|

|

市場調査レポート

商品コード

1125033

医療用セラミックスの世界市場:材料別 (生体不活性 (ジルコニア、アルミニウム)、生体活性 (ガラス、ハイドロキシアパタイト)、生体吸収性セラミックス)・用途別 (歯科用途、整形外科用途、形成外科、手術器具) の将来予測 (2027年まで)Medical Ceramics Market by Material (Bioinert (Zirconia, Aluminium), Bioactive (Glass, Hydroxyapatite), Bioresorbable Ceramics), Application (Dental Application, Orthopedic Application, Plastic Surgery, Surgical Instruments) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医療用セラミックスの世界市場:材料別 (生体不活性 (ジルコニア、アルミニウム)、生体活性 (ガラス、ハイドロキシアパタイト)、生体吸収性セラミックス)・用途別 (歯科用途、整形外科用途、形成外科、手術器具) の将来予測 (2027年まで) |

|

出版日: 2022年08月30日

発行: MarketsandMarkets

ページ情報: 英文 185 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

医療用セラミックスの世界市場は、2022年までに推定26億米ドルと評価され、予測期間中に6.6%のCAGRで成長し、2027年までに36億米ドルに達すると予測されています。

"予測期間中、種類別ではジルコニアセグメントが最も高い成長率を占めた"

生体不活性セラミックスの世界市場では2021年に、ジルコニアのセグメントが最大のシェアを占めています。また、予測期間中に最も高い成長率を示すと予想されます。その要因として、他のセラミック材料に対するジルコニアの利点などが挙げられます。審美的に魅力的な歯科修復物の需要の高まりは、市場成長を促進します。

"歯科用途セグメントが最も高いCAGRを占めた"

用途別では、2021年には歯科用途のセグメントが最大のシェアを占めています。成長を支える要因は、各地域で美容歯科処置や歯科インプラント処置の数が増加していることと、歯周病が増加していることです。

"アジア太平洋地域が予測期間中に最も高いCAGRで成長する"

地域別に見ると、アジア太平洋市場は、人口の高齢化、新興国の急速な経済成長、膝・股関節置換術の増加により、予測期間中に高い成長を遂げると期待されています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 規制分析

- エコシステムの範囲

- バリューチェーン分析

第6章 医療用セラミックス市場:材料の種類別

- イントロダクション

- 生体不活性セラミックス

- ジルコニア

- 酸化アルミニウム

- その他の生体不活性セラミックス

- 生物活性セラミックス

- ヒドロキシアパタイト

- ガラスセラミックス

- 生体吸収性セラミックス

第7章 医療用セラミックス市場:用途別

- イントロダクション

- 歯科用途

- 歯科インプラント

- クラウン・ブリッジ

- 歯列矯正器具

- インレー・オンレー

- 歯科用骨移植片・代替物

- 整形外科用途

- 関節置換術

- 骨折固定

- 人工骨移植

- 心血管インプラント

- 手術器具

- 診断器具

- 形成外科

- 頭蓋顎顔面インプラント

- 眼窩/眼球インプラント

- 皮膚充填剤

- その他の用途

第8章 医療用セラミックス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第9章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 市場シェア分析

- 企業評価マトリックス

- 競争状況と動向

- 製品の発売 (2019年~2022年)

- 拡張 (2019年~2022年)

- パートナーシップ・コラボレーション (2019年~2022年)

- 買収 (2019年~2022年)

第10章 企業プロファイル

- 主要企業

- INSTITUT STRAUMANN AG

- 3M

- ROYAL DSM

- CERAMTEC

- KYOCERA CORPORATION

- COORSTEK INC.

- MORGAN ADVANCED MATERIALS PLC

- NGK SPARK PLUG CO., LTD.

- TOSOH CORPORATION

- SUPERIOR TECHNICAL CERAMICS

- RAUSCHERT GMBH

- H.C. STARCK GMBH

- NOBEL BIOCARE SERVICES AG

- BERKELEY ADVANCED BIOMATERIALS

- BAKONY TECHNICAL CERAMICS LTD.

- その他の企業

- KURARAY NORITAKE DENTAL INC.

- QSIL CERAMICS GMBH

- FERRO CORPORATION

- ELAN TECHNOLOGY

- NISHIMURA ADVANCED CERAMICS

第11章 付録

The global medical ceramics market is valued at an estimated USD 2.6 billion by 2022 is projected to reached USD 3.6 billion by 2027, at a CAGR of 6.6% during forecast period.The growing demand for medical ceramics in plastic surgeries & wound healing applications; the rising number of hip & knee replacement procedures; and the increasing demand for implantable devices are the major factors hampering the growth of this market.

"The zirconia segment accounted for the highest growth rate in the medical ceramics market, by type, during the forecast period"

Based on type, the global bioinert ceramics market is segmented into zirconia, alumina, and other bioinert ceramics (titanium, pyrolytic carbon, and silicon nitride). In 2021, the zirconia segment accounted for the largest share of the global bioinert ceramics market. This segment is also expected to grow at the highest rate during the forecast period. The largest share of this segment can be atributed to advantages of zirconia over other ceramic materials, the rising demand for aesthetically attractive dental restorations will drive the market growth.

"Dental application segment accounted for the highest CAGR"

On the basis of application, the global medical ceramics market is segmented into - dental applications, orthopedic applications, surgical instruments, and plastic surgery. In 2021, the dental applications segment accounted for the largest share of the medical ceramics market. Factors supporting the growth increasing number of cosmetic dental procedures and dental implant procedures across various regions and rising periodontal disorders.

"The Asia-Pacific market is expected to grow at the highest CAGR during the forecast period."

The medical ceramics market is segmented into - North America, Europe, the Asia Pacific, Latin America, and Middle East and Africa. The medical ceramics market in several Asia-Pacific countries is expected to witness high growth during the forecast period owing to the aging population, rapid economic growth in emerging APAC countries and rising volume of knee & hip replacement procedures.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-34%, and Tier 3- 21%

- By Designation: C-level-47%, Director-level-33%, and Others-20%

- By Region: North America-35%, Europe-32%, Asia Pacific-25%, Latin America-6%, and the Middle East & Africa-2%

Lists of Companies Profiled in the Report:

- CeramTec GmbH (Germany)

- KYOCERA Corporation (Japan)

- Morgan Advanced Materials (UK)

- Nobel Biocare Services (Switzerland)

- Tosoh Corporation (Japan)

- Institut Straumann (Switzerland)

- 3M (US)

- Royal DSM (DSM) (Netherlands)

- Elan Technology (US)

- Bakony Technical Ceramic Ltd. (Hungary)

- Superior Technical Ceramics (US)

- QSIL Ceramics GmbH (Germany)

- NGK Spark Plug (Japan)

- CoorsTek, Inc. (US)

- Advanced Ceramic Materials (US)

- Berkeley Advanced Biomaterials (US)

- Kuraray Noritake Dental (Japan)

- Ferro Corporation (Japan)

- H.C. Stark GmbH (Germany)

- Berkeley Advanced Biomaterials (US).

Research Coverage

This report studies the medical ceramics market based on the type of material, application, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth. It analyzes the opportunities and challenges in the market and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall medical ceramics market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

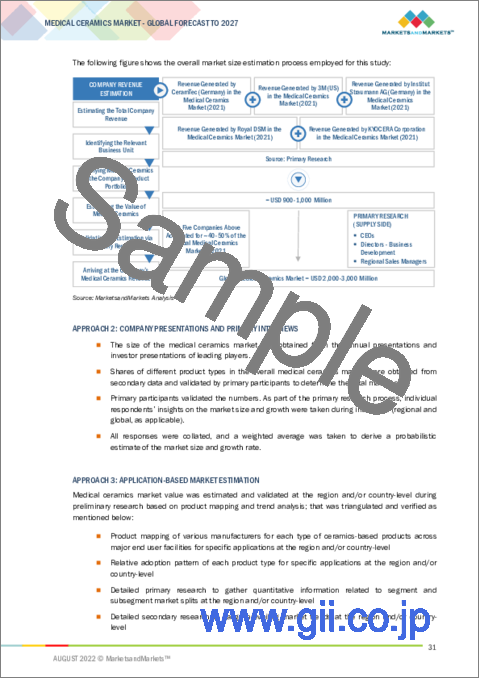

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 APPLICATION-BASED MARKET ESTIMATION

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 RISK ASSESSMENT/FACTOR ANALYSIS

- TABLE 2 RISK ASSESSMENT/FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 ZIRCONIA, BY TYPE, IS EXPECTED TO COMMAND LARGEST MARKET SHARE FROM 2022 TO 2027

- FIGURE 10 HYDROXYAPATITE SEGMENT TO COMMAND LARGEST MARKET SHARE FROM 2022 TO 2027

- FIGURE 11 DENTAL APPLICATIONS SEGMENT TO DOMINATE MEDICAL CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 MEDICAL CERAMICS MARKET OVERVIEW

- FIGURE 13 RISING NUMBER OF HIP & KNEE REPLACEMENT SURGERIES AND GROWING AWARENESS OF DENTAL CARE DRIVE MARKET GROWTH

- 4.2 GEOGRAPHIC ANALYSIS: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE AND REGION

- FIGURE 14 BIOINERT CERAMICS SEGMENT DOMINATED MARKET IN NORTH AMERICA IN 2021

- 4.3 GEOGRAPHICAL SNAPSHOT OF MEDICAL CERAMICS MARKET

- FIGURE 15 CHINA REGISTERS HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 MEDICAL CERAMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for implantable devices

- TABLE 3 INCREASING GERIATRIC POPULATION, BY REGION, 2022 VS. 2050

- 5.2.1.2 Increasing demand for medical ceramics in plastic surgeries and wound healing applications

- 5.2.1.3 Rising number of hip & knee replacement procedures

- FIGURE 17 TOTAL NUMBER OF REPLACEMENT PROCEDURES PERFORMED IN THE US FROM 2012 TO 2019

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent clinical & regulatory processes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing healthcare industry in emerging economies

- 5.2.3.2 3D printed ceramics

- 5.2.3.3 Gradual shift toward new materials & products

- 5.2.3.4 Growing research activities for nanotechnology applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to reparability & recycling

- 5.2.4.2 Shortage of skilled surgeons and dental professionals

- 5.3 REGULATORY ANALYSIS

- 5.3.1 NORTH AMERICA

- 5.3.1.1 US

- 5.3.1.1.1 FDA device classification

- 5.3.1.1 US

- FIGURE 18 US: REGULATORY APPROVAL PROCESS

- TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.3.1.2 Canada

- TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 19 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.3.2 EUROPE

- 5.3.2.1 European regulatory process

- FIGURE 20 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

- 5.3.3 ASIA PACIFIC

- 5.3.3.1 Japan

- TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- 5.3.3.2 China

- TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.3.3.3 India

- 5.3.1 NORTH AMERICA

- 5.4 ECOSYSTEM COVERAGE

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 MEDICAL CERAMICS MARKET: VALUE CHAIN ANALYSIS

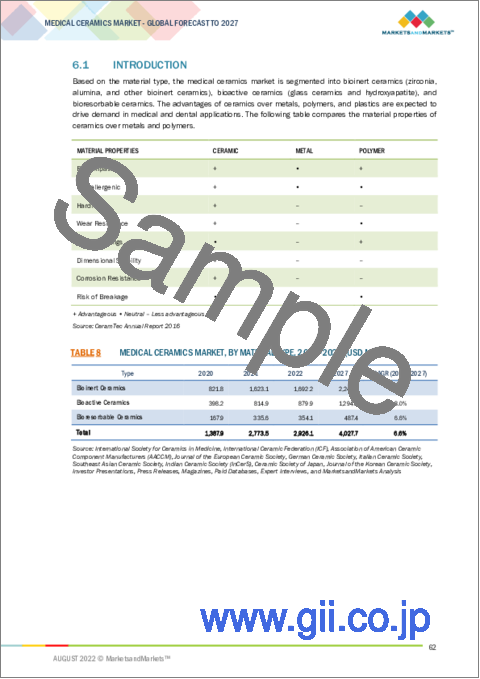

6 MEDICAL CERAMICS MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- TABLE 8 MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- 6.2 BIOINERT CERAMICS

- TABLE 9 MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 10 MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY REGION, 2020-2027 (USD MILLION)

- 6.2.1 ZIRCONIA

- 6.2.1.1 High resistance to corrosion to drive market growth

- TABLE 11 MEDICAL CERAMICS MARKET FOR ZIRCONIA, BY REGION, 2020-2027 (USD MILLION)

- 6.2.2 ALUMINUM OXIDE

- 6.2.2.1 Increasing use of aluminum oxide in hip replacements and dental implants to drive market growth

- TABLE 12 MEDICAL CERAMICS MARKET FOR ALUMINUM OXIDE, BY REGION, 2020-2027 (USD MILLION)

- 6.2.3 OTHER BIOINERT CERAMICS

- TABLE 13 OTHER BIOINERT CERAMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 BIOACTIVE CERAMICS

- TABLE 14 MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 15 MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1 HYDROXYAPATITE

- 6.3.1.1 Increasing R&D activities to support adoption of hydroxyapatite applications in medical care

- TABLE 16 MEDICAL CERAMICS MARKET FOR HYDROXYAPATITE, BY REGION, 2020-2027 (USD MILLION)

- 6.3.2 GLASS CERAMICS

- 6.3.2.1 Rising number of orthopedic & dental procedures to drive demand for glass ceramics

- TABLE 17 MEDICAL CERAMICS MARKET FOR GLASS CERAMICS, BY REGION, 2020-2027 (USD MILLION)

- 6.4 BIORESORBABLE CERAMICS

- 6.4.1 INCREASING R&D ACTIVITIES IN FUNCTIONAL REGENERATION OF TISSUES TO DRIVE SEGMENT GROWTH

- TABLE 18 MEDICAL CERAMICS MARKET FOR BIORESORBABLE CERAMICS, BY REGION, 2020-2027 (USD MILLION)

7 MEDICAL CERAMICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 19 MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 7.2 DENTAL APPLICATIONS

- TABLE 20 MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- 7.2.1 DENTAL IMPLANTS

- 7.2.1.1 Increasing cases of dental caries to drive market growth

- TABLE 21 MEDICAL CERAMICS MARKET FOR DENTAL IMPLANTS, BY REGION, 2020-2027 (USD MILLION)

- 7.2.2 DENTAL CROWNS & BRIDGES

- 7.2.2.1 Long lasting properties of dental crowns- key factor expected to support market growth

- TABLE 22 MEDICAL CERAMICS MARKET FOR DENTAL CROWNS & BRIDGES, BY REGION, 2020-2027 (USD MILLION)

- 7.2.3 BRACES

- 7.2.3.1 Increasing demand for invisible ceramic braces due to esthetic concerns to drive market growth

- TABLE 23 MEDICAL CERAMICS MARKET FOR BRACES, BY REGION, 2020-2027 (USD MILLION)

- 7.2.4 INLAYS & ONLAYS

- 7.2.4.1 Usage of CAD-CAM fabricated inlays & onlays to support market growth

- TABLE 24 MEDICAL CERAMICS MARKET FOR INLAYS AND ONLAYS, BY REGION, 2020-2027 (USD MILLION)

- 7.2.5 DENTAL BONE GRAFTS & SUBSTITUTES

- 7.2.5.1 Increasing use of bone grafts in dental implant procedures is expected to drive market growth

- TABLE 25 MEDICAL CERAMICS MARKET FOR DENTAL BONE GRAFTS & SUBSTITUTES, BY REGION, 2020-2027 (USD MILLION)

- 7.3 ORTHOPEDIC APPLICATIONS

- TABLE 26 MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- 7.3.1 JOINT REPLACEMENT SURGERIES

- 7.3.1.1 Rising volume of joint replacement procedures to drive market growth

- TABLE 27 MEDICAL CERAMICS MARKET FOR JOINT REPLACEMENT SURGERIES, BY REGION, 2020-2027 (USD MILLION)

- 7.3.1.2 Knee replacement

- 7.3.1.2.1 Growing number of knee replacement procedures to drive market growth

- 7.3.1.2 Knee replacement

- FIGURE 22 KNEE REPLACEMENT SURGERIES, 2015-2019 (PER 100,000)

- 7.3.1.3 Hip replacement

- 7.3.1.3.1 Use of ceramic materials in hip implants to drive market growth

- 7.3.1.3 Hip replacement

- FIGURE 23 HIP REPLACEMENT SURGERIES, 2015-2019 (PER 100,000)

- 7.3.1.4 Shoulder replacement surgery

- 7.3.1.4.1 Increasing incidence of shoulder injuries to drive market growth

- 7.3.1.5 Other joint replacement applications

- 7.3.1.4 Shoulder replacement surgery

- 7.3.2 FRACTURE FIXATION

- 7.3.2.1 Increasing demand for medical ceramics in constructing fracture fixation devices to support market growth

- TABLE 28 MEDICAL CERAMICS MARKET FOR FRACTURE FIXATION, BY REGION, 2020-2027 (USD MILLION)

- 7.3.3 SYNTHETIC BONE GRAFTS

- 7.3.3.1 Advantages of synthetic bone grafts over autografts & allografts to drive market growth

- TABLE 29 MEDICAL CERAMICS MARKET FOR SYNTHETIC BONE GRAFTS, BY REGION, 2020-2027 (USD MILLION)

- 7.4 CARDIOVASCULAR IMPLANTS

- 7.4.1 RISING ADOPTION OF HYDROXYAPATITE FOR COATING OF CARDIOVASCULAR IMPLANTS TO DRIVE MARKET GROWTH

- TABLE 30 MEDICAL CERAMICS MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

- 7.5 SURGICAL INSTRUMENTS

- 7.5.1 INCREASING NUMBER OF SURGICAL PROCEDURES WORLDWIDE TO DRIVE MARKET GROWTH

- TABLE 31 MEDICAL CERAMICS MARKET FOR SURGICAL INSTRUMENTS, BY REGION, 2020-2027 (USD MILLION)

- 7.6 DIAGNOSTIC INSTRUMENTS

- 7.6.1 GROWING AWARENESS AMONG PATIENTS ON EARLY DISEASE DIAGNOSIS TO SUPPORT MARKET GROWTH

- TABLE 32 MEDICAL CERAMICS MARKET FOR DIAGNOSTIC INSTRUMENTS, BY REGION, 2020-2027 (USD MILLION)

- 7.7 PLASTIC SURGERY

- TABLE 33 MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY REGION, 2020-2027 (USD MILLION)

- 7.7.1 CRANIOMAXILLOFACIAL IMPLANTS

- 7.7.1.1 Utilization of hydroxyapatite in craniomaxillofacial surgery for restorative purposes to support market growth

- TABLE 34 MEDICAL CERAMICS MARKET FOR CRANIOMAXILLOFACIAL IMPLANTS, BY REGION, 2020-2027 (USD MILLION)

- 7.7.2 ORBITAL/OCULAR IMPLANTS

- 7.7.2.1 Increasing prevalence of eye diseases to drive market growth

- TABLE 35 MEDICAL CERAMICS MARKET FOR ORBITAL/OCULAR IMPLANTS, BY REGION, 2020-2027 (USD MILLION)

- 7.7.3 DERMAL FILLERS

- 7.7.3.1 Usage of calcium hydroxyapatite in dermal fillers to support market growth

- TABLE 36 MEDICAL CERAMICS MARKET FOR DERMAL FILLERS, BY REGION, 2020-2027 (USD MILLION)

- 7.8 OTHER APPLICATIONS

- TABLE 37 MEDICAL CERAMICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2027 (USD MILLION)

8 GLOBAL MEDICAL CERAMICS MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 38 MEDICAL CERAMICS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 24 NORTH AMERICA: MEDICAL CERAMICS MARKET SNAPSHOT

- TABLE 39 NORTH AMERICA: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY TYPE, 2020-2027(USD MILLION)

- 8.2.1 US

- 8.2.1.1 Increasing elderly population & rising need for dental procedures to drive market growth

- FIGURE 25 AGING POPULATION IN THE US, 2014-2060

- TABLE 47 US: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 48 US: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 US: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Rising geriatric population to drive market growth for medical ceramics

- TABLE 50 CANADA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 51 CANADA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 CANADA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3 EUROPE

- TABLE 53 CONFERENCES AND SYMPOSIUMS ON MEDICAL CERAMICS IN EUROPE (2018-2020)

- TABLE 54 EUROPE: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 55 EUROPE: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 56 EUROPE: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 EUROPE: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 EUROPE: MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 59 EUROPE: MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 60 EUROPE: MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 EUROPE: MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Rising geriatric population and medical tourism to support market growth for medical ceramics

- FIGURE 26 GERMANY: AGING POPULATION AGED 65 AND ABOVE, 2015-2021 (MILLION)

- FIGURE 27 GERMANY: HIP REPLACEMENT SURGERIES, 2015-2019 (PER 100,000 POPULATION)

- TABLE 62 GERMANY: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 63 GERMANY: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 GERMANY: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.2 FRANCE

- 8.3.2.1 Growing awareness of dental care & rising surgical procedures to support market growth

- FIGURE 28 FRANCE: KNEE REPLACEMENT SURGERIES, 2015-2019 (PER 100,000 POPULATION)

- TABLE 65 FRANCE: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 66 FRANCE: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 FRANCE: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3 UK

- 8.3.3.1 Growing orthopedic & dental industry-key factor expected to drive adoption of medical ceramic products

- TABLE 68 UK: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 69 UK: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 70 UK: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Growing demand for medical ceramics in plastic surgeries to support market growth

- TABLE 71 ITALY: NUMBER OF KNEE AND HIP REPLACEMENT SURGERIES, 2015-2020 (PER 100,000)

- TABLE 72 ITALY: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 73 ITALY: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 74 ITALY: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 Growing demand for cosmetic dentistry to support uptake of medical ceramics

- TABLE 75 SPAIN: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 76 SPAIN: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 SPAIN: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 REST OF EUROPE: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: MEDICAL CERAMICS MARKET SNAPSHOT (2021)

- TABLE 81 ASIA PACIFIC: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.1 CHINA

- 8.4.1.1 Increasing awareness of oral healthcare & presence of specialized dental hospitals to drive market growth

- TABLE 89 CHINA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 90 CHINA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 CHINA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.2 JAPAN

- 8.4.2.1 Rising prevalence of age-related illnesses to drive market uptake of medical ceramics

- TABLE 92 JAPAN: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE , 2020-2027 (USD MILLION)

- TABLE 93 JAPAN: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 JAPAN: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3 INDIA

- 8.4.3.1 Creation of medical device cluster projects to drive demand for medical ceramics

- TABLE 95 INDIA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 96 INDIA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 INDIA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.4 AUSTRALIA

- 8.4.4.1 Growing target disease burden to support market growth

- TABLE 98 AUSTRALIA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 99 AUSTRALIA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 AUSTRALIA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Increasing dental care and plastic surgery procedures expected to support market growth

- TABLE 101 SOUTH KOREA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 102 SOUTH KOREA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 SOUTH KOREA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.6 REST OF ASIA PACIFIC

- TABLE 104 RISING GERIATRIC POPULATION (65 YEARS AND ABOVE), 2015-2021

- TABLE 105 REST OF ASIA PACIFIC: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.5 LATIN AMERICA

- TABLE 108 LATIN AMERICA: MEDICAL CERAMICS MARKET, BY COUNTRY, 2020-2027(USD MILLION)

- TABLE 109 LATIN AMERICA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 110 LATIN AMERICA: BIOINERT CERAMICS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 111 LATIN AMERICA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027(USD MILLION)

- TABLE 112 LATIN AMERICA: MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 113 LATIN AMERICA: MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 LATIN AMERICA: MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020-2027(USD MILLION)

- TABLE 115 LATIN AMERICA: MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.1 BRAZIL

- 8.5.1.1 Key market for medical ceramics owing to modernization of healthcare facilities

- TABLE 116 BRAZIL: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 117 BRAZIL: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 BRAZIL: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.2 MEXICO

- 8.5.2.1 Favorable investment scenario for medical device manufacturers to drive market growth

- TABLE 119 MEXICO: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 120 MEXICO: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 MEXICO: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.3 REST OF LATIN AMERICA

- TABLE 122 REST OF LATIN AMERICA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 123 REST OF LATIN AMERICA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 124 REST OF LATIN AMERICA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 INCREASING AWARENESS OF DENTAL TREATMENT TO DRIVE MARKET GROWTH

- TABLE 125 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET, BY MATERIAL TYPE, 2020-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET FOR BIOINERT CERAMICS, BY TYPE, 2020-2027(USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET FOR BIOACTIVE CERAMICS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET FOR DENTAL APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET FOR ORTHOPEDIC APPLICATIONS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MEDICAL CERAMICS MARKET FOR PLASTIC SURGERY, BY TYPE, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE MEDICAL CERAMICS MARKET

- 9.3 MARKET SHARE ANALYSIS

- TABLE 133 MEDICAL CERAMICS MARKET: DEGREE OF COMPETITION

- 9.4 COMPANY EVALUATION MATRIX

- 9.4.1 STARS

- 9.4.2 EMERGING LEADERS

- 9.4.3 PERVASIVE PLAYERS

- 9.4.4 PARTICIPANTS

- FIGURE 30 MEDICAL CERAMICS MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 9.5 COMPETITIVE SITUATIONS & TRENDS

- 9.5.1 PRODUCT LAUNCHES (2019-2022)

- 9.5.2 EXPANSIONS (2019-2022)

- 9.5.3 PARTNERSHIPS AND COLLABORATIONS (2019-2022)

- 9.5.4 ACQUISITIONS (2019-2022)

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1.1 INSTITUT STRAUMANN AG

- TABLE 134 INSTITUT STRAUMANN AG: BUSINESS OVERVIEW

- FIGURE 31 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT (2021)

- 10.1.2 3M

- TABLE 135 3M: BUSINESS OVERVIEW

- FIGURE 32 3M: COMPANY SNAPSHOT (2021)

- 10.1.3 ROYAL DSM

- TABLE 136 ROYAL DSM: BUSINESS OVERVIEW

- FIGURE 33 ROYAL DSM: COMPANY SNAPSHOT (2021)

- 10.1.4 CERAMTEC

- TABLE 137 CERAMTEC: BUSINESS OVERVIEW

- FIGURE 34 CERAMTEC: COMPANY SNAPSHOT (2021)

- 10.1.5 KYOCERA CORPORATION

- TABLE 138 KYOCERA: BUSINESS OVERVIEW

- FIGURE 35 KYOCERA CORPORATION: COMPANY SNAPSHOT (2021)

- 10.1.6 COORSTEK INC.

- TABLE 139 COORSTEK INC.: BUSINESS OVERVIEW

- 10.1.7 MORGAN ADVANCED MATERIALS PLC

- TABLE 140 MORGAN ADVANCED MATERIALS PLC.: BUSINESS OVERVIEW

- FIGURE 36 MORGAN ADVANCED MATERIALS PLC: COMPANY SNAPSHOT (2021)

- 10.1.8 NGK SPARK PLUG CO., LTD.

- TABLE 141 NGK SPARK PLUG CO. LTD: BUSINESS OVERVIEW

- FIGURE 37 NGK SPARK PLUG CO., LTD: COMPANY SNAPSHOT (2021)

- 10.1.9 TOSOH CORPORATION

- TABLE 142 TOSOH CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 TOSOH CORPORATION: COMPANY SNAPSHOT (2021)

- 10.1.10 SUPERIOR TECHNICAL CERAMICS

- TABLE 143 SUPERIOR TECHNICAL CERAMICS: BUSINESS OVERVIEW

- 10.1.11 RAUSCHERT GMBH

- TABLE 144 RAUSCHERT GMBH: BUSINESS OVERVIEW

- 10.1.12 H.C. STARCK GMBH

- TABLE 145 H.C. STARCK GMBH: BUSINESS OVERVIEW

- 10.1.13 NOBEL BIOCARE SERVICES AG

- TABLE 146 NOBEL BIOCARE SERVICES AG: BUSINESS OVERVIEW

- 10.1.14 BERKELEY ADVANCED BIOMATERIALS

- TABLE 147 BERKELEY ADVANCED BIOMATERIALS: BUSINESS OVERVIEW

- 10.1.15 BAKONY TECHNICAL CERAMICS LTD.

- TABLE 148 BAKONY TECHNICAL CERAMICS LTD: BUSINESS OVERVIEW

- 10.2 OTHER COMPANIES

- 10.2.1 KURARAY NORITAKE DENTAL INC.

- 10.2.2 QSIL CERAMICS GMBH

- 10.2.3 FERRO CORPORATION

- 10.2.4 ELAN TECHNOLOGY

- 10.2.5 NISHIMURA ADVANCED CERAMICS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS