIABLE FREQUENCY DRIVE MARKET: DEALS, JANUARY 2018- MARCH 2022

- TABLE 122 VARIABLE FREQUENCY DRIVE MARKET: OTHERS, JANUARY 2018- MARCH 2022

13 COMPANY PROFILES

- (Business overview, Products/solutions/services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- TABLE 123 ABB: BUSINESS OVERVIEW

- FIGURE 47 ABB: COMPANY SNAPSHOT, 2021

- TABLE 124 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 ABB: PRODUCT LAUNCHES

- TABLE 126 ABB: DEALS

- TABLE 127 ABB: OTHERS

- 13.1.2 SIEMENS

- TABLE 128 SIEMENS: BUSINESS OVERVIEW

- FIGURE 48 SIEMENS: COMPANY SNAPSHOT, 2021

- TABLE 129 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 SIEMENS: PRODUCT LAUNCHES

- TABLE 131 SIEMENS: DEALS

- TABLE 132 SIEMENS: OTHERS

- 13.1.3 SCHNEIDER ELECTRIC

- TABLE 133 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT, 2021

- TABLE 134 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 136 SCHNEIDER ELECTRIC: DEALS

- TABLE 137 SCHNEIDER ELECTRIC: OTHERS

- 13.1.4 DANFOSS

- TABLE 138 DANFOSS: COMPANY OVERVIEW

- FIGURE 50 DANFOSS: COMPANY SNAPSHOT, 2021

- TABLE 139 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 DANFOSS: PRODUCT LAUNCHES

- TABLE 141 DANFOSS: DEALS

- TABLE 142 DANFOSS: OTHERS

- 13.1.5 ROCKWELL AUTOMATION

- TABLE 143 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- FIGURE 51 ROCKWELL AUTOMATION: COMPANY SNAPSHOT, 2021

- TABLE 144 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 146 ROCKWELL AUTOMATION: DEALS

- 13.1.6 EATON

- TABLE 147 EATON: BUSINESS OVERVIEW

- FIGURE 52 EATON: COMPANY SNAPSHOT, 2021

- TABLE 148 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 EATON: PRODUCT LAUNCHES

- TABLE 150 EATON: DEALS

- TABLE 151 EATON: OTHERS

- 13.1.7 FUJI ELECTRIC

- TABLE 152 FUJI ELECTRIC: COMPANY OVERVIEW

- FIGURE 53 FUJI ELECTRIC: COMPANY SNAPSHOT, 2021

- TABLE 153 FUJI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 FUJI ELECTRIC: PRODUCT LAUNCHES

- TABLE 155 FUJI ELECTRIC: DEALS

- TABLE 156 FUJI ELECTRIC: OTHERS

- 13.1.8 HITACHI

- TABLE 157 HITACHI: COMPANY OVERVIEW

- FIGURE 54 HITACHI: COMPANY SNAPSHOT, 2021

- TABLE 158 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 GENERAL ELECTRIC

- TABLE 159 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 55 GENERAL ELECTRIC: COMPANY SNAPSHOT, 2021

- TABLE 160 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 GENERAL ELECTRIC: DEALS

- TABLE 162 GENERAL ELECTRIC: OTHERS

- 13.1.10 NIDEC

- TABLE 163 NIDEC: COMPANY OVERVIEW

- FIGURE 56 NIDEC: COMPANY SNAPSHOT, 2021

- TABLE 164 NIDEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 NIDEC: PRODUCT LAUNCHES

- TABLE 166 NIDEC: OTHERS

- 13.1.11 WEG SA

- TABLE 167 WEG SA: COMPANY OVERVIEW

- FIGURE 57 WEG SA: COMPANY SNAPSHOT, 2021

- TABLE 168 WEG SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 WEG SA: PRODUCT LAUNCHES

- TABLE 170 WEG SA: OTHERS

- 13.1.12 YASKAWA

- TABLE 171 YASKAWA: COMPANY OVERVIEW

- FIGURE 58 YASKAWA: COMPANY SNAPSHOT, 2020

- TABLE 172 YASKAWA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 YASKAWA: PRODUCT LAUNCHES

- TABLE 174 YASKAWA: DEALS

- 13.1.13 HONEYWELL INTERNATIONAL

- TABLE 175 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 59 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT, 2021

- TABLE 176 HONEYWELL INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED

- TABLE 177 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: COMPANY OVERVIEW

- FIGURE 60 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: COMPANY SNAPSHOT, 2021

- TABLE 178 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: PRODUCT LAUNCHES

- 13.1.15 TMEIC

- TABLE 180 TMEIC: COMPANY OVERVIEW

- TABLE 181 TMEIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 TMEIC: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 ANAHEIM AUTOMATION

- 13.2.2 SEW - EURODRIVE

- 13.2.3 DELTA ELECTRONICS

- 13.2.4 PARKER HANNIFIN

- 13.2.5 NORD DRIVE SYSTEMS

- 13.2.6 INOVANCE TECHNOLOGY

- 13.2.7 TECHSUPPEN

- 13.2.8 SHENZHEN GOZUK

- 13.2.9 SAKSUN INDUSTRIES

- 13.2.10 A.S. AUTOMATION & CONTROLS

- *Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 AVAILABLE CUSTOMIZATIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS